Transcription

CERTIFICATEOF COVERAGE2022 Medicare Advantage Dental PlanSupplemental Dental Package #1Y0140 2022DentalCOC1 CParamount Elite is an HMO plan and a PPO plan each with a Medicare contract.Enrollment in Paramount Elite (HMO/PPO) depends on contract renewal.

e Dental PlanCERTIFICATEOFCOVERAGE2021MedicareAdvantag

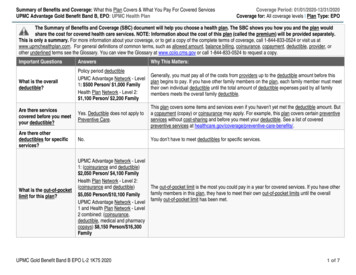

Paramount Dental Medicare Advantage Dental PlanMedicare Advantage Supplemental Dental PlanDENTAL ONLY CERTIFICATE OF COVERAGETABLE OF CONTENTSCertificate of Coverage . 2How to Contact Us . 3Eligibility – Initial, Open and Special Enrollment . 32022 Paramount Dental Benefits . 4Receiving Dental Care – Selection of Dentist . 5Accessing Your Benefits . 5How Payments are Made/Explanation of Benefits (EOB) . 5Plan Features .6General Exclusions .7Coordination of Benefits .8Grievance and Appeals .9Termination of Coverage .11General Conditions .11Fraud Hotline .12Definitions . 13Schedule of Benefits including Limitations and Restrictions .16Online materials are available through our dedicated website portal – paramounthealthcare.com – and serve asthe primary source of the most recent and up-to-date information. Any printed documents that you may have arebased on information at a certain point in time and may not be inclusive of all benefits, restrictions and limitations.NOTICE: IF YOU ARE COVERED BY MORE THAN ONE HEALTH CARE AND/OR DENTAL CARE PLAN, YOUMAY NOT BE ABLE TO COLLECT BENEFITS FROM BOTH PLANS. EACH PLAN MAY REQUIRE YOU TOFOLLOW ITS RULES OR USE SPECIFIC DENTISTS. IT MAY BE IMPOSSIBLE TO COMPLY WITH BOTHPLANS AT THE SAME TIME. READ ALL OF THE RULES VERY CAREFULLY, INCLUDING THECOORDINATION OF BENEFITS SECTION, AND COMPARE THEM WITH THE RULES OF ANY OTHER PLANTHAT COVERS YOU.READ THIS CERTIFICATE CAREFULLY!1

Welcome!Thank you for choosing Paramount Dental to supplement your Paramount Elite Medicare health plan. Focusedon prevention, this plan offers quality and cost-effective dental care. It also provides a wide, national network ofquality dentists – both generalists and specialists.Your enrollment in this dental plan is contingent on your enrollment in a Paramount Elite Medicare health plan.Paramount Elite is an HMO/PPO plan with a Medicare contract.We are committed to providing you with the highest quality member services. Our dedicated team is available toyou via phone. You may also access information at paramounthealthcare.org.It is your responsibility to understand your benefits and associated limitations and restrictions. Please read andsave this certificate for your reference.CERTIFICATE OF COVERAGEParamount Dental issues this Certificate of Coverage (referred to herein as certificate) to you, the member. Thecertificate is a summary of your dental benefits coverage and is a legal document between Paramount Dental(referred to herein as “we”, “us”, “our”) and you. Your coverage is subject to the terms, conditions, limitations andexclusions outlined in the certificate of coverage. The certificate reflects and is subject to the contract betweenParamount Dental and Paramount Elite Medicare. Reasonable effort has been made for this certificate torepresent the intent of the plan language between Paramount Elite Medicare and you.We issue this certificate based on your application and payment of the required premium. You must be enrolledin a Paramount Elite Medicare contract to be eligible for this supplemental dental plan. In addition to thiscertificate, the policy includes the schedule of benefits. The benefits provided under this plan may change ifany federal laws change. All the provisions in the following pages form a part of this document as fully as ifthey were stated over the signature below.IN WITNESS WHEREOF, this certificate is executed by an authorized officer.Sincerely,Lori A. JohnstonPresident, Paramount Health Care2

