Transcription

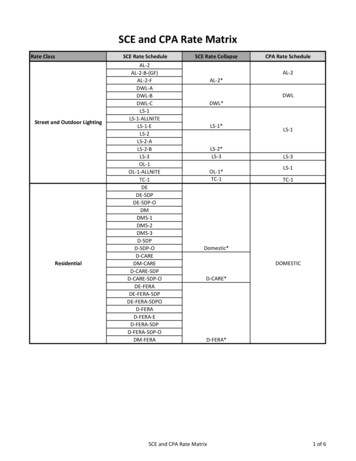

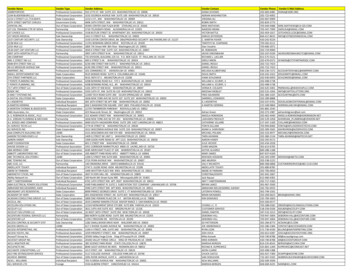

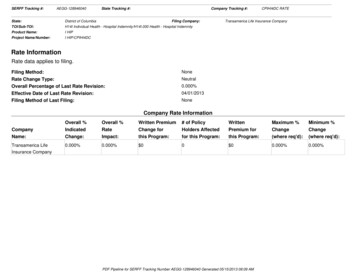

SERFF Tracking #:AEGG-128946040State Tracking #:Company Tracking #:State:District of ColumbiaTOI/Sub-TOI:H14I Individual Health - Hospital Indemnity/H14I.000 Health - Hospital IndemnityFiling Company:Product Name:I HIPProject Name/Number:I HIP/CPIHI4DCCPIHI4DC RATETransamerica Life Insurance CompanyRate InformationRate data applies to filing.NoneFiling Method:Rate Change Type:Overall Percentage of Last Rate Revision:Effective Date of Last Rate Revision:Filing Method of Last Filing:Neutral0.000%04/01/2013NoneCompany Rate InformationCompanyName:Transamerica LifeInsurance CompanyOverall %IndicatedChange:Overall %RateImpact:Written PremiumChange forthis Program:# of PolicyHolders Affectedfor this Program:WrittenPremium forthis Program:Maximum %Change(where req'd):Minimum %Change(where req'd):0.000%0.000% 00 00.000%0.000%PDF Pipeline for SERFF Tracking Number AEGG-128946040 Generated 05/15/2013 08:09 AM

SERFF Tracking #:AEGG-128946040State Tracking #:Company Tracking #:State:District of ColumbiaTOI/Sub-TOI:H14I Individual Health - Hospital Indemnity/H14I.000 Health - Hospital IndemnityFiling Company:Product Name:I HIPProject Name/Number:I HIP/CPIHI4DCCPIHI4DC RATETransamerica Life Insurance CompanyRate/Rule ScheduleItemNo.ScheduleItemStatusAffected Form Numbers(Separated with commas)Document NameRate ActionRate Action InformationAttachments1Rate SheetCPIHI4DC, CRAMB400,CRCI0400, CRERS400,CRHA0400, CRDA0400,CRMN0400, CRIPM400,CRISRG00, CRCICU00,CRACIN00, CRASD400,CRLAB400, CROPV400,CRSDT400, CROPS400,CRRX0400, CRSN0400,CRSRGP00, CRHWEL00,CRPREX00NewIndividual HospitalIndemnity Rate Sheet3-8-2013.pdf,2Actuarial MemorandumCPIHI4DC, CRAMB400,CRCI0400, CRERS400,CRHA0400, CRDA0400,CRMN0400, CRIPM400,CRISRG00, CRCICU00,CRACIN00, CRASD400,CRLAB400, CROPV400,CRSDT400, CROPS400,CRRX0400, CRSN0400,CRSRGP00, CRHWEL00,CRPREX00NewIndividual TransChoiceHospital Select ActMem - long version FAQ 7 changes DC.pdf,PDF Pipeline for SERFF Tracking Number AEGG-128946040 Generated 05/15/2013 08:09 AM

