Transcription

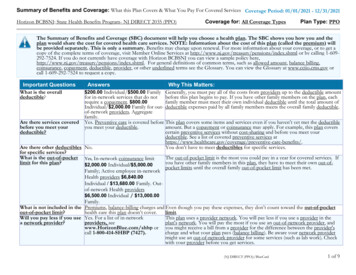

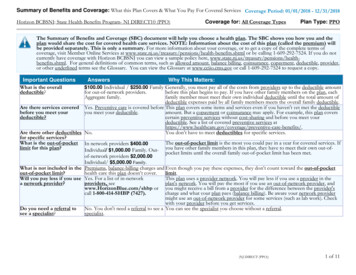

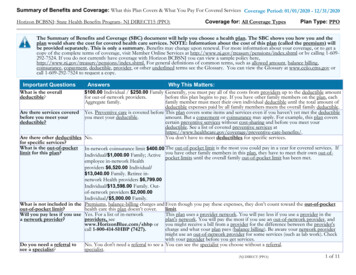

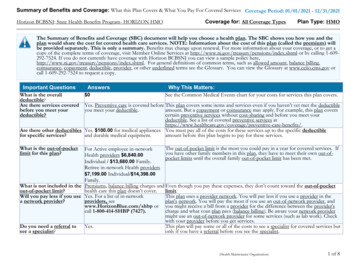

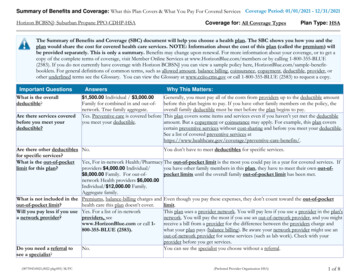

Summary of Benefits and Coverage: What this Plan Covers & What You Pay For Covered Services Coverage Period: 01/01/2021 - 12/31/2021Horizon BCBSNJ: Suburban Propane PPO-CDHP-HSACoverage for: All Coverage TypesPlan Type: HSAThe Summary of Benefits and Coverage (SBC) document will help you choose a health plan. The SBC shows you how you and theplan would share the cost for covered health care services. NOTE: Information about the cost of this plan (called the premium) willbe provided separately. This is only a summary. Benefits may change upon renewal. For more information about your coverage, or to get acopy of the complete terms of coverage, visit Member Online Services at www.HorizonBlue.com/members or by calling 1-800-355-BLUE(2583). If you do not currently have coverage with Horizon BCBSNJ you can view a sample policy here, HorizonBlue.com/sample-benefitbooklets. For general definitions of common terms, such as allowed amount, balance billing, coinsurance, copayment, deductible, provider, orother underlined terms see the Glossary. You can view the Glossary at www.cciio.cms.gov or call 1-800-355-BLUE (2583) to request a copy.Important QuestionsWhat is the overalldeductible?Are there services coveredbefore you meet yourdeductible?Answers 1,500.00 Individual / 3,000.00Family for combined in and out-ofnetwork. True family aggregate.Yes. Preventive care is covered beforeyou meet your deductible.Why This Matters:Generally, you must pay all of the costs from providers up to the deductible amountbefore this plan begins to pay. If you have other family members on the policy, theoverall family deductible must be met before the plan begins to pay.This plan covers some items and services even if you haven’t yet met the deductibleamount. But a copayment or coinsurance may apply. For example, this plan coverscertain preventive services without cost-sharing and before you meet your deductible.See a list of covered preventive services are-benefits/.Are there other deductibles No.You don’t have to meet deductibles for specific services.for specific services?What is the out-of-pocket Yes, For in-network Health/Pharmacy The out-of-pocket limit is the most you could pay in a year for covered services. Iflimit for this plan?providers 4,000.00 Individual/you have other family members in this plan, they have to meet their own out-of 8,000.00 Family. For out-ofpocket limits until the overall family out-of-pocket limit has been met.network Health providers 6,000.00Individual/ 12,000.00 Family.Aggregate family.What is not included in the Premiums, balance-billing charges and Even though you pay these expenses, they don’t count toward the out-of-pocketout-of-pocket limit?health care this plan doesn’t cover.limit.Will you pay less if you use Yes. For a list of in-networkThis plan uses a provider network. You will pay less if you use a provider in the plan'sa network provider?providers, seenetwork. You will pay the most if you use an out-of-network provider, and you mightwww.HorizonBlue.com or call 1receive a bill from a provider for the difference between the providers charge and800-355-BLUE (2583).what your plan pays (balance billing). Be aware your network provider might use anout-of-network provider for some services (such as lab work). Check with yourprovider before you get services.Do you need a referral toNo.You can see the specialist you choose without a referral.see a specialist?(0075943:0021,0022 pkg:001) M/FC(Preferred Provider Organization HSA)1 of 8

