Transcription

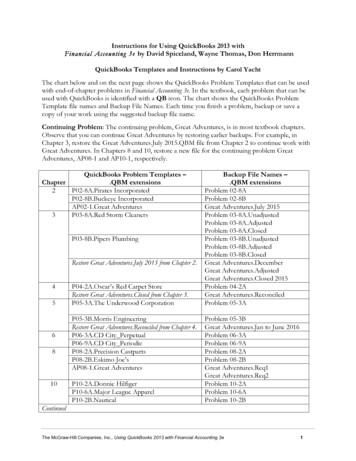

Instructions for Using QuickBooks 2013 withFinancial Accounting 3e by David Spiceland, Wayne Thomas, Don HerrmannQuickBooks Templates and Instructions by Carol YachtThe chart below and on the next page shows the QuickBooks Problem Templates that can be usedwith end-of-chapter problems in Financial Accounting 3e. In the textbook, each problem that can beused with QuickBooks is identified with a QB icon. The chart shows the QuickBooks ProblemTemplate file names and Backup File Names. Each time you finish a problem, backup or save acopy of your work using the suggested backup file name.Continuing Problem: The continuing problem, Great Adventures, is in most textbook chapters.Observe that you can continue Great Adventures by restoring earlier backups. For example, inChapter 3, restore the Great Adventures.July 2015.QBM file from Chapter 2 to continue work withGreat Adventures. In Chapters 8 and 10, restore a new file for the continuing problem GreatAdventures, AP08-1 and AP10-1, respectively.QuickBooks Problem Templates –Chapter.QBM extensions2P02-8A.Pirates IncorporatedP02-8B.Buckeye IncorporatedAP02-1.Great Adventures3P03-8A.Red Storm CleanersP03-8B.Pipers PlumbingRestore Great Adventures.July 2015 from Chapter 2.456810P04-2A.Oscar’s Red Carpet StoreRestore Great Adventures.Closed from Chapter 3.P05-3A.The Underwood CorporationP05-3B.Morris EngineeringRestore Great Adventures.Reconciled from Chapter 4.P06-3A.CD City PerpetualP06-9A.CD City PeriodicP08-2A.Precision CastpartsP08-2B.Eskimo Joe’sAP08-1.Great AdventuresP10-2A.Donnie HilfigerP10-6A.Major League ApparelP10-2B.NauticalBackup File Names –.QBM extensionsProblem 02-8AProblem 02-8BGreat Adventures.July 2015Problem 03-8A.UnadjustedProblem 03-8A.AdjustedProblem 03-8A.ClosedProblem 03-8B.UnadjustedProblem 03-8B.AdjustedProblem 03-8B.ClosedGreat Adventures.DecemberGreat Adventures.AdjustedGreat Adventures.Closed 2015Problem 04-2AGreat Adventures.ReconciledProblem 05-3AProblem 05-3BGreat Adventures.Jan to June 2016Problem 06-3AProblem 06-9AProblem 08-2AProblem 08-2BGreat Adventures.Req1Great Adventures.Req2Problem 10-2AProblem 10-6AProblem 10-2BContinuedThe McGraw-Hill Companies, Inc., Using QuickBooks 2013 with Financial Accounting 3e1

