Transcription

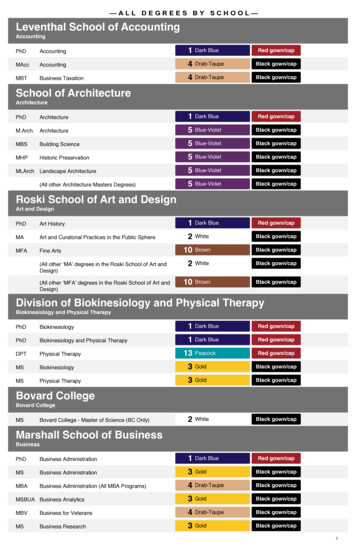

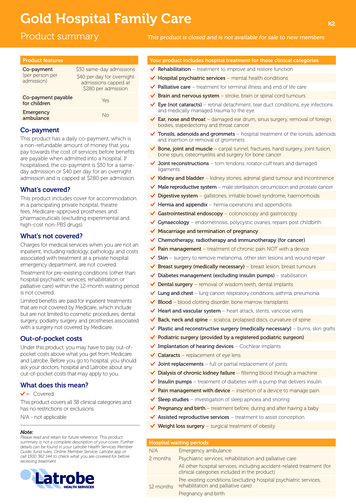

Gold Hospital Family CareProduct summaryThis product is closed and is not available for sale to new membersProduct featuresCo-payment(per person peradmission)K2Your product includes hospital treatment for these clinical categoriesRehabilitation – treatment to improve and restore function 30 same-day admissions 40 per day for overnightadmissions capped at 280 per admissionCo-payment payablefor childrenYesEmergencyambulanceNoHospital psychiatric services – mental health conditionsPalliative care – treatment for terminal illness and end of life careBrain and nervous system – stroke, brain or spinal cord tumoursEye (not cataracts) – retinal detachment, tear duct conditions, eye infectionsand medically managed trauma to the eyeEar, nose and throat – damaged ear drum, sinus surgery, removal of foreignbodies, stapedectomy and throat cancerCo-paymentTonsils, adenoids and grommets – hospital treatment of the tonsils, adenoidsand insertion or removal of grommetsThis product has a daily co-payment, which isa non-refundable amount of money that youpay towards the cost of services before benefitsare payable when admitted into a hospital. Ifhospitalised, the co-payment is 30 for a sameday admission or 40 per day for an overnightadmission and is capped at 280 per admission.Bone, joint and muscle – carpal tunnel, fractures, hand surgery, joint fusion,bone spurs, osteomyelitis and surgery for bone cancerJoint reconstructions – torn tendons, rotator cuff tears and damagedligamentsKidney and bladder – kidney stones, adrenal gland tumour and incontinenceMale reproductive system – male sterilisation, circumcision and prostate cancerWhat’s covered?Digestive system – gallstones, irritable bowel syndrome, haemorrhoidsThis product includes cover for accommodationin a participating private hospital, theatrefees, Medicare-approved prostheses andpharmaceuticals (excluding experimental andhigh-cost non-PBS drugs).Hernia and appendix – hernia operations and appendicitisGastrointestinal endoscopy – colonoscopy and gastroscopyGynaecology – endometriosis, polycystic ovaries, repairs post childbirthMiscarriage and termination of pregnancyWhat’s not covered?Chemotherapy, radiotherapy and immunotherapy (for cancer)Charges for medical services when you are not aninpatient, including radiology, pathology and costsassociated with treatment at a private hospitalemergency department, are not covered.Pain management – treatment of chronic pain NOT with a deviceSkin – surgery to remove melanoma, other skin lesions and wound repairBreast surgery (medically necessary) – breast lesion, breast tumoursTreatment for pre-existing conditions (other thanhospital psychiatric services, rehabilitation orpalliative care) within the 12-month waiting periodis not covered.Diabetes management (excluding insulin pumps) – stabilisationDental surgery – removal of wisdom teeth, dental implantsLung and chest – lung cancer, respiratory conditions, asthma, pneumoniaLimited benefits are paid for inpatient treatmentsthat are not covered by Medicare, which includebut are not limited to cosmetic procedures, dentalsurgery, podiatry surgery and prostheses associatedwith a surgery not covered by Medicare.Blood – blood clotting disorder, bone marrow transplantsHeart and vascular system – heart attack, stents, varicose veinsBack, neck and spine – sciatica, prolapsed discs, curvature of spinePlastic and reconstructive surgery (medically necessary) – burns, skin graftsOut-of-pocket costsPodiatric surgery (provided by a registered podiatric surgeon)Under this product, you may have to pay out-ofpocket costs above what you get from Medicareand Latrobe. Before you go to hospital, you shouldask your doctors, hospital and Latrobe about anyout-of-pocket costs that may apply to you.Implantation of hearing devices – Cochlear implantsCataracts – replacement of eye lensJoint replacements – full or partial replacement of jointsDialysis of chronic kidney failure – filtering blood through a machineInsulin pumps – treatment of diabetes with a pump that delivers insulinWhat does this mean?Pain management with device – insertion of a device to manage pain CoveredSleep studies – investigation of sleep apnoea and snoringThis product covers all 38 clinical categories andhas no restrictions or exclusions.Pregnancy and birth – treatment before, during and after having a babyN/A - not applicableAssisted reproductive services – treatment to assist conceptionWeight loss surgery – surgical treatment of obesityNote:Please read and retain for future reference. This productsummary is not a complete description of your cover. Furtherdetails can be found in your Latrobe Health Services MemberGuide, fund rules, Online Member Service, Latrobe app orcall 1300 362 144 to check what you are covered for beforereceiving treatment.Hospital waiting periodsN/AEmergency ambulance2 monthsPsychiatric services, rehabilitation and palliative careAll other hospital services, including accident-related treatment (forclinical categories included in the product)12 monthsPre-existing conditions (excluding hospital psychiatric services,rehabilitation and palliative care)Pregnancy and birth