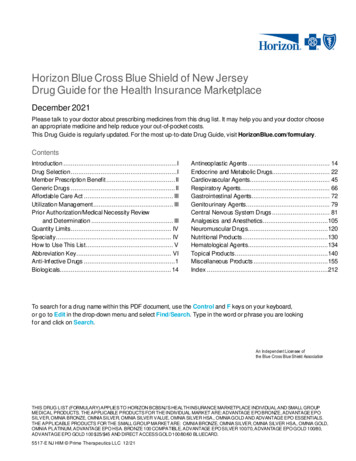

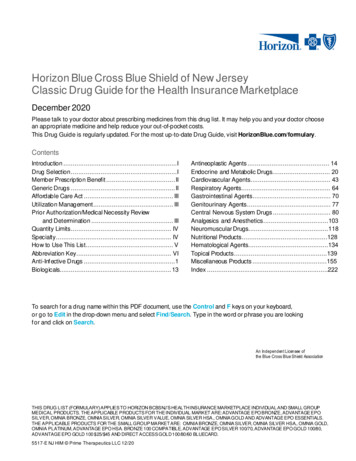

All copayment and coinsurance costs shown in this chart are after your deductible has been met, if a deductible applies.CommonMedical EventServices You May NeedIf you visit a healthPrimary care visit to treat ancare provider’s office injury or illnessor clinicSpecialist visitPreventivecare/screening/immunizationIf you have a testIf you need drugs totreat your illness orconditionWhat You Will PayLimitations, Exceptions, & OtherNetwork ProviderOut-of-NetworkImportant Information(You will pay theProvider(You will payleast)the most)20% Coinsurance.40% Coinsurance.Horizon CareOnline telemedicineservices is an additional telemedicinefeature provided through Horizon20% Coinsurance.40% Coinsurance.BCBSNJ's telemedicine vendor.No Charge,40% Coinsurance.One per calendar year. You may haveDeductible does not apply.to pay for services that aren'tpreventive. Ask your provider if theservices needed are preventive. Thencheck what your plan will pay for.Diagnostic test (x-ray, bloodwork)20% Coinsurance forOffice, OutpatientHospital, IndependentLaboratory.Imaging (CT/PET scans, MRIs) 20% Coinsurance forOutpatient Hospital.40% Coinsurance forOffice, OutpatientHospital, IndependentLaboratory.40% Coinsurance forOutpatient Hospital.Applies only to non-routine diagnosticradiology, laboratory, and pathologyservices.Generic drugs20% Coinsurance afterdeductible for retail andmail order.40% Coinsurance afterdeductible for retail; mailorder through ExpressScripts only.Preferred brand drugs20% Coinsurance afterdeductible for retail andmail order.40% Coinsurance afterdeductible for retail; mailorder through ExpressScripts only.Non-preferred brand drugs20% Coinsurance afterdeductible for retail andmail order.40% Coinsurance afterdeductible for retail; mailorder through ExpressScripts only.Specialty drugsCovered at mail orderbenefit level in aboveNot CoveredPrior authorization may be required.You pay the difference in costs if yourequest a brand name drug instead of itsgeneric equivalent drug. Your planrequires mandatory mail order formaintenance drugs, or you can useWalgreens. After a prescription is filled2 times at a non-Walgreens retailpharmacy, 100% retail coinsuranceapplies. For Out-of-Networkprescription (Rx), the plan willreimburse only the amount it wouldhave paid a participating pharmacy lessthe applicable deductible andcoinsurance. Not all drugs are covered* For more information about limitations and exceptions, see the plan or policy document atwww.HorizonBlue.com/members.none2 of 8

