Transcription

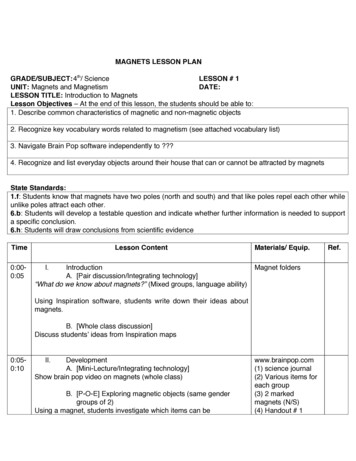

Lesson-13Elements of Cost and Cost SheetLearning Objectives To understand the elements of costTo classify overheads on different basesTo prepare a cost sheetElements of CostRaw materials are converted into finished products by a manufacturing concern with the helpof labor, plants etc. The elements that constitute the cost of manufacturing are known aselements of cost. The elements of cost include the following: MaterialLaborExpensesEach of these elements is again subdivided into direct and indirect material.Direct material, direct labor and direct expenses are those which can be traced in relationshipwith a particular process, job, operation or product. Indirect material, indirect labor andindirect expenses are those which are of general nature and cannot be traced in relationshipwith a particular process, operation, job or product.Direct materialDirect laborDirect expensestogether constitute prime costIndirect materialIndirect laborIndirect expensesof the factory together constitute factory (or works)Prime cost Factory (or works) overhead Factory cost or works costFactory cost Administration overhead Cost of productionCost of production Selling and distribution overhead Total cost or cost of salesWhile working out the cost of sales, following details are to be kept in mind:Opening stock of raw materialAdd: Purchasing of raw materialsLess: Return to suppliersLess: abnormal loss of materialsRs.************Rs.

Less: Closing stock of raw materialsRaw material consumedDirect wagesDirect expensesPrime costFactory overhead expensesAdd: Opening work in processLess: sales of scrapsLess: closing work in processFactory cost or works costOffice and administration overheadCost of productionAdd: Opening finished stockLess: closing finished stockCost of production of goods soldSelling overheadDistribution overheadTotal cost or cost of salesProfitSelling priceKey TermsDirect MaterialDirect material is the material which can be conveniently identified with or allocated to costcenters and cost units. It refers to the material out of which a product is manufactured. Forexample, leather shoes are produced out of leather, butter is produced out of milk, steelutensils are produced out of stainless steel and so on. Thus, leather, milk and stainless steelare the direct materials for the manufacture of shoes, butter and steel utensils respectively.Like direct material, another kind of material may be required for manufacturing but notdirectly. For example, machines used for production require lubricants, jute and cotton wastesetc. which are indirect materials.Direct material is a component of prime cost and indirect material is a component of factoryoverhead. Direct material directly varies with the output whereas indirect material does notso.Direct WagesDirect wages are the wages which can be conveniently identified with or allocated to costcenters and cost units. It refers to the wages paid to the workers who actually produce goods.In case of manual work, it is not difficult to locate direct worker because he is the one whoproduces goods. In case of the work done by a machine, the person who collects input and

output and in whose account the output is credited for the purpose of payment of wages isdirect worker.There are several other workers in a factory who help direct workers in connection with theirwork with regard to supply of materials, power etc. and in respect of supervision andmaintenance. These are indirect workers and wages of indirect workers at different stages ofproduction are indirect wages. Direct wage is a component of prime cost whereas indirectwage is a component of factory overhead. The former directly varies with the output whereasthe latter may not vary so.Direct ExpensesBesides direct material and direct layout, certain expenses may be wholly and exclusivelynecessary for a particular production. This expense is referred as direct expense and it can beeasily identified with or allocated to cost centers or cost units. For example, if an order isreceived, a manufacturer will have to prepare a mould exclusively for this purpose. The costof the mould may be regarded as direct expense of the production. Similarly, the charge forhiring a special plant for production is also direct expense and it can be easily identified withand allocated to cost centers or cost units. The cost of preparing blue print for a production isanother example of direct expense.OverheadOverhead is an indirect expense incurred at various levels of activities of an enterprise. Theseexpenses cannot be conveniently identified with or allocated to cost centers or cost units.According to functions, classification of overhead expenses may be done as follows:(i)Factory or Works OverheadFactory or works overhead refers to all indirect expenses of a factory. It includesthe following: (ii)Wages of all factory staff excluding those of direct workersIndirect materialRentRatesTaxes of factoryDepreciation of factory assetsExcise dutyCanteen expensesLabor welfare expensesAdministration OverheadIt refers to all the expenses incurred in connection with general administration. Inadministrative building, following things are included: Salary of administrative staffRent

