Transcription

PULSE R EP O RTPULSE OF THE INDUSTRYNext Generation Automotive:The C.A.S.E. for a Reimagined Future

PULSE R EP O RTA challenging year of pandemic protocols, massive supply chain disruption, chip and laborshortages and general human angst is now in the rearview mirror – at least on paper. The finalpage of the 2021 calendar has been ripped out, crumpled up and thrown in the Christmas treebonfire. It’s officially 2022, and all eyes are facing forward in the hopes that a New Year will bringnew opportunity and meaningful change to a world hard hit by COVID impacts for far too long.Will it happen? Only time will tell. With a New Year of change and opportunity, one age-oldindustry is ideally positioned to serve as its poster child: Automotive.Constant disruption and rapid transformation in not just one, but four material categories,define the automotive industry in 2022 and beyond. From a connected home on wheels enablingunprecedented data flow and car sharing to an evolutionary shift from combustion engines to fullyelectric and eventually self-driving cars – the automobile consumers have known and loved is athing of the past. And it all boils down to a simple acronym: C.A.S.E. Connected cars Autonomous/Automated driving Shared/Subscription services ElectricSo, how will C.A.S.E. impact the world and businesses? Let’s explore.2

CCONNECTING THE FUTUREA connected car is a car that can communicateMoreover, 60% of those polled favor the ability to deliverbidirectionally with other systems, allowing the vehicleinnovation via software as a priority, encompassing theto share internet access and its corresponding dataintelligence needed for autonomous driving, advancedwith other devices both inside and outside of itself. It’salgorithms to reduce energy consumption, remoteavailable here and now and has been for years withupdates of new capabilities and customized drivingevery automotive OEM offering connected servicesexperiences.dating back decades. (General Motors was first tomarket in 1995 with OnStar.) In fact, connectivity isSmartphones have changed the definition oftransforming the automotive experience with consumersconnectivity over time. Indeed, the shift to increasedmaking or receiving voice calls, sharing remoteconnectivity during all moments of life — whether atdiagnostic information, and using digital navigation as ahome or on the go — has drastically transformed thematter of course.auto industry as OEMs and suppliers alike envisionhow to create a frictionless, personalized, and saferConnectivity can be provided in a car using embedded,experience for drivers and passengers.integrated, or tethered connectivity solutions, allowingthe integration of every system and component ofWithout question, vehicle connectivity solutions havethe car with each other to enable safer, more secure,become the leading priority for automotive OEMs. Andand better maintained vehicles. But convenience andthe stats tell the story. Statista estimates that there areexperience are also driving the adoption. Advancedmore than one billion motor vehicles in use worldwideinfotainment devices, including gaming with a fastand in 2020, the global connected car market generatedwireless connection and multimedia streaming, areapproximately 54 billion in corresponding revenue. But,putting connected cars on the fast track.what a difference seven years will make: Allied MarketResearch predicts that the global connected car marketOriginal research conducted in January 2021 by Molexwill reach 225 billion by 2027. And the market is welland third-party research firm, Dimensional Research,on its way. Mordor Intelligence reports that the share ofconfirms it. Survey participants said “The Car of theconnected cars among new vehicles sold will rise fromFuture” would include three top features most likely35% in 2015 to fully 100% in 2025.to be standard by 2030: High-speed WiFi, wirelesscharging, and car-to-car communication. And inselecting the five most important innovation areas in thenext decade, respondents picked electrification (38%),connectivity (33%), passenger safety (29%), quality andreliability (28%), and software-defined infrastructure(27%), all powerful enablers of the connected car future.3

