Transcription

ALLIED TECHNOLOGIES LIMITED3 Temasek Avenue, Level 34Centennial Tower, Singapore 039190E: AL REPORT 2019ALLIED TECHNOLOGIES LIMITEDCompany Registration No. 199004310EALLIED TECHNOLOGIES LIMITEDENHANCINGFUTUREDEVELOPMENTSANNUAL REPORT 2019

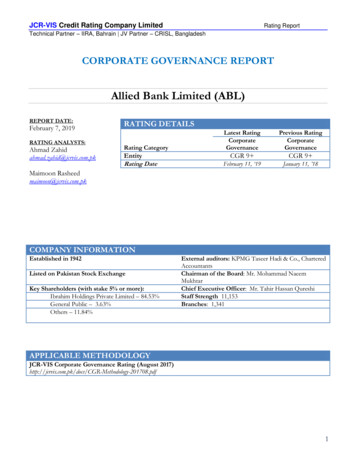

CORPORATEINFORMATIONBOARD OF DIRECTORSIndependent Non-Executive ChairmanMr Chin Chee ChoonExecutive DirectorsMr Leow Wee Kia ClementMr Low Si Ren, KennethIndependent DirectorsMr Lim Jin WeiMs Pok Mee YauAUDIT COMMITTEEChairmanMr Lim Jin WeiMembersMs Pok Mee YauMr Chin Chee ChoonSTNETfileNCO1 . CorporaltPerPesroence rsa0oldegion. Reareh.hS20oewter tRevi. Let rations.s30elight. Op ial High.50or sncrectFinai.Dfo06entardgem. Bo07 . ey Mana epor trtyR. Kepo09 . ainabilitce Rtnsauner. Sts11 . ate Govmen gsrotatepSrlolao din. Cnciareh31 .Finah.S.fo59sticsStati.166NOMINATING COMMITTEEChairmanMs Pok Mee YauMembersMr Lim Jin WeiMr Chin Chee ChoonREMUNERATION COMMITTEEChairmanMr Lim Jin WeiMembersMs Pok Mee YauMr Chin Chee ChoonREGISTERED OFFICE3 Temasek Avenue,Level 34, Centennial Tower,Singapore 039190Phone: 6549 7000AUDITORSErnst & Young LLPOne Raffles QuayLevel 18, North TowerSingapore 048583Partner-in-charge: Mr Philip Ng(Since Financial Year 2019)COMPANY SECRETARIESMr Ong Wei JinMr Chen JianHao KennedySHARE REGISTRARBoardroom Corporate & Advisory Services Pte. Ltd.50 Raffles Place,#32-01, Singapore Land Tower,Singapore 048623PRINCIPAL BANKERSAlliance BankCitibankCTBC BankDBS Bank LimitedOCBC BankMaybankStandard Chartered BankLEGAL COUNSELEversheds Harry Elias LLP4 Shenton Way,#17-01, SGX Centre 2Singapore 068807SPONSORStamford Corporate Services Pte. Ltd.10 Collyer Quay,#27-00 Ocean Financial Centre,Singapore 049315This annual report has been reviewed by the Company’s sponsor, Stamford Corporate Services Pte Ltd (the “Sponsor”). It has notbeen examined or approved by the Singapore Exchange Securities Trading Limited (the “SGX-ST”) and the SGX-ST assumes noresponsibility for the contents of this annual report, including the correctness of any of the statements or opinions made or reportscontained in this annual report.The contact person for the Sponsor is Mr. Bernard Lui, Telephone: 65 6389 3000, Email: bernard.lui@morganlewis.com.

