Transcription

H.I.T. Greatest HitsFebruary / March 2016M&AM A R L I N&A S S O C I A T E SHITMARKETU P D AT EINVESTMENT BANKING AND STRATEGIC ADVISORY TO THE TECHNOLOGY,INFORMATION AND HEALTHCARE INDUSTRIESNew YorkSan FranciscoWashington, D.C.Torontowww.MarlinLLC.com Marlin & Associates Holdings LLC, All Right Reserved

TO OUR CLIENTS AND FRIENDSWelcome to our February / March 2016 HIT Market UpdateA few weeks ago, like many of our colleages in our industry, we put on our comfortable shoesand trotted along the long aisles of the exhibit halls at HIMSS in Las Vegas. We visited manybooths, and talked to multiple vendors, regulators and clients. Here are a few of our keytakeaways.1.We did not see that many vendors with hospital beds on the show floor - We saythis with a bit of tongue-in-cheek. But it is a fact that “care” is increasingly moving out ofthe hospital to other care settings. Despite the increase in population, total number ofdays spent in hospitals is down. Companies are building successful businesses aroundthe whole concept of “care continuum”. That said, not all the pieces have come together.We foresee much more M&A activity before dominant players can emerge.2.CMS has laid down the law on value-based reimbursements and bundledpayments, but most providers are not ready - We were encouraged to see moremature pop health vendors, which are the cornerstones of the new reimbursementmodels. But we need a more cognitive computing approach to clinical data, rather thanthe existing patch work of basic statistical models, to address the regulatoryrequirements.3.Interoperability is inching ahead rather nicely - We are more optimistic than most inthis area. Even vendors that were historically protective of their data have seen the light.We like the fact that the government is leaning hard on all vendors. FDA has joined theforce and has issued guidance for manufacturers of interoperable devices. Mind you, theprogress will be slow but overtime the implications for vendors that make their living assystem-level interoperability engines are significant. They need to gradually move todata-level integration and analytics or run the risk of being marginalized.4.We were disappointed to see many clinical predictive analytics companies stillfocused on crunching claims data - We often forget that claims data is only 15-20% ofthe individual's health profile. It is retrospective, limited, and often yields poor results. Wesaw some exciting companies that are now able to ingest clinical data, genomics and lifestyle data (through wearables), and generate a more holistic view of the individual. It istime for all of us to realize that patient-generated data is a lot more valuable thansophisticated algorithms written on claims data.5.Ransomware and other security breaches are attracting large security softwareplayers from outside the industry - There have been multiple incidences wherehackers have discovered the right price to charge for returning hijacked medial data. InFebruary, Hollywood Presbyterian was hacked and faced a ransom of 3.4 millionpayable in Bitcoin. Blurring boundaries between applications and infrastructure willmaterially increase the complexity of providers’ and payers’ security needs. Vendors withexperience in sophisticated industries, such as finance, are better equipped to deal withthese hackers. So we were not surprised to see many of them on the show floor.6.The new care delivery models will be the biggest contributors to the U.S.productivity gain – Yes, it is true that U.S. healthcare expenditures account for over17% of GDP vs. defense spending which accounts for only 4%. But the rate of increasehas slowed down despite the addition of 10-15 million newly insured individuals to thesystem. We saw many companies that have successfully implemented technologiessuch as patient self-service, e-visits and patient self-management. As these new modelsgo mainstream, the net economic benefits are expected to exceed 10-12% of healthcarespending. That is more than any other industry in the U.S.As the conference came to a close, one thing became clear to us. While the human value thatour industry supports transcends economics, technology is our only hope for bringingefficiency to the system and making it affordable to all. We should be proud.Sincerely,Afsaneh Naimollahwww.MarlinLLC.comFor further information contact:Afsaneh NaimollahAfsaneh@marlinllc.com 1 (212) 257-6055Stephen Shankmansshankman@marlinllc.com 1 (212) 257-6044In this issue: CMS approves reimbursement for the firstdigital app, Omada Health IBM Watson makes its fourth acquisition andbuys Truven Health Analytics for 2.6 billion Allscripts and GI join hands to buy Netsmartfor 950 million in a highly engineeredtransaction Health Catalyst raises another 70 million,bringing its total funding to 220 million

