Transcription

JUNE 2021QUARTET COLLABORATEON UK ELECTRIFICATION

CONTENTS3OSV MARKET ROUND-UPABOUT SEABROKERS GROUP6OSV AVAILABILITY, RATES &UTILISATION - NORTH SEA7MONTHLY OSV SPOT RATES NORTH SEA8FEATURE VESSELThe Seabrokers Group was established in 1982. Weprovide a unique and varied range of services toclients. The Seabrokers Group has an experiencedworkforce within Shipbroking, Real Estate,Facilities Management, Construction, SeaSurveillance, Harbour Cranes and Safe LiftingOperations. Our head office is located in Stavanger,but we also have offices in Aberdeen, Bergen andRio de Janeiro.9 OSV NEWBUILDINGS, CONVERSIONS,SALE & PURCHASE11SUBSEA14RENEWABLES15RIGS16CONUNDRUM CORNER& DUTY PHONESProduction and Administration:Seabrokers Ltd, AberdeenFor your free copy ofSeabreeze, email:chartering@seabrokers.co.ukThe Seabrokers Group is different – and we areproud of this fact. Our information, experience andknowledge provide us with the ability to performin our diverse business areas.Seabrokers Chartering AS and Seabrokers Ltd arecertified by DNV GL in line with ManagementSystem Standard ISO 9001:2015.SHIPBROKINGREAL ESTATESECURALIFTFACILITY MANAGEMENTSEA SURVEILLANCEFOUNDATIONSYACHTINGHARBOUR CRANESThe Seabreeze Monthly Market Reportis distributed worldwide throughour offices in Aberdeen, Stavanger andRio de Janeiro.OUR OFFICES:STAVANGERABERDEEN Seabrokers Group 2021www.seabrokers-group.comBERGENRIO DE JANEIROSKIEN

OSV MARKET ROUND-UPSPOT PSV MARKET IN ELECTRIFYING UK OFFSHORE PLATFORMSOWNERS’ FAVOURFour major players in the UK oilwithin the coming months overPSV owners in the North Seahave been enjoying a prolongedspell of limited vessel availabilityon the spot market, with fixturerates remaining in their favourfor most of June.Charterers were well aware thatthe market would be tighteningsignificantly this summer witha long list of vessels tied up onproject fixtures in the Baltic Seaand up in the Arctic. Throughthe month of June, there wereno spot PSV fixtures made belowGBP 7,000 in the UK sector, orNOK 70,000 in Norway. Thevast majority of charters werefetching rates of more than GBP10,000 or NOK 110,000.Specific to Norway, it wasn’tnecessarily that busy a month interms of the number of fixturesbut some UK charterers wereforced to consider sourcingtonnage from the Norwegianmaket due to the lack of vesselsavailable closer to home.In the AHTS sector, it wasanother steady month. A fewcharterers were stung withhigher rates than they wouldhave hoped for due to the lownumber of vessels trading on thespot market, but with averagefixture rates of circa GBP 18,000in the UK and NOK 190,000in Norway, owners are stillstruggling to generate sufficientutilisation to turn a profit.& gas sector are coming togetherto collaborate on a high levelresearch study for the potentialelectrification of production hubsin the central North Sea.which concepts will be takenforward into early engineeringin 2022, with a view to havingat least two projects up andrunning by 2027.BP, Harbour Energy, Shell andTotalEnergies have confirmedtheir participation in the study,as the UK Oil & Gas Authorityhas voiced its satisfaction withthe early progress that has beenmade so far. The participantsare exploring how to converttheir offshore platforms to uselow-carbon electricity insteadof higher-emitting gas-fired ordiesel generators. The hope nowis that decisions could be madeDevelopments and technologicaladvancements of this naturewill be crucial if the sector is toachieve the targets that it hascommitted to within the NorthSea Transition Deal betweenindustry and government.The agreed target is for a 50%reduction in operational carbondioxide emissions by 2030. Thestudy is thought to be focused onthe Central Graben Area, hometo several production hubs.NORWAY PROGRESSING LICENSING ROUNDSThe Norwegian Ministry ofPetroleum and Energy hasannounced the award of fourproduction licences from its25th licensing round. This wasa limited offering for the moreprospective acreage offshoreNorway with just nine areasavailable for bidding.The winning participants wereEquinor, Idemitsu Petroleum,INEOS, Lundin, Norske Shell,OMV and Vår Energi. In termsof operatorships, Equinor willtake the lead role for two ofthe licences while INEOS andVår Energi were appointed theoperator of one licence apiece.Three of the licences are locatedin the Barents Sea with one inthe Norwegian Sea.With the 25th round concluded,the Ministry of Petroleum andEnergy has now launched itsAwards in Predefined Areas(APA) 2021 process, offeringacreage in the best-understoodgeological areas offshore Norwaynear to existing infrastructureor prior discoveries. This year,the predefined area open forlicensing has been expandedby 84 blocks. Four of these arelocated in the North Sea, with10 in the Norwegian Sea and 70in the Barents Sea. Awards areexpected to be made early in2022.SEABREEZE 3

