Transcription

Cost modelModularconstructionAn edited version of this article firstappeared in Building magazine in April 2017

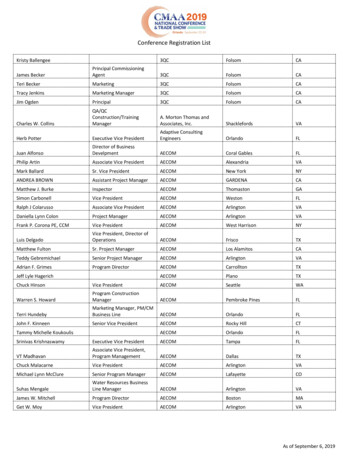

Contents1. Background042. Modular construction053. Design074. Procurement and construction085. Cost influencers106. Sustainability117. The cost model15All images:Ladywell, Lewisham Council (Rogers StirkHarbour Partners)

Debates about modular construction andoff-site manufacture are nothing new. Butwith more suppliers, better quality andgreater awareness within the industry,could it finally achieve critical mass?Rob Mills of AECOM looks at the figures.AcknowledgmentsThe author would like to thank Barry Nugent,James Barton and Garry Burdett of AECOM fortheir help in preparing this article.Rob MillsDirector, Program CostConsultancy, Commercialrob.mills@aecom.com

AECOM Cost model Modular construction April 2017 401BackgroundIt may have had different names overthe years — prefabrication, modularbuilding, design for manufacture andassembly, or off-site construction— but the idea of constructingbuildings away from the site wherethey will eventually stand has had along history, dating as far back as the16th century.The postwar pushPerhaps the most notable use ofmodular construction was during theUK’s post-war transitional period,which drove the need for homesand accelerated the search for aremedy to meet the country’s housingsupply issues. The legacy of thatbuilding programme survives today,with many of those postwar homesstill standing.In that period, redundant armsfactories were adapted to allow exservicemen and women to produceprefabricated housing in controlledfactory conditions. This addressed thepre-existing housing supply problemsand targeted employment issues — anidea that would surely resonate today.The most notable use ofmodular construction wasduring the UK’s post-wartransitional period.Yet this was an opportunity missed.A relatively small number of houseswere delivered in that post-war push.Technological innovations were notadopted, and so there was little changeto the development of the industry.Living the high-riseThroughout the 1950s and early 1960s,demand for housing was a result ofmajor slum clearances in inner cities.This set a precedent for governmenthousing targets and saw theintroduction of a large-panel residentialsystems on high-rise blocks, basedon their successful applicationin Scandinavia.The first use of such systems wasa nine-block residential schemecommissioned by the LondonBorough of Newham using the LarsenNielsen system. The subsequentprogressive collapse of the structure inthe Ronan Point block led to concernsaround durability and structuralperformance. This only added toexisting negative views of methods ofprefabricated construction.

AECOM Cost model Modular construction April 2017 502ModularconstructionTimes are a-changingCross-sector appealFast-forward to present day, andthings have changed. Performance isnow more than credible. Quality is verygood and viability assessments areencouraging when compared with atraditional approach.It is no surprise that interest inthis approach is gaining traction.Contractors like the enhanced healthand safety benefits gained from havingless heavy and time-consumingconstruction work occurring on siteand the logistical challenges eased,especially when faced with tight innercity sites where storage or lay-downareas are sometimes non-existent.There is also less waste.Recent cost estimates suggest that,for medium-size schemes, modularconstruction could be 10-20%more cost effective than traditionalmethods. In the past, the modularapproach has been seen to costmore and this can be attributed todesigners trying to fashion a design fora traditional build into something thatfits with the modular approach. Thisdoesn’t always work and economicalprojects have been designed asmodular from the outset.The modular supply chain is still fairlyimmature. However, modular suppliersthemselves have very strong supplychains and so can compete on priceversus their traditional counterparts.Project managers like the lean, onsite programmes that result fromoff-site manufacture. Developersoften approve of the reduced financecharges and the revenue streamsflowing from the earlier marketingand viewing of completed homesthat result.It all sounds too good to be true.But the usual hurdles around qualityperception have been resolvedand investors are placing cash andexpectation into expanding factories.Earlier drawdown of social housinggrants by social registered landlordsand earlier completion also makethis approach more attractive, whereapplicable. With an earlier and fastercompletion, the additional costsassociated with inflation and costescalation is minimised by reducedcontract duration.10-20%Cost estimates for medium-sizeschemes, modular construction,more cost effective thantraditional methods.

