Transcription

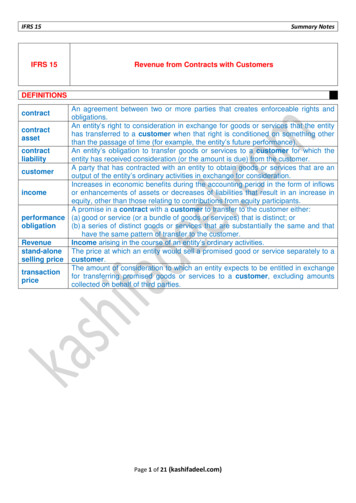

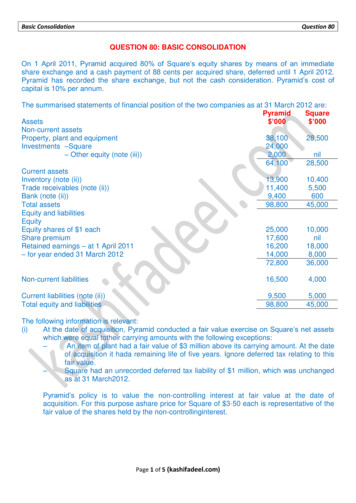

Basic ConsolidationQuestion 80QUESTION 80: BASIC CONSOLIDATIONOn 1 April 2011, Pyramid acquired 80% of Square’s equity shares by means of an immediateshare exchange and a cash payment of 88 cents per acquired share, deferred until 1 April 2012.Pyramid has recorded the share exchange, but not the cash consideration. Pyramid’s cost ofcapital is 10% per annum.The summarised statements of financial position of the two companies as at 31 March 2012 are:PyramidSquareAssets ’000 ’000Non-current assetsProperty, plant and equipment38,10028,500Investments –Square24,000– Other equity (note (iii))2,000nil64,10028,500Current assetsInventory (note (ii))13,90010,400Trade receivables (note (ii))11,4005,500Bank (note (ii))9,400600Total assets98,80045,000Equity and liabilitiesEquityEquity shares of 1 each25,00010,000Share premium17,600nilRetained earnings – at 1 April 201116,20018,000– for year ended 31 March 201214,0008,00072,80036,000Non-current liabilities16,5004,000Current liabilities (note (ii))Total equity and liabilities9,50098,8005,00045,000The following information is relevant:(i)At the date of acquisition, Pyramid conducted a fair value exercise on Square’s net assetswhich were equal totheir carrying amounts with the following exceptions:–An item of plant had a fair value of 3 million above its carrying amount. At the dateof acquisition it hada remaining life of five years. Ignore deferred tax relating to thisfair value.–Square had an unrecorded deferred tax liability of 1 million, which was unchangedas at 31 March2012.Pyramid’s policy is to value the non-controlling interest at fair value at the date ofacquisition. For this purpose ashare price for Square of 3·50 each is representative of thefair value of the shares held by the non-controllinginterest.Page 1 of 5 (kashifadeel.com)

Basic Consolidation(ii)Question 80Pyramid sells goods to Square at cost plus 50%. Below is a summary of theactivities for the year ended31 March 2012 and balances as at 31 March 2012:Pyramid ’000Sales to Square16,000Purchases from PyramidIncluded in Pyramid’s receivables4,400Included in Square’s payablesrecordedSquare ’00014,5001,700On 26 March 2012, Pyramid sold and despatched goods to Square, which Square did notrecord until they werereceived on 2 April 2012. Square’s inventory was counted on 31March 2012 and does not include any goodspurchased from Pyramid.On 27 March 2012, Square remitted to Pyramid a cash payment which was not received byPyramid until4 April 2012. This payment accounted for the remaining difference on thecurrent accounts.(iii)The other equity investments of Pyramid are carried at their fair values on 1 April 2011. At31 March 2012,these had increased to 2·8 million.Required:Prepare the consolidated statement of financial position for Pyramid as at 31 March 2012.(20 marks)ACCA F7 – June 2012 – Q1Page 2 of 5 (kashifadeel.com)

Basic ConsolidationQuestion 80ANSWER TO QUESTION 80: BASIC CONSOLIDATIONPyramidConsolidated Statement of Financial PositionAs at 31 March 2012 000Non – current assetsGoodwill W3Property, plant and equipment 38,100 28,500 3,000 J3 – 600 J4Investment in loan notes 2,500 – 2,500 J6Investment at fair value (other equity) 2,000 800 J8Current assetsInventory 13,900 10,400 1,500 J6 – 500 J7Trade receivables 11,400 5,500 – 4,400 J6Bank 9,400 600 1,200 J625,30012,50011,20049,000128,200Total assetsEquityEquity shares of 1 eachShare premiumRetained earnings W625,00017,60035,78078,3808,48086,860Non Controlling interest W5Non - current liabilities 16,500 4,000 1,000 J521,500Current liabilitiesDeferred consideration 6,400 J1 640 J2Other current liabilities 9,500 5,000 – 1,700 J67,04012,80019,840128,200Total equity and liabilitiesW1 GROUP STRUCTURESquareAcq date:1 Apr 20117,40069,0002,80079,200Group 80%W2 NET ASSETS (of subsidiary) AT ACQUISITIONEquity share capitalRetained earnings (pre)J3J5Page 3 of 5 (kashifadeel.com)NCI 20% 000S10,00018,0003,000(1,000)30,000

Basic ConsolidationQuestion 80W3 GOODWILLInvestment 24,000 6,400 J1Less: 30,000 W2 x r value of NCI 10,000 shares x 20% x 3.50Less: 29,000 W2 x 20%W1W4 POST ACQUISITION RESERVES (of subsidiary)BalanceJ4RE8,000(600)7,400W5 NON CONTROLLING INTEREST30,000 W2 x 20%W1W3 NCI goodwill7,400 W4 x 20% W1S6,0001,0001,4808,480W6 GROUP RESERVESParent reserves 16,200 7,400 W4 x 80% W1JOURNAL ENTRIES WITH WORKINGSInvestment in SDeferred consideration10,000 shares x 80% x 0.88 per share 7,040 x 1.10 -1 6,400(-)1RE (P) Finance costDeferred consideration 6,400 x 10% 640(-)2(i)3PPE 000Dr.Cr.6,4006,4006406403,000RE (pre)Fair value adjustment3,000RE (S)PPEExtra depreciation 3,000 / 5 years 600(i)4Page 4 of 5 (kashifadeel.com)600600

Basic ConsolidationQuestion 80RE (Pre)Deferred tax liabilityFair value adjustment1,000Trade payablesInventory (in transit)(iii)6Cash (in transit)ReceivableCancellation of intra group balances and in transit time recording.1,7001,5001,200(i)51,0004,400RE (P)Inventory 1,500 x 50/150 500500Investment (other)RE (P)Gain 2,800 – 2,000 800800(iii)-75008800Page 5 of 5 (kashifadeel.com)

(ii) Pyramid sells goods to Square at cost plus 50%. Below is a summary of the recorded activities for the year ended31 March 2012 and balances as at 31 March 2012: Pyramid Square '000 '000 Sales to Square 16,000 Purchases from Pyramid 14,500 Included in Pyramid's receivables 4,400 Included in Square's payables 1,700