Transcription

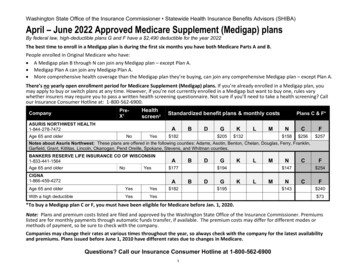

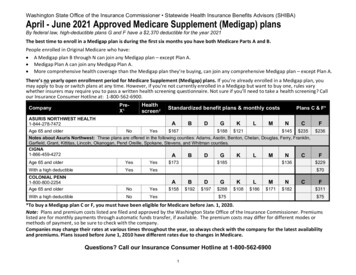

Washington State Office of the Insurance Commissioner Statewide Health Insurance Benefits Advisors (SHIBA)April - June 2021 Approved Medicare Supplement (Medigap) plansBy federal law, high-deductible plans G and F have a 2,370 deductible for the year 2021The best time to enroll in a Medigap plan is during the first six months you have both Medicare Parts A and B.People enrolled in Original Medicare who have: A Medigap plan B through N can join any Medigap plan – except Plan A. Medigap Plan A can join any Medigap Plan A. More comprehensive health coverage than the Medigap plan they’re buying, can join any comprehensive Medigap plan – except Plan A.There’s no yearly open enrollment period for Medicare Supplement (Medigap) plans. If you’re already enrolled in a Medigap plan, youmay apply to buy or switch plans at any time. However, if you’re not currently enrolled in a Medigap but want to buy one, rules varywhether insurers may require you to pass a written health screening questionnaire. Not sure if you’ll need to take a health screening? Callour Insurance Consumer Hotline at: 1-800-562-6900.PreX1CompanyHealthscreen2ASURIS NORTHWEST HEALTH1-844-278-7472Standardized benefit plans & monthly costsABDGKLMPlans C & F*NCFAge 65 and olderNoYes 167 188 121 145 235Notes about Asuris Northwest: These plans are offered in the following counties: Adams, Asotin, Benton, Chelan, Douglas, Ferry, Franklin,Garfield, Grant, Kittitas, Lincoln, Okanogan, Pend Oreille, Spokane, Stevens, and Whitman counties.CIGNA1-866-459-4272ABDGKLMNC 236Age 65 and olderYesYes 229With a high deductibleYesYesCOLONIAL PENN1-800-800-2254Age 65 and olderNoYesWith a high deductibleNoYes 173 185 136F 70ABDGKLMN 158 192 197 288 108 186 171 182 75CF 311 75*To buy a Medigap plan C or F, you must have been eligible for Medicare before Jan. 1, 2020.Note: Plans and premium costs listed are filed and approved by the Washington State Office of the Insurance Commissioner. Premiumslisted are for monthly payments through automatic funds transfer, if available. The premium costs may differ for different modes ormethods of payment, so be sure to check with the company.Companies may change their rates at various times throughout the year, so always check with the company for the latest availabilityand premiums. Plans issued before June 1, 2010 have different rates due to changes in Medicare.Questions? Call our Insurance Consumer Hotline at 1-800-562-69001

