Transcription

Benefits Guidefor US Employees On TravelUpdated 8.1.2020SectionPageTravel Assistance1-4Health Care in aForeign Country5-7Immunization and Rx8PurchasingAdditional MedicalInsurance9Workers’Compensation10Appendix A: MTSMedical Plan—Summary of Benefits &Coverage—PPO11-15Appendix B: MTSMedical Plan—Summary of Benefits &Coverage– HSA16-20Appendix C—MTSBenefits Mobile App21Appendix D—BlueCross Blue Shield App22Appendix E—FSA App23MTS Contacts:Lucina Ameslucina.ames@mts.com952-937-4171Cary Feikcary.feik@mts.com952-937-4826Zurich – Travel AssistSMTravel Assist (Zurich)Within US & Canada:800-263-0261Outside US (Call collect):1-416-977-0277MTS Medical Plan—Blue Cross Blue Shield (BCBS:#1-866-340-8653Seabury & SmithGateway Plan Administrator#800-282-4495 or 202-367-5097www.gatewayplans.comEmail: gateway@marshpm.comSummary of Commonly Asked QuestionsWhat is Travel Assistance?What would you do if you became ill orwere involved in an accident in a foreigncountry? How would you deal with suchan emergency where language is aproblem and adequate standards ofmedical care cannot be guaranteed? Thisis when you need travel assistance. TheMTS travel assistance benefits, throughZurich are available to MTS employees toanswer these questions and providemedical, personal, and travel assistanceservices when traveling internationally.These services are outlined on pages #25.How does Travel Assistance andthe MTS Medical Plan worktogether?These plans compliment each other. Travel assistance providesemergency medical and personalassistance for medical consultation,helps with hospital admissions andmedical payments, emergencyevacuation & transportation,repatriation, etc. It will not pay formedical care. Travelers enrolled in the MTS MedicalPlan have access to BlueCrossBlueShield Global Core, a programthat provides you with in-networkcoverage to doctors & hospitalsaround the world as well as access tomedical assistance services. Seepages #6-8 for more details.What coverage do I have for anemergency if I’m enrolled in theMTS Medical Plan?The MTS Medical Plan coverage forambulance and emergency room chargesis the same for care received from allproviders, both outside the US as well asemergencies in the US. This coverage isas follows:1. PPO: 100% after a 150 co-payment.The co-payment is waived if admittedwithin 24 hours.2. HSA: 80% after deductible.Note: The MTS Medical Plan definesemergency as a serious medical conditionwhich arises suddenly and requires immediatecare and treatment in order to avoid jeopardyto the life and health of the person.Is additional medical insurancecoverage available while ontravel?You may purchase a supplementalmedical insurance policy throughGateway Plans. See page #10 formore on what things to consider beforemaking this decision.Our customer requires MTS toprovide “proof of healthinsurance” before I can visit theirwork location. Who may I contactto get these documents before Itravel outside the US?For a.Contact.1.Certificate ofInsurance forworkers’compensationMelody Gunner atmelody.gunner@mts.com or call 952-93740082.Documentprovidingproof of yourMTS MedicalPlan coverageContactbenefits@mts.com orcall 952-937-4171 ifyou need proof ofyour MTS MedicalPlan coverage onMTS letterheadHow much Business TravelAccident (BTA) Insurancecoverage do I have?The BTA plan pays a benefit if you die orare severely injured as a direct result ofan accident while you are on a businesstrip. The amount payable depends on theseverity of the loss. For death, it is 3times your annual salary up to 600,000. The amount ranges from25% - 100% for other coveredinjuries. If more than one MTS employee diesor is injured in the same accident,the BTA Plan’s maximum benefit forall employees involved is 6 million. This benefit is paid in addition to yourbasic life insurance, and anyaccidental death anddismemberment insurance benefits.