QuickBooks Problem Templates –Chapter(Portable) .QBM extensions10P10-6B.National League GearAP10-1.Great AdventuresTotal18 problem templatesBackup File Names –.QBM extensionsProblem 10-6BGreat Adventures.201728 backupsThe instructions are written with QuickBooks 2013. Use the instructions that follow for completingend-of-chapter problems with QuickBooks 2013.SYSTEM REQUIREMENTSThe following systems requirements are online oks/accountant/, select System Requirements. QuickBooks 2013 accounting software. Refer to software compatibility on page 3.Windows XP (SP3), Vista (SP1 including 64-bit) or Windows 7 (including 64-bit). For usewith Windows 8, update QuickBooks 2013. QuickBooks 2013 Release 4 and higher aresupported on Windows 8 and Windows Server 2012 operating systems.2.0 GHz processor, 2.4 GHz recommended1 GB of RAM for a single user, 2 GB of RAM recommended for multiple usersMinimum 2.5 GB available disk space (additional space required for data files)250 MB disk space for Microsoft .NET 4.0 Runtime (provided on QuickBooks CD)Minimum 1024x768 screen resolution. 16-bit or higher color4x CD-ROMAll online features/services require Internet accessProduct registration is required. If QuickBooks 2013 software is needed, see Software forStudents below and Software for the Classroom on page 3. Using the License and ProductNumbers on the CD label, software registration can be completed one time.If you have an Apple Macintosh computer, go online to . Read the Built for compatibility information. To use Windows software with aMac, Boot Camp is included with OS X. Or, there is third-party emulation software that can be usedto start windows on a Mac. For example, VMware Fusion or Parallels are examples of third-partyemulation software.QUICKBOOKS 2013 SOFTWARESoftware for StudentsStudent trial versions of QuickBooks 2013 software are included with the following books:1.Student Guides for QuickBooks 2013 by Carol Yacht (for use with Fundamental AccountingPrinciples 21e and Financial and Managerial Accounting 5e by Wild et. al), McGraw-Hill 2013,www.mhhe.com/QBandSage .2.Computer Accounting with QuickBooks 2013 by Donna Kay, McGraw-Hill 2014.The McGraw-Hill Companies, Inc., Using QuickBooks 2013 with Financial Accounting 3e2

These books include instructions for installing the student trial version of QuickBooks 2013. TheQuickBooks 2013 student trial version is for single-use installation (one computer) and includes a140-day time period.Software for the ClassroomClassroom site licenses for QuickBooks 2013 are for one year. To order a classroom site license, callthe Intuit Education Program, (866) 570-3843 (Monday through Friday, 6am to 2pm Pacific Time),or email education@intuit.com; gram/.As of this writing, the cost for classroom site licenses is: 10 pack, 300.00*25 pack, 460.00*50 pack, 690.00**(Pricing is subject to change)Software CompatibilityThe QuickBooks 2013 problem templates for use with Financial Accounting 3e can be used withQuickBooks 2013 and higher. QuickBooks versions higher than 2013 can also be used, for example,QuickBooks Premier Accountant Edition 2013 or QB 2014 versions. QuickBooks templates areupwards but not downwards compatible. This means you can use a QuickBooks 2013 file with QB2014 but not the other way around.COPYING QUICKBOOKS PROBLEM TEMPLATESFollow these steps to copy the QuickBooks problem templates from the Online Learning Center toyour desktop.1.Go to the textbook’s website at www.mhhe.com/spicelandfa3e. Link to Student Edition.Choose the appropriate chapter. Then link to QuickBooks Templates. (Hint: For steps 2 and 3,Internet Explorer 10 is used.)2.Selectlocation.3.Extract the chapter files. Save the Chapter Templates zip folder to the desktop or otherThe QuickBooks templates that can be used with end-of-chapter problems are shown on thenext page.The McGraw-Hill Companies, Inc., Using QuickBooks 2013 with Financial Accounting 3e3

STARTING QUICKBOOKS AND OPENING A TEMPLATE FILEThe steps below assume you are starting QuickBooks and opening a company file for the first time.1.Click on the QuickBooks icon []. (A QuickBooks Update Service window may appear.Check with your instructor for his or her preference for selecting Install Now or Install Later.The author suggests selecting. For more information about software updates,refer to Troubleshooting, pages 8 and 9.) If a company opens, from the menu bar click File;Open or Restore Company. Go to step 3.2. Select Open or restore an existing company.3. The Open or Restore a Company window prompts, What type of file do you want to open orrestore? Select Restore a portable file.The McGraw-Hill Companies, Inc., Using QuickBooks 2013 with Financial Accounting 3e4

4.5.Click.The Open Portable Company File window appears. In the Look in field, go to the locationof the QuickBooks Problem Templates. Select the the P02-8A.Pirates Incorporated.QBMfile. Observe that the File name field ends in the extension .QBM, and that the Files of typefield shows QuickBooks Portable Company Files (*.QBM).The McGraw-Hill Companies, Inc., Using QuickBooks 2013 with Financial Accounting 3e5