OSV MARKET ROUND-UPNORTH SEA PSVS FLOCK TO BALTIC.Island Defender (pictured c/o P. Gowen)PSV availability on the NorthSea spot market has taken a hitafter Saipem chartered no fewerthan seven PSVs to providesupport for its pipelay activitiesat the Baltic Pipe project in theBaltic Sea.The contracts went to GoldenEnergy Offshore for the EnergyDuchess, Hoyland Offshorefor the Sar Brage and Sartor,Island Offshore for the IslandChampion and Island Defender,Seatankers for the Sea Goldcrest,and Vestland Offshore for theSolvik Supplier.Each of the vessels has beenchartered for a firm period of40-50 days with further optionsavailable. They will be providingsupport for the campaign whileSaipem is undertaking pipelayoperations with the Castoroneand Castoro Sei pipelay vessels.Most of the PSVs have beenactive in the North Sea recently,. WHILE OTHERS HEAD FOR THE ARCTICHermit Viking (c/o DanoAberdeen)Another batch of North Sea PSVsare heading north after GazpromNeft chartered them to supporta drilling campaign in ArcticRussia. Solstad picked up threefixtures for the Normand Sitella,Sea Spark and Sea Spear, whileRemøy Shipping secured thealthough the Energy Duchesshas just been reactivated aftermore than a year in layup, whilethe Sar Brage is returning towork for the first time in morethan five years.fourth slot for the Hermit Viking.The vessels have been charteredfor a firm period of three monthswith further options available.Sevnor has also sent the SayanPrincess north after picking up asimilar summer season contractin Russia.NORWAY FIXTURES FOR EIDESVIK & ISLANDIt has been a quiet spell inNorway for term charteringactivity but there have been acouple of recent PSV fixtures toreport. Eidesvik Offshore haspicked up a new charter for theViking Prince with AkerBP. Thevessel has just finished one term4 SEABREEZEfixture with Aker BP and, aftera brief interlude, will returnto the charterer in August tosupport a drilling campaign forroughly 100 days. Elsewhere,Island Offshore has picked up asix-month charter for the IslandChieftain with Lundin.Viking Prince (pictured c/o D. Dodds)

OSV MARKET ROUND-UPSOLSTAD SCOOPS UK HAT-TRICKNormand Supra (pictured c/o O. Halland)Solstad Offshore has had asuccessful spell in the UK sector,picking up new term contractsfor three PSVs.Harbour Energy is taking apair of Ulstein PX 105 vesselson hire for a firm period of twoyears with two further one-yearoptions available. The vesselsin question are the NormandService, which will go on hirefollowing the completion ofits current charter with SericaEnergy, and the Normand Suprawhich is currently being putthrough a class renewal havingrecently returned from SouthAmerica.The Ulstein PX 105 design isevidently proving popular withUK charterers, with EnQuestopting to take another one ofSolstad’s fleet on term charter.This time it is the Sea Falcon,which will be going on hire toEnQuest in August for a firmperiod of 18 months. EnQuestTOTALENERGIES KEEPS THREEHighland Defender (c/o D. Dodds)TotalEnergies appears pleasedwith the performance of itsincumbent fleet, with new dealsor contract extensions awardedto three units. In the UK sector,Tidewater PSV HighlandDefender has just concluded onefixture with TotalEnergies toalso holds a one-year option onthis contract. The Sea Falcon iscurrently supporting EquinorUK’s drilling operations withthe West Hercules alongside theNormand Titus.move onto a new one-year plusone-year option contract withthe same charterer. In Denmark,TotalEnergies has exercisedoptions to extend its contractswith the Havila Fanø and Herøyuntil early December 2021 andearly January 2022 respectively.LONG-TERM DEALS FOR MMAMMA Offshore has pickedup two significant long-termcontracts in Australasia. AHTSvessel MMA Vision has beenchartered by OMV New Zealandfor a three-year firm period toprovide field support duties atthe Maari and Maui gas fields inthe Taranaki Basin. OMV holdstwo further one-year options. InAustralia, INPEX has awardedMMA a contract extension tokeep the MMA Plover PSV onhire for at least two more yearsto provide drilling support at theIchthys field.MMA PloverSEABREEZE 5

