Transcription

MEDICARE SUPPLEMENTOUTLINE OF COVERAGE 2021QuartzBenefits.com/SeniorChoiceCustomer Service (800) 362-3310 orTTY 711 or (800) 877-8973

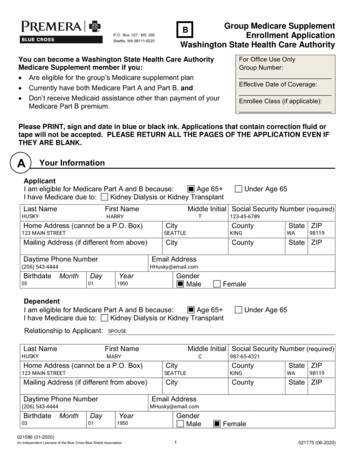

Offered by Quartz Health Plan CorporationSENIOR CHOICEMedicare Supplement Outline of CoverageThis Outline of Coverage is provided by Quartz Health Plan Corporation, referred to through thisOutline of Coverage as “Quartz,” “we” or “our.”The Wisconsin Insurance Commissioner has set standards for Medicare supplement insurance.This policy meets these standards. It, along with Medicare, may not cover all your medicalcosts. You should review carefully all policy limitations. For an explanation of these standardsand other important information, see the “Wisconsin Guide to Health Insurance for People withMedicare” given to you when you applied for this policy. Do not buy this policy if you did notreceive the Wisconsin Guide to Health Insurance for People with Medicare.CONTACT USIf you have questions or require language assistance, please call Customer Service at (800)362-3310. For people who are deaf, hard of hearing or speech impaired, please call (800)877-8973 or TTY 711. You may also call through a video relay service company of yourchoice. Interpreter services are provided free of charge to you. We can also give youinformation in Braille, in large print, or other alternate formats. A Customer Servicerepresentative is available to assist you Monday through Friday from 8 a.m. to 5 p.m. You canalso visit our website at QuartzBenefits.com. 2019 Quartz. Quartz is a registered trademark of Quartz Health Benefit Plans Corporation. “Quartz” refers to the family ofhealth plan businesses that includes Quartz Health Solutions, Inc.; Quartz Health Benefit Plans Corporation; Quartz Health PlanCorporation; Quartz Health Plan MN Corporation; and Quartz Health Insurance Corporation.QA00235 (0820)1Contact Us: (800) 362-3310QuartzBenefits.com

TABLE OF CONTENTSWHY BUY MEDICARE SUPPLEMENT INSURANCE? . 3ENROLLMENT INFORMATION . 3SERVICE LOCATIONS . 4PREMIUM INFORMATION . 4USE THIS OUTLINE TO COMPARE BENEFITS AND PREMIUMS AMONG POLICIES . 4RIGHT TO RETURN POLICY . 5POLICY REPLACEMENT . 5NOTICE . 5RENEWAL TERMS . 5PAYMENT OPTIONS . 5GRACE PERIOD . 6PREMIUM RATES . 7PREMIUM CALCULATION . 15BENEFIT TABLE . 16LIMITATIONS AND EXCLUSIONS . 25MANDATED BENEFITS . 26GRIEVANCE AND EXTERNAL REVIEW . 27GENERAL INFORMATION . 28QA00235 (0820)2Contact Us: (800) 362-3310QuartzBenefits.com

WHY BUY MEDICARE SUPPLEMENT INSURANCE?If you currently have Medicare alone, you know it does not always pay 100% of the bills.Supplemental insurance, such as Senior Choice, is additional insurance that will pick up thecosts after Medicare pays. It also covers certain benefits that Medicare does not. With thisadditional coverage, it leaves you with little to no out-of-pocket cost-sharing and gives youpeace of mind that your medical expenses will be taken care of. Senior Choice providesmultiple options to choose from. From these options, Quartz can build a plan that is right foryou and fits your needs.ENROLLMENT INFORMATIONTo enroll in Senior Choice, you need to meet the following criteria: You must be at least 65 years of age or under 65 with certain disabilities (e.g., EndStage Renal Disease). You must reside in Wisconsin on the effective date of the policy. You must have been enrolled in Medicare Part A and Part B by the date your SeniorChoice policy starts. You must not be covered by Medicaid (BadgerCare) or a Medicare Advantage plan.To apply you must meet all eligibility requirements, fill out an application, and return it to yourinsurance agent.If you join a Medicare Advantage Plan (MA Plan), you cannot use Medicare SupplementInsurance (Medigap) to pay for out-of-pocket costs you have in an MA Plan. If you already havean MA Plan, you cannot be sold a Medigap policy. You can only use a Medigap policy if youdisenroll from your MA Plan and return to original Medicare.If you are not enrolled in Medicare Part B or discontinue or lapse your Medicare Part B medicalinsurance, and you incur charges allowable by Medicare, we will pay Medicare-eligibleexpenses as if you had been insured under Medicare Part B. You will be responsible for thecharges that Medicare Part B should have covered, had you been enrolled.Open Enrollment PeriodThe Senior Choice open enrollment period is the six calendar months immediately following themonth you enroll in Medicare Parts A and B.Coverage begins the first of the month after we accept your application and premium. It couldalso begin on the effective date you requested on your application. The effective date yourequest can be up to three months from when you completed your application.QA00235 (0820)3Contact Us: (800) 362-3310QuartzBenefits.com

