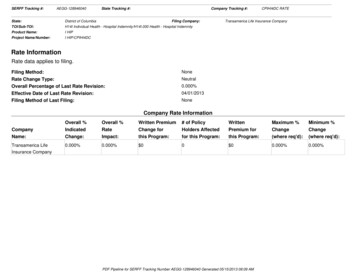

Transcription

Protection Series –Hospital Indemnity FlexInsurance PlansUnderwritten byContinental Life Insurance Companyof Brentwood, TennesseeAn Aetna 819

Our commitment to youContinental Life Insurance Company of Brentwood, Tennessee, an Aetna companyheadquartered in the Nashville, Tennessee area, has an unwavering commitmentto providing the best service possible, quick claims payment, quality products withsolid financial backing, and friendly associates with extensive knowledge andexperience to help with your insurance needs. For over 33 years, policyholdershave relied on our company to be there when they need us. We take thoseobligations very seriously and everything we do is focused on fulfilling ourcommitments in a timely, hassle-free manner – so you can have the bestexperience possible. aetnaseniorproducts.comNotice to buyer: This is not a Medicare Supplement policy. This is not a Major Medical policy. This policy may not cover all of your medical or health care expenses. This policy should not be purchased as a substitute for Medicare or Medicare related health plans. This is a supplement to health insurance and is not a substitute for Major Medical coverage. Lack of MajorMedical coverage (or other minimum essential coverage) may result in an additional payment with your taxes.This brochure is an illustration for a Hospital Indemnity Flex insurance policy and is not a contract of insurance.For complete details of all provisions or benefits, please read your policy carefully.2

Security, stability, serviceThat’s what you can expect when you choose a Hospital Indemnity Flexinsurance plan from Continental Life Insurance Company of Brentwood,Tennessee, an Aetna Company.This insurance can help pay for out-of-pocket costsassociated with your current medical coverageProtect your savingsIndemnity means “protection or securityagainst damage or loss.” Hospital IndemnityFlex insurance is designed to do just that –help protect your savings and your securityfor the future. This insurance can help offsetthe cost of deductibles, co-pays, andunexpected or additional expensesincurred but not covered by your otherinsurance plans. Benefits are paid directlyto you, or a medical provider that youdesignate, and are paid in addition to anyother health care coverage. Our planbenefits give you the choice of whichoptions are right for you.Source: dictionary.comHospital inpatient or observation outpatientEvery year, more Medicare beneficiaries are entering hospitals as observation patients.In a span of eight years, the number doubled to nearly 1.9 million.Source: Centers for Medicare and Medicaid Services, http://khn.org/news/observation-care-faq/If you have Medicare, askYour doctor may order observationservices to help decide whether youneed to be admitted to a hospital asan inpatient or can be discharged.During the time you’re gettingobservation services in a hospital,you’re considered an outpatient. Thatmeans you can’t count this timetowards the 3-day inpatient hospitalstay needed for Medicare to coveryour skilled nursing facility stay.Source: https://www.medicare.gov/Pubs/pdf/11435.pdfLeading causes of hospitalizationdue to nonfatal unintentional injury2001-2015Source: Centers for Disease Control and Prevention, National Centerfor Injury Prevention and Control. Web–based Injury Statistics Queryand Reporting System (WISQARS) [online]. Accessed August 25, 20173

Our solutions for protection –your choice for flexibilityThe benefits and premiums for this plan will vary based on the plan optionsselected. For complete details of all provisions or benefits, please read yourOutline of Coverage and policy carefully.Plan benefits (select one)Both options require a 31 day, 15 dailyhospital confinement benefit.Option 1Hospital Admission IndemnityThis benefit will pay a lump sum amount ifyou are confined in a hospital, includingobservation stays. The benefit is for one timeper period of care and is available in 250units, up to a maximum of 2,500.Option 2Daily Hospital IndemnityThis benefit will pay a daily amount if youare confined in a hospital, includingobservation stays. The benefit will be paidfor each day of confinement and is availablein 10 units, up to a daily maximum of 700.The benefit period is for one time perperiod of care. Available benefit periods are3-10 or 20 days with a lifetime maximum of365 days. Observation stays for less than 24consecutive hours will pay 50% of the dailyhospital confinement indemnity benefit,one time per period of care. This benefit isnot payable if you receive the daily hospitalconfinement indemnity benefit.Benefit ridersDaily Skilled Nursing Facility IndemnitySkilled care services are services that can only beprovided in a nursing facility, on a daily basis, andordered by a doctor. Admission to the nursingfacility must immediately follow a hospitalconfinement (including observation stays) of at4least three consecutive days, with the skilled carebeing received on a covered day. The benefit isavailable in 10 units, up to a daily maximum of 200. Choice of covered days includes: days 1-20,days 21-100, or days 1-100.Doctor’s Office Visit IndemnityThe benefit is available in 10 units, up to a maximumof 60 per visit and up to 20 visits per calendar year.Outpatient Surgical Procedure IndemnityThe benefit is available in 250 units, up to amaximum of 1,500 per surgical procedure, onetime per calendar year.Hospital Emergency Room Visit orAmbulance ServiceServices must be medically necessary and on anemergency basis. The benefit amount for thisservice is 200 per visit/service, two times percalendar year.Lump Sum Cancer Fixed IndemnityThis benefit will pay a lump sum amount for the firstoccurrence of medically diagnosed cancer after theeffective date and the expiration of a 30 day benefitwaiting period. Choice of 2,500; 5,000; and 10,000 benefit, once per lifetime. The riderterminates when the policy terminates or theone-time cancer benefit is paid.Outpatient RehabilitationThis benefit will pay for each day you receive oneof the following therapies on an outpatient basisfor treatment of a covered illness or coveredinjury: occupational, physical, or speech. Thebenefit is available for 15 or 30 visits percalendar year, 50 per visit.