AECOM Cost model Modular construction April 2017 6All-modular, finally?The government is also interested inmodular construction, notably in thepotential for upping the bandwidth ofhousing delivery and closing the gapbetween supply and demand, which isat the forefront of the current industrydebate. Add to that the prospect ofmitigating the skills shortage acrossthe industry as a whole — not tomention an estimated 20-30% declinein skilled labour over next decade dueto migration and retirement — and it’sno wonder that modular construction’stime is coming.Current situationThe recently published governmentwhite paper (Fixing a broken housingmarket, February 2017), talks abouthow the UK needs 225,000-275,000 oreven more homes to be built per yearin order to keep up with populationgrowth. This gives an indication as towhat the modular market size could be.It has taken a while to reach fruition.“Modern methods of construction” hasbeen industry jargon for years, but untilrecently the percentage of schemescompleted using these methods wasstuck in the single figures.Within the same report, thegovernment announced that there willbe 7.1bn made available for housingassociations and non-profit makingdevelopers to assist with fundingsuch projects, along with a further 2.3bn for private developers from thehousing infrastructure fund. A broadrange of developers are exploringthis methodology, especially formultibuilding sites where standardised,repetitive floor plates work well.Small-scale prefabrication and off-siteconstruction — bathroom pods, MEPelements, facades and the like — havehelped larger, traditional schemesmake time and cost savings. Butwholesale adoption has been slow, heldback in part by negative perceptionsaround quality and product lifespan.Planning conditions often dictate thataffordable accommodation is builtfirst when delivering a multi-blockand mixed tenure site. Typically, withmargins on lower-value sites beingtight, the efficiencies that modularconstruction brings can improveviability assessments.However, economies of scale seen asstandard in manufacturing industriessuddenly seem achievable. “Puremodular” projects, usually basedaround timber-framed structures, arenow a reality, with their standardisedcomponents and on-site installationmaking for a safe, efficient andsustainable delivery.This is a developing sector withinthe industry, which does havechallenges. There is still a limitedsupply chain, with around sixsufficiently mature manufacturersable to support projects whose orderbooks are full and a number of offsite manufacturers are keen to enterthe arena.The modular approach, however,is scalable. Factories are generallylocated in the Midlands and requirevery limited equipment and low utilitycapacity to set up. They assemble akit of parts, rather than manufacturinganything themselves. A mixtureof skilled and semi-skilled labouris required and quality is tightlycontrolled under factory conditionsby supervisors.At the moment very few largescale projects have been executed,and these are typically low-rise,affordable apartments.However, engineers are now exploringthe possibilities of building to 20storeys plus (logistics and accesspermitting) and producing privatetenure blocks with efficient massing.More and higher-profile schemes aresure to come on line in the future.20-30%Estimated decline in skilled labourover next decade due to migrationand retirement.