Enrollments made during the open enrollment period are guarantee issue.Special Enrollment PeriodIf you have lost or are losing other health insurance coverage, you may be guaranteedacceptance in one or more of our Medicare supplement plans that we offer. You may havereceived a notice from your prior insurer saying that you had certain rights and were eligible forguaranteed issue or a Medicare supplement insurance policy. You must submit a copy of thenotice from your prior insurer with your application to us. You must submit them to us no laterthan 63 days after your other coverage ends.Coverage begins the first of the month after we accept your application and premium. It couldalso begin on the effective date you requested on your application. The effective date must bewithin 63 days from the termination of your previous policy.Enrollments made during this period are guarantee issue.Other Enrollment Period(s)Enrollments made outside of the open enrollment period are subject to medical underwriting.SERVICE LOCATIONSUnlike an HMO, Senior Choice gives you the option to keep the same doctor you have beenseeing for years. You can also change doctors at any time. As long as you are a Wisconsinresident at the time your policy takes effect, you have complete freedom to see any Medicarepayable healthcare provider, anywhere in the U.S. If you move, your coverage can move withyou. It’s that easy.PREMIUM INFORMATIONWe can only raise your premium if we raise the premium for all policies like yours in this state.Premiums may change annually on your renewal date. They also may change if you move intoa new rating area. The first month’s premium must be received to activate your Senior Choicecoverage.USE THIS OUTLINE TO COMPARE BENEFITS AND PREMIUMS AMONG POLICIESRead your policy very carefully. This is only an outline describing your policy’s most importantfeatures. The policy is your insurance contract. You must read the policy itself to understandall of the rights and duties of both you and your insurance company.QA00235 (0820)4Contact Us: (800) 362-3310QuartzBenefits.com

RIGHT TO RETURN POLICYIf you find that you are not satisfied with your policy, you may return it to Quartz at 840Carolina St, Sauk City, WI 53583. If you send the policy back to us within 30 days after youreceive it, we will treat the policy as if it had never been issued. We will return all yourpayments directly to you.POLICY REPLACEMENTIf you are replacing another health insurance policy, do not cancel that policy until you haveactually received your new Senior Choice policy and are sure you want to keep it.NOTICEThis policy may not fully cover all your medical costs.RENEWAL TERMSAs a member of Senior Choice, you will never be cancelled because of your health. As long asyou continue to make your full premium payments on time, you are guaranteed renewable forlife.For your Senior Choice coverage to continue, we must receive your premium as required bythe policy. Your grace period for paying premium is 31 days after the premium due date.PAYMENT OPTIONSEach month you will receive a billing statement. There are several ways you can pay your planpremium.Option 1 - Pay by Check or Money Order (cash not accepted)If you choose to pay your monthly premium payment by check or money order, you mustsubmit the tear-off portion of your billing statement each month with your premium payment.Premium payments should be mailed to:Quartz Health Plan CorporationP.O. Box 78712Milwaukee, WI 53278-8712Option 2 - Online PaymentYou can pay your premium online through your MyChart account at QuartzMyChart.com.QA00235 (0820)5Contact Us: (800) 362-3310QuartzBenefits.com

Don’t have an account? Go to QuartzMyChart.com and select “SIGN UP NOW.” Next, followthe easy steps for instant activation or complete the process by mail.Option 3 - Phone PaymentTo pay your premium via telephone, call (800) 362-3310. This is an automated paymentprocess. You may provide your banking information or credit/debit account information whenmaking your payment through this option.GRACE PERIODAny premium not paid to us by the due date is in default. For each premium not paid whendue, there is a 31-day grace period. If you do not pay your premium in full, the policy willterminate automatically at the end of the 31-day grace period, back to the first day of themonth for which the premium was not paid. If you do not pay your premium by the end of thegrace period, you will be responsible for any services rendered during the grace period thatQuartz would have paid for on your behalf. You may notify us in advance if you want to endthe policy.Neither Senior Choice nor its agentsare connected with Medicare.QA00235 (0820)6Contact Us: (800) 362-3310QuartzBenefits.com

