Transcription

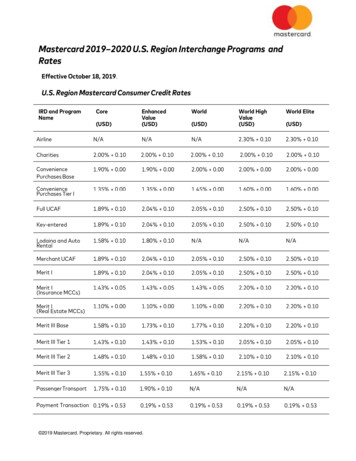

Mastercard 2019–2020 U.S. Region Interchange Programs andRatesEffective October 18, 2019.U.S. Region Mastercard Consumer Credit RatesIRD and ProgramNameCore(USD)EnhancedValue(USD)WorldWorld Elite(USD)World HighValue(USD)(USD)AirlineN/AN/AN/A2.30% 0.102.30% 0.10Charities2.00% 0.102.00% 0.102.00% 0.102.00% 0.102.00% 0.10ConveniencePurchases Base1.90% 0.001.90% 0.002.00% 0.002.00% 0.002.00% 0.00ConveniencePurchases Tier I1.35% 0.001.35% 0.001.45% 0.001.60% 0.001.60% 0.00Full UCAF1.89% 0.102.04% 0.102.05% 0.102.50% 0.102.50% 0.10Key-entered1.89% 0.102.04% 0.102.05% 0.102.50% 0.102.50% 0.10Lodging and AutoRental1.58% 0.101.80% 0.10N/AN/AN/AMerchant UCAF1.89% 0.102.04% 0.102.05% 0.102.50% 0.102.50% 0.10Merit I1.89% 0.102.04% 0.102.05% 0.102.50% 0.102.50% 0.10Merit I(Insurance MCCs)1.43% 0.051.43% 0.051.43% 0.052.20% 0.102.20% 0.10Merit I(Real Estate MCCs)1.10% 0.001.10% 0.001.10% 0.002.20% 0.102.20% 0.10Merit III Base1.58% 0.101.73% 0.101.77% 0.102.20% 0.102.20% 0.10Merit III Tier 11.43% 0.101.43% 0.101.53% 0.102.05% 0.102.05% 0.10Merit III Tier 21.48% 0.101.48% 0.101.58% 0.102.10% 0.102.10% 0.10Merit III Tier 31.55% 0.101.55% 0.101.65% 0.102.15% 0.102.15% 0.10Passenger Transport1.75% 0.101.90% 0.10N/AN/AN/APayment Transaction 0.19% 0.530.19% 0.530.19% 0.530.19% 0.530.19% 0.53 2019 Mastercard. Proprietary. All rights reserved.

IRD and ProgramNameEnhancedValue(USD)WorldWorld Elite(USD)World HighValue(USD)Payment Transaction 0.00% 0.10(Gov’t-owned Lotterya)0.00% 0.100.00% 0.100.00% 0.100.00% 0.10Petroleum Base1.90% 0.00(0.95 max)1.90% 0.00(0.95 max)2.00% 0.00(0.95 max)2.00% 0.00(0.95 max)2.00% 0.00(0.95 max)Public Sector1.55% 0.101.55% 0.101.55% 0.101.55% 0.101.55% 0.10RestaurantN/AN/A1.73% 0.102.20% 0.102.20% 0.10Service Industries1.15% 0.051.15% 0.051.15% 0.051.15% 0.051.15% 0.05Standard2.95% 0.102.95% 0.102.95% 0.103.25% 0.103.25% 0.10Supermarket Base1.48% 0.101.48% 0.101.58% 0.101.90% 0.101.90% 0.10Supermarket Tier 11.15% 0.051.15% 0.051.25% 0.051.25% 0.051.25% 0.05Supermarket Tier 21.15% 0.051.15% 0.051.25% 0.051.25% 0.051.25% 0.05Supermarket Tier 31.22% 0.051.22% 0.051.32% 0.051.32% 0.051.32% 0.05T&EN/AN/A2.30% 0.102.75% 0.102.75% 0.10T&E Large TicketN/AN/AN/A2.00% 0.002.00% 0.00Utilities0.00% 0.650.00% 0.650.00% 0.650.00% 0.750.00% 0.75Consumer CreditRefund Group 1N/AN/A2.42% 0.002.42% 0.002.42% 0.00Consumer CreditRefund Group 22.09% 0.002.09% 0.002.09% 0.002.09% 0.002.09% 0.00Consumer CreditRefund Group 31.95% 0.001.95% 0.001.95% 0.001.95% 0.001.95% 0.00Consumer CreditRefund Group 41.82% 0.001.82% 0.001.82% 0.001.82% 0.001.82% 0.00Consumer CreditRefund Group 51.73% 0.001.73% 0.001.73% 0.001.73% 0.001.73% 0.00aCore(USD)Applies to MCC 7800 - Government-owned Lottery (U.S. region only). 2019 Mastercard. Proprietary. All rights reserved.(USD)