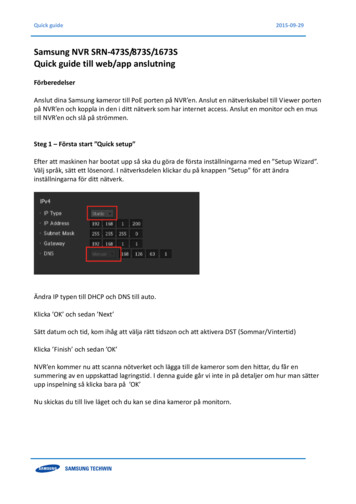

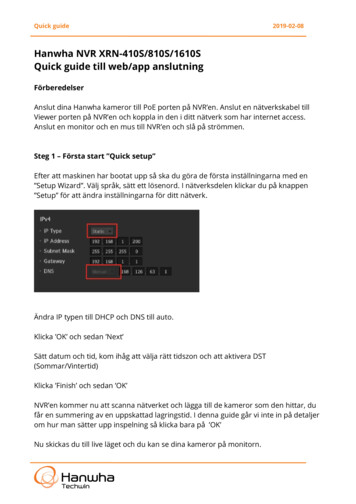

Travel Assistance summaryPage 2Zurich travel assistance is available to MTS employees to provide medical, personal, and travel assistance services when traveling internationally. These services are outlined below. More details are on pages 3-5.Medical Assistance Medical referralsMedical monitoringMedical evacuationPrescription drugassistanceHospital admissionsand help makingadvance medicalpaymentsPersonal Assistance Emergency messagetransmissionLegal referrals andassistanceLost document assistanceTranslation andinterpretersTravel Assistance Emergency family travelarrangements.Traveling companion assistanceDependent children assistanceTransportation to join disabledfamily memberPre-trip assistanceWe encourage traveling employees to carry a travel assistance card and overseas travel materials at all times. The Zurich travelassistance card contains the phone number to access travel assistance services. See below on instructions to print ID cards andenter our policy number. The ID cards will also provide you with the phone number to access your travel assistance benefits.Zurich Travel Assistance Plan: The transportation and/or services provided under this Travel Assistance Plan must be preauthorized by Zurich. You can access Zurich Travel Assist by calling 1-800-263-0261 and reference the policy # GTU3761086.You may be asked for your Coverage Class:Class 1Active, CEO and Executive level direct reports (which includes all Executive Officers) onthe U.S. payroll working at least 15 hours per weekClass 2Active, Regular Employees who are NOT on U.S. payroll working at least 15 hours perweekClass 3Active, Non-Employee Board MembersClass 4Active, Regular Employees who are on the U.S. payroll working at least 15 hours per weekClass 5Active, Non-US Part-Time Employees working at least 15 hours per weekClass 6All Expatriates working at least 15 hours per weekTo download an ID card, visit the MTSIntranet at Groups Human Resources YourBenefits & Compensation Empl AssistProgram & Travel Asst Travel Assistance

Travel assistance ion TranslationEligibilityMedical HomeSecurityEvacuationCoverage—Thisbenefit onlyapplies whiletraveling on acovered businesstrip.HospitalAdmissions gency CashLocating Lost/Stolen ItemsReturn ofVehicleLost BaggageServicesPage 3Zurich – Travel AssistTravel Assist’s 24-hour call center and global communications network is staffed bymultilingual physicians, nurses, travel assistance specialists and assistance coordinators.Employees, their spouse and dependents traveling 100 or more miles from home. Thespouse and dependent are only covered if traveling with the Employee.Travel Assist will provide the name, address, and telephone number of physicians, hospitals,and clinics for the area in which you are traveling. Where possible, the medical providerreferred by Zurich Travel Assist will be able to speak your language.When Zurich Travel Assist is notified of a medical emergency, its multilingual staff willestablish contact with the local attending physician and assist with arranging appropriatecare. Zurich Travel Assist will maintain contact with the attending physician and with yourfamily and business associates until the situation is resolved and you are able to resumetraveling.In the event a local hospital, medical facility, or clinic is not able to provide you with medicalcare comparable to Western medical standards, Zurich Travel Assist will arrange and coverthe cost of your transportation to the nearest hospital or medical facility which can providesuch care.Zurich will make arrangements for you to be safely returned to your principal residence. Thiscoverage provides for necessary evacuations from a location that is unsafe to a place ofsafety, and, when the danger is cleared, back to the original destination or to your principalresidence.Coverage includes the transport and related costs (including hotel/lodging, meals and ifnecessary physical protection). The maximum benefit is 100,000.Coverage applies to spouse and dependents if they are traveling with the employee on acovered business trip.If you are having difficulty in making payment arrangements for admission to a hospital ormedical provider, Zurich Travel Assist will facilitate admission with a satisfactory guarantee ofreimbursement from you. Zurich Travel Assist will debit your credit card and arrange for you toobtain the funds.If your traveling companion must forfeit or change reservations for airline tickets as a result ofyour illness or injury, Zurich Travel Assist will pay the lessor of the change fee or for one wayeconomy transportation.Upon your request, Zurich Travel Assist will provide funds with a satisfactory guarantee ofreimbursement. Zurich Travel Assist will debit your credit card and arrange for you to obtainthe funds in local currency.Travel Assist will assist in locating lost documents and other important personal items bycontacting hotels, airlines, and government authorities.If you have to leave a rented or privately owned vehicle stranded because of an illness orinjury, Zurich Travel Assist will arrange for its proper return.Zurich Travel Assist will advise you and provide message service to assist with locating lostluggage.