PREMIUM RATESWe can only raise your premium if we raise the premium for all policies like yours in this state.Premiums may change annually on your renewal date. They also may change if you move into anew rating area.Part BDeductiblePart BCopay/CoinsurancePart B .2910.6510.9911.3311.6712.0312.3612.7313.03QA00235 3913.8414.3014.7615.2415.7216.2016.62Foreign TravelEmergencyPart A 7.80255.89264.29272.95281.61289.91297.62418.46Home HealthPart A 808182838485 Senior Choice BaseCurrent AgeAREA ANon-tobacco user ratesCounties: Buffalo, Crawford, Grant, Jackson, Juneau, La Crosse, Monroe, Richland, Sauk,Trempealeau, and 2.70Contact Us: (800) 362-3310QuartzBenefits.com

QA00235 1Foreign TravelEmergency17.32Home 459.5262.7357.18Part B 927.9229.5631.1428.19Part BCopay/CoinsurancePart A 2.58281.48290.72300.25309.77318.90327.38460.31Part B DeductiblePart A 808182838485 Senior Choice BaseCurrent AgeAREA ATobacco user ratesCounties: Buffalo, Crawford, Grant, Jackson, Juneau, La Crosse, Monroe, Richland, Sauk,Trempealeau, and 6113.97Contact Us: (800) 362-3310QuartzBenefits.com

QA00235 67.86Foreign TravelEmergency17.32Home 664.9368.4462.38Part B 6830.4632.2433.9730.76Part BCopay/CoinsurancePart A 7.36307.07317.15327.54337.93347.89357.14502.15Part B DeductiblePart A 808182838485 Senior Choice BaseCurrent AgeAREA BNon-tobacco user ratesCounties: Milwaukee, Ozaukee, Washington, Waukesha, Racine, and 14.8415.24Contact Us: (800) 362-3310QuartzBenefits.com

QA00235 1.94-74.65Foreign TravelEmergency17.32Home 971.4375.2868.61Part B 5533.5035.4737.3733.83Part BCopay/CoinsurancePart A 7.10337.77348.86360.29371.73382.68392.86552.37Part B DeductiblePart A 808182838485 Senior Choice BaseCurrent AgeAREA BTobacco user ratesCounties: Milwaukee, Ozaukee, Washington, Waukesha, Racine, and 8716.3316.76Contact Us: (800) 362-3310QuartzBenefits.com

QA00235 Foreign TravelEmergency17.32Home 057.3660.4555.10Part B 26.9028.4830.0127.17Part BCopay/CoinsurancePart A 2.67271.24280.15289.33298.51307.30315.48443.57Part B DeductiblePart A 808182838485 Senior Choice BaseCurrent AgeAREA CNon-tobacco user ratesAll other Wisconsin .1113.46Contact Us: (800) 362-3310QuartzBenefits.com

QA00235 5.94Foreign TravelEmergency17.32Home 263.0966.5060.61Part B 729.5931.3333.0129.88Part BCopay/CoinsurancePart A 8.93298.37308.16318.26328.36338.04347.02487.92Part B DeductiblePart A 808182838485 Senior Choice BaseCurrent AgeAREA CTobacco user ratesAll other Wisconsin 14.4214.81Contact Us: (800) 362-3310QuartzBenefits.com

QA00235 23.27-79.17Foreign TravelEmergency17.32Home 875.7579.8472.77Part B 4635.5337.6239.6335.88Part BCopay/CoinsurancePart A 6.92358.25370.01382.13394.25405.87416.67585.84Part B DeductiblePart A 808182838485 Senior Choice BaseCurrent AgeAREA DNon-tobacco user ratesPolicyholders who relocate out of 8317.3217.78Contact Us: (800) 362-3310QuartzBenefits.com

QA00235 .9525.59-87.09Foreign TravelEmergency17.32Home 483.3387.8380.05Part B 8139.0941.3843.6039.47Part BCopay/CoinsurancePart A 1.61394.07407.01420.34433.68446.46458.33644.43Part B DeductiblePart A 808182838485 Senior Choice BaseCurrent AgeAREA DTobacco user ratesPolicyholders who relocate out of 8.5119.0519.56Contact Us: (800) 362-3310QuartzBenefits.com

