Transcription

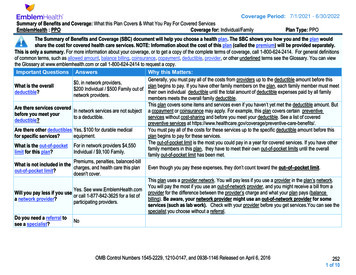

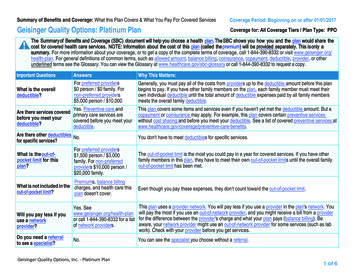

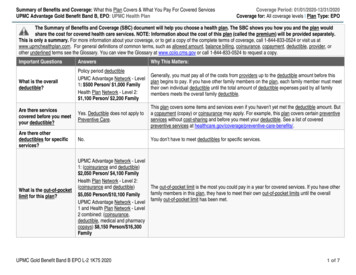

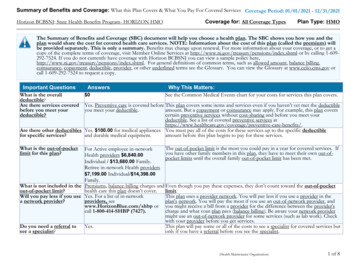

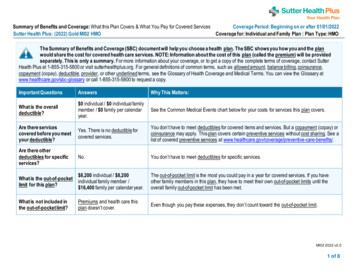

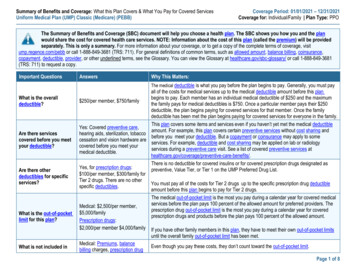

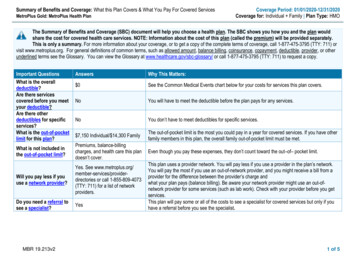

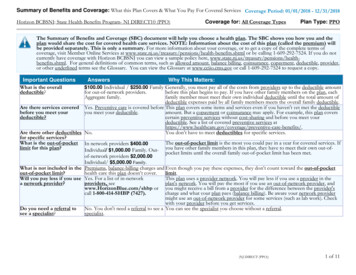

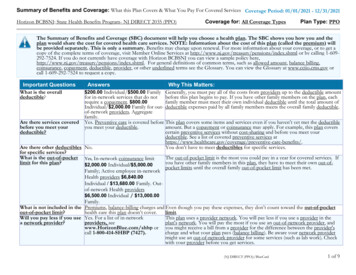

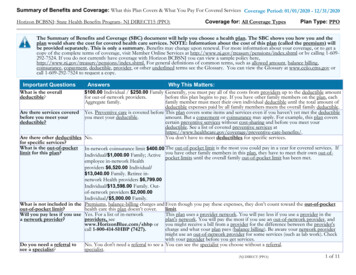

Summary of Benefits and Coverage: What this Plan Covers & What You Pay For Covered Services Coverage Period: 01/01/2022 - 12/31/2022Horizon BCBSNJ: Hackensack Meridian HealthCoverage for: All Coverage TypesPlan Type: EPOThe Summary of Benefits and Coverage (SBC) document will help you choose a health plan. The SBC shows you how you and theplan would share the cost for covered health care services. NOTE: Information about the cost of this plan (called the premium) willbe provided separately. This is only a summary. Benefits may change upon renewal. For more information about your coverage, or to get acopy of the complete terms of coverage, visit Member Online Services at www.HorizonBlue.com/HMH or by calling 1-844-383-2327. If you do notcurrently have coverage with Horizon BCBSNJ you can view a sample policy here, HorizonBlue.com/sample-benefit-booklets. For general definitions ofcommon terms, such as allowed amount, balance billing, coinsurance, copayment, deductible, provider, or other underlined terms see the Glossary. Youcan view the Glossary at www.cciio.cms.gov or call 1-844-383-2327 to request a copy.Important Questions AnswersWhat is the overall 0 for Inner Circle Prime. 500.00deductible?Individual/ 1,000.00 Family for InnerCircle providers. 1,500.00 Individual/ 3,000.00 Family for OMNIA Tier 1providers. 2,000.00 Individual/ 4,000.00 Family for Tier 2 providers.Aggregate family.Are there servicesYes. Preventive care is covered beforecovered before you meet you meet your deductible.your deductible?Why This Matters:Generally, you must pay all of the costs from providers up to the deductible amountbefore this plan begins to pay. If you have other family members on the plan, eachfamily member must meet their own individual deductible until the total amount ofdeductible expenses paid by all family members meets the overall family deductible.This plan covers some items and services even if you haven’t yet met the deductibleamount. But a copayment or coinsurance may apply. For example, this plan coverscertain preventive services without cost-sharing and before you meet your deductible.See a list of covered preventive services are-benefits/.You don’t have to meet deductibles for specific services.Are there otherNo.deductibles for specificservices?What is the out-of-pocket For Health/Pharmacy Inner CircleThe out-of-pocket limit is the most you could pay in a year for covered services. If youlimit for this plan?Prime providers 1,000.00 Individual/ have other