Transcription

FP CANADA STANDARDSCOUNCILTM COMPETENCYPROFILE

Published by FP Canada Disclaimer:FP Canada does not provide professional financial planning services, legal services, orother expert advisory services. If such services are required, a professional who iscompetent in the required field should be engaged. This publication is distributed withthe understanding that the creators and developers of the work are not responsiblefor any actions taken based on the information contained in the work. The publisher,the creators, and the developers of the work expressly disclaim all and any liability toany person in respect to the whole or any part of the publication. 2019 FP Canada All rights reserved. No part of this work may be reproduced or copied in any form or byany means—graphic, electronic or mechanical, including photocopying, recording,taping, scanning, or other information and retrieval systems—without the writtenpermission of the publisher.FP Canada Competency Profile Version 3.0FP Canada902-375 University Avenue Toronto, Ontario M5G 2J5fpcanada.ca

TABLE OF CONTENTSIntroduction. 3Development and Application of the Competency Profile . 5Structure of the Competency Profile. 6Elements of Competency . 10Fundamental Financial Planning Practices . 12Financial Management . 17Investment Planning . 23Insurance and Risk Management . 29Tax Planning. 34Retirement Planning . 39Estate Planning and Legal Aspects . 44Professional Skills . 51Critical Thinking Skills . 52Interpersonal and Relationship Skills . 55Communication Skills . 60Teamwork and Collaboration Skills . 63Glossary . 66

IntroductionAbout Financial PlanningFP Canada defines financial planning as a disciplined, multi-step process of assessing anindividual’s current financial and personal circumstances against an individual’s future desiredstate, and developing strategies that help meet personal goals, needs, and priorities by optimizingthe allocation of financial resources. Financial planning takes into account the interrelationshipsamong relevant financial planning areas in formulating appropriate strategies.Financial planning areas include financial management, investment planning, insurance and riskmanagement, retirement planning, tax planning, estate planning, and legal aspects. Financialplanning is an ongoing process involving regular monitoring of an individual’s progress towardmeeting personal goals, needs, and priorities, a re-evaluation of financial strategies in place andrecommended revisions, where and when necessary.FP CanadaAs a standards-setting and certification body working in the public interest, FP Canada’s purposeis to drive value and instill confidence in financial planning. FP Canada ensures those it certifies(CERTIFIED FINANCIAL PLANNER professionals and QUALIFIED ASSOCIATE FINANCIAL PLANNER professionals)meet appropriate standards of competence and professionalism through rigorous requirements ofeducation, examination, experience and ethics.CFP CertificationCFP certification is the most widely recognized financial planning designation in the Canada andthroughout the world and is considered the standard for the financial planning profession. Thereare 16,500 CERTIFIED FINANCIAL PLANNER professional across Canada, part of an international networkof more than 181,000 CFP professionals in 26 territories around the world.To qualify for CFP certification, candidates must have successfully completed an FP CanadaApproved Core Curriculum education program, FP Canada Institute Introduction to ProfessionalEthics an FP Canada-Approved Advanced Curriculum program, the FP Canada Institute CFPProfessional Education Program , and the CFP examination, as well as having completed threeyears of relevant work experience.Page 3

QAFP CertificationWhile CFP professionals have demonstrated the knowledge, skills and abilities to provide financialplanning solutions at all levels of complexity, QAFP professionals are equipped to provide financialplanning strategies and solutions for clients who have less complex financial planning needs. QAFPprofessionals are required to attest to the same standard of care, ethics and loyalty as CFPprofessionals, and have a continuing education requirement to ensure that competence ismaintained and continues to grow.To qualify for QAFP certification, candidates must have successfully completed an FP CanadaApproved Core Curriculum education program, FP Canada Institute Introduction to ProfessionalEthics, and the QAFP examination, as well as having completed one year of relevant workexperience. QAFP professionals must them successfully complete the FP Canada Institute QAFPProfessional Education Program within one year of QAFP certification.Note that throughout the FP Canada Standards Council Competency Profile,“CFP professionals and QAFP professionals” are referred to as “FP Canadacertificants”. Information in this document applies to both certifications.A Commitment to the Highest Standards of ExcellenceA client’s financial planning needs may encompass multiple goals and considerations, requiringproficiency in many areas. FP Canada certificants are skilled in providing financial planning in thecontext of the client’s entire personal and financial picture— addressing both today’s and futureneeds—while adhering to the principles and standards set out by FP Canada. These abilities andobligations distinguish FP Canada certificants from other providers of financial advice.The most fundamental of these obligations is adherence to the FP Canada Standards Council Codeof Ethics and FP Canada Standards Council Rules of Conduct included in the FP Canada StandardsCouncil Standards of Professional Responsibility, which provide an ethical standard to be expectedby clients and specific guidance to the FP Canada certificants. The FP Canada Standards CouncilFitness Standards lay out FP Canada’s character expectations for FP Canada certificants, to protectthe integrity of the profession and clients alike.Furthermore, because their work with clients can vary in terms of level of complexity and involvethe integration of many financial planning elements, FP Canada certificants are expected to followlogical, defined processes in order to perform their duties effectively. The FP Canada StandardsCouncil Practice Standards delineate these processes.FP Canada certificants may need to adapt their practices to the needs of their clients andemployers. Therefore, it is essential that they have a set of skills and abilities that allows them toperform effectively in any situation. These fundamental, common functions of the profession helpFP Canada certificants (and other stakeholders) establish expectations and measure success.These functions also form the basis of the FP Canada Standards Council Competency Profile(hereinafter referred to as the Competency Profile).Page 4