February / March 2016MARLIN & ASSOCIATES HIT MARKET UPDATE03Important Industry News03Merger & Acquisition Transactions04Capital Raising Activity06Sector Analyses06Healthcare Information Software Systems07Technology-Enabled Healthcare Services08Merger & Acquisition Activity TrendsSource: Marlin & Associates, Capital IQ and Public sources. All market and operating data is sourced as of 3/28/16. These companies are a sampleof firms in the sector as M&A defines it, and do not comprise a comprehensive list of all firms in the sector. M&A calculates mean and medianmultiples using data from a set of firms that it believes to be reasonable and which may not be identical to the set reflected above.02

IMPORTANT INDUSTRY NEWSApple announceshospitalsCareKit,anapptoolkit forApple ResearchKit, an open source framework, is nowspinning off a toolkit for hospitals and health systems forhome monitoring of Parkinson’s and post–surgicaldischarge. These are the first two apps from ResearchKit,and the market is expecting many more. The apps aredemonstrative of the importance of patient monitoring athome. Apple is quietly making its mark in healthcare. Wethink, over time, as consumerism takes its hold on ourindustry, healthcare will become a growth engine for thecompany.Medicare to reimburse for diabetes preventionprogram, including Omada’s digital versionThis is the first time a digital health company will receive thegovernment’s stamp of approval for reimbursement; asignificant step forward for our industry. To its credit,Omada spent considerable capital to prove its efficacyfollowing similar protocol to clinical trials.M&A TRANSACTIONSIBM Watson acquires Truven Health Analytics for 2.6 billionMI-based Truven is a leading health analytics company withover 8,500 clients. The company has been around for 40years and has one of the most extensive databases used byboth payers and providers.This is IBM Watson’s fourth major acquisition. The billionsthat the company is investing in these businesses remind usof the old saying “in God we trust, everybody else bringdata”. IBM Watson’s shopping spree is squarely focused onamassing as much health data, analytics and insight aspossible. We look forward to the day that Watson canprovide a systematic solution for the industry. Thus far, theachievements of the company have been limited to selectuse cases.ResMed acquires Brightree for 800 millionResMed (NYSE:RMD) is a medical device company and aleader in sleep-disorder breathing care. Brightree, based inGA, is a software solution provider for the post-acute sectorfocused on the home/durable medical equipment(HME/DME) market.Brightree had sales of 113 million and 43 million ofEBITDA in 2015. This is a high multiple to pay for abusiness that is essentially a distribution firm. Brightree maywell be one of the highest return investments for BatteryVentures, the backers of the company. We will be watchingthis acquisition closely.Nordic Capital and Novo A/S acquire eResearch fromGenstarPhiladelphia-based ERT captures quality efficacy and safetyendpoints for clinical trials.Market sources report that Genstar has generated an 8xreturn on its 400 million investment, which it made in thesummer of 2012. When an industry is so intensively paperbased and one can layer a great automation technology ontop of it, success is bound to happen. Congratulations to theGenstar g, forming the largest corporatewellness companyVirgin Pulse, backed by Insight Venture Partners, buys MAbased Shape Up and Gettheworldmoving in Australia, bothsmaller wellness companies.Allscripts agrees to form JV with GI Partners to buyNetsmart Technologies for 950 millionIt was less than a year ago when Insight acquired themajority stake in Virgin Pulse. This is the beauty of beingbacked by a large and well respected firm. Virgin bought itssmaller U.S. competitor, Shape Up and addedGettheworldmoving as its first foray into the internationalmarket.Allscripts (Nasdaq:MDRX) is contributing its homecarebusiness plus 70M of cash to the JV, and will own themajority of NewCo. Remaining funds are provided by GIPartners in the form of equity and UBS in the form of debt.Although there have been questions about the ROI ofcorporate wellness programs, the industry, particularly forthe self insured employers, is starting to make its mark. Welike this deal.A combination of strategic and private equity firms goingafter big deals is nothing new, but it is somewhat novel inthe healthcare industry. This comes on the heels of a similararrangement between Towerbrook, Ascension Health andAccretive Health. Netsmart, a provider of EMR and revenuecycle management services, has over 20,000 clientsranging from behavioral health facilities to public healthdepartments, with a primary focus on post-acute sector. TheJV is expected to generate 250 million in revenue and 60in operating income.Riverside Partners acquires majority stake in BottomLine SystemsBLS, based in KY, is a leading provider of RCM technologyto large hospital systems.This is a great platform play for Riverside. The RCMindustry needs to consolidate. Constellation HealthcareTechnologies, a US based, AIM listed company, has proventhat the roll up model works.Source: Marlin & Associates, Capital IQ and Public sources. All market and operating data is sourced as of 3/28/16. These companies are a sampleof firms in the sector as M&A defines it, and do not comprise a comprehensive list of all firms in the sector. M&A calculates mean and medianmultiples using data from a set of firms that it believes to be reasonable and which may not be identical to the set reflected above.03

