Transcription

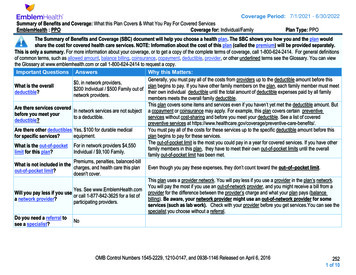

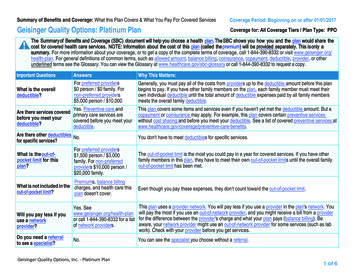

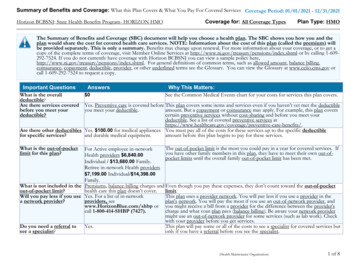

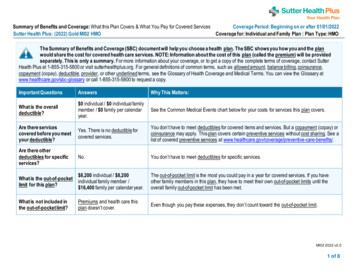

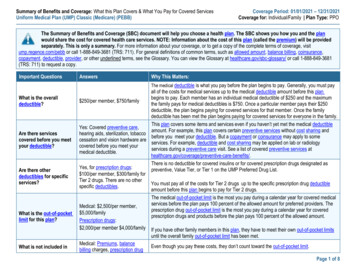

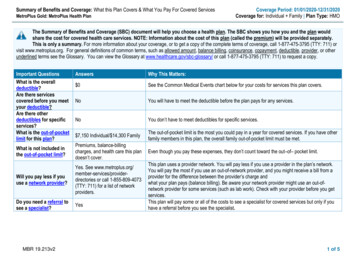

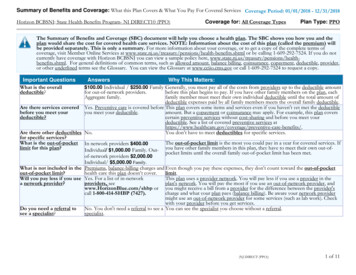

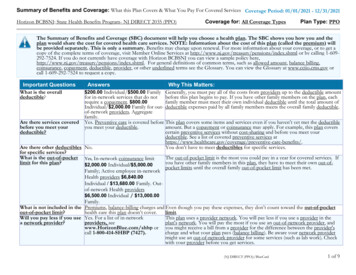

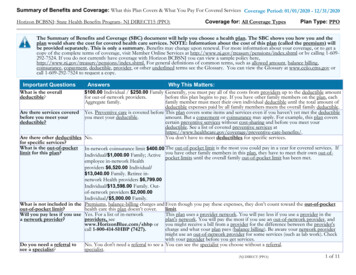

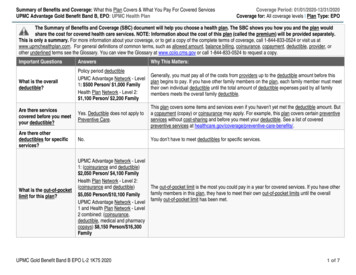

Summary of Benefits and Coverage: What this Plan Covers & What You Pay For Covered ServicesUPMC Advantage Gold Benefit Band B, EPO: UPMC Health PlanCoverage Period: 01/01/2020-12/31/2020Coverage for: All coverage levels Plan Type: EPOThe Summary of Benefits and Coverage (SBC) document will help you choose a health plan. The SBC shows you how you and the plan wouldshare the cost for covered health care services. NOTE: Information about the cost of this plan (called the premium) will be provided separately.This is only a summary. For more information about your coverage, or to get a copy of the complete terms of coverage, call 1-844-833-0524 or visit us atwww.upmchealthplan.com. For general definitions of common terms, such as allowed amount, balance billing, coinsurance, copayment, deductible, provider, orother underlined terms see the Glossary. You can view the Glossary at www.cciio.cms.gov or call 1-844-833-0524 to request a copy.Important QuestionsAnswersWhy This Matters:What is the overalldeductible?Policy period deductibleUPMC Advantage Network - Level1: 500 Person/ 1,000 FamilyHealth Plan Network - Level 2: 1,100 Person/ 2,200 FamilyGenerally, you must pay all of the costs from providers up to the deductible amount before thisplan begins to pay. If you have other family members on the plan, each family member must meettheir own individual deductible until the total amount of deductible expenses paid by all familymembers meets the overall family deductible.Are there servicescovered before you meetyour deductible?Yes. Deductible does not apply toPreventive Care.Are there otherdeductibles for specificservices?This plan covers some items and services even if you haven’t yet met the deductible amount. Buta copayment (copay) or coinsurance may apply. For example, this plan covers certain preventiveservices without cost-sharing and before you meet your deductible. See a list of coveredpreventive services at No.You don’t have to meet deductibles for specific services.What is the out-of-pocketlimit for this plan?UPMC Advantage Network - Level1: (coinsurance and deductible) 2,050 Person/ 4,100 FamilyHealth Plan Network - Level 2:(coinsurance and deductible)The out-of-pocket limit is the most you could pay in a year for covered services. If you have otherfamily members in this plan, they have to meet their own out-of-pocket limits until the overall 5,050 Person/ 10,100 FamilyUPMC Advantage Network - Level family out-of-pocket limit has been met.1 and Health Plan Network - Level2 combined: (coinsurance,deductible, medical and pharmacycopays) 8,150 Person/ 16,300FamilyUPMC Gold Benefit Band B EPO L-2 1K75 20201 of 7

