Transcription

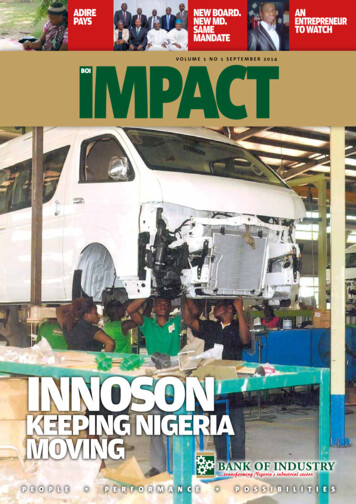

ADIREPAYSNEW BOARD.NEW MD.SAMEMANDATEANENTREPRENEURTO WATCHIMPACTVOLUME 1 NO 1 SEPTEMBER 2014BOIINNOSONKEEPING NIGERIAMOVINGP E O P L E P E R F O R M A N C E P O S S I B I L I T I E S

ForewordBY THE MD/CEOOrchestrating Development Impact at BOIAcontentsvery warm welcome to this inaugural issue of the BOI Impactmagazine.We have begun a journey towardstransforming the Bank of Industry intoa world-class Development FinanceInstitution and the most impactful inAfrica.As you are aware, BOI’s mandateis crucial to the success of the variousgovernment policies aimed at revampingand transforming the Nigerian economy.The Nigeria Industrial Revolution Plan(NIRP) and the National EnterpriseDevelopment Programme (NEDEP), werelaunched early 2014 by President GoodluckEbele Jonathan, GCFR, as integral parts ofthe Federal Government’s TransformationAgenda. Under these plans, BOI hasbeen assigned very important roles withrespect to the provision of the requireddevelopment finance.In cognisance of this hugeresponsibility, we are re-focusing on ourcore mandate of providing low-cost,medium-to-long term finance to largeindustrial projects as well as to smalland medium industries. For instance, werecently launched the N5.0 billion CottageAgro Processing (CAP) Fund to addressthe post-harvest agricultural value chain.By so doing, we are supporting the realsector in wealth creation and reducingunemployment in Nigeria.We are also adopting global bestpractices for the management ofdevelopment banks, and to this end,we have initiated a number of projectsdesigned to improve the efficiency andeffectiveness of our operations andprocesses. We expect our improvedpractices to result in significant costsavings and better service delivery to ourcustomers.BOI Impact seeks to orchestrateBOI’s efforts, activities and results in ourongoing quest for developmental impactand global best practices. In this issue theHonourable Minister of Industry, Trade8 LEAD THE INNOSON TESTAMENTThe story of Chief Innocent Chukwuma’s quest to keepNigeria moving through the manufacture of vehicles,motorcycles, plastics and other products at Nnewi andEnugu14 SPECIAL REPORT ADIRE MARKET TRADESECRETS (JUST A FEW) An insight into how thetie and dye industry works and how BOI helps18 Q&A WHERE THE JOBS ARE Interview withDr. Olusegun Aganga, Minister for Trade, Industryand InvestmentEditorEditorial AdviserHadiza Olaosebikan Kola AdewoleEDITORIALGbenga OyesanyaSolomon TommyAyo Oluwatuyi BOI IMPACTToyin OyekanmiADMINISTRATIONKehinde AladeLEGALAbdullahi Sadatand Investment, Dr. Olusegun Agangaand the Chairman, Board of Directors ofBOI, Alh. Abdulsamad Rabiu, share somevery interesting perspectives on Nigeria’sdevelopment agenda and the role ofBOI. We also highlight the activities andachievements of some of our exemplarycustomers. It is our hope that these storieswill inspire millions of other Nigerianbusinesses and entrepreneurs.My colleagues and I are working extrahard (and smart too!) to deliver resultin terms of better practices and greaterdevelopmental impact. I commend theirefforts and urge them to sustain thecurrent tempo, as it is in our nationalinterest to achieve the set goals andobjectives.We have printed limited hard copies ofthis issue, consistent with our objective ofmaking the publication 100% online by thethird issue. For now, the online edition isavailable at www.boinigeria.com/ImpactI invite you all to please sit back, relaxand enjoy BOI Impact.Warm regardsRasheed OlaoluwaManaging Director andChief Executive Officer21 Q&A WHAT WE NEED TO DO TO GET TOWHERE WE WANT TO Interview with BOI ChairmanAlhaji Abdulsamad Rabiu28 Q&A GIVING BACK. CREATING JOBS. BAKINGBIGGER CAKES. Interview with BOI MD Mr. RasheedOlaoluwa35 FOCUS UNCOMMON ENTREPRENEURSHIPOcheni Simon, a rising star37 INSIGHT DOING IT LIKE CHINAREGULARS3 ROUND-UP39 LOOK