U.S. Region Mastercard Consumer Credit Tier Qualifying CriteriaTier bMinimum Annual Consumer Credit Core Value, Enhanced Value, World, World HighValue, and World Elite VolumeMerit IIITier 1USD 1.80 billionTier 2USD 1.25 billionTier 3USD 750 millionSupermarketTier 1USD 6.00 billionTier 2USD 2.00 billionTier 3USD 750 millionConvenience PurchasesTier 1 cbUSD 1.00 billionThe minimum annual Consumer Credit Core Value, Enhanced Value, World, World High Value, and World Elite volume is based on a merchant’sOctober2017 – September 2018 volume settled through the Global Clearing Management System (GCMS) that qualified for the Merit III, Supermarket,or theConvenience Purchase interchange programs and requires a Mastercard approved and assigned Merchant ID. Only retail and restaurant MCCsmayqualify for Merit III Tier 1, 2, or 3.cA merchant may also qualify for the Convenience Purchases tier if ALL the following requirements are met (1) Minimum annual MastercardConsumer Credit volume of USD 75 million settled through GCMS that qualified for the Convenience Purchases interchange rate programs, (2) 60%of Mastercard Consumer Credit transactions are USD 20 or lower, (3) Merchant must offer Mastercard prepaid products (gift or reloadable), (4)Provide acceptance message at the point-of-sale (POS) AND (5) Not a tiered merchant for Consumer Credit Merit 3. 2019 Mastercard. Proprietary. All rights reserved.

U.S. Region Mastercard Unregulated Consumer Debit and Prepaid RatesIRD and Program NameDebit Rate (USD)Prepaid Rate (USD)Charities1.45% 0.151.45% 0.15Emerging Markets0.80% 0.250.80% 0.25Emerging Markets(Education /Gov’t MCCs d)0.65% 0.15 (2.00 max)0.65% 0.15 (2.00 max)Full UCAF1.65% 0.151.76% 0.20Key-Entered1.65% 0.151.76% 0.20Lodging and Auto Rental1.15% 0.151.15% 0.15Merchant UCAF1.65% 0.151.76% 0.20Merit I1.65% 0.151.76% 0.20Merit I(Real Estate MCCs)1.10% 0.001.10% 0.00Merit I(Consumer Loan MCCs e)0.80% 0.25 (2.95 max)0.80% 0.25 (2.95 max)Merit III Base1.05% 0.151.05% 0.15Merit III Tier 10.70% 0.150.70% 0.15Merit III Tier 20.83% 0.150.83% 0.15Merit III Tier 30.95% 0.150.95% 0.15Passenger Transport1.60% 0.151.60% 0.15Payment Transaction0.19% 0.530.19% 0.53Payment Transaction(Gov’t-owned Lottery f)0.00% 0.100.00% 0.10Petroleum CAT/AFD0.70% 0.17 (0.95 max)0.70% 0.17 (0.95 max)Petroleum Service Station0.70% 0.17 (0.95 max)0.70% 0.17 (0.95 max)Restaurant1.19% 0.101.19% 0.10Service Industries1.15% 0.051.15% 0.05Small Ticket Base1.55% 0.041.55% 0.04Small Ticket Tier 11.30% 0.031.30% 0.03Standard1.90% 0.251.90% 0.25Supermarket Base1.05% 0.15 (0.35 max)1.05% 0.15 (0.35 max)Supermarket Tier 1N/AN/A 2019 Mastercard. Proprietary. All rights reserved.