HOW TO CONTACT USBy MailParamount Dentalc/o Paramount Elite MedicareP.O. Box 928Toledo, Ohio 43697By PhonePlease contact Paramount Elite Member Services at 567-585-9888 or toll free 833-554-2335 from 8 a.m. to 8p.m., Monday through Friday. From Oct. 1 through March 31, we are available 8 a.m. to 8 p.m., seven days perweek. TTY users should call 888-740-5670.OnlineYou may also visit Paramount Dental online 24 hours a day, seven days a week at insuringsmiles.com. Heremembers can: Find a dentist who is in the Paramount Dental network Verify benefits, renewal dates, coverage and claimstatus Print member ID card Review benefit history Learn more about oral healthELIGIBILITYEnrollment and eligibility in this Paramount Dental Plan coincides with your Paramount Elite Medicare healthplan guidelines as set below:Open Enrollment Period – A set time each year when members in a Medicare Advantage plan, like ParamountElite Medicare, can cancel their plan enrollment (health and dental) and/or switch to Original Medicare or makechanges to your Part D coverage. The open enrollment period is from Jan. 1 until March 31 of each year.Annual Election Period – A set time each fall when members can change their dental, health and/or drug plansor switch to Original Medicare. The annual enrollment period is from Oct. 15 until Dec. 7.Initial Enrollment Period – This is the period when you can sign up for Medicare Part A and Part B for the veryfirst time. Your Initial Enrollment Period is the seven-month period that begins three months before the monthyou turn 65, includes the month you turn 65, and ends three months after the month you turn 65.Special Enrollment Period – A set time when members can change their dental, health and/or drug plans and/orreturn to Original Medicare. Situations in which you may be eligible for a special enrollment period include butare not limited to: moving outside the service area, getting “Extra Help” with your prescription drug costs, movinginto a nursing home, or the plan violating its contract with you.All Paramount Elite Medicare members are considered eligible to join the Paramount Dental supplemental dentalplan. The member pays the full cost of dental plan. Dependents are not eligible. If at any time coverage isterminated, you may not re-enroll until the following annual election period. Benefits will cease on the last day ofthe month in which eligibility is terminated.3

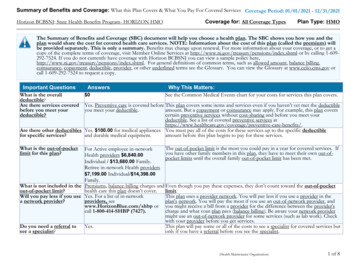

2022 Paramount Dental BenefitsSummary of your Comprehensive Dental Plan #1The below information is a summary of the comprehensive dental plan you have purchased. A few remindersto keepin mind:Services must be received from a dentist who participates in Paramount Dental’s Medicare Advantage network.This network provides dentists nationally. No payment will be made for services received from an out-of-networkdentist, and you will be responsible for the full amount charged.For questions about services that are included, excluded, or have limits under this dental plan,please refer tothe Schedule of Benefits later in this document.Embedded Preventive Benefits:2 periodic oral exams within any calendar year.2 preventive cleanings within a calendar year.Up to 4 bitewing dental X-rays within any calendar year.Comprehensive Dental Benefits:Monthly Premium: 28 per monthDeductible: 25 (applies only to basic and major services, does not apply toward embedded preventive dentalservices)Annual Maximum Plan Payment: Up to 1,000Crowns are covered at 50/50 cost sharing (after your 25 deductible has been met).All other covered comprehensive services are covered at 70/30 cost sharing (after your 25 deductible hasbeenmet).Comprehensive dental services that are covered for you Restorative services (fillings) – Amalgam and Resin basedcomposites are limited to a maximum of one procedure pertooth every 3 years. Crowns – (porcelain/ceramic substrate) arelimited to a maximum of one procedure per tooth every 7 years.Crowns are limited to non-cosmetic crowns and subject tosubmission of supporting documentation. Subject to utilizationreview** Endodontics (root canals) – maximum of 1 procedure per toothper lifetime. Periodontics – Periodontal Scaling and Root Planing procedurerequires submission of supporting documentation and subject toUtilization Review**. Must contain 4 teeth with 4 MM pocketsand eligible every 3 years. Simple extractions Prosthodontics – relines and repairs. Reline of dentures islimited to one procedure every four years. Additional Benefits - This Plan also includes EmergencyPalliative Treatment of dental pain - minor procedure - twotreatments per 12 month period and incisional biopsy of oraltissue. All services must be provided at a participating plandental provider to be covered. Diagnostic evaluations – This Plan covers problem-focusedexams which are limited to two evaluations per calendar year.Diagnostic Services includes Intraoral - complete series ofradiographic images or Panoramic Radiographic image onceevery four years. These evaluations do not add to the twopreventive evaluations covered in your preventive dental benefit(limit of 2 evaluations in total).4In-Network Paramount DentalMedicare Advantage Providers ONLYAfter you pay the 25 deductible: You pay 30% Coinsurance forrestorative services (fillings),endodontics, periodontics, andsimple extractions. You pay 50% Coinsurance forrestorative services (crowns). You pay 0% Coinsurance.Deductible does not apply to theseservices.