6.7.ClickThe Open or Restore a Company window prompts, Where do you want to restore the file?8.Click. The Save Company File as window appears. The Save in field showsthe location where the company file is restored. If necessary, in the Save in field go to theappropriate location; or, accept the default location. Note: the File name ends in .QBW.QuickBooks company files end in a .QBW extension.9.Click. (If a Confirm Save As window appears, refer to Troubleshooting page 7.)A Working window appears. Be patient; it will take a few minutes to restore. When the scaleis 100% complete, the file is restored and a QuickBooks Information window* says “TheQuickBooks portable company file has been opened successfully. Click. The titlebar shows Pirates Incorporated – QuickBooks Accountant 2013. The Home page is shown.If the Home page does not appear, on the left side of the screen, click.*The QuickBooks Information window does not appear. What should I do? Refer toTroubleshooting, pages 8 and 9. Read the information about updating company data,releases, and versions.The McGraw-Hill Companies, Inc., Using QuickBooks 2013 with Financial Accounting 3e6

TROUBLESHOOTING: Confirm Save As window If a Confirm Save As window appears saying that Pirates Incorporated.QBW alreadyexists, click. In the File name field, type YOUR INITIALS (or change the filename slightly) before the company name. The author’s inititals are shown on the SaveCompany File as window. Click. Wait while your file is being restored. When the title bar shows PiratesIncorporated – QuickBooks 2013, your file is restored and the Home page appears.The McGraw-Hill Companies, Inc., Using QuickBooks 2013 with Financial Accounting 3e7

Update CompanyIf you installed a QB update, an Update Company window may appear when you restoreProblem Template.Select Yes . When the Updating Data scale is 100% complete, the problemis restored. Click OK .thetemplate dataHave you updated the release?If a Newer QuickBooks Release Available window appears, read the information on the screen.Select Yes .Depending on the QB release you are using, a window may prompt that you should update the fileto the latest release. The author suggests updating to the most recent release.Follow the screen prompts to Update Now, then Get Updates. When the screen says themaintenance release is ready to be installed, click OK . Close the Update QuickBooks window.The next time you start QB, the release will be updated.The McGraw-Hill Companies, Inc., Using QuickBooks 2013 with Financial Accounting 3e8

How do I determine which updates have been downloaded?1. From the menu bar, select Help; Update QuickBooks. Select thetab.2. Scroll down the list. The Last Checked column displays when each update was downloaded.3. To get the most recent software update, select thebutton.Update Company File to New VersionThe problem template files were created with QuickBooks 2013. If you are using a later version, forexample QB 2014, you may need to update problem templates to a new version.Click on the box next to I understand that my company file will be updated to this new version ofQuickBooks to put a checkmark in it. Then, select. ClickFollow the screen prompts to update. Updating takes several minutes.to continue.How do I see the release?Start QB. Press the function key, F2 . The Product version and release is shown. The author’sProduct Information window shows:For use with Windows 8, update QuickBooks 2013. QuickBooks 2013 Release 4 and higher aresupported on Windows 8 and Windows Server 2012 operating systems.The McGraw-Hill Companies, Inc., Using QuickBooks 2013 with Financial Accounting 3e9

COMPLETING P2-8AThe steps that follow show how to complete P2-8A. The QuickBooks Problem Templates chart onpages 1 and 2 lists each end-of-chapter textbook problem that can be completed with QuickBooks.When completing the QuickBooks problems for use with Financial Accounting 3e, refer to theinformation below and pages 11-15.Pirates Incorporated’s Chart of AccountsP2-8A includes general journal transactions for the month of September 2015. The data that yourestored from the problem template contains starting data for P2-8A. This file also includes a chartof accounts and a trial balance with beginning balances.1.From the Home page’s Company area, link tobelow. The Chart of Accounts is shownCOMMENTNotice that QuickBooks’ chart of accounts includes the Name of the account, the Type of account, andBalance Total. The balance for Account No. 305, Retained Earnings, will be shown when you display thetrial balance. The QB chart of accounts includes Account No. 300, Opening Balance Equity. Beginningbalances post to this account. The balance of this account should be zero.2.Clickon the Chart of Accounts title bar to close the window. (Or, instead of closing theChart of Accounts, click on the down-arrow next to the Reports icon. Select Reports on AllThe McGraw-Hill Companies, Inc., Using QuickBooks 2013 with Financial Accounting 3e10

