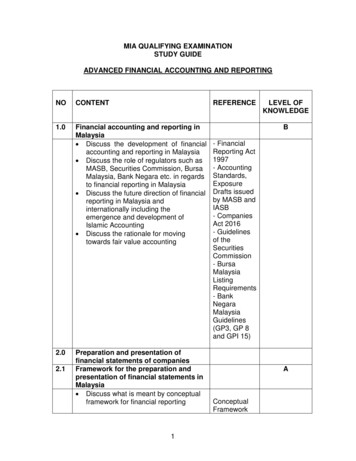

Transcription

UNAUDITED INTERIMFINANCIAL STATEMENTS2019AND CASH DIVIDENDDECLARATION FORTHE SIX MONTHS ENDED31 MARCH 2019

CONTENTSCOMMENTARY1CONDENSED SUMMARISED CONSOLIDATED STATEMENTOF PROFIT OR LOSS6CONDENSED SUMMARISED CONSOLIDATED STATEMENTOF COMPREHENSIVE INCOME8CONDENSED SUMMARISED CONSOLIDATED STATEMENTOF FINANCIAL POSITION9CONDENSED SUMMARISED CONSOLIDATED STATEMENTOF CHANGES IN EQUITY10CONDENSED SUMMARISED CONSOLIDATED STATEMENTOF CASH FLOWS12CONDENSED SUMMARISED SEGMENTAL ANALYSIS13NOTES15ADDITIONAL INFORMATION28ADMINISTRATION29GROUP PROFILEReunert comprises a diversified portfolio of businesses in the fields of electrical engineering, informationcommunication technologies (ICT), and applied electronics. The group was established in 1888, byTheodore Reunert and Otto Lenz, and has contributed to the South African economy in numerous ways.Reunert was listed on the JSE in 1948 and is included in the industrial goods and services (electronic andelectrical equipment) sector of the JSE. The group operates mainly in South Africa with minor operations inAustralia, Lesotho, Mauritius, the USA, Zambia and Zimbabwe. Reunert’s offices are located in Woodmead,Johannesburg, South Africa.

COMMENTARYOVERVIEWRevenue increased by 9%, from R4 841 million to R5 288 million, and operating profit increased by 8%from R567 million to R615 million. This was achieved despite a weak economic environment in South Africaand continued subdued demand specifically in the electrical engineering segment. Profit after tax (PAT)declined by 16%, from R448 million to R377 million. The decline in PAT was impacted by two non-recurringitems:i) During the prior period, the group successfully defended an action brought by the South AfricanRevenue Service which allowed the group to release a R42 million tax provision resulting in anabnormally low tax charge for that period of 21%; andii) In March 2019, the group disposed of its controlling shareholding in Prodoc Svenska AB (Prodoc),the group’s Swedish office automation business. The rationale for this disposal was the consistentlow earnings from this business and the weakened strategic alignment of the business with thebroader ICT segment strategy. This disposal realised a loss of R44 million. djusting PAT* for the above non-recurring items, resulted in an increase of 4% in the adjusted PAT (referAto table below), which is a more appropriate reflection of the core performance of the group.6 Months to31 March 20196 Months to31 March 2018% Change377448(16)–(42)944–104214064Units6 Months to31 March 20196 Months to31 March 2018% ChangeRevenueR million5 2884 8419Operating profitR million6155678%1212–R million377448(16)Basic earnings per shareCents227275(17)Headline earnings per shareCents253275(8)Normalised headline earnings per shareCents253276(8)PAT as reportedLess: impact of release of tax provisionAdd: loss on disposal of ProdocAdjusted PAT*FINANCIAL RESULTSFinancial performance group results andkey earnings metricsOperating marginProfit for the period* This pro forma financial information has been prepared for illustrative purposes only in order to provide information on howthe earnings adjustments highlighted have impacted on the financial results of the group. Because of its nature, this proforma financial information may not be a fair reflection of the group’s results of operations and is not intended to complywith the requirements of IFRS. The directors are responsible for compiling the pro forma financial information on the basisof the applicable criteria specified in the JSE Listings Requirements.1