RECEIVING DENTAL CARE – SELECTION OF YOUR DENTISTDentistry is a highly personal service. The plan does not dictate what treatment you receive. Only you and yourdentist can determine that. However, the plan does determine what services are covered and by what type ofdentist. The plan pays for only those covered services listed in this booklet within the limitations and restrictionspresented. You must personally pay for any service which is not covered or for any service that is covered but issubject to limitations and restrictions.Under this in-network plan, you must receive care from a dentist who is a member of the Paramount Dentalnetwork to receive benefits. Benefits will be denied if you do not use an in-network dentist. An in-network dentistis a dentist who is contracted with the Paramount Dental Network or its leased dental network.Our network includes more 190,000 locations nationwide, including specialists, who have agreed to acceptdiscounts on your covered dental services. They have also agreed not to balance bill you for the differencebetween their fees charged and the contracted fee paid to them. Before enrolling in this dental plan, confirm ifyour dentist participates in the network and consider if you are willing to change to an in-network dental provider.In-network dentists are independent contractors and not employees of the plan.Remember, this is an in-network only program. Visit the Find a Dentist link on paramounthealthcare.org toreview a listing of Paramount Dental in-network dentists. When accessing Paramount Dental’s online directory,select the link labeled Medicare Advantage Network. Or, you may call Paramount Dental at 800-727-1444.IMPORTANT: If you receive services from a dentist who does not participate in Paramount Dental’s EliteMedicare network, you will be responsible for the full amount charged for those services. No payment will bemade by Paramount Dental.ACCESSING YOUR BENEFITSPlease read this certificate and the schedule of benefits carefully so you are familiar with your benefits, paymentmethods, and terms of this plan.When you make an appointment with a Paramount Dental dentist, let the office know that you have ParamountDental, a supplemental dental plan through Paramount Elite Medicare. If your dentist is not familiar with this planor network or has any questions, they should contact Paramount Dental by calling the toll-free number at800-727-1444.After you receive your dental treatment, your participating Paramount Dental provider will fill out and submit yourdental claims (including supporting attachments) for you electronically (Payor ID CX019). They may also fax ormail claims to:Paramount DentalP.O. Box 659Evansville, IN 47704-0659Fax: 812-401-3609HOW PAYMENT FOR BENEFITS IS MADE – EXPLANATION OF BENEFITS (EOB)Paramount Dental will make payments for covered services in accordance with this plan. Your plan is identifiedon your schedule of benefits within this certificate.Once your dentist files a claim, Paramount Dental will decide within 30 days of receipt if it is a legitimate claim. Ifthere is not enough information to approve your claim, Paramount Dental will notify you and your dentist within30 days. The notice will describe the information needed, explain why it is needed and inform you and yourdentist that the information must be received within 60 days or your claim will be denied. You will receive a copyof any notice sent to your dentist. Once we receive the requested information, your claim will be processed. Ifyou or your dentist does not supply the requested information, we will deny your claim. Notification of denial willbe sent to both you and your dentist.Once we process your dental claim, you will receive an Explanation of Benefits explaining payment amounts. It ispossible that your dentist’s charges for one or more of the procedures may be higher than the maximum allowedunder your plan. If so, a contracted in-network dentist must reduce the charged amounts.5