PREMIUM CALCULATIONSenior Choice Base Plan Senior Choice Base Plan Optional EnhancementsEach of these riders may be purchased separately.Choose one type of coverage:Part A 100% Deductible RiderWe’ll pay 100% of your Medicare Part A deductible of 1,484 during the first60 days of a confinement.orPart A 50% Deductible RiderWe’ll pay 50% of your Medicare Part A deductible of 1,484 during the first 60days of a confinement. Choose one type of coverage:Part B Deductible Rider (only for applicants who were Medicare-eligible before 01/01/2020) We’ll pay your Medicare Part B deductible of 203 each calendar year.or Part B Copay/Coinsurance RiderYour copayment or coinsurance will be the lesser of 20 per office visit, or 50per emergency room visit, or the Medicare Part B coinsurance. The MedicarePart B medical deductible will apply.Part B Excess Charges RiderWe’ll pay the difference between what Medicare approves for payment andthe amount charged by the provider, if your provider does not acceptMedicare assignment. The difference shall be no more than the actualcharge or the limiting charge allowed by Medicare, whichever is less. Home Health RiderWe’ll pay benefits for an additional 325 home health care visits eachcalendar year, up to a total of 365 visits per year, in addition to thosecovered by Medicare. Foreign Travel Emergency RiderWe’ll pay 80% of expenses associated with the emergency medical care youreceive outside the U.S. that begins in the first 60 days of a trip, after yousatisfy a deductible of 250, up to a lifetime maximum benefit of 50,000. BASE POLICY and SELECTED OPTIONAL RIDERS TOTALMONTHLY PREMIUMQA00235 (0820)15 Contact Us: (800) 362-3310QuartzBenefits.com

In addition to this Outline of Coverage, Quartz will send an annual notice to you 30 days prior tothe effective date of Medicare changes that will describe these changes and the changes inyour Medicare supplement coverage.BENEFIT TABLEThe amounts listed in the benefit table are based on 2021 Medicare deductible and coinsuranceamounts. They are subject to change. These benefits apply only to Medicare-approved servicesunless otherwise noted.NOTE: A benefit period begins on the first day you receive services as an inpatient in a hospital.It ends after you have been out of the hospital and have not received skilled care in any otherfacility for 60 days in a row.SERVICESPART A BENEFITSHospitalization perbenefit period:Inpatient servicessuch as semiprivate room andboard, generalnursing, andmiscellaneoushospital servicesand suppliesQA00235 (0820)MEDICAREBENEFITSSENIOR CHOICEBASE PLANOPTIONALBENEFITSYOU PAYBase PlanDays 1-60:Days 1-60: SeniorMedicare pays all Choice pays 0but the 1,484Part A deductibleDays 1-60: Youpay 1,484 PartA deductiblewith SeniorChoicePart A 100% Deductible RiderDays 1-60:Medicare pays allbut the 1,484 Part AdeductibleDays 1-60:Medicare Part A100%DeductibleRider* withSenior Choicepays the 1,484deductible16Days 1-60: Youpay 0 Part Adeductible withSenior Choiceand theoptional benefitContact Us: (800) 362-3310QuartzBenefits.com

Days 1-60:Medicare pays allbut the 1,484 Part AdeductibleQA00235 (0820)Part A 50% Deductible RiderDays 1-60:Medicare Part A50% DeductibleRider*** withSenior Choicepays 742 ofthe deductibleDays 1-60: Youpay 742 Part Adeductible withSenior Choiceand theoptional benefitDays 61-90:Days 61-90: SeniorMedicare pays all Choice pays 371but 371 per day per dayDays 61-90: Youpay 0 withSenior Choice60 lifetimereserve days:Medicare pays allbut 742 per day60 lifetime reservedays: SeniorChoice pays 742per day60 lifetimereserve days:You pay 0 withSenior ChoiceDays beyond thelifetime reservedays: Medicaredoes not coverany expensesDays beyond thelifetime reservedays: SeniorChoice pays 100%of Part AMedicare-eligibleexpenses for anadditional 365lifetime days**Days beyondthe lifetimereserve days:You pay 0 ofPart AMedicareeligibleexpenses for anadditional 365lifetime days**with SeniorChoice17Contact Us: (800) 362-3310QuartzBenefits.com