Travel assistance ServicesServicePage 4Zurich – Travel AssistMedicalRepatriationOnce you have sufficiently recovered from an illness or injury to travel in a non-scheduledcommercial air flight or regularly scheduled air flight with special equipment and/orpersonnel, Zurich Travel Assist will arrange and cover the cost of your transportation toyour principal residence or the country where you are currently assigned.Non-MedicalRepatriationOnce you have sufficiently recovered to travel in a regularly scheduled economy classflight, Zurich Travel Assist will pay for the increase in cost to change the travel date and/oran upgrade in the seating at our discretion.EmergencyMessageTransmissionZurich Travel Assist can send or receive emergency messages on your behalf.Transportation toJoin PatientIf you are expected to be hospitalized for more than seven days and request to have afriend or family member at your bedside, Zurich Travel Assist will arrange and cover thecost of economy round-trip transportation for one.DependentChildrenAssistanceIf your child, under the age of 19, is left unattended as a result of an illness or injury, ZurichTravel Assist will arrange and cover the cost of economy transportation for their travelhome. Zurich Travel Assist will also provide an attendant for a child who cannot travelalone.Return of MortalRemainsIn case of death, Zurich Travel Assist will provide for the local preparation of the body toreturn the remains for burial, including travel clearances, authorizations, and standardshipping container to its country of destination.LegalAssistanceZurich Travel Assist can assist you with locating a lawyer in the area in which you aretraveling. Where possible, the referred lawyer will be able to speak your language. Also,Travel Assist will facilitate bail with satisfactory guarantee of reimbursement from you.InformationalAssistanceTravel Assist can inform you of visa and passport, and inoculation and immunizationrequirements for any destination and assist you in obtaining necessary documentation.Travel Assist can also provide you with the latest weather forecasts for major cities, informyou about important cultural events around the world, and advise you on daily exchangerates for world currencies.