IRD and Program NameDebit Rate (USD)Prepaid Rate (USD)Supermarket Tier 2N/AN/ASupermarket Tier 3N/AN/AUtilities0.00% 0.650.00% 0.65Consumer Debit Refund Group 10.00% 0.000.00% 0.00Consumer Debit Refund Group 20.00% 0.000.00% 0.00Consumer Debit Refund Group 30.00% 0.000.00% 0.00d.The following MCC’s qualify for the Emerging market Education and Gov’t rate: 7800, 8211, 8220, 8299, 9211, 9222, 9223, 9311, 9399, and 9402.e.The Merit 1 Consumer Loan rate requires a Mastercard approved and assigned Merchant ID.f.Applies to MCC 7800 - Government-owned Lottery (U.S. region only).U.S. Region Mastercard Unregulated Consumer Debit and PrepaidTier Qualifying CriteriaTier gMinimum Annual Consumer Debit and PrepaidMerit III VolumeSupermarket VolumeTier 1USD 400 millionN/ATier 2USD 275 millionN/ATier 3USD 175 millionN/AgThe minimum annual Consumer Debit and Prepaid volume is based on a merchant’s October 2017 – September 2018 unregulated volume settledthrough GCMS that qualified for the Merit III interchange programs and requires a Mastercard approved and assigned Merchant ID.Only retail and restaurant MCCs may qualify for Merit III Tier 1, 2, or 3.U.S. Region Mastercard Unregulated Consumer Debit and PrepaidSmall Ticket Tier Qualifying CriteriaTier hMinimum Annual Consumer Debit and Prepaid Small Ticket TransactionsTier 1175 millionhThe minimum Consumer Debit and Prepaid volume or transactions is based on a merchant’s October 2017 – September 2018 unregulatedvolume or transactions settled through GCMS that qualified for the Small Ticket interchange programs and requires a Mastercard approved andassigned Merchant ID. 2019 Mastercard. Proprietary. All rights reserved.

U.S. Region Mastercard Regulated Consumer/Commercial Debit and Prepaid RatesIRD and Program NameDebit Rate (USD)Prepaid Rate (USD)Purchases, Purchases with Cash-back and UniqueRegulated POS Debit0.05% 0.210.05% 0.21Regulated POS Debit with FraudAdjustment0.05% 0.220.05% 0.22Regulated POS Debit Small Ticket0.05% 0.210.05% 0.21Regulated POS Debit Small Ticket withFraud Adjustment0.05% 0.220.05% 0.22Regulated POS Debit0.00% 0.000.00% 0.00Regulated POS Debit with FraudAdjustment0.00% 0.000.00% 0.00Regulated POS Debit Small Ticket0.00% 0.000.00% 0.00Regulated POS Debit Small Ticket withFraud Adjustment0.00% 0.000.00% 0.00Payment Transaction0.19% 0.530.19% 0.53Payment Transaction(Gov’t-owned Lottery k)0.00% 0.100.00% 0.10Credits (Refunds/Returns)Payment TransactionskApplies to MCC 7800 - Government-owned Lottery (U.S. region only).Note: Regulated rates also apply to any U.S. Interregional transaction between the U.S., American Samoa,Guam, the Northern Mariana Islands, Puerto Rico, and the U.S. Virgin Islands. 2019 Mastercard. Proprietary. All rights reserved.