Advantage Family Care ExtrasProduct summaryPKThis product is closed and is not available for sale to new membersWhat’s covered?We pay benefits on the services listed below when: the provider is in private practice in Australia and is approved by Latrobe all goods and services are supplied within Australia claims are made within two years of the date of service the service is provided once per day (you cannot claim the same service twice in the same day, e.g. physio).ServicesDescriptionBenefitPeriodic oral examination 26Scale and clean 50 1000 per personGeneral dentalSimple tooth extraction 37.40Items as per dentalschedule 2000 permembershipAdhesive restoration(filling 1 surface) 51.90Mouth guard (supplied by adentist or dental technician) 80 per personTreatment of acuteperiodontal infection 32.20Preparation of 1 root canal 87.40Filling of 1 root canal 93.10Major dentalItems as per dentalscheduleBridge pontic –indirect 361Surgical tooth extraction 88Full crown veneers 456AnnualOrthodonticsBenefits are fixed at thelevel in which the course oftreatment commences andpaid over a 3 year periodAnnual LimitCombined generaland major dentallimitsWaiting period3 monthsYear 1 – 0Year 2 – 300Year 3 – 600Year 4 – 100012 monthsCombined generaland major dentallimitsLifetime limitYear 1 – 0Year 1 – 0Year 2 – 300Year 2 – 900Year 3 – 350Year 3 – 1050Year 4 – 400Year 4 – 1200Year 5 – 450Year 5 – 1350Year 6 – 600Year 6 – 1800 135 135 per person12 monthsSpectacles and repairsOpticalContact lenses12 monthsPrescription sunglassesGroup physiotherapy /hydrotherapyGroup sessions 27 ractic X-ray(one per person) 22 subsequent 26 initial 19 subsequentX-ray consultation 300 per person 600 per membershipCombined limit*2 months 28 25 initialOsteopathyConsultationAcupunctureAudiology 10 17 subsequent 25 initial 17 subsequentConsultation 25 initial 17 subsequent 300 per person 300 per person2 monthsNote: Please read and retain for future reference. This product summary is not a completedescription of your cover. Further details can be found in your Latrobe Health Services MemberGuide, fund rules, Online Member Service, Latrobe app or call 1300 362 144 to check what youare covered for before receiving treatment./1