Commentary continuedSEGMENTAL RESULTSElectrical EngineeringAlthough depressed demand from key state institutions continued in the period under review, segmentrevenue increased by 14% from R2 431 million to R2 775 million with segment operating income improvingby 3% from R219 million to R225 million.CBi-Electric African Cables continues to contend with low demand from Eskom and some municipalities.To counter this, this business continues to actively pursue other segments of the cable market, althoughany such sales are generally at lower margins due to the type and length of cables produced.The adverse liquidity environment in Zambia continued and limited progress was made in collecting overduestate debt by Zamefa, our Zambian power cable manufacturer. The business was managed to preserve cashby limiting manufacturing output to cash received. Positively, the draft legislation for the new general salestax has been published and is expected to be promulgated this year which will result in the repeal of ValueAdded Tax (VAT). This should allow Zamefa to return to normal operating levels in 2020 as it should nolonger be burdened by the slow settlement of VAT refunds arising on manufacturing inputs.Subsequent to 31 March 2019, the rapid depreciation of the Zambian Kwacha against the United StatesDollar (the currency in which the majority of Zamefa’s liabilities are denominated), resulted in the technicalinsolvency of Zamefa. To remedy this, the group has subordinated its loan account of US 20 million infavour of Zamefa’s other creditors.Orders for copper and fibre optic telecommunication cables partially recovered from the levels experiencedin 2018, which together with reduction in the base cost at CBi-electricTelecom, a joint venture company,saw this business returning to profitability in the current reporting period.Our circuit breaker business continued to make good progress in increasing export volumes to bothAustralia and the USA, thereby increasing factory throughput. The improved export performance resulted inthe company improving their year-on-year performance, notwithstanding weak local market conditions.Information Communication TechnologiesThis segment increased revenue by 3% from R1 670 million to R1 722 million and operating profit by 11%from R317 million to R351 million.The Nashua Office Automation cluster continued to progress its strategy of evolving to a ‘total workspaceprovider’ with new services forming an increasingly important part of its revenue and profit mix. Theserevenues relieved some of the pressure on the lower sales of hardware units because of the prevailingeconomic conditions. Margins were maintained through a combination of increased service revenue andcost control resulting in a solid performance for this business.Our voice over internet business, Electronic Communications Network, gained a record number of newcustomers, which largely offset the decline in usage per customer due to the economic environment andalternative technology offerings. To improve the operating efficiency of the business, we are migrating to abest-in-class industry standard software platform to manage the network.2REUNERT LIMITED

SkyWire’s integration into the ICT segment is complete. Connection rates are not yet at the required rate.However, the cash generation of the business remains in line with the investment case.Applied ElectronicsRevenue in this segment increased by 16% from R863 million to R999 million with operating profitincreasing by 39% from R61 million to R85 million.The increase in both revenue and operating profit was mainly as a result of increased exports and therecovery in our mining radar business.The Communications business’ revenue and operating profit increased substantially over the prior period.The business continued to achieve higher throughput and improved its operational efficiencies byoptimising its production lines. The second tranche of the contract for the renewal of the South AfricanNational Defence Force’s tactical communication system is currently being executed and the businesswas successful in securing and delivering export orders for its new range of digital tactical radios.The fuze factory’s exports increased in the period under review, although the mix of fuzes sold had a lowermargin than in the prior year.Our solar energy business continued to accelerate growth as the volume of contracts secured increased.Margins have come under some pressure as market competition increases.The rest of the business units in the Applied Electronics segment did not materially contribute to the profit,primarily due to timing of their export contracts.GROUP CASH RESOURCESThe group continued to generate positive operating cash flow and ended the period with R426 million in netliquid resources (30 September 2018: R572 million) after payment of the final dividend of 2018 amountingto R606 million.NEW ACCOUNTING STANDARDSThe group adopted IFRS:15 Revenue from Contracts with Customers and IFRS: 9 Financial Instrumentswith effect from 1 October 2018. The new standards did not materially impact the results for the periodunder review and the transitional adjustments are set out in Note 15: changes in accounting policy.DIRECTORATEThere were no changes to the Board during the period under review.3