Transamerica Life Insurance CompanyPolicy CPIHI400Rate SheetThe following shows the annual per unit rates for employees or members.Daily In-Hospital Indemnity BenefitOption 1: Maximum 31 days per confinementPremium perAge Band 100 5260-6480.0465-74105.00Option 2: Maximum annual benefitMaximum 5Kper person peryearAge 7.5265-74101.64Maximum 10KMaximum 20Kper person perper person peryearyearPremium per 100 daily 1681.24105.12106.56Outpatient Physician Office Visit Indemnity Benefit RiderMaximum number of days per yearPremium per 10 per dayAge Band18-2930-3940-4950-5960-6465-746 Days7 Days8 Days9 Days10 3.761Maximum 100Kper person peryear51.6051.6051.6069.9681.60107.16

Transamerica Life Insurance CompanyPolicy CPIHI400Outpatient Diagnostic Laboratory Test Indemnity Benefit RiderBenefit is payable per test dayMax 2 testMax 3 testMax 4 testMax 5 testAge Banddays/insured/year days/insured/year days/insured/year days/insured/yearPremium per 5 of benefit per test 2.282.4065-741.802.282.402.52Outpatient Select Diagnostic Test Indemnity Benefit RiderBenefit is payable per test dayMaximum 1 testMaximum 2 testAge Bandday/insured/year days/insured/yearPremium per 25 of benefit per test 0.9216.3260-6410.9216.3265-7411.7617.52Outpatient Advanced Studies Diagnostic Test Indemnity Benefit RiderBenefit is payable per test dayMaximum 1 testMaximum 2 testAge Bandday/insured/year days/insured/yearPremium per 100 of benefit per test 5916.0820.0460-6416.0820.0465-7417.2821.602

Transamerica Life Insurance CompanyPolicy CPIHI400Hospital Confinement Indemnity Benefit RiderAge Band18-2930-3940-4950-5960-6465-74Maximum 1 Day perperson per yearMaximum 2 Days perperson per yearMaximum 3 Days perperson per year10.0810.0810.0813.5116.0121.00Premium per 0817.5220.7627.24Off-the-Job Accidental Injury Indemnity Benefit RiderAge Band18-2930-3940-4950-5960-6465-74Per 50 Unit7.927.927.927.927.927.92Wellness Indemnity Benefit RiderMaximum is expressed in number of days per insured per yearMaximum 1Maximum 2Age Bandday/insured/year days/insured/yearPremium per 50 of benefit per -5930.4852.0860-6430.4852.0865-7430.4852.083

Transamerica Life Insurance CompanyPolicy CPIHI400Critical Illness Indemnity Benefit RiderBenefit payment for dependents is a percentage of the benefit payment for the employee.Age Band18-2930-3940-4950-5960-6465-74Premium per 2,500 benefit3.489.0026.0460.0084.96111.96Emergency Room Sickness Indemnity Benefit RiderPremium per 25 benefitAge Band18-2930-3940-4950-5960-6465-74Maximum 2 days/ insured / year11.1613.9213.9213.9213.9213.92Maximum 4 days/ insured / year11.6414.5214.5214.5214.5214.52Ambulance Indemnity Benefit RiderUnits are 50 for ground and 150 for air.Age Band Premium per 4.324.324

Transamerica Life Insurance CompanyPolicy CPIHI400Inpatient Drug and Alcohol Abuse Indemnity Benefit RiderAnnual maximum benefit is 31 days of confinement per insured.Age Band18-2930-3940-4950-5960-6465-74Premium per 100 t Mental and Nervous Disorder Indemnity Benefit RiderAnnual maximum benefit is 31 days of confinement per insured.Age Band18-2930-3940-4950-5960-6465-74Premium per 100 e Care Indemnity Benefit RiderMaximum 30Maximum 10days per covered days per coveredperson per yearperson per yearPremium per 100 daily 9620.8829.0427.60Age Band18-2930-3940-4950-5960-6465-745