RatesTaxes of administrative accommodationPostageTelegram and telephoneStationeryLighting of administrative buildingDepreciation of office appliancesDepreciation of office appliances etc. is included in administration overhead.(iii)Selling OverheadSelling overhead refers to all expenses incurred in connection with sales. Inselling overhead, following things are included: (iv)Salary of sales staffTraveler’s commissionAdvertisementRentRatesTaxes of sales officeDepreciation of sales office appliancesCost of participation in industrial fares and exhibitionsCost of free giftsCost of free after sales serviceNormal bad debtDistribution OverheadDistribution overhead refers to all the expenses incurred in connection with thedelivery of a product after the sale is affected. In distribution overhead, followingthings are included: Delivery van expensesFright and insurancePacking for delivery loading and unloadingSalary of the deliverymenCustoms dutyAccording to behavior, classification of overhead expenses may be done as follows:a. Variable OverheadThe overhead expenses that vary proportionately with the output are variableoverhead.b. Semi-Variable or Semi-Fixed Overhead

The overhead expenses that vary with the output but not proportionately are semivariable or semi-fixed overhead.It should be always kept in mind that in this connection direct materials, direct wages anddirect expenses are variable items of direct cost. Therefore, if we classify cost according tobehavior, we get the following classification:a. Fixed CostsFixed costs include only those overhead expenses which remain fixed irrespective ofthe level of output. Some of the items of fixed costs are as follows: Rent and rate of buildingSalary of work mangers, administrative manager, sales managersDepreciation of buildingsInsuranceb. Variable costsVariable costs include prime cost and variable overheads. These costs varyproportionately with the output. Some of the items of variable costs are as follows: Direct materialDirect wagesDirect expensesConsumable storesPowerFuelc. Semi-Variable CostsSemi-variable costs include overhead expenses that vary according to output but notproportionately, so these costs are partly fixed and partly variable. Some of the itemsof semi-variable costs are as follows: Normal repairs and maintenance of building and plantSalary of supervisorsCharge menForemenService department expensesDepreciation of plant and machineryConsider the element repairs. Normal repair is mostly fixed in nature because within acertain degree of capacity, utilization is beyond that degree. More frequent repairswill be necessary involving further cost. But still, such an increase in cost will not beproportionate to an increase in output. This is why the element is semi-fixed or semivariable.

It is important to know the behavior-wise classification of cost because the total of variablecosts per unit of output is known as marginal cost. Marginal cost represents the cost incurredin producing one extra unit. If one extra unit is to be produced, the fixed costs will notincrease. Only the variable costs will come into the picture.Summary1. The elements that constitute the cost of manufacturing are known as elements of cost.2. Direct material is the material which can be conveniently identified with or allocated tocost centers and cost units.3. Direct wages are the wages which can be conveniently identified with or allocated tocost centers and cost units4. Overhead is an indirect expense incurred at various levels of activities of an enterprise.These expenses cannot be conveniently identified with or allocated to cost centers orcost units.ExerciseProblem 1A manufacturer has shown an amount of Rs. 16190 in his books as “establishment” whichincludes the following expenses: Agents commission-- Rs. 5750Warehouse wages-- Rs. 1800Warehouse repairs-- Rs. 510Lighting of office-- Rs. 70Office salaries-- Rs. 1130Director’s remuneration-- Rs. 1400Traveling expenses-- Rs. 760Rent, rates and insurance of warehouse-- Rs. 310Rent, rates and insurance of office-- Rs. 230Lighting of warehouse-- Rs. 270Printing and stationery-- Rs. 1500Trade magazines-- Rs. 70Donations-- Rs. 150Bank charges-- Rs. 100Discount allowed-- Rs. 1970Bad debts-- Rs. 170From the above information, prepare a statement showing the following (in separate totals): Selling expensesDistribution expensesAdministration expensesExpenses which you will exclude form total costSolution