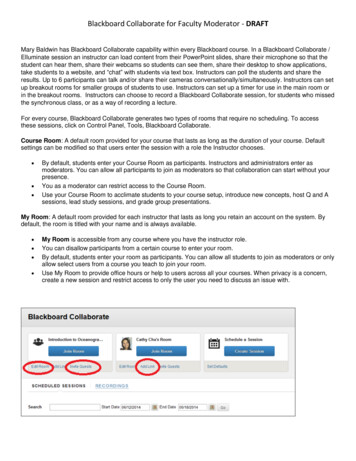

OSV RATES & UTILISATIONJUNE 2021 - DAILY NORTH SEA OSV AVAILABILITYPSV 202122PSV 2020AHTS 2021AHTS 2020201816141210864201 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30RATES & UTILISATIONNORTH SEA SPOT AVERAGE UTILISATION JUNE 2021TYPEJUN 2021MAY 2021APR 2021MAR 2021FEB 2021JAN 2021MED PSV78%70%64%51%65%67%LARGE PSV75%79%68%71%82%77%MED AHTS56%67%49%37%30%39%LARGE AHTS59%64%54%62%54%40%NORTH SEA AVERAGE RATES JUNE 2021AVERAGE RATEJUN 2021AVERAGE RATEJUN 2020% CHANGEMINIMUMMAXIMUMSUPPLY DUTIES PSVS 900M2 10,524 4,485 134.65% 5,925 14,500SUPPLY DUTIES PSVS 900M2 11,774 4,769 146.89% 8,000 15,000AHTS DUTIES AHTS 22,000 BHP 16,287 16,898-3.62% 6,772 30,000AHTS DUTIES AHTS 22,000 BHP 17,604 17,197 2.37% 7,618 34,500CATEGORYSPOT MARKET ARRIVALS & DEPARTURES: JUNE 2021ARRIVALS - NORTH SEA SPOTDEPARTURES - NORTH SEA SPOTDEPARTURES - CONTINUEDISLAND DISCOVERERNEWBUILDHERMIT VIKINGRUSSIANORMAND SITELLARUSSIAPRINCESSEX MEDITERRANEANHORIZON ARCTICNORTH ATLANTICSAYAN PRINCESSRUSSIAISLAND CHAMPIONBALTIC SEASIEM DIAMONDFRANCEMAERSK HANDLERBALTIC SEASKANDI RONASOUTH AMERICAMAERSK TENDERPACIFIC OCEANSOLVIK SUPPLIERBALTIC SEA* Vessels arriving in or departing from the North Sea term/layup market are not included here.6 SEABREEZE