Transamerica Life Insurance CompanyPolicy CPIHI400Skilled Nursing Indemnity Benefit RiderAge Band18-2930-3940-4950-5960-6465-74Premium per 100 t Miscellaneous Indemnity Benefit RiderMaximum 31 days per confinement per person per yearAge Band18-2930-3940-4950-5960-6465-74Premium per 100 nt Surgical Indemnity Benefit RiderAge Band20% Anesthesia 30% AnesthesiaPremium per 100 per day of 420.1665-7424.248.4012.7217.1621.8421.8426.166

Transamerica Life Insurance CompanyPolicy CPIHI400Outpatient Surgical Indemnity Benefit RiderAge Band20% Anesthesia 30% AnesthesiaPremium per 100 per day of cal and Anesthesia Indemnity Benefit RiderOne unit is 100 for Inpatient surgery, 50 for most outpatient surgeries and 10 for minor outpatientsurgeries.Age Band20% Anesthesia 30% AnesthesiaPremium per Unit per day of scription Drug Indemnity Benefit RiderAge Band18-2930-3940-4950-5960-6465-74Premium per unitUnit is 5 benefit for generic and 10 benefit for brandPays 1 generic and 1 brand max per dayMax 12Max 24Max 36Max 1Max 2Max 3days per days per days perday perdays per days 46.4447.407

Transamerica Life Insurance CompanyPolicy CPIHI400Prescription Drug Indemnity Benefit Rider (Continued)Age Band18-2930-3940-4950-5960-6465-74Premium per unitUnit is 5 benefit for generic and 10 benefit for brandPays either one generic or one brand per day maxMax 12Max 24Max 36Max 1Max 2Max 3days per days per days perday perdays per days 45.0044.888

Transamerica Life Insurance CompanyPolicy CPIHI400Rating FactorsThe following shows the rating factors for coverage tiers and risk classes.Coverage Tiers FactorsCoverage TierIndividualIndividual & SpouseSingle Parent ellness1.02.32.03.01.02.23.03.6Risk Class ctors take into account the existence (or non-existence) of a pre-existing condition exclusion as well asindustry and company experience where appropriate. Factors are applied to monthly rates and thenrounded to 2 decimal places.9

Transamerica Life Insurance CompanyPolicy CPIHI400Actuarial MemorandumI.Scope and PurposeThis actuarial memorandum has been prepared with the intent of complying with regulations in yourstate applicable to the filing of this proposed policy form and rates. A specific listing of the applicableregulations can be provided upon request. This document may not be appropriate for other purposes.II.Benefit DescriptionThis is an individual hospital indemnity policy, guaranteed renewable to age 75. The policy and its ridersare intended to provide limited benefit coverage to part‐time, full‐time, and entry‐level employees ormembers. In addition, it will be used for conversions from similar group forms. Coverage options are setby the employer or association.The following riders may be attached. CRCI0400Critical Illness Indemnity Benefit Rider CRHWEL00Wellness Indemnity Benefit Rider CRRX0400Prescription Drug Indemnity Benefit Rider CRACIN00Off‐the‐Job Accidental Injury Indemnity Benefit Rider CRASD400Outpatient Advanced Studies Diagnostic Test Indemnity Benefit Rider CRSDT400Outpatient Select Diagnostic Test Indemnity Benefit Rider CRLAB400Outpatient Diagnostic Laboratory Test Indemnity Benefit Rider CROPV400Outpatient Physician Office Visit Indemnity Benefit Rider CROPS400Outpatient Surgical Indemnity Benefit Rider CRMN0400Inpatient Mental and Nervous Disorder Indemnity Benefit Rider CRDA0400Inpatient Drug and Alcohol Addiction Indemnity Benefit Rider CRAMB400Ambulance Indemnity Benefit Rider CRCICU00Intensive Care Indemnity Benefit Rider CRERS400Emergency Room Sickness Indemnity Benefit Rider CRIPM400Inpatient Miscellaneous Indemnity Benefit Rider CRHA0400Hospital Confinement Indemnity Benefit Rider CRISRG00Inpatient Surgical Indemnity Benefit Rider CRSN0400Skilled Nursing Indemnity Benefit Rider CRSRGP00Surgical and Anesthesia Indemnity Benefit RiderThe range of benefit amounts offered is shown on the schedule page of the policy.III.Applicability and RenewabilityIssued policies will be guaranteed renewable to age 75. Employees or members and their dependentsare eligible for coverage.IV.MorbidityAssumed claim costs for the base policy and rider coverages were developed based on companyexperience and the Tillinghast Towers Perrin “HealthMAPS” claim cost manual.1