Paramount Dental will send payment directly to your dentist and you will be responsible for any applicablecopayments or deductibles. Your in-network Paramount Dental provider will base payment on the maximumallowable charges for covered services. If you elect to receive services from a dentist who is not in theParamount Dental network, you will be responsible for the full amount charged and Paramount Dental willmake no payment.If a claim is not received within one year of the date of service, the claim will not be considered for payment. Thisincludes submitted claims for which we have not received the documentation from your dentist (federal W9 form,radiographs, narratives, etc., or unable to process due to incorrect filing information) required to determine andfinalize the claim benefit.Maximum Allowable ChargesMaximum allowable charges are the charges an in-network dentist agrees to accept for covered services.Maximum allowable charges apply to all covered services under a member’s benefit plan -- whether payable bythe plan or the member.Pre-Treatment EstimateA pre-treatment estimate is for informational purposes only. It is not required before you receive dental care.Your claim will be processed after completion of the dental service. If you are not sure whether a particular dentaltreatment is covered or how much you will be required to pay, request a pre-treatment estimate from your dentist.It is a free service offered by Paramount Dental. The benefits estimate provided on a pre-treatment estimatenotice is based on benefits available on the date the notice is issued. It is not a guarantee of future dentalbenefits or payment. We recommend requesting pre-treatment estimates for procedures requiring utilizationreview and procedures that require coinsurance/out-of-pocket costs.Non-Covered ServicesUnless prohibited by federal law, you will be responsible for the dentist’s submitted amount for services notcovered by your plan. Services you receive from dentists who are not in Paramount Dental’s Medicare networkare also considered non-covered benefits.PLAN FEATURESThe benefits covered by this plan are set forth in your schedule of benefits and as summarized below.Plan Annual Maximum Benefits/Plan YearBenefits payable under the plan, regardless of whether coverage is continuous or not, will be subject to the planannual maximum for each plan year. Payments under your certificate for ALL covered services apply to the planannual maximum benefit. You will continue to pay maximum allowable charges and realize savings on allcovered services after your annual maximum has been reached.DeductibleThe plan year deductible is applicable to non-preventive and diagnostic covered services incurred in each planyear. A benefit deductible is the amount a member must pay for covered services before the Paramount Dentalwill reimburse for those covered services. This amount may vary based upon the coinsurance of the coveredservice.Example: (Fee Allowed - Deductible) x Coinsurance Plan PaymentPatient receives major services covered at 50% under the plan. The member is responsible for a 25 individualdeductible.Waiting PeriodThe waiting period is the period of time beginning on the member’s effective date before benefits for certaincovered service become eligible for reimbursement. Unless otherwise specified, the most recent effective date isutilized in the application of the waiting period. This includes a change to your dental plan coverage such astermination and reinstatement of coverage.6

