Transcription

FREIGHTMATTERSINSIGHT INTO THE UK FREIGHT INDUSTRY'SKEY DATA, TRENDS AND ISSUES 2020

2020 EDITIONFREIGHT MATTERSFOREWORDFREIGHTMATTERSContact:Amidst all the devastation and heartachecaused by the coronavirus crisis a silverlining has emerged across a number ofsocietal behaviours, and legacies areforming that will have lasting impacts.Freight and logistics sector shares partof this silver-lining in that the profileof the sector has been elevated closerto its rightful place, and its importanceas an integral and indispensable part ofa healthy economy is now being betterrecognised. In operational terms, thesector benefited from quieter roadsand lower congestion and drivershave been able to maintain the mosteconomical speeds, reducing fuel useand associated pollutants — minorblessings on this front!Aside from the daily challenges ofrunning a busy transport operation andcoping with the pandemic, many freightbusinesses involved in internationalmovements have been gearing up formajor change once the Brexit transitionperiod finishes at the end of this year.Given the timing of this report — andthe fact that advice on procedures,documentation, licences and permitsis constantly being updated — we wantto wait until the dust has settled beforefurther analysing the impacts. As a result,the focus of this report falls elsewhere.On a personal level, one aspect from2020 truly stands out.Our sector’s success in keeping thecountry moving depended on thoseindividuals who turned up for workdespite difficult circumstances — andthe entire AECOM Freight and Logisticsteam feel that those efforts should berecognised. So, to those in ports andshipping who move 95 per cent of ourimports/exports; to those in the airindustry flying essential pharmaceuticals,medical supplies, perishable goods andvital parcels around the world; to those inthe rail freight sector moving consumergoods across the country; to those inroad freight delivering supermarketgoods, medical supplies and homedeliveries; and finally to those workingin warehousing, freight terminals andtransport office support functions, wewant to say a heartfelt thank you. In theface of immense challenges, you showedthe country that Freight Matters.Keyvan RahmatabadiDirector, Head of TransportationPlanning, UK and IrelandKeyvan RahmatabadiDirector, Head of TransportationPlanning, UK and Ireland, AECOM 44 (0)7879 437 335keyvan.rahmatabadi@aecom.com4610CORONAVIRUS: HOW FREIGHT HAS RISENTO THE CHALLENGEFREIGHT IN THE UKWAREHOUSING MATTERSThe freight sector supports awide range of industries and isintegral to the UK economy. Mostgoods and services bought andsold in the UK rely on the logisticssupply chain at some point.Warehousing is a practical andcost-effective method of storingand managing goods. It is a vitalpart of the overall freight andlogistics industry both here andacross the globe.162228THE ENVIRONMENT MATTERSROAD FREIGHT MATTERSRAIL FREIGHT MATTERSThe freight sector has anacknowledged impact on theenvironment, most obvious ofwhich is the greenhouse gasemissions produced from the useof fossil fuels to move goods.The road freight transportindustry is fast, reliable andhas the added convenience ofoffering door-to-door haulage.The rail freight industrytransports large quantities ofgoods over long distances,offering an alternative totransport by road.344046WATER FREIGHT MATTERSAIR FREIGHT MATTERSDATA SOURCESThe shipping industry in theUK encompasses the inlandwaterway network through to themegaships delivering thousandsof containers to major portsaround the country.The air freight industry ispredominately used to transportsmall high-value goods.List of data sources throughoutthis document.The global effects of thecoronavirus pandemic have beenmomentous and devastating, somuch so that in decades to comefuture generations and historiansmay look back on this period inthe same way that we think of thebubonic plague or the Great Fireof London.Authors:John HixHead of Freight and LogisticsAECOM UK and Irelandjohn.hix@aecom.com48Dr. Aida KaddoussaiPrincipal Consultant Freight andLogisticsAECOM UK and Irelandaida.kaddoussi@aecom.comAECOM is a global network ofexperts working with clients,communities and colleaguesto develop and implementinnovative solutions to the world’smost complex challenges.AECOM FREIGHT AND LOGISTICSSam Walker-SharpConsultant Freight and LogisticsAECOM UK and Irelandsam.walkersharp@aecom.comMatt WebbConsultant Freight and LogisticsAECOM UK and Irelandmatt.webb1@aecom.com2Cover image credit: Rafael de Campos,Pexels3