From left: Minister of Industry, Trade andInvestment, Dr Olusegun Aganga; ChairmanBank of Industry, Alhaji Abdulsamad Rabiu;and the new Managing Director/Chief Executive Officer, Bank of Industry, Mr RasheedOlaoluwa, at the inauguration of the 4thBoard of the Bank of IndustryTO BE THE CATALYSTCatalyst (noun):a person or thing that precipitates an event or changeThat’s what the new Board ofDirectors of the Bank of Industry(BOI) has been charged tobecome; in respect of fundingof Medium, Small and Micro Enterprises(MSMEs) in Nigeria. The charge camefrom the Minister of Industry, Trade andInvestment, Dr Olusegun Aganga, atthe inauguration of the Board, in Abuja.It’s indeed the Board’s first priority as IThas been asked to achieve this within a“reasonable timeframe.”Aganga described the MSMEs, witha workforce of over 35 million, as agroup the Federal Government couldnot ignore. He stressed that an upwardreview of the bank’s loan portfoliocould not be over-emphasised in view ofthe multiplier effects of MSMEs on thenation’s industrial base, employmentgeneration’s drive and its potentialcontribution to the GDP.“I would like to use this occasion toremind BOI that the future of MSMEsrests squarely on how responsible youare to their funding needs. The currentarrangement where less than 15%loanable funds is being set aside forMSMEs’ need is unacceptable and mustbe reviewed upwards having regard tothe potential of the sector to create jobsand generate wealth.“The practice in China and Indonesiawhere significant portion of loanablefunds in most cases without collateralis extended to MSMEs with close to97% repayment rate should encourageyou to emulate and do even more forNigeria’s MSMEs,” he said. (See: “Doingit like China,” p37)He added that on its part, the FederalGovernment is already repositioning theministry as a major driver of PresidentGoodluck Jonathan’s TransformationAgenda through the full implementationof the National Industrial RevolutionPlan, NIRP and the National EnterpriseDevelopment Programme, NEDEP, bothrecently launched by the President.He urged the Board to activelysupport the NIRP and NEDEP to stimulatethe Federal Government’s quest for rapidindustrial development in the country,and the bank’s mission of wealthcreation and employment generation.Just to let the Board knows that hetakes this seriously, the minister toldthem:“I expect your board to forward tome quarterly progress reports showingperformance in the quarter and yearto date with details of analysis of loanbook by gender, by sector, impact onNIRP and NEDEP, jobs created, andcontribution to national development.”The Minister reiterated that the bank’smission is to transform Nigeria’s industrialsector, integrate it into the global economyand provide financial and business supportservices to existing and new industries toenable them attain modern capabilities tocontinued on page 6BOI IMPACT

round-upMeet the Board Alhaji Abdulsamad Rabiu CON is the Chairman/CEO ofthe BUA Group of Companies, and two-time Chairman of theBank of Industry’s Board of Directors. He was Chairman of BOI’sthird Board of Directors up till 2011. Over a period of 25 yearshe has grown BUA Group into a world-class conglomeratewith interests in manufacturing (sugar, cement, flour and oilmills), ports and terminals as well as real estate. He was recentlyranked by the influential international Forbes Magazine, as oneof Africa’s billionaires. Alhaji Abdulsamad sits on the Boardsof several companies. In the past, he served as the Chairmanof the Board of the defunct Tropical Commercial Bank Ltdfrom 1993-1999 and was a member of the board of TranscorpHilton Plc. He currently sits as the Chairman, Board of Directors,Cement Company of Northern Nigeria Plc. Alhaji Rabiu has wonmany prestigious awards, both locally and internationally, asa testimony to his hard work, leadership, excellent businessacumen and indefatigable entrepreneurial spirit. He studiedeconomics at Capital University, U.S.A and holds an honorarydoctorate degree from the Crescent University, Abeokuta, OgunState, Nigeria. He was also awarded with the Nigerian nationalhonour of Commander of the Order of the Niger (CON) by theFederal Government in 2012. He is happily married and haschildren. Mr. Rasheed Adejare Olaoluwa has over 26 yearsexperience in banking and financial services sector, playingsenior and executive level roles in Commercial and InvestmentBanking, Treasury Management, Financial Control and StrategicManagement gained at reputable institutions such as KPMG,GTBank, Ecobank and UBA.He was the pioneer Group CEO of UBA Capital Plc, a leadingfinancial investment services company. Prior to this, he was anExecutive Director at the United Bank for Africa (UBA) Plc, wherehe led the largest strategic