NORTH SEA AVERAGE SPOT RATES 40,000 15,000 12,500 30,000 10,000PSVs 900m²All Cargo Runs 20,000 7,500 5,000 10,000 2,500 -JanFebMarAprMayJunJulAugSepOctNovDec2020 5,257 6,308 8,863 3,485 3,751 4,485 4,650 7,529 8,872 6,651 3,854 7,6182021 6,774 11,012 7,778 7,755 9,241 10,524 - - - - - - 15,000 12,500PSVs 900m²PSVs 900M²900M2 10,000 7,500 5,000 2,500 -JanFebMarAprMayJunJulAugSepOctNovDec2020 6,810 8,014 7,132 3,733 4,370 4,769 4,310 4,175 9,651 6,664 4,890 5,5422021 5,818 9,861 8,360 10,496 10,872 11,774 - - - - - - 40,000 40,000 35,000 30,000 30,000 25,000 20,000 20,000 15,000 10,000 5,000 -AHTS 22,000 bhpPSVs 0 7,959 18,562 25,486 7,087 10,745 16,898 16,961 32,250 23,271 12,042 9,100 12,5262021 8,656 10,928 27,971 15,068 12,843 16,287 - - - - - - 40,000 35,000 30,000 25,000 20,000 15,000 10,000 5,000 -AHTS 22,000bhpRig MovesJanFebMarAprMayJunJulAugSepOctNovDec2020 9,203 16,901 21,268 8,141 13,100 17,197 18,132 32,256 29,683 9,585 13,013 11,7622021 8,442 20,121 35,211 19,327 15,401 17,604 - - - - - - 25,000 25,000 20,000 20,000AverageDay RatesTo2021)Month (June 2013)Average Day RatesTo Month(June 15,000 10,000 5,000 -PSVs 900m²PSVs 900m²AHTS 22,000 bhpAHTS 22,000 bhp2020 5,850 6,064 15,599 14,7602021 8,941 9,034 16,386 20,939SEABREEZE 7

FEATURE VESSELISLAND DISCOVERERpicture c/o UAVPICIsland Offshore has accepted delivery of its long-awaited newbuild PSV Island Discoverer from theVARD Langsten Shipyard in Norway.Originally ordered back in 2014,delivery of the vessel had beenpostponed due to the difficulttrading conditions that PSVowners have been experiencingfor many years. However, inlight of an improving marketsituation for owners today,Island Offshore has decided thetime is right to welcome theDiscoverer into its North Seafleet.The Norwegian-flagged vesselwas built to the UT 717 CDXdesign, giving her a length of86m, breadth of 18.5m and adeck area of 900m². She has adeadweight of 4,215t and deck8 SEABREEZEcargo capacity of 2,500t. TheDiscoverer has a main engineoutput of 7,724 bhp and she isoutfitted with accommodationquarters for 26 persons.The Island Discoverer willbe utilised by charterers totransport and supply both liquidand dry cargo in tanks, as wellas containers and pipes on deck.Following her delivery at theend of May, she has alreadybeen awarded several charterson the Norwegian spot market.The Island Discoverer is thefifth UT 717 CDX PSV in theIsland Offshore fleet.picture c/o O. HallandIsland Discoverer Specs:Delivery: May 2021Build Yard: VARD LangstenDesign: UT 717 CDXDesigner: Kongsberg MaritimeLength: 86.0mBreadth: 18.5mDeck Area: 900m²Deadweight: 4,215tMain engine output: 7,724 bhpAccommodation: 26 persons

NEWBUILDS, CONVERSIONS, S&PSAYAN PRINCE DELIVERED TO SEVNORSevnor has added a newbuildAHTS vessel to its fleet in theform of the Sayan Prince. Builtto the MOSS 919 design, thevessel was ordered by Finargeback in 2013. The original planwas for the unit to be builtby SPP Shipbuilding in SouthKorea, however the partially-SIEM SELLS TWODiamond & Garnet (c/o F. Montreuil)built vessel was resold toSevnor in 2016 after the Finargecontract had been cancelled.Construction was completed atthe Tersan Shipyard in Yalova,Turkey. Sevnor has alreadysecured a three-month firmcharter for the Sayan Princewith Gazprom Nedra in Russia.The Siem AHTS Pool AS, asubsidiary of Siem Offshore Inc,has sold sister AHTS vesselsSiem Diamond and Siem Garnet.The VS 491 CD vessels have beensold for further trading outsidethe offshore shipping industry.The pair have been mobilisedto Le Havre in northern France,with the buyers rumoured tobe the French Coastguard. Theobjective of the sale for Siem wasto reduce debt. The surplus cashafter debt repayment on the twovessels sold will be used by Siemfor additional debt repaymenton the eight remaining vessels inthe Siem AHTS Pool AS fleet.STANDARD SELLING OLYMPUSStandard Drilling has enteredinto a Memorandum ofAgreement to sell the StandardOlympus to undisclosed buyersfor USD 7.5 million. StandardDrilling will recognise a grossgain of USD 1.3 million. Builtto the Havyard 832 design, thePSV was originally deliveredby Havyard Ship Technology inNorway in 2014. She was lateracquired by Standard Drilling in2019. Under the management ofthe Fletcher Group, the StandardOlympus is currently on hire toPSE Kinsale Energy in Ireland.The transaction is expected to beconcluded by August 2021.CALEDONIAN CLASS PSVS DEPARTINGCaledonian Vision (pictured c/o J. Bartels)The last Caledonian Class PSVwill soon depart the North Seamarket following BP Shipping’ssale of the four vessels to GSP.The Caledonian Vanguard leftin late 2020; she is now tradingin Romania as the GSP Pegasus.The Caledonian Vision had beenrenamed as the GSP Phoenix butStandard Olympus (pictured c/o J. Moore)she is now known as the Ile deMolene; she has been relocatedto Dunkirk, France, with AlcatelSubmarine Networks listed asher owner. She has been joinedin Dunkirk by the GSP Licorn(ex Caledonian Vigilance). TheCaledonian Victory will be thelast to leave.SEABREEZE 9