Washington State Office of the Insurance Commissioner Statewide Health Insurance Benefits Advisors (SHIBA)April - June 2021 Approved Medicare Supplement (Medigap) plansCompanyFIRST HEALTH LIFE &HEALTH1-800-264-4000Age 65 and olderPreX1NoHealthscreen2YesGARDEN STATE LIFE INSURANCE CO1-888-350-1488Age 65 and olderNoYesWith a high deductibleNoYesGLOBE LIFE AND ACCIDENT INSURANCE CO1-800-801-6831Age 65 and olderYesYesWith a high deductibleYesYesGPM HEALTH & LIFE1-866-242-7573Age 65 and olderNoYesB 154 189ABYesYesWith a high deductibleYesYesLOYAL AMERICAN (Cigna)1-866-459-4272YesPREMERA BLUE CROSS1-800-752-6663YesYesWith a high deductibleYesYesREGENCE BLUECROSS BLUESHIELD OF OREGON1-844-734-3623NoB 121 198LM 211DGNC 167KLF 227MNC 163 159FMNCF 181 229 231 280DGKL 212 54BD 195G 54KLM 243BD 143GNC 162KLM 185NBD 210GC 150D 184GF 229 67KLM 219BF 287 66NC 145KLM 189NF 287CFNCF 160 249 251 182 47AYesK 192AAAge 65 and olderGPlans C & F* 64AYesD 170AAge 65 and olderAge 65 and olderAAHUMANADENTAL INSURANCE CO1-866-205-0000Age 65 and olderStandardized benefit plans & monthly costsB 173DGK 201 131LMNotes about Regence BlueCross BlueShield of Oregon plans: These plans are available only to Clark County residents.2

*To buy a Medigap plan C or F, you must have been eligible for Medicare before Jan. 1, 2020.Washington State Office of the Insurance Commissioner Statewide Health Insurance Benefits Advisors (SHIBA)April - June 2021 Approved Medicare Supplement (Medigap) plansPreX1CompanyREGENCE BLUE SHIELD1-844-734-3623Age 65 and olderHealthscreen2Standardized benefit plans & monthly costsANoYesBD 167GK 188 121LMPlans C & F*NCF 145 235 236Notes about Regence Blue Shield plans: These plans are offered in the following counties: Clallam, Cowlitz, Columbia, Grays Harbor, Island,Jefferson, King, Kitsap, Klickitat, Lewis, Mason, Pacific, Pierce, San Juan, Skagit, Skamania, Snohomish, Thurston, Wahkiakum, Walla Walla,Whatcom, and Yakima.SENTINEL1-888-510-0668Age 65 and olderNoYesSTATE FARM INSURANCE(Call local agent)Age 65 and olderYesYesTRANSAMERICA1-866-205-9120Age 65 and olderNoYesUNITED AMERICAN INSURANCE CO1-800-755-2137Age 65 and olderYesYesWith a high deductibleYesYesYesYesNoYesNoYesUnder age 65 Medicare disabilityUNITEDHEALTHCARE (AARP)1-800-523-5800Age 65 and older3Medicare Select Plan*UNITED OF OMAHA LIFE INSURANCE CO1-800-667-2937Age 65 and olderNoYesWith a high deductibleNoYesABD 307 342 365ABDG 169 169 161GKKLLMMNCF 423 428NCF 131 261 264ABDGKLMNCF 138 182 199 199 99 147 181 170 215 216ABDGKLMNCF 167 230 246 222 205 259 288 44 44 449AB 145 214DGKL 210 66 147M 199AB 196DG 221 54*To buy a Medigap plan C or F, you must have been eligible for Medicare before Jan. 1, 2020.3KLMNCF 171 253 254 163 238 239NCF 146 294 70

Washington State Office of the Insurance Commissioner Statewide Health Insurance Benefits Advisors (SHIBA)April - June 2021 Approved Medicare Supplement (Medigap) plansCompanyUSAA1-800-292-8556Age 65 and olderPreX1Healthscreen2Standardized benefit plans & monthly costsANoYesWASHINGTON STATE HEALTH CARE AUTHORITY (HCA)BLUE CROSS PREMERA PLANS1-888-208-6264BD 135AGKLM 180BDGAge 65 and olderNoNo 189Under age 65 Medicare disabilityNoNo 321Plans C & F*NC 135KLMNF 228CFNote about Washington State HCA plans: These rates are for Washington state residents who are NOT a Public Employees Benefits Board (PEBB)member (PEBB members must enroll directly with the HCA). State residents should call the Blue Cross Premera number at 1-888-208-6264 and askfor a paper application for Group ID: 1000041, and for P2019196 (the HCA Plan G pre-sales enrollment kit).*To buy a Medigap plan C or F, you must have been eligible for Medicare before Jan. 1, 2020.Footnotes Explained:1 PreX (pre-existing condition) is a health problem you had within the three months before the effective date ofyour new plan. For this condition, a company cannot exclude benefits for that condition for more than threemonths after the coverage effective date. If you replace your policy and your previous policy was in effect for atleast three months, you have no waiting period for any pre-existing conditions.2 No health screen means the insurance company will not ask you any health questions to decide if they will enrollyou in its plan.3 You must be a member of an association to buy these plans.* Medicare Select policies may require you to use specific hospitals, doctors, or other health care providers to get fullcoverage. They must disclose network restrictions to you.The appearance of acompany on this listdoes not constitute anendorsement of acompany or its policiesby the Washington StateOffice of the InsuranceCommissioner, SHIBA, orits volunteers.Rev. 6-1-20214