Health Care in A foreign CountryPage 5What if I need medical care in a foreign country?If you are enrolled in the MTS Medical PlanIf you are outside the US, the Commonwealth of Puerto Rico, and the US Virgin Islands, you may be able to takeadvantage of the BlueCross BlueShield Global Core Program when accessing covered health care services. TheBlueCross BlueShield Global Core Program is unlike the BlueCard Program available in the BlueCard service area incertain ways. For instance, although the BlueCross BlueShield Global Core Program assists you with accessing anetwork of inpatient, outpatient and professional providers, the network is not served by a Host Blue. As such, whenyou receive care from providers outside the BlueCard service area, you will typically have to pay the providers andsubmit the claims yourself to obtain reimbursement for these services.If you need medical assistance services (including locating a doctor or hospital) outside the BlueCard service area, callthe BlueCross BlueShield Global Core Service Center at 1-800-810-BLUE (2583) or call collect at 1-804-673-1177,24/7. An assistance coordinator, working with a medical professional, can arrange a physician appointment orhospitalization, if necessary.1. Before you leave, review the coverage details for the MTS Medical Plan PPO and HSA found on pages 12-21.2. Always carry your current MTS Medical Plan ID card. Note: The phone number for Blue Cross Blue Shield, the MTSMedical Plan claims administrator, is found on the back of your MTS Medical Plan ID card.3. In an emergency, go directly to the nearest doctor or hospital, then call the BlueCross BlueShield Global CoreService Center if hospitalized.4. In most cases, for inpatient care arranged by BlueCross BlueShield Global Core Service Center, hospitals will notrequire you to pay for covered inpatient services, except for your deductibles, coinsurance, etc. In such cases, thehospital will submit your claims to BlueCross BlueShield Global Core Service Center to begin claims processing.However, if you paid in full at the time of service, you must submit a claim to receive reimbursement for coveredhealth care services. You must contact the Claims Administrator to obtain precertification for non-emergencyinpatient services.5. If you are hospitalized, call Blue Cross Blue Shield of Minnesota at 1-866-340-8652 within two working days or assoon as reasonably possible to help manage your care effectively and ensure you receive the maximum benefitcoverage.6. For outpatient services, physicians, urgent care centers and other outpatient providers located outside theBlueCard service area will typically require you to pay in full at the time of service. You must submit a claim toobtain reimbursement for covered health care services.7. Review a-d below on when you may need to make a payment upfront, when to report an inpatient admission, andthe definition of inpatient care.a. When You Are Required to Make An Upfront Payment: If the patient is seen by a GlobalCore provider ina clinic, urgent care, emergency room or a hospital as an outpatient, the patient is responsible forsubmitting any/all charges to the health plan (via GlobalCore) and may be asked to pay upfront forservices. Here’s the link to the claim form.b. When You Are Not Required to Make an Upfront Payment: If the patient is admitted to the hospital andthe facility participates with GlobalCore, the facility will not bill the patient upfront and will submit the facilityclaim on the patient’s behalf.c. When to Report an Inpatient Admission: If the inpatient admission is not coordinated by GlobalCore, thepatient must call 1-800-340-8652 within 2 business days or as soon as reasonably possible to report theadmission.d. Definition of Inpatient Care – Confinement of at least 23 hours. Hospital services under 23 hours isconsidered outpatient and the patient may be responsible for submitting their own claims and may be billedupfront by the facility.8. When you pay for covered health care services outside the BlueCard service area, you must submit a claim toobtain reimbursement. For institutional and professional claims, you should complete a BlueCross BlueShieldGlobal Core International claim form and send the claim form with the provider’s itemized bill(s) to the BlueCrossBlueShield Global Core Service Center (the address is on the form) to initiate claims processing. Following theinstructions on the claim form will help ensure timely processing of your claim. The claim form is available from theClaims Administrator, the BlueCross BlueShield Global Core Service Center, or online at www.bcbsglobalcore.com.If you need assistance with your claim submission, you should call the BlueCross BlueShield Global Core ServiceCenter at 1-800-810-BLUE (2583) or call collect at 1-804-673-1177, 24 hours a day, seven days a week.

Health Care in A foreign CountryPage 6What if I need medical care in a foreign country?If you are or are not enrolled in the MTS Medical Plan .1. If you need to locate a doctor or hospital, or need medical assistance services, call Zurich. An assistancecoordinator, in conjunction with a medical professional, can arrange a physician appointment or hospitalization, ifnecessary.2. If you need to pay upfront for care received by a doctor and/or non-participating hospital, take this action: Review the Hospital Admissions and Medical Payments on page 4. Follow the steps on page #8 for submitting an out-of-network claim.Flexible Spending Account (FSA)You may seek reimbursement of eligible medical expenses from a non-US provider.The MTS FSA claims Administrator, benefitexpress, recommends that claims be translated to English andconverted to US dollars prior to submission.Health Savings Account (HSA)You can use the funds in your HSA account to pay for medical expenses, including expenses that count towardthe MTS PPO BlueCard with HSA medical plan deductible.You can also pay qualified dental and vision expenses.Emergency DentalYou will need to pay for services out-of-pocket and submit your claim to Delta.Reimbursement checks will be sent to your home address.

