Transcription

For par t icipant s in the OPER S health care plan .Connector Readiness 2016Connector ReadinessOPERS is introducing a new, standing newslettersection called Connector Readiness. In eachissue, articles pertaining to the OPERS MedicareConnector or general Medicare education will beplaced within this section. The section will bedesigned using an exclusive dark red accent color,so important information can be easily identified.We continue to receive questions around thespecifics of the Connector implementation in2016. Because we are currently in the process ofnegotiating a contract with a Connector vendor,we have relatively few details to share right now.However, in the coming months and into 2015, wewill be providing information onthe Connector vendor,Medicare plans,persHCpremiumallowancesounceS annOPERealthamounts andes to hgna1hcr 20 6lan focare pthe enrollmentprocess. Please staytuned and read theConnector Readinesssection thoroughly tostay informed.BulletintorcennCore Planalth CaS HeOPERTable of contents4June 201smiumsing pre ntiallyd of raie substainsteayears,, we havts andge.In recent for inflationet coscoveraf-pockount, out-oarmacy Sto accs thataysphizeognsed cop medical andOPERees recincreanexts to theTrustelth caribles for jor changed in theul heaard ofingdeductmamenteERS Bo to meaningf nt in providumsimplet of theThe OPpremiessmeIn lighn beingreasehealthing acctant eleeragecare pla opted to incvidingprovid is an imporBoardacy covhealthugh pro’vethegearmwe,Thopherars,scovby lawurity.few yea medical andsolutionuirednt secverch forlthretireme ge is not reqand lea d for 2014.ually seaerairee heae beenngecare cov S staff contin funding retwe hav s fromunchaERl years,larges oface.and OPrketplt severachallenllion dolRP),et theay’s mar the las 180 mim (ERto mein todt seePrograAlso, ove more thaneragewill no ge.urancee Careto usecare covpantseeraticie Reinsordablablcovparses.ly Retire ion of the Affe planarmacyincreathe Earlth carvisal or phmiumheaireesprodicpreSaissetny retOPERtheir me same.seswhichhelp off m ERRP, mases toincreatheA), toumfroain(ACirincreasmiActdollaribles remse in thential preut theincreadeductn substaWithoolledsee anes enrhave seets wille2013.Retirewouldticipan2 andaverag2014.vides1, 201see aneum inPlan parlly. It pro4. Iin 201B willedicarly premiin carefu e plan for 201 d. Non-Mts A andmonthlletse 12Parbusreatocarincmentedicareread thi ERS healthse of 10miumin Mee impleyPleaseOPeswe havly increa a monthly prewill var ron ther retirereaseutionsmonthdetailsthe soloffer ou e.will seeer to you. The incud ofable toase reffacretirees imately 45ails.am pros so pleges wen we areroxcific detendentchallenof appthe plafor speofdepdandayentollestateme the arrfor enrdespitollmentneed foropen enritheind thege of theJane Sm e Committes are behFirst, usavingCarsteesle factor ses in 2014. sed, thus dri eHealthof TruMultipreareaS Boardlth carum inchas incOPERo, heaspremipantsplan. Als reased. Thiparticiof theincsttorplan byhascosldocal leveloveral, fromnationup thespitalsthehoatateon.inflatit of carreasedthe cos ons has incmeansatimedicand forConnector Readiness1Medicare 1012-3Featured question3Connector Readiness -Can Ibe denied coverage.4It’s your health5Brand-name drugsthat will soon havegeneric equivalents6Be one in aMILLION HEARTS7New in 2014 Humana Vitality8