Accel-KKR buys IntegriChainPA-based IntegriChain is focused on the life scienceindustry. The company provides channel managementsolutions to nine of the top 10 pharmaceutical companies.IntegriChain has been around for almost 10 years. Thecompany’s products help pharma companies managesupply chain relationships, inventories, orders andecommerce through their distribution channels. This is agood deal for both the sellers and the buyer. IntegriChainhad been with their previous investors for over nine years.Decision Resources acquires Adaptive Software forclose to 25 millionDecision Resources, owned by the Indian conglomerate,Piramal, acquired the KS-based Adaptive Software, asolution provider for pharmacy benefit management.DR is a large provider of a variety of services to the pharmaindustry, including custom research and advisory services.Adaptive has a large presence in the payer market. Theircustomers manage pharmacy benefits for over 95 millionlives. The majority of the purchase price is based on certainclosing conditions and future performance. The parent ofDR is an aggressive acquirer of successful niche players inthe pharma industry. We like this deal.Nautic Partners acquires the majority ownership ofExactCare Pharmacy from Primus CapitalThis Ohio-based company is focused on medicationadherence for patients with chronic conditions who are onmultiple medications.ExactCare dispenses two million prescriptions serving20,000 patients. They work with payers, home healthagencies and providers; offering a high touch modelincluding multi-dose packaging to simplify daily medicationmanagement, as well as home visits. The companyoperates two pharmacies, one in Ohio and one in NewJersey. ExactCare’s novel approach to medicationadherence is visionary and a great model for similarcompanies.eviCore healthcare acquires medicalmanagement company, QPID HealthbenefitseviCore, a specialty benefit management company servingself-insured entities and risk bearing providers, purchasedQPID, based in Boston. The company delivers a healthrecord intelligence platform for EHRs.QPID’s NLP technology aggregates EHR data, preparesinformation for search and delivers meaningful informationto clinicians and administrators. The company’s corecompetency is the clinical logic and machine learningcapability, which can analyze both structured andunstructured data. The company had raised about 20million prior to the sale. Clinical decision support comes in avariety of colors. This is one way to ensure that theclinicians have the ability to query the vast amount of dataresident in the EHR systems.Citra Health Solutions acquires SironaHealthCitra Health focuses on new alternative payment models.ME-based SironaHealth provides telehealth, call center andengagement services to healthcare organizations.SironaHealth has a long history of clinical care coordinationand patient care and case management. Citra serves 22million members. Citra already manages 250,000 patientsunder new reimbursement models primarily in oncology andjoint replacement programs. We like this deal as activepatient engagement throughout the care continuum is acornerstone of the new reimbursement models.FUNDRAISINGHealth Catalyst raises 70 million of capital led byNorwest Venture PartnersHealth Catalyst, based in UT, and one of the most dynamicclinical analytics companies in the U.S., raises anothermega round, bringing the total funding to 220 million.We have always been big fans of this company. Thecompany is now pushing the envelope in building moreadvanced clinical and workflow applications to prepareproviders for the new reimbursement models. Are welooking at an IPO soon?Ability Network acquires G4 Health Systems10X Genomics raises 55.5 millionAbility Network, one of the largest providers of RCM andclinical applications to the post-acute, acute and ambulatoryproviders, acquired the OK-based G4 Health Systems,which provides RCM services to small and mid sizehospitals.This CA-based company has invented a novel approach togene sequencing.Ability is one of the biggest success stories in the HITsector. The company started life in the post-acute sectorand gradually moved to acute and ambulatory setting viaacquisitions and organic growth. This solves another pieceof the puzzle for the company.One of the biggest problems in gene sequencing is the lackof capability to sequence “long reads” of DNA which canbetter identify subtle variations that are overlooked bydominant companies like Illumina. Companies like Illuminashred biological samples into tiny fragments beforesequencing the short stretches and using computers toassemble them into a genome. 10X is not the only game intown, but it looks like they want to be a partner to Illuminarather than compete with them.Source: Marlin & Associates, Capital IQ and Public sources. All market and operating data is sourced as of 3/28/16. These companies are a sampleof firms in the sector as M&A defines it, and do not comprise a comprehensive list of all firms in the sector. M&A calculates mean and medianmultiples using data from a set of firms that it believes to be reasonable and which may not be identical to the set reflected above.04

