Transcription

Core Changes to the2020 GIPS Standards PMAR Web ConferenceNovember 10, 2020L. Todd Juillerat, CFA

First of all What is GIPS?The Global Investment Performance Standards(“GIPS ”) standards are:Voluntary standards governing the calculation andpresentation of investment performance based on theethical principles of fair representation and fulldisclosure2

Goals of the GIPS Standards Ensure accurate and consistent data Obtain worldwide acceptance of a single standard forcalculating and presenting performance Promote fair, global competition amongst investmentfirms Promote industry self-regulation on a global basis Promote investor interests and instill investor confidence3

GIPS Standards Resources GIPS Handbook Standards - released Explanations/Interpretations – released/pending Guidance Statements – pending GIPS website – www.gipsstandards.org GIPS Handbook (2010 version currently available) Q&A Database News & Events4

Background: Why Update? Expand the appeal and pertinence for more firms Firms managing alternative asset classes/strategies Private client and wealth management firms Pooled fund (e.g., MF and ETF) oriented firms Provide clarity and appeal for asset owners Dedicated “chapter” More contextualized, appropriate and pertinent content Consolidation of all accumulated guidance Q&As and Guidance Statements5

Most Impactful Changes Core Structural Changes Standalone “chapters” for firms, asset owners, and verifiers Distinctions regarding treatment of pooled funds Expanded Opportunity for Use of MWRs Re-introduction of Carve-outs with Allocated Cash Changes to Performance Record Portability More Do’s and Don’ts Reported elements, disclosures, policies/procedures, etc.6

Broad Terminology Changes The term “compliant presentation” has been re-phrasedto “GIPS Report”, with differentiation between GIPSComposite Report and GIPS Pooled Fund Report The term “prospective client” has been bifurcated to“prospective client” and “prospective investor”7

New Structure: GIPS “Chapters” GIPS Standards for Firms GIPS Standards for Asset Owners GIPS Standards for Verifiers8

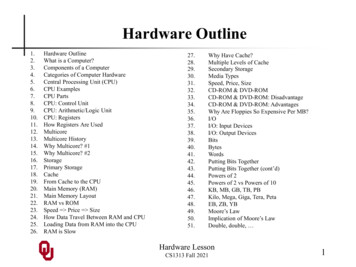

Alignment of Sections:Provisions (For Firms)General Provisions1. Fundamentals of Compliance2. Input Data and Calculation Methodology3. Composite and Pooled Fund MaintenanceGIPS Composite Reports4. Composite Time-Weighted Return Report5. Composite Money-Weighted Return ReportGIPS Pooled Fund Reports6. Pooled Fund Time-Weighted Return Report7. Pooled Fund Money-Weighted Return Report8. GIPS Advertising Guidelines-Composites; LDPFs; BDPFs9

Alignment of Sections:Provisions (For Asset Owners)General Provisions21. Fundamentals of Compliance22. Input Data and Calculation Methodology23. Total Fund and Composite MaintenanceGIPS Composite Reports24. Total Fund and Composite Time-Weighted Return Report25. Additional Composite Money-Weighted Return Report26. GIPS Advertising Guidelines- Composites; LDPFs; BDPFs10

Other Pertinent Sections forBoth Firms and Asset Owners GIPS Glossary Appendices for Sample GIPS Reports Appendices for Sample GIPS Advertisements Appendices for Sample Lists11

Differentiation of Pooled FundsBroad distribution pooled fund (BDPF): Pooled fund that is regulatedunder a framework that would permit the general public to purchase orhold the pooled fund’s shares, and is not exclusively offered in one-onone presentations Limited distribution pooled fund (LDPF): Any pooled fund that is not abroad distribution pooled fund “Explanation of the Provisions” for 1.A.13 includes a very helpful table,for use in determining how to classify pooled funds as one or the other NB: Classification as BDPF or LDPF is made at the fund level, not at theshare class level12

Treatment of Pooled Funds(1 of 2) Pooled funds must be included in any composite forwhich it meets the composite definition (i.e., can’tbe excluded due to vehicle type) If historic separation of segregated accounts andpooled funds can’t be supported, firms mustredefine one of them to include the other, or createa new composite to include all historically13

