Transcription

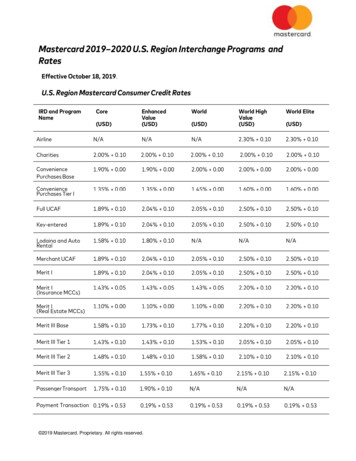

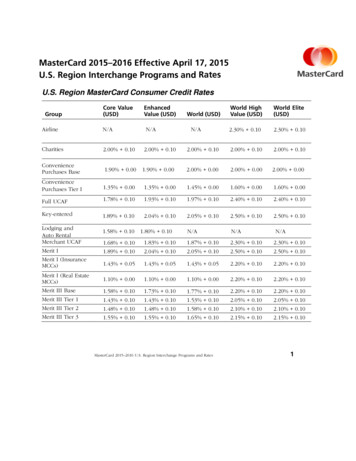

MasterCard 2015–2016 Effective April 17, 2015U.S. Region Interchange Programs and RatesU.S. Region MasterCard Consumer Credit RatesGroupCore Value(USD)EnhancedValue (USD)World Elite(USD)2.30% 0.102.30% 0.10N/ACharities2.00% 0.102.00% 0.102.00% 0.102.00% 0.102.00% 0.10ConveniencePurchases Base1.90% 0.001.90% 0.002.00% 0.002.00% 0.002.00% 0.00ConveniencePurchases Tier I1.35% 0.001.35% 0.001.45% 0.001.60% 0.001.60% 0.00Full UCAF1.78% 0.101.93% 0.101.97% 0.102.40% 0.102.40% 0.10Key-entered1.89% 0.102.04% 0.102.05% 0.102.50% 0.102.50% 0.10N/AN/A1.58% 0.10 1.80% 0.10N/AWorld HighValue (USD)AirlineLodging andAuto RentalMerchant UCAFN/AWorld (USD)N/A1.83% 0.101.87% 0.102.30% 0.102.30% 0.10Merit I1.68% 0.101.89% 0.102.04% 0.102.05% 0.102.50% 0.102.50% 0.10Merit I (InsuranceMCCs)1.43% 0.051.43% 0.051.43% 0.052.20% 0.102.20% 0.101.10% 0.001.10% 0.001.10% 0.002.20% 0.102.20% 0.101.58% 0.101.73% 0.102.20% 0.102.20% 0.10Merit III Tier 11.43% 0.101.43% 0.101.77% 0.101.53% 0.102.05% 0.102.05% 0.10Merit III Tier 21.48% 0.101.55% 0.101.48% 0.101.55% 0.101.58% 0.101.65% 0.102.10% 0.102.15% 0.102.10% 0.102.15% 0.10Merit I (Real EstateMCCs)Merit III BaseMerit III Tier 3MasterCard 2015–2016 U.S. Region Interchange Programs and Rates1

Core Value(USD)EnhancedValue (USD)World (USD)World HighValue (USD)World Elite(USD)Passenger Transport1.75% 0.101.90% 0.10N/AN/AN/APaymentTransaction0.19% 0.530.19% 0.530.19% 0.530.19% 0.530.19% 0.531.90% 0.00max fee: 0.951.55% 0.101.90% 0.00max fee: 0.952.00% 0.00max fee: 0.952.00% 0.00max fee: 0.952.00% 0.00max fee: 0.951.55% 0.101.55% 0.101.55% 0.101.55% 0.101.73% 0.102.20% 0.102.20% 0.10GroupPetroleum BasePublic SectorRestaurantService Industries1.15% 0.051.15% 0.051.15% 0.051.15% 0.051.15% 0.05Standard2.95% 0.102.95% 0.102.95% 0.103.25% 0.103.25% 0.10Supermarket Base1.48% 0.101.48% 0.101.58% 0.101.90% 0.101.90% 0.10Supermarket Tier 11.15% 0.051.15% 0.051.25% 0.051.25% 0.051.25% 0.05Supermarket Tier 21.15% 0.051.15% 0.051.25% 0.051.25% 0.051.25% 0.05Supermarket Tier 31.22% 0.051.22% 0.051.32% 0.051.32% 0.051.32% 0.052.30% 0.102.75% 0.102.75% 0.102.00% 0.002.00% 0.00T&EN/AN/AN/AN/AN/A0.00% 0.650.00% 0.650.00% 0.650.00% 0.750.00% 0.75Consumer CreditRefund Group 1N/AN/A2.42% 0.002.42% 0.002.42% 0.00Consumer CreditRefund Group 22.09% 0.002.09% 0.002.09% 0.002.09% 0.002.09% 0.00T&E Large TicketUtilities2MasterCard 2015–2016 U.S. Region Interchange Programs and Rates