Statement of CostRs.Selling expenses:Agents’ commissionTraveling expensesBad debtsRs.5,7507601706,680Distribution expenses:Warehouse wagesWarehouse repairsRent, rates and insurance of warehouseLighting of warehouse1,800510310270Administration expenses:Lighting of officeOffice salariesDirectors’ remunerationRent, rates and insurance of officePrinting and stationeryTrade magazinesBank charges701,1301,4002301,50070100Total expenses to be considered in estimation costsExpenses to be excluded form costs:DonationsDiscount roblem 2ABC Ltd., a manufacturing company, incurred the following expenses during a certainperiod. You are required to prepare a statement showing the subdivision of total cost.Materials used on jobsWages traceable to jobsWages paid to men formaintenance workSalaries of sales menDirectors’ feesCarriage inwards on rawmaterialsCarriage outwardsFactory rent and ratesWorks salariesHire of crane for job no, 132Consumable 8,30020,4001,300Depreciation of plantDepreciation of delivery vansInsurance on finished goodsLubrication oilBad debtsCommission to salesmenCost of idle time in factoryAuditors feesDividends paidLighting of showroomOffice salaries and expensesIncome 7,0008,600

340SolutionStatement of CostRs.1,20,540860Direct materialsAdd: carriage inwardsDirect wagesDirect expenses (hire of crane for job no. 132)Prime costWorks overheadWages paid to men on maintenance workFactory rent and ratesWorks salariesConsumable storesDepreciation of plantLubricating oilCost of idle time in factoryWorks costAdministration overheadDirectory feesAuditors feesOffice salaries and expensesCost of productionSelling and distribution overheadSalaries of salesmenCarriage outwardsDepreciation of delivery vansInsurance of finished goodsCommission to sales menLighting of showroomBad ,8001,6002,5002,8501,500300Total cost20,8002,76,35026,6503,03,000Problem 4The following figures are taken from the books of a manufacturing company for the yearended on March 31, 1995. Prepare a cost sheet showing clearly the cost per unit under thevarious elements and also the profit or loss per unit.Direct materialsDirect laborDepreciation of factory buildingInsurance:Rs.Branch office expenses25,00,000Depreciation of office8,00,000building16,000Depreciation of staff carsRs.30,00010,000

Staff carsOffice buildingFactory buildingDelivery van-maintenance andrunning expensesSalaries (including that of SalesManager Rs. 20,000 and FactoryChief Engineer (Rs.25,000)Finished goods warehouse city (including Rs.5,000) for administrativeoffice)AdvertisementSundry factory expensesSales promotionOfficeadministrationexpensesExpenses for participatingin industrial exhibitionSales (10,000 units)Units 0008,00050,000SolutionOutput-- 10,000Cost SheetPeriod -- Year ended on March 31, 1995TotalRs.Direct materialsDirect laborPrime costWorks overheadDepreciation of factory buildingInsurance 0f factory buildingSalary of factory chief engineerElectricity (35,000-5,000)Sundry factory expensesWork costOffice and administration overheadDepreciation of office buildingDepreciation of staff carsInsurance of staff carsInsurance of office buildingSalaries (2,75,000-20,000-25,000)ElectricityOther office administration expensesCost of productionSelling and distribution overhead:Sales manager’s salaryAdvertisementSales 0041,16,50020,00018,0004,000Per unitRs250.0080.0032.35411.652.001.800.40

Expenses in industrial exhibitionBranch office expensesFinished goods warehouse expensesDelivery van-maintenance and 1.201,07,00042,23,5007,76,50050,00,000Cost of salesProfit (balancing figure)Sales10.70422.3577.65500.00Problem 5From the following figures, prepare separate statements of cost and profit for the month ofOctober 1995.stStock on 1 October, 95Raw materialsFinished goodsStock on 31st October, 95Raw materialsFinished goodsWork-in-progress:On 1st October, 95On 31st October, rchase of raw materialsSale of finished goodsDirect wagesFactory expensesOffice and administrationexpensesSelling and distributionexpensesSale of 002,600SolutionStatement of Cost of ProductionPeriod-- October 1995Rs.Rs.Materials consumedOpening stockPurchasesLess: Closing stockDirect wagesPrime costFactory ,0006,46,300

2,12,500(2,600)Less: Sale of scrapAdjustment for work-in- 42,200)Works costOffice and administration expensesCost of t of Profit or LossStock of finished goods on October 01, 1995Add: Cost of productionLess-- Stock of finished goods on October 31, 1995Cost of goods soldSelling and distribution expensesCost of salesProfit (balancing figure)SalesPeriod-- October 010,23,0003,17,00013,40,000Note-- Office and administration expenses may also be shown in the statement of profit orloss as illustrated in the next problem.Problem 6The Susan and company makes art prints. The following details are available for the yearended on June 30, 1995.Rs. (thousands)Opening stockDirect materialsWork-in-progressFinished goodsDirect materials purchasedDirect laborIndirect labor andsupervisionAdministrative expenses267412043612044160Selling expensesFactory power, heatand lightSundry factoryoverheadsFinancial chargesSalesClosing stock:Direct materialsRs. (thousands)14020121201,46042

