Transcription

COST ACCOUNTINGSTUDY TEXT

iiCOST ACCOUNTINGCopy r i ghtALL RIGHTS RESERVED.No part of this publication may be reproduced, stored in a retrieval system or transmitted in any form or by anymeans, electronic, mechanical, photocopying, recording or otherwise without the prior written permission ofthe copyright owner. This publication may not be lent, resold, hired or otherwise disposed of in anyway of tradeS T U D YT E X Twithout the prior written consent of the copyright owner.ISBN NO: 9966-760-18-0 2009 STRATHMORE UNIVERSITY PRESSFirst Published 2009STRATHMORE UNIVERSITY PRESSP.O. Box 59857, 00200,Nairobi, Kenya.Tel: 254 (0) 20 606155Fax: 254 (0) 20 607498Design Concept & Layout - Simplicity Ltd - P.O Box 22586-00400 Nairobi. Email: info@simplicityltd.com

ACKNOWLEDGMENTiiiS T U D YWe gratefully acknowledge permission to quote from the past examination papers of KenyaAccountants and Secretaries National Examination Board (KASNEB).T E X TAcknowledgment

S T U D YT E X TivCOST ACCOUNTING

vTable of ContentsAcknowledgment.iiiTable of Contents.vCHAPTER ONE.1NATURE AND PURPOSE OF COST ACCOUNTING.3CHAPTER TWO.21COST CLASSIFICATION.23CHAPTER THREE.41COST ESTIMATION.43CHAPTER FOUR.65MATERIAL COSTS.67CHAPTER SIX.129OVERHEAD COSTS.131CHAPTER SEVEN.165COST BOOK KEEPING.167CHAPTER EIGHT.193MARGINAL AND ABSORPTION COSTING.195CHAPTER NINE.253COSTING SYSTEMS.255CHAPTER TEN.315BUDGETING AND BUDGETARY CONTROL.317CHAPTER ELEVEN.355STANDARD COSTING.357CHAPTER TWELVE.373VARIANCE ANALYSIS.375CHAPTER THIRTEEN.411COST MANAGEMENT.413ANSWERS TO EXAM & REVIEW QUESTIONS.433REFERENCES.483GLOSSARY.487INDEX.495S T U D YLABOUR COSTS.103T E X TCHAPTER FIVE.101

S T U D YT E X TviCOST ACCOUNTING

1STS TT SUU TDDUYYD YT EE TXX ETTX TCHAPTER ONENATURE AND PURPOSE OFCOST ACCOUNTING

S T U D YT E X T2COST ACCOUNTING

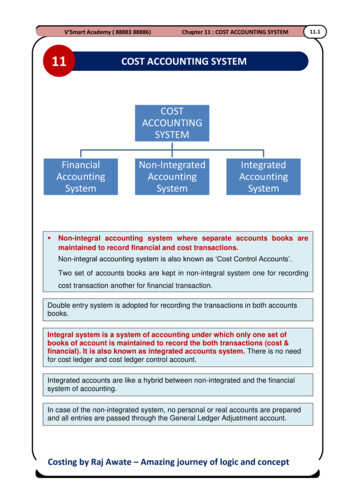

3CHAPTER ONENATURE AND PURPOSE OF COST ACCOUNTINGOBJECTIVES Define cost accountingDistinguish between cost accounting and other accounting subjects such as financialaccounting and management accounting based on various aspectsDefine the various cost accounting terminologiesExplain the role of a cost accounting department in an organizationExplain the design and operation of a Cost and Management Accounting systemExplain the relationship between nature of business enterprise and cost accountingDistinguish between qualitative and quantitative informationExplain the features of an effective cost center frameworkINTRODUCTIONThe purpose of this chapter is to introduce the basic concepts of cost accounting, terminologiesand distinguish cost accounting from financial accounting. It is aimed at making it clear on whatcost accounting is all about and introduce some of the terminologies used in the chapters thatfollow.First, we will discuss the nature of cost accounting and budgeting and then introduce the key costaccounting terminologies, which will act as the base for other discussions.DEFINITION OF KEY TERMSCost: Cost is simply a quantification or measurement of the economic sacrifice made to achievea given objective. It is, therefore, a measurement of the amount of resources sacrificed in attaininga specified goalCost object or cost unit: This is an activity for which a separate measure of cost is desired.Cost Accountant: He/she is a member of the accounting department responsible for collectingproduct costs and preparing accurate and timely reports to evaluate and control companyoperations.S T U D Y T E X TAfter studying this chapter, you should be able to:

4COST ACCOUNTINGCost Analysis: This is an activity that uses engineering, time and motion studies, timekeeper’srecords and planning schedules from production supervisors.Cost center: This may be defined as any point at which costs are gathered in order to controlcost, fix responsibility and enable costs to be recharged on an equitable basisEXAM CONTEXTYou must be prepared to answer questions touching on definition of cost accounting terminologiesand distinguish cost accounting from other disciplines of accounting such as management andtax accounting. Questions normally set from this section are theoretical and thus you need tounderstand the theory to be able to answer them well.The applicability of this topic comes in handy when holding discussions with other managers ina firm or during meetings. You need to understand the cost accounting terminologies and howit relates to other disciplines for effective relay of the messages intended for managers of otherfields.S T U D YT E X TINDUSTRY CONTEXTDEFINITION OF COST ACCOUNTINGIn general, cost accounting is a field of accounting that measures, records and reports informationabout costs. It involves the comprehensive set of principles, methods and techniques to determinean appropriate analysis of costs to suit the various parts of organizational structure within theenterprise.There is, however, no watertight definition for cost accounting. Various authorities and scholarshave gone ahead to give their definitions. Some of the definitions include:“That part of management accounting, which establishes budgets and standard costsand actual costs of operations, processes, departments or products and the analysisof variances, profitability or social use of funds.” (Chartered Institute of ManagementAccountants - CIMA).“That which identities, defines, measures, reports and analyzes the various elements ofdirect and indirect costs associated with producing and marketing goods and services.Cost accounting also measures performance, product quality and productivity.” (LetriciaGayle Rayburn).

NATURE AND PURPOSE OF COST ACCOUNTING5“A systematic process of collecting, summarizing and recording data regarding thevarious resources and activities in a firm so as to calculate the basis of production costsused in financial accounting or making other relevant decisions in a firm.” (Horngrenc.T)Cost accounting is broad and extends beyond calculating production costs for inventoryvaluation, which government-reporting requirements largely dictate. However, accountants donot allow external reporting requirements to determine how they measure and control internalorganization’s activities. In fact, the focus of cost accounting is shifting from inventory valuationfor financial reporting to costing for decision-making.The main objective of cost accounting is communicating financial information to management forplanning, evaluating and controlling performance, and to assist management to make decisionsthat are more informed. Its data are used by managers to guide their decisions.Cost planning and cost control of activities of operations since it aims at improvingefficiency by controlling and reducing costs§Resource allocation decisions, for instance, production, pricing and product costing§Performance measurement and evaluation of managerial performance; this is donethrough variance analysis, comparing actual output with the standard or budgetedoutput.§Formulation of overall strategies and long range plans; Cost accounting will be usefulin forecastingCost accounting aims at providing useful information to decision makers to enable them makebetter decisions. It helps them in preparing various statements such as cash budgets andperformance reports, cost data collection and application of costs to products and services.Cost Accounting Termsa)CostA cost is simply a quantification or measurement of the economic sacrifice made toachieve a given objective. It is, therefore, a measurement of the amount of resourcessacrificed in attaining a specified goal. For a product, cost represents the monetarymeasurement of resources used such as materials, labor and overheads. For a service,cost is the monetary sacrifice made to provide the service. Accountants generally usecost with other descriptive terms, for example, historical, product, prime, labour ormaterial. Each of these terms defines some characteristic of the cost measurementprocess or an aspect of the object being measured.S T U D Y§T E X TFrom the definitions above, we can generally say that cost accounting is concernedwith:

S T U D YT E X T6COST ACCOUNTINGb)Cost object or cost unitThis is an activity for which a separate measure of costs is desired. Examples includecost of providing a service to a client or cost of manufacturing a specific product orundertaking a specific assignment, and cost of running an organizational segment. Inother words, a cost object/cost unit is the quantitative unit of the product or service inrelation to which costs are ascertained. It is determined by the nature of the businessenterprise.c)Cost accountantHe/she is a member of the accounting department responsible for collecting productcosts and preparing accurate and timely reports to evaluate and control companyoperations. He/she assembles, classifies and summarizes financial and economic dataon the production and pricing of goods and services. Some of the roles that he plays inthe various aspects of the organization include:§Material cost control: this includes tracing materials issued to departments, reportingof the cost of material wasted (variance analysis) and provision of information aboutordering and holding costs of stocks.§Labour cost control: this includes time keeping and payroll operation, establishing ofstandard labour cost for various products, monitoring productivity of labour and analysisof hours worked§Overhead cost planning and control: understanding the cost behavior of cost items,identifying the expenditure on overheads by various departments and establishing theabsorption rate guides.§Operational efficiency: this includes ensuring that maximum output is achieved atminimum cost.d)Cost analysisThis is an activity that uses engineering, time and motion studies, timekeeper’srecords and planning schedules from production supervisors. Cost analysis techniquesinclude break-even analysis, comparative cost analysis, capital expenditure analysisand budgeting techniques. After determining what is actually happening, accountantsshould identify available alternatives. Professional judgment is then needed to applyand interpret the results of each costing technique.e)Cost benefit approachThis is the primary criterion for choosing among alternative accounting approaches. Ina company, there is a direct relationship between the amount of time and the funds thatmanagement is willing to spend on cost analysis and the degree of reliability desired.If a company wants detailed reco

1 STUDY TEXT CHAPTER ONE NATURE AND PURPOSE OF COST ACCOUNTING STUDY TEXTSTUDY TEXT. 2 COST ACCOUNTING STUDY TEXT. 3 STUDY TEXT CHAPTER ONE NATURE AND PURPOSE OF COST ACCOUNTING OBJECTIVES After studying this chapter, you should be able to: Define cost accounting Distinguish between cost accounting and other accounting subjects such as financial accounting and management accounting .