AECOM Cost model Modular construction April 2017 703Design16 storey towersare achievableand mostdevelopmentsto date have notexceeded 12storeys.To many designers, modular buildingsalways look like modular buildingsand the stigma of post-war prefabsmay take time to shake off. Architectsand their design teams will need todevelop better facade details forprivate-tenure modular schemesto become possible. Clearly, somepremium architects have beennurturing this idea for a while now, andforesee the opportunity and growth.External walls usually consist of: abreathable outer; weatherboard;insulation; punched windows;and necessary fire stopping. Asolid exterior is then applied asa rainscreen system. On-siteamendments, such as double-heightunbroken glazed facades shouldbe avoided, to retain the structuralintegrity and air-tightness ofeach unit.Modules usually consist of a timberor lightweight steel frame heldtogether using heavy-duty brackets.A sub floor and outer ceiling is theninserted using timber joists or a metalequivalent, with finishes appliedafterwards. Internal partitions, linings,doors, wall, floor and ceiling finishes,kitchens, bathrooms, joinery and MEPare installed as per a traditional fit-outsolution, albeit in the factory.Those preferring tall towers mayneed to revise their expectations fornow — 16 storeys is achievable andmost developments to date have notexceeded 12 storeys. But as you gohigher, the cost increases — simplybecause specialised mobile cranesare required for installation at height,for which there are only a few inEurope, as well as the requirementsfor structural integrity and servicesrequirements, just as would be thecase for a traditionally constructedtall building.For MEP, modular construction isflexible. A common MEP strategy(made possible by the super-insulatednature of the modules) is to designthe modules to utilise an all-electricalsystem for heating and hot water.However, where an energy centre isavailable, along with centralised lowtemperature hot water being piped toeach plot, the overall energy strategycan be more resilient. The capacitythat comes with an energy centre isflexible and usually attracts betterenergy rates from the provider.25%When compared with atraditional build programme,modular methods can reducethe overall programme byaround 25%.A tightly managed design phase isessential for the benefits of a modularproject to be achieved. In particular,design will need to be fixed early toallow for lead-in times and mockup approval. This also reduces riskacross the rest of the project. Whencompared with a traditional buildprogramme, modular methods canreduce the overall programme byaround 25%.

AECOM Cost model Modular construction April 2017 804Procurement andconstructionMoving to modular requires a changeof approach, which is not alwayswelcome. Clients may be morealigned to traditional procurementstrategies and be unwilling or slowto adapt. Contractors and theirprofessional teams may find it hardnot to tinker with detailed designs.This may be exacerbated by the factthat there are limited incentives forcontractors, designers or clients toinnovate. Modular construction israrely specified in tender documentsor planning conditions.Many main contractors lackexperience in modular schemes.This has, occasionally, meant thatdevelopers engage their supplieras the main contractor. Whilethis makes sense from a productviewpoint, the supplier’s inexperiencein tendering work packages oroperating in non-local markets hascaused problems. A main contractormodel is still desirable, to ensureefficient management of the onsite work packages and deliverywithin programme.In some instances, to further improveefficiency, suppliers can actually taketheir factory to site by setting uptemporary structures in order to cutout the cost of haulage and risks thatcome with transporting large loads.However, because the actual onsite construction is generally lesscomplex, modular schemes mayprovide an opportunity to use tier twoand three main contractors, or evenlarger trade contractors, to manageprocurement and oversee assembly.The simplicity of modular schemes,once detailed, could make singlestage procurement more attractive tomain contractors.The number of highly-trained andexperienced construction personnelrequired to deliver a modular schemeis fewer than on a traditional build,making the construction industry’sskills shortage less of a problem. Withfurther potential labour shortagespost-Brexit, this can be both anadvantage and an opportunityto invest in a modular-savvyUK workforce.The supply chain remains an issue.The small number of manufacturersmeans they need to be engaged early,and design needs to be fixed beforestarting the production line. Changesduring manufacture will be costly andcould result in the contractor losingtheir allocated manufacturing slot.The number of highly-trained andexperienced construction personnelrequired to deliver a modular scheme isfewer than on a traditional build, makingthe construction industry’s skillsshortage less of a problem.