SERVICESInpatientPsychiatric Care: Ina participatingpsychiatric hospitalper benefit period.Medicare limits thenumber of inpatientpsychiatric benefitdays to a lifetimelimit of 190 days.Senior Choicecovers an additional175 days for acombined lifetimelimit of 365 days.MEDICAREBENEFITSOPTIONALBENEFITSBase PlanDays 1-60:Days 1-60: SeniorMedicare pays all Choice pays 0but the 1,484 Part AdeductibleDays 1-60:Medicare pays allbut the 1,484 Part AdeductibleDays 1-60:Medicare pays allbut the 1,484 Part AdeductibleQA00235 (0820)SENIOR CHOICEBASE PLANYOU PAYDays 1-60: Youpay 1,484 PartA deductiblewith SeniorChoicePart A 100% Deductible RiderDays 1-60:Medicare Part A100%DeductibleRider* withSenior Choicepays the 1,484deductiblePart A 50% Deductible RiderDays 1-60:Medicare Part A50% DeductibleRider*** withSenior Choicepays 742 ofthe deductibleDays 1-60: Youpay 0 Part Adeductible withSenior Choiceand theoptional benefitDays 1-60: Youpay 742 Part Adeductible withSenior Choiceand theoptional benefitDays 61-90:Days 61-90: SeniorMedicare pays all Choice pays 371but 371 per day per dayDays 61-90: Youpay 0 withSenior Choice60 lifetimereserve days:Medicare pays allbut 742 per day60 lifetimereserve days:You pay 0 withSenior Choice60 lifetime reservedays: SeniorChoice pays 742per day18Contact Us: (800) 362-3310QuartzBenefits.com

Skilled NursingFacility Care(Swing Bed) perbenefit period:You must havebeen in a hospitalfor at least threedays and entereda Medicareapproved facilitywithin 30 daysafter leaving thehospital. Skillednursing care andqualifying hospitalswing bed careare consideredthe same. See thepolicy foradditionalinformation.Non-qualifiedMedicare Stay orbenefits forqualified stayexhausted.QA00235 (0820)Days beyond thelifetime reservedays: Medicaredoes not coverany expensesDays beyond thelifetime reservedays: SeniorChoice pays 100%of all Part AMedicare-eligibleexpenses up to alifetime limit of365 days**Days beyondthe lifetimereserve days:You pay 0 ofPart AMedicareeligibleexpenses up toa lifetime limitof 365 days**with SeniorChoiceDays 1-20:Medicare pays100%Days 1-20: SeniorChoice pays 0Days 1-20: Youpay 0 with PartA MedicareDays 21-100:Days 21-100:Medicare pays all Senior Choice paysbut 185.50 per 185.50 per daydayDays 21-100:You pay 0 withSenior ChoiceDays over 100:Medicare doesnot cover anyExpensesDays over 100:Senior Choicedoes not coverany expensesDays over 100:You pay 100%of all expensesMedicare doesnot cover anyexpensesDays 1-30: SeniorChoice pays 100%19Contact Us: (800) 362-3310QuartzBenefits.com

Blood, first 3 pintsMedicare pays 0 Senior Choice pays100%You pay 0 withSenior ChoiceHospice Care: Yourdoctor must certifythat you areterminally ill.Medicare pays allbut limitedcopayments andcoinsurance foroutpatient drugsand inpatientrespite careYou pay 0 withSenior ChoiceSenior Choice pays100% of anycopayment orcoinsuranceamount*These are optional riders. You may purchase these benefits if you pay an additional premium.**NOTICE: When your Medicare Part A hospital benefits are exhausted, the issuer standsin the place of Medicare and will pay whatever amount Medicare would have paid asprovided in the policy's "Core Benefits."***This optional rider may reduce your premium when you pay 50% of Medicare Part Adeductible.This outline of coverage does not give all the details of Medicare coverage. Contact your localSocial Security Office or consult “Medicare & You” for more details.SERVICESPART B BENEFITSMedical Expenses:Includes Medicareeligible expensesfor physicianservices; inpatientand outpatientmedical servicesand supplies;physical,occupational andspeech therapy;diagnostic tests;durable medicalequipment.QA00235 (0820)MEDICAREBENEFITSSENIOR CHOICEBASE PLANMedicare, ingeneral, pays 80%after Part Bdeductible*OPTIONALBENEFITSBase PlanSenior Choice, ingeneral, pays 20%after Part Bdeductible*YOU PAYYou pay 203Part Bdeductible*Part B Deductible Rider(only if Medicare-eligible before 01/01/2020)Medicare, ingeneral, pays 80%after Part Bdeductible*Senior Choice, ingeneral, pays 20%after Part Bdeductible*20Medicare Part BDeductibleRider** withSenior Choicepays 203 PartB deductibleYou pay 0 PartB deductible*with SeniorChoice and theoptional benefitContact Us: (800) 362-3310QuartzBenefits.com

SERVICESMedical Expenses

If you join a Medicare Advantage Plan (MA Plan), you cannot use Medicare Supplement Insurance (Medigap) to pay for out- of-pocket costs you have in an MA Plan. If you already have an MA Plan, you cannot be sold a Medigap policy. You can only use a Medigap policy if you disenroll from your MA Plan and return to original Medicare.