2020 EDITIONFREIGHT MATTERSCORONAVIRUS:HOW FREIGHT HAS RISEN TO THE CHALLENGEThe global effects of thecoronavirus pandemichave been momentous anddevastating, so much so thatin decades to come futuregenerations and historiansmay look back on this period in thesame way that we think of the bubonicplague or the Great Fire of London.Many people have been forced to stop,take stock and review their priorities.The same can be said of attitudestowards the freight and logisticssector. After the onset of widespreadlockdowns, the general public (andhopefully strategic planners as well)have become more aware that themovement of goods is essential formodern life as we know it. After all,if the freight industry and the widersupply chain had ceased working duringthe lockdowns, supermarket shelveswould have been unstocked, hospitalswould have run short of resourcesand tonnes of goods would haveremained undelivered.The effects of the pandemic onroad freight have been mixed — somesectors are suffering while someare thriving. Over 84 per cent ofrespondents to the Freight TransportAssociation’s Coronavirus LogisticsImpact survey reported ‘lack of work’as a barrier to getting back to normalwhen restrictions lift. Interestingly, thesurvey also found that operations areunable to provide work for all drivers,with firms reporting 14 per cent ofHGV drivers and seven per cent of vandrivers being furloughed.—1234564THE EFFECTS OFTHE PANDEMICON ROAD FREIGHTHAVE BEEN MIXED— SOME SECTORSARE SUFFERINGWHILE SOMEARE THRIVING.—Conversely, rise in demand forsupermarket home deliveries and onlineshopping has created thousands ofnew jobs in this sector, although a lackof delivery drivers both in the UK andoverseas may prove a barrier if demandincreases much more in the future. On apositive note however the lack of carson the roads during lockdown meantthat more truck deliveries were madeon-time each day1. This poses questionsas to how road policy can be configuredand what steps can be taken to allowthese benefits for freight to remain ascar traffic levels increase again, both atthe national strategic level and at thelast-mile stage of deliveries.According to industry publicationInternational Airport Review, global aircargo capacity fell by 35 per cent due tothe withdrawal of passenger serviceson some routes as a result of thepandemic2. The reduction in passengerservices also reduced overall belly holdcapacity by 75 per cent in April 2020compared to the previous year3. Someairlines, with ticket sales significantlydown, have converted passengeraircraft to freighters, with Emiratesalone using 70 passenger Boeing 777sin this manner4.Some of these aircraft have beenused on trips to and from locations suchas China to ferry Personal ProtectiveEquipment (PPE) back to the UK.This shift has thrown the freight andlogistics industry into the public eye ina way not often seen before and acts asa positive example of the global freightsector coming together to meet themost pressing of ights-for-freight-post-covid-19/Geoff ClarkeRegional Director,Freight and Logistics,AECOM, UK and IrelandRail freight operations havecontinued during the pandemic, withfreight trains proving a cost-effectiveand time-efficient way for supermarketsto keep the shelves stocked as much aspossible, especially with the onset ofpanic buying back in March. Speciallycommissioned express servicesdelivering critical medical supplies havealso played a vital part5. Interestingly,due to the decrease of passenger trafficand associated services, the punctualityof international freight trains hasimproved from around 60 per cent to80-90 per cent6. This, in a similar wayto road traffic, provides a glimpse