dGym raises 45 million for connectedequipment and launches US operationsgymThis brings total funding of this German-based company to 60 million. The company’s equipment offers a trainingportal that allows members to view their workout history,plan their training and connect with friends from dGym’sapp. Users can also sync exercise data from other devices,including apps like Runkeeper to devices from Fitbit orJawbone.We all know that healthcare IT is not a global business.Every country has its own rules and regulations. But when itcomes to healthcare consumerism, the whole dynamicchanges. dGym is a great example of how quicklyhealthcare consumerism can take a company to a globalplatform.medCPU raises 35 million from University ofPittsburgh Medical Center and other investorsNew York-based medCPU, a clinical decision supportcompany, entered into an agreement to sell its majorityownership to UPMC.medCPU is a long time portfolio company of the MerckGlobal Health Innovation Fund. The company’s R&D isbased in Israel. UPMC will become a client of the companyand plans to co-develop new products to take to market. Wehave always been impressed by medCPU’s real timeclinical decision support technology, which is now used inover 60 hospital facilities.Preteus Digital Health raises 25 million from HarbinGloria Pharmaceuticals of ChinaPreteus, based in California has raised close to 400 millionin capital since its founding in 2001.The company offers a digital medication adherenceprotocol. Via sensors embedded in medication, theproviders and caregivers are able to follow the patientsmedication adherence. Patient self management is clearlyimportant but we are not sure the market for Preteus willhave a lot of traction in the immediate future.Connecture raises 52 million from FranciscoPartners and current investor ChysalisConnecture, based in Wisconsin, is a leading infrastructuresoftware company for building health insurancemarketplaces.The company rode the hype in building public healthexchanges for some time. The stock reached a high of 14and is now down to just under 3. We have said before thatFrancisco Partners is one of the savviest investors inhealthcare. There are many options for Connecture torepurpose its capabilities and pivot its business to become aplayer in health e commerce market.Medgate receives a large investment from NorwestVenture Partners, Bank of Montreal and othersThe Toronto-based company provides software to theenvironmental, health and safety (EHS) industry.Medgate is considered a leader in the EHS industry offeringa SaaS-based solution that captures, tracks, and reportsessential corporate data pertaining to EHS management.Industry sources estimate that the EHS market is about 1.0 billion in size, growing at double digits. With increasingregulatory and compliance requirement facing all industries,the company is well positioned for continued growth. As amatter of fact, Medgate just won a large contract fromNASA managing the agency’s occupational health andindustrial hygiene data management requirements.Maxwell Health raises 22 million to scale itsemployee benefits offeringThe MA-based company has raised over 56 million so far.The solutions are sold to small and mid-size employers.Employees use Maxwell Health to access their benefitsinformation and manage their health. The HR departmentsin turn use the platform to communicate with employeesand manage administrative tasks.We are starting to see the footprint of many wellnesscompanies expand beyond just health. This is a greatexample of that trend.Vivify Health raises 17 million of capital led byUPMCThe TX-based company has raised over 24 million incapital.There are many players in the patient monitoring businessbut Vivify’s is one of the most dynamic companies in thebusiness. The company has over 500 hospitals undercontract and has proven a 65% success ratio inreadmission reduction. With strategic investors likeAscension, UPMC, Envision Healthcare and LabCorp, Vivifystands an excellent chance of becoming a success story.PokitDok receives a strategic investment fromMcKesson VenturesPrior to this round, this CA-based company had raised over 55 million of capital.We have been huge fans of this company for some time.PokitDok provides a comprehensive back end for a varietyof healthcare providers including the new on demand digitalhealthcare companies. The founders come from largetechnology companies like Microsoft. If you want to start adigital health company today, PokitDok, through its API’s,can perform the back end applications and processing foryou. We think McKesson is attracted to the companybecause they can run their non-acute business via thePokitDok’s API’s.Source: Marlin & Associates, Capital IQ and Public sources. All market and operating data is sourced as of 3/28/16. These companies are a sampleof firms in the sector as M&A defines it, and do not comprise a comprehensive list of all firms in the sector. M&A calculates mean and medianmultiples using data from a set of firms that it believes to be reasonable and which may not be identical to the set reflected above.05