Core Value(USD)EnhancedValue (USD)World (USD)World HighValue (USD)World Elite(USD)Consumer CreditRefund Group 31.95% 0.001.95% 0.001.95% 0.001.95% 0.001.95% 0.00Consumer CreditRefund Group 41.82% 0.001.82% 0.001.82% 0.001.82% 0.001.82% 0.00Consumer CreditRefund Group 51.73% 0.001.73% 0.001.73% 0.001.73% 0.001.73% 0.00GroupU.S. Region MasterCard Consumer Credit Tier Qualifying CriteriaTier aMinimum Annual Consumer Credit Core Value, Enhanced Value, World, WorldHigh Value, and World Elite VolumeMerit IIITier 1USD 1.80 billionTier 2USD 1.25 billionTier 3USD 750 millionSupermarketTier 1USD 6.00 billionTier 2USD 2.00 billionTier 3USD 750 millionConvenience PurchasesTier 1abUSD 1.00 billionThe minimum annual Consumer Credit Core Value, Enhanced Value, World, World High Value, and World Elite volume is based on a merchant’sOctober 2013–September 2014 volume settled through the Global Clearing Management System (GCMS) that qualified for the Merit III, Supermarket,or the Convenience Purchase interchange programs and requires a MasterCard approved and assigned Merchant ID. Only retail and restaurant MCCsmay qualify for Merit III Tier 1, 2, or 3.bA merchant may also qualify for the Convenience Purchases tier if ALL the following requirements are met (1) Minimum annual MasterCardConsumer Credit volume of USD 75 million settled through GCMS that qualified for the Convenience Purchases interchange rate programs, (2) 60%of MasterCard Consumer Credit transactions are USD 20 or lower, (3) Merchant must offer MasterCard prepaid products (gift or reloadable), (4)Provide acceptance message at the point-of-sale CPOS) AND (5) Not a tiered merchant for Consumer Credit Merit 3.MasterCard 2015–2016 U.S. Region Interchange Programs and Rates3

U.S. Region MasterCard Consumer Debit and Prepaid RatesProgram NameDebit Rate (USD)Prepaid Rate (USD)Charities1.45% 0.151.45% 0.15Emerging Markets0.80% 0.250.80% 0.25Emerging Markets (Education/Gov’t)0.65% 0.150.65% 0.15Full UCAF1.25% 0.151.25% 0.15Key-Entered1.60% 0.151.76% 0.20Lodging and Auto Rental1.15% 0.151.15% 0.15Merchant UCAF1.15% 0.151.15% 0.15Merit I1.60% 0.151.76% 0.20Merit I (Real Estate MCCs)1.10% 0.001.10% 0.000.80% 0.25 (2.95 maximum)0.80% 0.25 (2.95 maximum)Merit III Base1.05% 0.151.05% 0.15Merit III Tier 10.70% 0.150.70% 0.15Merit III Tier 20.83% 0.150.83% 0.15Merit III Tier 30.95% 0.150.95% 0.15Passenger Transport1.60% 0.151.60% 0.15Payment Transaction0.19% 0.530.19% 0.53Merit I (Consumer Loan MCC)aPetroleum CAT/AFD0.70% 0.17 (0.95 maximum)0.70% 0.17 (0.95 maximum)Petroleum Service Station0.70% 0.17 (0.95 maximum)0.70% 0.17 (0.95 maximum)Restaurant1.19% 0.101.19% 0.10Service Industries1.15% 0.051.15% 0.05Small Ticket Base1.55% 0.041.55% 0.04Small Ticket Tier 11.30% 0.031.30% 0.03Standard1.90% 0.251.90% 0.25Supermarket Base1.05% 0.15 (0.35 maximum)1.05% 0.15 (0.35 maximum)Supermarket Tier 10.70% 0.15 (0.35 maximum)0.70% 0.15 (0.35 maximum)Supermarket Tier 20.83% 0.15 (0.35 maximum)0.83% 0.15 (0.35 maximum)Supermarket Tier 30.95% 0.15 (0.35 maximum)Utilities40.00% 0.45MasterCard 2015–2016 U.S. Region Interchange Programs and Rates0.95% 0.15 (0.35 maximum)0.00% 0.65