PULSE R EP O RTAutomakers are following new vehicle safety norms toMany think the disruption is not only healthy, but alsoinspire the safety of the vehicle and make it more securea game-changing accelerator that’s inspiring traditionalfrom both cyber hacking and malfunction, and this too isautomakers to make what may have previously beenpropelling the demand for the connected car. It has alsoconsidered riskier investments. Indeed, connected carsbrought about massive disruption in the market’s keyare here to stay and the future is being written today,players. Case in point: Ford, GM, Mercedes, Volvo andbut there are hurdles that must be overcome first toBMW are facing a new form of competitive tension fromdeliver a fully connected experience. Everything froma new wave of companies from outside the automotivebetter integration into the global mobility ecosystemindustry supplying the supporting software, componentsand advanced infrastructure (5G and beyond), progressand infrastructure. Tech firms like Google, Facebook,in telematics and software and firmware over-the-airNokia, Cisco, Apple, and Intel have all announcedcapabilities (SOTA and FOTA), as well as system andplans for multimillion dollar investments in connecteddata security and more seamless technology interfacescar technology in large part fueled by the promise ofwith less complexity are powerful blockers.new data-driven business models. And they are on tosomething. After all, when consumers connect from theirThere’s no doubt that alignment with the very playerscars, they generate data that’s infinitely valuable tothat are giving OEMs a run for their money will supportthird-party companies – from insurers to wireless carriersan accelerated future for connected cars. Automotiveand advertisers.manufacturing is a multi-disciplinary enterprise thatdemands high levels of collaboration and input fromAccording to the McKinsey article, “Unlocking the fullnumerous cross-industry sectors to ensure effectivelife-cycle value from connected-car data,” connectedproduction of advanced technology.car-data monetization could deliver between 250 billionto 400 billion in annual incremental value. And that’sMolex partners on all fronts, with automotive andrevenue that OEMs cannot afford to ignore or be slow toconnectivity expertise and experience dating back 30exploit.years and including significant investments in highbandwidth cabling, seamless connectivity of wiredand wireless consumer devices, and industry-leadingmobile antenna technology. As electronics becomea bigger player in the car of the future, Molex willcontinue to focus on accelerating innovation where it’sneeded most: enabling connectivity. Its global footprintand longstanding reputation for excellence extendsacross the entire automotive ecosystem, spanningelectrification, Advanced Driver-Assistance Systems(ADAS), automotive high-speed networking, vehicleantenna systems, connected mobility solutions andvehicle-to-everything communications (V2X).4

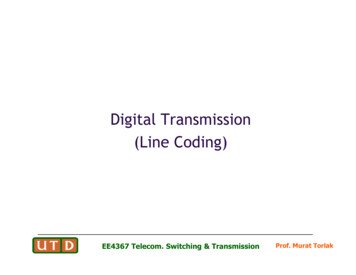

AAUTONOMY FOR ALLConnectivity inspiring new monetized businesscomplexities to cyber security and infrastructure lags –models and more powerful driver experiences justifiesall stand in the way. And so does the notable factor ofinvestment in new capabilities and technologies. And onehuman reluctance.of the most inspiring value-drivers of them all is the risein vehicle-to-vehicle (V2V) and vehicle-to-infrastructureResearchers from Arizona State University, along with(V2I) communications and the advent of semi- and fullythose at four other universities, conducted a survey inautonomous driving – or the “A” in C.A.S.E.four American cities in 2020 including Phoenix, Atlanta,Tampa, and Austin. Approximately 40% of respondentsThe evolution of autonomy levels is outlined by thesaid they’d never buy an autonomous vehicle, whileSociety of Automotive Engineers, starting with no5% said they’d be early adopters. The rest said they’dautomation where the driver performs all driving taskseventually buy one but need to feel more comfortableand progressing over time to full automation where thewith them first. Accordingly, reports have shown thatvehicle performs all driving functions under all conditions.vehicle development and deployment is based onexperience with previous vehicle technologies, theirThe autonomy levels are billed as an evolution for alikely benefits and costs, how they will affect travelreason. Technology will both enable and deter theactivity, and their impacts on road, parking and publicevolution of autonomous driving because seamlesstransit planning.connectivity is table stakes for the movement across theautonomous spectrum from zero to full. The connectivityblockers highlighted earlier in the report – from interfaceLEVELS OF DRIVING TOMATIONZero autonomy:the driverperforms alldriving tasks.Vehicle is controlled bythe driver, but somedriving assist featuresmay be included in thevehicle design.Vehicle has combinedautomated functions,like accelerationand steering, butthe driver mustremain engaged withthe monitor theenvironment atall times.Autonomylevelsoutlinedby Societyof AutomotiveEngineers(SAE)Autonomylevelsoutlinedby Societyof HAUTOMATIONFULLAUTOMATIONDriver is a necessity,but if not requiredto monitor theenvironment. Thedriver must be readyto take control of thevehicle at all timesThe vehicle is capable ofperforming all drivingfunctions under certainconditions. When thefeature requests, thedriver must take controlof the vehicle.The vehicle is capableof performing all drivingfunctions.Zero human attentionor interaction required.3 2022 Molex 2022 Molex5