Development and Application of the Competency ProfileThe Competency Profile is based on FP Canada’s comprehensive analysis of the financial planningprofession. Version 3.0 is founded on the previous version of the Competency Profile released byFP Canada (formerly Financial Planning Standards Council) in 2011, the global Financial PlannerCompetency Profile released by Financial Planning Standards Board Ltd. in 2015, and considerableinput from industry.Every five years, FP Canada Standards Council revalidates the Competency Profile to ensure itcontinues to be relevant to the financial planning profession, representative of the competenciesand skills that Canadians require and an accurate reflection of the demands related to the practiceof financial planning. To complete Version 3.0, a national task force of CFP professionals andindustry representatives was struck to refine and update language, identify new or evolvingcompetencies, address unnecessary competencies and update the definition and statementsspecific to the professional skills required for the practice of financial planning. The work of thistask force was validated through a survey of FP Canada certificants, educators and industryrepresentatives to confirm its relevance, currency and accuracy.The Competency Profile reflects what FP Canada certificants do today and the expectations for theprofession over the next several years. It sets the bar for those aspiring to become FP Canadacertificants in the future; as such, it is intended to lead the profession, not follow it.The Competency Profile identifies the core knowledge, skills and abilities required for competentfinancial practice, and thus sets out the value proposition of financial planning. It is not anexhaustive list of every element possible in every variation of practice, but rather it outlines whatFP Canada certificants actually do.The Competency Profile has four direct applications for FP Canada: examination blueprints, Coreand Advanced Curriculum education, work experience evaluation and Continuing Educationrequirements. Although other possible applications of the Competency Profile may be significant,these four applications are most relevant to ongoing FP Canada activities.FP Canada certificants can use the Competency Profile to validate their skills and abilities andarticulate their value to clients, employers and other stakeholders. It also serves as the sourcedocument to help determine their appropriate continuous professional development.Candidates for certification can use the Competency Profile to understand the scope ofcompetence required for the examination components of CFP certification and QAFP certification.Specifically, the Competency Profile is the foundation for the blueprints of each of FP Canada’scertification examinations. The Competency Profile serves as the primary measure of what willqualify as acceptable under the work experience requirement for CFP certification and QAFPcertification.Page 5

Education providers can use the Competency Profile to guide the development of financialplanning curricula to ensure their students acquire the knowledge, skills and abilities they willneed to be effective, competent and prepared for employment and the practice of financialplanning. FP Canada Institute uses the Competency Profile to determine which educationprograms meet FP Canada’s Core and Advanced Curriculum requirements.Employers can use the Competency Profile to better understand the value and importance ofhiring FP Canada certificants and to appreciate the knowledge, skills and abilities that FP Canadacertificants bring.Canadian consumers can use the Competency Profile to better understand the value propositionof financial planning and the role that FP Canada certificants can play in helping them meet theirlife goals. The Competency Profile also provides the public with a summary of the areas ofplanning that FP Canada certificants can address.Structure of the Competency ProfileWhat is a “Competency”?The ability to perform a particular job function is called a “competency”. However, a competencyis not simply a job-related task. It also includes the integrated application of knowledge, skills,attitudes and judgments required to perform key functions of the job at an expected level.The Competency Profile has been created to help describe competencies that define expectationsfor FP Canada certificants. Competencies are the focal point of FP Canada certificants’ underlyingskills and knowledge. In addition to adhering to standards of professional responsibility, FPCanada certificants’ fulfillment of these competencies will be one of the most importantdeterminants of their clients’ financial planning experiences.Competencies are a combination of: Activities – the “functional” elements of a competency or the drivers of actualtasks performed as FP Canada certificants move through the financial planningprocess; and Skills and technical knowledge – the “foundational” elements of a competencythat include the behaviours and required knowledge that support achievementof the financial planning tasks.By defining competencies in this way, we recognize the importance of the underlying elements,while acknowledging that FP Canada certificants must combine these elements effectively in orderto apply a particular competency in practice.Page 6