Important QuestionsAnswersWhy This Matters:What is not included inthe out-of-pocket limit?Premium, balance-billed charges(unless balanced billing isprohibited), and health care thisplan doesn't cover.Even though you pay these expenses, they don’t count toward the out-of-pocket limit.Will you pay less if youuse a network provider?Yes. Seewww.upmchealthplan.com or call1-844-833-0524 for a list of innetwork providers.Do you need a referral tosee a specialist?This plan uses a provider network. You will pay less if you use a provider in the plan’s network.You will pay the most if you use an out-of-network provider, and you might receive a bill from aprovider for the difference between the provider’s charge and what your plan pays (balancebilling). Be aware your network provider might use an out-of-network provider for some services(such as lab work). Check with your provider before you get services.No.You can see the specialist you choose without a referral.All copayment and coinsurance costs shown in this chart are after your deductible has been met, if a deductible applies.CommonMedical EventIf you visit a health careprovider’s office orclinicWhat You Will PayParticipating ProviderNon-Participating Provider(You will pay the least)(You will pay the most)Services YouMay NeedPrimary care visitto treat an injuryor illnessSpecialist ic test (xray, blood work)If you have a testImaging (CT/PETscans, MRIs)Limitations, Exceptions, & OtherImportant Information 20 copayment per visitNot coveredNone 50 copayment per visitNot coveredNo costNot coveredNonePlease see your Schedule of Benefitsfor details. You may have to pay forservices that aren’t preventive. Askyour provider if the services you needare preventive. Then check what yourplan will pay for.UPMC Advantage Network - Level 1:10% coinsuranceHealth Plan Network - Level 2: 40%coinsuranceUPMC Advantage Network - Level 1:10% coinsuranceHealth Plan Network - Level 2: 40%coinsuranceNot coveredCertain Diagnostic Services may haveadditional cost sharing. Please seeyour Schedule of Benefits for details.Not coveredNone2 of 7

CommonMedical EventIf you need drugs totreat your illness orconditionMore information aboutprescription drugcoverage is available atwww.upmchealthplan.comIf you have outpatientsurgeryIf you need immediatemedical attentionIf you have a hospitalstayIf you need mentalhealth, behavioralhealth, or substanceabuse servicesIf you are pregnantServices YouMay NeedGeneric drugsPreferred branddrugsNon-preferredbrand drugsWhat You Will PayParticipating ProviderNon-Participating Provider(You will pay the least)(You will pay the most) 20 copayment per prescription(Retail), 40 copayment perNot coveredprescription (Mail order) 50 copayment per prescription(Retail), 100 copayment perNot coveredprescription (Mail order) 100 copayment per prescription(Retail), 200 copayment perNot coveredprescription (Mail order)Limitations, Exceptions, & OtherImportant InformationNoneNoneNoneSpecialty drugs 100 copayment per prescriptionNot coveredFacility fee (e.g.,ambulatorysurgery center)UPMC Advantage Network - Level 1:10% coinsuranceHealth Plan Network - Level 2: 40%coinsurancePlease see your PrescriptionMedication Rider for details.Not coveredNone10% coinsuranceNot coveredNone 150 copayment per visit 150 copayment per visitCopayment waived if admitted.10% coinsurance10% coinsuranceNone 40 copayment per visitUPMC Advantage Network - Level 1:10% coinsuranceHealth Plan Network - Level 2: 40%coinsuranceNot coveredNoneNot coveredPreauthorization may be required. Ifpreauthorization is not obtained,benefits could be denied.10% coinsuranceNot coveredNone 20 copayment per visitNot coveredNoneInpatient services10% coinsuranceNot coveredOffice visits 20 copayment per visitNot coveredPreauthorization may be required. Ifpreauthorization is not obtained,benefits could be denied.Physician/surgeon feesEmergency roomcareEmergencymedicaltransportationUrgent careFacility fee (e.g.,hospital room)Physician/surgeon feesOutpatientservices3 of 7