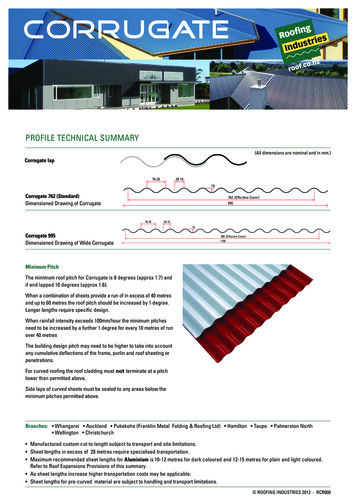

February / March 2016Healthcare Information Software SystemsPublic Market Data5 Year M&A HISS Index[1] vs. S&P 500, base r-12Apr-13Apr-14Apr-15EV / LTM RevenueCom pany(USD m illions)Cerner200EV / EBITDAEV / Revenue5 Year LTM Revenue & EBITDA Multiples[1]10xApr-1615010050Apr-11Apr-12Apr-13EV / LTM EBITDAMarket EnterpriseCapValueEV / RevenueCY2015A CY2016EApr-14Apr-15M&A HISS IndexEV / EBITDACY2015A CY2016ERevenue Grow thCY2015A CY2016EApr-16S&P 500EBITDA MarginCY2015A CY2016E17,94118,0334.1x3.6x15.0x10.7xna a 23%20%7%21%Veeva Systems3,5123,1667.7x6.2x36.4x21.9xna 31%25%21%28%Inovalon2,7882,3415.4x4.6x16.7x13.0xna 21%18%32%35%CompuGroup Medical2,3852,7684.5x4.3x23.3x18.7xna 5%5%19%23%Allscripts2,3272,8472.1x2.0x25.3x10.3xna 1%4%8%19%Medidata2,0512,0345.2x4.4x50.8x19.0xna 3xna 44%36%27%33%The Advisory Board1,2851,7662.3x2.2x17.2x9.4xna 34%7%13%23%Benefitfocus8858614.7x3.7xnmnana 35%26%nanaQuality Systems8737681.6x1.4x13.5x8.3xna 3%9%12%17%Computer Programs & ivata2942432.0x1.8xnmnana x20.2x14.7x13.0x20%23%18%17%17%18%26%23%Trim MeanMedianInovalon added as of 2/12/15Source: Marlin & Associates, Capital IQ and Public sources. All market and operating data is sourced as of 3/28/16. These companies are a sampleof firms in the sector as M&A defines it, and do not comprise a comprehensive list of all firms in the sector. M&A calculates mean and medianmultiples using data from a set of firms that it believes to be reasonable and which may not be identical to the set reflected above.06