Out-of-Network MTS MedicalPage 7HOW TO FILE AN OUT-OF-NETWORK CLAIMThe information below will explain: The steps you or your out-of-network provider will need to follow when submitting an out-of-network medicalclaim to the MTS Medical Plan claims administrator (Blue Cross Blue Shield Global Core) and The approximate timeframe it will take for a medical claim to be processed.StepInstructionsDetails1If the out-of-network Provideris .1. Able or willing to submit a claim on your behalf, present your MTSMedical Plan ID card to ensure your claim is submitted correctly tothe BlueCross BlueShield Global Core claims address found on theInternational Claim Form.2. Not able or willing to submit a claim on your behalf, you may submita claim yourself. Blue Cross Blue Shield of Minnesota willreimburse you at the converted currency rate for the date of servicefor foreign currency.2Go here for an out-of-networkclaim form www.bcbsglobalcore.com3Take the following action onthe claim form 1. Review claim filing instructions on back side of claim form, and2. Complete sections 1-5 and sign and date the form.4Send the claim form with yourout-of-network provider’sreceipt to BlueCrossBlueShield Global Core nolater than one year followingyour date of service.BlueCross BlueShield Global Core Service CenterP.O. Box 2048Southeastern, PA 19399 USAAny missing or incomplete information may result in delay of payment or the form being returned.Time to CompleteThe time to complete the following claims process depends on when you submit the claim after your office visit,hospital stay, etc. On average, Blue Cross Blue Shield processes MTS claims within 10 days of receipt of theclaim. Claims requiring medical information, accident investigation, or coordination of benefits may experience adelay as the additional information is requested.You or your out-of-networkprovider submits claim toBlueCross BlueShieldGlobal Core.Blue Cross Blue Shield ofMinnesota then processesthe claim according toMTS Medical Plan design.Can take up to 30 days.You and your provider receive an explanation of benefits that will includea payment if healthcare received iscovered under the MTS Medical Plan.

Immunizations and RxPage 8Foreign travel and your prescriptionsGetting an Early RefillTypically, prescription refills authorizedby your doctor may be filled after youhave used 70% of the medication. Forexample, if you’ve used 21 days ofmedication out of a 30-day supply.If you travel outside the US and wish to refill yourmedication early to ensure you have enough medicationto last the length of your travel, contact BCBS customerservice (1-866-340-8653) and request an early refillauthorization (one month supply) or vacation override(more than one-month supply). Make sure to include allapplicable prescriptions in your request. BCBS will workwith MTS HR/Benefits to assess your request.Filling a Prescription Outsidethe United StatesIn the event you need to refill your prescriptionwhile outside the United States, it is best to geta written prescription from your doctor prior totravel. Take the prescription to a pharmacy inthe country you are visiting to receive yourmedication.If you fall ill while traveling and are given awritten prescription by a local doctor, simply fillthat prescription at an area pharmacy.If you must fill a prescription while outside theUS, you will be responsible for paying the retailprice and filing for a reimbursement. Be sure tosave your pharmacy receipts.Manual Claim ReimbursementFor reimbursement on your eligible prescriptions, contact BCBS customer service and request a PrescriptionDrug Claim form. When you complete this form, please note that the prescription was purchased outside theUS in the space provided.Your completed form must be accompanied by your pharmacy receipt(s). Pharmacy receipts provide detailson medication name, prescription number (Rx#), quantity, days supply, and amount paid. Cash/credit registerreceipts are not valid for processing.Immunizations or vaccinationsIf you are enrolled in the MTS Medical Plan, coverage for immunizationsand vaccinations are included in your preventive benefit andare covered at 100 percent.Note: If business travel to a country outside the US requires you to start a newprescription before you begin business travel, contact MTS HR/Benefits on havingyour new prescription covered at 100%.

Additional Medical InsurancePurchasing Additional Medical InsurancePage 9Factors to Consider BeforePurchasing AdditionalMedical InsuranceYou may purchase a supplemental medical insurance policy throughGateway Plans. Their contact information bal.comPhone1-877-808-7434Fax1-317-655-4505Note: MTS will not compensate you or provide reimbursement forthe additional cost of private insurance.How to Enroll in GatewayIf paying by check or money order, enclose checkwith completed Application (available on website)and mail to the Gateway Plan Administrator. Ifpaying by credit card, you may either mail or faxyour Application. (Please do not mail and faxyour Application, duplication may delayprocessing.)International Medical GroupPO Box 88509Indianapolis, IN 46208-0509Selecting the right plandepends on factors such asdestination, length of timeaway from country ofresidence, frequency oftravel, and most importantly,what type of coverage andservices are needed.What is the Claim PaymentProcess under the GatewaySupplemental Medical Plan?The claim payment process includes theemployee being reimbursed or the insurancecompany paying the provider directly.Will I get an ID Card?Yes. The ID card can be mailed to you ordownloaded from the insurance company’swebsite.