Limitations and RestrictionsSome services are limited by the age of the patient, how often the service may be performed, or specific teeth.All time intervals (frequency limitations) required by coverage are independent of calendar year or plan year.Frequency limitations regarding how often services may be performed are continuous. Change of dental plancoverage, termination and reinstatement of coverage does not eliminate the frequency limitations.Utilization ReviewUtilization review is the process by which a licensed dentist consultant for Paramount Dental reviewsdocumentation (X-rays, charting, narratives, etc.) submitted by your dentist to determine if the service meetsestablished criteria for payment by the plan. If a covered procedure requires utilization review, it will be noted inyour certificate.Alternate BenefitsOften, more than one service can be used to treat a dental problem or disease. In determining the benefitspayable on a claim, different materials and methods of treatment will be considered. If applicable, the amountpayable will be limited to the covered expense for the least costly service, which meets broadly acceptedstandards of dental care as determined by Paramount Dental. A member and his/her dentist may decide to use amore costly service or material that is satisfactory for the treatment of the condition. However, the plan paymentwill be limited to the least costly covered service for covered American Dental Association codes/expenses.UnbundlingWhen charges are separated for less complicated services performed with a more comprehensive or extensivedefinitive treatment, the less complicated components may be considered as parts of the primary service. If thedentist bills separately for the primary service and each of its component parts, the total benefit payable for allrelated charges will be limited to the benefits payable for covered expenses for the primary service.GENERAL EXCLUSIONSThe certificate issued is subject to the following general exclusions: This certificate will not pay for dental services that are not listed in the schedule of benefits included withthis certificate. This certificate will not pay claims for cosmetic dentistry for aesthetic reasons. This certificate will not pay claims for dental services rendered before the effective date or after coverageis terminated. This certificate will not pay claims for dental services covered under non-dental insurance. This certificate will not pay claims for charges made by hospitals or prescription drugs ormedicaments/solutions. This certificate will not pay claims for services performed primarily to rebuild occlusion or full mouthreconstruction. This certificate will not pay claims for members until we receive the appropriate contracted payment(s) forpremiums. This certificate will not pay claims for services which are not completed. This certificate will not pay for duplicates, lost or stolen prostheses, appliances and/or radiographicimages. This certificate will not pay claims received one year after the date of service. Infection control/sterilization is not considered a separate billable procedure or service and cannot bebilled to a member or Paramount Dental.All covered services will be considered in relation to the most global or comprehensive procedure and as suchseparate charges for procedural components may be denied or disallowed. This includes, but is not limited to,7

separate charges for the use of local anesthetic, bonding agents, bases, pulp capping, etchants, etc.COORDINATION OF BENEFITSThe Coordination of Benefits provision applies when a person has dental or healthcare coverage under morethan one plan. The order of benefit determination rules govern the order in which each plan will pay a claim forbenefits.The plan that pays first is called the primary plan. The primary plan must pay benefits in accordance with itspolicy terms without regard to the possibility that another plan may cover some expenses.The plan that pays after the primary plan is the secondary plan. The secondary plan may reduce the benefits itpays so that payments from all plans do not exceed 100% of the total allowable expense.Terms1. A plan is any of the following that provide benefits or services for medical or dental care or treatment. Ifseparate contracts are used to provide coordinated coverage for members of a group, the separatecontracts are considered parts of the same plan and there will be no Coordination of Benefits among theseparate contracts.a. Plan includes: group and non-group insurance contracts, health maintenance organizationcontracts, closed panel plans or other forms of group or group-type coverage (whether insured oruninsured); medical care components of long-term care contracts, such as skilled nursing care;and Medicare or any other federal governmental plan, as permitted by law.b. Plan does not include: hospital indemnity coverage or other fixed indemnity coverage; accidentonly coverage; specified disease or specified accident coverage; limited benefit health coverage,as defined by state law; school accident type coverage; benefits for non-medical components oflong-term care policies; Medicare supplement policies; Medicaid policies; or coverage under otherfederal governmental plans, unless permitted by law.2. Each contract for coverage under a. or b. is a separate plan. If a plan has two parts and Coordination ofBenefits rules apply only to one of the two, then each part is treated as a separate plan.3. This plan means, in a Coordination of Benefits provision, the part of the contract providing the healthcarebenefits to which the Coordination of Benefits provision applies and which may be reduced because ofthe benefits of other plans. Any other part of the contract providing healthcare benefits is separate fromthis plan. A contract may apply one Coordination of Benefits provision to certain benefits, such as dentalbenefits, coordinating only with similar benefits and may apply another Coordination of Benefits provisionto coordinate other benefits.4. Allowable expense is a healthcare expense, including deductibles, coinsurance and copayments, which isassociated with a covered service for which reimbursement is available or for which reimbursement wouldbe available but for the application of contractual limitations. When a plan provides benefits in the form ofservices, the reasonable cash value of each service will be considered an allowable expense and abenefit paid. An expense that is not covered by any plan covering the person is not an allowable expense.In addition, any expense that a provider by law or in accordance with a contractual agreement isprohibited from charging a covered person is not an allowable expense.5. Benefit reserve is the savings recorded by a plan for claims paid for a covered person as a secondaryplan rather than as a primary plan.Order of Benefit Determination RulesWhen a person is covered by two or more plans, the rules for determining the order of benefit payments are asfollows:1. The primary plan pays or provides its benefits according to its terms of coverage and without regardtothe benefits of under any other plan.2. A plan that does not contain a Coordination of Benefits provision that is consistent with this regulation isalways primary unless the provisions of both plans state that the complying plan is primary.8