family members in this plan, they have to meet their own out-of-pocket 2,000.00 Family. Forlimits until the overall family out-of-pocket limit has been met.Health/Pharmacy Inner Circle providers 2,000.00 Individual/ 4,000.00 Family.For Health/Pharmacy OMNIA Tier 1providers 4,000.00 Individual/ 8,000.00 Family. For Health Tier 2providers 5,000.00 Individual/ 10,000.00 Family. Aggregate family.What is not included in Premiums, balance-billing charges,Even though you pay these expenses, they don’t count toward the out-of-pocket limit.the out-of-pocket limit? penalties for failure to obtain preauthorization for services, and healthcare this plan doesn’t cover.(0076321:0000-0035 pkg:001) M/PM(OMNIA)\BlueCard1 of 11

Will you pay less if you Yes. For a list of in-network providers,use a network provider? see www.HorizonBlue.com/hmh or call1-844-383-2327. Benefits provided byin-network providers other than InnerCircle Prime, Inner Circle and OMNIATier 1 providers are at the Tier 2 level ofbenefits, such as Tier 2 and BlueCardPPO providers.You pay the least if you use an Inner Circle Prime and Inner Circle provider. You paymore if you use an OMNIA Tier 1 or Tier 2 provider. You will pay the most if you usean out-of-network provider, and you might receive a bill from a provider for thedifference between the provider's charge and what your plan pays (balance billing). Beaware your network provider might use an out-of-network provider for some services(such as lab work). Check with your provider before you get services.Do you need a referral to No.see a specialist?You can see the specialist you choose without a referral.All copayment and coinsurance costs shown in this chart are after your deductible has been met, if a deductible applies.What You Will PayCommon Services You MayNeedMedicalEventIf you visit ahealthcareprovider’sofficeor clinicYour Cost IfYour Cost IfYou Use anYou Use anInner CircleInner CirclePrime Provider Provider (you(you will pay the will pay more)least)Limitations,Exceptions, & OtherYour Cost IfYour Cost If Your Cost IfImportant InformationYou Use an You Use a Tier You Use anOMNIA Tier 1 2 Provider (You Out-ofProvider (You will pay more) networkwill pay more)Provider (Youwill pay themost) 50.00 Copayment 50% Coinsurance. Not Covered.noneper visit.Deductible doesnot apply.Primary care visit to No Charge.treat an injury orillness 5.00 Copaymentper visit.Specialist visitNo Charge. 15.00 Copayment 100.00 Copayment 50% Coinsurance. Not Covered.per visit.per visit.Deductible doesnot apply.Preventive care/screening/immunizationNo Charge.No Charge.No Charge.Deductible doesnot apply.No Charge.Deductible doesnot apply.* For more information about limitations and exceptions, see the plan or policy document atwww.HorizonBlue.com/members.Not Covered.One per calendar year. Youmay have to pay forservices that aren'tpreventive. Ask yourprovider if the servicesneeded are preventive.2 of 11