PULSE R EP O RTDespite this, autonomous vehicles are slowly gainingCar of the Future survey believed that by 2030 all newlymarket share. While in 2019, there were some 31 millionpurchased cars will be either fully electric or hybrid andwith at least some level of automation in operationthey also expect new cars will all have some degreeworldwide, Statista reports that the number is expectedof autonomous functionality by 2030. That means thatto surpass 54 million in 2024. Correspondingly, thewithin a decade or so, nearly all cars and trucks will beglobal autonomous car market is projected to growtechnologically unrecognizable when compared to theiras well. Although the market shrank by around threepredecessors, accommodating design features neededpercent in 2020 due to the economic slowdown causedfor the latest EV technology while also being robustby the Covid-19 pandemic, it is forecast that betweenenough to perform reliably under harsh conditions.2020 and 2023, the market will grow by almost 60 percent.Technologically unrecognizable. What, exactly, does thatThe evolution of electric vehicles and autonomousmean? Molex believes there are four notable factorsdriving capabilities has led the auto industry to rapidlyto keep in mind. Recognizing and resolving these fourpursue technological changes that represent a paradigmkey considerations early in the design phase will helpshift in how vehicles are made. A remarkable 91% ofoptimize performance and capabilities to drive EV andautomotive decision maker respondents to the MolexADAS/AD applications to achieve their highly anticipatedpotential.1HIGH-VOLTAGE POWERTRAINSAs electric vehicles in their various forms replace mechanical and hydraulic systems, there is greaterdemand for DC power, which can’t be delivered by the typical 12V DC systems. Even internalcombustion engines and “mild hybrid” vehicles are seeing an evolution of basic electrical systems withincreases commonly quadrupling voltages to 48V DC, and power requirements for all-electric vehiclesstarting at 400V DC. In turn, higher voltage delivers greater efficiencies, realized by the need forsmaller-diameter wire, decreasing cost and weight, and reduced charging times.Further, to ensure proper safety in the high-voltage environment of an electric powertrain, interconnectsrequire greater degrees of isolation and strong connections that can withstand various heat, moistureand vibration conditions are required in the harsh environment of the vehicle powertrain. Operationalreliability is also critical in preventing vehicle failures and corresponding repair costs.6

2KEEPING POWER UNDER CONTROLThe battery management system (BMS) plays a key role in ensuring the safety and reliability ofelectric vehicle batteries, as it monitors the health and charging state of the battery cells. The BMSrelies on sensors distributed throughout the battery that monitor current output, temperature andother factors with interconnects ensuring that nothing occurs to disrupt this relationship.Molex leveraged its automotive industry expertise along with consumer device experience todevelop micro-interconnect solutions with design features needed for the latest EV technologywhile also being robust enough to perform reliably under harsh conditions.For example, Molex has designed FPC-to-board connectors for use in BMS applications that have alow-profile and contacts that are slightly recessed so they cannot be damaged if the mating shellis ‘scooped’ into it during mating. Additionally, the dual-beam contact delivers connection integrityeven under high levels of vibration and thermal shock, providing high-caliber micro-interconnectproducts that ensure dependable and robust power for battery management.Likewise, for high-voltage powertrains, Molex has designed compact 1.00mm-pitch high-powerboard-to-board connectors with a dielectric withstand value of 100mA (when voltages under 500Vare applied), plus 100 Megohms insulation resistance (below 1,000V AC/1,600V DC). They alsohave a deep wipe length of 1.75mm and dust-proof terminal covers to help mitigate the risk ofshort circuits, delivering both high reliability and safety.3MEETING DATA REQUIREMENTSTurning the focus to high-speed data, cars have relied on controller area network (CAN) and localinterconnect network (LIN) technology for decades. However, the data rate limitations of theseprotocols make them incapable of handling the amount of data produced by electronic controlunits (ECUs), cameras, radar, lidar and the other data-producing devices within today’s vehicle.Therefore, the widespread adoption of ethernet-based connectivity and zonal architectures willenable more efficient data transmission throughout the vehicle, reducing cabling weight andcost. In zonal architecture, ECUs will be replaced by domain controller units (DCUs), which areexpected to proliferate.7

PULSE R EP O RT4HIGH-PERFORMING CAMERASAs vehicles move toward higher levels of autonomy, the number of ADAS cameras insideand outside the vehicle is increasing, with some car models having 10 to 12 cameras. Thesecameras also will require high-speed data transfer and low latency to quickly inform driversafety systems of potential hazards. Additionally, cameras must provide 8-megapixel resolution,compared to the 1.3-megapixel-resolution cameras generally deployed today.As camera modules get smaller, they require single PCB arrangements, which creates additionalelectromagnetic interference (EMI) due to more densely packed components. Finally, both thecamera and cabling must operate reliably under harsh conditions, including high degrees ofshock, vibrational forces, and extreme temperatures.To accommodate these high data rate requirements of the new autonomous vehicles, Molexcamera cable assemblies have bandwidths from 3 to 6 GHz and include robust connectionfeatures, such as retention force capabilities to withstand 110 N. Integrated plastic backshellsalso prevent EMI from impacting signal integrity performance. At the board level, Molexconnectors for PCIe Gen 4 have up to 200 contacts and support data rates up to 20 Gbps, morethan enough bandwidth to accommodate in-vehicle networking requirements.To dive in deeper on these topics, please refer to the Molex tech briefs:Micro-Interconnect Solutions Addressing Electric Vehicle Demands andMicro-Interconnect Solutions for Increasing Vehicle Autonomy.8

SSHARING IS CARING– AND SO IS SUBSCRIBINGThe “S” in C.A.S.E., is where things get interesting andto supply them with autonomous vehicles. General(if possible) even more disruptive, with Sharing andMotors tested the concept with ahead of its time andSubscriptions being the name of the game.now failed car-sharing service, Maven. And Tesla is alsobuilding an app to allow car owners to rent their cars forThe future of automotive and the transportation industryextra income. The market disruption seems to predictitself is changing with speed as new players like Lyft andthat people are beginning to devalue car ownership inUber invade the market to shift the model from taxisplace of car-sharing.to rideshare convenience. But ride on-demand is nowrelatively old news in the transportation vernacular. AndBut sharing comes in many forms. Another economicthe next evolution is car sharing, one of the ground-driver supporting the “S” in C.A.S.E. is Subscriptionbreaking ideas introduced by Singapore’s sharingservices – which allows buyers to subscribe only to theeconomy. A rental service where drivers rent a privatecar features they want. And what a brilliant conceptcar by the hour or day, car-sharing is gaining popularityfor both automakers and owners. Car makers canas individuals and families balance the need to get fromcollect recurring revenue from car owners as they rollplace to place with the growing cost of car ownership.out regular software improvements. And lease vehicleDeferring maintenance and repair costs, the new modelowners and frequent traders can buy only the featurescalls for the driver to pay per time used and distancethey want and need for the few years they own their cars.traveled – and only that.Automakers including Porsche, Volvo and GM’s CadillacAlthough slow to take hold, car manufacturers are alsobrand have tried vehicle subscription models with mixedseeing the trend and are designing cars for the car-success. But industry disruptor Tesla is leading the newsharing economy. For example, transportation giantsubscription charge, having announced in July 2021Penske Corp, jumped into the car-sharing business inthat it will allow customers to subscribe to its “Full Self-2019, providing customers with a wide range of vehicles.Driving” advanced driver assistance package for 199 aGerman Carmaker Daimler partnered with Uber in 2017month, rather than paying 10,000 upfront. And a spate9