Washington State Office of the Insurance Commissioner Statewide Health Insurance Benefits Advisors (SHIBA)10 Standardized Medicare Supplement (Medigap) plans chartThis chart shows the benefits included in each of the standard Medigap plans effective on or after Jan. 1, 2021.The Medigap policy covers coinsurance only after you’ve paid the Medicare deductible (unless the policy you have also covers the deductible).Note about Plans C and F:Only applicants’ first eligible for Medicare before 2020 can buy/keep Plans C, F, and high-deductible Plan F. Medigap Plans C and F are no longer availableto people new to Medicare as of Jan. 1, 2020. If you were eligible for Medicare before Jan. 1, 2020, but not yet enrolled, you might be able to still buy aPlan C, F or high-deductible Plan F.How to read the chart: policy covers 100% of benefit; % policy covers that percentage; Blank policy doesn’t cover that benefitPlans available to all Medigap applicantsBasic benefitsMedicare-eligible before 2020ABDG*KLMNCF* 50%75% Part B: Coinsurance or copayMedicare preventive care Part B coinsurance 50% 75% *** Parts A & B: Blood (first 3 pints) A B D G*50%K75%L M NCF* 50%50%75%75% 50% Part A: Hospital coinsurance (plus costs up to anadditional 365 days after Medicare benefits end)Part A: Hospice care coinsurance or copayAdditional benefitsSkilled nursing facility care coinsurancePart A deductible: 1,484Part B deductible: 203Part B excess chargesForeign travel emergency (lifetime limit of 50,000)Out-of-pocket yearly limit** 80% 80%80%80%80%80% 6,220 3,110*Plans F and G offer a high-deductible plan. You pay for Medicare-covered costs up to the deductible amount ( 2,370 in 2021) before your plan pays anything.**After you meet your out-of-pocket yearly limit and Part B deductible, the plan pays 100% of covered services for the rest of the calendar year.***Plan N pays 100% of the Part B coinsurance except up to 20 copays for some office visits and up to 50 copays for emergency room visits (if the hospitaladmits you, the plan waives your emergency room copays).Need more help?There’s no yearly open enrollment period for Medicare Supplement (Medigap) plans. You may apply to buy or switch plans at any time. However, insurers may require you to pass ahealth questionnaire. If you have questions about who needs to take the questionnaire, call our Insurance Consumer Hotline. If you want individual help understanding all of youroptions, call our hotline and ask to speak with a SHIBA counselor in your area: 1-800-562-6900.5

This project was supported, in part by grant number 90SAPG0012-02, from the U.S.Administration for Community Living, Department of Health and Human Services,Washington, D.C. 20201.SHP521-SHIBA-Medigap-plans-Rev. 12-20206

April - June 2021 Approved Medicare Supplement (Medigap) plans . By federal law, highdeductible plan- sG and F have a 2,370 deductible for the year 202 1 . The best time to enroll in a Medigap plan is during the first six months you have both Medicare Parts A and B. People enrolled in Original Medicare who have: