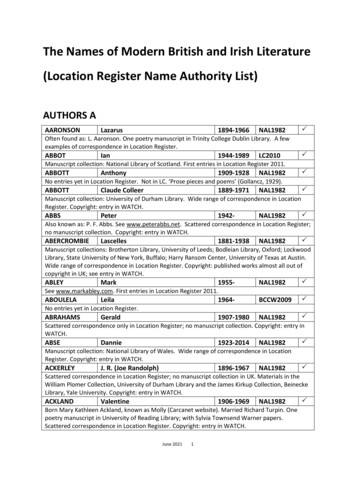

Transcription

ShareholdersReportFor the financial year ended 31 December 2017AIB Group plc

AIB is a financial services group operating predominantlyin the Republic of Ireland. We provide a comprehensiverange of services to retail, business and corporate customers,and hold market-leading positions in key segments in theRepublic of Ireland.AIB also operates in Great Britain, as Allied Irish Bank (GB),and in Northern Ireland, under the trading nameof First Trust Bank.Our purpose, as a financial institution, is to back ourcustomers to achieve their dreams and ambitions.ContentsFinancial highlightsForward-looking statementsConsolidated financial statementsAIB at a glanceChairman’s statementChief Executive’s reviewOur strategyStrategy in actionGovernance at a glanceBoard of DirectorsDirectors’ remunerationInterests in sharesGovernance in actionSustainable banking12368101416202224262730This Shareholders Report contains forward-looking statements with respect to certain of the Group’s plans and its currentgoals and expectations relating to its future financial condition, performance, results, strategic initiatives and objectives.See page 2.

FINANCIAL HIGHLIGHTSA strong performance in 2017Net interest margin 12.58%Cost income ratio 248%Profit before tax 1.3bnNew lending 3 9.4bnEarning loans 57.0bnImpaired loans 6.3bnCET1 fully 017Increased income contributed to lower cost incomeratio (CIR) of 48%. CIR excluding income from cured/restructured loans was 53%.Profit before tax is lower due to higher exceptional costs.Profit before tax and exceptional items increased to 1.6bn. 1.3bn 1.7bn2016 9.4bn20172016Continued positive net interest margin (NIM) growthfrom stable asset yield and reducing cost of funds.NIM excluding interest on cured loans was 2.50%.New lending increased by 13% with growth acrossall segments. 8.4bn2017 57.0bn2016 56.1bnGrowth of 1.6bn in earning loan book excludingFX impact, as a result of higher new lending and loansupgraded from impaired.2016 9.1bnContinued focus on reducing impaired loans throughsustainable restructuring solutions and disposal ofdistressed loan portfolios.201717.5%20172016 6.3bn15.3%Robust capital position with CET1 of 17.5%, after proposedordinary dividend of 326m, supporting future growth andcapacity for capital return.Net interest margin (NIM) including eligible liabilities guarantee (ELG) charge. ELG charge is no longer material and is no longer separately disclosed.Before bank levies, regulatory fees and exceptional items, cost income ratio (CIR) including these items was 61% in 2017 (2016: 54%).New lending for 2016 has been restated by 0.3bn to exclude all transaction based new lending.AIB Group plc Shareholders Report 20171

FORWARD-LOOKING STATEMENTSThis document contains certain forward-looking statements with respect to the financial condition, results of operations andbusiness of AIB Group and certain of the plans and objectives of the Group. These forward-looking statements can be identifiedby the fact that they do not relate only to historical or current facts. Forward-looking statements sometimes use words such as‘aim’, ‘anticipate’, ‘target’, ‘expect’, ‘estimate’, ‘intend’, ‘plan’, ‘goal’, ‘believe’, ‘may’, ‘could’, ‘will’, ‘seek’, ‘continue’, ‘should’, ‘assume’,or other words of similar meaning. Examples of forward-looking statements include, among others, statements regarding theGroup’s future financial position, capital structure, Government shareholding in the Group, income growth, loan losses, businessstrategy, projected costs, capital ratios, estimates of capital expenditures, and plans and objectives for future operations.Because such statements are inherently subject to risks and uncertainties, actual results may differ materially from thoseexpressed or implied by such forward-looking information. By their nature, forward-looking statements involve risk anduncertainty because they relate to events and depend on circumstances that will occur in the future. There are a number offactors that could cause actual results and developments to differ materially from those expressed or implied by these forwardlooking statements. These are set out in the Principal risks and uncertainties on pages 58 to 68 in the 2017 Annual FinancialReport. In addition to matters relating to the Group’s business, future performance will be impacted by Irish, UK and widerEuropean and global economic and financial market considerations. Any forward-looking statements made by or on behalf ofthe Group speak only as of the date they are made. The Group cautions that the list of important factors on pages 58 to 68 ofthe 2017 Annual Financial Report is not exhaustive. Investors and others should carefully consider the foregoing factors andother uncertainties and events when making an investment decision based on any forward-looking statement.2AIB Group plc Shareholders Report 2017