PKAdvantage Family Care ExtrasProduct summaryServicesThis product is closed and is not available for sale to new membersDescription 25 initialEye therapy 17 subsequentMassage(with registered provider)Benefit 25 initialConsultation 17 subsequent 25 initialMyotherapy 17 subsequent 25 initialNutrition and dietetics 17 subsequent 25 initialOccupational therapy 17 subsequentConsultation 25 initialSpeech therapy 17 subsequentPodiatryAnnual LimitWaiting period 300 per person 600 per membershipCombined limit* 300 per person 600 per membershipCombined limit*2 months 300 per person 300 per person 300 per person 600 per membershipCombined limit* 300 per person2 months 600 per membershipCombined limit* 25Podiatry services(including orthotics)ConsultationBenefit amount variesdepending on item number 300 per person2 monthsPsychologyConsultation 50 300 per person2 monthsAmbulance membershipfee 44Health appliancesBlood glucose monitorCPAP machineNebuliserAir compressor pumpsTENS machine2 months 200 total per personevery 3 yearsPurchase of device70% 400 total allappliances permembership every3 years12 monthsBone density testing 45 45 per person every2 years2 monthsHearing aidsPurchase of device. Includesrepairs other than batteries 500 500 per personevery 5 years12 monthsPharmaceuticalsIncludes most prescribeditems not subsidised by thegovernment. Benefits will bepaid after the PBS standardsubsidy charge has beendeducted 25 per script 600 per membershipPurchase of externalprostheses (not includingbreast prostheses)70% 500 per personevery 3 years12 monthsPurchase of externalprostheses70% 500 per person2 monthsHealth screeningMammogramsMole mappingProstheses(non-surgically implanted)Lymphoedema garments(4 garments per year)Visiting nurseThe provision of a benefit fornursing services provided byan approved private practice 300 per person2 monthsCombined limit* 25 initial 17 subsequent 300 per person 600 per membership2 monthsCombined limit** Combined annual limit 300 per person, maximum 600 per couple or family membership per calendar year applies forphysiotherapy, chiropractic, osteopathy, speech therapy, eye therapy, occupational therapy, visiting nurse, pharmacy and remedialmassage.Note: Please read and retain for future reference. This product summary is not a completedescription of your cover. Further details can be found in your Latrobe Health Services MemberGuide, fund rules, Online Member Service, Latrobe app or call 1300 362 144 to check what youare covered for before receiving treatment./2

MemberGuide1 July 2022This information is current as of 1 July 2022This is important information. Please read and retain for future reference.

ContentsWelcomeGovernmentsurcharges andincentivesAbout yourprivate healthinsuranceHospitaladmissionsAmbulanceAbout this Member GuideOur commitment to youAbout your policy documentsPrivate Patients’ Hospital Charter4445Private health insurance rebateMedicare Levy SurchargeLifetime Health CoverAge-based discount5566Waiting periods explainedHospitalExtrasPre-existing conditionsYour responsibilityCooling-off periodPayment optionsUpgrading your coverHaving a baby?Children/DependantsOut-of-pocket costsTransferring from another fundInternational fund transferDocuments needed for transfersSuspension of your membershipFinancial hardshipOverseas travelAnnual premium riseCover we don’t provideMembership for non-residents of 1Choose your medical specialist (doctor)Choose your hospitalParticipating private hospitalsNon-participating private hospitalsPublic hospitalsAccommodation chargesNursing home-type patients in a recognised private or public hospitalPrivate room fees for day admissionsInpatient services (in hospital)Hospital testsExcess or co-paymentsSupported dischargeBefore you receive treatment12121212121313131313141414VIC, SA, NT or WANSW and ACT membersQueensland membersTasmanian members15151515This is important information. Please read and retain for future reference.2/ Latrobe Health Services Member Guide – 1 July 2022

