Transcription

Health Net MedicareSupplement (Medigap) PlansCLOSE THE GAP WITH COVERAGE THAT FITS YOUR LIFESTYLEhealthnet.com/medsupp

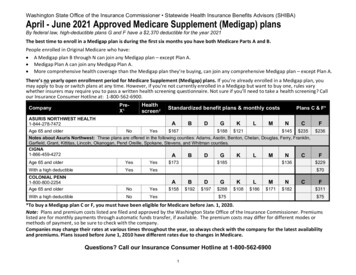

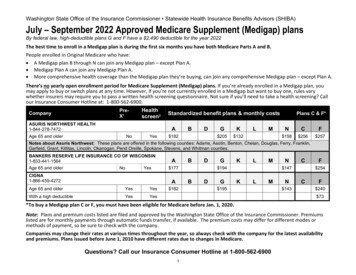

Medicare Supplement 101Medicare is a good program, but it only covers about 80%of your medical and hospital costs. A Health Net MedicareSupplement (also known as Medigap) plan, protects you fromthe out-of-pocket costs Medicare doesn’t cover, like copayments,coinsurance and deductibles. These costs can quickly add up tothousands of dollars.A Health Net Medicare Supplement Plan helps payfor your out-of-pocket costs and more not covered byOriginal Medicare,* including: P art A coinsurance, with many plans paying the hospitaldeductible. Some out-of-pocket expenses not paid for by Part B. Some plans have enhanced hearing, vision and chiro benefits.* After paying your Part B premium and monthly MedicareSupplement plan insurance premium.80%Portion of eligibleexpenses covered byOriginal Medicare20%Medicare Supplementplans help fill the gapA Medicare Supplementplan may work for youif you want: The flexibility to chooseany doctor or hospital thataccepts Medicare patients. To avoid paying copays,coinsurance and otherout-of-pocket costs thatOriginal Medicare doesnot cover.

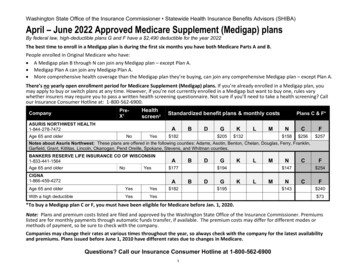

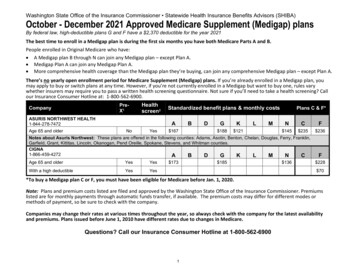

We’ve Got You CoveredHealth Net Life Insurance Company (HNL) offers 9 MedicareSupplement plans to meet your unique needs, health andbudget. Benefit plan options include A, D, F, High DeductiblePlan F, Innovative Plan F, G, High Deductible Plan G,Innovative Plan G, and N.Guaranteed acceptanceduring MedicareSupplement OpenEnrollment periodYou are guaranteed acceptancein any plan during your MedicareSupplement open enrollmentperiod, regardless of your healthstatus. The period begins on thefirst day of your birthday monthwhen you turn 65 (you mustbe enrolled in Medicare PartB). Please review the enclosedGuaranteed Issue Guide tolearn more about your rights,eligibility and options.Rate guarantee forfirst-time enrollees!HNL provides an initialsix-month rate guaranteeto members enrolling for thefirst time in a HNL MedicareSupplement plan. During thissix-month rate guaranteeperiod, your premium will notincrease even if HNL has a rateincrease or you have a birthdaywhich moves you into the nexthigher age rate bracket.Important UpdatesAbout F PlansAs of January 1, 2020,Medicare Supplementplans that pay theMedicare Part B deductibleare no longer sold to thosenewly eligible for MedicarePart B.If you were eligible forMedicare before 2020 buthave delayed it becauseyou are still working andhave employer insurance,don’t worry. When youleave that insurance andswitch to Medicare, youwill still have the rightto enroll in any of theMedicare Supplement Fplans.

More Options,Competitive RatesHealth Net introducedInnovative Plan G in2020. This Plan includesenhanced vision andhearing benefits, plusroutine chiropractic andacupuncture coverage.For 2022, Health Net isexpanding its MedicareSupplement lineup byadding High DeductiblePlan G. You’ll get the samebenefits as Plan G, butlower monthly premiums.Freedom of Choice,Peace of MindThis enrollment booklet provides all the information you needto get the most from your Health Net plan. This is where you’llfind information about: Your plan options. Extra benefits. Important updates. How to enroll.You can also boost standard Medicare Supplement coverage byadding Health Net’s Optional Standard PPO Dental Plan. Pleasereview the enclosed Optional Standard PPO Dental Brochure tolearn more.New Member Discount!When you enroll within sixmonths of your Part B effectivedate, you qualify for 30 offyour monthly payment for thefirst 12 months. Enroll nowand start saving!Benefits of choosing aMedicare Supplementplan You can visit any doctoror hospital that acceptsMedicare. No referrals needed to seea specialist. You can receive medicalservices in any state orU.S. territory.**Some Medicare Supplementplans offer foreign travelemergency coverage.

Wellness Benefits toEmpower and SupportYour Good HealthHealth Net’s Decision Power program combines information,helpful tools and one-on-one support to help you craft custom,long-term wellness solutions. You can use it to help stay fit,stop smoking, manage ailments, or just make better healthcare choices.Nurse Advice Lineoffers peace of mindOur toll-free 24/7 nurse lineprovides real-time supportfor routine health issues. Getanswers to your questions ontreatment options, chronicailments and medications. Theycan even help you get ready fordoctor visits!DISCOUNTS AND MOREGet discounts on healthproducts and services AcupunctureChiropracticWeight loss programsLASIK or PRK surgeryHealth productsHearing aids and screeningsStay active and fitHave fun and improve yourhealth through the Silver&FitHealthy Aging and ExerciseProgram!Health Net MedicareSupplement members haveaccess to a wide rangeof classes, fitness centersand at-home fitness kitsdesigned to help improvehealth through education andexercise. With Silver&Fit you’llhave access to: No-cost membership at aparticipating fitness center Healthy Aging classes(online or mail) At-home fitness kitsDecision Power is designed tohelp you improve your healthand well-being.

Three Easy Ways to Enroll!1. Complete the Medicare Supplement Enrollment Formthat comes with this kit.2. You can apply online at healthnet.com/medsupp bychoosing the “Enroll Online” button.3. Call the number below and speak with one ofHealth Net’s helpful Inside Sales experts. They canhelp you enroll in a Medicare Supplement plan.For enrollment questions, please callPhone: 1-800-944-7287 (TTY 711)Hours: 8 :00 a.m. to 6:00 p.m., Monday through Friday(except holidays)healthnet.com/medsuppYou have access to Decision Power through your current enrollment with Health Net Life InsuranceCompany (Health Net). Decision Power is not part of Health Net’s commercial medical benefit plans. Itis not affiliated with Health Net’s provider network, and it may be revised or withdrawn without notice.Decision Power services, including clinicians, are additional resources that Health Net makes availableto enrollees.Health Net Life Insurance Company is a subsidiary of Health Net, LLC. Health Net and Decision Powerare registered service marks of Health Net, LLC. All rights reserved.BRO054971ED00 (3/22)

Original Medicare 20% Medicare Supplement plans help fill the gap Medicar e Supplement 101 Medicare is a good program, but it only covers about 80% of your medical and hospital costs. A Health Net Medicare Supplement (also known as Medigap) plan, protects you from the out-of-pocket costs Medicare doesn't cover, like copayments,