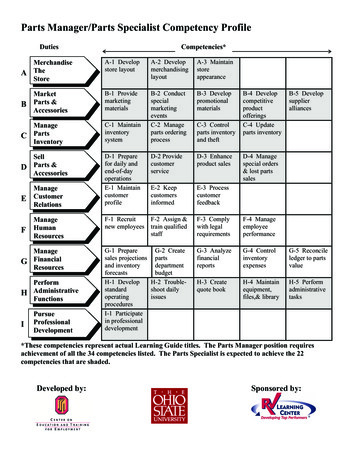

Functional Drivers of CompetenciesThe functional drivers of the competencies consist of two major elements: Financial Planning Areas: Outline the areas of focus in which FP Canadacertificants will address different client goals and financial issues Financial Planning Functions: Outline the more broadly defined, general activitiescommon to all financial planning areasFinancial Planning AreasThe following six areas, together with Fundamental Financial Planning Practices, comprise thewhole of financial planning competencies: financial management investment planning insurance and risk management tax planning retirement planning estate planning and legal aspectsIn reviewing the Competency Profile, it is important to recognize that although manycompetencies could appear under multiple areas, each statement of competency is assigned tothe most representative area within a particular function and appears only once. For example, acompetency that appears as an element within Collection in Estate Planning may also be relevantto Collection for Insurance and Risk Management.The practice of financial planning is integrative in nature—one area cannot be considered inisolation. Within any single Financial Planning Area, FP Canada certificants will assess overlappingstatements of competency from other areas. It is the diligence expected of them to address allrelevant statements of competency, as appropriate, in working with any financial planningengagement.Fundamental Financial Planning Practices represent general competencies that are pervasiveacross all financial planning areas. These competencies relate to the integration andinterrelationships among the financial planning areas. With every client engagement, theFundamental Financial Planning Practices are essential building blocks to which FP Canadacertificants will add from the other areas depending on the details of the engagement.Page 7

Financial Planning FunctionsAt the most general level, financial planning consists of three basic functions:1. CollectionGathers the client’s information: Gathering both quantitative and qualitative information Identifying relevant facts and documentation Preparing and organizing information in a way that allows for appropriateanalysis2. AnalysisAssesses the client’s situation and identifies and evaluates appropriate strategies: Identifying issues and opportunities Performing required calculations Developing projections Preparing and assessing the resulting information to identify and evaluateappropriate strategies3. RecommendationDevelops recommendations to help optimize the client’s situation: Developing recommendations, in order of priority, that help meet theclient’s personal goals, needs and prioritiesProfessional SkillsProfessional skills describe the ability to act in a manner that is constructive, collaborative andresponsive to the needs of clients and colleagues. They are a key foundational element to theapplication of financial planning competencies. Professional skills refer to the non-technicalcompetencies expected of members of a profession. They describe how FP Canada certificants areexpected to behave and interact with clients and others, and are inherent to being a competentfinancial planning professional. They are transferable competencies that apply to most situationsand, in fact, most professions. Professional skills are categorized as follows: critical thinking skills interpersonal and relationship skills communication skills teamwork and collaboration skillsProfessional skills separate qualified financial planners from others in the financial servicesindustry and form the foundation for financial planning as a profession.Page 8