U.S. Region Mastercard Commercial Rates - Small Business CreditIRD andProgram NameLevel 1 /Business Core(USD)Level 2 /Business World(USD)Charities2.00% 0.102.00% 0.10Data Rate I2.65% 0.10Data Rate IILevel 4(USD)Level 5(USD)2.00% 0.102.00% 0.102.00% 0.102.80% 0.102.85% 0.102.95% 0.103.00% 0.101.90% 0.102.05% 0.102.10% 0.102.20% 0.102.25% 0.10Data Rate e Ticket IEliminatedEliminatedEliminatedEliminatedN/ALarge Ticket IIEliminatedEliminatedEliminatedEliminatedN/ALarge Ticket entTransaction0.19% 0.530.19% 0.530.19% 0.530.19% 0.530.19% 0.53Rebate0.00% 0.000.00% 0.000.00% 0.000.00% 0.000.00% 0.00Standard2.95% 0.103.10% 0.103.15% 0.103.25% 0.103.30% 0.10T&E Rate IEliminatedEliminatedEliminatedEliminatedT&E Rate m2.35% 0.102.50% 0.102.55% 0.102.65% 0.10T&E Rate es0.00% 1.500.00% 1.500.00% 1.500.00% 1.500.00% 1.50CommercialRefund Group 12.37% 0.002.37% 0.002.37% 0.002.37% 0.002.37% 0.00CommercialRefund Group 22.30% 0.002.30% 0.002.30% 0.002.30% 0.002.30% 0.00CommercialRefund Group 32.21% 0.002.21% 0.002.21% 0.002.21% 0.002.21% 0.00CommercialRefund Group 42.16% 0.002.16% 0.002.16% 0.002.16% 0.002.16% 0.00mPreviously referred to as “T&E Rate II”. 2019 Mastercard. Proprietary. All rights reserved.Level 3 /Business WorldElite (USD)N/A2.70% 0.10N/A

U.S. Region Mastercard Commercial Rates - Unregulated Commercial Debit/Prepaid andLarge Market CreditIRD and Program NameCommercial Debit tCommercial Prepaid t(USD)(USD)Large Market Credit(USD)Charities2.00% 0.102.00% 0.102.00% 0.10Data Rate I2.65% 0.102.65% 0.102.70% 0.10Data Rate I (Healthcare MCCs n)1.00% (5.00 max)1.00% (5.00 max)1.00% (5.00 max)Data Rate II2.10% 0.102.65% 0.102.50% 0.10Data Rate II (Petroleum MCCs)2.05% 0.102.05% 0.102.20% 0.10Data Rate IIIEliminatedEliminated1.90% 0.10Large Ticket pEliminatedEliminated1.45% 35.00Large Ticket IIEliminatedEliminatedEliminatedLarge Ticket IIIEliminatedEliminatedEliminatedLarge Ticket I, II and III (Lodging MCCs r)N/AN/AEliminatedPayment Transaction0.19% 0.530.19% 0.530.19% 0.53Rebate0.00% 0.000.00% 0.000.00% 0.00Standard2.95% 0.102.95% 0.102.95% 0.10T&E Rate IEliminatedEliminatedEliminatedT&E Rate s2.35% 0.102.35% 0.102.65% 0.10T&E Rate IIIEliminatedEliminatedEliminatedT&E Rate III (Airline MCCs)EliminatedEliminatedEliminatedUtilities0.00% 1.500.00% 1.50N/ACommercial Refund Group 12.37% 0.002.37% 0.002.37% 0.00Commercial Refund Group 22.30% 0.002.30% 0.002.30% 0.00Commercial Refund Group 32.21% 0.002.21% 0.002.21% 0.00Commercial Refund Group 42.16% 0.002.16% 0.002.16% 0.00nThe Healthcare Services MCCs (8011, 8021, 8031, 8041, 8042, 8043, 8049, 8050, 8062, 8071 and 8099) override is applied to GCM S product codes MAP (MastercardCommercial Payments Account) and MAQ (Mastercard Prepaid Commercial Payments Account) only.pPreviously referred to as “Large Ticket I”. In addition, the minimum dollar amount to qualify is 10,000.rThe Lodging MCCs (3501-3999 or 7011) override is applied to Large Market Large Ticket 1, 2, and 3.sPreviously referred to as “T&E Rate II”.tPreviously referred to as “Business Debit”. 2019 Mastercard. Proprietary. All rights reserved.

