Transcription

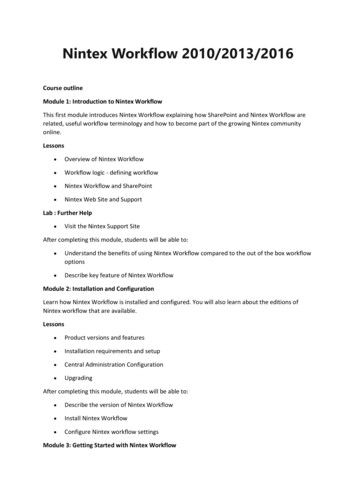

Accounting Department Workflow

Binders Needed Invoices/Purchase Orders/Order Forms (copies of forms)Sales Journal/Accounts Receivable Record (Excel spreadsheets)Purchases (copies of forms)Purchases Journal/Accounts Payable Record (Excel spreadsheets)Cash Receipts and Payments Journal (Excel spreadsheets)Inventory Log (Excel spreadsheets)Tax Forms (copies of forms prepared in Excel)Payroll (Excel spreadsheets)Bank Statements (copies of bank statements)

Recording a SaleYou receive a PURCHASE ORDER or anORDER FORM (through your website, mail,or fax).Staple the PURCHASE ORDER/ORDER FORMand INVOICE together and file in a binder innumerical order by Invoice.Send the Invoice to the customer.Order INVENTORY when needed.A Sales Associate creates an INVOICE.Order information is entered into the SALESJOURNAL/ACCOUNTS RECEIVABLE RECORDand the INVENTORY RECORDS.

Making a PurchaseYou receive an invoice from the company.Your company prepares a PURCHASE ORDER andsends it to another company (vendor). Keep afile copy in the PURCHASES binder.Enter the information in the PURCHASESJOURNAL/ACCOUNTS PAYABLE RECORDThe invoice is forwarded to the BankManager.If the purchase is for inventory, update theINVENTORY RECORDS.The Bank Manager pays the bill, marks itpaid, and files it.

Recording Cash Receipts And PaymentsEach week the Bank Managerprints out a copy of the currentbank transactions.If one of the invoices that you sent outhas been paid, retrieve the invoice fromthe binder, mark it paid, and file it.Update the SALES JOURNAL/ ACCOUNTSRECEIVABLE RECORD to reflect thepayment.The Accounting Department recordsALL transactions in the CASH RECEIPTSand PAYMENTS JOURNAL in theappropriate places (as payments orreceipts of cash and an explanation).When you pay invoices from vendors thatyour firm has purchased from, update thePURCHASES JOURNAL/ACCOUNTSPAYABLE RECORD.

PayrollThe Payroll Manager completesthe PAYROLL REGISTER for thepay period. The original is filedin a binder and a copy is givento the Bank Manager.The Payroll Associate createsand distributes pay stubs.By the 15th of the month, the PayrollManager prepares the 941 TaxWithholding form for the prior month’spayroll. The data is submitted to the VEC.The form is filed with the payroll records.The Bank Manager pays eachemployee.Note: Payroll is completed twice a month.By the 15th of the month, the BankManager pays the payroll taxes that havebeen reported on the 941 Tax withholdingform. The payment is recorded in theCASH RECEIPTS AND PAYMENTSJOURNAL.

Summary Sales Journal/Accounts Receivable, Purchases Journal/Accounts Payable,and Inventory Records are updated as needed. Payroll is completed twice a month. Bank Statements should be printed out at least once a week. Cash Receipts and Payments Journal should be updated each time a bankstatement is printed. Tax Forms should be completed according to the calendar.–––––941 – monthlySales tax – quarterlyW2 and W3 – yearly1040 individual tax return – yearly1120 Corporate tax return – yearly

Recording a Sale You receive a PURCHASE ORDER or an ORDER FORM (through your website, mail, or fax). Order information is entered into the SALES JOURNAL/ACCOUNTS RECEIVABLE RECORD and the INVENTORY RECORDS. A Sales Associate creates an INVOICE. Staple the PURCHASE ORDER/ORDER FORM and INVOICE together and file in a binderin numerical order by Invoice.