Thank you forchoosing LatrobeUnderstandingclinicalcategoriesMaking a claimWhen tocontact usFeedback andcomplaintsPrivacy PolicyRestricted cover even if included as a clinical categoryDental surgeryPodiatry surgeryCosmetic surgery (not included in any clinical category)Surgically implanted prosthesesOther non-Medicare-covered treatmentsRespite careAllied health service providersExceptional fundingNew technologiesCommonwealth Prostheses List, non-implanted medical devicesConsumables and non-implanted medical devices (not onCommonwealth Prostheses List)High-cost drugsHormone treatmentCell storageOutpatient attendanceOverseas treatmentPersonal items17171717181818MedicalMy GovMedicareExtrasReceiptsCompensation from other sources191919192020Access/update your personal details ReceiptsUpgrade of coverPlanning hospital treatmentWho can make changes to my policy?21212121How to lodge a complaintFeedback processCode of Conduct222222Your privacy is important to usWho is collecting my personal sensitive information?Why is my personal and sensitive information being collected?What happens if my personal and sensitive information is not collected?Who will you disclose my personal and sensitive information to?Is any of my personal or sensitive information disclosed to overseasrecipients?How can I access my personal information or make a complaint?2323232323Fund rulesDefinitions241616161617171717171717232325This is important information. Please read and retain for future reference.Latrobe Health Services Member Guide – 1 July 2022 /3

Welcome!Congratulations forchoosing Latrobe HealthServices insurance.You’re now part of an 81,000-strong family thattrusts Latrobe to help manage its health.We’ve been part of the community for 70 years.In 1991, we established Gippsland’s only surgicaland acute medical private hospital, MaryvalePrivate. We support and sponsor community healthand wellbeing projects, such as the communityCOVID support, natural disaster support andencouragement to local small businesses.Latrobe is a Members Own Health Fund, whichmeans we exist to benefit and support ourmembers. In short, we’re not here to make a profit,we’re here to guide, much as a friend would. Andwe’re pretty proud of that.About this Member GuideOur Member Guide is a handy ‘how to’ for gettingthe most out of your Latrobe membership. It’ll helpyou understand your cover and how to work yourway around the health system in general.Our Customer Experience team is available to helpyou work through any tricky bits and you get tochoose how you want to communicate with us.Call us on 1300 362 144 – our CustomerExperience team members are here to assist you.Come visit us at a Member Experience Hub – hubsare located in Gippsland (Warragul, Bairnsdale,Traralgon and Moe) and offer personal, face-toface support and assistance.Send an email to info@lhs.com.auOur commitment to youWe will use HEART in all our communications, toempower and build trust and connections with allour members.If we change any part of your cover, we promiseto tell you about it with at least 30 days’ noticefor basic changes and 60 days’ notice for anydetrimental changes.We sometimes get things wrong and makemistakes. We have a formal complaintsprocess (see page 22), but please talk tous first about any issue as we would lovethe opportunity to discuss and correct ourmistake.About your policy documentsYour cover is detailed in your policy documents.These include the: product summary, which has specific detailsabout the product you choose Member Guide, which contains the generaldetails that apply about Latrobe, private healthinsurance, the health system and how to useyour product Private Health Insurance Information Statement(PHIS) fund rules, which detail top-level legal information.The fund rules are available on our website.You’ll get the best from your membership ifyou make an effort to understand thisinformation and check in with us regularlyor when your circumstances change.Private Patients’ Hospital CharterThe Private Patients’ Hospital Charter is a guide towhat it means to be a private patient in a publichospital, a private hospital or day hospital. It alsoprovides information about what to do if you havea problem with your medical treatment or yourprivate health insurance (also see the Feedbackand Complaints section in this guide). For moreinformation, visit latrobehealth.com.au and go topublications and forms in the Help Centre.This is important information. Please read andretain for future reference.4/ Latrobe Health Services Member Guide – 1 July 2022