Commentary continuedPROSPECTS*The results from the national election and the anticipated improvements that are likely to ensue, should bepositive for business confidence, foreign direct and local investment and improved management of stateowned entities and municipalities. All of these factors are positive for the Reunert investment case andshould result in improved economic activity as the changes are implemented.The exact timing of this improvement in electrical infrastructure and investment remains uncertain andaccordingly, the profitability of the Electrical Engineering segment in the second half of the financial yearis expected to remain at current levels.The ICT segment is expected to continue positively for the balance of the financial year with strongerbusiness confidence, post national elections, hopefully creating an improved environment for assetinvestment by its customers.The Applied Electronics segment commences the second half of the financial year with strong exportorders and our solar energy business should continue its growth, which should result in a strong segmentperformance in the second half of the financial year.Despite the above, the group is unlikely to match the performance of the second half of the prior financialyear. However with our strong balance sheet and operational focus, we remain well positioned to benefitfrom any improvement in local economic conditions.* Any forecast financial information is the responsibility of the directors and has not been reviewed or reported on by thegroup’s auditors.4REUNERT LIMITED

CASH DIVIDENDNotice is hereby given that a gross interim cash dividend No 186 of 130,0 cents per ordinary share(2018: 125,0 cents per share) has been declared by the directors for the six months ended 31 March 2019.The dividend has been declared from retained earnings.A dividend withholding tax of 20% will be applicable to all shareholders who are not exempt from, or whodo not qualify for a reduced rate of withholding tax. Accordingly, for those shareholders subject towithholding tax, the net dividend amounts to 104,0 cents per share (2018: 100,0 cents per share).The issued share capital at the declaration date is 184 659 796 ordinary shares.In compliance with the requirements of Strate Proprietary Limited and the Listings Requirements of theJSE Limited, the following dates are applicable:Last date to trade (cum dividend)Tuesday, 18 June 2019First date of trading (ex dividend)Wednesday, 19 June 2019Record dateFriday, 21 June 2019Payment dateMonday, 24 June 2019Shareholders may not dematerialise or rematerialise their shares between Wednesday, 19 June 2019 andFriday, 21 June 2019, both days inclusive.On behalf of the boardTrevor MundayAlan DicksonNick ThomsonChairmanChief Executive OfficerChief Financial OfficerSandton, 24 May 20195

CONDENSED CONSOLIDATED STATEMENTOF PROFIT OR LOSSFOR THE SIX MONTHS ENDED 31 MARCH 2019Six months ended 31 MarchR 5 2884 841EBITDA*698Depreciation and amortisation(83)615Operating profit3Year ended30 September%2018change(Audited)910 492636101 699(69)20(157)56781 542–11Net interest (expense)/incomeand dividends4(4)8Loss on disposal of subsidiary11(44)–––(2)(42)5(6)(1)Empowerment transactions5Share of joint ventures’ andassociate’s profit/(loss)Profit before taxationTaxationProfit for the period57256711 510(195)(119)64(358)377448(16)1 152Profit attributable to:Non-controlling interestsEquity holders of Reunert113267(6)366445(18)1 158CentsBasic earnings per share6,7227275(17)717Diluted earnings per share6,7223270(17)705* Earnings before net interest income and dividends; taxation; depreciation and amortisation; loss on disposal of subsidiary,empowerment transactions and share of joint ventures’ and associate’s profit/(loss).6REUNERT LIMITED

Other measures of earnings per shareSix months ended 31 MarchCentsNotes2019(Unaudited)2018(Unaudited)Year ended30 September%2018change(Audited)Headline earnings per share6, 7253275(8)703Diluted headline earningsper share6, 7248270(8)691Normalised headline earningsper share6, 7253276(8)687Diluted normalised headlineearnings per share6, 7248271(8)6751301254493Interim/total cash dividendper share7