Pre-existing conditionsIssue agesPre-existing conditions are not covered unless theloss begins more than three months after thecoverage effective date. This means a condition forwhich the insured has been medically diagnosed,treated by, or sought advice from, or consultedwith, a physician during the six months before thecoverage effective date.Issue ages 18-89 based on the application signaturedate.Guaranteed renewableYou have the right to renew your policy forconsecutive terms by paying the required premiumbefore the end of each grace period. Subject to thePolicy and Coverage Termination provisionsdetailed in the policy.DefinitionsAmbulance servicePhysical transportation by ground, air, or water in avehicle registered to a licensed medicaltransportation service.Ambulatory surgical center or outpatientsurgical facilityA public or private permanent establishment withan organized staff of doctors, equipped andoperated for the primary purpose of performingsurgeries. Does not accommodate overnightpatient stays.Covered daysThe range of days that makes up the period of timethat the benefits are covered. Benefits begin on thefirst day of the range of days selected.Hospital confinement or confinedWhen the insured is formally admitted to a hospitalas an inpatient or receives necessary andcontinuous observation in a hospital for at least24 hours.Medically necessaryThe service or care that is required to diagnose ortreat the insured’s condition and is: (a) prescribedby a physician; (b) in accordance with standards ofgood medical practice; (c) not mainly forconvenience of the insured, the insured’simmediate family, a physician or other provider; and(d) is the most appropriate medical treatment orlevel of care, which can safely be provided.OutpatientEmergency room services, observation services,outpatient surgery, lab tests, x-rays or any otherhospital service received and a doctor has not writtenan order to admit to a hospital as an inpatient.Period of careBegins with the first day of hospital confinementdue to a covered illness or injury. Ends when out ofthe hospital or skilled nursing facility and do notrequire medical care for 60 continuous days.Reference Outline of Coverage and policy forcomplete details.5

ExclusionsWe will not pay for losses resulting from,or expenses of:1. Treatment, services or supplies including:experimental/investigational procedures orparticipation in clinical trials; diagnostic labtesting, x-rays, advanced studies andvenipuncture; cosmetic surgery, routine footcare, dental services, acne or varicose veins;allergy testing/injections; speech, occupationaland physical therapy (unless optional OutpatientRehabilitation rider is chosen); pre-employment,pre-marital or routine physical examinations;therapy or treatment of learning disorders ordisabilities, developmental delays, mentaldisorders, nervous disorders withoutdemonstrable organic disease or sleep disorders;programs, treatment or procedures for tobaccocessation or substance use disorders; and weightreduction, including, but not limited to, wiring ofthe teeth and all forms of surgery including, butnot limited to, bariatric surgery, intestinal bypasssurgery and complications resulting from anysuch surgery.2. Eye examinations, eyeglasses, or contact lensesto correct refractive errors and related servicesincluding surgery performed to eliminate theneed for eyeglasses, for refractive errors such asradial keratotomy or keratoplasty; treatment forcataracts; orthoptics and visual eye training.63. Hospice care, custodial care or home health care.4. Pregnancy and reproduction.5. War or an act of war, riot or in the commission orattempted commission of an assault or felony.This includes an act of international armedconflict.6. The commission or attempted commission of acrime or felony or while engaged in an illegal act;or while imprisoned.7. Suicide or attempted suicide or intentionallyself-inflicted injury, whether while sane or insane.8. Injury sustained while operating a motor vehiclewhere the insured’s blood alcohol level, asdefined by law, exceeds that level permitted bylaw or otherwise violates legal standards for aperson operating a motor vehicle in the statewhere the injury occurred.9. Treatment or services provided by a member ofyour immediate family.Reference Outline of Coverage and policy forcomplete details.

7

Aetna is the brand name used for products and services provided by one or more of the Aetna group of subsidiarycompanies, including Continental Life Insurance Company of Brentwood, Tennessee, and its affiliates (Aetna). Notconnected with or endorsed by the U.S. Government or the Federal Medicare Program. 2019 Aetna Inc.

This insurance can help pay for out-of-pocket costs associated with your current medical coverage Protect your savings Indemnity means "protection or security against damage or loss." Hospital Indemnity Flex insurance is designed to do just that - help protect your savings and your security for the future. This insurance can help offset