U.S. Region Mastercard Commercial Rates –Commercial Payments Account and Variable Interchange ProgramsCommercial Payments Account TransactionAmountRate (USD)Less than USD 10,000.00Commercial rates applyLarge Ticket 1 (USD 10,000.00–25,000)1.20%Large Ticket 2 (USD 25,000.01–100,000)1.00%Large Ticket 3 (USD 100,000.01–500,000)0.90%Large Ticket 4 (USD 500,000.01–1,000,000)0.80%Large Ticket 5 (More than USD 1,000,000)0.70%Variable Interchange Programs (VIP)Rate (USD)VIP Rate 10.80% 0.10VIP Rate 21.05% 0.10VIP Rate 31.35% 0.10VIP Rate 41.45% 0.10VIP Rate 51.90% 0.10VIP Rate 62.50% 0.10VIP Rate 73.00% 0.10VIP Rate 81.25% 40.00VIP Rate 91.20% 60.00VIP Rate 101.15% 80.00VIP Rate 111.45% 35.00 2019 Mastercard. Proprietary. All rights reserved.

U.S. Region Mastercard PIN Debit RatesProgram NameRate (USD)Purchases, Payment TransactionsPIN Debit All Other Base0.90% 0.15PIN Debit Convenience Base0.75% 0.17 (0.95 max)PIN Debit Supermarket/Warehouse Base1.05% 0.15 (0.35 max)PIN Debit Payment Transaction0.19% 0.53PIN Debit Payment Transaction0.00% 0.10(Gov’t-owned Lotteryv)PIN Regulated POS Debit0.05% 0.21PIN Regulated POS Debit with Fraud Adjustment0.05% 0.22Credits (Refunds/Returns)vPIN Unregulated - Credits (Refunds/Returns)0.00% 0.00PIN Regulated - Credits (Refunds/Returns)0.00% 0.00Applies to MCC 7800 - Government-owned Lottery (U.S. region only).Note: Regulated rates also apply to any U.S. Interregional transaction between the U.S., American Samoa,Guam, the Northern Mariana Islands, Puerto Rico, and the U.S. Virgin Islands.U.S. Region Mastercard ATM RatesInterchange Program NameMinimum Quarterly TransactionsRate (USD)ATM Financial Tier 17.5 million0.00% 0.35ATM Financial Tier 25.0 million0.00% 0.45ATM Financial BaseN/A0.00% 0.50ATM Financial NebraskaN/A0.00% 0.45ATM Non - FinancialN/A0.00% 0.28ATM Shared DepositN/A0.00% 2.00The minimum quarterly transaction threshold is reviewed quarterly based on an issuer’s ATMtransactions settled during the prior calendar quarter for the next subsequent quarter. Please notethat the tier qualifications are effective in the second month of the next subsequent quarter. An 2019 Mastercard. Proprietary. All rights reserved.

issuer that qualifies for a tier based on their first quarter transactions (January - March), they willqualify for the new tiered rate commencing in May. 2019 Mastercard. Proprietary. All rights reserved.

Mastercard 2019–2020 U.S. Region Interchange Programs and Rates Effective October 18, 2019. U.S. Region Mastercard Consumer Credit Rates IRD and Program Name Core (USD) Enhanced Val