Transcription

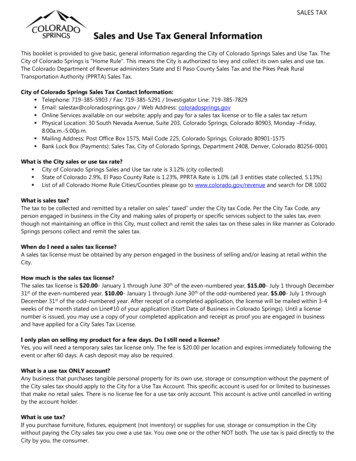

ColoradoConsumer UseTax Guide

Colorado Consumer Use TaxColorado use tax is a complement to Colorado sales taxand is imposed for the privilege of storing, using, orconsuming tangible personal property in Colorado.Taxable uses of tangible personal property include, butare not limited to, the keeping or retention of it, anyexercise of dominion or control over it, and the wasteor destruction of it.This publication is designed to provide generalguidance regarding Colorado use tax requirementsprescribed by law. Nothing in this publication modifiesor is intended to modify the requirements of Colorado’sstatutes and regulations. Taxpayers are encouraged toconsult their tax advisors for guidance regardingspecific situations.In general, whenever a purchaser acquires tangiblepersonal property without paying sales tax at the timeof the sale, they must pay consumer use tax directly tothe Department. If an item is exempt from sales tax, itis generally exempt from use tax as well.Table of ContentsPart 1: Liability for Consumer Use Tax . . . . . . . . . 2Part 2: Taxable Property . . . . . . . . . . . . . . . . . 4The Colorado use tax rate is 2.9%, the same as the salestax rate in Colorado, and use tax is calculated in thesame manner as sales tax. If the item was purchasedoutside of Colorado, any sales tax the purchaser paid atthe time of purchase is allowed as a credit against theColorado use tax due.Part 3: Calculating Consumer Use Tax . . . . . . . . . 7Part 4: Filing, Remittance & Recordkeeping . . . . . 9Part 5: Refunds and Assessments . . . . . . . . . . . . 12The filing and remittance requirements for Colorado usetax depend on multiple factors. Individuals maygenerally remit use tax annually with their Coloradoincome tax return, but businesses generally must remituse tax as it is accrued, with the Consumer Use TaxReturn. Any Colorado use tax due for a motor vehiclemust be remitted to the county clerk at the time ofregistration.The Colorado Department of Revenue administers usetaxes for both the State of Colorado and certain specialdistricts within the state, including the RegionalTransportation District (RTD), the Scientific and CulturalFacilities District (CD), and certain RegionalTransportation Authorities (RTA). However, theDepartment does not administer any city or county usetaxes. The information in this publication applies tostate and state-administered special district use taxes,but generally does not apply to city and county usetaxes, including any use taxes imposed and collected byany home-rule cities. Please see the information aboutmotor vehicles and construction and building materialsin Part 4 of this publication and contact the city orcounty directly for information about their use tax.1Revised June 2021

Part 1: Liability for Consumer Use TaxIn general, anyone who stores, uses, or consumestangible personal property in Colorado is subject toconsumer use tax, although Colorado law authorizescertain exemptions from the tax. Furthermore, directpay permit holders are generally required to remitsales tax, rather than use tax, to the Department forall of their purchases. This Part 1 discusses individuals,entities, and organizations that are subject to orexempt from consumer use tax.Certain governmental entitiesA use tax exemption is allowed for the storage, use, orconsumption of tangible personal property by certaingovernmental entities, in their governmental capacitiesonly. The exemption is allowed to: the United States government; the Colorado government and its institutions; and any city, county, and other local government inColorado.Taxpayers who owe consumer use taxIn general, every individual, corporation, limitedliability company, partnershipy, firm, joint venture,association, estate, trust, and receiver in Colorado issubject to consumer use tax, regardless of whetherthey conduct any business in the state.The exemption also applies to any property loaned toany of the governmental entities listed above. Pleasesee Sales & Use Tax Topics: Governmental Entities foradditional information.Charitable organizationsExempt entities and organizationsA use tax exemption is allowed for the storage, use, orconsumption of tangible personal property by certaincharitable organizations, in the conduct of their regularcharitable functions and activities. In general, theexemption is allowed to any organization meeting therequirement of section 501(c)(3) of the InternalRevenue Code. Please see Department publicationSales & Use Tax Topics: Charitable Organizations foradditional information about qualifying criteria forcharitable organizations.Certain entities and organizations are exempt fromboth sales and use taxes. Exempt organizations andentities include: certain governmental entities; charitable organizations; and affordable housing projects.The exemption also applies to any property loaned toany qualifying charitable organization.Additionally, construction and building materials usedin building, erection, alteration, or repair of structures,highways, roads, streets, and other public works ownedand used by governmental entities or charitableorganizations may qualify for exemption. Please seeDepartment publication FYI Sales 6: Contractors andRetailer-Contractors for additional information.Affordable housing projectsIn general, an exemption from consumer use tax appliesto tangible personal property purchased for theconstruction of any affordable housing projects directlyor indirectly owned by, leased to, or under constructionby a housing authority created pursuant to section 29-4201, et seq., C.R.S. Please see Department publicationFYI Sales 95: Sales/Use Tax Exemption for AffordableHousing Projects for additional information.2Revised June 2021

