Transcription

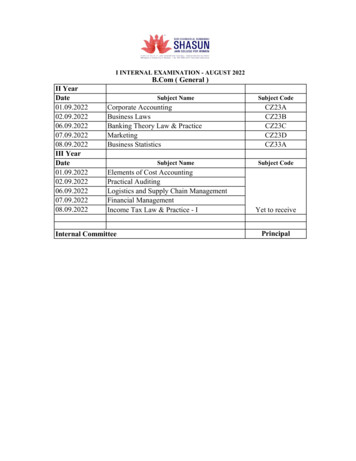

The State StreetFloating Rate FundThe State Street Floating Rate Fund isa portfolio of high quality, Australian,interest-bearing investments which aimsto preserve your capital while deliveringmonthly income.The portfolio of investment grade assetsaims to generate a yield above theReserve Bank of Australia (RBA) CashRate Total Return Index (TRI).Product ProfileFixed IncomeMay 2022Product ObjectiveThe actively managed floating rate note fund may aidAustralian investors with their growing income needs at acompetitive fee of 0.25% p.a. The State Street Floating RateFund has a ‘floating’ interest rate profile, adjusting to futureReserve Bank of Australia (RBA) rate changes.Fund Facts — State Street Floating Rate Fund 1Return Target 2RBA Cash Rate TRI 1.0%–1.5%over a rolling three-year periodbefore feesInception18 October 2017Management Costs0.25%Buy/Sell Spread0%/0.03%Minimum Initial InvestmentAUD 25,000PricingDailyDistribution FrequencyMonthlyAPIR CodeSST4725AUARSN Code618 268 8211 As of 31 March 2022.2 There is no guarantee that this objective will be met.Source: State Street Global Advisors.The Fund invests in interest-bearing securities of high creditquality. Supported by an extensive global credit researcheffort, the Fund holds a diversified portfolio of highly liquidfixed income instruments issued in AUD. The Fund’s mandateallows for a minimum average credit rating of BBB . TheFund also aims to avoid exposure to companies that scoreunfavourably on financially material sustainability issuesrelative to their industry peers, as well as performanceagainst market specific corporate governance codes.The transparent, simple and conservative approach ofthis product aims to preserve your investment whilst alsodistributing attractive income on a monthly basis.1

As one of the world’s dominant players in the global bond,cash and repurchase agreement markets, we have uniqueinsights into market liquidity and positioning across fixedincome segments. As markets restructure, and liquidityis increasingly challenged: Our portfolio managers have deep visibility into liquiditytrends, helping them to build more robust portfolios We use the strength and scale of our relationships withtrading counterparties to continuously help improveaccess to liquidity.Investment ProcessThe Australian based Portfolio Managers are ultimatelyresponsible for the investment strategy. The PortfolioManagers make relative value trading decisions and evaluatethe size of investments relative to market liquidity tominimise market impact.Our conservative cash credit approach aims to preserveand protect your investment, and is reinforced by SSGA’sdedicated cash credit research team, one of the largest andmost experienced in the industry. Significant credit analysisis undertaken on each issuer and security to determinewhether they meet the Fund’s investment criteria.Investment PhilosophyThe investment approach of the Fund is to retain principaland provide daily liquidity by investing in a set of high qualitydiversified securities using active portfolio management. Preservation of Principal Aims to ensure preservationof principal, we create diversified portfolios that have highcredit quality and short interest rate duration. Liquidity To help provide daily liquidity, we havestructured a short duration portfolio designed toaccommodate client cash flows.These two fundamentals work together to provide anattractive enhanced cash return. While many market factorscontribute to return outcomes, our large and experiencedglobal credit research team use a broad range of tools toconduct fundamental credit research. This ensures thatthe Fund can add value in a conservative manner whilst alsomanaging the risks.How the Portfolio is Managed, Investment Process for the State Street Floating Rate FundGlobal ent RiskManagementComplianceProduct DesignCredit Analysis

Fixed Income May 2022 The State Street Floating Rate Fund Product Objective The actively managed floating rate note fund may aid Australian investors with their growing income needs at a competitive fee of 0.25% p.a. The State Street Floating Rate Fund has a 'floating' interest rate profile, adjusting to future