3. When a person is covered by two or more plans, the rules for determining the order of benefit paymentsare as follows:a. This plan will pay primary over any Medicaid or retiree plan that you may have.b. This plan will pay secondary to any employer sponsored, automobile, group or individual plan youmay have except for those listed above in a.c. If this plan is the primary plan, it will pay its benefits according to its terms of coverage and withoutregard to the benefits under any other plan.d. Except as provided in the following paragraph, a plan that does not contain a Coordination ofBenefits provision is always primary unless otherwise required by law.e. If the preceding rules do not determine the order of benefits, the allowable expenses shall beshared equally between the plans meeting the definition of a plan. In addition, this plan will not paymore than it would have if it had been the primary plan.4. Coverage that is obtained by virtue of membership in a group that is designed to supplement a part of abasic package of benefits and provides that this supplementary coverage shall be excess to any otherparts of the plan provided by the contract holder, shall be secondary regardless of whether or not itcontains a Coordination of Benefits provision.Effect on the Benefits of this PlanWhen this plan is secondary, it may reduce its benefits so that the total benefits paid or provided by all plansduring a plan year are not more than the total allowable expenses. To determine the amount to be paid for anyclaim, the secondary plan will calculate the benefits it would have paid in the absence of other healthcarecoverage and apply that calculated amount to any allowable expense under its plan that is unpaid by the primaryplan. The secondary plan may then reduce its payment by the amount so that, when combined with the amountpaid by the primary plan, the total benefits paid or provided by all plans for the claim do not exceed the totalallowable expense for that claim. In addition, the secondary plan will credit to its plan deductible any amounts itwould have credited to its deductible in the absence of other healthcare coverage.If a covered person is enrolled in two or more closed panel plans and if, for any reason, including the provision ofservice by a non-panel provider, benefits are not payable by one closed panel plan, Coordination of Benefitsshall not apply between that plan and other closed panel plans.If the amount of the payments made by this plan is more than it should have paid under this Coordination ofBenefits provision, it may recover the excess from one or more of those paid.Certain facts about healthcare coverage and services are needed to apply these Coordination of Benefits rulesand to determine benefits payable under this plan and other plans. We may give information to or get informationfrom other organizations or persons for the purpose of applying these rules and determining benefits payableunder this plan and other plans covering the person claiming benefits. We need not tell or get the consent of anyperson to do this. Each person claiming benefits under this plan must give us any facts needed to apply thoserules and determine benefits payable.If you believe that we have not paid a claim properly, first try to resolve the problem by contacting us. Also, youmay follow the Grievance and Appeals Procedure below.GRIEVANCE AND APPEAL PROCEDURESNoticeYour plan has been designed carefully to provide you with the maximum amount of covered benefits for yourlevel of payment/premium. Because we are always looking for ways to make our plans and certificates better,your suggestions are encouraged. Occasionally, even after you have reviewed the applicable sections of thiscertificate pertaining to your issue at hand, you may have a question. Your questions may involve dentists,covered services, the agents who sold and service your plan, or our policies or procedures.We must receive your grievance or appeal notice within 60 days after you received your Explanation of Benefits.Failure to give notice within this timeframe will not invalidate or reduce any claim if it can be shown that it was not9

reasonably possible to give notice within the 60 days. However, such notice should always be given as soon asreasonably possible.Informal Claims Appeal ProcedureWe always notify you of a benefit determination after your claim is filed. This notice is made via an Explanation ofBenefits. An adverse benefit determination is any denial, reduction or termination of the benefit for which youfiled a claim or failed to provide or make payment (in whole or in part) of the benefit you sought. This includes adetermination based on eligibility, the administration of covered services, limitations or restrictions, and paymentamount

When you make an appointment with a Paramount Dental dentist, let the office know that you have Paramount Dental, a supplemental dental plan through Paramount Elite Medicare. If your dentist is not familiar with this plan or network or has any questions, they should contact Paramount Dental by calling the toll -free number at 800-727-1444.