PULSE R EP O RTof carmakers are now offering subscriptions to individualSo, what’s the upshot for automakers given newfeatures as a new twist on the model. Mercedes-subscription realities? Kelly McCartney, directorBenz will offer rear-wheel steering on its EQS electricof corporate strategy at Molex, predicts that thesedan as a 575 annual subscription in Germany, fordecoupling of hardware and software will impact everyexample. Likewise, certain features in the BMW suchpart of the vehicle, well beyond infotainment, forcingas heated seats and steering wheels can be unlockedboth OEMs and suppliers to leverage software expertisevia subscription fees, and Cadillac charges drivers 25for automotive design. This supports zonal architecturesper month for its Super Cruise hands-free driving optionand the central nervous system analogy.after expiration of the three-year free trial as well.“Consumers will continue to ramp up demand for moreWhat’s inspiring the shift to subscription models?customization in their automotive choices, requestingClearly, learned consumer behavior has everythingmore pick and choose and ad hoc bundles that allowto do with it. After all consumers buy subscriptions inthem to create their own world, including entertainment,their daily lives for everything from movies and winewarranties, maintenance bundles, and insuranceto premium shipping services. But in the automotivebundles,” she said. “But 2022 will likely see a delay inbusiness, the key is pricing. The minute it gets tooproviding these full features due to the chip shortage,high, it seems, all bets are off. In fact, a survey byforcing auto makers to keep buyers engaged andthe automotive website Autolist found that mostinterested with creative solutions that rely on connectedpeople were willing to pay just 11 to 25 a month fordevices and fast data in the short term and offering thesubscription features, so automakers are watching thepromise of leap-frogged advancements once chipsetsdata (enabled by connectivity, of course) carefully tobecome available.” Only time will tell. But, there’sgauge fluctuation and nuanced understanding of whatlittle doubt that the “S” in C.A.S.E. will be one factor towill fly (or drive) the new subscription models.watch as the automotive industry continues to swiftlytransform.The decoupling of hardware and software will impactevery part of the vehicle, well beyond infotainment,forcing both OEMs and suppliers to leverage softwareexpertise for automotive design.Kelly McCartneyDirector of Corporate Strategy at Molex10

EIT’S ELECTRICThe “E” in C.A.S.E. is as predictable as the ball drop onNew Year’s Eve. And the reasons are clear. Electrificationis on fire!Research firm McKinsey believes the tipping point inpassenger EV adoption occurred in the second half of2020 when EV sales and penetration accelerated inmajor markets despite the economic crisis caused bythe COVID-19 pandemic. All signs point to Europe asthe facilitators of the development, where EV adoptionreached 8% due to stricter emissions targets for OEMsand generous subsidies for consumers.Looking ahead, The McKinsey Center for Future Mobilitypredicts that China will continue to see strong growthin electrification and remain the largest EV marketelectrification among automakers and their suppliersin absolute terms. Despite low EV subsidies, stronghas increased dramatically over the past two years inconsumer pull coupled with the government’s dual-relation to customer experience (55%), business resultscredit policy has driven an increased EV share of(51%), executive attention (50%) and expected speed ofmanufacturers’ portfolios. McKinsey research models amarket delivery (48%).Chinese EV share above 70% for new car sales in 2030.And the United States isn’t far behind, with governmentBut those same automaker respondents point totargets for electrification placed at 50% by 2030,hurdles as well. “Automobile electrification is a complexfueled by substantial investments in infrastructure andundertaking, involving much more than transitioningstringent fleet emissions targets. California regulatoryfrom internal combustion to electric engines,” saidsupport for EV and the other states following its CARBKevin Alberts, SVP and GM, Power & Signal BusinessZEV regulation is driving uptake. So much so that someUnit (PSBU), Molex. “The quickening pace of innovationbelieve the US will exceed regulatory targets and reachacross all aspects of electrification is being propelled65% EV sales by 2030.by highly sophisticated engineering and fully integratedmanufacturing that leverages ultrasonic welding,In November 2021, Molex unveiled results of a globalsustainable production and automation to speed deliverysurvey of automotive stakeholders that identify topof next-generation electrification solutions.”trends and roadblocks impacting innovation in ElectrifiedVehicles (EVs). Fully 93% of respondents believeAs a major catalyst for change in the complete vehicleelectrification is on the cusp of a huge breakthrough, butarchitecture, including charging stations, successful94% of those polled agree that electrification goes wellelectrification requires greater collaboration amongbeyond a move to electric motors.automotive OEMs and their suppliers, increasedR&D and capital investments, as well as the design,The top-three growth factors identified by the surveydevelopment and delivery of breakthrough technologiesrespondents include the increase in pro-electrificationin power control and battery management.government policies, improved battery technology and awider selection of electric/hybrid cars for the consumersleaning to an electric future. Clearly the focus on11