CommonMedical EventServices YouMay rth/deliveryfacility servicesHome health careRehabilitationservicesHabilitationIf you need helpservicesrecovering or have otherspecial health needsSkilled nursingcareDurable medicalequipmentIf your child needsdental or eye careHospice servicesChildren’s eyeexamChildren’s glassesChildren’s dentalcheck-upWhat You Will PayParticipating ProviderNon-Participating Provider(You will pay the least)(You will pay the most)10% coinsuranceUPMC Advantage Network - Level 1:10% coinsuranceHealth Plan Network - Level 2: 40%coinsuranceUPMC Advantage Network - Level 1:10% coinsuranceHealth Plan Network - Level 2: 40%coinsuranceNot coveredNot coveredNot coveredUPMC Advantage Network - Level 1: 25 copayment per visitHealth Plan Network - Level 2: 40%coinsuranceNot coveredUPMC Advantage Network - Level 1: 25 copayment per visitHealth Plan Network - Level 2: 40%coinsuranceNot coveredUPMC Advantage Network - Level 1:10% coinsuranceHealth Plan Network - Level 2: 40%coinsuranceNot coveredUPMC Advantage Network - Level 1:10% coinsuranceHealth Plan Network - Level 2: 40%coinsurance10% coinsuranceLimitations, Exceptions, & OtherImportant InformationDepending on the type of services,other cost shares may apply. Maternitycare may include tests and servicesdescribed elsewhere in the SBC (i.e.,ultrasound). Office visit cost shareapplies to first visit only.NonePhysical, Occupational and SpeechTherapy: Limited to the greater of: 60consecutive days of coverage OR 25visits per condition, per Benefit Period,for all three therapies combined.Physical, Occupational and SpeechTherapy: Limited to the greater of: 60consecutive days of coverage OR 25visits per condition, per Benefit Period,for all three therapies combined.Covered up to 100 days per BenefitPeriod. Non-Hospital services will becovered at the UPMC AdvantageNetwork cost-share. Preauthorizationmay be required. If preauthorization isnot obtained, benefits could be denied.Not coveredPhysician Services will be covered atthe UPMC Advantage Network costshare.Not coveredNoneNot coveredNot coveredNoneNot coveredNot coveredNoneNot coveredNot coveredNone4 of 7

Excluded Services & Other Covered Services:Services Your Plan Generally Does NOT Cover (Check your policy or plan document for more information and a list of any other excludedservices.) Cosmetic surgery Long-term care Routine eye care (Adult) Dental care (Adult) Hearing aids Non-emergency care when traveling outsidethe U.S. Weight loss programsOther Covered Services (Limitations may apply to these services. This isn’t a complete list. Please see your plan document.) Acupuncture only covered for specific Chiropractic care covered with limitations Private-duty nursing subject to medical reviewdiagnosis Infertility treatment Routine foot care only covered for specific Bariatric surgery subject to medical reviewdiagnosisYour Rights to Continue Coverage: There are agencies that can help if you want to continue your coverage after it ends. The contact information for thoseagencies is: 1-877-881-6388 for the state insurance department, Department of Labor’s Employee Benefits Security Administration at 1-866-444-EBSA (3272) orwww.dol.gov/ebsa/healthreform or the insurer at 1-844-833-0524. Other coverage options may be available to you too, including buying individual insurancecoverage through the Health Insurance Marketplace. For more information about the Marketplace, visit www.HealthCare.gov or call 1-800-318-2596.Your Grievance and Appeals Rights: There are agencies that can help if you have a complaint against your plan for a denial of a claim. This complaint is called agrievance or appeal. For more information about your rights, look at the explanation of benefits you will receive for that medical claim. Your plan documents alsoprovide complete information to submit a claim, appeal, or a grievance for any reason to your plan. For more information about your rights, this notice, or assistance,contact: your plan at 1-844-833-0524 or Department of Labor’s Employee Benefits Security Administration at 1-866-444-EBSA (3272) orwww.dol.gov/ebsa/healthreform. Additionally, a consumer assistance program can help you file your appeal. Contact 1-877-881-6388.Does this plan provide Minimum Essential Coverage? Yes.If you don’t have Minimum Essential Coverage for a month, you’ll have to make a payment when you file your tax return unless you qualify for an exemption from therequirement that you have health coverage for that month.Does this plan meet Minimum Value Standards? Yes.If your plan doesn’t meet the Minimum Value Standards, you may be eligible for a premium tax credit to help you pay for a plan through the Marketplace.Language Access Services:Spanish (Español): Para obtener asistencia en Español, llame al 1-844-833-0524.Tagalog (Tagalog): Kung kailangan ninyo ang tulong sa Tagalog tumawag sa 1-844-833-0524.Chinese (中文): �1-844-833-0524.Navajo (Dine): Dinek'ehgo shika at'ohwol ninisingo, kwiijigo holne' 1-844-833-0524.5 of 7

