Transcription

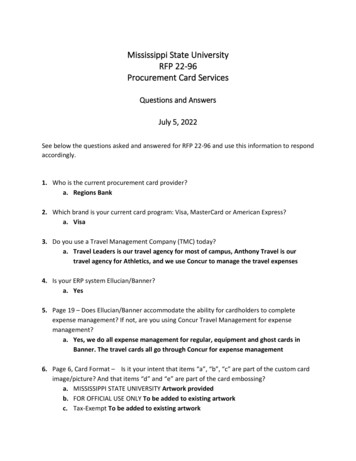

Mississippi State UniversityRFP 22-96Procurement Card ServicesQuestions and AnswersJuly 5, 2022See below the questions asked and answered for RFP 22-96 and use this information to respondaccordingly.1. Who is the current procurement card provider?a. Regions Bank2. Which brand is your current card program: Visa, MasterCard or American Express?a. Visa3. Do you use a Travel Management Company (TMC) today?a. Travel Leaders is our travel agency for most of campus, Anthony Travel is ourtravel agency for Athletics, and we use Concur to manage the travel expenses4. Is your ERP system Ellucian/Banner?a. Yes5. Page 19 – Does Ellucian/Banner accommodate the ability for cardholders to completeexpense management? If not, are you using Concur Travel Management for expensemanagement?a. Yes, we do all expense management for regular, equipment and ghost cards inBanner. The travel cards all go through Concur for expense management6. Page 6, Card Format – Is it your intent that items “a”, “b”, “c” are part of the custom cardimage/picture? And that items “d” and “e” are part of the card embossing?a. MISSISSIPPI STATE UNIVERSITY Artwork providedb. FOR OFFICIAL USE ONLY To be added to existing artworkc. Tax-Exempt To be added to existing artwork

d. The cardholder's name Embossinge. An option for an extra embossing line Embossing7. Page 6 – “MSU would have the ability to retroactively edit default account information”What account information needs to be edited and why does it need to be retroactivelyedited?a. The default account codes tied to each card at time of set up i.e. university fund,organization, program, and activity. It needs to be retroactively changed based onstatement dates because our ERP system pulls departmental JV’s based on likefund and organization combination. If a fund changes mid cycle, then half of thecharges will be on one JV and the other charges on another JV, all for a singlestatement. We do not want multiple JV’s per statement.8. Page 7 – Are you using declining balance cards today? This is listed as an optional service todescribe. If you are using or considering declining balance cards, will you please outline theneed/situation?a. We do not currently use them.9. Page 17 – “Does your company have the ability to provide billing statements that willreflect the foreign currency transaction amounts (local currency) as well as the convertedhome currency equivalent (USD)?” How much of your existing spend is outside of the US?a. Around 300,000.0010. Page 17 – “Describe what levels of data (i.e.: level 1, level 2, level 3), and line-item detailis captured at the point of sale. Can this be viewed before statement has been released?”Contractor Question: Please share what % of your program is made up of level 3 data?a. About 33.8%11. Page 16/17 – “Describe any new concepts or innovative ideas. This could include epayables as well as any other concepts that could improve the effectiveness, efficiency,revenues, or other aspects of the program. Describe any additional type of cards yourcompany offers (i.e. virtual cards, one time use cards, etc.)” Have you considered an epayables program before? Please describe any experience if you have attempted previouslyand/or MSU’s general interest in this type of product.a. We have heard about it, been through a demonstration but do not currently useone. We are not against hearing about them if it brings a real benefit to us, theuniversity and end users.

12. Is it a requirement to have automated HR file feeds?a. We do not do any feeds to HR only into Banner13. Will MSU accept a secure email submission in lieu of paper and/or flash drive copies?a. No, this cannot be submitted solely electronically. If your company has a policyagainst flash drive copies, Jennifer Mayfield will contact you after the openingdate and then you can email a copy. We will however HAVE to have a hard copysent prior to the opening date.14. Will MSU please extend the due date from July 19, 2:00 p.m. CT by one week to July 26,5:00 p.m. CT?a. No this project is time sensitive. The original due date will remain.15. Why does MSU utilize different payment terms for different card programs under theirsupervision?a. We will be using a 10-day payment schedule for all programs16. You referenced implementing a travel card program but it appears you currently use onetoday? What future travel needs will there be associated with this new and/or expansion ofthe program? Is this specifically for the expansion to use for meals or something else?a. The travel program has been a pilot program with only 9 departments since thebeginning of the contract until January 2022. It has just recently been offered to alldepartments. The expansion is that, offering to everyone on campus. In 5 monthsthe spend amount and the number of cards issued has more than tripled. And yes,we plan on adding food at a later date. We expect significant growth as the card isissued to more and more people.17. Why does MSU utilize different payment terms for different card programs under theirsupervision?a. See #1518. You referenced implementing a travel card program but it appears you currently use onetoday? What future travel needs will there be associated with this new and/or expansion ofthe program? Is this specifically for the expansion to use for meals or something else?a. See #16