NEWBUILDS, CONVERSIONS, S&PANOTHER SALE FOR SOLSTADSolstad Offshore is continuingto make good progress with itsplans to sell the non-core vesselsin its OSV fleet. The latesttransaction has seen FarstadMarine AS, a wholly ownedsubsidiary of Solstad, sell the FarSpirit PSV to undisclosed buyers.Far Spirit (c/o D. Debnam)AXXIS GEO SELLS NAIADOcean bottom node seismiccompany Axxis Geo Solutionshas completed the sale of itsseismic survey vessel NeptuneNaiad. Axxis had entered intoa Memorandum of Agreementwith Sanco Holding in May forthe sale of the 65m vessel alongwith certain equipment. AxxisGeo has also confirmed that ithas now repaid the remainingprinciple and accrued interestfrom its loan with EksportkredittNorge.WESTERN TRIDENT TO BE RECYCLEDAs seismic companies continueto right-size their fleets in anattempt to secure financial andoperational stability, ShearwaterGeoServices has recently soldthe Western Trident seismicvessel for recycling. The 1999-Western Trident (c/o P. Lenderink)The Far Spirit is a VS 470 MkIIvessel that was delivered in2007. She has been out of worksince concluding her most recentfixture in Southeast Asia back inthe first quarter of 2016. Solstadis looking to offload a total of 37non-strategic vessels this year.built unit has been delivered toa shipbreaking facility in Turkeyfor recycling in line with EUlaws and the 2009 Hong KongInternational Convention for theSafe and Environmentally SoundRecycling of Ships.FOUR GRANDWELD CREWBOATS FOR HSMGrandweld Shipyards in theUAE has delivered four newcrew boats to Saudi-based ownerHigh Seas Marine IndustrialServices Co (HSM). The fourunits have been delivered withina period of 14 months despite thechallenges posed by Covid-19.HSM will be utilising the vesselsto provide fast crew transferservices to Saudi Aramco. Theyare heavier vessels with a deeperdraft than standard crew boatsin the region.RECENT DELIVERIES OF NEWBUILD OSVSNAMETYPE/DESIGNOWNER/ MANAGERCOMMITMENTISLAND DISCOVERERUT 717 CDX PSVISLAND OFFSHORENORTH SEA SPOTSAYAN PRINCEMOSS 919 AHTSSEVNORARCTIC RUSSIA10 SEABREEZE