AECOM Cost model Modular construction April 2017 905Cost influencersRepetition is key to a successfulmodular construction scheme.Project teams should think of whatis required when using bathroompods in a traditional project and scalethat up.The usual design and cost metricsapply, such as net-to-gross ratios.Square buildings are particularlygood for modular construction, andfive-plus apartments per core shouldbe targeted.Haulage is a cost to consider,especially on a high-volume project.An alternative is to build a factory onsite, space and logistics permitting.While not a cost driver, clients shouldexpect to cash flow for an advancepayment — typically 10-25% of thetotal contract value protected bya bond.06SustainabilityThere are some strong sustainabilityadvantages associated with modularconstruction, which should be factoredin to the design and client expectations.Typically, off-site assembly meansreduced waste compared withtraditional construction, and thematerials used general have a higherrecyclable content.Energy consumption is lower — somuch so that each module is almost atPassivhaus standards. Thermal valuesoften outperform traditional schemesand, where there are no central hotwater system keeping corridors andrisers warm, there are fewer issueswith overheating.There is the potential for big costsavings using modular construction.Pure modular projects can becompleted in half the time oftraditional schemes once on site.Fewer packages need to be bought(usually ground works/substructure,cores, stairs, apartment modules,shell and core MEP works, builders’works, lifts and potentially balconies,roof finishes and the like, dependingon the project).As a result, prelims are muchlower — usually around 12% fora 160-apartment scheme. Thiscombination of fewer packages andsimpler design also means costs areeasier to predict.

07The cost modelThis cost model is based on the following: Fully modular utilising a timber framePrivate tenure project (London, Zone 3)12 storeys160,500 ft² GIA121,000 ft² NIA residential7,500 ft² NIA retail/other @ ground floor160 residential apartmentsNo comfort coolingExcluding inflationExcluding all fees

AECOM Cost model Modular construction April 2017 11Shell and core worksSubstructureRoofTotal ( ) /m2%Total ( ) /m2%897,97060.222.67325,89021.860.97Works to existing site: site clearance and preparation(2,236m³ @ 15/m³).Note: The roof forms part of the module and so finishesrequired to be applied on siteOff site; assumed 0.5m reduce level dig (2,818m³ @ 50/m³) including say 15% for bulking.Allowance for lift overruns, AO Vs etc (4nr @ 10,000each).Allow for say 15% contaminated soil (423m³ @ 100/m³).Allowance for membrane roof covering to timber framemodule including.Allow for removal of unknown obstructions (item@ 25,000).Allowance for piling mat to footprint of building, say400mm thick; including excavation and disposal andcompacting (1,243m² @ 40/m²).Allowance for mobilising and demobilising of piling rig;including setting up plunging rig at pile positions (item@ 25,000).CFA local piling to cores only; 600mm dia 20m in length;cut off top of piles; allow for pile caps and disposal ofarisings including pile caps.Allowance for under slab drainage (1,243m² @ 35m²).Allowance for lift pits (4nr @ 7,000 each).Allowance for ground floor slab say 650mm thick (1,243m²@ 290/m²).Frame and upper floorsinsulation, waterproofing, drainage, etc.Extra over allowance for green roof coverings.External walls, windows, doorsand balconiesTotal ( ) /m2%2,130,142142.866.33Note: The facade forms part of the module and so leavesthe factory already weather tight.Allowance for site-applied rain screen (reconstitutedstone) on a track and rail system mechanically fixed to themodule external wall (4,921m² @ 250/m²).Extra over for doors to balconies and external areas.Included within module shell and core rate.Extra over allowance for material interfaces and features.Total ( ) /m2%694,80046.602.06Note: The modular system does not require a traditionalframe and upper floors arrangement.Allowance for canopies to entrances (2nr @ 15,000).Allowances for balconies to apartments; bolt-on steelbalconies; including.balustrades etc (160nr @ 4,500 each).Allowance for reinforced concrete cores; comprising200mm thick walls (1,512m² @ 200/m²).Internal walls, partitions and doorsAllowance for landings to immediate area around cores.Total ( ) /m2%107,8007.230.32Allowance for steel support to lifts (4nr @ 1,500 each).StairsTotal ( ) /m2%217,00014.550.64Pre-cast reinforced concrete stairs; powder coated metalbalustrading and handrails; ground to L16.Allowance for ladders for roof access (2nr @ 2,500 each).Allowance for mansafe system, hand rail and the like.Note: The party walls, corridor walls and doors are part ofthe module.Partitions; party walls, corridor walls and walls to landlordsareas — included within module rate.Single leaf, timber doors to landlord’s areas.Double leaf, timber doors to landlord’s areas.Allowance for WC and shower cubicles to amenityareas etc.