CONDENSED CONSOLIDATED STATEMENTOF COMPREHENSIVE INCOMEFOR THE SIX MONTHS ENDED 31 MARCH 2019Six months ended 31 March2019(Unaudited)R millionProfit for the periodYear ended30 September20182018(Unaudited)(Audited)3774481 1525(62)(65)Other comprehensive income, net of taxation:Items that may be reclassified subsequently toprofit or lossGains/(losses) arising from translating the financialresults of foreign subsidiaries2(40)(23)Translation gain/(loss) on net investment in subsidiary*3(22)(42)3823861 087Non-controlling interests11(2)(9) Share of profit for the period Share of other comprehensive income113(6)–(5)(3)Equity holders of Reunert3713881 096 Share of profit for the period Share of other comprehensive income3664451 1585(57)(62)Total comprehensive incomeTotal comprehensive income attributable to:* Translation gain/(loss) arising on the loan component of the group’s net investment in a foreign subsidiary.8REUNERT LIMITED

CONDENSED CONSOLIDATED STATEMENTOF FINANCIAL POSITIONAS AT 31 MARCH 2019Six months ended 31 MarchR millionNotes2019(Unaudited)2018(Unaudited)30 September2018(Audited)Non-current assetsProperty, plant and equipment, investmentproperties and intangible assetsGoodwill8Investments and loansInvestment in joint ventures and associateRental and finance lease receivablesDeferred taxation1 2701 2461 2979911 0881 0535561561691531581 9951 8511 9901371111514 6174 5104 7051 5671 3721 4618547738212 4012 2562 694Current assetsInventoryRental and finance lease receivablesAccounts receivable and taxationDerivative assetsCash and cash equivalentsTotal assetsEquity attributable to equity holders of ReunertNon-controlling interestsTotal equity41678941 0557655 7205 4725 74810 3379 98210 4537 1256 8967 4387597887 2006 9937 526Non-current liabilitiesDeferred 12 3142 0952 270112665468551193Put option liabilityLong-term borrowingsShare based payment liabilityCurrent liabilitiesAccounts payable, provisions and taxationDerivative liabilitiesBank overdrafts and short-term loansCurrent portion of long-term borrowings10Total equity and liabilities9111182 7942 6832 54610 3379 98210 453

CONDENSED CONSOLIDATED STATEMENTOF CHANGES IN EQUITYFOR THE SIX MONTHS ENDED 31 MARCH 2019Six months ended 31 March2019(Unaudited)R millionShare capitalBalance at the beginning of the periodIssue of sharesShare-based payment reservesBalance at the beginning of the periodEquity-settled share-based paymentsShares acquired for incentive schemeTax impact of cost of incentive shares charged to equityTransfer to deferred taxTransfer from retained earningsEquity transactions/put option with non-controllingshareholders2018(Unaudited)30 3)–11Empowerment shares1Treasury shares2(276)(342)(276)(312)(276)(342)Balance at the beginning of the periodShares bought back during the periodForeign currency translation �(42)7 2857 0997 5997 599(56)3667 225–4457 225–1 158(593)(31)(571)–(772)(12)6 8967 438Balance at the beginning of the periodAcquisition of businessesPartial disposal of subsidiariesTransfer to retained earningsBalance at the beginning of the periodOther comprehensive incomeRecycled to the statement of profit or loss on disposalof foreign subsidiaryTranslation loss on net investment in foreign subsidiaryBalance at the beginning of the periodCurrent period gain/(loss)Retained earningsBalance at the beginning of the periodIFRS 9 and IFRS 15 transitionProfit for the period attributable to equity holdersof ReunertCash dividends declared and paidTransfer to reservesEquity attributable to equity holders of Reunert(carried forward)7 12510REUNERT LIMITED