Program NameDebit Rate (USD)Prepaid Rate (USD)Consumer Debit RefundGroup 11.72% 0.001.72% 0.00Consumer Debit RefundGroup 21.68% 0.001.68% 0.00Consumer Debit RefundGroup 31.40% 0.001.40% 0.00Regulated POS Debit0.05% 0.210.05% 0.21Regulated POS Debit withFraud Adjustment0.05% 0.220.05% 0.22Regulated POS Debit SmallTicket0.05% 0.210.05% 0.21Regulated POS Debit SmallTicket with Fraud Adjustment0.05% 0.220.05% 0.22aThe Merit 1 Consumer Loan rate requires a MasterCard approved and assigned Merchant ID.U.S. Region MasterCard Consumer Debit and Prepaid Tier Qualifying CriteriaTierMinimum Annual Consumer Debit and Prepaid Merit III and SupermarketVolumeaTier 1USD 400 millionTier 2USD 275 millionTier 3aUSD 150 millionThe minimum annual Consumer Debit and Prepaid volume is based on a merchant’s October 2013–September 2014 unregulated volume settledthrough GCMS that qualified for the Merit III or Supermarket interchange programs and requires a MasterCard approved and assigned Merchant ID.Only retail and restaurant MCCs may qualify for Merit III Tier 1, 2, or 3.U.S. Region MasterCard Consumer Debit and Prepaid Small Ticket TierQualifying CriteriaTier aMinimum Annual Consumer Debit and Prepaid Small Ticket TransactionsTier 1175 millionaThe minimum Consumer Debit and Prepaid volume or transactions is based on a merchant’s October 2013–September 2014 unregulatedvolume or transactions settled through GCMS that qualified for the Small Ticket interchange programs and requires a MasterCard approved andassigned Merchant ID.MasterCard 2015–2016 U.S. Region Interchange Programs and Rates5

U.S. Region MasterCard Commercial Rates—Small Business CreditProgramNameLevel 1/BusinessCore (USD)Level 2 /BusinessWorld (USD)Level 3/BusinessWorld Elite (USD)Level 4 (USD)Charities2.00% 0.102.00% 0.102.00% 0.102.00% 0.10Data Rate I2.65% 0.102.81% 0.102.86% 0.102.96% 0.10Data Rate II2.00% 0.102.16% 0.102.21% 0.102.31% 0.10Data Rate III1.75% 0.101.91% 0.101.96% 0.102.06% 0.10Face-to-face2.00% 0.102.16% 0.102.21% 0.102.31% 0.10Large Ticket I1.20% 40.001.36% 40.001.41% 40.001.51% 40.00Large Ticket II1.20% 40.001.36% 40.001.41% 40.001.51% 40.00Large Ticket III1.20% 40.001.36% 40.001.41% 40.001.51% 40.00Large Ticket I, II, andIII (Lodging MCCs) a2.30% 0.10N/AN/AN/APaymentTransaction0.19% 0.530.19% 0.530.19% 0.530.19% 0.53Rebate0.00% 0.000.00% 0.000.00% 0.000.00% 0.00Standard2.95% 0.103.11% 0.103.16% 0.103.26% 0.10Supermarket2.00% 0.102.16% 0.102.21% 0.102.31% 0.10T&E Rate I2.50% 0.002.66% 0.002.71% 0.002.81% 0.00T&E Rate II2.35% 0.102.51% 0.102.56% 0.10T&E Rate III2.30% 0.102.46% 0.102.51% 0.102.66% 0.102.61% 0.106MasterCard 2015–2016 U.S. Region Interchange Programs and Rates

ProgramNameLevel 1/BusinessCore (USD)Level 2 /BusinessWorld (USD)Level 3/BusinessWorld Elite (USD)Level 4 (USD)Utilities0.00% 1.500.00% 1.500.00% 1.500.00% 1.50CommercialRefund Group 12.37% 0.002.37% 0.002.37% 0.002.37% 0.00CommercialRefund Group 22.30% 0.002.30% 0.002.30% 0.002.30% 0.00CommercialRefund Group 32.21% 0.002.21% 0.002.21% 0.002.21% 0.00CommercialRefund Group 42.16% 0.002.16% 0.002.16% 0.002.16% 0.00aThe Lodging MCC’s (3501-3999 and 7011) were added to the Large Ticket IRDS (62,94,and 99) which will have an MCC override applied tothem for Business Debit/Prepaid and the Small Business Level 1 only. The override will be set equal to the corresponding product T&E 3rate.U.S. Region MasterCard Commercial Rates—Business Debit/Prepaid andLarge Market CreditProgram NameBusinessDebit/Prepaid (USD)Large Market(USD)Charities2.00% 0.102.00% 0.10Data Rate I2.65% 0.102.65% 0.10Data Rate II2.20% 0.102.50% 0.10Data Rate II (Petroleum MCCs)2.05% 0.102.05% 0.10Data Rate III1.80% 0.101.80% 0.10Face-to-face2.20% 0.102.50% 0.102.05% 0.102.05% 0.10Large Ticket I1.25% 40.001.25% 40.00Large Ticket II1.25% 40.001.20% 60.00Large Ticket III1.25% 40.001.15% 80.00Face-to-face (Petroleum MCCs)aMasterCard 2015–2016 U.S. Region Interchange Programs and Rates7