Part 1: Liability for Consumer Use TaxDirect pay permit holdersAdditional resourcesIn general, direct pay permit holders must remit salestax to the Department, rather than consumer use tax,for all taxable purchases they make in Colorado.However, a direct pay permit holder is required toremit consumer use tax to the Department in thefollowing situations:The following is a list of statutes, regulations, forms,and guidance pertaining to Colorado use tax andexemptions. This list is not, and is not intended to be,an exhaustive list of authorities that govern the taxtreatment of every situation. Individuals and businesseswith specific questions should consult their tax advisors.1) The direct pay permit holder purchased and tookpossession of taxable property outside of Coloradobefore bringing the property into Colorado.Statutes and regulations § 39-26-103.5, C.R.S. Qualified purchaser – directpay permit number – qualifications.2) The direct pay permit holder made a tax-exemptwholesale purchase of an item, ingredient, orcomponent part for resale, but later removed suchitem, ingredient, or component part frominventory for their own use. § 39-26-201, C.R.S. Definitions. § 39-26-202, C.R.S. Authorization of tax. § 39-26-204, C.R.S. Periodic return.See Department publication FYI Sales 78: Direct PayPermit for Colorado Sales Tax for additionalinformation about direct pay permit holders. § 39-26-704, C.R.S. Miscellaneous sales taxexemptions – governmental entities. § 39-26-713, C.R.S. Tangible personal property. Rule 39-26-202. Imposition of use tax. Rule 39-26-704-2. Sales Tax Exemption for HousingAuthorities.Forms and guidance Tax.Colorado.gov Tax.Colorado.gov/consumer-use-tax FYI Sales 6: Contractors and Retailer-Contractors FYI Sales 78: Direct Pay Permit for Colorado Sales Tax FYI Sales 95: Sales/Use Tax Exemption forAffordable Housing Projects Sales & Use Tax Topics: Charitable Organizations Sales & Use Tax Topics: Governmental Entities3Revised June 2021

Part 2: Taxable PropertyProperty subject to use tax generally includes alltangible personal property, except if a specificexemption is authorized by law. Consumer use tax isdue if any taxpayer stores, uses, or consumes inColorado any taxable property without having paid allapplicable sales and/or use taxes at the time ofacquisition. This occurs most commonly when apurchase is from an out-of-state seller who does notcollect Colorado sales tax.Non-taxable propertyUse tax does not apply to either real property orintangible personal property. However, prior to theirincorporation into real property, construction andbuilding materials are tangible personal property thatare subject to sales and use taxes.Real propertyThis Part 2 provides information about tangiblepersonal property that is subject to use tax anddiscusses the kind of transactions in which a seller maynot have collected sales tax.Real property, such as land and buildings, is not subjectto use tax. Real property includes any tangible personalproperty that lost its identity as tangible personalproperty when it was installed and became an integraland inseparable part of real property and that isremovable only with substantial damage to the realproperty. If some part of real property is severed andremoved, it once again becomes tangible personalproperty that is subject to sales and use taxes.Tangible personal propertyTangible personal property that is subject to use taxincludes all goods, wares, merchandise, products, andcommodities, and all tangible or corporeal things andsubstances that are dealt in and capable of beingpossessed and exchanged. However, Colorado lawexempts several types of tangible personal propertyfrom use tax. Additional information regardingexemptions can be found at the end of this Part 2.Intangible personal propertyIntangible personal property, which constitutes mererights of action with no intrinsic value, is not subject touse tax. Examples of intangible personal propertyinclude the following:Colorado has specific rules regarding the taxability ofcomputer software. If a particular purchase ofcomputer software is exempt from sales tax, thatcomputer software will generally be exempt from usetax as well. See Department publication Sales & UseTax Topics: Computer Software for additionalinformation. contracts, deeds, mortgages, stocks, bonds, or certificates of deposit.4Revised June 2021