19. On the P cards with the 5,000 max transaction size, how often is there an approval for a 5,000 purchase, and of those, how often do they go over 10,000?a. On average (our last 3 months) we have about 110 transactions a month that areover 5,000 with about 37% of those 110 transactions being over 10,00020. On the Small Purchase Card program m, you say 829 accounts and 1016 plastics? Can youclarify the difference from Account and Plastics?a. The account is the actual number on the card. Some accounts have multiple cardsissued with the same number on each card.21. Do you use a Travel Agency to book your travel with the Ghost Cards?a. Travel Leaders for BTA and EBTA, Anthony Travel for Athletics22. We typically sends references during the next phase of the RFP process out of respect forour current clients’ time and privacy. Will this be an issue?a. Yes, we will be looking at references during the initial stage of our evaluation.They will be required with the proposal.23. As part of your reference requirement, you ask for four references of which two must beuniversities that spend 40,000,000 and have 20,000 students. Is this requirement adisqualifying factor?a. It’s a requirement24. Since the last time MSU has gone out to RFP, there have been many changes to theinterchange models. There are now various discount interchanges Mastercard and Visahave created such as Large Ticket, Merchant Preferred Interchange and Level 3 Interchange.All these are discounted from standard interchange and make it difficult for respondents tooffer a single rebate factor. Most contracts now include an additional grid called “discountinterchange”, allowing banks to offer a larger rebate percentage for standard interchangetransactions and a lower one for discounted interchange transactions. Would MSU pleaseconsider adding a grid for discount interchange?a. The RFP includes the following language which we believe provides the providerwith an opportunity to submit a proposal which includes “discount interchange”:“If the provider feels a different structure is needed, we will consider otherstructures, however, the provider should clearly explain why the proposedstructure is superior to that which we have provided”

25. In order to ensure that all respondents are assessing all the same data, please identify yourspend volumes in the various discount interchange categories, as listed below. Your currentprovider should be able to provide these numbers: Large Ticket interchange 2,747,996 Visa Preferred Merchant interchange 4,516,183 Level 3 interchange 18,258,78226. Can MSU clarify what is meant by the 'Dual Authentication' bullet part of Card Issuance andProgram Functionality (page 7) of the RFP?a. The ability to log in with normal login but then also have a secondary login toverify identity token or app with an authentication code27. Could MSU please provide a breakdown of their Discounted Interchange Rate Programswhich include the following:a. What is MSU’s current Network Negotiated Rates? We do not feel the need toshare this information at this time.b. What is MSU’s current Level III Interchange spend? 18,258,782c. What is MSU’s current Large Ticket spend volume/transactions? (MC transactionsover 10K) 2,747,99628. Provide projected increase in travel spend over the next three years.a. At this time, due to the current economic and socio-political situations we areunable to make a reasonable estimate of future activity.29. Does MSU plan to increase the current threshold of 5,000 for small dollar purchases?a. We have set this limit so it is in compliance with state law, which requires quotesabove 5,000. If the law changes, then we’ll change, but the decision is out of ourhands.30. Please describe MSU’s appetite to explore issuing mobile virtual cards for travel programexpenditures.a. We are open to suggestions to better serve our end users

31. In the event MSU decides to expand the use of the Travel cards to allow meal purchases,will there be any limitations placed on the cards to restrict usage, i.e.: dollar limits per meal,etc. Also, please describe how meal transactions will be reconciled, will this be performedby the cardholder or MSU’s program administrator(s)?a. Considering there are different per diems depending on the travel location, I amnot sure we would be putting limits on the card. The cardholder would reconcile inConcur and then reviewed by travel services administrators.32. Does MSU have the desire to leverage Concur for expense management processing needs ?a. Potentially, yes33. Please describe your program objectives over the next three years.a. To continue to grow a solid program. Goals are to increase spend in any way thatwe possibly can, reducing the amount of PO’s and direct pays issued by theuniversity while maintaining accountability34. What is more valuable to MSU; additional revenue earned on early payment or, additionalrevenue earned on year over year growth?a. Year over growth. The payment terms will be 10 days.35. Page 9 Program and Transaction Data Reports – Could you please share a description of the“Locked Card” reports?a. A report of cards/cardholders whose cards are locked either due to us temporarilylocking the card or locked due to fraud by the bank.36. Page 10 Training – Can the University please provide an outline of the new cardholdertraining that the card issuer is expected to provide? And how is this cardholder trainingexpected to be supported and deployed by the card issuer?a. We expect the card issuer to know and understand their products and programand to be able to recommend and provide adequate training to allow our endusers to easily use the product and the reports. The training should be what theprovider feels is appropriate.

37. Page 12 Billing/Reporting – What type of transaction data is required for “unbilledtransactions”? Is the University looking for access to Authorizations on cards that have notyet settle or posted to the billing statement?a. Yes, the ability to see “pending” transactions that have not posted to the accountor a statement.38. Page 13 Liability – What does the University consider a “Violation of the standard IndustryClassification Code and/or Merchant Category Code restrictions specified to the contractorby MSU” as the merchants self-register their codes with Visa/Mastercard and Citi as thecard issuer only enables the codes authorized by MSU?a. Allowing a charge to go through from a vendor we do not allow. I do not ever seethis being a problem if we have codes registered with the vendor as allowable ornot and having the ability to do an override of any unauthorized.39. How much of the 54M of Pcard spend is with international/foreign merchants?a. See #940. How much of the 54M of Pcard spend is eligible for large ticket interchange rates or anyother specialty rate?a. See #2541. What are the top 3 airlines by total spend on any of the three Ghost Pcard programs forBTE/EBTE/Athletics Travel?a. Delta Airlines 592,850.53, American Airlines 60,775.81, United Airlines 37,635.87

interchange models. There are now various discount interchanges Mastercard and Visa have created such as Large Ticket, Merchant Preferred Interchange and Level 3 Interchange. All these are discounted from standard interchange and make it difficult for respondents to offer a single rebate factor.