Technical Knowledge: Financial Planning Body of Knowledge (FP-BoK)The Financial Planning Body of Knowledge (FP-BoK) describes the knowledge expected of FPCanada certificants in 12 technical topic areas:1. financial planning profession and financialservices industry regulation2. financial analysis3. credit and debt4. registered retirement plans5. government benefit plans6. registered education and disability plans7. economics8. investments9. taxation10. law11. insurance12. human behaviourAs a key foundational support to the demonstration of financial planning competence, the FP-BoKprovides the underpinning for the Competency Profile. It is essential for demonstratingcompetence in the fundamental financial planning practices and financial planning areas offinancial management, investment planning, retirement planning, tax planning, insurance and riskmanagement, estate planning and legal aspects. Knowledge around human behaviour, decisionmaking and relationships is important for the demonstration of professional skills. Withoutappropriate levels of knowledge, the competencies cannot be demonstrated.By cataloguing the knowledge expected of FP Canada certificants, the FP-BoK builds on theCanadian Financial Planning Definitions, Standards and Competencies to further define the holisticnature and scope of financial planning for the benefit of the Canadian public, educators, students,industry firms and financial planning professionals.Access the FP-BoK at fpcanada.ca/bokPage 9

Elements of CompetencyA competency is the application and integration of knowledge, skills, attitudes and judgments thatallow FP Canada certificants to perform specific job functions. At the basis of competencies arethe processes and methods that FP Canada certificants use to complete the day-to-dayrequirements of financial planning.The tables on pages 10–36 list the elements of competency associated with each financialplanning area and the fundamental financial planning practices. Each table also provides a briefdescription of the elements of competency and examples of how FP Canada certificants may applythem. The descriptions and examples are not intended to provide full details on the elements ofcompetency. They are not taken to be exhaustive or prescriptive, but rather serve as guidance forthose seeking greater clarity on the intent of each competency statement.Please note that in keeping with the FP Canada Standards Council Rules of Conduct, FP Canadacertificants shall perform financial planning in accordance with applicable laws, regulations, rules orestablished policies of government agencies and other applicable authorities, including FP Canada.The accompanying diagram is a graphic representation. It illustrates the concept that in allfinancial planning areas, elements of competency are the focal point, the summative result ofFP Canada certificants’ performance of financial planning functions, professional skills anddemonstration of their technical knowledge.Page 10

Page 11

Fundamental Financial Planning PracticesApplying the fundamental financial planning practices in preparing a financial plan for a client relatesto the integration and interrelationships among the six financial planning areas. These practices are keyto providing a thorough plan that details the impact that recommendations will have on each planningarea. Using the practices enables FP Canada certificants to assess the client’s entire position anddevelop a comprehensive financial plan, providing recommendations that work in concert with all ofthe financial planning areas. In order to provide meaningful advice and planning,FP Canada certificantsmust be aware of all of the client’s goals and objectives, understand the overlap and interdependencyof the planning areas, recognize the gaps, constraints and opportunities present in the client’ssituation, recommend appropriate financial strategies, and establish planning priorities that meet theclient’s needs and optimize the client’s overall financial situation.11.001Identifies client’sobjectives, needs,values, andexpectations that havefinancial implications1.002Determines client’scomfort with financialplanning assumptionsCollection:Gathers and prepares the client’s informationFP Canada certificants gather information about the client’squantitative financial goals, as well as other relevant qualitativeconsiderations, such as the client’s attitudes about financial planning.Issues regarding family, business or other matters can have financialimplications. For example, FP Canada certificants may learn about theclient’s general tendency to be cautious when making decisions, theimportance of providing for a child with special needs or concernsabout the protection of business interests. The client’s behaviours,objectives and concerns will have an impact on the financial planningto be done.FP Canada certificants discuss with the client the understanding andcomfort with the financial planning assumptions used in the plan. Inpreparing retirement projections for the client, financial planningassumptions can include a review of the rate of return to be earnedon assets, the rate of interest to be charged on debt or the client’santicipated life expectancy.FP Canada certificants discuss all of the assumptions used, theirrelevance and implications to ensure the client understands andagrees to their use in the preparation of the financial plan.Page 12