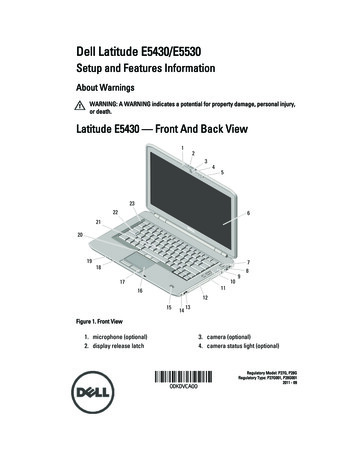

Medicare 101 – IndividualMedicare Plans – What’s theDifference?Medigap plans (also called Medicaresupplement plans)What is a Medigap plan? A Medigap plan isprivate health insurance that supplements or fillsin the “gaps” where Medicare Parts A and B leavean individual uncovered. Medicare Parts A andB cover only some health care costs. Medicaregenerally pays 80 percent after deductibles(annual and/or hospital) leaving the member topay 20 percent of the cost of medical care afterdeductibles. As a result, many Americans chooseto purchase a Medigap policy.What will a Medigap plan cost? These plans havea higher monthly premium (around 80- 280 amonth) but often have little or no out-of-pocketcosts for medical services.22Who should purchase a Medigap plan? Anindividual must be enrolled in both MedicareParts A and B before applying for a Medigap plan.Medigap plans are most appropriate for peoplewho travel or have medical issues requiringfrequent visits to doctors/hospitals. Most times,Medigap plans do not have networks. Therefore,policy holders can utilize any provider who takesMedicare.OPERS Health Care NewsletterBecause Medigap plans do not provide drugcoverage, individuals who select a Medigapplan generally also select a Medicare Part Dprescription drug plan. Premiums range between 20 and 90 per month.Medicare Advantage plansWhat is a Medicare Advantage plan? MedicareAdvantage (MA) plans are private health insuranceplans that replace traditional Medicare and mustprovide the same level of coverage that traditionalMedicare does. MA plans often provide additionalcoverage as well.What will a Medicare Advantage plan cost?Medicare Advantage plans have a lower monthlypremium ( 0 - 80 a month), but often featurehigher out-of-pocket costs for medical coverage.While monthly costs will be low, MA planparticipants will have deductibles and co-pays forphysician visits, hospital stays and testing.Who should purchase a Medicare Advantageplan? An individual must be enrolled in bothMedicare Parts A and B before applying for aMedicare Advantage plan. MA plans are mostappropriate for people who do not travel and haverelatively few medical issues and do not frequentlyvisit physicians or hospitals.MA plans generally feature a network. Participantsmust utilize physicians and hospitals in theirnetwork for the best coverage.A prescription drug plan is often included with aMedicare Advantage plan. In that case, they arecalled MAPD plans.How does the current OPERS Humana Plancompare? Though the current OPERS Humanaplan is technically a Medicare Advantage plan,it is designed much like a Medigap or MedicareSupplement plan. For example, the OPERSHumana plan has more comprehensive coveragethan is typically found in an MA plan. Also, theplan does not require the use of a network ofdoctors that retirees must use to get the highestlevel of coverage. The cost share an OPERSHumana Plan participant currently pays formedical services ranges between 0 percent and 8percent . The annual deductible is only 250 peryear and there is no daily hospital deductible.

Medicare 101(continued)The Humana plan does feature office visit co-paysfor emergency room or urgent care visits. Due tothe relatively low levels of cost sharing, the OPERSHumana plan is considered somewhat richer, ormore comprehensive, than the typical MedicareAdvantage plan on the individual marketplace.The current monthly cost for the OPERS HumanaMedicare Plan is 383 a month, much higherthan most plans on the individual market—whichis why making the move to a Connector is soimportant. OPERS can provide our retirees withmore affordable choices than ever before.How will I choose the best Medicare planfor me?In fall 2015, OPERS retirees enrolled in MedicareParts A and B will have the opportunity to select ahealth care plan that best meets their individualneeds and budget via the OPERS MedicareConnector. Retirees will receive personalized helpwith choosing a plan. The Connector will provideguidance so that each retiree makes the choicethat is right for them.For more information on individual Medicareplans available where you live, please visitwww.medicare.gov or www.insurance.ohio.gov.Heath Care Preservation Plan –Featured QuestionWhy did OPERS decide to stop reimbursing retirees for MedicarePart B premiums? OPERS has provided reimbursement of MedicarePart B premiums to qualified recipients for more than a decade. Lessthan 1 percent of the retirement plans across the nation provide thislevel of compensation for retirees. In 2012, OPERS reimbursed retireesmore than 112 million for those premiums.Reimbursing for Medicare Part B premiums became astrain on the health care fund. As part of the HealthCare Preservation Plan adopted by OPERS in 2012,the reimbursement will be incrementally eliminated.Reductions to the amount of reimbursement a retireereceives per month will begin in 2015 ( 63.62), continuein 2016 ( 31.81) and reach a 0 reimbursement in 2017.As we look to the implementation of the Connector andbeyond, OPERS has a new allowance model that mayhelp to compensate for this lost reimbursement. We willsoon be able to communicate more about the OPERSMedicare Connector and how retirees may be ableto use some of their monthly allowance to offsetthe cost of their Medicare Part B premium.3