Factory rent, rates andinsuranceDepreciation of factoryequipment94Work-in-progressFinished goods548070The company values work-in-progress at factory cost.You are required to prepare the following:a) A schedule of cost of goods manufactured for the year ended on 30th June, 95b) A profit statement for the year ended on 30th June, 95SolutionSchedule of Cost of Goods ManufacturedPeriod-- Year ended on June 30, 1995Rs.Rs.(Thousands)(Thousands)Direct materials consumedOpening stockPurchases26436462(42)Less: Closing stockDirect laborPrime costFactory overheadIndirect labor and supervisionRent, rates and insuranceDepreciation of equipmentPower, heat and lightSundry4494702012Adjustment for work-in-progress:OpeningClosingCost of goods manufactured74(54)42012054024078020800Profit StatementSalesLess: Cost of goods sold:Period-- Year ended on June 30, 1995Rs.Rs.(Thousands)(Thousands)1,460

Opening stock of finished goodsCost of goods manufacturedLess: Closing stock of finished goodsGross profitLess: Administrative expensesSelling expensesFinancial chargesNet m 7A company is manufacturing refrigerators and the following details are furnished in respectof its factory operations for the year ended on December 31, 1995:Work-in-progress on 1st January, 1995At prime costManufacturing , 31 December, 95At prime costManufacturing expenses45,0009,000Stock of raw materials on 1st January, 95Purchase of raw materialsDirect laborManufacturing expensesStock of raw materials on 31st 4,00On the basis of above data, prepare a statement showing the cost of production.SolutionSchedule of Cost of ProductionRs.Raw materials consumed:Opening stockPurchasesLess: Closing stockDirect 1,0006,69,000

Adjustment for work in progress:OpeningClosing51,000(45,000)Prime costManufacturing expensesAdjustment for work in 0-----------6,00090,0007,65,000Cost of productionProblem 8The accounts of the Steel Ways Engineering Co. Ltd for 1995 are as follows:Materials usedManual and machine labor wages directly chargeableWorks overhead expenditureEstablishment and general expensesRs.1,80,0001,60,00040,00019,000a. Show the works cost and total cost, the percentage that the works overhead cost bearsto the manual and machines labor wages and the percentage that the establishmentand general expenses bear to the works cost.b. What price should the company quote to manufacture a machine which is estimated torequire an expenditure of Rs. 8,000 on materials and Rs. 6,000 on wages so that it willyield a profit of 25% on the total cost or 20% on selling price.SolutionStatement of CostMaterials usedManual and machine labor wages (directly chargeable)Prime costWorks overhead expenditureWorks costEstablishment and general expensesTotal costPercentage of works overhead to manual and machine labor(40000/160000) x 100Percentage of establishment and general expenses to works cost(19000/380000) x 3,99,00025%5%

Statement of Estimated Cost for the Manufacture of the MachineEnquiry from 4Cost of materialsDirect wagesPrime costWorks overhead: 25% of wagesWorks costEstablishment and general expenses: 5% of works costTotal costProfit (20% on selling price or 25% on cost)Price to be quotedDate .Prepared by .Checked by .Problem 9From the following details, prepare a statement in the way which you consider most suitablefor showing clearly all elements of cost:Opening stock or raw materialsPurchase of raw materialsRaw materials returned to suppliersClosing stock of raw materialsWages paid to-Productive workersNon-productive workersSalaries paid to office staffCarriage on raw 2,0005,000Carriage on goods soldRent and rates of workshopFlues, gas, water etc.Repairs to plantDepreciation on machineryOffice expensesDirect chargeable expensesAdvertisingAbnormal loss of raw 0500SolutionStatement of CostRs.Materials consumed:Opening stockPurchasingCarriage on purchasesLess: ReturnsLess: abnormal 0Rs.