intohow passenger and freight trains canpotentially interact more effectivelygoing forward, in particular withopening up new freight paths to allowgreater amounts of transportation byrail and prioritising freight to a greaterextent to enable faster journeys.The maritime sector moves around95 per cent of world cargo by volume7and has continued to do so throughoutthe pandemic. There were short-termspace issues at docks and in warehousesas freight forwarders tried to find spacefor the goods already in transit whereorders had been cancelled by strugglingindustries. A key issue has been shipsstuck at sea mid-voyage, often unableto dock because of bans on entry atborders especially in hard-hit areassuch as the USA and South America⁸.However, it was noteworthy howthe UK government classified crossborder freight workers as essential, andtherefore free from quarantine, thusexemplifying the importance of freightand the high esteem in which theindustry has been held.The coronavirus pandemic hasopened the eyes of many people tothe importance of freight and logisticsat all scales, whether it be the multinational organisations transportingPPE to the local ‘last mile’ deliveriesensuring people have been able to getfood and other necessities when theyhave really needed them. It is nowimportant that the freight and logisticsindustry uses this new-found exposureto its advantage, ensuring that theimportance of the industry is reflectedin future policy. Furthermore, itis important that freight remainsa priority for development andinvestment and does not get forgottenby both the public and the plannerswhen passenger numbers return to prepandemic levels again.—78910However, the biggest challengefor the freight industry for all modesmay be yet to come. The effectivedistribution of the vaccine againstcoronavirus has been described as being“one of the biggest logistical challengesin modern history”⁹. A single Boeing777 Freighter can carry around onemillion individual doses of a vaccine,meaning delivering double-doses tohalf the world’s population will requirespace in around 8,000 cargo planes10.This is not to mention the need forend-to-end cold chain distribution, aswell as the on-ground transport andthe challenge of getting a vaccine insuch numbers to the world’s poorestand hardest-to-reach areas, which isa great challenge for conventionalfreight, let alone potentially life-savingimmunisations. However, it is clearthat the freight industry has met thechallenges of the pandemic so far, andit remains to see how it is able to meetthe further challenges going forward.As we move into this next phase, theglobal spotlight will be firmly fixedon freight to ensure that the vaccineis delivered successfully. We mustnot disappoint.INTERESTINGLY, DUE TO THEDECREASE OF PASSENGER TRAFFICAND ASSOCIATED SERVICES, THEPUNCTUALITY OF INTERNATIONALFREIGHT TRAINS HAS IMPROVEDFROM AROUND 60 PER CENT TO80-90 PER t/uploads/system/uploads/attachment sea-predict-anarchy-not-sent-home-2020-7?r US&IR Tnovamedica.com/media/theme -a-vaccine5

2020 EDITIONFREIGHT MATTERSImage credit: Matt Webb, AECOMFREIGHTIN THE UKThe freight sector supports awide range of industries andis integral to the UK economy.Most goods and servicesbought and sold in the UK relyon the logistics supply chain atsome point. The performance of freightin the UK is measured on the amount ofgoods moved and lifted, alongside thevalue of freight to the UK economy, andthe number of workers in the industry.In 2018, 193 billion tonne-kilometres ofdomestic freight were lifted throughoutthe UK freight system¹, up two per centon the previous year.Fast forward to 2020 and theunprecedented impact of coronavirusand we see just how critical thesmooth functioning of freight acrossall the modes has been in keeping6the economy moving. Crucially, thehuge increase in online shopping haschanged the demand for goods andservices — and the freight sectoris expected to adapt². Most of thisdemand will be met by road freighttransport, which moves the majorityof domestic goods throughout the UK,followed by water and then rail³.Despite freight’s strategicimportance in the national picture, itis often overshadowed by passengertransport. Freight is often called the‘Cinderella industry’ as it operates inthe background without recognition.Coronavirus has brought freight tothe forefront as goods continue to bemoved and the industry continuesto grow with changing consumerbehaviour such as online vernment/uploads/system/uploads/attachment nment/uploads/system/uploads/attachment data/file/870647/tsgb-2019.pdf7