business directorate in the BankingGroup. He was also the pioneer CEO of UBA Africa from 2007 to2011, during which time he extended UBA’s operations into 18countries in Sub-Saharan Africa.Standing from L-R: Waheed Olagunju, ED (Small and Medium Enterprises); Kenneth Effa, ED (Corporate Services); *Ahmad Abdullahi, formerDirector (representing Central Bank of Nigeria); Mohammed Alkali, Executive Director (Large Enterprises); Omoniyi Ezekiel Fagbemi, Director(representing Ministry of Finance Incorporated, MOFI). Sitting from L-R: Uju Aisha Hassan Baba, OON, Director (representing Min. of Industry,Trade and Investment); Rasheed Olaoluwa, Managing Director/Chief Executive Officer; Abdulsamad Rabiu, Chairman, Board of Directors;Lawrence Osayemi, Director (representing Manufacturers Association of Nigeria, MAN). *Olufemi Fabamwo (not in picture), now representsCentral Bank of Nigeria on the Board BOI IMPACT

round-upHe holds a first class honours degree in civil engineering, anAssociate Membership of the Institute of Chartered Accountantsof Nigeria (ICAN) and an Executive MBA from InternationalGraduate School of Management (IESE), Spain. Mr. Waheed A. Olagunju who joined the Bank of Industry’sprecursor institution, the Nigerian Industrial Development Bank(NIDB) in 1990, was appointed Bank of Industry’s ExecutiveDirector (Business Development) in 2012. Over the past 24years, he has served as Company Secretary of NIDB/BOI formore than 15 years between 1997 and 2012 in addition to beingGeneral Manager, Strategic Planning, Corporate Secretariat andCorporate Communications of BOI between 2007 and 2012. Hewas recently made the Executive Director (Small and MediumEnterprises) following the reorganisation of the Bank in 2014.Mr Olagunju bagged his first and second degrees in 1981 and1984 respectively from the University of Lagos and holds aprofessional certificate in Investment Appraisal and Risk Analysisfrom the Queen’s University, Canada. Mr. Mohammed G. Alkali holds a first-class BachelorsDegree in accounting from Bayero University Kano (1983) anda Masters Degree in economics from the London School ofEconomics (1986). He started his working career in 1983 as alecturer with the University of Maiduguri and joined the bankingindustry in 1988. During the span of 25 years in banking, he hasgarnered composite experience that cuts across commercial,investment and development finance. Prior to his appointmentas Executive Director, Operations at the Bank of Industry in2010, he served as BOI’s General Manager, Large Enterprises(2002 to 2005) and General Manager, Small and MediumEnterprises (2005 to 2010). Following the restructuring of thebank in 2014, he was re-designated Executive Director, LargeEnterprises. Alkali is also an alumnus of Harvard University, theUniversity of Chicago, the Stanford University and the ColumbiaUniversity, amongst others Mr. Kenneth N. Effa who bagged a Bachelors degree ineconomics from the University of Maiduguri in 1980 is a fellowof the Institute of Industrialists and Corporate Administrators(IICA) and the Chartered Institute of Management Accountants(CIMA). He had spent 30 years in the Central Bank of Nigeria,where he rose to the position of Assistant Director and wasappointed Executive Director representing the CBN on BOI’sBoard in January, 2014. Mr. Omoniyi Ezekiel Fagbemi (FCA, mni) is a 1988accountancy graduate from the Obafemi Awolowo University,Ile-Ife. He has an MBA from the same university in 2000, andis a member of the National Institute for Policy and StrategicStudies, Kuru having completed the Senior Executive Course35 in 2013. He has 25 years working in both the private andpublic sectors, starting as an Internal Auditor at a privatefirm to becoming the Director, Revenue and Investment,Office of the Accountant-General of the Federation. He hasalso served as an Assistant Director, Deputy Director, andDirector in the Federal Ministry of Health, the Office of theSecretary to the Government of the Federation, and the Officeof the Accountant General of the Federation. He is a fellowof the Institute of Chartered Accountants of Nigeria (ICAN),the Chartered Institute of Taxation in Nigeria (CITN), and theNigerian Institute of Management (NIM). Mrs. Uju Aisha Hassan Baba, OON has more than 30years’ post-bar experience in Nigeria’s legal system. She