Program NameBusinessDebit/Prepaid (USD)Large Market (USD)Large Ticket I, II, and III (LodgingMCCs) b2.30% 0.10N/APayment Transaction0.19% 0.530.19% 0.53Rebate0.00% 0.000.00% 0.00Standard2.95% 0.102.95% 0.10Supermarket2.20% 0.102.50% 0.10T&E Rate I2.50% 0.002.70% 0.00T&E Rate II2.35% 0.102.55% 0.10T&E Rate III2.30% 0.102.50% 0.10T&E Rate III (Airline MCCS)2.30% 0.102.43% 0.10Utilities0.00% 1.50N/ACommercial Refund Group 12.37% 0.002.37% 0.00Commercial Refund Group 22.30% 0.002.30% 0.00Commercial Refund Group 32.21% 0.002.21% 0.00Commercial Refund Group 42.16% 0.002.16% 0.00Regulated POS Debit0.05% 0.21N/ARegulated POS Debit with FraudAdjustment0.05% 0.22N/ARegulated POS Debit Small Ticket Base0.05% 0.21N/ARegulated POS Debit Small Ticket withFraud Adjustment0.05% 0.22N/Aab8Face-to-face (Petroleum MCCs) is not available for the Fleet product.The Lodging MCC’s (3501-3999 and 7011) were added to the Large Ticket IRDS (62,94,and 99) which will have an MCC override applied tothem for Business Debit/Prepaid and the Small Business Level 1 only. The override will be set equal to the corresponding product T&E 3rate.MasterCard 2015–2016 U.S. Region Interchange Programs and Rates

U.S. Region MasterCard Commercial Rates—Large Ticket MPG / CommercialPayments AccountLarge Ticket MPG /Commercial Payments AccountTransaction AmountsRateLess than USD 7,255Large Market Rates applyLarge Ticket 1 (USD 7,255.01–25,000)1.20%Large Ticket 2 (USD 25,000.01–100,000)1.00%Large Ticket 3 (USD 100,000.01–500,000)0.90%Large Ticket 4 (USD 500,000.01–999,999)0.80%Large Ticket 5 (More than USD 1,000,000)0.70%Refer to the following Large Ticket Transaction Size Requirements table.Large Ticket Transaction Size RequirementsProgram NameAll Commercial ProductsCommercial Large Ticket I7,255Commercial Large Ticket II25,000Commercial Large Ticket III100,000U.S. Region MasterCard PIN Debit RatesProgram NameRate (USD)PIN Debit All Other Base0.90% 0.15PIN Debit All Other Tier 10.50% 0.08 (0.50 maximum)PIN Debit All Other Tier 20.60% 0.12 (0.65 maximum)PIN Debit Convenience Base0.75% 0.17 (0.95 maximum)PIN Debit Convenience Tier 10.75% 0.17 (0.95 maximum)PIN Debit Convenience Tier 20.75% 0.17 (0.95 maximum)PIN Debit Supermarket/Warehouse Base1.05% 0.15 (0.35 maximum)PIN Debit Supermarket/Warehouse Tier 10.00% 0.18PIN Debit Supermarket/Warehouse Tier 20.00% 0.23PIN Regulated POS Debit0.05% 0.21PIN Regulated POS Debit with Fraud Adjustment0.05% 0.22MasterCard 2015–2016 U.S. Region Interchange Programs and Rates9

U.S. Region MasterCard PIN Debit Tier Qualifying CriteriaTierMinimum Annual PIN Debit Supermarket, Convenience, and All OtherTransactionsTier 112.5 millionTier 25.5 millionThe minimum annual PIN debit transactions is based on a merchant’s October 2013–September2014 unregulated transactions settled through the Single Message System and requires a MasterCardapproved and assigned Merchant ID.10MasterCard 2015–2016 U.S. Region Interchange Programs and Rate

U.S. Region Interchange Bulletin 1, 12 February 2015 2015 MasterCard. Proprietary. All rights reserved.

of MasterCard Consumer Credit transactions are USD 20 or lower, (3) Merchant must offer MasterCard prepaid products (gift or reloadable), (4) Provide acceptance message at the point-of-sale CPOS) AND (5) Not a tiered merchant for Consumer Credit Merit 3. MasterCard 2015-2016 U.S. Region Interchange Programs and Rates 3