(18,800)Less: closing stock73,50018,00080092,300Productive wagesDirect chargeable expensesPrime cost2,0002,5001,0006001,400Works overhead:Non-productive wagesRent and rates of workshopFuel, gas, water etc.Repairs to plantDepreciation on machinery7,50099,800Works costOffice overhead:Salaries to office staffOffice expenses5,0001,500Cost of productionSelling and distribution overheadCarriages on goods 0Cost of salesProblem 10The following data relates to the manufacture of a standard product during the four weeksperiod to June 30, 1995:Rs. 4,000Rs.600100050 paise20% on works cost6paise per unit2000018000 @ Re. 1 per unitRaw materials consumedWagesMachine hours workedMachine hours rateOffice overheadSelling overheadUnits producedUnits soldYou are required to prepare a cost sheet showing the cost per units and profit for the period.SolutionOutput-- 20000 unitsCost SheetPeriod-- 4 weeks ended on June 30, 1995TotalPer unit

Raw materials consumedWagesPrime costWorks overhead (1000 hrs. @ Re. 0.50)Works costOffice overhead (20% on works cost)Cost of productionLess: Closing stock (2000 units @Re. 0.630)Cost of goods sold (18000 units)Selling overhead (Re. 0.06 per unit on 18000 units)Cost of salesProfit (balance 0Problem 11The following figures for the month of April 1995 were taken from the records of a factory:Opening stock of finished goods (5000 units)Purchase of raw materialsDirect wagesFactory overheadAdministration overheadSelling and distribution overheadClosing stock of finished goods (10000 units)Sales (45000 units)Rs.45,0002,57,1001,05,00010% of direct wagesRe. 1 per unit10% of sales103,420Rs. 6,60,000Prepare a cost sheet for the month of April 1995 assuming that the sales are made on the basisof first in first out principle.SolutionCost SheetOutput-- 50000 unitsRaw materialsDirect wagesPrime costFactory overhead: 100 % of direct wagesWorks costAdministrations overhead: Re. 1 per unitCost of productionAdd: opening stock of finished goodsPeriod-- April 1995TotalPer 245,000

5,62,100Less: closing stock of finished goods:10000 units @ Rs. 10.342Cost of goods sold (45000 units)Selling and distribution overhead @10% of salesCost of salesProfit (balancing 06,60,00010.1931.46711.6603.00714.6674Working Notes1. Production during the month (sales 45000 units closing stock 10000 units –opening stock 5000 units) 50000 units.2. Since goods have been sold on FIFO basis, the entire closing stock represents currentproduction @ Rs. 10.342 pr unit because sales include all opening stock and part ofcurrent production.3. Per unit cost of goods sold Rs. 10.193 has been obtained by dividing Rs. 4,58,680 by45000 sales units.4. Per unit Rs. 14.667 has been obtained by dividing Rs. 6,60,000 by 45,000 sales units.Problem 12From the following details related to production and sales for the year ended on December31, 1992, prepare a cost statement showing the following things: Prime costWorks costCost of productionCost of salesProfit or lossStock on 1.1.92:(a) Raw materials-(b) Work in progress-At prime costAdd manufacturing expensesRs.25,000Rs. 30,000Rs. 6,000------------(c) Finished goods (at cost)Raw materials purchasedFreight on raw materialMachines hours worked-- 48000 hoursChargeable expensesFactory wages for direct laborAdministration expensesSelling expensesDistribution expensesSales proceeds of finished goods (30000 00,00054,00036,0009,00,000

Stock as on December 31, 1992:(a) Raw materials(b) Work in progressAt prime costAdd: Manufacturing expenses45,000Rs. 45,000Rs. 9,000-------------54,000(c) Finished goods at cost (10000 units)Finished goods produced 32000 unitsApply FIFO principal in finished goods valuation.SolutionCost SheetOutput-- 32000 unitsPeriod--Year ended on December 31, 1992Rs.Raw materials consumed:Opening stockPurchaseFreight on purchasesLess: closing stock25,0002,00,00010,0002,35,000(45,000)Factory wagesChargeable expensesAdjustment for work in progress:OpeningClosing30,000(45,000)Prime costWorks overhead (48000 hrs. @Rs, 3.00 per hr.)Adjustment for work in progress:OpeningClosingWorks costAdministration expensesCost of production (32000 units @Rs. 23 per units)Add: opening stock of finished goods (8000 units)Less: closing stock of finished goods (10000 units)Cost of goods sold (30000 units)Selling expensesDistribution expensesCost of salesProfit (balancing ,00036,0007,80,0001,20,000

Sales9,00,000Working Notes1. Units of opening stock (sales 30000 units closing stock 10000 units – productionduring the year 32000 units) 8000 units2. Value of closing stock (applying FIFO basic):Rs.8000 units at least year’s rate1,44,0002000 units at current year rate of Rs. 23 per unit46,000---------1,90,000------------Problem 13A manufacturing company submits the following information on March 31, 1995:Rs.2,75,000Sales for yearInventories at the beginning of the year:MaterialsFinished goodsWork in progressRs.3,0007,0004,0001,10,00065,000Purchase of raw materials for the yearDirect laborInventories at the end of the year:MaterialsWork in progressFinished goods4,0006,0008,000Other expenses for the yearSelling expenses @10% of salesFactory overhead @ 60% of direct labor costAdministrative expenses @5% of salesPrepare a statement of costSolutionStatement of CostFor the year ended on March 31, 1995Rs.Rs.