ALLIED TECHNOLOGIES LIMITEDA N N U A L R E P O RT 2 0 1 9CORPORATEPROFILEListed on the Main Board of the Singapore Exchange in June 2003 and transferred to the Catalist Board in May 2017, Allied TechnologiesLimited (the “Company”), together with its subsidiaries (the “Group”), is a manufacturer of precision stamped metal parts and has, in2018, diversified into the e-commerce space.The Group commenced its metal stamping operations in May 1994 and provides vertically integrated precision manufacturing services,including design and product development, prototyping services, tool and die fabrication, mass production, plastic injection moulding andmechanical sub-assembly as well as box assembly services to a wide base of customers.Over the years, the Group’s, metal stamping business has expanded and marked its footprint in various countries such as China, Malaysia,Vietnam and Thailand as a metal stamped parts supplier to world renowned customers.The Group’s major customers include Konica Minolta, and Cal-comp Group, which have been its customers for over a decade, as wellas multi-national companies such as Flextronics Group, Samsung and the Hewlett Packard Group. The products manufactured by theGroup are used as components in various industries, including computer and computer peripherals, consumer electronics and homeappliances, office equipment, automotive, plastic and other industries.Following the streamlining and restructuring plan for its metal stamping business, which commenced in 2016 with the disposal of twosubsidiaries located in China, namely Shanghai and Taicang, Allied Technologies had, in 2017, liquidated its two dormant or inactivesubsidiaries located in Dongguan, China and Taiwan, and also disposed of its Suzhou and Shanghai subsidiaries. These exercises weredone with the view to improve the overall financial performance, increase cost efficiency and reduce potential business risk of theGroup. Since the completion of disposal of Suzhou and Shanghai subsidiaries, the Group has a total of four production facilities in SouthEast Asia, specifically in Malaysia (two facilities),Vietnam and Thailand, as well as a marketing office located in Suzhou, China, which wasincorporated in May 2018.In March 2018, the Group proposed and received shareholders’ approval to diversify into new business areas, mainly in e-commerce andrelated technologies such as e-payment systems and platforms. This move is aimed at achieving diversified returns for shareholders asthe Group seeks to build a new pillar of growth in the years ahead.The Group completed the acquisition of Asia Box Office Pte. Ltd., in April 2018, and Activpass Holdings Pte. Ltd., in July 2018, marking itsfirst move into the e-commerce, promotion of events and event ticketing industry.VISIONOur vision is to be the leading originaldesign manufacturer and provider of fullyintegrated manufacturing solutions in theelectronics and precision engineeringindustries, and the leading E-commerceplatform in the area of ticketing, classbooking, and events management andpromoting.MISSIONTo create long-term, sustainablegrowth for all stakeholders, and todeliver sustained and superior returnsto all shareholders.01

ALLIED TECHNOLOGIES LIMITED02A N N U A L R E P O RT 2 0 1 9REGIONALPRESENCESINGAPOREMALAYSIACHINAHONG KONGTHAILANDVIETNAMALLIED TECHNOLOGIESLIMITED

ALLIED TECHNOLOGIES LIMITEDA N N U A L R E P O RT 2 0 1 9LETTER TOSHAREHOLDERSNotwithstanding the challenging economic climate in FY2019,the Group’s Metal Stamping segment recorded an increase of9.9% in revenue from S 112.09 million for FY2018 toS 123.16 million for FY2019.Dear ShareholdersFY2019 was a difficult time for the Group as it was faced withnumerous challenges in its attempt to consolidate its newlyacquired businesses in the e-Commerce, promotion of eventsand event ticketing industry (the “Diversification”).As noted in our Annual Report 2018, as we were undergoingchanges and reorganising the Group, our auditors from Ernst &Young LLP (the “Auditor”) have raised certain queries in relationto the impairment assessment of goodwill relating to the Group’sacquisitions of (i) Asia Box Office Pte. Ltd. (“ABO”) and itssubsidiary, Asia Box Office (HK) Limited (“ABO HK”) (collectively“ABO Group”), and (ii) Activpass Holdings Pte. Ltd. (“Activpass”).They have also raised queries on certain transactions of the ABOGroup. In connection with the foregoing, Singapore ExchangeRegulation Pte. Ltd. (“SGX Regco”) had, on 8 May 2019, issued aNotice of Compliance (the “First Notice”) to the Group whichrequired, amongst others, the Group to conduct a special auditon the observations raised by the Auditors (the “Special Audit”).Further, the Company was also informed on 23 May 2019 thatit may have difficulty recovering the balance of the escrow funds(the “JLC Issue”) amounting to approximately S 33.15 million(the “Escrow Funds”) that it had placed with JLC Advisors LLP(“JLC”) in the period of October 2017 – April 2018. This is furtherelaborated in the “Financial Performance” section. We have beeninformed that the relevant authorities are conducting their owninvestigations as regards the JLC Issue. In the meantime, we haveappointed Rajah and Tann Singapore LLP as our legal counsel tohelp in the recovery of escrow funds placed with JLC. We havealso lodged a police report and issued a complaint letter to theLaw Society in relation to the JLC Issue. As at 24 February 2020,we note from the media reports that the Managing Director forJLC has since been charged with 12 different charges, 11 of whichinvolving alleged criminal breach of trust as an attorney in relationto the JLC issue. The whereabouts of the Escrow Funds remainunclear to the Company as at the date of this annual report.On 23 May 2019, SGX Regco issued a Notice of Complianceto the Group (the “Second Notice”) which required, amongstothers, the Group and the special auditor to look into thecircumstances pertaining to the JLC Issue. Further, pursuant to theFirst Notice, the Company is also required to place any cash andbank balances in excess of the Group’s operational requirementsinto an escrow account (the “Escrow Account”). The Companyhas since opened the Escrow Account with DBS Bank, and willkeep shareholders informed on any material updates. In viewof certain conflicts of interest and after consultation with theSGX Regco following the First Notice, the authorised signatoriesof this Escrow Account will be both ourselves, Mr. Chin CheeChoon, the Independent non-Executive Director and Chairman,and Mr. Clement Leow Wee Kia, Chief Executive Officer andExecutive Director.On 14 June 2019, Pricewaterhousecoopers Risk Services PteLtd was appointed as the Group’s special auditor (the “SpecialAuditor”) to conduct the Special Audit. Since then, the Grouphas been using its best endeavors to work with the SpecialAuditor and SGX Recgo to resolve the Special Audit, and toaddress any other concerns highlighted by the Group’s Auditor.In the meantime, the Group has also been extending its fullcooperation with the authorities in order to obtain a moreexpedient resolution of, among others, the JLC Issue, and torecover the Escrow Funds. The Group has also strengthened itscorporate governance and internal controls even as it is awaitingthe resolution of the Special Audit.In the meantime, the Group is doing its level best to controlcost, and to continue to seek new business opportunities forthe Group. We note that the worsening business environmentis further exacerbated by the recent COVID-19 issue that hasparticularly affected economics in Asia. For instance, on 16 March2020, the Federal Government of Malaysia announced that massmovements and gatherings across Malaysia, including religious,sports, social and cultural activities are prohibited (the “MCO”).In enforcing this prohibition, all houses of worship and businesspremises are required to be closed from 18 March 2020 to31 March 2020, except for supermarkets, public markets, grocerystores and convenience stores selling everyday necessities. On25 March 2020, the Federal Government of Malaysia furtherannounced that it would be extending the MCO by two (2)weeks till 14 April 2020 (the “Extended MCO”). In complyingwith the MCO and the Extended MCO, all operations in Malaccaand Johor Bahru from 18 March 2020 until 14 April 2020 wereclosed. During this period, the offices in both Malacca and JohorBahru remained contactable, and all business support functionswere supported by the Group’s offices in Singapore. Given the03