Part 2: Taxable PropertySales made without tax collectionPurchases made outside of ColoradoIn general, any retailer who sells tangible personalproperty in Colorado is required to collect theapplicable state and state-administered local salestaxes at the time of the sale. However, the consumermust pay use tax directly to the Department if theseller did not collect the applicable tax for any reason.Some of the more common reasons that a seller mightnot have collected the applicable sales tax arediscussed in the following sections.If a person, business, or other legal entity purchasestaxable property outside of Colorado and brings thatproperty into Colorado for use in this state, theproperty will be subject to consumer use tax. However,if the purchaser paid sales tax to the other state at thetime of purchase, the purchaser will be allowed acredit toward the use tax due in the amount of thesales tax paid. Please see Part 3 of this publication foradditional information about the credit allowed forsales taxes paid to another state.Purchases made over the internetSales between private partiesTangible personal property purchased over the internetand delivered into Colorado is not exempt from taxationsimply because it was purchased online. However, if theseller does not have a store, warehouse, or otherphysical location in Colorado and makes only minimalsales into Colorado, the seller might not be required tocollect the applicable sales tax at the time of thepurchase. If a person, business, or other legal entitypurchases tangible personal property online for use inColorado, and pays no sales or use tax to the seller atthe time of purchase, that purchaser will owe use tax onthe purchased property.If tangible personal property is purchased from aprivate party who does not have a sales tax license andtherefore does not collect sales tax, the purchasermust pay the applicable consumer use tax directly tothe Department.Items removed from inventoryA wholesaler or retailer may purchase tangible personalproperty, including ingredients and component parts,for resale without paying sales tax at the time ofpurchase. However, if the wholesaler or retailerwithdraws an item purchased tax-free from inventoryfor the retailer’s own use, the retailer will owe use taxon that item. Use tax applies regardless of whether thewholesaler or retailer uses the withdrawn item for itscustomary purpose, for testing, for quality control, forresearch and development purposes, or for any otherpurpose.An out-of-state retailer who sells taxable property intoColorado, but does not collect Colorado tax, must: present the purchaser with a notice at the time ofthe sale advising them of their obligation to payconsumer use tax directly to the Department; send the purchaser an annual summary in Januarylisting the purchases they made during the prioryear; and report to the Department the total dollar amount ofthe purchases each purchaser in Colorado made.The annual summary will assist purchasers in reportingand paying consumer use tax. Please see Part 4 of thispublication for information about reporting and payingconsumer use tax.5Revised June 2021

Part 2: Taxable PropertyUse tax exemptionsAdditional resourcesColorado law exempts several types of property fromuse tax. Some of the more common types of exemptproperty are:The following is a list of statutes, regulations, forms,and guidance pertaining to Colorado use tax andexemptions. This list is not, and is not intended to be,an exhaustive list of authorities that govern the taxtreatment of every situation. Individuals and businesseswith specific questions should consult their tax advisors. property for which the purchaser paid the applicableColorado sales tax at the time of purchase; property for which the purchaser paid, at the timeof purchase, sales tax to another state in anamount equal to or greater than the use tax due;Statutes and regulations § 39-21-112, C.R.S. Duties and powers of executivedirector. food for domestic home consumption (seeDepartment publication FYI Sales 4: Taxable andTax-Exempt Sales of Food and Related Items); § 39-26-102, C.R.S. Definitions. § 39-26-201, C.R.S. Definitions. certain machinery and machine tools used inmanufacturing (see Department publication Sales& Use Tax Topics: Manufacturing); § 39-26-202, C.R.S. Authorization of tax. § 39-26-204, C.R.S. Periodic return. property purchased and held for resale in theregular course of business, either in its originalform or as an ingredient or a constituent part of amanufactured product; § 39-26-707, C.R.S. Food, meals, beverages, andpackaging. § 39-26-709, C.R.S. Machinery and machine tools. § 39-26-713, C.R.S. Tangible personal property. property held by a nonresident and brought intoColorado either temporarily or when thenonresident acquires residency in Colorado; Rule 39-21-112(3.5). Notice of reportingrequirements for non-collecting retailers. property purchased for 100 or less by Coloradoresidents while outside of Colorado. Rule 39-26-102(15). Tangible personal property. Rule 39-26-713-3.Please see Part 7 of Article 26 of Title 39 of theColorado Revised Statutes for information about othertypes of property that are exempt from use tax.Forms and guidance Tax.Colorado.gov Tax.Colorado.gov/consumer-use-tax FYI Sales 4: Taxable and Tax-Exempt Sales of Foodand Related Items Sales & Use Tax Topics: Computer Software Sales & Use Tax Topics: Manufacturing6Revised June 2021