Six months ended 31 March2019(Unaudited)R millionEquity attributable to equity holders of Reunert(brought forward)Non-controlling interests7 12575Balance at the beginning of the periodIFRS 9 and IFRS 15 transitionShare of total comprehensive incomeDividends declared and paidNet changes in non-controlling interests2018(Unaudited)30 September2018(Audited)6 896977 43888105–(2)(5)(1)105–(9)(9)16 9937 52688(9)11(13)(2)Total equity at end of the period7 2001This is the cost of Reunert Limited shares held by Bargenel Investments Proprietary Limited (Bargenel), a company sold byReunert to its empowerment partner in 2007. Until the amount owing by the empowerment partner is repaid to Reunert,Bargenel is consolidated by the group as the significant risks and rewards of ownership of the equity have not passed tothe empowerment partner.2Reunert shares bought back in the market and held by a subsidiary: 4 997 698 (2018: 4 604 380)(September 2018: 4 997 698).11

CONDENSED CONSOLIDATED STATEMENTOF CASH FLOWSFOR THE SIX MONTHS ENDED 31 MARCH 2019Six months ended 31 MarchNotesR million2019(Unaudited)2018(Unaudited)30 September2018(Audited)EBITDADecrease/(Increase) in net working capitalOther net non-cash movements6989355636(269)251 699(498)(79)Cash generated from operationsNet cash interest income and dividendsTaxation paidDividends paid (including to non-controllinginterests)8461(205)39212(210)1 12220(445)(606)(576)(781)Net inflow/(outflow) from operating activitiesNet outflow from investing ��(2)(2)(1)(147)(821)(766)5721 3251 3251–13426504572894(175)(293)1 055(344)(207)765(126)(67)426504572Capital expenditureNet inflow arising from disposal of businessesGross cash flows on acquisition of businessesIncrease in total rental and finance leasereceivablesNet other investments and loans repaid/(granted)Investments net of other capital proceeds111Net outflow from financing activitiesShares issuedInvestment in treasury sharesNet long term borrowings raised/(repaid)Shares acquired in terms of the ConditionalShare PlanNet transactions with non-controlling interestsExercise of Ryonic put optionDecrease in net cash resourcesNet cash resources at the beginning ofthe periodNet exchange translation adjustments to netcash resources2Net cash resources at the end of the periodCash and cash equivalentsBank overdraftsShort-term borrowingsNet cash resources at the end of the period12In the prior period, this includes a withdrawal from investments in long-dated money market instruments(September 2018: R130 million).In March 2018, these effects were insignificant.12REUNERT LIMITED

CONDENSED SEGMENTAL ANALYSISAT 31 MARCH 2019Six months ended 31 MarchR million2019(Unaudited)%of total2018(Unaudited)%of total%changeYear ended30 September2018(Audited)%of totalRevenue1Electrical Engineering2 775512 43149145 13948ICT1 722311 6703433 44332Applied Electronics9991886317162 19820Other(21)–5–15–1004 96910010 795100Total segment revenue5 47510Revenue from equityaccounted joint venturein Electrical Engineeringsegment(170)(114)(271)Revenue from equityaccounted associate inICT segment(14)(14)(29)Revenue from equityaccounted joint venturein Other segment(3)–(3)Revenue as reported4 8415 288910 492Operating profitElectrical 61113938025Other(38)(6)(38)(7)–(73)(5)Total segmentoperating profit623100559100111 539100Applied ElectronicsOperating (profit)/lossfrom equity accountedjoint venture in ElectricalEngineering segment(4)99Operating profit fromequity accountedassociate in ICT segment(2)(1)(3)Operating profit fromequity accounted jointventure in Other segment(2)–(3)Operating profitas reported1256761581 542Inter-segment revenue is immaterial and has not been separately disclosed.The net interest charged on group funding provided to the group’s in-house finance operation has beeneliminated in line with the consolidation principles of IFRS. This interest amounted to R82 million(March 2018: R70 million) (September 2018: R146 million). Should this operation be externally funded, thiswould result in a reduction of ICT’s operating profit by the quantum of the interest paid.1329