wasone-time Attorney-General of Anambra State, Director GeneralLegal Aid Council of Nigeria and current Director of LegalServices, Federal Ministry of Industry, Trade and Investment.She is a Law graduate of University of Nigeria, Nsukka andattended the International Law Institute, Washington D.C, aswell as the University of London where she bagged a certificatein Legislative Drafting. She is a member of the Nigerian BarAssociation and has served on various committees. She is alsoan Officer of the Order of the Niger (OON). Mr. Olufemi Adeoye Fabamwo holds a Master of BusinessAdministration (MBA) from the Universityof Lagos. He has worked with theCentral Bank of Nigeria since 1982, risingfrom Senior Supervisor, DevelopmentFinance, to Director, Other FinancialInstitutions. He has served on the boardsof several FG establishments, includingthe Nigeria Export-Import Bank (NEXIM)and the National Insurance Commission(NAICOM). He is an associate member of the Chartered Instituteof Bankers (CIB) UK, a member of the British Institute ofManagement, and a fellow of the Chartered Institute of Bankersof Nigeria (CIBN). Chief Lawrence Ayinde Olakunle Osayemi who is theNational Treasurer of the Manufacturers Association of Nigeria(MAN) represents the Association on BOI’s Board of Directors.He is an alumnus of the London Business School, the HarvardBusiness School, and was one-time Managing Director ofThomas Wyatt Nigeria Plc. Chief Osayemi, who is a lawyerand also a fellow of the Institute of Chartered Accountants ofNigeria (ICAN), also holds a Bachelor’s degree in Economics andwas a member of the Steering Committee for Vision 20:2020.He was also the Pro-Chancellor of the Federal University ofAgriculture, Abeokuta and was awarded a Member of theOrder of the Niger (MON) by the Federal Government based onhis contributions in the Organised Private Sector.BOI IMPACT

round-upCATALYSTcontinued from page 3produce goods that are competitive in bothdomestic and external markets.Speaking for himself as the Board Chairman as well as his members, Alhaji Abdulsamad Rabiu, who is also Chairman/CEOof BUA Group of Companies, expressed hisappreciation to the president for imposingconfidence in them. He equally commendedthe minister for the people-oriented policiesand programmes he has set for the economic development of the country.BOI’s Managing Director/CEO, Mr. Rasheed Adejare Olaoluwa, affirmed that thatthe management would work hand-in-handwith the board with a view to strengtheningthe bank’s operations for global competitiveness and to be at par with some of theworld’s leading development finance insti-tutions.Olaoluwa noted that he would workclosely with other relevant stakeholderstowards addressing the non-financial issuesfacing the manufacturing sector and MSMEs.“Urgent steps,” he added, “would have to betaken to improve on BOI’s service delivery toenable it meet the unemployment challenges facing the country especially in the areasof wealth and job creation.”L-R: Executive Director (Corporate Services and Commercial), BOI, Mr Kenneth Effa; Sen. Chris Ngige; Managing Director/CEO, BOI, Mr Rasheed Olaoluwa; Sen.Nenadi Usman, Committee Chair; Sen. Ahmad Maccido; Sen. Ahman Zannah; Sen Ibrahim Musa; Sen. Gbenga Obadara and Mr Niyi Olorishade, CommitteeSecretaryBOOST FOR AGRICThe Bank of Industry (BOI) believes with the FederalGovernment of Nigeria that agribusiness can changethe nation’s fortunes. Therefore, the bank is committedto helping move Nigerians from farming to small-scaleenterprises, food processing and industrialised agriculture.BOI’s Managing Director/Chief Executive, RasheedOlaoluwa revealed this plan to members of the SenateCommittee on Investment who were on an oversight visit tothe Bank’s Corporate Headquarters in Lagos. It’s simply keyinginto the government’s Industrial Revolution Plan as well asthe National Enterprises Development Programme. Thus, thebank would be creating job opportunities in the agriculturalsector. Its success in the Solid Minerals sector –where the BOI IMPACTbank has been focussing on the identified commerciallyviable 44 solid minerals deposits available in the country – willserve as template. Olaoluwa said the bank has entered intopartnerships with many microfinance banks, which are veryclose to the grassroots and communities.The Chairperson, Senate Committee on Industry, SenatorNenadi Usman, assured the MD/CEO of the Senate’s partnershipbecause “we believe that the Bank is one of the strongestagencies that the government has been using to ensure thatthe industrial sector in Nigeria is being properly positioned toabsorb the nation’s manpower,” adding, “I believe that if small,medium and even large scale industries are assisted in Nigeria,we would have most of these people who have no work today,fully employed.” It’s a win-win situation for everyone: the bank,the Government, the unemployed.