What You Will PayCommon Services You MayNeedMedicalEventYour Cost IfYour Cost IfYou Use anYou Use anInner CircleInner CirclePrime Provider Provider (you(you will pay the will pay more)least)Limitations,Exceptions, & OtherYour Cost IfYour Cost If Your Cost IfImportant InformationYou Use an You Use a Tier You Use anOMNIA Tier 1 2 Provider (You Out-ofProvider (You will pay more) networkwill pay more)Provider (Youwill pay themost)Then check what your planwill pay for.If you have a Diagnostic test (x-ray, No Charge fortestblood work)Office, OutpatientHospital,IndependentLaboratory.10% Coinsurancefor Office,OutpatientHospital,IndependentLaboratory.No Charge for10% CoinsuranceOutpatientfor OutpatientHospital.Hospital. 5 Copay (30 day) 5 Copay (30 day) 10 Copay (90 day) 10 Copay (90 day)30% Coinsurance 50% Coinsurance Not Covered.for Office,for ,OutpatientOutpatientHospital.Hospital.Imaging (CT/PET30% Coinsurance 50% Coinsurance Not Covered.scans, MRIs)for Outpatientfor OutpatientHospital.Hospital.If you need Generic drugs 10 Copay – Retail 10 Copay – Retail Not Covered.drugs to 25 Copay – Mail 25 Copay – Mailtreat yourOrder. Deductible Order. Deductibleillness ordoes not apply.does not apply.conditionPreferred brand drugs 25 Copay (30 day) 25 Copay (30 day) 30%30%Not Covered. 50 Copay (90 day) 50 Copay (90 day) (Min 35/Max(Min 35/Max 100 – Retail) 100 – Retail)(Min 80/Max(Min 80/Max 200 – Mail Order). 200 – MailDeductible doesOrder). Deductiblenot apply.does not apply.Non-preferred brand 50 Copay (30 day) 50 Copay (30 day) 30%30%Not Covered.drugs 100 Copay (90 100 Copay (90(Min 55/Max(Min 55/Maxday)day) 150 – Retail) 150 – Retail)(Min 125/Max(Min 125/Max 350 – Mail Order). 350 – MailDeductible doesOrder). Deductiblenot apply.does not apply.* For more information about limitations and exceptions, see the plan or policy document atwww.HorizonBlue.com/members.nonenoneMandatory GenericApplies.Maintenance prescriptionsmust be filled at In-HousePharmacy or through MailOrder.3 of 11

What You Will PayCommon Services You MayNeedMedicalEventSpecialty drugsIf you have Facility fee (e.g.,outpatient ambulatory surgerysurgerycenter)Physician/surgeonfeesIf you need Emergency roomimmediate caremedicalattentionLimitations,Exceptions, & OtherYour Cost IfYour Cost If Your Cost IfImportant InformationYou Use an You Use a Tier You Use anOMNIA Tier 1 2 Provider (You Out-ofProvider (You will pay more) networkwill pay more)Provider (Youwill pay themost) 70 Copay (30 day) 70 Copay (30 day) 150 Copay 150 CopayNot Covered.through BriovaRx, through BriovaRx,OptumRx’sOptumRx’sSpecialty Pharmacy. SpecialtyDeductible doesPharmacy.not apply.Deductible doesnot apply.No Charge for10% Coinsurance 30% Coinsurance 50% Coinsurance Not Covered.noneOutpatientfor Outpatientfor Outpatientfor latoryAmbulatoryAmbulatoryAmbulatorySurgical Center.Surgical Center.Surgical Center.Surgical Center.Your Cost IfYour Cost IfYou Use anYou Use anInner CircleInner CirclePrime Provider Provider (you(you will pay the will pay more)least)No Charge forOutpatientHospital,AmbulatorySurgical Center.10% Coinsurancefor OutpatientHospital,AmbulatorySurgical Center.30% Coinsurancefor OutpatientHospital,AmbulatorySurgical Center.50% Coinsurance Not Covered.for OutpatientHospital,AmbulatorySurgical Center.No Charge.No Charge.No Charge.Deductible doesnot apply.No Charge.Deductible doesnot apply.* For more information about limitations and exceptions, see the plan or policy document atwww.HorizonBlue.com/members.30% Coinsurance forOMNIA Tier 1 anesthesia.50% Coinsurance for Tier2 anesthesia.No Charge.Payment at the in-networkDeductible does level of benefits appliesnot apply.only to true medicalemergencies and accidentalinjuries. If service renderedis not deemed emergent, 200.00 Copayment appliesto Inner Circle Prime,Inner Circle, OMNIA Tier1/Tier 2. Out-of-networknon-emergent services are4 of 11