Treatment of Pooled Funds(2 of 2) If LDPF or BDPF is included in a composite, it still mustappear on the list of LDPF descriptions or the list of BDPFs Firms may terminate historic composites comprisedexclusively of pooled funds if they’re not managed or offeredas a segregated account But they should be sure they won’t decide to offerthem in the future14

Expanded Opp’ties for Use ofMoney-Weighted Returns (1 of 4) Option for MWR (in addition to or instead of TWR) for awider range of structures, if criteria are met:The firm has control over the external cash flows into the portfolios inthe composite or pooled fund The portfolios have at least one of the following characteristics:a. Closed-end b. Fixed lifec. Fixed commitmentd. Illiquid investments as a significant part of the investment strategy15

Expanded Opp’ties for Use ofMoney-Weighted Returns (2 of 4) If these conditions are not met for the composite/fund, thefirm must present TWRs in the GIPS Report, but maypresent MWRs as supplemental information16

Expanded Opp’ties for Use ofMoney-Weighted Returns (3 of 4) If reporting MWRs, firms are only required to present sinceinception MWR through the most recent annual period end Prior requirement was since inception through each annual period end Similarly, in 2020, GIPS Reports that include MWRs arerequired to include information about committed capital,distributions, and related multiples only as of the most recentannual period end (rather than as of each annual period end)17

Expanded Opp’ties for Use ofMoney-Weighted Returns (4 of 4) With expanded MWR flexibility comes clarity regardinglimitations: No back-and-forth cherry picking Firms must “consistently present the return(s) selected for eachcomposite or pooled funds unless there is a compelling reason tochange the type of return presented”18

New (Reintroduced) Options re:Carve-outs with Allocated Cash Carve-outs with actual cash have always been allowed Carve-outs with allocated cash are again permitted Must be representative of a standalone portfolioIf creating a carved-out segment, must carve-out from all portfoliosmanaged to that strategy and include in the carve-out compositeMust include the phrase “carve-out” within composite nameOnce a firm has standalone portfolios in the same strategy, it mustcreate a separate composite for these and include the results in thecarve-out composite’s GIPS Report See “Explanation of the Provisions in Section 3” for detailsSee Appendix A, Sample 5, for an example19

New Wrinkle re: Carve-outsWith or Without Allocated Cash Firms were previously required to include all multi-strategy portfolios within a composite New provisions allow firms to include each segment(“carve-out”, with either dedicated or allocated cash)within an appropriate composite May include multi-strategy portfolio in an appropriatemulti-strategy if desired, but not required to do so20

Changes to Performance RecordPortability Key Change #1: No longer required to port performanceif tests are met Key Change #2: Specificity re: what can/can’t be donein the event of a “break” in the performance betweenpast firm and new firm (Supplemental information) Key Change #3: Clarity re: “one year grace period”21

Portability Tests May use composite performance from a prior firm andlink it to new firm if certain portability tests are met:Substantially all the investment decision makers are employed bythe new firm The decision-making process remains substantially intact andindependent within the new firm The firm has records to support the performance from the past firm There is no break in performance between the past firm and thenew firm (New criteria) 22

Portability “Grace Period” Clarity If a firm acquires another, it has one year to bring anynon-compliant assets into complianceAssets of the acquired non-compliant firm must meet allrequirement of the GIPS standards within one year of theacquisition date, on a going forward basis (i.e. retroactivecompliance is not required) If the firm does not construct the composite retroactively, a breakin the track record will occur and the firm will be unable to link tothe prior firm’s track record A firm may decide to port a track record from an acquired firm atany point in the future, if the portability requirements are met 23

Portability: Add’l Clarifications(1 of 3) If a non-compliant firm acquires a compliant firm, thenon-compliant firm cannot then claim compliance,even if all the portability tests are met The non-compliant acquiring firm must attain compliance for its ownassets for at least a five-year period (or since inception if less than fiveyears) before it can claim compliance for the newly combined entity24

Portability: Add’l Clarifications(2 of 3) Explicit indication that a track record based on a subset ofportfolios from the past firm can be presented only assupplemental information in a GIPS Report, and must not belinked to the track record of the composite at the new oracquiring firm This is contrary to some prior interpretations that the creation of acomposite based upon a subset (such as client accounts whichtransferred to the new firm) was permissible25