Condensed segmental analysis continuedAT 31 MARCH 2019Six months ended 31 March2019(Unaudited)R million%of total2018(Unaudited)Year ended30 September%2018of total(Audited)%of totalTotal assetsElectrical Engineering3 340322 869292 97828ICT4 592454 490454 66245Applied Electronics2 054201 970202 4432335136536370410 3371009 98210010 453100Other1Total assets as reported2Total liabilities1 29241913301 10538ICT767241 0343584529Applied Electronics840277362580727Other23883061017063 1371002 9891002 927100Electrical EngineeringTotal liabilities as reported122In March 2019 and September 2018 this comprises mainly of properties. In March 2018 it comprised of both grouptreasury cash balances and properties.Intercompany receivables, payables and loans have been eliminated in line with the consolidation principles of IFRS.14REUNERT LIMITED

NOTES1Basis of preparationThis unaudited interim financial report has been prepared in accordance with the frameworkconcepts and the recognition and measurement requirements of International Financial ReportingStandards (IFRS) in effect for the group at 1 October 2018, and further complies with the SAICAFinancial Reporting Guides, as issued by the Accounting Practices Committees and the FinancialReporting pronouncements as issued by the Financial Reporting Standards Council. This interimfinancial report was prepared using the information as required by IAS 34 – Interim FinancialReporting, and complies with the Listings Requirements of the JSE Limited and the requirementsof the Companies Act, No 71 of 2008, of South Africa. This report was compiled under thesupervision of NA Thomson CA(SA) (chief financial officer).The group’s accounting policies applied for the six-month period ended 31 March 2019, wereconsistent with those applied in the prior financial year’s audited consolidated annual financialstatements, except for the impact of the first time adoption of IFRS 15: Revenue from Contractswith Customers and IFRS 9: Financial Instruments, the impact of which is set out in Note 15.These accounting policies comply with IFRS.Six months ended 31 March2019(Unaudited)R million22018(Unaudited)30 September2018(Audited)RevenueRevenue from contracts with customers4 4673 6808 243ServicesSale of goods4657261 488Contract revenue10310430220918437944147805 2884 84110 492OtherInterest received on lease receivablesRental and other revenueTotalThe Electrical Engineering segment earned the majority of its revenue in the sale of goods andservices categories. The ICT segment earned revenue in each of the above categories. The AppliedElectronics segment earned revenue in each category except for interest. Refer to the segmentalanalysis, for a disaggregation of the revenue contribution by each segment.On adoption of IFRS 15 Revenue from Contracts with Customers, the revenue recognition relatingto contracts and services has changed. Refer to Note 15.15

Notes continuedSix months ended 31 March2018(Unaudited)30 September2018(Audited)3 6533 3236 9999639031 976262182––1008369157– Realised loss on foreign exchange andderivative instruments(11)(10)(99)– Unrealised gain/(loss) on foreign exchangeand derivative instruments23(11)21– Auditors’ remuneration1413252019(Unaudited)R million3Operating profitOperating profit includes:– Cost of sales (excluding depreciation andamortisation)– Other expenses (excluding depreciationand amortisation)– Other income– Fair value gain on contingent consideration*– Depreciation and amortisation**Included in other expenses above are:* For March 2019 and 2018, these amounts have been included in other income above due to their immateriality.September 2018 includes routine movements of R23 million and a non routine movement of R77 million arisingfrom SkyWire.** Depreciation and amortisation allocated to cost of sales in gross margin calculations is R30 million(2018: R27 million) (September 2018: R51 million). Depreciation and amortisation allocated to otherexpenses is R53 million (2018: R42 million) (September 2018: R106 million).Six months ended 31 March2019(Unaudited)R million42018(Unaudited)30 September2018(Audited)Net interest income and dividendsInterest income and dividends233160(22)(19)(40)Interest on unwinding of put option liability(5)(4)(9)Total(4)811Interest expense16REUNERT LIMITED

