Transcription

UBA TARIFF GUIDE2020UNITED BANK FOR AFRICA (GHANA) LIMITED

COT / ACCOUNT MAINTENANCE CHARGESINDIVIDUAL/RETAIL ACCOUNTS0.00 - 2,999.003,000.00 - 5,999.006,000.00 - 9,999.0010,000.00 - 19,999.0020,000.00 - 59,999.0060,000.00 - 99,999.00100,000.00 - AboveGHS 5.00GHS 10.00GHS 15.00GHS 30.00GHS 100.00GHS 150.00GHS 200.00CORPORATE ACCOUNTSNormalMinimumMaximum1.5/mil on monthly debit turnoverGHS 20.00GHS 50,000.00Payment TypeNew Charge Applicable (2020 - )GIS CHARGESGIS transaction processing FeeGHS 30.00Request for extension of GIS cut of time (3.30PM) (initial/final)GHS550Payments sent beyond cut of time (GIS cut offtime is 3:30pm)GHS250 per transactionRequest for reprioritisation of queued paymentsRequest to enter payments manuallyInterbank settlements of FX payments (MT205)GHS 100GHS 2000.5% 30 – MIN; 200 - MAXDOM CHARGESCommission on foreign/FX currency cashwithdrawals2.5% - Local FX3% - Foreign Inflows

STATEMENT(Charge Equivalent for FCY Accounts)RegularRequest before due dateDuplicateAdditional copy request – End of Month StatementAdhoc statement requestStatement for the period before 1st July 2007FREEGHS 5.00GHS 10.00GHS 10.00 per pageGHS 10.00 per pageGHS 10.00 per pageStatement for the period for 1 year and aboveScreen printedIntegrity StatementGHS 10.00 per pageGHS 10.00 per pageGHS 2.50 per pageDRAFTBank customers (Account holder)MinimumMaximumNon-bank customersMinimumMaximumCHEQUE BOOK CHARGESCorporate Cheque Book (GHS) - 100 LeafletIndividual Cheque Book (USD) - 50 LeafletDollar Cheque Book (USD) - 50 leafletsPound Cheque Book (GBP) - 50 leafletsEuro Cheque Book (EUR) - 50 leaflets0.25% of amount subject to GHS 3.00GHS 15.000.50% of amount subject to GHS 5.00GHS 20.00GHS 30.00GHS 15.00USD 7.00GBP 5.00EUR 5.00CHEQUE ACTIVITY CHARGESExpress / Special Clearing GH 20,000 and aboveFREEExpress / Special Clearing below GH 20,000Counter ChequeStopped ChequeReturned ChequeLocal Forex/VisaForeign FX/OTC0.50% - Min GHS30; Max GHS 50GHS 10.00GHS 10.00NIL2.00% of amount withdrawn2.50% of amount withdrawnAUDITOR'S REPORT CHARGESAuditor’s ConfirmationLetter of Comfort/IntentGHS 50.00GHS 200.00

STANDING INSTRUCTION (SI) CHARGESIn-houseInternal for Insurance ClientsACH Direct DebitOnline Interbank Transfers (ACH)Normal External Transfers (ACH)Express ACHPenalty for Insufficient FundsGIPFREE1% - 2.5% on collection as per MOUGHS 0.75 – GHS 2.50 as per MOUGHS 6.00GHS 3.50GHS 4.50GHS 10.001.15% - Max GHS 5.00SALARY PROCESSING CHARGESExternal (flat charge per bank)GHS 30.00AFRICASHSending3% 10

ACCOUNT OPENINGUBA SAVINGSMinimum Opening BalanceMinimum Operating BalanceMinimum to earn interestGHS 20GHS 20GHS 50UBA KIDDIES (0-12 years)Minimum Opening BalanceMinimum Operating BalanceGHS 10GHS 10UBA TEENS (13yrs – 17yrs)Minimum Opening BalanceMinimum Operating BalanceGHS 50GHS 15UBA NEXT GENMinimum Opening BalanceMinimum Operating BalanceGHS 50GHS 20UBA-BUMPERMinimum Opening BalanceMinimum Operating BalanceGHS 100GHS 50UBA TARGETMinimum Opening BalanceMinimum Operating BalanceGHS 1,000GHS 1,000FOREIGN ACCOUNTMinimum Opening Balance (USD)Minimum Opening Balance (GBP)Minimum Opening Balance (EUR)Maintenance feeGHS 0.00GHS 0.00GHS 0.00FREEFOREX ACCOUNTMinimum Opening Balance (USD)Minimum Opening Balance (GBP)Minimum Opening Balance (EUR)Maintenance feeUSD 200.00GBP 200.00EUR 200.00FREE

TERM/FIXED DEPOSITSWHT applies to corporate accounts (excludingpublic and financial institutions)Fixed DepositsCall (Regular)Call (Sweep)Min. of GHS 1,000.00Min. of GHS 5,000.00Min. of GHS 5,000.00TERM/FIXED DEPOSITS PRE-LIQUIDATION CHARGESMaturity Period Less than 50%Maturity Period is 50% – 60%Maturity Period is 60% – 70%Maturity Period is 70% - less than 100%50% of Interest Amount40% of Interest Amount30% of Interest Amount20% of Interest AmountLENDING FEESCONSUMER LOANSProcessing FeeInsurance FeeMonitoring FeeInterest RateTEMPORARY OVERDRAFT (TOD)Processing FeeMonitoring Fee2.00%1.50%1.00%GRR Risk Premium (1.00%-12.00%)Interest Rate (minimum margin of at least 8.50%)2.00%1.00%GRR Risk Premium (1.00%-12.00%)GUARANTEESProcessing FeeMonitoring Fee2.00%1.00%LOAN PRE-LIQUIDATIONNo Wahala/Standard Living/Flex LoanOther Loans1.50%As stated in Loan Agreement