leadNOSONNIEHTTNEMATTESIn his younger days, Chief (Dr) Innocent IfediasoChukwuma, OFR, took to the moniker, Innoson,with glee. So much so that when the time came toincorporate his first business, no other name clicked.Innoson Nigeria Limited (INL) Nnewi, registered withthe Corporate Affairs Commission in 1981 to trade intyres and motorcycle spare parts, has now grown intothe conglomerate, Innoson Group (www.innoson-group.com), not only manufacturing motorcyles but also plastics- Innoson Technical and Industrial Company Limited (ITIC)Enugu; motor vehicles – Innoson Vehicle ManufacturingCompany Limited (IVM) Nnewi; and tyres – General Tyresand Tubes Company Limited (GTT) Enugu. With its totalworkforce of 7,200, the group has a projected turnover ofmore than N50b per annum.“I was into buying and sellinglike everyone else,” the Nnewi-borngentleman explained to BOI Impact inhis spaciously appointed office at ITIC BOI IMPACTalong the Enugu-Abakaliki Expressway.The ambulatory schedule occasioned bythe growth of his business has him onoccasion shuttling to meet contingenciesin his other offices in Nnewi, Abuja andAccra in Ghana when he is not travellingabroad.“My senior brother apprenticed meto our townsman Pius Emeka Maduka,elder brother to Cosmas Madukaof Coscharis, under whom I learntthe buying and selling of tyres andmotorcycle spare parts at the NkwoNnewi Market.“At the end of the apprenticeshipI started on my own; buying fromimporters and selling to the finalconsumers. In fact, I was doing so wellthat my brother left his original businessto join me. When I was ready to start onmy own, my brother settled me as wasthe practice and I registered my owncompany.“In no time we started importingand selling to wholesalers as well. From1984, we started importing motorcycles

leadwhole. Then we moved into bringingthe motorcycles completely knockeddown and assembling them there inNnewi. From very slow beginningsour sales volume rose to over 600,000units per annum following which someChinese companies granted us soledistributorship of their brands.”In this meteoric rise, Chukwuma ishowever quick to remind you that it tooka proper look at the field to convincehim – and in good time too – thatmanufacturing was not just the way outbut the only way forward. Thus, while hiscompetitors wallowed in the success oftheir trading exploits, he had his eyes setahead.We did the local assembling byourselves for about 10 years beforeentering into an agreement withChongquing North Jianshe Import andExport Company Limited, a Chinesemotorcycle manufacturer to establish amanual plant in Nnewi where top qualitymotor cycles were produced. When thisdid not make for enough productionvolume to achieve agreeable economiesof scale, the next year we installed afully automated assembly line makingus the first fully indigenous motorcyclemanufacturers in Nigeria.”Eventually, it was this determineddrive for comparatively low prices andtransfer of production technology thatpushed him into plastic production.“Following our production ofmotorcycles, we discovered that mostof the parts of the motorcycle apartfrom the tank, frame, exhaust pipe andengine were all made of plastic – thefenders, tail, headlight casing, front andrear bumpers, side covers and even thevery helmet worn for protection, namethem.”Apart from the motorcycle parts, ITIC– arguably the biggest plastic industry inNigeria – was incorporated in 2002 withtechnical support from Cretec IndustriesCompany Ltd Hangzhou, China. It iscapable of producing injection, blowingand rotational moulds; metre boxes andaccessories; melamine tableware, roofceiling and foam products. Courtesy ofupgraded production lines featuringstate-of-the-art injection moulds, it hasthe capacity to produce 10,000 plasticseats per day