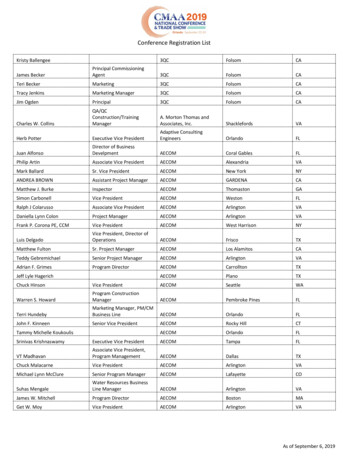

2020 EDITIONFREIGHT MATTERSFREIGHT IN THE UKIn 2017 the UK freight industrycomprised around 192,525 enterprises,employed 2.7 million people andcontributed an estimated 124 billionGross Value Added (GVA) to the UKeconomy. This figure includes 83million GVA from wholesale andcontributions from several other subsectors within the freight industry1.AIR 0.19 BILLION GVA(2017)In 2019, 75,901 tonnes of freightwere moved domestically by airWATER 3.9 BILLION GVA(2017)Water freight accounted for13 per cent of the UK’s freightmovements in 2018RAIL 0.40 BILLION GVA(2017)Rail freight accounted for 9 per centof the UK’s freight movementsin 2018WAREHOUSING 12.9 BILLION GVA(2017)England had 486 million squarefeet of warehouse space across allregions in 2019ROAD 23.4 BILLION GVA(2017)Road freight accounted for 78 percent of the UK’s freight movementsin 2018—The linked sources for these figures are listed in Sources, page 4689

2020 EDITIONFREIGHT MATTERSWAREHOUSINGMATTERSJARGON BUSTERDYNAMIC CAPACITYWarehousing is a practicaland cost-effective methodof storing and managinggoods. It is a vital partof the overall freight andlogistics industry bothhere and across the globe. The squarefootage of available warehousing spacevaries across the UK, as does thevariable costs of warehousing goods.One of the metrics for measuringwarehousing is based on the amountof goods that can be stored.Currently, there are severalchallenges facing the warehousingsector in the UK. There is an estimated486 million square feet of warehousingspace in the UK1, however significantregional imbalances exist. For example,warehousing capacity in Londonand the South East is 1.4 times larger10than the warehousing capacity of theWest Midlands and is significantlymore expensive when compared to thenational average2. Unless addressed,there is a danger that these imbalancesmay persist in the long term.Furthermore, there is a growingneed for greater investment in effectivewarehouse management systems, bothto increase operational efficiencies in ahighly-competitive market and to meetdemands set by increasingly-automatedand faster-paced delivery trends.Addressing these issues willensure that warehousing remains aneconomically viable part of the freightand logistics industry as the sectoradapts to the changes and challengesarising from both coronavirusand Britain’s departure from theEuropean Union.The amount of throughput a facilitycan handle, relating to commonlydemanded products. As theseitems are consistently picked,high selectivity is vital to maintaindynamic capacity levels.CROSS-DOCKINGThe action of unloading materialsfrom an incoming trailer or rail carand immediately loading thesematerials in outbound trailers or railcars, thus eliminating the need forwarehousing (storage).REPLENISHMENT CYCLE—12www.savills.co.uk/research 2019.pdf(calculated based on vacancy space and vacancy rate)See warehousing domestic statsThis refers to the time betweenorders of a specific item. It is mosteasily calculated by dividing the orderquantity by the annual demand andmultiplying by the number of daysin the year.11