Workers’ CompensationPage 10Workers’ compensationIn general, workers’ compensation pays necessary medicalexpenses (physicians, hospital and prescription drugs) arising froman injury or illness incurred in the course of and arising out ofemployment. Injuries or illnesses occurring during personal activities(e.g., sightseeing excursions, personal shopping, entertainment,etc.) are generally not covered by workers’ compensation.You should report any work-related injuries or illnesses to MTS HR/Benefits (benefits@mts.com at 952-937-4171) immediately andmaintain all documentation of medical treatment, prescription drugs,and associated expenses. Claims must be reported as soon as possible.If an injury is determined to be work related1, all medical bills associated with the injury are coveredunder MTS' worker's compensation insurance program.If an injury is not the result of a work related injury, all medical expenses are considered under yourregular medical insurance. If you have signed up for a medical plan offered through MTS, please seethe Appendix “MTS Medical Plan Summary of Benefits & Coverage (SBC)”.1The Minnesota Department of Labor and Industry defines the types of injuries covered by workers’ compensation as “A work-related injury can be anycondition that is caused, aggravated or accelerated by employment activities. This includes traumatic injuries, gradual injuries or occupationaldiseases”. Our workers’ compensation insurance carrier makes all determinations of workers’ compensation compensability when they are filed byemployees. For more information about workers’ compensation, visit the Department of Labor website at https://www.dli.mn.gov/workcomp.aspEmergency travel Assistance from Euro AssistanceAdditional travel assistance services, beyond those provided by Zurich (described above), areavailable to international business travelers who have a work-related illness or injury.For example, hotel arrangements for convalescence is available through Euro Assistance. EuroAssistance will assist the employee with hotel stays and room requirements before or afterhospitalization. See the card below for contact information:For more details on this travel assistance benefit, contact benefits@mts.com or call 952-937-4171.

Appendix A: Healthcare Summary of Benefits & CoveragePage 11NOTE: The format of the Summary of Benefits & Coverage (SBC) is prescribed by the U.S. Department of Labor and the U.S.Department of Health & Human Services. As a result, you’ll see the following pages in a different format.MTS Medical Plan—PPO

Appendix A: Healthcare Summary of Benefits & CoverageMTS Medical Plan—PPO (continued pg. 2)Page 12

Appendix A: Healthcare Summary of Benefits & CoverageMTS Medical Plan—PPO (continued pg. 3)Page 13

Appendix A: Healthcare Summary of Benefits & CoverageMTS Medical Plan—PPO (continued pg. 4)Page 14

Appendix A: Healthcare Summary of Benefits & CoverageMTS Medical Plan—PPO (continued pg. 5)PPO Coverage ExamplesPage 15

Appendix B: Healthcare Summary of Benefits & CoveragePage 16NOTE: The format of the Summary of Benefits & Coverage (SBC) is prescribed by the U.S. Department of Labor and the U.S.Department of Health & Human Services. As a result, you’ll see the following pages in a different format.MTS Medical Plan—HDHP with HSA

Appendix A: Healthcare Summary of Benefits & CoverageMTS Medical Plan—HDHP (continued pg. 2)Page 17

Appendix A: Healthcare Summary of Benefits & CoverageMTS Medical Plan—HDHP (continued pg. 2)Page 18

Appendix A: Healthcare Summary of Benefits & CoverageMTS Medical Plan—HDHP (continued pg. 3)Page 19

Appendix A: Healthcare Summary of Benefits & CoverageMTS Medical Plan—HDHP (continued pg. 4)HDHP Coverage ExamplesPage 20

Appendix CPage 21

Appendix DPage 22

Appendix EPage 23

Page 24If you have questions and/or need clarification about this benefit guide,please contact the MTS HR Benefits Department.This is only a summary and is subject to the terms of the Plan Document and/or Summary Plan Description.MTS Systems Corporation14000 Technology DriveEden Prairie, MN 55344

your illness or injury, Zurich Travel Assist will pay the lessor of the change fee or for one way economy transportation. Emergency Cash Upon your request, Zurich Travel Assist will provide funds with a satisfactory guarantee of reimbursement. Zurich Travel Assist will debit your credit card and arrange for you to obtain the funds in local .