AECOM Cost model Modular construction April 2017 12Wall finishesFittings, furnishings and equipmentTotal ( ) /m2%Total ( ) rd lining to core walls, service cupboards etc.Paint to internal partitions; residential corridors, linings andback of house areas.MDF skirtings with painted finishes to lift lobbies,residential corridors, management suite.Enhanced finishes to apartment entrances and lift lobbiesat ground level (item @ 100,000).Timber panelling to residents lounge.Allowance for modules shell and core elements other thanthose items mentioned elsewhere.Statutory signage (item @ 30,000).Mail boxes (160nr @ 150/each).Allowance for back-of-house storage for estatemanagement and facilities management (item @ 20,000).Sundry joinery items to residents lounge (item @ 50,000).Allowance for desks and seats – excluded.Service panelling to WCs and showers.Sundries; notice board, signage etc (item 10,000).Porcelain tiles to WCs and showers.Reception desks to apartment entrance areas and estatemanagement suite (item @ 25,000).Floor finishesTotal ( ) /m2%116,6007.820.35Timber batten floors to corridors and lift lobbies,apartment entrances, residents.lounge and estate management suites.Sanitary ware (MEPG)Total ( ) /m2%11,9000.800.04Cleaners sinks (2nr @ 450 each).Carpet finishes to residential corridors and lift lobbies.Sanitary ware to estate management suite (4nr @ 650 each).Porcelain tiles to WCs and showers.Sanitary ware for residents lounge (4nr @ 850 each).Vinyl finishes to storage areas, refuse areas, and so on.Extra over allowance for wheel chair userprovisions ( 5,000).Ceiling finishesTotal ( ) /m2%25,0001.680.07Note: The modules form this part of the works andsurfaces arrive pre–finished.Painted plasterboard ceiling to residential corridors,residents’ lounges and back-of-house areas.Acoustic rated demountable suspended ceiling includingpaint finish to estate management suite.Enhanced finishes to reception and lift lobbies at groundfloor (item @ 25,000).Painted moisture resistant plasterboard celling to WCs andshower rooms.Allowance for bullheads and level changes.(MEPG) MEP GenerallyDisposal installations (MEPG)Total ( ) /m2%367,94924.681.09Rainwater disposal from roof outlets connection tounderground drainage (14,911m² @ 3/m²).Foul water disposal to amenity areas and apartments.Drainage from bin stores and the like via floor gullies (item@ 20,000).