Materials consumed:Opening inventoryPurchases3,0001,10,0001,13,0004,000Less: closing inventoryDirect laborPrime costFactory overheads: 60% of direct labor costAdjustment for work in processOpeningClosingCost of finished goods manufactured4,000(6,000)Add: opening inventory of finished goodsLess: closing inventory of finished goodsCost of goods soldAdministration expenses: 5 % of salesSelling expenses: 10% of 2,51,25023,7502,75,000Cost of salesProfit (balancing figure)SalesNoteSince administration expenses have been expressed as a percentage of sales, these have notbeen included in cost of goods manufactured.Problem 14The books of a manufacturing company present the following data for the month of April1992:Direct labor cost Rs. 17,500 being 175% of works overhead. Cost of goods sold excludingadministrative expenses Rs. 56000.Inventory account showed the following opening and closing balances:Raw materialsWork in progressFinished goodsApril 1Rs.8,00010,50017,600April 30Rs.10,60014,50019,000

Rs.3,5002,50075,000Other data are:Selling expensesGeneral and administration expensesSales for the monthYou are required to:(i)(ii)Compute the value of raw material purchased.Prepare a cost statement showing the various elements of cost and also the profitearned.Solution(i) Statement Computing the Value of Raw Materials PurchasedCost of goods soldAdd: closing stock of finished goodsLess: opening stock of finished goodsWorks cost of cost of productionAdd: closing stock of work in progressLess: opening stock of work in progressLess: works overhead (100/175 x direct labor, i.e. 100/175x17500)Prime costLess: direct laborRaw materials consumedAdd: closing stock of raw materialsLess: opening stock of raw materialsValues of raw material ,60044,500(8,000)36,500(ii) Cost StatementPeriod-- April 1992Rs.33,90017,50051,40010,00061,400Raw materials consumed [as in (i) above]Direct laborPrime laborWorks overheadAdjustment for work in progress:OpeningClosingWorks cost or cost of production10,500(14,500)------------(4,000)57,400

Add: opening stock of finished 00075,000Less: closing stock of finished goodsCost of goods soldGeneral and administration expensesSelling expensesProfit (balancing figures)SalesProblem 15Shrelekha Mfg. Co. manufactures two types of pens P and Q. The cost data for the year endedon June 30, 1995 is as follows:Direct materialsDirect wagesProduction ---------It is further ascertained that:(i) Direct materials of type P costs twice as much direct materials of type Q(ii) Direct wages for type Q were 60% of those for type P(iii) Productions overhead was of the same rate for both types(iv) Administration overhead for each was 200% of direct labor(v) Selling costs were 50 paise per pen for both types(vi) Production during the year:Type PType Q40000120000(vii) Sales during the year:Type PType Q36000100000(viii) Selling prices were Rs. 14 per pen for type P and Rs. 10 per pen for type Q.Prepare a statement showing per unit cost of production total cost, profit and also totalsales value and profit separately for the two types of pen P and Q.SolutionStatement of CostFor the year ended on June 30, 1995P 40000 unitsQ120000 units

Total Rs.Total Rs.Direct materials40000 x 2:120000 x 14,00,000Direct wages40000 x100-- 120000x602,24,000Prime cost6,24,000Production overhead40000: 12000096,000Works cost7,20,000Administration overhead 4,48,000Cost of production11,68,000Less: Closing stock offinished goods:(P-4000 x Rs.10.60, Q20000 x Rs.6.20)Cost of goods sold (P –1,66,40036000, Q-100000)Selling costs @50 p. per10,

Bank charges Total expenses to be considered in estimation costs Expenses to be excluded form costs: Donations Discount allowed Total Rs. 5,750 760 170 1,800 510 310 270 70 1,130 1,400 230 1,500 70 100 150 1,970 Rs. 6,680 2,890 4,500 1,4,070 2,120 1,6,190 Problem 2 ABC Ltd., a manufacturing company, incurred the following expenses during a certain