February / March 2016Technology-Enabled Healthcare ServicesPublic Market Data5 Year LTM Revenue & EBITDA Multiples[1]5 Year M&A Tech-Enabled HCS Sector Index[1] vs. S&P 500, base 10020x2004.0xEV / EBITDAEV / -14Apr-15EV / LTM RevenueCom pany(USD m illions)McKesson8xApr-1615010050Apr-11Apr-12EV / LTM EBITDAMarket EnterpriseCapValueEV / RevenueCY2015A CY2016EApr-13Apr-14Apr-15M&A Tech-Enabled HCS IndexEV / EBITDACY2015A CY2016ERevenue Grow thCY2015A CY2016EApr-16S&P 500EBITDA MarginCY2015A 2,9953,1565.0x4.5x21.5x14.1x10%10%23%32%Press Ganey1,5151,6695.2x4.7x58.8x12.7x13%10%9%37%HMS t %56%nan/aHealthw ays3535880.8x0.8x17.8x6.9x4%(0%)4%11%Vocera Communication3382222.1x1.9xnmn/a9%10%na1%Castlight Health2941742.3x1.7xnmn/a65%33%nan/aAccretive Health2571521.3x0.6xnm5.8x(44%)128%na10%Everyday Health1732541.1x1.0x10.5x5.7x26%11%10%17%Cranew 3.2x8.8x8.0x19%13%24%11%17%16%21%21%EmisTrim MeanMedianna naPress Ganey added as of 5/20/15, Evolent added as of 6/8/15, MINDBODY added as of 6/19/15 and Teladoc added as of 7/1/15Source: Marlin & Associates, Capital IQ and Public sources. All market and operating data is sourced as of 3/28/16. These companies are a sampleof firms in the sector as M&A defines it, and do not comprise a comprehensive list of all firms in the sector. M&A calculates mean and medianmultiples using data from a set of firms that it believes to be reasonable and which may not be identical to the set reflected above.07

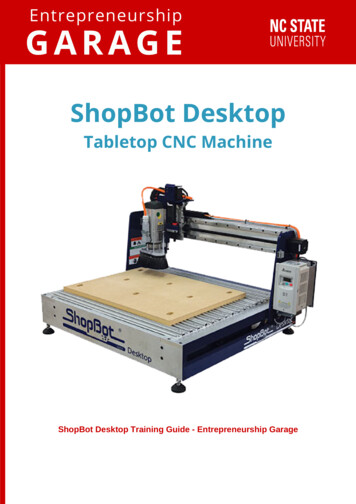

February / March 2016MERGER AND ACQUISITION TRANSACTIONSHealthcare Technology and Services Transaction Activity18025.0160Number of Transactions12015.01008010.06040Aggregate Value ( B)20.01405.02000.0Q4Q1Q2Q3Q4Q1Q22014Q3Q42015Number of TransactionsAggregate ValueNote: Excludes Medtronic acquisition of Covidien, Anthem acquisition of Cigna, and Aetna acquisition of HumanaHealthcare Technology and Services Transaction Multiples4x18x3.5x16x14x3x10x2x8x1.5xEV / EBITDAEV / Q42015EV / RevenueSource: Marlin & Associates, Capital IQ and Public sources. All market and operating data is sourced as of 3/28/16. These companies are a sampleof firms in the sector as M&A defines it, and do not comprise a comprehensive list of all firms in the sector. M&A calculates mean and medianmultiples using data from a set of firms that it believes to be reasonable and which may not be identical to the set reflected above.EV / EBITDA08