V.Total TerminationThe following assumed termination rates include voluntary termination by lapse as well as involuntarytermination by death.Policy Year12345 LapseRate55%50%46%42%39%VI.ExpensesThe following expenses were assumed.Benefits:Expenses:Premium Marketing MethodThese policies will be sold to individuals mainly through worksite marketing efforts via an agencydistribution system to employees at the workplace, members of affinity associations and 1099contractors. This product will also be available for conversions from a group product.VIII.UnderwritingEmployees or members and any eligible dependents will be underwritten on a class basis with riskclasses determined by industry, existence or absence of a pre‐existing condition exclusion, and pastcompany experience.IX.Premium Cells and Issue Age RangePremium rates vary by issue age, family coverage tier and risk classification.X.Area FactorsPremiums do not vary by geographic area.XI.Distribution of Business and Average Annual PremiumThe following distribution of policies was assumed by age and family 40–4922%50–5920%2

AttainedDistributionAge60–646%65 2%Distribution of Business by Family StatusEmployee Employee 1‐Parent 2‐ParentTotalOnly SpouseFamilyFamily58%17%11%14%100%The average first‐year annual premium per certificate is 850.XII.Premium ModalizationThe following premium modalization factors will be applied in billing calculations. Billable premiums willbe rounded to the nearest cent following application of the modalization factor.Annual modeSemiannual modeQuarterly modeMonthly mode1.0000.5000.2500.083XIII.ReservesReserves will be calculated to meet the minimum reserve requirements in your state.XIV.Trend AssumptionsNo claim trend was included.XV.Anticipated Loss RatiosThe anticipated lifetime loss ratio for this policy form is 50.6%.XVI.Contingency and Risk MarginsA 5% contingency margin for adverse deviation was included in the claims costs.XVII. Proposed Effective DateThe proposed rates are effective upon approval.3

XVIII. Actuarial CertificationI hereby certify that to the best of my knowledge and judgment, the following are true with respect tothis filing:(1)The assumptions represent my best judgment as to the expected value for each assumption andare consistent with the issuer’s business plan at the time of filing;(2)The anticipated lifetime loss ratio meets or exceeds the appropriate regulatory minimum value;(3)The filing was prepared based on the current standards of practice as promulgated by theActuarial Standards Board, including the Standard on data quality;(4)The filing is in compliance with applicable laws and regulations in the State;(5)The rates are reasonable in relationship to the benefits.March 4, 2013DateGray Townsend, FSA, MAAAActuary4

SERFF Tracking #:AEGG-128946040State Tracking #:Company Tracking #:State:District of ColumbiaTOI/Sub-TOI:H14I Individual Health - Hospital Indemnity/H14I.000 Health - Hospital IndemnityFiling Company:Product Name:I HIPProject Name/Number:I HIP/CPIHI4DCCPIHI4DC RATETransamerica Life Insurance CompanySupporting Document SchedulesSatisfied - Item:Cover Letter All FilingsComments:Attachment(s):DC Rate Cover Letter 4-12-2013 bj.pdfItem Status:Status Date:Bypassed - Item:Certificate of Authority to FileBypass Reason:No third party filer is involved.Attachment(s):Item Status:Status Date:Bypassed - Item:Actuarial MemorandumBypass Reason:Actuarial Memorandum has been revised and is in more detail. It is attached to the rate/rule tab.Attachment(s):Item Status:Status Date:Bypassed - Item:Actuarial JustificationBypass Reason:The Actuarial Memornadum is being filed as a rate filing.Attachment(s):Item Status:Status Date:Bypassed - Item:District of Columbia and Countrywide Loss Ratio Analysis (P&C)Bypass Reason:Not applicable for a new rate filing.Attachment(s):Item Status:Status Date:Bypassed - Item:District of Columbia and Countrywide Experience for the Last 5 Years (P&C)PDF Pipeline for SERFF Tracking Number AEGG-128946040 Generated 05/15/2013 08:09 AM