E-BANKING PRODUCT BUNDLE PRICINGSole Proprietor/Corporate –Wise alert & Internet Banking CorporateGHS 20.00Individual Accounts –Wise alert & Internet Banking RetailIndividual Accounts - Debit CardGHS 3.00VISA GOLDMASTERCARD PLATINUMGHS 30.00GHS 300.00UBA DEBIT CARDS (VISA AND MASTERCARD)Issuance feeCard monthly feeGHS 20.00GHS 5.00GHS 5.00UBA PREPAID CARDS - AFRICARDIssuance feeLoading feeMonthly FeeGHS 30.00GHS 5.00GHS 5.00ADDITIONAL TOKENGHS 5.00POINT OF SALE (POS)Set Up Fee30-days non-utilisation penalty fee for POSMerchantLocal CardsInternational CardsMobile Money on POSE-ZWICH CARDSRegular walk in customersCard for National Service PersonnelFREEGHS100.002.50%3.50%1.80%GHS 20.00GHS 10.00

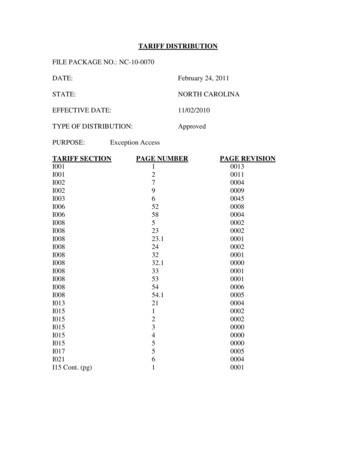

andling Charge 25.00N/AN/AN/A2Payment Commission (AllAccounts)3Payment Commission FEA(Locally Sourced Forex)1.00% of facevalueplus 1%Externalization 20.00N/A 25.00Payment Commission FCA1.00% of facevalue 10.00N/A 25.00Payment Commission GHS1.00% of facevalue 10.00N/A 25.00Holding Charges ofOverdue Bills (per quarter) 25.00N/AN/AN/A 100N/AN/AN/A 50.00N/AN/AN/ACommission onExport Collection0.50% Flat 50.00N/AN/ACourier Charges 100 FlatN/AN/AN/A11Negotiation0.75% FlatN/AN/AN/A12SWIFT charge 25 FlatN/AN/AN/A13LC Establishment CommissionCash Backed1% Per QuarterGHS 100.00N/A 25.0014LC Establishment Commission No Cash Cover1.00% PerQuarterGHS 100.00N/A 25.0015LC Establishment Commission Additional Quarter0.50% PerQuarterGHS 100.00N/A 25.0016LC Amendment 50 FlatN/AN/A 25.0017LC Amendment - Increase inAmount1.00% PerQuarter on DiffGHS 100.00N/A 25.0018Discrepancies Fees 100 ns(Payment for Goodsi.e. Open Account,Advance Paymentsand Bills forcollection)6Return of documents toremitting bank outsideGhana - courierTransfer of CollectionDocumentsto other banks in Ghana78910ExportCollectionsImport Letters ofCredit

19LC Cancellation 100.00N/AN/AN/A20Confirmation0.75% PerQuarterNAN/AN/A20Drawing under LC0.75%GHS 100.00N/A 25.0021Advise of Export LCs 100.00 FlatN/AN/AN/A22Advise of Export LCs to OtherBanks 100.00 FlatN/AN/AN/A23Negotiation0.75% Flat 25N/AN/A24Payment of Export LC0.50% Flat 25N/AN/A25Confirmation0.75% perQuarter /3% per annumNAN/AN/A26Cancellation 100.00N/AN/AN/A27Comm on Transfers (FEA)(Locally Sourced Forex)1.00% of facevalueplus 1%Externalization 20.00 1,000 25.00Comm on Transfers (FCA)1.00% of facevalue 10N/A 25.0029Comm on Transfers (GHS)1.00% of facevalue 10N/A 25.0030Local ChequeNo ChargeN/AN/AN/A31Offshore Cheque2% of face value25% 1,000 25.00Return Cheque (Offshore) 10.00N/AN/AN/AReturn Cheque (Local) 0.00N/AN/AN/A34Request for International Draft0.75%N/AN/AN/A35Transfer through BOG (MT205)0.25%(SAME) 30 200N/AExport LCs283233OUTWARD TT(Transfer of Funds i.e.Payment of services)CHEQUELODGMENT/INTERNATIONALDRAFT

STANDING INSTRUCTION (SI) CHARGES In-house FREE Internal for Insurance Clients 1% - 2.5% on collection as per MOU ACH Direct Debit GHS 0.75 - GHS 2.50 as per MOU Online Interbank Transfers (ACH) GHS 6.00 Normal External Transfers (ACH) GHS 3.50 Express ACH GHS 4.50 Penalty for Insufficient Funds GHS 10.00 GIP 1.15% - Max GHS 5.00 SALARY PROCESSING CHARGES