Government surchargesand incentivesPrivate health insurance rebateThe Australian Government’s private health insurance rebate helps reduce the cost ofhealth insurance. The rebate you are entitled to depends on your income and age and isindexed annually.You can nominate your rebate entitlement to avoid a tax liability if your circumstanceschange. Simply log-in to your Online Member Services account or give us a call.Rebate tiersAge thresholdBase tierTier 1Tier 2Tier 3Under 03%0.00%70 32.812%24.608%16.405%0.00%The rebate tiers are effective 1 April 2021. For more information on rebate tiers, please visithealth.gov.auMedicare Levy SurchargeThe Medicare Levy Surcharge is an extra tax paid by high income earners withoutprivate hospital insurance. It applies to singles, couples and families. The surcharge variesdepending on your taxable income and is in addition to the Medicare Levy, which is paidby most Australian taxpayers.An extras product without an appropriate hospital insurance product will not provide anexemption to the surcharge. If you have a hospital product with an excess of 1000 youwill still have to pay the surcharge.For further information regarding your specific circumstances for either the rebate orsurcharge please contact your accountant, financial planner or the Australian TaxationOffice at ato.gov.au.Medicare Levy Surcharge income rchargeBase tierTier 1Tier 2Up to 90,001 – 105,001 – 90,000 105,000 140,000Up to 180,001 – 210,001 – 180,000 210,000 280,0000.0%1.0%1.2%Tier 3 140,000 280,000 1.5%The income threshold tiers are effective from 1 April 2021. For more information onincome thresholds, please visit health.gov.au or consult your tax/financial adviser.Alternatively, you can calculate your income by using the calculator at ato.gov.au.This is important information. Please read and retain for future reference.Latrobe Health Services Member Guide – 1 July 2022 /5

Government surchargesand incentivesLifetime Health CoverLifetime Health Cover is an Australian Government initiative designed to encouragepeople to take out private hospital insurance at a younger age and maintain it throughouttheir lifetime.You have until 1 July after your 31st birthday to take out private hospital cover; otherwise,you may be required to pay a loading on your private health insurance when you dodecide to buy it. The loading is 2% for each year you delay joining to a maximum of 70%.After 10 continuous years of coverage, the loading is removed.Lifetime Health Cover does not apply to extras products or ambulance memberships.If you were born before 1 July 1934 you are not affected and you do not pay a loading.Special rules apply to: Australian citizens living overseas when they turned 31 people in the Australian Defence Force or the Australian Antarctic Division immigrants and refugees ex-Norfolk Island residents people no longer entitled to a Veteran’s Affairs Gold Card.If you believe you may be eligible for the special rules, please contact us. It is importantto note that in each of these categories, documentation will be required to validate yourstatus.Age-based discountAge-based discounts are applicable on selected health products for members aged 18 to29. The discount can be quite substantial, depending on your age, and is locked in untilyou reach age 41, at which point it reduces by 2% each year until it reaches zero.This is important information. Please readand retain for future reference.6/ Latrobe Health Services Member Guide – 1 July 2022

