Transcription

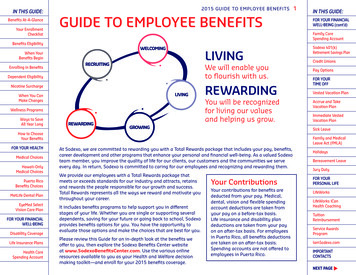

2015-2016EMPLOYEEBENEFITS GUIDE1

WHY PUTTING THE BEST TEAM ONTHE FIELD MATTERSOur employees are our most valuable asset in furthering our Mission of College for All Children. For this very reason, IDEAPublic Schools is committed to offering a comprehensive employee benefits program that helps our employees stay healthy, feelsecure, and maintain a work/life balance.Benefits offered through the workplace can help protect important things such as your income and your assets if you becomesick or injured. Other benefits can help cover expenses that might not be covered in your medical plan such as day care, travelexpenses, rent, mortgage, and every day cost of living expenses. These benefits are not only valuable, but also provide greatprotection for you and your family while reducing financial exposure in your medical plan. For this very reason we at IDEA PublicSchools work to ensure that the benefits we offer are best-in-class. The voluntary benefits program is something we also find valuein because these benefits work hand-in-hand with the medical plan in lowering financial exposure for you and your family whileproviding benefits over and above what is covered by a traditional medical plan. Below is a brief snapshot of the benefits we offer atIDEA Public Schools. Thank you for all that you do!BenefitsCarrierFundingDescriptionMedical InsuranceTRS ActiveCareIDEA contributes a minimum of 341/month/ employee towardsmonthly premiumsIDEA Public Schools provides you the opportunity to enroll in the TRSActive Care health plan, which offers you options of Aetna PPO, Scottand White HMO, and Allegian HMO plans.AmeriFlexIDEA contributes 1,000/employee/year into an HRA account for full timeemployees enrolled in a medical plan(prorated contributions are made formid-year hires)IDEA Public Schools provides 1,000 in a Health ReimbursementArrangement Account to assist with your out-of-pocket cost formedical, dental, and vision prescription. You must participate in amedical plan through IDEA Public Schools in order to receive Flexible SpendingAccountAmeriFlexEmployee PaidThis is a tax savings account that allows you to pay for eligible outof-pocket medical, dental, and vision expenses with tax free dollars.In addition, it comes with a dependent day care account that assistswith eligible day care expenses. DCA plan is a separate plan offeredthrough Ameriflex. It is not part of the FSA although they are both taxsheltered. Employees have to actually enroll in a DCA plan.DentalGuardianEmployee PaidProvides benefits for preventive dental services, restorative care,periodontics, root canals, major servicesVisionGuardianEmployee PaidProvides benefits for eye exams, lenses, frames, and/or contacts.Voluntary GroupTerm LifeRelianceStandardEmployee paidProvides a voluntary group term life benefit for employees up to 200,000 in coverage, for a spouse up to 50,000 in coverage, anddependents up to 10,000 in coverage.Short Term DisabilityRelianceStandardEmployee PaidBenefit pays 60% of weekly salary up to 2,700 per week after a 7 daywaiting period.Long Term DisabilityRelianceStandardEmployee PaidBenefit pays 60% of monthly salary up to 15,000 per month after 90day waiting period.Cancer InsuranceTrans AmericaEmployee PaidCovers Radiation/Chemotherapy, New and Experimental Treatment,and comes with a Wellness Benefit.Accident InsuranceTrustMarkEmployee PaidProvides coverage for Emergency Accidents, Hospital Admission andcomes with a Wellness Benefit.Critical IllnessAllstateEmployee PaidPays a lump sum up to 10,000 for Heart Attack, Stroke, and othermajor illness.Universal Life withLTCTrustMarkEmployee PaidProvides permanent life insurance coverage with long term carecoverage.Total LifestyleAdvantage PlanTotal BenefitsSolutionEmployee PaidProvides six benefits in one: Doctor by Phone, Roadside Assistance,Identity Theft, Vision Care, Chiropractic Care and Savings Guide.EmployeeAssistance ProgramRelianceStandardNo CostProvides professional counseling and referral service designated tohelp you with your personal, family and job issues.