What You Will PayCommon Services You MayNeedMedicalEventEmergency medicaltransportationNo Charge.Urgent careNo Charge forSpecialist.If you have a Facility fee (e.g.,hospital stay hospital room)Limitations,Exceptions, & OtherYour Cost IfYour Cost If Your Cost IfImportant InformationYou Use an You Use a Tier You Use anOMNIA Tier 1 2 Provider (You Out-ofProvider (You will pay more) networkwill pay more)Provider (Youwill pay themost)not covered. Deductibledoes not apply.No Charge.No Charge.No Charge.No Charge.Out-of-network payment atDeductible doesDeductible does Deductible does the in-network level ofnot apply.not apply.not apply.benefits applies only to truemedical emergencies andaccidental injuries.Non emergent AmbulanceNo Charge for Inner CirclePrime, 30% Coinsurancefor Inner Circle, 30%Coinsurance for OMNIATier 1 and 50%Coinsurance for Tier 2.Out-of-network nonemergent ambulance is notcovered. 15.00 Copayment 30.00 Copayment 50% Coinsurance Not Covered.noneper visit forper visit forfor Specialist.Specialist.Specialist.Deductible doesnot apply.Your Cost IfYour Cost IfYou Use anYou Use anInner CircleInner CirclePrime Provider Provider (you(you will pay the will pay more)least)No Charge forNo Charge for30% CoinsuranceInpatient Hospital. Inpatient Hospital. for InpatientHospital.50% Coinsurance Not Covered.for InpatientHospital.* For more information about limitations and exceptions, see the plan or policy document atwww.HorizonBlue.com/members.Requires pre-approval; 400.00 penalty applies fornon-compliance. Inpatientseparation period is 90 dayscombined across all tiers.5 of 11

What You Will PayCommon Services You MayNeedMedicalEventPhysician/surgeonfeesYour Cost IfYour Cost IfYou Use anYou Use anInner CircleInner CirclePrime Provider Provider (you(you will pay the will pay more)least)No Charge for10% CoinsuranceInpatient Hospital. for InpatientHospital.Your Cost IfYour Cost If Your Cost IfYou Use an You Use a Tier You Use anOMNIA Tier 1 2 Provider (You Out-ofProvider (You will pay more) networkwill pay more)Provider (Youwill pay themost)30% Coinsurance 50% Coinsurance Not Covered.for Inpatientfor InpatientHospital.Hospital.If you need Outpatient servicesmentalhealth,behavioral Inpatient serviceshealth, orsubstanceabuseservicesNo Charge forOutpatientHospital.No Charge forInpatient Hospital.No Charge forOutpatientHospital.No Charge forInpatient Hospital.If you arepregnantNo Charge forOffice. 5.00 Copayment 50.00 Copayment 50% Coinsurance. Not Covered.per visit for Office. per visit for Office.Deductible doesnot apply.Office visitsChildbirth/delivery No Charge for10% Coinsuranceprofessional services Inpatient Hospital. for InpatientHospital.Childbirth/deliveryfacility servicesIf you need Home health carehelprecovering30% Coinsurancefor OutpatientHospital.30% Coinsurancefor InpatientHospital.50% Coinsurance Not Covered.for OutpatientHospital.50% Coinsurance Not Covered.for InpatientHospital.Limitations,Exceptions, & OtherImportant Information30% Coinsurance forOMNIA Tier 1 anesthesia.50% Coinsurance for Tier2 anesthesia.noneRequires pre-approval; 400.00 penalty applies fornon-compliance. Inpatientseparation period is 90 dayscombined across all tiers.Cost sharing does notapply for preventiveservices. Maternity caremay include tests andservices describedelsewhere in the SBC (i.e.Ultrasound).none30% Coinsurancefor InpatientHospital.50% Coinsurance Not Covered.for InpatientHospital.No Charge forNo Charge for30% CoinsuranceInpatient Hospital. Inpatient Hospital. for InpatientHospital.50% Coinsurance Not Covered.for InpatientHospital.Inpatient separation periodis 90 days combined acrossall tiers.10% Coinsurance. 30% Coinsurance. 50% Coinsurance. Not Covered.Requires pre-approval; 400.00 penalty applies fornon-compliance. HomeNo Charge.* For more information about limitations and exceptions, see the plan or policy document atwww.HorizonBlue.com/members.6 of 11