Accounts, Other, Trial Balance, From 9/1/2015 to 9/1/2015, Refresh.) Skip ahead to TrialBalance displayed on page 12.)Display the Trial BalanceTo see Pirates Incorporated’s account balances for the beginning of September, follow these steps.1. From the Icon bar on the left side of the QB window, select. In theStandard report list, link to. In the Account Activity Area, select TrialBalance. Select these dates: 9/1/2015 to 9/1/2015.2. Click. The Trial Balance appears.Hint: You can also display the Trial Balance from the menu bar: select Reports; Accountant & Taxes, TrialBalance, in the From field, type 9/1/2015, in the To field, type 9/1/2015, clickThe McGraw-Hill Companies, Inc., Using QuickBooks 2013 with Financial Accounting 3e.11

3. Close the trial balance by selectingon the title bar.QuickBooks’ General JournalThe transactions for P2-8A are shown in the textbook. The instructions that follow explain how tojournalize and post the September 1 transaction in QuickBooks’ general journal. After followingthese steps for the September 1 journal entry, journalize and post the remaining transactions forSeptember 2 through 30. These transactions are shown in the textbook.DateSeptember 11.TransactionProvide services to customers for cash, 4,700.From the menu bar, select Company, Make General Journal Entries. The Make GeneralJournal Entries window appears.(Hint: If necessary, uncheck the ADJUSTING ENTRY field -2.3.4.5.6.)Type 09012015 in the Date field. Press Tab three times.Click on the down-arrow in the Account field. The Account list displays. Select Account 101,Cash. Press Tab . (Hint: You can also type 101 in the account field, or type the name of theaccount. 101 Cash is automatically completed.)Type 4700 in the Debit field. Press Tab four times.In the Account field, type 401 or select Account No. 401, Service Revenue. Observe that4,700.00 is automatically completed in the credit column.Press Tab to go to the Memo field (or, click on the Memo field). Type a transactiondescription; for example, Provide services for cash. Compare your Make General JournalEntries window to the one shown.The McGraw-Hill Companies, Inc., Using QuickBooks 2013 with Financial Accounting 3e12

7.8.To post this entry to the general ledger, click.Record and post the September 2 through 30 transactions. After completing each transaction,clickso that your journal entry is posted to the general ledger and you areready to complete the next entry. (After recording the entry for Land, a fixed assets windowappears. Read the information and then click OK.) When you complete the last transaction,9.click.When you are through recording transactions in the general journal, close the Make GeneralJournal Entries window.Print the General Journal1.If necessary, from the Icon bar, select. The Home page appears.2.From the Icon bar, select; then Accountant & Taxes. Select theJournal. In the Dates area, type or select 9/1/2015 to 9/30/2015.The McGraw-Hill Companies, Inc., Using QuickBooks 2013 with Financial Accounting 3e13

3.Click. When the Collapsing and Expanding Transactions window appears, click on the4.box next to Do not display this message in the future, then click2015 Journal displays.Close the Journal report without saving. The SeptemberPrint the General Ledger1. From the Reports menu, select Accountants & Taxes, General Ledger. Substitute QB’s generalledger for the textbook’s T-accounts.2. In the Dates area, type or select 09012015 to 09302015. Clickreport as of September 30, 2015 appears.3. Close the report without saving.The McGraw-Hill Companies, Inc., Using QuickBooks 2013 with Financial Accounting 3e. The General Ledger14