2020 EDITIONFREIGHT MATTERSImage credit: Tiger Lily, PexelsWAREHOUSING:MORE THAN JUST STORAGEAsk someone to describea warehouse and they’llprobably mention row uponrow of shelving packed fullof packages, and forklifttrucks trundling aboutamongst men and women in hi-visjackets. By and large, it’s an accurateimage. However, warehousing isevolving — and fast. In this article wedescribe some of the trends shapingwarehouse design and industryprocesses, as well as challenges facingthe industry.deter potential employees withthe required skills from applying.There are several reasons for this.A role in warehousing is hard workand includes a lot of repeat processes,which can be off-putting especially forapplicants looking for variety in theirwork to keep them challenged andengaged. The sector needs to focus ondeveloping and supporting the careerdevelopment of existing employees,along with improved salary incentives,while also promoting these career pathsto potential new applicants.ADDRESSING THESKILLS SHORTAGETHE IMPORTANCEOF DATAThere is a critical skills shortage in thewarehousing industry. Applicants withthe required technical skills are notgravitating towards warehousing as acareer as the industry invests more intechnologies to improve efficiency¹.The running of a warehouse isdependent on a team of employeeswith the computer literacy andproblem-solving skills needed tomanage the goods flowing in andout. When vacancies arise however,employers tend to hire applicants thathave both the necessary skill sets, aswell as prior experience. For example,knowledge of automated warehousingsystems is often a requirement, butthat experience is difficult to comeby for someone who has not alreadyworked in the industry. As an industry,we need to find ways of bridging thatskills gap by offering apprenticeshipsor better training.Crucially, negative perceptionsaround working in warehousingare also hugely problematic as theyData continues to be a hot topic inthe freight and logistics industry asit gives us a better understanding ofindustry trends and can inform businessdecisions based on customer needs— and warehousing is no exception.Questions such as how data can begathered, how it can it be analysedand how can it be used to improveefficiencies are at the forefront of thedebate as technology evolves.Technology moves quickly to meetdemand. Forty years ago, the widespreadroll-out of barcode technology wasa key enabler — products could befound easily and inventory recordsbecame far more accurate².Nowadays, that technology hasnow evolved into Radio FrequencyIdentification (RFID) where productsfitted with RFID tags are identifiedwirelessly, accurately and — crucially— quickly, resulting in significantlyfaster flow.—1212THE RISE OFAUTOMATIONIN TODAY’SMARKET, THEFOCUS IS ONLEVERAGINGDATA TO PROVIDEAS MUCHINFORMATIONAS POSSIBLE.—Scott MillardSenior Consultant,Freight and Logistics,AECOM, UK and IrelandAutomation is revolutionising theway warehouses operate. Many ofthe repetitive tasks involved inwarehousing can be automated,plugging the gap in the labour market.Automated vehicles can load andunload goods from vehicles and thenstack them on to the shelves. In aprocess known as automated picking, amachine can grab several products andpack goods onto a pallet which can thenbe automatically labelled and scannedby another robot.Amazon uses a lot of automationin their warehouses — autonomousvehicles transport goods to pickingstations in a determined sequence (toallow for maximum efficiency) whichare then labelled and transported totheir destinations³.The use of automation has positiveimplications for warehouse designas space, such as the full height ofa building, can be fully optimised.Ocado’s hive/grid fulfilment system,which uses autonomous vehicles, is amodular system that can be adapted tothe specific dimensions of a warehouseto maximise the use of space⁴.LOCATION MATTERSChanges to consumer behaviour areinfluencing the location of warehouses.As demand comes primarily fromurban areas, goods need to be closeto city centres so that operators andretailers can fulfil next day deliveryexpectations. For example, warehousespecialists SEGRO recently acquired anurban warehouse in Perivale Park, WestLondon which benefits from excellentmain road and public transportconnections⁵ for the movement ofgoods and staff. The challenge isgetting the balance right between theadditional rental cost of buildings inurban areas and the flow of goods tocustomers. In these cases, automationmay offset additional rental costs byreducing outgoings.In today’s market, the focus is onleveraging data to