What You Will PayCommon Services You MayNeedMedicalEventYour Cost IfYour Cost IfYou Use anYou Use anInner CircleInner CirclePrime Provider Provider (you(you will pay the will pay more)least)or haveother s,Exceptions, & OtherYour Cost IfYour Cost If Your Cost IfImportant InformationYou Use an You Use a Tier You Use anOMNIA Tier 1 2 Provider (You Out-ofProvider (You will pay more) networkwill pay more)Provider (Youwill pay themost)health care visit limit is 120visits combined across alltiers.No Charge for10% CoinsuranceInpatient Hospital. for InpatientHospital.30% Coinsurancefor InpatientHospital.50% Coinsurance Not Covered.for InpatientHospital.Habilitation services No Charge for10% CoinsuranceInpatient Hospital. for InpatientHospital.30% Coinsurancefor InpatientHospital.50% Coinsurance Not Covered.for InpatientHospital.Skilled nursing careNo Charge forInpatient Facility.10% Coinsurancefor InpatientFacility.30% Coinsurancefor InpatientFacility.50% Coinsurance Not Covered.for InpatientFacility.Durable medicalequipmentNo Charge.10% Coinsurance. 30% Coinsurance. 50% Coinsurance. Not Covered.noneHospice servicesNo Charge forInpatient Facility.No Charge forInpatient Facility.30% Coinsurancefor InpatientFacility.50% Coinsurance Not Covered.for InpatientFacility.Requires pre-approval; 400.00 penalty applies fornon-compliance.Not Covered.Not Covered.Not Covered.Not Covered.noneNot Covered.Not Covered.Not Covered.Not Covered.noneNot Covered.Not CoveredNot Covered.Not Covered.noneIf your child Children’s eye exam Not Covered.needsdental or eye Children’s glassesNot Covered.careChildren’s dentalNot Covered.* For more information about limitations and exceptions, see the plan or policy document atwww.HorizonBlue.com/members.Requires pre-approval; 400.00 penalty applies fornon-compliance. Inpatientseparation period is 90 dayscombined across all tiers.Requires pre-approval; 400.00 penalty applies fornon-compliance. Inpatientskilled nursing facility daysare limited to 120 dayscombined across all tiers.7 of 11

What You Will PayCommon Services You MayNeedMedicalEventYour Cost IfYour Cost IfYou Use anYou Use anInner CircleInner CirclePrime Provider Provider (you(you will pay the will pay more)least)Limitations,Exceptions, & OtherYour Cost IfYour Cost If Your Cost IfImportant InformationYou Use an You Use a Tier You Use anOMNIA Tier 1 2 Provider (You Out-ofProvider (You will pay more) networkwill pay more)Provider (Youwill pay themost)check-upExcluded Services & Other Covered Services:Services Your Plan Generally Does NOT Cover (Check your policy or plan document for more information and a list of any other excludedservices.) Cosmetic Surgery Dental care (Adult) Long Term Care Most coverage provided outside theUnited States. (Inner Circle Prime,Inner Circle, and OMNIA Tier 1level of benefit)Non-emergency care when travelingoutside the U.S. (Inner Circle Prime,Inner Circle, and OMNIA Tier 1level of benefit) Routine eye care (Adult, Optometrist/Ophthalmologist office. For verificationof coverage on routine vision services,please see your policy or plan document) Routine foot care Weight Loss ProgramsOther Covered Services (Limitations may apply to these services. This isn’t a complete list. Please see your plan document.) Acupuncture when used for PainManagement and as a substitute forother forms of anesthesia Bariatric surgery Chiropractic care Hearing Aids (Only covered forMembers age 15 or younger) Infertility treatmentMost coverage provided outside theUnited States. Seewww.HorizonBlue.com/HMH (Tier 2level of benefit)* For more information about limitations and exceptions, see the plan or policy document atwww.HorizonBlue.com/members.Non-emergency care when travelingoutside the U.S. Seewww.HorizonBlue.com/HMH (Tier 2level of benefit)Private-duty nursing8 of 11