at full tilt.With expertise acquired in the terrainof motorcycles, and with his mindset on “keeping the nation moving,”Chukwuma ventured into the automotiveindustry. IVM, also the first indigenousmotor manufacturing industry in Nigeria,produces cars and commercial vehicles,making use of substantial local content –70 per cent, for now. Built in conjunctionwith a consortium of Chineseautomakers, it now produces intra- andinter-city buses with various seatingcapacities, Sports Utility Vehicles (SUVs),trucks, pick-up vans, refuse collectors/compactors and tricycles.Officially commissioning the factoryon 15 October, 2010, President GoodluckJonathan commended Chukwuma’sresilient spirit, crediting it to the fact thatthough Anambra was one of the smalleststates in the country by land mass, itspeople have “high brain density.”Nonetheless, there is a commendablemotive. “When we ventured into theproduction of motorcycles we wereable to make brand-new motorcyclesaffordable to needful Nigerians whohitherto patronised the tokunbo(used) ones. Nothing can stop us fromreplicating it in the automotive industry.”With a projected roll-out programmeof 5,200 vehicles per month IVM startedat 300 a month but manages about 600a month as yet. However, Chukwumabelieves that they are on course tomeet the 1,200 vehicles a month targetthey have set for year’s end. Part ofthe conviction for this, accordingto him, comes from the fact that –unlike with motorcycles – they neverassembled vehicles. They started withmanufacturing outright.“We shall stop at nothing tillwe achieve total local content,” hesubmitted. “Assuming Ajaokuta (SteelCompany) was working, the story wouldhave been drastically different. Tofurther achieve this is one of the reasonswhy with some Nigerian partners wemoved into the manufacture of tyres atGTT. With all the tyre companies in thecountry moribund and Nigeria boastingof very good rubber, we have decided totake the bull by the horns. It’s our hopeto play a leading role in the tyre supplychain for both motorcycles and vehiclesin no distant time.”He concluded the latter rather tooself-assuredly. Reminded that cynicscould still see it all amounting to buyingand selling in the long run, he took adeep breath and threw in a clincher: “Idon’t know about others but I wouldrather buy raw materials and sell myown finished products at the mostcompetitive of prices than buy anotherman’s finished products to sell to mypeople at exorbitant prices.”“Apart from the price difference thatit will visit on the goods like I have said,what of the jobs manufacturing willmake available for our people? Insteadof the youth parading the streets jobless,they are given means of livelihood. Inturn, this makes the country safer as it isjoblessness that will push them to crimeand nefarious acts that’ll make themconstitute a burden to the society.”A commendation of the wisdomin his analysis brought a twinkle of asmile flashing across his face. He let thecompliments sink in well enough beforeamplifying that it all goes back to hisroots. According to him, the eponymousprogenitor that begat the four villagesthat constitute his hometown waswisdom writ large. He capped theBOI IMPACT

leadensuing lesson in their ancestral historywith a popular Igbo proverb -“thefoolishness of an Nnewi man amounted towisdom in neighbouring towns.” Invariablyan overstatement as the late ChinuaAchebe would have said, some truismappears to lurk in it judged by the decisiontaken by his second-bite-shy townsfolkto domesticate their businesses in Nnewiafter the experience of the NigerianCivil War (1967-70). Very strong in theautomotive parts trade, Nnewi, no soonerafter, became the hub of the trade in thecountry; attracting customers from as faraway as the west and east coasts of Africa– a happenstance that undoubtedly playeda major part in the emergence of InnosonGroup when and where it did. Born on 10 August, 1961 to a junior civilservant Mr Godwin Chukwuma Mojekwu ofUru-Umudim Village and his wife Martina, BOI IMPACT‘BOI is tailor-made for manufacturers.Without them, I wonder how I would’ve managed.’- Innocent ChukwumaInnocent Chukwuma surmounted a stackof odds to become this entrepreneurialstatement of our time. An indubitable childof destiny, the story of how he was left fordead after being run over by a hit-and-rundriver at the tender age of six years is nowa reporter’s delight. “I strayed back ontothe road for my toy watch that had slippedfrom my hand as I crossed the road in thegrip of an elder brother,” he recounted.