CommonMedical EventIf you haveoutpatient surgeryServices You May NeedFacility fee (e.g., ambulatorysurgery center)Physician/surgeon feesIf you needimmediate medicalattentionEmergency room careEmergency medicaltransportationUrgent careIf you have ahospital stayFacility fee (e.g., hospital room)Physician/surgeon feesIf you need mentalhealth, behavioralhealth, or substanceabuse servicesOutpatient servicesIf you are pregnantOffice visitsInpatient servicesWhat You Will PayNetwork ProviderOut-of-Network(You will pay theProvider(You will payleast)the most)applicable tiers.20% Coinsurance for40% Coinsurance forOutpatient Hospital,Outpatient Hospital,Ambulatory SurgicalAmbulatory SurgicalCenter.Center.20% Coinsurance for40% Coinsurance forOutpatient Hospital,Outpatient Hospital,Ambulatory SurgicalAmbulatory SurgicalCenter.Center.20% Coinsurance for20% Coinsurance forOutpatient Hospital.Outpatient Hospital.20% Coinsurance.20% Coinsurance.20% Coinsurance forOffice.20% Coinsurance forInpatient Hospital.20% Coinsurance forInpatient Hospital.40% Coinsurance forOffice.40% Coinsurance forInpatient Hospital.40% Coinsurance forInpatient Hospital.20% Coinsurance forOutpatient Hospital.20% Coinsurance forInpatient Hospital.40% Coinsurance forOutpatient Hospital.40% Coinsurance forInpatient Hospital.20% Coinsurance forOffice.40% Coinsurance forOffice.Childbirth/delivery professional 20% Coinsurance.servicesChildbirth/delivery facility20% Coinsurance forservicesInpatient Hospital.40% Coinsurance.40% Coinsurance forInpatient Hospital.* For more information about limitations and exceptions, see the plan or policy document atwww.HorizonBlue.com/members.Limitations, Exceptions, & OtherImportant Informationunder the plan.none20% Coinsurance for in-networkanesthesia. 40% Coinsurance for outof-network anesthesia.Payment at the in-network level ofbenefits applies only to true medicalemergencies and accidental injuries.Ambulance is not covered for nonemergent diagnosisnoneRequires pre-approval; 50% cut backpenalty applies for non-compliance.20% Coinsurance for in-networkanesthesia. 40% Coinsurance for outof-network anesthesia.noneRequires pre-approval; 50% cut backpenalty applies for non-compliance.Cost sharing does not apply forpreventive services. Maternity care mayinclude tests and services describedelsewhere in the SBC (i.e. Ultrasound.)nonenone3 of 8

CommonMedical EventIf you need helprecovering or haveother special healthneedsServices You May NeedHome health careRehabilitation servicesHabilitation servicesSkilled nursing careDurable medical equipmentIf your child needsdental or eye careWhat You Will PayLimitations, Exceptions, & OtherNetwork ProviderOut-of-NetworkImportant Information(You will pay theProvider(You will payleast)the most)20% Coinsurance.40% Coinsurance.Requires pre-approval; 50% cut backpenalty applies for non-compliance. Innetwork & Out-of-network homehealth care visit limit is limited to 40visits.20% Coinsurance for40% Coinsurance forRequires pre-approval; 50% cut backInpatient Hospital.Inpatient Hospital.penalty applies for non-compliance.20% Coinsurance for40% Coinsurance forInpatient Hospital.Inpatient Hospital.20% Coinsurance for40% Coinsurance forRequires pre-approval; 50% cut backInpatient Facility.Inpatient Facility.penalty applies for non-compliance. Innetwork & Out-of-network inpatientskilled nursing facility day limit islimited to 60 days.20% Coinsurance.40% Coinsurance.Prior authorization required for DMEpurchases over 500. 50% cut-backpenalty applies for non-compliance.Insulin pumps and the associatedsupplies are covered under the medicalplan. All other diabetic supplies such asinsulin, syringes, lancets and test stripsare covered under the prescription (Rx)plan.Hospice services20% Coinsurance forInpatient Facility.40% Coinsurance forInpatient Facility.Children’s eye examChildren’s glassesChildren’s dental check-upNot CoveredNot CoveredNot CoveredNot CoveredNot CoveredNot Covered* For more information about limitations and exceptions, see the plan or policy document atwww.HorizonBlue.com/members.Diabetic Shoes are covered.Requires pre-approval; 50% cut backpenalty applies for non-compliance. Innetwork & Out-of-network hospice daylimit is limited to 180 days per lifetime.nonenonenone4 of 8

Excluded Services & Other Covered Services:Services Your Plan Generally Does NOT Cover (Check your policy or plan document for more information and a list of any other excludedservices.) Cosmetic Surgery Hearing Aids Routine foot care Dental care (Adult) Long Term Care Weight Loss Programs Routine eye care (Adult)Other Covered Services (Limitations may apply to these services. This isn’t a complete list. Please see your plan document.) Acupuncture Bariatric surgery Chiropractic careInfertility treatment (Diagnostic Only) Most coverage provided outside the UnitedStates. See www.HorizonBlue.com * For more information about limitations and exceptions, see the plan or policy document atwww.HorizonBlue.com/members.Non-emergency care when traveling outsidethe U.S. See www.HorizonBlue.comPrivate-duty nursing5 of 8