CONSOLIDATED FINANCIAL STATEMENTSConsolidated income statementfor the financial year ended 31 December 20172017 m2016* mContinuing operationsInterest and similar incomeInterest expense and similar charges2,481(305)2,611(598)Net interest incomeDividend incomeFee and commission incomeFee and commission expenseNet trading incomeProfit on disposal of loans and receivablesOther operating incomeOther )(1,571)Operating profit before provisionsWriteback of provisions for impairment on loans and receivablesWriteback of provisions for impairment on financial investments available for saleWriteback of provisions for liabilities and commitments1,166113–81,34829422Operating profitAssociated undertakings and joint ventureProfit on disposal of business1,28719–1,646351Profit before taxation from continuing operationsIncome tax charge from continuing operations1,306(192)1,682(326)Profit after taxation from continuing operationsattributable to owners of the parent1,1141,35639.7c48.6c39.7c47.9cTotal operating incomeAdministrative expensesImpairment and amortisation of intangible assetsImpairment and depreciation of property, plant and equipmentTotal operating expensesBasic earnings per shareContinuing operationsDiluted earnings per shareContinuing operations* As reported in the 2016 consolidated financial statements of Allied Irish Banks, p.l.c.AIB Group plc Shareholders Report 20173

CONSOLIDATED FINANCIAL STATEMENTS CONTINUEDConsolidated statement of comprehensive incomefor the financial year ended 31 December 20172017 mProfit for the yearOther comprehensive income – continuing operationsItems that will not be reclassified subsequently to profit or loss:Net change in property revaluation reservesNet actuarial gains in retirement benefit schemes, net of tax2016* m1,1141,356–24(1)10324102Items that will be reclassified subsequently to profit or losswhen specific conditions are met:Net change in foreign currency translation reservesNet change in cash flow hedges, net of taxNet change in fair value of available for sale securities, net of tax(53)(203)(132)(168)106(359)Total items that will be reclassified subsequently to profit or losswhen specific conditions are met(388)(421)Other comprehensive income for the year, net of tax from continuing operations(364)(319)Total items that will not be reclassified subsequently to profit or lossTotal comprehensive income for the year from continuing operationsattributable to owners of the parent* As reported in the 2016 consolidated financial statements of Allied Irish Banks, p.l.c.4AIB Group plc Shareholders Report 20177501,037

Consolidated statement of financial positionas at 31 December 20172017 m2016* mAssetsCash and balances at central banksItems in course of collectionDisposal groups and non-current assets held for saleTrading portfolio financial assetsDerivative financial instrumentsLoans and receivables to banksLoans and receivables to customersNAMA senior bondsFinancial investments available for saleFinancial investments held to maturityInterests in associated undertakingsIntangible assetsProperty, plant and equipmentOther assetsCurrent taxationDeferred tax assetsPrepayments and accrued incomeRetirement benefit 15,4373,35665392357248132,828444166Total assets90,06295,622LiabilitiesDeposits by central banks and banksCustomer accountsTrading portfolio financial liabilitiesDerivative financial instrumentsDebt securities in issueCurrent taxationDeferred tax liabilitiesRetirement benefit liabilitiesOther liabilitiesAccruals and deferred incomeProvisions for liabilities and commitmentsSubordinated liabilities and other capital 937,73263,502–1,6096,8801881158973484246791Total liabilities76,45082,474EquityShare capitalShare premiumReservesTotal shareholders’ equityOther equity 654494Total equityTotal liabilities and equity13,61213,14890,06295,622* As reported in the 2016 consolidated financial statements of Allied Irish Banks, p.l.c.Richard PymChairmanBernard ByrneChief Executive OfficerMark BourkeChief Financial OfficerSarah McLaughlinGroup Company Secretary28 February 2018AIB Group plc Shareholders Report 20175