About your privatehealth insuranceThere are two types of private health insurance products and you can have eitheror both: hospital cover – for when you are admitted to a hospital for an operation or an illness extras cover – for services such as dental, physiotherapy and optical.Private health insurance sits alongside Medicare, Australia’s publicly funded health caresystem. Medicare is designed to provide affordable medical services, hospital treatmentand prescription medicines. It is publicly funded by taxpayers through the Medicare Levy.Mid to high-income earners without private health insurance pay the Medicare LevySurcharge. Under Medicare, your choice of hospitals and health providers is limited to thepublic hospital system.Private health insurance provides you with options, choice and control over your healthcare. Hospital cover, available as Gold, Silver and Bronze options with a range of excesschoices, allows you to choose your doctor or surgeon, when you are treated, and givesaccess to both private and public hospitals.Waiting periods explainedIn the first 12 months of your new Latrobe health insurance product you may need toserve ‘waiting periods’ before you can use your cover.HospitalTwo months: hospital psychiatric treatment, rehabilitation, palliative care.Two months: accident-related admissions for clinical categories included in the product.12 months: pregnancy and birth.12 months: pre-existing conditions.ExtrasFor extras, the waiting periods range from two to 12 months.Both hospital and extras waiting periods apply to: new members existing members upgrading their level of cover members changing from a single membership to a family membership for the birth ofbaby new members transferring from other funds and upgrading to a higher level of cover.Pre-existing conditionsIf you had signs or symptoms of a condition, illness or ailment during the six monthsbefore or on the day you joined Latrobe Health Services (or in the six months before youupgraded to a higher level of cover or reduced your excess), this means the condition was‘pre-existing’ even if no diagnosis was made before your cover started.Latrobe Health Services will have a medical expert look at information from your doctorand any other relevant claim details to decide whether your condition was pre-existing. Ifit was, a 12-month waiting period will apply to services related to that condition from yourpolicy start date.This rule applies to all new members, members upgrading their cover or reducing theirexcess, and to other adult dependants and children you’ve added to a policy. If youupgrade, you only serve waiting periods for any new services that you weren’t covered forpreviously or a reduced excess if you’ve chosen to lower it.This is important information. Please read and retain for future reference.Latrobe Health Services Member Guide – 1 July 2022 /7

About your privatehealth insuranceYour responsibilityFor any hospital admission occurring during the first 12 months of cover or upgradedcover, you will be asked to have two medical certificates completed – one by your usualGP and one by your treating specialist.We need these certificates to make a determination about your pre-existing medicalcondition status. This determination may also involve consultation with your medicalpractitioners.We strongly advise that you do not proceed with an admission to a private hospital untilthe determination has been made as you may be liable for considerable costs should thecondition be deemed as pre-existing.If you are planning treatment it is essential that you contact us for a benefit estimationbefore you are admitted to hospital.Cooling-off periodIf you cancel your cover within 30 days of starting or changing your cover, we will refundthe premiums you have paid provided no claims have been made. If a claim has beenmade, the cooling-off period is void.Payment optionsTo make your payments as easy as possible you can pay in one of several ways. Direct debit: payments are automatically debited from your nominated bank account,Mastercard or VISA credit card and may attract a discount depending on the paymentfrequency. Payment period options are weekly, fortnightly, monthly, quarterly, halfyearly and yearly. BPay: fast easy and at any time of the day or night. By phone: using Mastercard or VISA. Call us on 1300 362 144 (8.30am to 6pm AEST,Monday to Friday) or register online at latrobehealth.com.au Post BillPay: options to pay by internet, phone or in person at any Australia Post office. In person: visit one of our hubs, located in Warragul, Bairnsdale, Traralgon and Moe.For details of opening hours and locations, visit latrobehealth.com.au.To ensure you are covered you need to keep your payments up to date. If you are morethan 60 days’ late paying your cover will be cancelled and you will have serve all yourwaiting periods again.We do understand that sometimes members may have financial challenges and we canwork on a solution with you. Please call us on 1300 362 144 and speak with a member ofour Customer Experience team.Upgrading your coverHigher benefits relate to: benefits payable for services that were not part of your previous product a change in hospital insurance to a lower excess or co-payment services for which a higher benefit is payable under your new cover services for which there is a higher annual/personal limit.During waiting periods for higher benefits, existing members and members who havetransferred from another fund are entitled to the nearest Latrobe-equivalent cover, providedthey have served our required waiting periods before upgrading or transferring their cover.This is important information. Please read and retain for future reference.8/ Latrobe Health Services Member Guide – 1 July 2022