ANNUAL BENEFITS OPENENROLLMENT OVERVIEW07/15/15 to 08/26/16We understand that life can be busy. But we encourage you to take the time to read the material inside this Benefits Guide tofamiliarize yourself with the benefits available to you. At this time of the year, you will have the opportunity to participate in openenrollment and make changes to your benefit elections.What do you need to do during the Benefits Open Enrollment period?You must complete the enrollment process and either elect, change, or waive benefits. Even if you don’t wish to make anychanges to your current benefit elections, you are still required to complete the enrollment process by August 26th.NOTE: After the Open Enrollment Period ends on August 26th, you cannot make changes to your plan elections unless youexperience a change in family status, such as: Loss or gain of coverage through your spouse Loss of eligibility of a covered dependent Death of your covered spouse or child Birth or adoption of a child Marriage, divorce or legal separationYou have 30 days from a change in family status to make changes to your current coverage.What benefits changed compared to last year?MEDICALIDEA will continue to provide employees with an array of medical plans administered through TRS ActiveCare. There are a fewchanges this year which include: Monthly premium rate increases ranged from 3.29% to 14.97% across all tiers and plan types. For the second year ina row, IDEA will absorb these increases to avoid increases to our staff. This means plan premium rates willremain the same for our staff in the 2015-2016 plan year. Out of pocket maximums and deductible amounts have been slightly adjusted*.*Please review the enclosed TRS ActiveCare Plan Highlight comparison for detailed information of specific plan changes.HEALTH REIMBURSEMENT ARRANGEMENT (HRA)IDEA will continue to offer the Health Reimbursement Arrangement (HRA). An HRA is an employer-funded account that will assistemployees with out-of-pocket medical expenses. IDEA will rollover unused HRA balances from the 2014-2015 plan year into the 2015-2016 plan year. IDEA will continue to contribute 1,000 annually for every full time employee that enrolls in any of the PPO or HMO TRSActiveCare medical plans offered through IDEA (pro-rated contributions will be made for mid-year enrollers). Married IDEA staff members are each both eligible to receive 1000 if they are full time and enrolled in a medical plan.DENTAL and VISIONThe dental and vision plan offered through Guardian provides a high level of benefits for you and your family. The monthly premiumamounts for these plans are slightly increasing due to the high number of claims experienced last year.We thank you for being a part of IDEA’s Team & Family and look forward to supporting you through this year’s annual openenrollment. If you have any questions or concerns, please feel free to reach out to us.IDEA Benefits Team956-377-8000

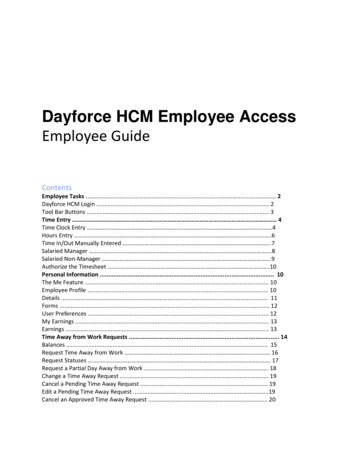

TABLE OF CONTENTS2015-2016 Open Enrollment Benefit Election Worksheet.5Benefit Enrollment Methods.6Open Enrollment Calendar of Events.7Medical Insurance – TRS Active Care PPO Plan Highlights by Aetna.8Medical Insurance – Scott & White HMO Plan Highlights (Austin only).10Medical Insurance – Allegian HMO Plan Highlights (RGV only).112015-2016 Health Insurance Plans – Cost to Employee.12Health Reimbursement Account.13Flexible Spending Account And Dependent Care Account.14Dental Insurance Plan Highlights.15Vision Insurance Plan Highlights.16Voluntary Group Term Life Insurance.17Short Term and Long Term Disability.18Cancer Insurance Benefit Plans.20Accident Insurance Benefit Plan.21Critical Illness Benefit Plan.22Universal Life with Long Term Care.23Total Lifestyle Advantage Plan .24Employee Assistance Program.25403(b) Plan.26Benefits FAQs.27Benefit Communication and Engagement Resources.28Benefits Contact Information .29Afforable Care Act Overview.30Glossary of Benefit Terms.314

2015-2016 OPEN ENROLLMENT BENEFIT ELECTION WORKSHEETIDEA Public Schools2015-2016 Open Enrollment Benefit Elec on WorksheetUse this worksheet to help facilitate your enrollment process through self-enrollment or assisted-enrollment. As you review the variousplans available, fill in the plan type, note the er you would like to par cipate in (i.e. employee only, employee and spouse, employee andchildren, family), and add the cost of each plan you elected.EXAMPLE:MedicalPlan NameCoverage TierPre-Tax/ PostTax Deduc onDeduc on AmountAc veCare SelectEmployee OnlyPre- Tax 125.00MedicalPre-Tax Pre-Tax DentalPre-Tax VisionPre-Tax Voluntary Group Term LifePost - Tax Short-Term DisabilityPost - Tax Long-Term DisabilityPost - Tax CancerPost - Tax AccidentPost - Tax Cri cal IllnessPost - Tax Universal Life with LTCPost - Tax TBS Lifestyle AdvantagePost - Tax 403BPre - Tax Total Monthly Cost Total Biweekly Cost Flexible Spending Account*Add all items in the deduc on amount column to determine your total cost of premiums per month/biweekly. Please note these are es mated costs. Some plans arecalculated on a pre-tax basis while others are calculated post-tax and may affect your paychecks.EXPLANATION OF THE PREMIUM CALCULATIONS BY PAY FREQUENCYAny staff member who enrolls in any of the plans offered by IDEA will have the corresponding deduction according to their pay frequencyMonthly (12 Pay):Monthly (12 Pay):Biweekly(24 Pay):Monthlypremiumsdeducted once a month to IDEA Staff who are salary and paid on a monthly basis (All salary staff).Biweekly Premiums deducted twice a month to IDEA Staff that are paid on a biweekly basis year-round (example: Clerical Hourly Staff and Custodians).Biweekly(24 Pay):Manual TradeBiweekly (20 Pay):This is a premiumsspecial BiweeklyPremiumdeducteda monthhourlyStaffthatpaidare onpaidanonannualizeda biweekly biweeklybasis but onlyworkmonthsof theBiweeklydeductedtwicea monthtwiceto IDEAStafftowhoareIDEAhourlyandbasis(All 10hourlystaffoutwithexceptionyear (Bus Drivers and Cafeteria staff only).of bus drivers and hourly cafeteria staff).Biweekly (20 Pay):Biweekly Premium deducted twice a month for hourly IDEA Staff that are paid on a biweekly basis but only work 10 months out of theyear (Hourly Bus Drivers and Cafeteria Staff Only).5

BENEFIT ENROLLMENT METHODS EASY AS 1, 2, 3!It is required that every employee go through the enrollment process to either elect or waive benefits.1. ONE-ON-ONE ENROLLMENT METHODEmployees have the option to enroll in benefits one-on-one with a benefits counselor at their convenience. Benefitscounselors will be available by appointment at designated times during the annual open enrollment period. To set upyour appointment, login to www.meetme.so/IDEABenefits to look for appointment times available at your campusand region.2. CALL CENTER ENROLLMENT METHODIn the event you don’t have the time to meet with a Benefits Counselor one-on-one, IDEA’s benefits enrollment callcenter is available to you from 8 a.m. to 4:30 p.m. CST Monday through Friday. The design of the call center is the sameas a one-on-one session but facilitated over the telephone. Please contact Total Benefit Solutions at 1-888-783-9653 tospeak with a benefits counselor who can assist you with your benefits enrollment needs.3. WEB SELF-ENROLLMENT METHODIn the event you don’t have time to meet with a benefits counselor or contact IDEA’s benefits call center, you canconduct your enrollment by going online. It’s easy! Below is a snapshot of what the site portal looks like. Simply go tohttps://www.benselect.com/Enroll/Login.aspx to start your enrollment today!Username: Social Security NumberPIN: Last 4 of social followed by year ofbirth (ex. 555584)Enrollment Guide: Once you enter into thesite you will be prompted to change your pinand set up a security pass code. In the eventForgot PIN6you forgot your PIN, go to FORGOT PIN toreset for future use.

BENEFITS OPEN ENROLLMENT METHOD SCHEDULEMETHOD AVAILABILITYDaySelfEnrollmentDateWednesdayJuly 15ThursdayJuly 16FridayJuly 17SaturdayJuly 18SundayJuly 19MondayJuly 20TuesdayJuly 21WednesdayJuly 22ThursdayJuly 23FridayJuly 24SaturdayJuly 25SundayJuly 26MondayJuly 27TuesdayJuly 28WednesdayJuly 29ThursdayJuly 30FridayJuly 31SaturdayAugust 1SundayAugust 2MondayAugust 3TuesdayAugust 4WednesdayAugust 5ThursdayAugust 6FridayAugust 7SaturdayAugust 8SundayAugust 9MondayAugust 10TuesdayAugust 11WednesdayAugust 12ThursdayAugust 13FridayAugust 14SaturdayAugust 15SundayAugust 16MondayAugust 17TuesdayAugust 18WednesdayAugust 19ThursdayAugust 20FridayAugust 21SaturdayAugust 22SundayAugust 23MondayAugust 24TuesdayAugust 25WednesdayAugust 26Call CenterEnrollmentOne-on-OneEnrollmentIDEA’s BenefitCounselorSelf-Enrollment (Online Portal)Available 24/7Call Center EnrollmentAvailable 8:00am-4:30pmOne-on-One EnrollmentBy Appointment OnlyIDEA’s Benefit CounselorAt HQ - By Appointment OnlyGroup Benefits PresentationIDEA Staff will now have an improved 24/7 online benefit presentation throughout Open Enrollment. The link to watch this online benefit presentation will beavailable on July 15th at The Hub. The IDEA Benefits Team will ensure communication is sent to all IDEA Staff in advance.For Auxiliary Departments, IDEA Benefits Team will have a Face-to-Face Benefits Presentation during the Summer Trainings already scheduled byHQ leaders to participate. Benefits counselors will also be present during the assigned 3-days scheduled trainings:Facilities Staff: July 14th & 17th Transportation Staff: July 23rd – July 24th Child Nutrition Program Staff: July 31st7

TRS ACTIVE CARE PPO PLAN HIGHLIGHTSActiveCare Select or ActiveCareSelect – Aetna Whole HealthType of Service(Baptist Health System and HealthTexas MedicalGroup; Baylor Scott & White Quality Alliance; MemorialHermann Accountable Care Network; SetonHealth Alliance)ActiveCare 2Deductible 2,500 employee only 5,000 employee and spouse; employeeand child(ren); employee and family 1,200 individual 3,600 family 1,000 individual 3,000 familyOut-of-Pocket Maximum 6,350 employee only** 9,200 employee and spouse; employeeand child(ren); employee and family** 6,600 individual 13,200 family 6,600 individual 13,200 familyPlan pays (up to allowable amount)Participant pays (after deductible)80%20%80%20%80%20%Office Visit Copay20% after deductible 30 copay for primary 60 copay for specialist 30 copay for primary 50 copay for specialistDiagnostic Lab20% after deductiblePlan pays 100% (deductible waived) ifperformed at the Quest facility; 20% afterdeductible at other facilityPlan pays 100% (deductible waived)if performed at the Quest facility;20% after deductible at other facilityPreventative CarePlan pays 100%Plan pays 100%Plan pays 100%Teladoc Physician Services 40 consultation fee (applies todeductible and out-of-pocket maximum)Plan pays 100%Plan pays 100%High-Tech Radiology20% after deductible 100 copay plus 20% after deductible 100 copay plus 20% afterdeductibleInpatient Hospital20% after deductible 150 copay per day plus 20% afterdeductible ( 750 maximum copay peradmission) 150 copay per day plus 20% afterdeductible ( 750 maximum copayper admission; 2,250 maximumcopay per plan year)Emergency Room20% after deductible 150 copay per visit plus 20% afterdeductible (copay waived if admitted) 150 copay per visit plus 20%after deductible (copay waived ifadmitted)Outpatient SurgeryParticipant pays20% after deductible 150 copay per visit plus 20% afterdeductible 150 copay per visit plus 20% afterdeductibleBariatric Surgery 5,000 copay plus 20% after deductibleNot covered 5,000 copay (does not apply to outof-pocket maximum) plus 20% afterdeductiblePrescription DrugsSubject to plan year deductible 0 for generic drugs 200 per person for brand-name drugs 0 for generic drugs 200 per person for brand-namedrugsRetail Short-Term20% after deductible 20 40***50% coinsurance 20 40*** 65*** 25 50***50% coinsurance 25 50*** 80*** 45 105***50% coinsurance 45 105*** 180***20% coinsurance per fill 200 per fill (up to 31-day supply)(per plan year)(per plan year; does include medicaldeductible/any medical copays/coinsurance/any prescription drugdeductible and applicable copays/coinsurance)CoinsuranceParticipant paysParticipant paysSee next page for list of services(CT Scan, MRI, nuclear medicine)Participant Pays(preauthorization required)(facility charges)Participant pays(true emergency use)Participant paysPhysician charges (only covered ifperformed at an IOQ facility)Participant paysDrug deductible (per plan year)(up to a 31-day supply)Participant pays Generic copay Brand copay (preferred list) Brand copay (non-preferred list)Retail Maintenance(after first fill; up to a 31-day supply)Participant pays Generic copay Brand copay (preferred list) Brand copay (non-preferred list)Mail Order and Retail-Plus(up to a 90-day supply)Participant pays Generic copay Brand copay (preferred list) Brand copay (non-preferred list)Specialty DrugsParticipant pays8ActiveCare 1-HD20% after deductible20% after deductible20% after deductible 450 per fill (up to 90-day supply)A specialist is any phsyician other than family practitioner, internist, OG/GYN or pediatrician. *Illustrates benefits when network providers are sued. For some plans non-network benefits are alsoavailable; see Enrollment Guide for more information. Non-contracting providers may bill for amounts exceeding the allowable amount for covered services. Participants will be responsible for thisbalance bill amount, which may be considerable. **Includes perscript

Active Care health plan, which offers you options of Aetna PPO, Scott and White HMO, and Allegian HMO plans. Health Reimbursement Arrangement Account AmeriFlex IDEA contributes 1,000/employee/ year into an HRA account for full time employees enrolled in a medical plan