Transcription

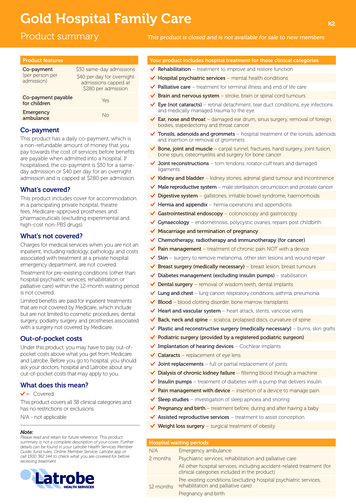

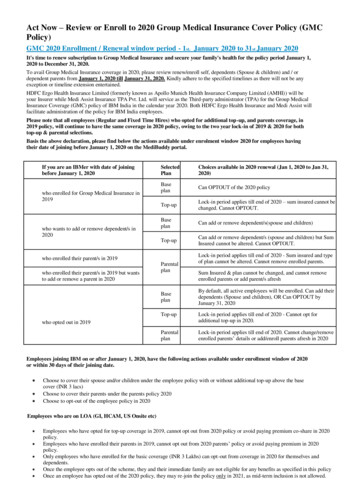

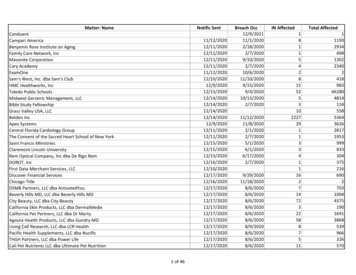

Plan Year 2020 Medical Plan ComparisonThe information in the tables below contain general plan benefits and may not include additional provisionsor exclusion. To review more in-depth plan benefits, please refer to the applicable Master Plan Document.MEDICALPLAN DESIGNFEATURESServiceAreasAnnualDeductible(medical ocketMaximumSpecialistReferralRequiredCONSUMER DRIVEN HEALTH PLAN HEALTH PLAN OF NEVADA(CDHP - PPO)(HPN-Southern HMO)PREMIER PLAN(Northern NetworkOut-ofNetworkGlobalGlobalStatewideUrgent andEmergentStatewideUrgent andEmergent 1,500 Individual 3,000 Family 1,500 Individual 3,000 Family 2,700 IndividualFamily MemberDeductible 2,700 IndividualFamily MemberDeductible20% afterdeductible20% to 50%after deductible* 3,900 Individual 7,800 Family 6,850 IndividualFamily MemberMax Out of Pocket 10,600 Individual 21,200 Family 7,150Individual 14,300FamilyN/AN/AN/AN/AN/A 7,150Individual 14,300FamilyN/ANoNoNoN/ANoN/APrimary CareOffice Visit20% afterdeductible50% afterdeductible* 20 CopayN/A 20 CopayN/ASpecialist CareOffice Visit20% afterdeductible50% afterdeductible* 40 CopayN/A 40 CopayN/AUrgentCare Visit20% afterdeductible50% afterdeductible* 30 Copay 30 Copay 50 Copay 50 Copay**Subject to Usual & Customary Limits

Plan Year 2020 Medical Plan ComparisonThe information in the tables below contain general plan benefits and may not include additional provisionsor exclusion. To review more in-depth plan benefits, please refer to the applicable Master Plan Document.MEDICALPLAN DESIGNFEATURESCONSUMER DRIVEN HEALTH PLAN HEALTH PLAN OF NEVADA(CDHP - PPO)(HPN-Southern HMO)PREMIER PLAN(Northern NetworkOut-ofNetworkEmergencyRoom Visit20% after deductible20% afterdeductible* 500 Copayper visit 500 Copayper visit 500 Copayper visit 500 Copayper visit*In-PatientHospital20% after deductible50% afterdeductible* 500 Copay peradmitN/A 500 Copayper admitN/AOutpatientSurgeryAffordableCare ActPreventiveServices20% after deductibleRequiresPre-Authorization 0(Covered at 100%)50% afterdeductible* 350 Copay 50 CopayN/ARequiresPre-AuthorizationNo BenefitN/ARequiresPre-Authorization 0(Covered at100%)No Benefit 0(Covered at100%)No Benefit 700 Primary ParticipantBaseHSA/HRAFundingEffective 7/1 200 per Dependent(max 3 Dependents)N/AN/AAdditional 400 one-time Contribution 200 applied automatically and 200 aftercompletion of program requirements***Subject to Usual & Customary Limits** For detailed requirements regarding the additional HSA/HRA funding please refer to the Plan Year 2020Consumer Driven Health Plan Master Plan Document or Plan Year 2020 HSA/HRA FAQs.