�–––––To see examples of how this plan might cover costs for a sample medical situation, see the next ––––––––6 of 7

About these Coverage Examples:This is not a cost estimator. Treatments shown are just examples of how this plan might cover medical care. Your actual costs will bedifferent depending on the actual care you receive, the prices your providers charge, and many other factors. Focus on the cost sharingamounts (deductibles, copayments and coinsurance) and excluded services under the plan. Use this information to compare the portion ofcosts you might pay under different health plans. Please note these coverage examples are based on self-only coverage.Peg is Having a Baby(9 months of in-network pre-natal care and ahospital delivery) The plan’s overall deductible Specialist Hospital (facility) Other coinsurance 500 5010%10%This EXAMPLE event includes services like:Specialist office visits (prenatal care)Childbirth/Delivery Professional ServicesChildbirth/Delivery Facility ServicesDiagnostic tests (ultrasounds and blood work)Specialist visit (anesthesia)Total Example CostIn this example, Peg would pay:Cost SharingDeductiblesCopaymentsCoinsuranceWhat isn’t coveredLimits or exclusionsThe total Peg would pay is 12,840 500 120 1,240 60 1,920Managing Joe’s type 2 Diabetes(a year of routine in-network care of a wellcontrolled condition) The plan’s overall deductible Specialist Hospital (facility) Other coinsurance 500 5010%10%This EXAMPLE event includes services like:Primary care physician office visits (includingdisease education)Diagnostic tests (blood work)Prescription drugsDurable medical equipment (glucose meter)Total Example CostIn this example, Joe would pay:Cost SharingDeductiblesCopaymentsCoinsuranceWhat isn’t coveredLimits or exclusionsThe total Joe would pay is 7,460 120 3,230 10 60 3,420Mia’s Simple Fracture(in-network emergency room visit and follow upcare) The plan’s overall deductible Specialist Hospital (facility) Other coinsurance 500 5010%10%This EXAMPLE event includes services like:Emergency room care (including medicalsupplies)Diagnostic test (x-ray)Durable medical equipment (crutches)Rehabilitation services (physical therapy)Total Example CostIn this example, Mia would pay:Cost SharingDeductiblesCopaymentsCoinsuranceWhat isn’t coveredLimits or exclusionsThe total Mia would pay is 2,010 500 700 90 0 1,2907 of 7

Nondiscrimination NoticeUPMC Health Plan1 complies with applicable federal civil rights laws and does not discriminate on the basis of race, color, national origin, age,disability, or sex. UPMC Health Plan does not exclude people or treat them differently because of race, color, national origin, age, disability, orsex.UPMC Health Plan: Provides free aids and services to people with disabilities so that they can communicate effectively with us, such as:ooQualified sign language interpreters.Written information in other formats (large print, audio, accessible electronic formats, other formats). Provides free language services to people whose primary language is not English, such as:ooQualified interpreters.Information written in other languages.If you need these services, contact the Member Services phone number listed on the back of your member ID card.If you believe that UPMC Health Plan has failed to provide these services or has discriminated in another way on the basis of race, color, nationalorigin, age, disability, or sex, you can file a complaint with:Complaints and GrievancesPO Box 2939Pittsburgh, PA 15230-2939Phone: 1-844-755-5611 (TTY: 711)Fax: 1-412-454-5964Email: HealthPlanCompliance@upmc.eduYou can file a civil rights complaint with the U.S. Department of Health and Human Services, Office for Civil Rights electronically through theOffice for Civil Rights Complaint Portal, available at https://ocrportal.hhs.gov/ocr/portal/lobby.jsf, or by mail or phone at U.S. Department ofHealth and Human Services, 200 Independence Avenue SW., Room 509F, HHH Building, Washington, DC 20201, 1-800-368-1019. TTY/TDD usersshould call 1-800-537-7697.