Portability: Add’l Clarifications(3 of 3) Explicit indication that records must include the entirety ofperformance (including underlying portfolios), contrary tosome prior interpretations that simply having compositereturns submitted to an industry database was adequate If porting performance from an acquired firm to be linked toongoing performance (per criteria), the track record mustcover at least five years or since inception (if less than fiveyears) Cannot “cherry pick” time periods and only show, for example, the pasttwo years of good performance and drop the preceding poor results26

New Disclosure Requirements(1 of 3) New language for claim of compliance disclosure Firms must not exclude any portion of the compliancestatement, and any modifications must be additive CFA Institute registered trademark disclosure NB: Trademark usage guidelines on CFAI website27

New Disclosure Requirements(2 of 3) Must indicate a GIPS Report is within marketing materials Must present the percentage of composite or pooled fundassets that were valued using subjective unobservableinputs (if material) Composite Descriptions: Explicit new componentsMaterial risks of the composite’s strategy How leverage/derivatives/shorts may be used, if material If illiquid investments are a material part of the strategy 28

New Disclosure Requirements(3 of 3) Must disclose composite inception date Must disclosure of total firm assets (distinct from the prioroption to report composite percentage of total firm assets29

New Reporting Requirements(1 of 3) Optional reporting of advisory-only assets in GIPS Reports(for composite assets and/or firm assets) Optional reporting of committed capital in GIPS Reports(for composite assets and/or firm assets)30

New Reporting Requirements(2 of 3) Must make every reasonable effort to provide a GIPSReport to a prospect when they become one, and provideReport at least every twelve months if they remain one Explicit indication or footnote for number of accounts andinternal dispersion statistics being not applicable For example, less than or equal to five31

New Reporting Requirements(3 of 3) Must present initial, partial period for new composites Must present final, partial period for terminated composites Must include benchmark returns for the same periods asthe composite or pooled fund32

Required Lists/Descriptions List of composite descriptions (as before) List of LDPF descriptions List of BDPFs (description not required, except upon requestfor a particular fund) The firm may use its website for the list if all are included33

Fees and Expenses Overall lots of nuances, esp. due to differentiation in treatment ofpooled funds (for both Composite Reports and Pooled FundReports, and whether fund is or isn’t in the composite) Highlight: If GIPS Composite Report is being provided to aprospective investor for a pooled fund, you must include the feeschedule / total expense ratio applicable to the pooled fundMay use highest and distribute to all prospective investors, or includemultiple ones, but a range is insufficient Consider how to manage scenario of multiple pooled funds within acomposite for which you use GIPS Report for prospective investors 34

Policy/Procedure Requirements(1 of 2) Numerous new things must be explicitly documented anddescribed within policies & procedures Broadly speaking, if you’re required to do it, you’re required todocument exactly what you do and how you do it35

Policy/Procedure Requirements(2 of 2) Error Correction (Material Errors): Must provide correctedGIPS Report (including disclosure of material error) to Current verifier Any prior verifier that received it Current clients/investors that received it (already required) And make every reasonable effort to provide to currentprospects that received it (already required) Verifier independence (for firms that are verified)36

Add’l Flexibility (Good News!)(1 of 2) Sunset provisions for disclosures such as composite namechanges and significant events (minimum of one year, andfor as long as relevant) Flexibility moving accounts to/from composites (e.g., privatewealth clients who’ve given firms discretion over assetallocation, etc.)37

Add’l Flexibility (Good News!)(2 of 2) Allowance of estimated transaction costs, whenactual costs are not known (e.g. “wrap” accounts),but must disclose such use and methodology used38

More Do’s and Don’ts And various others 39

Contact DetailsL. Todd Juillerat, Main Office: 732-873-570040

1. Fundamentals of Compliance. 2. Input Data and Calculation Methodology. 3. Composite and Pooled Fund Maintenance. GIPS Composite Reports. 4. Composite Time -Weighted Return Report . 5. Composite Money -Weighted Return Report. GIPS Pooled Fund Reports. 6. Pooled Fund Time-Weighted Return Report . 7. Pooled Fund Money-Weighted Return Report. 8 .