Print the Trial Balance1. From the icon bar, select2. Type or select 09012015 to 09302015. Clickappears.3. Close the report., Accountant & Taxes, Trial Balance. The September 30, 2015 trial balanceFor each QB problem that you complete, review the Required steps for that problem in thetextbook. For example, for P2-8A, the textbook required steps are shown below.1. Record each transaction. (In QB, you journalized and posted each transaction in the generaljournal.)2. Post each transaction to the appropriate T-account. (In QB, substitute the general ledger forT-accounts.)3. Calculate the balance of each account at September 30. Hint: Be sure to include the balanceat the beginning of September in each T-account. (In QB, when you posted (saved) eachtransaction, account balances, which include the beginning balances, are automaticallycalculated.)4. Prepare a trial balance as of September 30.The detailed steps and instructions on pages 10-15 show you how to complete the textbook’sRequired steps for P2-8A. Use these steps as you complete subsequent QB problems.Create Copy or BackupBefore you end work or leave the computer lab, remember to back up. When you back up data inQuickBooks, you are saving to that point. QuickBooks back up files are identified with theextension .QBM. This is the same extension as the QuickBooks Problem Templates. The instructionsthat follow show how to back up data. You may back up to a USB flash drive, the hard drive,network location, or external media. If necessary, substitute the appropriate drive letter for thelocation of your back up. Refer to the chart on pages 1and 2 for backup file names.These steps use the P02-8A.QBM file as the example. Refer to the chart on pages 1 and 2 forbackup file names for subsequent end-of-chapter problems completed with QuickBooks.1.2.Before making a backup, close all windows. From the menu bar, select Window, Close All.Select, Create Copy. The Save Copy or Backup window prompts, What type of file do youwant to save? Select Portable company file.The McGraw-Hill Companies, Inc., Using QuickBooks 2013 with Financial Accounting 3e15

3.4.Click. Go to the location where you want to save the file. (Hint: You couldinsert a USB drive and save to external media. In the Save in field, select the location of yourUSB drive.)In the File name field, type Problem 02-8A. Observe that the Save as type field showsQuickBooks Portable Company Files (.QBM). The extension, .QBM, is automatically added toportable files.5.Click6.When the Close and reopen window appears, read the information. Then click.Awindow prompts Creating portable company file. Please wait. When the QuickBooksinformation window appears, read it. The QuickBooks Information window tells you the file7.path where you backed up (saved) the file. Click. You are returned the PiratesIncorporated – QuickBooks 2013 Accountant window.Exit QuickBooks.The McGraw-Hill Companies, Inc., Using QuickBooks 2013 with Financial Accounting 3e16

If an Update QuickBooks? window appears saying that “You have not used the QuickBooksUpdate Service this month,” select Yes . Then, select Update Now; Get Updates. While theupdate is working, a green square blinks. When the QuickBooks Information window appears,click OK ; then Close the Update QuickBooks window. The next time you start QB,select Install Now to update to the next release.Restore an Existing CompanyOnce you back up, you can use QuickBooks’ Open or restore an existing company selection to startwhere you left off the last time you used QuickBooks. QuickBooks’ restore allows you to retrieveinformation that was previously saved or backed up. Restore is also used to open the QuickBooksProblem templates.These steps show how to restore the Problem 02-8A.QBM file. This is the file that you saved whenyou completed P2-8A. Refer to the chart on pages 1 and 2 for the names of the backed up files.1.Start QuickBooks. If a company opens, select File; Open or Restore Company. Go to step 3.2.3.Select.The Open or Restore Company window prompts, What type of file do you want to open orrestore? Select Restore a portable file.4.Click. The Open Portable Company File window appears. If necessary, go tothe location of your backup file. Select the file; for example Problem 02-8A.QBM.The McGraw-Hill Companies, Inc., Using QuickBooks 2013 with Financial Accounting 3e17

5.Clickrestore the file?. The Open or Restore Company window prompts, Where do you want to6.Click. The Save Company File as window appears. If necessary, in the Save infield go to the appropriate location. Observe that the file name field shows the company namewith a .QBW extension. Click. Hint: If a window appears that says the [companyname].QBW file already exists. Do you want to replace it? Click No . Change the file nameslightly; for example, type the problem number in front of the file name. ClickBe patient while the portable file is being restored. It may take several minutes.7.When the file is restored, click.).QB Problem CompletedYou have completed P2-8A. Refer to these steps for completing the end-of-chapter problems withQuickBooks. The QuickBooks Problem Templates chart on pages 1 and 2 lists each textbookproblem that can be completed with QuickBooks. For each end-of-chapter problem that can beused with QuickBooks, refer to the textbook for the transactions to journalize and post. Refer to therequired steps for which reports to print. Use the detailed steps on pages 4-15 for startingQuickBooks, opening problem templates, recording transactions, and printing reports. For makingbackups, refer to pages 15-16. For restoring files, refer to pages 17-18.The McGraw-Hill Companies, Inc., Using QuickBooks 2013 with Financial Accounting 3e18