PULSE R EP O RTAnd that’s no small feat. Fully 92% of those polled in thethe ECUs. In addition to gaining topology that is betterMolex survey report their design teams face difficultiessuited to the increasing number of electronic systemswith electrification while 91% report challenges findingin the vehicle, zonal architectures also introducemuch-needed expertise to engineer the right solutionsweight savings that translates into increased efficiencyto changing consumer needs. Indeed, consumers areand improved range on each charge. Successfuldemanding safer cars that are not only comfortable, butimplementation of zonal architectures requires flawless,convenient, sustainable, and packed with infotainmentrobust, and high-speed data connections that can keepfunctionality. And that requires electronic systems anddata flowing securely.modules with newly designed electrical architecture.According to the Molex Electrification survey, 84% ofTake electronic control units (ECU’s), for example.respondents agreed that zonal architecture is the futureTo meet consumer demands, the design of high-and will address new design concerns as traditionalend vehicles can have over 100 ECUs, creating newapproaches reach their limits, which is why Molex ischallenges in how to connect, package, and manage thefocused on helping customers transition from traditionalsystems that transport command-and-control specificto all the intermediate phases that ultimately lead tofunctions that are vital to the vehicle. This is where zonalflexible products supporting a true zonal architecture.architecture comes in to increase the limits of scalability12posed by incumbent architectures. By segmenting theBut the move to zonal is just one of the engineeringvehicle into zones, each zone has assigned functionalityhurdles. Heat or “thermal management” is heating up asand then passes information between the zones asan electric car challenge with the volume of electronicsnecessary. Zonal architecture optimizes and reducesand ECUs being designed into both ICE vehicles andthe overall volume of wiring, and it also consolidatesEVs. The combination creates design complexities that

require innovation in connector miniaturization due tospace constraints that also raise temperature levels thatmust be addressed with innovative design solutions andadvanced predictive modeling. Further, miniaturizationand increased electrical content necessitate greatercomponent density. Dissipating the same or moreheat in a smaller space over the reduced surface areaof miniaturized systems can create excessive heatrisks that must be managed. Likewise, heat risks canincrease if the electronics are in a sealed ECU andlocated where extremes of ambient temperaturesare experienced, such as under the hood. The harshenvironment combined with high-circuit density andsmall package size requirements for next-generationconnection systems can result in thermal challengesthat cause safety, reliability and lifetime issues if notdesigned properly.Molex’s accelerometer-based road noise cancellationMolex executes high-fidelity thermal simulation tosensor is strategically positioned on the vehicle chassisdrive design exploration and mitigate thermal issuesto monitor road noise, and along with intelligentbefore mass production, providing immediate visibilityalgorithms, deliver a noise cancellation wave at theinto potential concerns and allowing for acceleratedmoment unwanted noise hits the occupants’ ears.modification cycles and custom development that avoidsNoise management technology is giving OEMs a wider“build then test” approaches that are rife with rework.range of noise reduction benefit enabling a head-startin designing and deploying a lighter, higher-performing,If heat wasn’t scary enough, noise is the final frontiermore flexible, and more efficient solutions for reducingin the electric evolution. And it’s rather scary in itsunwanted noise.own right due to the impacts it creates for drivers.How? Internal combustion engines dampen ambientnoise generated from the road, tire, wind, and vehiclestructures that elevate fatigue and correspondingdriver safety concerns. But in the electric car, engineerscan no longer rely on mechanical methods of noisedampening, such as sound deadening materials or foamlining, as these add cost and weight to a vehicle whichimpacts both energy consumption and range. But noisecancellation sensors enable automakers to electronicallycontrol unwanted sound.13

PULSE R EP O RTIT TAKES A VILLAGESUPPLY CHAIN MATTERSThe continued increase of electrical content and theAt the heart of this is a global organization built on aelectrification of powertrains on vehicles is a positiveshared vision of mutual benefit between its customers,and inevitable progression in the lifecycle of thesuppliers and employees. Molex continues to evaluateautomobile. It is important for experienced innovatorsand invest in capabilities that empower its teams tolike Molex to support this megatrend by collaboratingbetter serve customers, work with suppliers and createacross the automotive ecosystems.value. One of those critical capabilities is “Design For”thinking, which Molex applies during new productThis means staying at the forefront of designdevelopment (NPD) that enables enhanced supply-chainrequirements, reducing potential risks associated withresiliency throughout the product lifecycle.profoundly squeezed supply chains and developingsolutions that fit the unique need

connectivity expertise and experience dating back 30 years and including significant investments in high-bandwidth cabling, seamless connectivity of wired and wireless consumer devices, and industry-leading mobile antenna technology. As electronics become a bigger player in the car of the future, Molex will