AECOM Cost model Modular construction April 2017 13Water installations (MEPG)Gas installation (MEPG)Total ( ) /m2%Total ( ) /m2%320,85021.520.95000Cold water installation incoming main, storage tank,water treatement.Cold water distribution to sanitary ware including estatemanagement suite.Hot water installations to sanitary ware including estatemanagement suite.Space heating/air treatment (MEPG)Total ( ) /m2%72,0004.830.21Distribution to apartments, valves, etc, terminating in HIUs– excluded all electric.Landlord’s heating to stair cores and back-of-house areasvia electric panel heaters (item @ 12,000).Gas installation boilers and associated works — excluded.Heat source (MEPG)Total ( ) /m2%000Gas fired boilers — excluded — all electrical system.Protective installations (MEPG)Total ( ) /m2%256,75117.220.76Domestic sprinkler distribution to apartments, monitoredfloor valves (14,911m² @ 12/m²).Dry risers (24 outlets @ 2,000 each).Lightning and surge protection (14,911m² @ 2/m²).Ventilation installations (MEPG)Total ( ) /m2%225,00015.090.67Communication installations (MEPG)Total ( ) /m2Stairwell make up via AoV — 2 nr.%551,20736.971.64Smoke clearance to corridors.Fire alarm to landlord areas, interlink to apartments(14,911m² @ 7/m²).Electrical installations (MEPG)Total ( ) /m2%1,060,17671.103.15Primary distribution board, landlords power and lightingboards, cabling and containment, sub metering, reyfieldinstallation to apartments (14,911m² @ 34/m²).Life safety standby generator and flue (item @ 100,000).Life safety cabling and equipment to for fire fighting lifts,smoke extract and sprinkler installations (14,911m²@ 5/m²).Lighting to landlord areas and circulation areas includinglighting control and emergency lighting (3,950m² @ 58/m²).Feature lighting internal/external (item @ 50,000).Earthing and bonding (14,911m² @ 2m²).(MEPG) MEP GenerallyWheel chair user refuge and WC alarm installations (item@ 50,000).Containment for data/telephone installations (14,911m²@ 3.50m²).Satellite farm and aerial installations to roof (4nr satellitesand 1 aerial) (item @ 20,000).Telephone/TV/satellite to apartments (item @ 120,000).Data outlets to landlord areas and wi–fi installation toresidents’ lounge (item @ 25,000).Door entry system and sub door entry installation,including Cat 6 cabling to apartments (2nr entrances @ 30,000).

AECOM Cost model Modular construction April 2017 14Special installations (MEPG)Total ( ) /m2%104,3767.000.31Remote metering to apartments and billing system for LTHW heating only — excluded all electric.Controls (14,911m² @ 7/m²).Lift installations (MEPG)Total ( ) /m2%678,00045.472.0113 person, 1.6m/s.17 person 1.6m/s.Enhanced finishes to lift car (item @ 30,000).Builders work (MEPG)Total ( ) /m2%109,4467.340.33BWIC.Preliminaries and contingenciesTotal ( ) /m2%4,420,349296.4513.13Main contractor preliminaries @ 12.0%.Overheads and profit @ 5.00%.Contractor risk transfer @ 3.0%.Pre and post contract award novated fees – excluded.Contingency and design reserve @ 5.0%.Total shell and core worksTotal ( ) /m2%20,681,0001,38761.45(MEPG) MEP Generally

AECOM Cost model Modular construction April 2017 15Residential fit-out worksInternal walls, partitions and doorsTotal ( ) /m2%496,10033.271.47Plasterboard stud partitions within apartments.Extra over allowance for boxing out and acoustic treatmentto SVPs including crossovers.Internal apartment doors; flush painted, solid core singleleaf doors sets including ironmongery.Utility cupboard doors; flush painted, solid core, doubleleaf door sets including ironmongery.Wall finishesTotal ( ) /m2%515,94434.601.53Painted plasterboard lining to internal face of external wall.Paint finish to all internal partitions.44.58177.007.84Allowance for kitchens including furniture, brassware,white goods (fridge freezer, hob, oven, extractor hood andwasher dryer) and recon stone work tops — Studio.Allowance for kitchens including furniture, brassware,white goods (fridge freezer, hob, oven, extractor hood andwasher dryer) and recon stone work tops — 1 bed.Allowance for kitchens including furniture, brassware,white goods (fridge freezer, hob, oven, extractor hood andwasher dryer) and recon stone work tops — 2 bed.Allowance for kitchens including furniture, brassware,white goods (fridge freezer, hob, oven, extractor hood andwasher dryer) and recon stone work tops — 3 bed.Wardrobes to master and second bedrooms with drawerpack in the master bedroom only.Mirror to bathrooms.Floor finishes664,774%2,639,252Toilet roll holder, brush, robe hooks and the like.MDF skirting including paint finish. /m /m2Bath panel.Allowance for splashbacks to kitchens.Total ( )Total ( )Vanity units within bathrooms.Plywood behind kitchen walls.2Fittings, furnishings and equipment%1.98Acoustic timber batten sub floor to all areas.Good quality carpet to bedrooms generally.Good quality engineered timber flooring to kitchen, loungeand hallway.Sanitary ware (MEPG)Total ( ) /m2%496,10033.271.47Allowance for WCs and associated items, wash handbasins including waste traps and brassware, baths,showers and screens including all necessary fixtures andfittings for studio, 1-bed, 2-bed and 3-bed apartment.Large format tile to bathroom floors.Disposal installations (MEPG)Ceiling finishesTotal ( ) /m2%128,9868.650.38Total ( ) /m2%267,89417.970.80Painted plasterboard ceilings.Allowance for blind boxes/recesses.Access hatches where required.Solid and waste to white goods and bathrooms.Water installations (MEPG)Total ( ) /m2%287,73819.300.85Hot and cold water pipework to white goodsand bathrooms.(MEPG) MEP Generally