SERFF Tracking #:AEGG-128946040State Tracking #:Company Tracking #:State:District of ColumbiaTOI/Sub-TOI:H14I Individual Health - Hospital Indemnity/H14I.000 Health - Hospital IndemnityProduct Name:I HIPProject Name/Number:I HIP/CPIHI4DCBypass Reason:Filing Company:Transamerica Life Insurance CompanyNot applicable for a new rate supplemental hospital indemnity rate filing.Attachment(s):Item Status:Status Date:Bypassed - Item:Rate Summary WorksheetBypass Reason:This is bypassed since this is a hospital indemnity rate filing.CPIHI4DC RATEAttachment(s):Item Status:Status Date:PDF Pipeline for SERFF Tracking Number AEGG-128946040 Generated 05/15/2013 08:09 AM

April 11, 2013Ms. Darniece ShirleyDistrict of Columbia Department of Insurance,Securities and Banking810 First Street, NEWashington, DC 20002RE:TRANSAMERICA LIFE INSURANCE COMPANYNAIC: 468-86231 FEIN: 39-0989781New Individual Health Rate FilingCPIHI4DC, et al. – Individual Hospital Indemnity Insurance PolicyResponse to your comments dated April 3, 2013We have provided your comments below with our response following each comment.Objection 1Comments:The Rate Review Data Detail section of the filing is missing. The State understands this is a new filing and notrequired, however completing would be preferred. Please correct, via post-submission update.RESPONSE: I have not done both a post submission update and a “regular” response at the same time onSERFF. I tried to provide this information via post submission update. This process will not allow inclusion of therevised Actuarial Memorandum, so I will try to send the response first, then submit the post submission update.Objection 2 Actuarial Memorandum (Supporting Document)Comments:Please provide a detailed make-up of expenses as a percentage of premiums. Each expense item should beaccounted for separately and total 100%. Expenses such as profit, claims, commission, e.g. should be included.RESPONSE: We have attached a detailed Actuarial Memorandum for your review under the Rate/Rule Scheduletab.Objection 3 Cover Letter All Filings (Supporting Document)Certificate of Authority to File (Supporting Document)Actuarial Memorandum (Supporting Document)Actuarial Justification (Supporting Document)District of Columbia and Countrywide Loss Ratio Analysis (P&C) (Supporting Document)District of Columbia and Countrywide Experience for the Last 5 Years (P&C) (Supporting Document)Rate Summary Worksheet (Supporting Document)Rate Sheet (Rate)Actuarial Memorandum (Rate)Comments:This rate review is limited to DC resident policyholders or DC domiciled group certificate holders. All other raterequests will need to be reviewed by that respective state.

RESPONSE: We agree and confirm that this filing is limited to DC resident policyholders or DC domiciled groupcertificate holders.Objection 4 Cover Letter All Filings (Supporting Document)Certificate of Authority to File (Supporting Document)Actuarial Memorandum (Supporting Document)Actuarial Justification (Supporting Document)District of Columbia and Countrywide Loss Ratio Analysis (P&C) (Supporting Document)District of Columbia and Countrywide Experience for the Last 5 Years (P&C) (Supporting Document)Rate Summary Worksheet (Supporting Document)Rate Sheet (Rate)Actuarial Memorandum (Rate)Comments:Please note, this rate filing is subject to conformity with the corresponding forms’ filing. This department reservesthe right to withdraw the filing if not.RESPONSE: The forms were approved on April 2, 2013 via SERFF AEGG-128946041.We hope our response will meet with your satisfaction. To the best of our knowledge, this filing is complete andintended to comply with the insurance laws of your state. If you have any questions which can be resolved over thetelephone, please contact me at 800-400-3042, x127-1098.Sincerely,Billie Jean Baldwin, FLMI, AIRC, CCPSenior Product Manager, Contract Compliance & Assistant SecretaryProduct Implementation DepartmentTransamerica Life Insurance CompanyTelephone: 800-400-3042 x127-1098Email: bj.baldwin@transamerica.com