SUBSEASUBSEA MARKET ROUND-UPBrazil has been a focal point forconversation for a while nowwith an anticipated increasein activity levels, particularlydeep water, prompting manycompanies to vye for a piece ofthe action.In June, TechnipFMC securedits first integrated engineering,procurement, construction andinstallation (iEPCI) contract inBrazil with Karoon Energy. Thecontract includes engineering,procurement, construction andinstallation of subsea trees,flexible pipes and umbilicals atthe Patola field. Patola is situatedin water depths of 300m andwill be tied back to the existingBaúna floating production,storage and offloading (FPSO)vessel Cidade de Itajaí.Delivery and installation isscheduled to take place duringthe second quarter of 2022, withfirst oil anticipated for the firstquarter of 2023.At the end of June, Petrobras alsoawarded TechnipFMC a subseacontract covering the Búzios6-9 fields. The contract will seeTechnipFMC supply subseatrees with controls, electrical& hydraulic distribution unitsand topside systems, as well asinstallation and interventionsupport services with rentaltooling. Delivery is expected tobegin in the first quarter of 2023.Also in June, Equinor and itspartners ExxonMobil, Petrogaland Pré-sal Petróleo SA (PPSA)made a final investment decisionSIA SECURES MAJOR CONTRACT FOR BACALHAUFollowing on from the BacalhauFID, the Subsea IntegrationAlliance, a partnership betweenSubsea 7 and OneSubsea, hasbeen awarded a major contractwith Equinor for the BacalhauPhase 1 project offshore Brazil.The work scope will incorporatethe engineering, procurement,construction and installation(EPCI) of the subsea pipelines(SURF) and production systems(SPS). The first phase of thedevelopment will consistof 140km of rigid risers andflowlines, 40km of umbilicals,for Phase 1 of the Bacalhaufield in the Brazilian pre-saltSantos area. The USD 8 billioninvestment makes Bacalhau thefirst green field development byan international operator in thepre-salt area.The project has a breakevenprice below USD 35 per barreland first oil is planned for 2024.However, due to the Covid-19pandemic and associateduncertainties, project plansmay be adjusted in response tohealth and safety restrictions.The development will consistof 19 subsea wells tied back tothe FPSO, which will be one ofthe largest in Brazil with a totalproduction capacity of 220,000barrels per day with two millionbarrels in storage capacity.19 subsea trees, and associatedsubsea equipment to be installedin water depths of 2,050m.Offshore activities for theproject will take place from2022 to 2023, utilising Subsea7’s reel-lay, flex-lay and lightconstruction vessels.SIEM AWARDED CABLE LAY CONTRACTSiem Offshore has secured acontract for its 2013-built OCVSiem Day to undertake cable layactivities offshore Norway.The name of the client has notyet been revealed but the vesselwill carry out cable lay activitiesfor a period potentially reaching150 days in 2022. This will bethe first campaign Siem hascarried out for the undisclosedclient. The Siem Day was builtto the STX OSCV 11L designwith a length of 120m, a 250tsubsea crane and a quarterscapacity for 110 persons.Siem Day (pictured c/o J. Bartels)SEABREEZE 11

SUBSEALIMBAYONG EPCI AWARDED TO TECHNIPFMCPrior to securing its Búziossubsea contract with Petrobraslast month, Technip FMC hadalready secured a new EPCIcontract with Petronas relatingto the subsea equipment forthe operator’s Limbayong deepwater development offshoreMalaysia.TechnipFMC’s subsidiary FMCWellhead Equipment will beresponsible for the provision ofthe subsea production system,umbilical, riser and flowline(SURF) scope for the Limbayongproject.The field consists of 10 deepwater wells which will be tiedback to the project’s FPSO whilethe subsea system is made up ofMAERSK SUPPLY WINS BIG IN BRAZILWhile TechnipFMC and theSubsea Integration Alliance havebeen picking up contracts inBrazil, Maersk Supply Servicehas also been getting in on theact. The Libra Consortium hasselected Maersk to perform thepre-lay of the mooring systemfor the newbuild FPSO Sepetiba.The award includes engineering,procurement, construction andinstallation (EPCI) work at theMero 2 project with operationsto be carried out during 2021and 2022. The scope of workfor the campaign will includethe pre-lay of twenty-four 23mtorpedo anchors, each weighing120 tonnes, in water depths of2,000m offshore Rio de Janeiro.Maersk will be responsible forall activities from engineering,procurement and offshoreexecution.The FPSO Sepetiba, currentlyunder construction, will becapable of producing 180,000bbl of oil and 12 MMcm/d ofMCDERMOTT AWARDED SHENZI PROJECTBHP has awarded McDermottthe installation contract forits Shenzi subsea multiphasepumping project in the US Gulfof Mexico. The work scopecovers project management,detailed design and fabricationfor a pump station suctionpile, umbilical installation andflexible jumpers and flying leadsinstallation, transport of allmaterials and equipment, andpre-commissioning servicesand other necessary testing andsurveys.12 SEABREEZEMcDermott will utilise its2009-built flexlay vessel NorthOcean 102 to transport andinstall all of the materials andequipment.The project is scheduled forcompletion during the summerof 2022.The North Ocean 102 has alength of 133.6m and she isequipped with a vertical laysystem, a 4,000 tonne carousel, a300 tonne single tensioner and a250 tonne main crane.BHP, the operator of the Shenziumbilicals, risers and flowlines.The Limbayong campaign isexpected to pave the way for thedevelopment of the surroundingprospects within 18-30km of theproject’s vicinity.gas, and will be connected to 16wells. It will also have a waterinjection capacity of 250,000 b/dand a minimum storage capacityof 1.4 MMbbl of crude oil. Firstoil is targeted for 2023.The Libra consortium includesPetrobras (40% and operator),Shell (20%), TotalEnergies (20%),CNODC (10%) and CNOOC(10%).field, entered into a deal withHess late last year to boost itsShenzi interest. Following thecompletion of that agreement inNovember 2020, BHP’s stake inthe field was increased from 44%to 72%.