provide as muchinformation as possible. As an example,consumers expect next-day deliveryas well as accurate data regardingproduct availability. The challengefor traditional warehouses is howthey enable data gathering to improvethe customer experience and therequirements to do so. It can beexpensive to invest in necessarytechnology and automation. Staff alsoneed to possess the necessary datacollection skills.Warehousing management systemsprovide real-time data to both thewarehouse and to the customer aboutthe availability of products, andthe movement of goods within thesystem. A typical example is the abilityto track (through an app and emailnotifications) the location of a parcelfrom purchase to -ocado-andover-amazon (2018 — Welcome to the automated warehouse of the 06-2020?sc lang en13

2020 EDITIONFREIGHT MATTERSWAREHOUSING BY REGION 2019EAST MIDLANDSWarehousing space (square footage per capita)The least populated region, with4.8 MILLION peopleWEST MIDLANDS99 MILLION square feet of5.9 MILLIONwarehouse space, second only toLondon and the South Eastpeople81 MILLIONsquare feet of warehouse spaceLONDON AND THE SOUTH EASTOVER 10%vacancy rate, the highest of all regions18 MILLIONpeople111 MILLIONTHE GOLDEN TRIANGLEsquare feet of warehouse spaceA key warehousing areawith high accessibilityThe national average costs are up to2.3 TIMESSquare feet per capitaWAREHOUSING COSTLess than 5Grade A warehousing rent ( per square foot)5–10East of England10–12Yorkshire and the North East12–15North WestMore than 15East MidlandsWest MidlandsSouth WestSouth EastDEVELOPMENT PIPELINEH1 2019 compared to H1 2018East Midlands, WestMidlands, London and theSouth EastNorth West, South West,East of England, Yorkshireand the North EastTotal development:Total development:5.11 MILLION sq ft1.13 MILLION sq ftLondon 0.00 5.00 10.00 15.00 20.00—The linked sources for these figures are listed in Sources, page 461415

2020 EDITIONFREIGHT MATTERSImage credit: DronePics.Wales - CC-BY 4.0THE ENVIRONMENTMATTERSJARGON BUSTERALTERNATIVE FUELSLow-polluting fuels which areused to propel a vehicle insteadof high-sulphur diesel or gasoline.They include methanol, ethanol,propane or compressed natural gas,liquid natural gas, low-sulphur or‘clean’ diesel and electricity.CARBON FOOTPRINTThe freight sector has anacknowledged impact on theenvironment, most obviousof which is the greenhousegas emissions producedfrom the use of fossil fuels tomove goods. The wider impacts aremeasured by the type and amount offuel being used, which includes the useof renewable energy sources, alongsidethe amount of the greenhouse gases16produced. In 2019 transport in theUK accounted for a third (34 percent) of all carbon dioxide emissions,with the large majority coming fromroad transport1.To reduce emissions and mitigateagainst the effects of climate change,the entire sector is actively lookingat new technologies, greener fuelsand industry best practice includingemission targets.The amount of carbon dioxidereleased into the atmosphereas a result of the activities of aparticular individual, organisation,or community.ENVIRONMENTAL MANAGEMENTLEADING ent/uploads/system/uploads/attachment data/file/875485/2019 UK greenhouse gas emissions provisional figures statistical release.pdfA set of procedures and techniquesenabling an organisation to reduceenvironmental impacts and helpincrease its operating efficiency.17

2020 EDITIONFREIGHT MATTERSImage credit: Matt Webb, AECOMDECARBONISATION:HOW FREIGHT IS LEADING THE WAYThe transport sector is amajor contributor to climatechange — in 2018 it accountedfor over 24 per cent ofglobal CO2 emissions fromfuel combustion1. Whileindividual freight modes — rail, air,road and water — have committedto decarbonisation, the sector asa whole is playing catch up withothers such as the UK energy sector,which has reduced its reliance onfossil fuels through the adoptionof solar, hydro and wind powertechnologies leading to a 68 per centreduction in CO2 emissions since1990². So, what action is the freightindustry taking to accelerate progresstowards decarbonisation?RAIL FREIGHTRail freight is a low-carbon formof transporting goods, producing76 per cent less CO2 emissionsthan HGVs for the equivalentjourney3. Nevertheless, in 2019,independent advisory body theNational Infrastructure Commissionrecommended that the UK governmentshould publish within the next twoyears a full strategy for rail freight toreach zero emissions by 20504.Numerous initiatives exist todevelop ways of lowering emissions.An example is the Rail Safety andStandards Board (RSSB) IntelligentPower Solutions to Decarbonise Railcompetition in which six winnerswere awarded a share of 1 millionto develop decarbonisation projects.