Part 3: Calculating Consumer Use TaxColorado use tax is calculated at the same 2.9% rate asthe state sales tax. Some cities, counties, and specialdistricts in Colorado also impose a use tax. Please seeDepartment publication DR 1002, Colorado Sales/UseTax Rates for information about local use tax rates andapplicability in Colorado. Additional information aboutthe remittance of local use taxes can be found in Part 4of this publication.Exchanged propertyUnder certain conditions, the fair market value oftangible personal property exchanged by the purchaseras part of a sale is excluded from the taxable purchaseprice. The fair market value of the tangible personalproperty exchanged by the purchaser is excluded fromthe taxable purchase price, if either:This Part 3 provides information about the calculationof Colorado use tax. such exchanged property is to be sold thereafter inthe usual course of the retailer's business; or such exchanged property is a vehicle and isexchanged for another vehicle and both vehiclesare subject to licensing, registration, orcertification in Colorado, including, but notlimited to, vehicles operated upon craft, and aircraft.Purchase priceIn general, Colorado use tax is calculated on the fullpurchase price of the taxable item. The taxablepurchase price includes the full amount paid, orpromised to be paid, by the buyer at the time ofpurchase of the property, excluding only any directfederal tax and any state and local sales tax imposedon the sale. The taxable purchase price includes thegross value of all material, labor, and service, and theprofit thereon included in the price charged to the useror consumer.If the purchaser transfers intangible property or performsservices in exchange for tangible personal property, thefair market value of the intangible property or service isnot excluded from the purchase price.Gifted propertyCouponsIn the case of a bona fide gift of tangible personalproperty, the recipient of the gift owes no use tax on theitems since they did not purchase the item at retail.Instead, the giver must pay sales tax when purchasing theitem or, if no sales tax was collected by the seller at thetime of the sale, the giver must pay use tax based on thepurchase price of the item.Whether a coupon reduces the taxable purchase pricefor use tax purposes depends on whether the coupon isa manufacturer's coupon or a store coupon.In the case of a manufacturer's coupon, themanufacturer compensates the retailer for reducingthe price the purchaser pays. Because the retailer isreimbursed by the manufacturer for the amount of thereduction, use tax applies to the full selling pricebefore the deduction for the manufacturer's coupon.A store coupon is issued by the retailer for a reductionin the sales price when the coupon is presented to theretailer by the customer. Because there is noreimbursement to the retailer for such reduction, thetaxable purchase price is the reduced price that thepurchaser pays.7Revised June 2021