ALLIED TECHNOLOGIES LIMITED04A N N U A L R E P O RT 2 0 1 9LETTER TOSHAREHOLDERSfluid situation as regards COVID-19, the Company will makefurther announcements, where suitable, on the impact to theGroup’s operations in Malaysia, and when they would resumeoperations in due course. While the Group is still assessing theimpact caused by the COVID-19 issue given that the COVID-19issue is a relatively recent one, the Group Covid-19 pandemic andits effects on the global and domestic economy may potentiallyimpair the Group’s earnings capacity and ability to secure newsales for ongoing and new projects in the next 12 months. Inparticular, certain supplies for the Group’s metal stampingsegment comes from China while Malaysia is the site of two (2)of our production plants, and COVID-19 has had a wide impacton business sentiments throughout Asia.and Executive Director, and Mr Low Si Ren Kenneth remainedas Executive Director of the Company, while Mr Chin CheeChoon remained as an Independent Director/IndependentNon-Executive Chairman, a member of the Audit Committee,Nominating Committee and Remuneration Committee.In addition, going forward, we will also continue to look intoenhancing the operational efficiency of the Group to improvethe profitability of the existing and newly acquired businessesand continue to explore business opportunities to diversify theGroup’s business portfolio and improve its prospects.FUTURE OUTLOOK AND PROSPECTSFINANCIAL PERFORMANCEIn FY2019, the Group had shown slight decrease in its revenueas a result of lower revenue recorded from the e-commercesubsidiaries, which was offset by an increase from the precisionmetal stamping subsidiaries.The Group recorded revenue of S 123.35 million in FY2019,a decrease of 2% from S 125.92 million reported in FY2018.The largest revenue contributors of the Group were Vietnamsubsidiary followed by the Malaysian subsidiaries, representing57% and 35% of the Group revenue, respectively.Nevertheless, due to audit issues raised by our Auditor (formore information, please refer to the Company’s announcementdated 5 June 2019 titled “Response to SGX Queries” andannouncement dated 8 May 2019 titled “Grant of Extensionof Time to hold AGM and announce its financial results for 1Q2019”) and the difficulty in the recovery of the Escrow Funds ofsome 33.15 million, our Group accounts have been disclaimed.The Special Auditor was also appointed on 14 June 2019. Weexpect the Special Auditor to complete their work and issue itsreport sometime in 2020.SUSTAINABILITY REPORTIn affirmation of our commitment to sustainability, we are proudto present our second Sustainability Report this year. This reportdocuments our sustainability initiatives and achievements relatedto economic, environmental and social issues over the pastfinancial year.Looking ahead, the business environment in the current financialyear is expected to remain challenging for the Group in light ofthe weak global economic outlook, the COVID-19 issue, andthe JLC Issue. Besides streamlining its operations, the Groupwill be looking to explore other possible avenues for businessopportunities. With the economic uncertainties ahea

ALLIED TECHNOLOGIES LIMITED ANNUAL REPORT 2019 ALLIED TECHNOLOGIES LIMITED Company Registration No. 199004310E 3 Temasek Avenue, Level 34 Centennial Tower, Singapore 039190 E: sales@allied-tech.com.sg www.allied-tech.com.sg ALLIED TECHNOLOGIES LIMITED ANNUAL REPORT 2019 ENHANCING FUTURE DEVELOPMENTS