Your Rights to Continue Coverage:There are agencies that can help if you want to continue your coverage after it ends. The contact information for those agencies is: Department of Labor'sEmployee Benefits Security Administration at 1-866-444-EBSA (3272) or www.dol.gov/ebsa/healthreform. Other coverage options may be available toyou, too, including buying individual insurance coverage through the Health Insurance Marketplace. For more information about the Marketplace, visitwww.HealthCare.gov or call 1-800-318-2596.Your Grievance and Appeals Rights:There are agencies that can help if you have a complaint against your plan for a denial of a claim. This complaint is called a grievance or appeal. For moreinformation about your rights, look at the explanation of benefits you will receive for that medical claim. Your plan documents also provide completeinformation to submit a claim, appeal, or a grievance for any reason to your plan. For more information about your rights, this notice, or assistance,contact: 1-800-355-BLUE (2583) or visit www.Horizonblue.com. You may also contact the Department of Labor’s Employee Benefits SecurityAdministration at 1-866-444-EBSA (3272) or www.dol.gov/ebsa/healthreform. You may also contact the NJ Department of Banking and InsuranceConsumer Protection Services at 1-888-393-1062 ext 50998.Does this plan provide Minimum Essential Coverage? YesMinimum Essential Coverage generally includes plans, health insurance available through the Marketplace or other individual market policies, Medicare,Medicaid, CHIP, TRICARE, and certain other coverage. If you are eligible for certain types of Minimum Essential Coverage, you may not be eligible forthe premium tax credit.Does this plan meet the Minimum Value Standards? YesIf your plan doesn’t meet the Minimum Value Standards, you may be eligible for a premium tax credit to help you pay for a plan through the ---To see examples of how this plan might cover costs for a sample medical situation, see the next ---* For more information about limitations and exceptions, see the plan or policy document atwww.HorizonBlue.com/members.6 of 8

About these Coverage Examples:This is not a cost estimator. Treatments shown are just examples of how this plan might cover medical care. Your actual costs willbe different depending on the actual care you receive, the prices your providers charge, and many other factors. Focus on the costsharing amounts (deductibles, copayments and coinsurance) and excluded services under the plan. Use this information to comparethe portion of costs you might pay under different health plans. Please note these coverage examples are based on self-only coverage.Managing Joe’s type 2 Diabetes(a year of routine in-network care of awell-controlled condition)Peg is Having a Baby(9 months of in-network pre-natal careand a hospital delivery) The plan’s overall deductible 1,500.00Specialist Copayment 0.00Hospital (facility) Coinsurance20%Other Coinsurance20%This EXAMPLE event includes services like:Specialist office visits (prenatal care)Childbirth/Delivery Professional ServicesChildbirth/Delivery Facility ServicesDiagnostic tests (ultrasounds and blood work)Specialist visit (anesthesia)Total Example CostIn this example, Peg would pay:Cost SharingDeductiblesCopaymentsCoinsuranceWhat isn’t coveredLimits or exclusionsThe total Peg would pay is 12,700.00 1,500.00 0.00 2,220.00 70.00 3,770.00 The plan’s overall deductible 1,500.00Specialist Copayment 0.00Hospital (facility) Coinsurance20%Other Coinsurance20%This EXAMPLE event includes services like:Primary care physician office visits (including diseaseeducation)Diagnostic tests (blood work)Prescription drugsDurable medical equipment (glucose meter)Total Example CostIn this example, Joe would pay:Cost SharingDeductiblesCopaymentsCoinsuranceWhat isn’t coveredLimits or exclusionsThe total Joe would pay is 5,600.00 1,100.00 0.00 0.00 4,300.00 5,400.00Mia’s Simple Fracture(in-network emergency room visit andfollow up care) The plan’s overall deductible 1,500.00Specialist Copayment 0.00Hospital (facility) Coinsurance20%Other Coinsurance20%This EXAMPLE event includes services like:Emergency room care (including medical supplies)Diagnostic test (x-ray)Durable medical equipment (crutches)Rehabilitation services (physical therapy)Total Example CostIn this example, Mia would pay:Cost SharingDeductiblesCopaymentsCoinsuranceWhat isn’t coveredLimits or exclusionsThe total Mia would pay is 2,800.00 1,500.00 0.00 300.00 10.00 1,810.00The plan would be responsible for the other costs of these EXAMPLE covered services.* For more information about limitations and exceptions, see the plan or policy document atwww.HorizonBlue.com/members.7 of 8

* For more information about limitations and exceptions, see the plan or policy document atwww.HorizonBlue.com/members.8 of 8

Summary of Benefits and Coverage: Coverage Period: 01/01/2021 What this Plan Covers & What You Pay For Covered Services - 12/31/2021 Horizon BCBSNJ: Suburban Propane PPO-CDHP-HSA Coverage for: All Coverage Types Plan Type: HSA 1(0075943:0021,0022 pkg:001) M/FC (Preferred Provider Organization HSA) of 8 The Summary of Benefits and Coverage (SBC) document will help you choose a health plan.