Complaint forms are available at www.hhs.gov/ocr/office/file/index.html.UPMC Health Plan is the marketing name used to refer to the following companies, which are licensed to issue individual and group healthinsurance products or which provide third party administration services for group health plans: UPMC Health Network Inc., UPMC HealthOptions Inc., UPMC Health Coverage Inc., UPMC Health Plan Inc., UPMC Health Benefits Inc., UPMC for You Inc., and/or UPMC BenefitManagement Services Inc.1Translation ServicesATENCIÓN: si habla español, tiene a su disposición servicios gratuitos de asistencia lingüística. Llame al 1-866-420-9589(TTY: 以免費獲得語言援助服務。請致電 1-866-420-9589(TTY:711)。CHÚ Ý: Nếu bạn nói Tiếng Việt, có các dịch vụ hỗ trợ ngôn ngữ miễn phí dành cho bạn. Gọi số1-866-420-9589 (TTY: 711).ВНИМАНИЕ: Если вы говорите на русском языке, то вам доступны бесплатные услуги перевода. Звоните 1-866-420-9589 (телетайп: 711).Wann du Deitsch (Pennsylvania German / Dutch)] schwetzscht, kannscht du mitaus Koschte ebber gricke, ass dihr helft mit die englischSchprooch. Ruf selli Nummer uff: Call 1-866-420-9589(TTY: 711).주의: 한국어를 사용하시는 경우, 언어 지원 서비스를 무료로 이용하실 수 있습니다.1-866-420-9589 (TTY: 711)번으로 전화해 주십시오.ATTENZIONE: In caso la lingua parlata sia l'italiano, sono disponibili servizi di assistenza linguistica gratuiti. Chiamare il numero 1-866-420-9589(TTY: 711).(711: )رﻗم ھﺎﺗف اﻟﺻم واﻟﺑﻛم 1-866-420-9589 اﺗﺻل ﺑرﻗم . ﻓﺈن ﺧدﻣﺎت اﻟﻣﺳﺎﻋدة اﻟﻠﻐوﯾﺔ ﺗﺗواﻓر ﻟك ﺑﺎﻟﻣﺟﺎن ، إذا ﻛﻧت ﺗﺗﺣدث اذﻛر اﻟﻠﻐﺔ : ﻣﻠﺣوظﺔ ATTENTION : Si vous parlez français, des services d'aide linguistique vous sont proposés gratuitement. Appelez le 1-866-420-9589 (ATS : 711).

ACHTUNG: Wenn Sie Deutsch sprechen, stehen Ihnen kostenlos sprachliche Hilfsdienstleistungen zur Verfügung. Rufnummer: 1-866-420-9589(TTY: 711). ુચના: જો તમે ુજરાતી બોલતા હો, તો િ ન: ુલ્ક ભાષા સહાય સેવાઓ તમારા માટ ઉપલબ્ધ છે . ફોન કરો 1-866-420-9589 (TTY: 711).UWAGA: Jeżeli mówisz po polsku, możesz skorzystać z bezpłatnej pomocy językowej. Zadzwoń pod numer 1-866-420-9589 (TTY: 711).ATANSYON: Si w pale Kreyòl Ayisyen, gen sèvis èd pou lang ki disponib gratis pou ou. Rele1-866-420-9589 (TTY: 711).្របយ័ត ៖ េបើសិន អ កនិ យ ែខ រ, េស ជំនួយែផ ក េ យមិនគិតឈ ល គឺ ច នសំ ប់បំេ រ អ ក។ ចូ រ ទូ រស័ព 1-866-420-9589(TTY: 711)។ATENÇÃO: Se fala português, encontram-se disponíveis serviços linguísticos, grátis. Ligue para1-866-420-9589 (TTY: 711).

Summary of Benefits and Coverage: What this Plan Covers & What You Pay For Covered Services Coverage Period: 01/01/2020-12/31/2020 UPMC Advantage Gold Benefit Band B, EPO: UPMC Health Plan Coverage for: All coverage levels Plan Type: EPO UPMC Gold Benefit Band B EPO L -2 1K75 2020 1 of 7 The Summary of Benefits and Coverage (SBC) document will help you choose a health plan.