Transcription

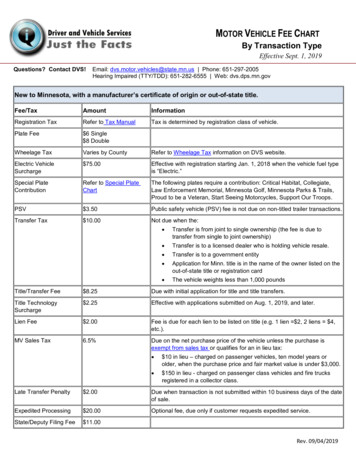

MOTOR VEHICLE FEE CHARTBy Transaction TypeEffective Sept. 1, 2019Questions? Contact DVS!Email: dvs.motor.vehicles@state.mn.us Phone: 651-297-2005Hearing Impaired (TTY/TDD): 651-282-6555 Web: dvs.dps.mn.govNew to Minnesota, with a manufacturer’s certificate of origin or out-of-state title.Fee/TaxAmountInformationRegistration TaxRefer to Tax ManualTax is determined by registration class of vehicle.Plate Fee 6 Single 8 DoubleWheelage TaxVaries by CountyRefer to Wheelage Tax information on DVS website.Electric VehicleSurcharge 75.00Effective with registration starting Jan. 1, 2018 when the vehicle fuel typeis “Electric.”Special PlateContributionRefer to Special PlateChartThe following plates require a contribution: Critical Habitat, Collegiate,Law Enforcement Memorial, Minnesota Golf, Minnesota Parks & Trails,Proud to be a Veteran, Start Seeing Motorcycles, Support Our Troops.PSV 3.50Public safety vehicle (PSV) fee is not due on non-titled trailer transactions.Transfer Tax 10.00Not due when the: Transfer is from joint to single ownership (the fee is due totransfer from single to joint ownership) Transfer is to a licensed dealer who is holding vehicle resale. Transfer is to a government entity Application for Minn. title is in the name of the owner listed on theout-of-state title or registration card The vehicle weights less than 1,000 poundsTitle/Transfer Fee 8.25Due with initial application for title and title transfers.Title TechnologySurcharge 2.25Effective with applications submitted on Aug. 1, 2019, and later.Lien Fee 2.00Fee is due for each lien to be listed on title (e.g. 1 lien 2, 2 liens 4,etc.).MV Sales Tax6.5%Due on the net purchase price of the vehicle unless the purchase isexempt from sales tax or qualifies for an in lieu tax: 10 in lieu – charged on passenger vehicles, ten model years orolder, when the purchase price and fair market value is under 3,000. 150 in lieu - charged on passenger class vehicles and fire trucksregistered in a collector class.Late Transfer Penalty 2.00Due when transaction is not submitted within 10 business days of the dateof sale.Expedited Processing 20.00Optional fee, due only if customer requests expedited service.State/Deputy Filing Fee 11.00Rev. 09/04/2019

Transfer of Minnesota title with registration renewal.Required FeeFee AmountExplanationRegistration TaxRefer to Tax ManualTax is determined by registration class of vehicle.Plate Fee 6 Single 8 DoubleWheelage TaxVaries by CountyRefer to Wheelage Tax information on DVS website.Electric VehicleSurcharge 75.00Effective with registration starting Jan. 1, 2018 when the vehicle fuel typeis “Electric.”Registration Technology 2.25SurchargeApplies to registration renewals submitted on or after Aug. 1, 2019.Special PlateContributionsRefer to Special PlateChartThe following plates require a contribution: Critical Habitat, Collegiate,Law Enforcement Memorial, Minnesota Golf, Minnesota Parks & Trails,Proud to be a Veteran, Start Seeing Motorcycles, Support Our Troops.PSV 3.50Public safety vehicle (PSV) fee is not due on non-titled trailer transactions.Transfer Tax 10.00Not due when the: Transfer is from joint to single ownership (the fee is due totransfer from single to joint ownership) Transfer is to a licensed dealer who is holding vehicle resale. Transfer is to a government entity Application for Minn. title is in the name of the owner listed on theout-of-state title or registration card The vehicle weights less than 1,000 poundsTitle/Transfer Fee 8.25Due with initial application for title and title transfers.Title TechnologySurcharge 2.25Effective with applications submitted on or after Aug. 1, 2019.Lien Fee 2.00Fee is due for each lien to be listed on title (e.g. 1 lien 2, 2 liens 4,etc.).Motor VehicleSales Tax6.5%Due on the net purchase price of the vehicle unless the purchase isexempt from sales tax or qualifies for an in lieu tax: 10 in lieu – charged on passenger vehicles, ten model years orolder, when the purchase price and fair market value is under 3,000. 150 in lieu - charged on passenger class vehicles and fire trucksregistered in a collector class.Late Transfer Penalty 2.00Due when transaction is not submitted within 10 business days of thedate-of-sale.Expedited Processing 20.00Optional fee, due only if customer requests expedited service.State/Deputy Filing Fee 11.00Rev. 09/04/2019