Plan Year 2020 Prescription Plan ComparisonThe information in the tables below contain general plan benefits and may not include additional provisionsor exclusion. To review more in-depth plan benefits, please refer to the applicable Master Plan Document.PRESCRIPTIONPLAN DESIGNFEATURESCONSUMER DRIVEN HEALTH PLAN HEALTH PLAN OF NEVADA(CDHP - PPO)PREMIER PLAN(Northern EPO)(HPN-Southern NetworkOut-ofNetworkPreferredGeneric20% afterdeductible*N/A 10 CopayN/A 10 CopayN/APreferredBrand20% afterdeductibleN/A 40 CopayN/A 40 CopayN/ANon-Formulary20% afterdeductibleN/A 75 CopayN/A 75 Copay forSingle SourceN/ASpecialty20% /AACAPreventiveMedications 0No Benefit 0N/A 0N/ACDHPPreventiveMedications20% Coinsurance*Not subjectto deductibleNo BenefitN/AN/AN/AN/A*Consumer Driven Health Plan Preventive Drug BenefitThe Preventive Drug Benefit provides CDHP participants access to certain preventive medications without having to meet a deductible andwill instead only be subject to coinsurance. Coinsurance paid under the benefit will not apply to the deductible but will apply to theout-of-pocket maximum. The drugs covered under this benefit include categories of prescription drugs that are used for preventive purposesor conditions, such as hypertension, asthma or high cholesterol. This benefit only applies if using an in-network provider.For more information on this program, contact Express Scripts at 1-855-889-7708 or log in or register at www.express-scripts.com. A listof commonly prescribed preventive medications available under this benefit can be found under the “Benefit and account notifications”section of the home page.Important: The Smart90 Pharmacy Network is now mandatory for CDHP ParticipantsThis benefit allows members to save themselves and the plan money on their 90-day supply of medications. To receive a 90-daysupply of maintenance (long-term) medications, members can either have their prescription filled through Express Scripts homedelivery or through a Smart90 participating pharmacy (this excludes pharmacies such as CVS and Walgreens but includes most ofthe other chains). A 90-day supply of maintenance medications will only be available at a Smart90 participating pharmacy.For more information on this benefit, or to locate a Smart90 participating pharmacy, please contact Express Scripts at1-855-889-7708 or visit www.express-scripts.com/NVPEBP.

Plan Year 2020 Vision Plan ComparisonThe information in the tables below contain general plan benefits and may not include additional provisionsor exclusion. For Plan Limitations and Exclusions, refer to the CDHP or Premier (EPO) Plan Master PlanDocuments or the Health Plan of Nevada’s Evidence of Coverage Certificate available at www.pebp.state.nv.us.VISION PLANDESIGN FEATURESVision ExamHardware (frames,lenses, contacts)CONSUMER DRIVENHEALTH PLAN OF NEVADA(HPN-Southern HMO)HEALTH PLAN (CDHP - PPO)PREMIER PLAN(Northern EPO) 25 CopayMaximum benefit of 95 per annual exam* 10 Copay every12 months 10 Copay every 12 months 100 maximum benefitNo Benefit 10 Copay for glasses( 100 allowance)or 10 Copay for contactsin lieu of glasses( 115 allowance) 10 Copay for glasses 100 maximum benefitevery 24 months*Out-of-network providers will be paid at Usual and Customary (U&C). One annual vision exam, maximum annualbenefit 95 per plan year after the 25 copayment.Please note: PEBP does not maintain a network specific to vision care for the CDHP or EPO plan.Additional information about the voluntary visionbenefits can be found once you have logged on toyour E-PEBP Portal at www.pebp.state.nv.us.

Plan Year 2020 Dental Plan ComparisonThe information in the tables below contain general plan benefits and may not include additional provisions orexclusion. To review more in-depth plan benefits, please refer to the Master Plan Document for the Self-Funded PPODental Plan and Summary of Benefits for Life and Long-Term Disability Insurance available on your PEBP Portal.Dental PlanAll PPO, HMO, EPO and Medicare Exchange eligible ParticipantsDENTAL PLANDESIGN FEATURESIndividual Plan Year Maximum(applies to basic and major services)Plan Year Deductible(applies to basic and major services only)In-NetworkOut-of-Network 1,500 per person 1,500 per person 100 per person or 300 per family (3 or more) 100 per person or 300 per family (3 or more)Preventive ServicesFour cleanings/plan year, exams,bitewing X-rays (2/plan year)100% of allowable fee schedule,Not subject to the deductiblePreventive Services do not applytowards individual plan year maximumBasic ServicesPeriodontal, fillings, extractions, rootcanals, full-mouth X-raysMajor ServicesBridges, crowns, dentures,tooth implants80% of allowable fee schedule,after deductible50% of allowable fee schedule,after deductible80% of allowable fee schedule for the LasVegas area for participants using an out-ofnetwork provider within the in-networkservice area;ORFor services received out-of-network,outside of Nevada, the plan will reimburseat the U&C rates50% (after deductible) of allowable feeschedule for the Las Vegas area forparticipants using an out-of-networkprovider within the in-network service area;ORFor services received out-of-network,outside of Nevada, the plan will reimburseat the U&C rates50% (after deductible) of allowable feeschedule for the Las Vegas area forparticipants using an out-of-networkprovider within the in-network service area;ORFor services received out-of-network,outside of Nevada, the plan will reimburseat the U&C rates Family Deductible may be met by any combination of eligible dental expenses of three or more members of the samefamily coverage tier. No one single family member will be required to contribute more than the equivalent of theindividual deductible toward the family deductible. Under no circumstances will the combination of PPO and Non-PPO benefit payments exceed the plan year maximumbenefit of 1,500.

3,000 Family 3,000 Family . Plan Year 2020 Dental Plan Comparison The information in the tables below contain general plan benefits and may not include additional provisions or exclusion. To review more in-depth plan benefits, please refer to the Master Plan Document for the Self-Funded PPO