SUBSEABEACON LIGHTS UP HELIXBeacon Offshore has awardedHelix Robotics Solutions a120-day plus options contractfor the Volstad Maritime-ownedST259 CD-designed OCV GrandCanyon II.The DP3 vessel has a length of127.75m and she is equippedwith a 250 tonne subsea craneand accommodation for 104person. She commenced thecampaign in late June.The work scope covers wellseverance and decommissioningwork in the Gulf of Thailand.The Grand Canyon II’s longterm charter agreement withHelix has been extended through2021 with an option to renewthe contract through 2022.FLOATEL ENDURANCE TO REMAIN AT MARTIN LINGEEquinor has been grantedconsent from the NorwegianPetroleum Safety Authorityfor the extended use of FloatelInternational’s 2015-builtaccommodation unit FloatelEndurance at Martin Linge.The consent is an extension tothe existing contract which wasHELIX CHARTERS SIEM DORADOReturning to South America,Helix has agreed to charter SiemOffshore’s 2009-built IMR vesselSiem Dorado for a cable laycontract offshore Guyana. Helixwill charter the MT 6017 MkIIvessel for a firm period of 55days plus options, in addition tomobilisation and demobilisationperiods. The work scope willconsist of fibre optic cable lay,support and hook-up.The 93.6m diesel electric vesselis equipped with a 100 tonneheave compensated offshorecrane, accommodation for 68persons and 1,046m² of deckspace.due to expire at the end of Junefor the 440-bed accommodationunit. Equinor now has approvalto use the unit at the field until2nd October 2021. The FloatelEndurance has been workingfor Equinor at the Martin Lingefield since November 2019 whenshe replaced Floatel Superior.It is worth noting that last yearlocal media in Guyana reportedthat ExxonMobil, the operatorof the prolific Stabroek offshoreblock, was moving forward withplans to build its own fibre-opticline to assist its offshore andonshore operations in Guyana.NEW CONTRACT AND UPGRADE FOR NORMAND OCEANAfter securing a new long-termcontract with DeepOcean toutilise the MT6022 IMR vesselNormand Ocean, Solstad willupgrade the vessel with a 1MWhbattery system and shore powerconnection to reduce overallemissions in line with bothSolstad and DeepOcean’s goals.The upgrade will allow the107.6m vessel to operate withthe same efficiency but with lessemissions.The 2014-built vessel, which isequipped with a 150 tonne craneand accommodation for 110persons, has been on charter toDeepOcean since her deliveryin 2014. The contract renewalwill keep her occupied untilthe end of 2023, with optionsavailable to extend the contractfor a further year. The NormandOcean will continue to supportDeepOcean’s IMR and lightconstruction projects in theNorth Sea.SEABREEZE 13