SELECT MARLIN & ASSOCIATES AWARDS“Boutique Investment Banking Firm of the Year (2014)”Acquisition International recognized Marlin& Associates for the M&A Award USA TMTAdvisory Firm of the Year (2012)The Global M&A Network recognized Marlin& Associates for excellence in multiple dealcategories through its M&A Atlas Awards: Financial Technology Deal of the Year (2012, 2011) North America Small Mid Markets Corporate Deal of theYear (2013) Entertainment & Media Deal of the Year (2011) Corporate M&A Deal of the Year (2010) Technologies Deal of the Year (2010)The M&A Advisor and The M&A Forum,conference producers and newsletterpublishers serving the middle marketfinance industry, named Marlin & Associatesas the: Boutique Investment Banking Firm of the Year (2014) Middle Market Investment Banking Firm of the Year(2008 and 2007) Middle Market Financing Agent of the Year – Equity(2007)The M&A Advisor and The M&A Forumhave recognized Marlin & Associatesfor excellence in multiple dealcategories including: Healthcare and Life Science Deal of the Year (Over 100Mto 500M) (2013) Financial Services Deal of the Year (2013, 2012 and 2011) Nominated for Middle Market Healthcare Services Deal ofthe Year (2012) Information Technology Deal of the Year (2011) Middle Market Deal of the Year 25M (2011) Corporate and Strategic Acquisition of the Year (2011) Middle Market Financial Services Deal of the Year(2011 and 2010) Middle Market Information Technology Deal of the Year(2011 and 2010) Middle Market International Financial Services Dealof the Year (2013 and 2010) Middle Market International Information Technology Dealof the Year (2010) Middle Market International Professional Services (B-to-B)Deal of the Year (2013) Middle Market Professional Services Deal of the Year (2010) Middle Market Financial Services Turnaround Deal of theYear (2009) Middle Market Information Technology TurnaroundDeal of the Year (2009) Middle Market International Deal of the Year(2008) Middle Market Financial Services Deal of the Year (2008) Middle Market Technology Deal of the Year (2008) Middle Market International/Cross Border Deal of the Year(2007, Below 100M) Middle Market Financial Services Deal of the Year (2007,Below 100M) Middle Market Computer and Information Technology Dealof the Year (2007, Below 100M) Middle Market Financing Deal of the Year - Equity (2007) Middle Market Financing - Financial Services Deal of theYear (2007) Middle Market Financing - Computer, Technology andTelecommunications Deal of the Year (2007)The 451 Group, a noted independenttechnology industry analyst company,identified Marlin & Associates as a leader incross-Atlantic technology merger andacquisition transaction advisorySNL Financial, a market researchcompany, identified Marlin & Associates asleading the most financial technologytransactions in 2009, in a tie with Citigroupand Credit Suisse, and one of the top 10advisors in 2010Two transactions on which Marlin & Associatesadvised were named as part of The M&AAdvisor’s “Deals-of-the Decade CelebrationSource: Marlin & Associates, Capital IQ and Public sources. All market and operating data is sourced as of 3/28/16. These companies are a sampleof firms in the sector as M&A defines it, and do not comprise a comprehensive list of all firms in the sector. M&A calculates mean and medianmultiples using data from a set of firms that it believes to be reasonable and which may not be identical to the set reflected above.09

MARLIN & ASSOCIATES SENIOR TEAMKen MarlinChief Operating Officer M&A 18 years of M&A experience M&A attorney of Skadden, Arps, Slate,Meagher and Flom CFO of JCF Group VP Business Development at FactSet Law Degree from Fordham LawSchool MBA from Columbia Business School CFA CharterholderFounder and Managing Partner of M&A Twice named to II’s tech 50 Member Market Data Hall of Fame MD Veronis Suhler Stevenson CEO of Telesphere Corporation CEO of Telekurs (NA) EVP Bridge Information systems SVP at Dun & Bradstreet BA from the University of California (Irvine) MBA from UCLA, post-MBA from New YorkUniversity 15 years of investment banking andprivate equity experience Named to Dealer’s Digest 40-Under-40 Founded Marlin & Associates withKen Marlin Led VSS research Morgan Stanley American International Group BS from Binghamton UniversityJason PanzerMichael Maxworthy 20 years of M&A experience Founder of Chela Capital Global Head of Barclays’ CapitalTechnology Group BA in Economics

Allscripts agrees to form JV with GI Partners to buy Netsmart Technologies for 950 million Allscripts (Nasdaq:MDRX) is contributing its homecare business plus 70M of cash to the JV, and will own the majority of NewCo. Remaining funds are provided by GI Partners in the form of equity and UBS in the form of debt.