AIB AT A GLANCECustomer-focused, strong capital baseand well-positioned for growthRetail & CommercialBanking (RCB)69%of net loansRCB is the leading provider of financial productsand services to personal and business customersin Ireland. Its key business lines include: mortgages,consumer lending, SME lending, asset-backedlending, wealth management, daily banking,and general insurance.2.4mLeading retail banking franchisein Ireland with 2.4 million personaland SME customerscustomers297Number one physical distributionnetwork in Ireland with 297 locationsand a further c. 1,100 locationsthrough An Post networklocations1.3mdigitalcustomersNumber one digital channeldistribution in Ireland with 1.3 millionactive digital customers; over 60% ofkey products sold via digital channel 4.6bnNew lending 41.4bnNet loans 1,199mOperatingcontribution1Wholesale, Institutional& Corporate Banking (WIB)WIB provides customer-focused solutionsin private and public markets to AIB’s largestcustomers and customers requiring specificsector or product expertise.relationshipdriven ll-established and diversifiedbusiness with market-leading positionin key sectorsPrimary focus on senior debtorigination through CorporateBanking, Real Estate Finance, Energy,Climate Action & InfrastructureComplementing traditional debtoffering through Specialised Finance,Syndicated & International Finance,and advisory services inCorporate Finance 3.2bnNew lending 10.3bnNet loans 225mOperatingcontribution1Market offeringMarket offeringLeading mortgage providerNumber one mortgage provider in a growing marketenabled via AIB’s multi-brand strategy, incl. EBS and Haven.Corporate BankingLeading domestic franchise and number one bank for foreigndirect investment (FDI).Business bankingSector-led strategy and local expertise delivering the leadingmarket share across key SME products, incl. current account,deposits and loans (Source: IPSOS January 2018).Real Estate FinanceMulti-disciplinary team with established market position.Personal bankingLeading provider of financial services to personal customersin the market, via digital innovation and relationshipmanagement expertise. Full suite of services, incl. dailybanking, consumer credit, wealth management, savingsand investments.Energy, Climate Action & InfrastructureA centre of excellence with particular focus on supportingIreland’s decarbonisation.Specialised FinanceServices such as mezzanine, equity and structured finance.Syndicated and International FinanceProven ability with strong track record and reputation.Corporate FinanceProviding advisory services and solutions.617%of net loansAIB Group plc Shareholders Report 2017

AIB UKAIB UK operates in two distinct markets, providingcorporate and commercial banking services inGreat Britain, trading as Allied Irish Bank (GB), andretail and business banking services in NorthernIreland, trading as First Trust Bank.322kGroup14%of net loansGroup comprises wholesale treasury activities,Group control and support functions.Over 322,000 retail, corporateand business customers across GreatBritain and Northern IrelandTreasurycustomers30locations119kA distribution network of 30 locationsthroughout the United Kingdom:Great Britain (15 business centres),and Northern Ireland (15 branches,including six co-locatedbusiness centres)control andsupportTreasury manages the Group’sliquidity and funding position andprovides customer treasury servicesand economic researchThe Group control and supportfunctions include business andcustomer services, marketing,risk, compliance, audit, finance,legal, human resources, andcorporate affairsOver 119,000 active digital customersdigitalcustomers 1.5bnNew lending 7.3bnNet loans 154mOperating contribution 1 by segmentOperatingcontribution1Market offeringAllied Irish Bank (GB)Niche commercial and corporate bank with locations in keycities across Great Britain. Banking services include: lending,treasury, trade facilities, asset finance, invoice discounting, andday-to-day transactional banking.AIB UK11%Wholesale,Institutional &Corporate Banking14%First Trust Bank (FTB)A long-established bank in Northern Ireland providing a fullbanking service, including mobile, online, post office andtraditional banking to business and personal customers.1.2.FY 2017 total:2 1.6bnRetail &CommercialBanking75%Pre-provision operating contribution.Excludes the Group segment.AIB Group plc Shareholders Report 20177

CHAIRMAN’S STATEMENT2017 was a significant year for AIBReflecting on a year in which the bank delivered an IPO, a new groupholding company and a strong financial p

We approved 14.4bn in new lending during 2017, with actual customer drawdowns at 9.4bn, up from 8.4bn in 2016. In Ireland, personal lending was up 16%, business lending was up 15%, corporate lending was up 15% and mortgages were up 17%. Our market share

![Shareholders’ Agreement of [Company name] company. 1 .](/img/1/startup-founders-sha-sample.jpg)