RENEWABLESOFFSHORE WIND HEADING TO THE U.S. GULF OF MEXICO?The U.S. Department of theInterior is assessing potentialopportunities to advance winddevelopment on the Gulf ofMexico Outer Continental Shelf.The discussion will focus on theWestern and Central PlanningAreas offshore the states ofLouisiana, Texas, Mississippi,and Alabama. It will also look atBP ADDS TO CONSORTIUMBP is joining the recentlyestablished consortium betweenStatkraft and Aker OffshoreWind, which is preparing a bidto build a wind farm offshoreNorway. The consortium willpropose to develop a windproject in the Sørlige NordsjøII area, with a plan to explorefurther opportunities to poweroffshore oil and gas facilitieswith clean electricity. Statkraftand Aker Offshore Wind enteredinto a cooperation for thedevelopment of a fixed-bottomoffshore wind project in Norwayat the beginning of this year,after the Norwegian governmentopened two areas for offshorewind in 2020.The two areas, with a totalpotential capacity of 4.5 GW, areUtsira Nord and Sørlige NordsjøII. According to the government,ESVAGT ALBA DELIVEREDEsvagt has accepted delivery ofits newbuild Havyard 831L SOVEsvagt Alba from the HavyardLeirvik shipyard in Norway.This is the second of three sistervessels ordered in September2018. The 70.5m vessels areequipped with an SMSTwalk-to-work gangway andaccommodation for 60 persons.The Esvagt Alba is contractedto MHI Vestas for 15 years andwill operate at Moray Offshore’s950MW Moray East offshorewind farm which is currentlyunder construction off the coastof Scotland.The first Havyard 831L SOV, theEsvagt Schelde, was delivered inDecember 2020 and is workingWIND OF HOPE ENTERS SERVICEThe Cemre Shipyard in Turkeyhas delivered the newbuild SOVWind of Hope to Louis DreyfusArmateurs. The vessel is nowbeing mobilised to the UK tocommence her maiden charterwith Ørsted at the Hornsea Twooffshore wind farm. The 83mvessel features carbon saving14 SEABREEZEtechnology. She has a hybridpropulsion system that usesvariable speed diesel generatorsets linked with ABB’s OnBoardDC GridTM switchboards withthe support of batteries.The Wind of Hope is alsoequipped with a TTS Horizongangway system, a TTS Colibriother renewable technologies.The move is part of the Bidenadministration’s goal to deploy30 GW of offshore wind by2030.Utsira Nord is best suited forfloating wind technology, whileSørlige Nordsjø II will hostfixed-bottom offshore windfarms. For the latter, which isthe area BP, Statkraft and AkerOffshore Wind are set to bid for,the award announcement is duein the first quarter of 2022. Thegovernment expects that theSørlige Nordsjø II wind farmswill be built without state aid.for Vestas at the Borssele 3 & 4and Northwester 2 wind farms.crane and an accommodationcapacity for 90 persons. Thisis the second SOV in the LouisDreyfus fleet. Sister vessel Windof Change was delivered inMay 2019 and is fully booked byØrsted at the Borkum Riffgrund1 & 2 and Gode Wind 1 and 2offshore wind farms.

RIGSOIL PRICE VS CONTRACTED RIG UTILISATION100% 73.1790% 61.9680% 54.55 49.8770% 39.9360%54.3% 42.81 44.2651.6% 50.7%50%40%30% 65.19 64.77 68.0438.0%36.1%38.8% 41.09 40.4754.3% 43.2361.7%51.1% 50.0%49.2% 48.3% 49.4% 49.4%40.7% 40.8% 39.3% 40.8%54.7%57.3%43.2%36.2% 37.0%33.3% 34.1%37.2%Jun 20 Jul 20 Aug 20 Sep 20 Oct 20 Nov 20 Dec 20 Jan 21 Feb 21 Mar 21 Apr 21 May 21 Jun 21Average Brent Crude US / BblNorthwest Europe Rig UtilisationINACTIVE RIGS NORTHWEST EUROPE 75 70 65 60 55 50 45 40 35 30 25 20 15 10 5 0US Gulf Rig UtilisationNEW NORWAY GIGS FOR TRANSOCEANTransocean has secured twonew fixtures in Norway, addingUSD 116 million to its contractbacklog. The Transocean Norgewas awarded a four

Seabrokers Chartering AS and Seabrokers Ltd are certified by DNV GL in line with Management System Standard ISO 9001:2015. OUR OFFICES: STAVANGERBERGENSKIEN ABERDEEN RIO DE JANEIRO www.seabrokers-group.com 3 OSV MARKET ROUND-UP 6 OSV AVAILABILITY, RATES & UTILISATION - NORTH SEA 7 MONTHLY OSV SPOT RATES - NORTH SEA 8 FEATURE VESSEL