1.003Identifies informationand documentationrequired to preparethe financial plan1.004Identifies client’s legalissues that affect thefinancial plan1.005Determines client’slevel of financialsophistication1.006Identifies materialchanges in client’spersonal and financialsituationPage 13FP Canada certificants know what information is needed, and are ableto identify the specific client material necessary to prepare thefinancial plan. The required information and documentation caninclude information and corresponding statements for assets andliabilities and for current and projected income and expenseamounts, copies of the client’s will, power of attorney, income taxfilings and business and other agreements. FP Canada certificantsmay request other supporting documentation that has not alreadybeen provided, and may provide guidance to the client aboutobtaining documents that may not be immediately available.FP Canada certificants recognize legal situations that will have afinancial impact on the client. Current and potential legal issues, suchas the client’s citizenship and family status (whether single, married,common-law, separated or divorced) may affect the client’s financialposition. Other legal issues may relate to spousal and child supportobligations or entitlements, outdated or invalid wills, an ongoingincome tax audit or any other legal proceedings that impact theclient’s achievement of the financial goals.FP Canada certificants discern the client’s level of knowledgeregarding financial matters. If the client has had a financial plandeveloped previously, FP Canada certificants will understand theclient’s familiarity with and expectations of financial planning. FPCanada certificants may also review current plans in place to achievethe client’s goals. A client who has a well structured investment andretirement plan and a family trust set up to benefit children may beconsidered to have some experience and understanding in financialmatters, and a higher level of financial sophistication.FP Canada certificants recognize the changes in the client’s life thatwill impact the financial planning. Material changes in the client’spersonal and financial situation can include changes in marital status,starting a family, losing one’s employment, venturing into a newbusiness, receiving an inheritance or experiencing health issues.These examples of changes will all have an impact on the client’sfinancial situation and can affect the achievement of the financialgoals.

1.007Determinescompleteness ofinformation to enableanalysis22.001Analyzes collectedinformation toprioritize the financialplanning areas2.002Considersinterrelationshipsamong financialplanning areasPage 14FP Canada certificants establish if all of the required information hasbeen provided before analysis begins. Organizing and reviewing thecollected information ensures all details are known and complete inorder to prepare an accurate and relevant analysis. For instance, inpreparing a statement of investment holdings, FP Canada certificantswill need to know whether the investments are held in a nonregistered or registered account, their adjusted cost base, fair marketvalue, interest or dividend payments, accrued gain or loss positionand any other relevant details.Analysis:Assesses the client’s situation and identifies and evaluates appropriatestrategiesFP Canada certificants determine the financial planning areas that area priority and should be addressed first by the client. A detailedanalysis of the information collected helps establish the priority ofeach financial area relative to the overall plan. For example, FPCanada certificants may prioritize risk management and estateplanning for a client who has a young family with significantprotection needs, but has no insurance or a valid will in place.FP Canada certificants recognize the integrative nature of financialplanning and how recommendations in one financial planning areawill have an impact in other financial planning areas. For instance,when FP Canada certificants work with a high-income client whowants to make retirement planning a priority, they can determine theefficient allocation of the client’s surplus cash flow to registeredplans, including the client’s and spouse’s respective RRSPs and TFSAs(retirement planning). In terms of contributions to the client’s lowerincome spouse’s RRSP and TFSA, FP Canada certificants considerincome splitting and tax saving opportunities (tax planning). FPCanada certificants then ensure that registered contributions areinvested in line with the client’s and spouse’s respective investmentobjectives and risk tolerance (investment planning).

2.003Assesses opportunitiesand constraints acrossfinancial planning reas2.004Considers impact ofeconomic, politicaland regulatoryenvironments2.005Assesses costs andbenefits of competingalternatives acrossfinancial planningareas2.006Measures progresstoward achievementof objectives of thefinancial planPage 15FP Canada certificants review and evaluate the client’s financialposition across all of the financial planning areas. Assessing areas ofopportunity and constraint helps determine where the client’scurrent resources and plans may help or hinder the achievement offinancial goals. For example, a client’s family circumstances may havechanged due to divorce or remarriage. In reviewing the client’s estateplanning objectives, a new will may need to be drafted (estateplanning) to provide for dependants and family members, lifeinsurance may be required to fund any required support obligations(risk management) and cash flow requirements may need to beadjusted to fund the cost of additional life insurance premiums(financial management).FP Canada certificants recognize and consider how the economy, thepolitical landscape and regulatory requirements will impact theclient’s financial plan. These environments can include mattersrelevant to Canada, as well as international issues and situations.Economic, political and regulatory factors may guide or limit theclient’s financial planning options. When preparing retirementprojections for a client, the impact of inflation on the client’santicipated retirement living costs, as well as investment returns,needs to be calculated in order to assess the client’s ability to fundretirement and meet objectives.FP Canada certificants evaluate the advantages and disadvantages ofcompeting planning options available to the client from all planningareas. FP Canada certificants may need to advise the client who wantsto pay down a mortgage or fund an RRSP for retirement on the bestuse of surplus cash flow. As part of this assessment, FP Canadacertificants would include

Competency Profile The Competency Profile is based on FP Canada's comprehensive analysis of the financial planning profession. Version 3.0 is founded on the previous version of the Competency Profile released by FP Canada (formerly Financial Planning Standards Council) in 2011, the global Financial Planner Competency Profile