Part 3: Calculating Consumer Use TaxAssociated service chargesAdditional resourcesWith certain exceptions discussed below, the taxablepurchase price includes any service charges associatedwith the sale of tangible personal property, such ascharges for installation or delivery. Associated servicecharges are included in the taxable purchase price unlessboth the service is separable from the sale of the propertyand the service charge is separately stated from the priceof the property sold on the invoice or receipt.The following is a list of statutes, regulations, forms,and guidance pertaining to the calculation of Coloradouse tax. This list is not, and is not intended to be, anexhaustive list of authorities that govern the taxtreatment of every situation. Individuals and businesseswith specific questions should consult their tax advisors.Statutes and regulationsAn associated service is separable from the sale of theproperty if the service is performed after the taxableproperty is offered for sale and the purchaser has theoption not to purchase the associated service. Forexample, if delivery is optional and the purchaser mayelect to pick up the property at the seller’s store,without paying the delivery charge, the delivery chargeis separable. § 24-60-1301, C.R.S. Execution of compact. § 39-26-102, C.R.S. Definitions. § 39-26-201, C.R.S. Definitions. § 39-26-202, C.R.S. Authorization of tax. § 39-26-713, C.R.S. Tangible personal property.An associated service charge is separately stated if itappears as a distinct line item on a written salescontract, retailer’s invoice, or other written documentissued in connection with the sale, apart from the priceof the property sold. However, the statement of acharge as a separate line item does not necessarilyindicate that the charge is also separable. Rule 39-26-102(7)(a). Rule 39-26-102(10). Rule 39-26-102(12). Rule 39-26-104-3. Exchanged tangible personalproperty.A service charge that is overstated or intended to shiftcost and avoid the proper taxation of the property soldis not excluded from the purchase price, even if theservice charge is both separable and separately stated. Rule 39-26-713-4. Special Rule 11. Coupons. Special Rule 18. Transportation charges.Credit for tax paid to another state Special Rule 21. Gifts, premiums, and prizes.A purchaser liable for a use tax on tangible personalproperty is allowed a credit for any legally imposed sales oruse taxes the purchaser paid in another state for the sameproperty. Credit is not allowed if the tax paid to the otherstate was not legally due under the laws of that state.Forms and guidance Tax.Colorado.gov Tax.Colorado.gov/consumer-use-taxCredit may be claimed on the Consumer Use Tax Return(DR 0252). The credit must be first applied against anyColorado use tax due, and any unused portion of thecredit is then applied against any local use taxes due. Colorado Sales/Use Tax Rates (DR 1002) Consumer Use Tax Return (DR 0252)8Revised June 2021

Part 4: Filing, Remittance & RecordkeepingWhile a purchaser typically will pay sales tax to theseller at the time of the sale, if the seller does notcollect sales tax, the purchaser generally must remitthe applicable use tax directly to the Department. Thetime and manner for filing and remitting Colorado usetax differ for individuals and businesses. Additionally,special rules apply to the imposition of local use taxeson motor vehicles and construction and buildingmaterials. This Part 4 provides information regardingfiling and payment requirements for Colorado use tax.Businesses and other legal entitiesBusiness and other legal entities that owe use tax mustreport and pay the applicable tax with a Consumer UseTax Return (DR 0252) and, if applicable, the RTAConsumer Use Tax Return (DR 0251), both of which canbe filed electronically at Colorado.Gov/RevenueOnline.The due date for businesses and other legal entities thatowe consumer use tax depends upon the amount of usetax owed. If the business or other legal entity accruesless than 300 of total consumer use tax over the courseof the year, the business or other legal entity must filean annual use tax return by January 20th of the followingyear, to report and pay the tax due. If the cumulativeuse tax due at the end of any month is in excess of 300,the business or legal entity must file a return by the 20thday of the following month.IndividualsIndividuals can report and pay consumer use tax in oneof two ways, both of which can be filed electronicallyat Colorado.Gov/RevenueOnline: with the Consumer Use Tax Reporting Schedule(DR 104US) as an attachment to their ColoradoIndividual Income Tax Return (DR 104); orConstruction and building materials with the Consumer Use Tax Return (DR 0252) and,if applicable, the RTA Consumer Use Tax Return(DR 0251).Construction and building materials are exempt from salestaxes imposed by any county, statutory city, or home-rulecity if the purchaser of such materials presents to theseller a building permit or similar documentation showingthat local use tax has been paid or is required to be paid.The exemption from city and county sales tax applieseven if the materials are purchased outside of the city orcounty in which the materials will be used. The applicablelocal use taxes must be paid to the appropriate localgovernmental agency.The schedule or return must include use tax for anytangible personal property the individual stored, used,or consumed during the preceding taxable year and forwhich sales or use tax was not previously paid.Consumer use tax for individuals is due April 15th. If the15th falls on a Saturday, Sunday, or legal holiday, thereturn and tax remittance is due the next business day.Building permits do not affect the collection andpayment of state and state-administered specialdistrict sales taxes on construction and buildingmaterials. In general, the seller must collect theapplicable state and state-administered special districtsales taxes on any sale of construction and buildingmaterials in Colorado. If, for any reason, the applicablestate and state-administered special district sales taxeswere not collected at the time of the sale, thepurchaser must remit the applicable state and specialdistrict use taxes to the Department with a ConsumerUse Tax Return (DR 0252).9Revised June 2021