Transfer of Minnesota title, no registration.Required FeeFee AmountExplanationPSV 3.50Public safety vehicle (PSV) fee is not due on non-titled trailer transactions.Transfer Tax 10.00Not due when the: Transfer is from joint to single ownership (the fee is due totransfer from single to joint ownership) Transfer is to a licensed dealer who is holding vehicle resale. Transfer is to a government entity Application for Minn. title is in the name of the owner listed on theout-of-state title or registration card The vehicle weights less than 1,000 poundsTitle/Transfer fee 8.25Due with initial application for title and title transfers.Title TechnologySurcharge 2.25Effective with applications submitted on and after Aug. 1, 2019.Lien Fee 2.00Fee is due for each lien to be listed on title (e.g. 1 lien 2, 2 liens 4,etc.).Motor VehicleSales Tax6.5%Due on the net purchase price of the vehicle unless the purchase isexempt from sales tax or qualifies for an in lieu tax: 10 in lieu – charged on passenger vehicles, ten model years orolder, when the purchase price and fair market value is under 3,000. 150 in lieu - charged on passenger class vehicles and fire trucksregistered in a collector class.Late Transfer Penalty 2.00Due when transaction is not submitted within 10 business days of thedate-of-sale.Expedited Processing 20.00Optional fee, due only if customer requests expedited service.State/Deputy Filing Fee 11.00Duplicate Minnesota TitleRequired FeeFee AmountExplanationTitle/Transfer fee 7.25Due with initial application for title and title transfers.Title TechnologySurcharge 2.25Effective with applications submitted on or after Aug. 1, 2019.Lien Fee 2.00Fee is due for each lien to be listed on title (e.g. 1 lien 2, 2 liens 4,etc.).Expedited Processing 20.00Optional fee, due only if customer requests expedited service. Deputyregistrars may print duplicate titles in their office.State/Deputy Filing Fee 11.00.Rev. 09/04/2019

Duplicate PlatesRequired FeeFee AmountExplanationPassenger 8 double plates 6 single plateFee includes replacement registration stickers.TruckFee includes replacement registration stickers.Non-titled trailer 8 double plates 6 single plateRefer to Special PlateChart 2.50State/Deputy Filing Fee 11.00Special PlatePlate is an adhesive sticker that is affixed to trailer.Duplicate Registration Stickers-OnlyRequired FeeFee AmountExplanationSticker Fee 1.50Applies to all classes of registration.State/Deputy Filing Fee 11.00Duplicate Registration CardRequired FeeFee AmountCard Fee 1.00State/Deputy Filing Fee 11.00ExplanationDuplicate Lien CardRequired FeeFee AmountState/Deputy Filing Fee 11.00ExplanationAdding a lien to an existing Minnesota title without a transfer of ownership.Required FeeFee AmountExplanationLien Fee 2.00Fee is due for each lien to be listed on title (e.g. 1 lien 2, 2 liens 4,etc.).Expedited Processing 20.00Optional fee, due only if customer requests expedited service.State/Deputy Filing Fee 11.00.Rev. 09/04/2019

Removing a lien from an existing Minnesota title without a transfer of ownership.rRequired FeeFee AmountExplanationExpedited Processing 20.00Optional fee, due only if customer requests expedited service.State/Deputy Filing Fee 11.00.Repossession by a lienholder listed on Minnesota title.Required FeeFee AmountExplanationPSV 3.50Public safety vehicle (PSV) fee is not due on non-titled trailertransactions.Title/Transfer Fee 8.25Due with initial application for title and title transfers.Title TechnologySurcharge 2.25Effective with applications submitted on Aug. 1, 2019, and later.Expedited Processing 20.00Optional fee, due only if customer requests expedited service.State/Deputy Filing Fee 11.00Manufactured HomeRequired FeeFee AmountExplanationPSV 3.50Public safety vehicle (PSV) fee is not due on non-titled trailertransactions.Title/Transfer Fee 8.25Due with initial application for title and title transfers.Title TechnologySurcharge 2.25Effective with applications submitted on or after Aug. 1, 2019.Lien Fee 2.00Fee is due for each lien to be listed on title (e.g. 1 lien 2, 2 liens 4,etc.).Late Transfer Penalty 2.00Due when transaction is not submitted within 10 business days of thedate-of-sale.Expedited Processing 20.00Optional fee, due only if customer requests expedited service.State/Deputy Filing Fee 11.00.Initial Non-Titled Utility TrailerRequired FeeFee AmountExplanationRegistration Tax 55.00Permanent one-time registration.Plate Fee 2.50Plate is an adhesive sticker that is affixed to trailer.MV Sales Tax6.5 %Due on the net purchase price of the vehicle unless the purchase isexempt from sales tax .State/Deputy Filing Fee 11.00.Rev. 09/04/2019

Transfer of a Non-Titled Utility TrailerRequired FeeFee AmountExplanationTitle/Transfer Fee 3.00Due with initial application for title and title transfers.MV Sales Tax6.5%Due on the net purchase price of the vehicle unless the purchase isexempt from sales tax .State/Deputy Filing Fee 11.00Salvage InspectionRequired FeeFee AmountExplanationSalvage Inspection Fee 35.00Due for inspections of salvage vehicles only.Expedited Processing 20.00Optional fee, due only if customer requests expedited service.State/Deputy Filing Fee 11.00Transfer of Special PlateSpecial Plate TransferFeeFiling fee 5.00Fee due when transferring a special plate to another vehicle. 11.00Fee may be due if the plate transfer is not done in conjunction withanother transaction, such as title transfer.Special Plate FeesFor information about special plate eligibility, fees and contribution requirements refer to the Special Plate Chart.Rev. 09/04/2019

Application for Minn. title is in the name of the owner listed on the out-of-state title or registration card The vehicle weights less than 1,000 pounds Title/Transfer Fee 8.25 Due with initial application for title and title transfers. Title Technology Sur