Connector Readiness – Can I bedenied coverage on the OPERSMedicare Connector?When the OPERS Humana plan is closed atthe end of 2015, can I be denied coverage onthe Connector? As an OPERS retiree or qualifieddependent enrolled in both Medicare Parts Aand B, you cannot be denied the opportunity toenroll in an individual Medicare plan throughthe Connector as long as you do so during therequired open enrollment period. For OPERSretirees moving to the Connector, this openenrollment period will occur in the fall of 2015.42Individual Medicare plans must offer coverageto individuals whose Medicare group plans havebeen terminated provided they enroll duringthe required timeframe. This rule is commonlyreferred to as guaranteed issue. You areguaranteed that the insurance company will issueyou a plan. Guaranteed issue also applies whenpeople first turn age 65 and become eligible forMedicare or when they first retire if they are olderthan 65.If you fail to enroll during the open enrollmentperiod, you could be subject to medicalunderwriting. Medical underwriting requires youto answer questions about your health status.Insurance companies can deny your coverageor charge you a higher premium based on thefindings of medical underwriting.What if I select a Medicare plan but want tochange to a different one in the future? Once youare enrolled in an individual Medicare plan, rulesfor guaranteed issue and medical underwritingvary depending on the type of plan. All MedicareAdvantage (MA) and Part D prescription drugplans are always guaranteed issue. You cannot bedenied insurance based on a medical condition.You will never need to go through medicalunderwriting when moving to a MA plan or aPart D drug plan, no matter how many times youswitch plans.If, after your initial enrollment period, you wish toswitch from an individual MA plan to a Medigapplan, you can be required to undergo medicalunderwriting and you can be denied coverage.Also, if you want to switch from one Medigapplan to another (after the initial enrollmentperiod), you may be required to undergo medicalunderwriting.In order to avoid any potential problems withguaranteed issue and medical underwriting, it isvery important that you choose the Medicare planthat is right for you during the initial Connectoropen enrollment period. Please pay closeattention to open enrollment time frames anddeadlines when they are announced in 2015.OPERS Health Care NewsletterThe chart below helps illustrate when you may besubject to medical underwriting if you choose toswitch plans after your initial enrollment.FromToMedical Underwriting?*Medicare AdvantageMedicare AdvantageNoMedicare Supplement (Medigap)Medicare Supplement (Medigap)Yes**Medicare AdvantageMedicare Supplement (Medigap)YesMedicare Supplement (Medigap)Medicare AdvantageNoMedicare D Prescription PlanMedicare D Prescription PlanNo* This chart includes general information only.** If lower level coverage with same carrier is selected, then medical underwriting will not be required.

It’s Your HealthWith this issue of the newsletter, OPERS isintroducing a standing column called It’s YourHealth. Topics will focus on the importance ofbeing an active partner in your health care.OPERS encourages Medical Mutual participantsto use patient-centered medical homesIf you seek care from a patient-centered medicalhome (PCMH) recognized by the NationalCommittee for Quality Assurance (NCQA), you willpay a lower copay - just 10 - for an office visit.NCQA-recognized medical homes follow nationalstandards, and have changed their practices withthe goals of improving the health of their patientsand enhancing the patient experience throughbetter care coordination and communication withthe patient, their family, and all members of thepatient’s care team. The medical home is not abuilding or, for that matter, a final destination.Instead, it is a model for providing primary healthcare that facilitates partnerships between patientsand their personal health care providers.Currently, there are more than 300 NCQArecognized medical homes in Ohio. To find out ifyour primary care doctor is a PCMH:1. Visit MedMutual.com to use the Provider Searchtool.2. Confirm the state in which you are looking for adoctor and the network in which you participate.3. Select “NCQA-Patient-Centered Medical Home”under the Awards and Recognitions section.If you have any questions, contact Medical Mutualdirectly at 1-877-520-6728.Help your doctor help youYour health depends on good communicationbetween you and your doctor. Despite being verybusy, your doctor needs and wants you to shareyour questions and concerns. By doing so, youactually make it easier for your doctor to help you.Ask questionsAsking questions is key to goodcommunication with your doctor. If youdon’t ask questions, your doctor maythink you do not need or want moreinformation. Asking questions helps yourdoctor know what is important to you.Before your appointment, take time to preparea list of questions you want to ask. Making alist before your visit will help you remembereverything you need to address during theappointment. And, your doctor’s responses willhelp you receive quality care and make betterdecisions about your health.Understand the answers and next stepsAsking questions is important, but so is makingsure you hear—and understand—the answersyou get. If you don’t understand or are confused,ask your doctor to explain the answer again. Takenotes. Or, bring someone to your appointmentto help you understand and remember what youheard.If you get home and realize you are unsure aboutwhat your doctor said - including instructionsyou were given - call your doctor’s office. A staffmember can check with your doctor and call youback.For help in preparing questions you may wantto ask your doctor before, during or after anappointment, check out: www.ahrq.gov and clickon “Questions are the Answer”.5