The next QB problem is P2-8B and includes general journal transactions for the month ofNovember 2015. Chapter 2 also includes the continuing problem, Great Adventures, AP2-1. Thetextbook identifies QuickBooks problems with the icon, QB. The QuickBooks Problem Templateschart on pages 1 and 2 lists each end-of-chapter textbook problem that can be completed withQuickBooks.ADDITIONAL INSTRUCTIONSThe Additional Instructions below and on pages 20-26 are specific to individual end-of-chapterproblems.a.b.c.d.e.f.g.h.AP2-1 below.P3-8A and P3-8B. Information about P3-8A and P3-8B is shown on pages 19 and 20.AP3-1, page 20.P4-2A, pages 20-23.AP4-1, pages 23-25.P6-3A and P6-9A, pages 25-26.AP8-1, page 26.AP10-1, page 26.AP2-1: Great AdventuresWhen a fixed asset is debited, for example, the July 8 transaction, Equipment (Bikes), a TrackingFixed Assets on Journal Entries window appears. Click on the box Do not display this message inthe future to put a checkmark in it. Then, click OK .Problem 3-8A: Red Storm Cleaners and Problem 3-8B, Pipers PlumbingRefer to the textbook’s Required steps for completing P3-8A. This problem includes three types ofgeneral journal transactions.1. In the textbook, transactions are identified as a. through g. For completing QB work, useJanuary 1-7, 2015 for transactions a. through g. After textbook Required step 4, make aThe McGraw-Hill Companies, Inc., Using QuickBooks 2013 with Financial Accounting 3e19

backup of your work. The chart on page 1 shows Problem 03-8A.Unadjusted as thesuggested file name.2. Required steps 5-7 refer to the adjusting entries. When recording adjusting entries in thegeneral journal, click on the box next to ADJUSTING ENTRY . Datethe adjusting entries December 31, 2015. After Required step 8, backup your work. Thesuggested file name is Problem 3-8A.Adjusted.3. To print the Adjusted Trial Balance, from the Icon bar select;Accountant & Taxes, Adjusted Trial Balance. Date the Adjusted Trial Balance 12/31/2015.4. After required step 8, backup your work. The chart on page 1 shows Problem 3-8A.Adjustedas the suggested file name.5. To print the Income Statement (Profit & Loss) and Balance Sheet, select Reports, Company& Financial selections. Substitute the balance sheet standard for the textbook’s classifiedbalance sheet. When you print reports remember to use the dates 01/01/2015 through12/31/2015.6. Required steps 9-11 refer to the closing entries. Date the closing entries December 31, 2015.On the Make General Journal Entries window, uncheck the adjusting entry box. Afterrequired step 11, backup your work. The chart on page 1 shows Project 3-8A.Closed as thesuggested file name.7. Use the same pattern for P3-8B, Pipers Plumbing.AP3-1: Great Adventures continuing problem1. Complete the transactions shown in the textbook for Aug. 1 through December 31, 2015.Then, backup. The suggested file name is Great Adventures.December.2. Date the adjusting entries December 31, 2015. On the General Journal Entries window,remember to put a checkmark in the ADJUSTING ENTRY box .3. Print an adjusting trial balance, income statement (Profit & Loss standard), and balance sheetstandard. Backup. The suggested file name is Great Adventures.Adjusted. The date range is7/1/2015 to 12/31/2015. (Substitute the Equity section of the balance sheet for thestatement of owner’s equity.)4. Complete the closing entries and print a Postclosing Trial Balance. Backup. The suggestedfile name is Great Adventures.Closed 2015.P4-2A: Oscar’s Red Carpet StoreFollow these steps to complete bank reconciliation.1. Read the information for P4-2A in the textbook.2. On February 28, 2015, record the necessary cash adjustments in the general journal beforecompleting bank reconciliation. (This is Required step 2 in the textbook.)The McGraw-Hill Companies, Inc., Using QuickBooks 2013 with Financial Accounting 3e20