AECOM Cost model Modular construction April 2017 16Heat source (MEPG)Special installations (MEPG)Total ( ) /m2%Total ( ) /m2%644,93043.251.92208,36213.970.62N/A.Local control to heating.Space heating/air treatment (MEPG)Builders work (MEPG)Total ( ) /m2%Total ( ) /m2%1,190,64079.853.54158,75210.650.47LTHW underfloor heating.BWIC.Heated towel rails within bathrooms.Preliminaries and contingenciesVentilation installations (MEPG)Total ( ) /m2%357,19223.961.06Total ( ) /m2%2,635,978176.787.83Main contractor preliminaries @ 12%.Whole house ventilation with heat recovery and boostfunction.Overheads and profit @ 5.00%.Electrical installations (MEPG)Post contract award novated fees — excluded.Total ( ) /m2%1,537,910103.144.57Tenants’ distribution board, meter etc.Protective installations (MEPG)2Total ( ) /m109,1427.32%0.32Sprinkler protection.Communication installations (MEPG)Total ( ) /m2%218,28414.640.65Fire alarm.Data/voice/TV outlets etc.Entry system.(MEPG) MEP GenerallyContractor risk transfer @ 2.5%.Contingency and design reserve @ 5.0%.Total fit-out worksTotal ( ) /m2%12,558,00084237.31

AECOM Cost model Modular construction April 2017 17External works and utilitiesExternal works – allowance for externalworksTotal ( ) /m2%750,00050.302.23Total ( ) /m2%417,00027.971.24UtilitiesWater infrastructure charges (160nr @ 350 per unit).Plus connection charge (item @ 30,000).Foul infrastructure charges (160nr @ 350 per unit).Plus connection charge (item @ 50,000).Electrical connection — no reinforcement (1nr @ 125,000).Fibre installation (item @ 100,000).Gas installations — excluded.Total modular cost modelTotal ( ) /m2%34,406,0002,307100

AECOM is built to deliver a better world. Wedesign, build, finance and operate infrastructureassets for governments, businesses andorganizations in more than 150 countries. Asa fully integrated firm, we connect knowledgeand experience across our global network ofexperts to help clients solve their most complexchallenges. From high-performance buildingsand infrastructure, to resilient communities andenvironments, to stable and secure nations,our work is transformative, differentiated andvital. A Fortune 500 firm, AECOM had revenueof approximately 17.4 billion during fiscal year2016. See how we deliver what others can onlyimagine at aecom.com and @AECOM.aecom.comLM00092 0517 v3.0

construction — bathroom pods, MEP elements, facades and the like — have helped larger, traditional schemes make time and cost savings. But wholesale adoption has been slow, held back in part by negative perceptions around quality and product lifespan. However, economies of scale seen as standard in manufacturing industries