“As God would have it, just before burialobsequies could commence after the closeto-three-hour interlude it took to hunt theerring driver down, I woke.”Relationship with Bank of IndustryIt started when he ventured intomanufacturing. Admittedly, as a “buyerand seller” he had been stuck with thecommercial banks like most people else.“The first loan I ever took way backthen,” he recounts with nostalgia, “wasN5,000 from the old United Bank for Africa(UBA) repayable in one year. I paid it backon schedule - with the accruing interest and they doubled it for the next year. Theyhave been doubling and doubling it so forme year after ever since.”According to Chukwuma, he wasattracted to BOI because the terms andconditions of the commercial banks wouldbe difficult to meet for an industrialist whoneeded better understanding from hiscreditors to raise his head in the slipperywaters of manufacturing.“The Bank of Industry is tailor-made formanufacturers,” he enthused. “You see,every manufacturer needs enough timeand space to operate so as to be able to

leadpay back any loan. The money has to go afull cycle that takes more time than whenone is just trading with it.”Like he opined in a YouTube testimonialposted on BOI’s website, the bank assistshim primarily in the buying of equipment.“Without them,” he posits now, “I wonderhow we would have been managing. Thefirst loan they made available to us was forN600m with a four-year tenor. We finishedrepaying it in two years and took anotherfor N300m. This one took us two and a halfyears to repay. The third one for N600mwas also repaid in record time and we arenow paying back the fourth tranche worthN1.4 billion. God willing, we shall also meetwith that and keep ploughing on.”Any wonder that in 2011 he won thebank’s Best Customer Award for LoanRepayment and Contribution to Nigeria’sEconomic Development.Though admittedly he had to sellvirtually all the property he had acquiredacross the country as a trader to meet theirinitial start-up requirements, Chukwumaupon hindsight still thinks the effort wasmore than worth it. Given his experiencewith the bank, his advice to would-beindustrialists is to look the bank’s way andno other for financing as nowhere elsewould suffice if they wanted to get a loanthat will enable them sleep with their twoeyes closed.By him, accessing loans from BOI isalso not as difficult as people are made tothink. The onus, he says, is on the wouldbe industrialist to write transparentlyfeasible and concise project proposals;that are clear and to the point and notunnecessarily outsized and unmanageableat first sight.“The thing is to take it step by step,”he elucidated. “Like in my own case, I buyequipment one after the other. I don’twant to buy another one when I have notfinished paying for the outstanding one.”He is however quick to point out thatthe most important aspect for a rapidindustrialisation of the country is theprevalence of favourable governmentpolicies. Such that made a BOI possible inthe first place. A member of the committeeoverseeing the Federal Government’sNational Industrial Revolution Plan (NIRP)launched in February 2014, he sees it aswell as the rest of the TransformationAgenda of the Federal Government ascapable of leading Nigeria to the PromisedLand in record time.“We (the committee) have startedwork in earnest,” he stated. “The effectwill start being felt much sooner thanlater. I strongly believe that with the inputof people like my humble self from theprivate sector, the country would havecome a long way in industrial developmentwithin the projected period. A case in pointis the power aspect. Most of the moneywe would otherwise have used for R&D(Research and Development) is investedin power supply instead. But wi

Banking, Treasury Management, Financial Control and Strategic Management gained at reputable institutions such as KPMG, GTBank, Ecobank and UBA. He was the pioneer Group CEO of UBA Capital Plc, a leading financial investment services company. Prior to this, he was an Executive Director at the United Bank for Africa (UBA) Plc, where he led the largest strategic business directorate in the .