—1234518One of the winning projects — acollaboration between low-carbontechnology company G-volution andGB Railfreight, Network Rail, LoramUK, Colas Rail Freight, Europhoenixand Deutsche Bahn — demonstratedto rail freight operators the benefitsand the feasibility of adopting dual fuelengines as a way to decarbonise theiroperations, with a particular focus onType 3 locomotives which comprise10 per cent of the UK’s fleet andType 5 locomotives which comprise72 per cent of the UK’s fleet.ROAD FREIGHTFurthermore, the planes used totransport freight are generallyolder and more polluting.The International Transport Forum(ITF) predicts that more emissions willbe produced from air freight cargo thanpassengers by 2050⁶. The air industryhas set goals of achieving carbonneutral growth by 2020 meaning thatCO2 levels will remain the same levelpost-2020 and aims to reduce airfreight’s net emissions by 50 per centby 2050.As ways of measuring air cargo’scarbon footprint become moreaccurate, processes are being putin place to meet reduction targets.For example, reducing weight onboard can reduce fuel consumption.In addition, operators are developingstrategies to modernise fleets anduse biofuels⁷.10%Type 3 locomotivesof UK's fleet.72%WATER FREIGHTInternational shipping accountsfor approximately 3.1 per cent ofannual global CO2 emissions⁸.The International MaritimeOrganization (IMO) expects this torise to 10 per cent by 2050 based oncurrent practice.In 2018 the IMO agreed on aninitial greenhouse gas strategy whichsignalled a shift for the shippingindustry. This landmark strategy setsout a timeline alongside key goals totackle decarbonisation — a 50 per centreduction of total annual greenhousegas emissions from internationalshipping by 2050 (compared to 2008),and an additional call to further effortsto phase them out entirely by as soonas possible.50%Reduction of totalannual greenhousegas emissionsfrom internationalshipping by 2050.Notably, the IMO is the onlyorganisation to have adopted energyefficiency measures that are legallybinding across an entire global industry,applying to all countries.Shipping and cargo companies arestepping up to the challenge. In 2018,Maersk set a target of achieving netzero operational carbon emissions by2050 and has committed to introducingzero carbon emission vessels by2030. To achieve this, the company isdeveloping new carbon-neutral fuels,as well as new technologies such asharnessing wind power to propeltheir vessels.Raj SharmaPrincipal Consultant,Freight and Logistics,AECOM, UK and IrelandType 5 locomotivesof UK's fleet.In the context of decarbonisation, mostpeople outside the industry usuallyconsider the impacts of road freight tobe the greatest (alongside air freight) —and they would be correct. Accordingto the Organisation for Economic Cooperation and Development's (OECD)International Transport Forum, HGVsare the fastest growing source of globaloil demand, accounting for 40 per centof oil demand growth by 2050 and 15per cent of the projected increase inglobal CO2 emissions5.This is largely due to increased demandand usage from countries such asIndia and China.In the UK, the government isredu

AIR FREIGHT MATTERS The air freight industry is predominately used to transport small high-value goods. 46 DATA SOURCES List of data sources throughout this document. 48 AECOM FREIGHT AND LOGISTICS AECOM is a global network of experts working with clients, communities and colleagues to develop and implement innovative solutions to the world's