Commonly Prescribed BrandName Drugs Will Soon HaveGeneric EquivalentsA number of commonly prescribed, brand-namemedications will lose their patent protection in2014. This will allow drug manufacturers to offerlower cost, generic versions of these medications.The use of generics saves health care dollarsfor both OPERS and you. Express Scripts willautomatically substitute a generic version of amedication when one becomes available,unless your provider has indicated “dispenseas written.” You do not need to obtain a newprescription. The information about genericavailability is subject to change. Commonmedications scheduled for generic release thisyear include:Common medications scheduled for generic release in 20146Actonel (Osteoporosis) June 2014Lumigan (Glaucoma) Aug. 2014Copaxone (Multiple Sclerosis) May 2014Lunesta (Sleep Disorders) May 2014Detrol LA (Urinary Incontinence), March 2014Micardis/Micardis HCT (Blood Pressure, Heart Disease) Jan.2014Evista (Osteoporosis), March 2014Nasonex (Nasal Allergies) 2014*Exforge/Exforge HCT (Blood Pressure, Heart Disease) 2014*Nexium (Ulcers) May 2014Flector (Pain, Inflammation) April 2014Renagel (Chronic Kidney Disease) March 2014Lovaza (High Cholesterol) 2014*Restasis (Dry Eyes) May 2014*Exact date yet to be determinedOPERS Health Care Newsletter

Be one in a MILLION HEARTS Launched in 2011 by the U.S. Department of Healthand Human Services, Million Hearts is a nationalinitiative to prevent 1 million heart attacks andstrokes in the U.S. by 2017.What can you do?Talk to your doctor about how you canprevent or manage heart disease, andthen visit http://millionhearts.hhs.gov/to take advantage of various resources tolearn more about cardiovascular disease,assess your risk, and engage with theinitiative.Key Facts:Heart disease is the leading cause of death.Stroke is the fourth leading cause of death.Cardiovascular disease is responsiblefor 1 of every 3 deaths.Everyday 2,200 people die from cardiovasculardisease.Cardiovascular risk factors such as blood pressure,cholesterol, smoking and obesity are controllable.1. Get started. Heart360 is an online tool whichhelps track and manage your heart health.www.heart360.org2. Calculate my risk. Discover your 10-year risk ofheart attack or dying from coronary heart diseasesand what you can do about it.http://50.56.33.51/hart01/main en US.html3. Get my assessment. With My Life Check, you canlearn the state of your heart and what you can doto live a better life.http://50.56.33.51/mlc01/main en US.htmlSources:American Heart Association, American Stroke Associationwww.heart360.orgMillion Hearts, http://millionhearts.hhs.gov7

New in 2014 - HumanaVitality Effective Jan. 1, 2014, Humana began offeringHumanaVitality , a new wellness programexclusively for Humana participants. All OPERSHumana participants should have received aninformational packet from Humana detailingthis new program.Participants will earn incentives from Humanafor completing Medicare-approved preventionactivities, such as doctor check-ups, screeningsand vaccinations, and they can be spent onitems like gift cards and fitness gear in theonline HumanaVitality Mall.HumanaVitality is a fun, interactive online andtelephonic program based on a comprehensivelifestyle approach to wellness. This program isfree of charge to all Humana participants, and itprovides tips and activities to help improve yourhealth. The program focuses on the following:In addition, Humana Vitality participants areeligible for 10 percent savings on “Great For You”labeled foods at Walmart. Physical activity Education Preventive screenings Tobacco cessationYou have to register for Humana Vitality totake advantage of these program features.Please use your current Humana login atHumana.com to register. Or if you don’tcurrently have an online Humana account, youcan register at HumanaVitality.com. Any furtherquestions regarding the program should bedirected to Humana at 1-877-890-4777. NutritionOhio PublicEmployeesRetirementSystem277 East Town StreetColumbus, rtwitter.com/ohiopers

findings of medical underwriting. What if I select a Medicare plan but want to change to a different one in the future? . Medicare Supplement (Medigap) Medicare Supplement (Medigap) Yes** Medicare Advantage Medicare Supplement (Medigap) Yes . If you have any questions, contact Medical Mutual directly at 1-877-520-6728.