3. From the Home page, link to. The Begin Reconciliation window appears.4. Type 02282015 in the Statement Date field.5. Type 13325 in the Ending Balance field. Since you already recorded a journal entry thatincluded Interest Revenue and the Service Charge, there is no need to complete those fieldson the Begin Reconciliation window.Note: Type 02282015 in the Service Charge and Interest Earned fields.6. Click. The Reconcile – Cash window appears. Click on the Checks andPayments column for each check that cleared.7. Click on the Deposits and Other Credits column for each deposit that cleared. (Include thecash adjustment entries made on February 28, 2015.)The McGraw-Hill Companies, Inc., Using QuickBooks 2013 with Financial Accounting 3e21

8. The Reconcile - Cash window’s Difference shows 0.00. Click.9. The Select Reconciliation Report window appears and says that your account is balanced.Accept the default for Both. Click Display or Print. If the Reconciliation Report windowappears, click OK . The Reconciliation Summary appears. The Ending Balance fieldshows 12,825.00.The McGraw-Hill Companies, Inc., Using QuickBooks 2013 with Financial Accounting 3e22

10.11.When you close the Reconciliation Summary, the Reconciliation Detail window appears.When you are through reviewing the information, close the window.Backup. The suggested file name is Problem 04-2A.QBM.AP4-1: Great Adventures Continuing Problem1. Restore the Great Adventures.Closed 2015.QBM file that was backed up in Chapter 3.2. Read the information for AP4-1 in the textbook.3. From the Home page, select. The Begin Reconciliation window appears. Type12312015 in the Statement Date field. Type 50500 in the Ending Balance field.4. In the Service Charge field, type 200. In the Interest Earned field, type 500. Use 12312015 asthe date. Select the appropriate accounts.5. Click. The Reconcile – Cash window appears. Click on the Checks andPayments column for each check that cleared.The McGraw-Hill Companies, Inc., Using QuickBooks 2013 with Financial Accounting 3e23

6. Click. Read the Information window; click. TheReconciliation Summary window appears. Accept the default for Both. Click Display (orPrint).The McGraw-Hill Companies, Inc., Using QuickBooks 2013 with Financial Accounting 3e24

7. When you close the Reconciliation Summary window the Reconciliation Detail windowappears. Review the information. Close.8. Backup. The suggested file name is Great Adventures.Reconciled.QBM.P6-3A, CD City (Perpetual Inventory), and P6-9A (Periodic Inventory)After completing the textbook’s transactions for July 2015, Required step 2 (P6-3A) andRequired Step 3 (P6-9A) include preparation of a multi-step income statement. In QuickBooks,substitute the Profit & Loss Standard for the textbook’s multi-step income statement.QuickBooks’ Profit & Loss statement reports revenue and expense accounts only. The inventoryaccount, which is an asset, is reported on QuickBooks’ balance sheet. For this reason, thetextbook’s gross profit amount and QuickBooks' gross profit amount will differ.Follow these steps to complete P6-3A.1. Record the July 2-30, 2015 perpetual inventory transactions. (Refer to Required step 1 in thetextbook.)2. Display or print QuickBooks' Profit & Loss Standard report. QB's P&L reports revenue andexpenses only. Inventory, which is an asset, is reported on the Balance Sheet.3. Backup. The suggested file name is Problem 06-3A.Follow these steps to complete P6-9A.1. Record the July 2-30, 2015 periodic inventory transactions. (Refer to Required step 1 in thetextbook.)The McGraw-Hill Companies, Inc., Using QuickBooks 2013 with Financial Accounting 3e25

2. Record the month-end adjustment to inventory. (Refer to Required step 2 in the textbook.)3. Display or Print QuickBooks’ Profit & Loss Standard report. QB’s P&L reports revenue andexpenses only. Inventory, which is an asset account, is reported on the Balance Sheet.4. Backup. The suggested file name is Problem 06-9A.5. For P6-9A, complete Required 3 on a blank piece of paper. (You may also want to printQB’s Profit & Loss Standard and compare

Using QuickBooks 2013 with Financial Accounting 3e 1 Instructions for Using QuickBooks 2013 with Financial Accounting 3e by David Spiceland, Wayne Thomas, Don Herrmann QuickBooks Templates and Instructions by Carol Yacht The chart below and on the next page shows the QuickBooks Problem Templates that can be used . Computer Accounting with .