About your privatehealth insuranceHaving a baby?To ensure your newborn is covered from birth, an upgrade of cover from a singlemembership to a family membership or a single parent membership is required twomonths before the expected delivery date.A single membership only covers the person who applied for the membership. Anewborn baby is not covered under your single membership. If you are planning apregnancy, please contact Latrobe for advice about your health insurance.Written confirmation of the expected delivery date is required from the treatingobstetrician. A family membership automatically covers newborn babies subject towaiting periods being served. Non-admitted baby: A newborn less than nine days old is not an ‘admitted patient’.Any medical bills resulting from consultation for the baby do not qualify for any benefitsfrom Latrobe. This also includes any fees incurred for procedures such as circumcision.Medicare will rebate 85% of the Medicare benefit schedule fee. Admitted baby: The hospital cannot raise a charge for a newborn unless it hasbeen admitted to a neonatal facility by a paediatrician for the treatment of a medicalcondition. In these circumstances, any medical bills resulting from consultation to thebaby qualify for benefits from Latrobe. Multiple births: In accordance with the National Health Act 1953, second orsubsequent babies are considered as inpatients. In this instance, any excess or copayment applicable to your selected hospital product will apply to the baby’s admission. Private midwife: A benefit of up to 450 is payable for the attendance of a registeredmidwife at a birth in a private hospital. The midwife must be in private practice andcannot be an employee of the hospital.Children/DependantsAt Latrobe your children are defined as dependants on a your policy (not including yourspouse) dependant child aged 0–17 years dependant non classified aged 18–20 years (not married or in a de facto relationship) dependant student aged 21–31 years (not married or in a de facto relationship, isundertaking full time study at a recognised training facility) dependant non student aged 21–31 years (not married or in de facto relationship). Anadult dependant extension is available only on selected products and an additionalpremium applies. Independent tax advice is recommended.Out-of-pocket costsWhen you are admitted to hospital, you will be charged separately for medical fees byyour doctor, medical specialist, surgeon, anaesthetist, radiologist or pathologist. These feesare in addition to your accommodation and theatre fees.You will receive 100% of the Medicare Benefit Schedule (MBS) amount towards thepayment of these fees from both Medicare and Latrobe. Medicare pays 75% of theMedicare Benefit Schedule fee for in-hospital medical charges and Latrobe pays theremaining 25%. One or more of your providers may choose to charge above the MBSamount; your provider should advise you of any out-of-pocket costs before youradmission. This advice is called Informed Financial Consent.This is important information. Please read and retain for future reference.Latrobe Health Services Member Guide – 1 July 2022 /9

About your privatehealth insuranceIf you have received Informed Financial Consent, we will pay up to an additional 20%above the schedule fee to assist with reducing your out-of-pocket costs.Please contact us before any planned hospitalisation with the MBS item numbersand fees the doctor will be charging so we can provide you with more informationabout any out-of-pocket expenses. You can read more about out-of-pocket costson our website – look for the ‘Reducing the Gap’ guide in the publications andforms section. See also ‘Claiming Details’ under ‘Members’ on the website for moreinformation about claiming your medical fees after a hospital admission.Transferring from another fundWhen transferring into Latrobe from another fund, you do not have to serve waitingperiods that you have already served with your previous fund. If you upgrade your coverwhen transferring to Latrobe, waiting periods will apply to services that were not coveredand/or where a benefit was lower with your previous fund. Your membership with yourprevious fund must be up to date when you transfer.A gap of less than 30 days will mean we can pay claims once we have received aclearance certificate from your previous fund. Until we have received the certificate,your new membership card will not work.Any

Full crown veneers 456 Orthodontics Benefits are fixed at the level in which the course of treatment commences and paid over a 3 year period Annual Year 1 - 0 Year 2 - 300 Year 3 - 350 Year 4 - 400 Year 5 - 450 Year 6 - 600 Lifetime limit Year 1 - 0 Year 2 - 900 Year 3 - 1050 Year 4 - 1200 Year 5 - 1350 Year 6 .