Your Rights to Continue Coverage:There are agencies that can help if you want to continue your coverage after it ends. The contact information for those agencies is: Department of Labor'sEmployee Benefits Security Administration at 1-866-444-EBSA (3272) or www.dol.gov/ebsa/healthreform. Other coverage options may be available toyou, too, including buying individual insurance coverage through the Health Insurance Marketplace. For more information about the Marketplace, visitwww.getcovered.nj.gov or call 1-833-677-1010.Your Grievance and Appeals Rights:There are agencies that can help if you have a complaint against your plan for a denial of a claim. This complaint is called a grievance or appeal. For moreinformation about your rights, look at the explanation of benefits you will receive for that medical claim. Your plan documents also provide completeinformation to submit a claim, appeal, or a grievance for any reason to your plan. For more information about your rights, this notice, or assistance,contact: 1-800-355-BLUE (2583) or visit www.Horizonblue.com. You may also contact the Department of Labor’s Employee Benefits SecurityAdministration at 1-866-444-EBSA (3272) or www.dol.gov/ebsa/healthreform.Does this plan provide Minimum Essential Coverage? YesMinimum Essential Coverage generally includes plans, health insurance available through the Marketplace or other individual market policies, Medicare,Medicaid, CHIP, TRICARE, and certain other coverage. If you are eligible for certain types of Minimum Essential Coverage, you may not be eligible for thepremium tax credit.Does this plan meet the Minimum Value Standards? YesIf your plan doesn’t meet the Minimum Value Standards, you may be eligible for a premium tax credit to help you pay for a plan through the ---To see examples of how this plan might cover costs for a sample medical situation, see the next ---* For more information about limitations and exceptions, see the plan or policy document atwww.HorizonBlue.com/members.9 of 11

About these Coverage Examples:This is not a cost estimator. Treatments shown are just examples of how this plan might cover medical care. Your actual costs willbe different depending on the actual care you receive, the prices your providers charge, and many other factors. Focus on the costsharing amounts (deductibles, copayments and coinsurance) and excluded services under the plan. Use this information to comparethe portion of costs you might pay under different health plans. Please note these coverage examples are based on self-only coverage.Managing Joe’s type 2 Diabetes(a year of routine in-network care of awell-controlled condition)Peg is Having a Baby(9 months of in-network pre-natal careand a hospital delivery) The plan’s overall deductibleSpecialist CopaymentHospital (facility) CoinsuranceOther Coinsurance 0.00 0.000%0%This EXAMPLE event includes services like:Specialist office visits (prenatal care)Childbirth/Delivery Professional ServicesChildbirth/Delivery Facility ServicesDiagnostic tests (ultrasounds and blood work)Specialist visit (anesthesia)Total Example CostIn this example, Peg would pay:Cost SharingDeductiblesCopaymentsCoinsuranceWhat isn’t coveredLimits or exclusionsThe total Peg would pay is 12,700.00 0.00 0.00 0.00 70.00 70.00 The plan’s overall deductibleSpecialist CopaymentHospital (facility) CoinsuranceOther Coinsurance 0.00 0.000%0%This EXAMPLE event includes services like:Primary care physician office visits (including diseaseeducation)Diagnostic tests (blood work)Prescription drugsDurable medical equipment (glucose meter)Total Example CostIn this example, Joe would pay:Cost SharingDeductiblesCopaymentsCoinsuranceWhat isn’t coveredLimits or exclusionsThe total Joe would pay is 5,600.00 0.00 0.00 0.00 4,300.00 4,300.00Mia’s Simple Fracture(in-network emergency room visit andfollow up care) The plan’s overall deductibleSpecialist CopaymentHospital (facility) CoinsuranceOther Coinsurance 0.00 0.000%0%This EXAMPLE event includes services like:Emergency room care (including medical supplies)Diagnostic test (x-ray)Durable medical equipment (crutches)Rehabilitation services (physical therapy)Total Example Cost 2,800.00In this example, Mia would pay:Cost SharingDeductiblesCopaymentsCoinsuranceWhat isn’t coveredLimits or exclusionsThe total Mia would pay isThe plan would be responsible for the other costs of these EXAMPLE covered services.* For more information about limitations and exceptions, see the plan or policy document atwww.HorizonBlue.com/members.10 of 11 0.00 0.00 0.00 10.00 10.00

* For more information about limitations and exceptions, see the plan or policy document atwww.HorizonBlue.com/members.11 of 11

Summary of Benefits and Coverage: What this Plan Covers & What You Pay For Covered Services Coverage Period: 01/01/2022 - 12/31/2022 Horizon BCBSNJ: Hackensack Meridian Health Coverage for: All Coverage Types Plan Type: EPO (0076321:0000-0035 pkg:001) M/PM (OMNIA)\BlueCard 1 of 11 The Summary of Benefits and Coverage (SBC) document will help you choose a health plan.