Part 4: Filing, Remittance & RecordkeepingMotor vehiclesPenalties and interestIn most cases, a motor vehicle dealer will collect allapplicable state and state-administered local sales taxesat the time of the sale. At the time of titling andregistration, the county clerk must verify that allapplicable state and local sales and use taxes have beenpaid. The county clerk must collect any remaining taxesdue prior to titling and registering the vehicle.If anyone who owes consumer use tax does not file andpay the tax by the applicable due date, penalty andinterest will be due. Penalty is imposed at a rate of 10%of the unpaid tax, plus an additional 0.5% for eachmonth the tax remains unpaid, not to exceed a total of18%. Any underpayment of consumer use tax is alsosubject to the assessment of penalty interest in anamount equal to the interest due, as described below.Additional penalties may be imposed for negligence orfraud.In general, state and state-administered sales taxesapply whenever the purchaser takes possession of thevehicle in the same taxing jurisdiction as the vehiclewill be registered. If the applicable sales taxes are notcollected at the time of the sale because, for example,the vehicle is purchased from a private party who doesnot have a sales tax license, the county clerk mustcollect the applicable sales taxes.Interest accrues on any late payment of tax from theoriginal due date of the tax to the date the tax is paid.The rate of interest accrual depends on the calendaryear(s) over which the deficiency continues.Additionally, a discounted rate is allowed if:If the purchaser takes possession of the vehicle outsideof the taxing jurisdiction in which it will be registered,the purchaser may owe use tax, rather than sales tax,for that jurisdiction. In order to facilitate titling andregistration, motor vehicle dealers may collectapplicable local use taxes and remit them to the countyclerk with Department form DR 0024, Standard SalesTax Receipt for Vehicle Sales. If the seller has notcollected and remitted to the county clerk allapplicable use taxes, the county clerk must collect anyunpaid use taxes prior to titling and registering thevehicle. the taxpayer pays the tax in full prior to theissuance of a notice of deficiency; the taxpayer pays the tax in full within 30 days ofthe issuance of a notice of deficiency; or within 30 days of the issuance of a notice ofdeficiency, the taxpayer enters into an agreementto pay the tax in monthly installments.The discounted and non-discounted, regular interestrates for recent years are listed in the following table.Annual Interest RatesPlease see Department publication Sales & Use TaxTopics: Motor Vehicles for additional informationregarding the application of state and local sales anduse taxes to motor vehicles.Calendar yearDiscounted rateRegular sed June 2021

Part 4: Filing, Remittance & RecordkeepingFailure to fileAdditional resourcesIf anyone neglects or refuses to file any required returnor to remit any tax due, the Department will estimatethe tax due based upon the best available informationand issue a notice of deficiency based upon thisestimate. When such estimate and notice of deficiencyhave been made, the taxpayer may prepare and file areturn for the tax period in question or otherwiseprotest the notice of deficiency as provided by law.The following is a list of statutes, regulations, forms,and guidance pertaining to filing, remittance, andrecordkeeping requirements for Colorado’s consumeruse tax. This list is not, and is not intended to be, anexhaustive list of authorities that govern the taxtreatment of every situation. Individuals and businesseswith specific questions should consult their taxadvisors.Statutes and regulationsRecordkeeping requirements § 29-2-105, C.R.S. Contents of sales tax ordinances.Every taxpayer that is subject to Colorado consumeruse tax must keep and preserve such books, accounts,and records as may be necessary to determine thecorrect amount of tax. Such books, accounts, andrecords must be kept and preserved for a period ofthree years following the due date of the return, thefiling of the return, or the payment of the tax,whichever occurs later. All such books, accounts, andrecords shall be open for examination by theDepartment at any time. § 29-2-109, C.R.S. Contents of use tax ordinances. § 39-21-109, C.R.S. Interest on underpayment. § 39-21-119, C.R.S. Filing with executive director. § 39-26-104, C.R.S. Property and services taxed. § 39-26-113, C.R.S. Collection of sales tax – motorvehicles. § 39-26-115, C.R.S. Deficiency due to negligence. § 39-26-204, C.R.S. Periodic return. § 39-26-208, C.R.S. Collection of use tax – motorvehicles.Forms and guidance Tax.Colorado.gov Tax.Colorado.gov/consumer-use-tax Colorado.Gov/RevenueOnline Consumer Use Tax Reporting Schedule (DR 104US) Consumer Use Tax Return (DR 0252)11Revised June

the Department. Part 1: If an item is exempt from sales tax, it is generally exempt from use tax as well. The Colorado use tax rate is 2.9%, the same as the sales tax rate in Colorado, and use tax is calculated in the same manner as sales tax. If the item was purchased outside of Colorado, any sales tax the purchaser paid at