Six months ended 31 MarchR million530 September2018(Audited)––32Empowerment transactionsIFRS 2 share-based payment cost of BBBEEtransactionsProfessional costs related to �210Taxation thereon–––Net empowerment transactions after taxation–242Number of shares and earnings used tocalculate earnings per share1Weighted average number of shares in issue,net of empowerment and treasury shares,used to determine basic earnings, headlineearnings and normalised headline earnings pershare (millions of shares)161162161Adjusted by the dilutive effect of unexercisedshare options granted (millions of shares)333Weighted average number of shares used todetermine diluted basic, headline andnormalised headline earnings per share(millions of shares)1641651641The earnings used to determine earnings per share and diluted earnings per share is the profit for theperiod attributable to equity holders of Reunert, as per the statement of profit or loss, of R366 million(2018: R445 million) (September 2018: R1 158 million).17

Notes continuedSix months ended 31 March2018(Unaudited)30 September2018(Audited)3664451 15844––(2)–(23)4084451 135Empowerment Transactions–242Once-off IFRS 2 share based payment cost ofBBBEE transactions (tax and NCI of Rnil)(March and September 2018: tax and NCI of Rnil)––32Professional fees for BBBEE transactions (taxand NCI of Rnil) (March and September 2018:tax and NCI of Rnil)–210Acquisition (Unaudited)R million7Headline earnings7.1Headline earningsProfit attributable to equity holders of ReunertHeadline earnings are determined by eliminatingthe effect of the following items fromattributable earnings:Net loss on disposal of subsidiary (after a taxcharge of Rnil) (2018 Rnil) (September 2018charge of Rnil)Net gain on disposal of assets (after a taxcharge of R1 million and non-controlling interest(NCI) portion of Rnil) (2018: tax and NCI of Rnil)(September 2018: tax charge of R5 million andNCI of Rnil)Headline earnings#7.2Normalised headline earningsNormalised headline earnings are determinedby eliminating the effect of the following itemsfrom headline earnings:Recurring professional fees for acquisitions (taxand NCI of Rnil) (March and September 2018:tax and NCI of Rnil)Once-off contingent consideration fair valueremeasurement (tax and NCI of Rnil) (Marchand September 2018: tax and NCI of Rnil)*Normalised headline earnings18REUNERT LIMITED1 109

77.2Headline earnings continuedNormalised headline earnings# continued# The pro forma financial information above has been prepared for illustrative purposes only to provideinformation on how the normalised earnings adjustments might have impacted on the financial results of thegroup. Because of its nature, the pro forma financial information may not be a fair reflection of the group’s resultsof operations, financial position, changes in equity or cash flows.The pro forma financial effects have been prepared in a manner consistent in all respects with IFRS, theaccounting policies adopted by Reunert Limited as at 30 September 2018, the revised SAICA guide on proforma financial information and the Listings Requirements of the JSE Limited.There are no post balance sheet events that necessitate adjustment to the pro forma financial information.The directors are responsible for compiling the pro forma financial information on the basis of the applicablecriteria specified in the JSE Listings Requirements.* In respect of the SkyWire acquisition in 2018.Six months ended 31 MarchR million82018(Unaudited)30 September2018(Audited)1 053921921–183146–––(16)(14)9911 0881 0532019(Unaudited)GoodwillCarrying value at the beginning of the periodAcquisition of businessesDisposal of business (Note 11)(62)Exchange differences on consolidation offoreign subsidiariesCarrying value at the end of the period19

Notes continuedSix months ended 31 March2019(Unaudited)R million92018(Unaudited)30 September2018(Audited)121Put option liabilityAs part of the Terra Firma and Ryonicacquisitions, the group granted put options infavour of the non-controlling shareholders for25% of the issued share capital.A reconciliation of the closing balance isas below:120121Fair value remeasurementsBalance at the beginning of the period––(9)Payment to option holder (Ryonic)––(1)Unwinding of discount549125125120Balance at the

Add: loss on disposal of Prodoc 44 - 10 Adjusted PAT* 421 406 4 FINANCIAL RESULTS Financial performance group results and key earnings metrics Units 6 Months to 31 March 2019 . best-in-class industry standard software platform to manage the network. 2 3 REUNERT LIMITED SkyWire's integration into the ICT segment is complete. Connection .