SERFF Tracking #:AEGG-128946040State Tracking #:Company Tracking #:State:District of ColumbiaTOI/Sub-TOI:H14I Individual Health - Hospital Indemnity/H14I.000 Health - Hospital IndemnityFiling Company:Product Name:I HIPProject Name/Number:I HIP/CPIHI4DCCPIHI4DC RATETransamerica Life Insurance CompanySuperseded Schedule ItemsPlease note that all items on the following pages are items, which have been replaced by a newer version. The newest version is located with the appropriate scheduleon previous pages. These items are in date order with most recent first.Creation DateSchedule ItemStatusScheduleSchedule Item NameReplacementCreation DateAttached Document(s)03/18/2013RateActuarial Memorandum04/11/2013Individual Hospital Indemnity ActMem - long version entCover Letter All Filings04/11/2013DC Rate Cover Letter 3-18-2013bj.pdf (Superceded)03/18/2013SupportingDocumentActuarial Memorandum04/11/2013PDF Pipeline for SERFF Tracking Number AEGG-128946040 Generated 05/15/2013 08:09 AM

Transamerica Life Insurance CompanyPolicy CPIHI400Actuarial MemorandumI.Scope and PurposeThis actuarial memorandum has been prepared with the intent of complying with regulations in yourstate applicable to the filing of this proposed policy form and rates. A specific listing of the applicableregulations can be provided upon request. This document may not be appropriate for other purposes.II.Benefit DescriptionThis is an individual hospital indemnity policy, guaranteed renewable to age 75. The policy and its ridersare intended to provide limited benefit coverage to part-time, full-time, and entry-level employees ormembers. In addition, it will be used for conversions from similar group forms. Coverage options are setby the employer or association.The following riders may be attached. CRCI0400Critical Illness Indemnity Benefit Rider CRHWEL00Wellness Indemnity Benefit Rider CRRX0400Prescription Drug Indemnity Benefit Rider CRACIN00Off-the-Job Accidental Injury Indemnity Benefit Rider CRASD400Outpatient Advanced Studies Diagnostic Test Indemnity Benefit Rider CRSDT400Outpatient Select Diagnostic Test Indemnity Benefit Rider CRLAB400Outpatient Diagnostic Laboratory Test Indemnity Benefit Rider CROPV400Outpatient Physician Office Visit Indemnity Benefit Rider CROPS400Outpatient Surgical Indemnity Benefit Rider CRMN0400Inpatient Mental and Nervous Disorder Indemnity Benefit Rider CRDA0400Inpatient Drug and Alcohol Addiction Indemnity Benefit Rider CRAMB400Ambulance Indemnity Benefit Rider CRCICU00Intensive Care Indemnity Benefit Rider CRERS400Emergency Room Sickness Indemnity Benefit Rider CRIPM400Inpatient Miscellaneous Indemnity Benefit Rider CRHA0400Hospital Confinement Indemnity Benefit Rider CRISRG00Inpatient Surgical Indemnity Benefit Rider CRSN0400Skilled Nursing Indemnity Benefit Rider CRSRGP00Surgical and Anesthesia Indemnity Benefit RiderThe range of benefit amounts offered is shown on the schedule page of the policy.III.Applicability and RenewabilityIssued policies will be guaranteed renewable to age 75. Employees or members and their dependentsare eligible for coverage.IV.MorbidityAssumed claim costs for the base policy and rider coverages were developed based on companyexperience and the Tillinghast Towers Perrin “HealthMAPS” claim cost manual.1

V.Total TerminationThe following assumed termination rates include voluntary termination by lapse as well as involuntarytermination by death.Policy Year12345 LapseRate55%50%46%42%39%VI.ExpensesThe total expense assumption is 41.5% of earned premium, which includes issue and maintenanceexpenses, premium tax and commissions.VII.Marketing MethodThese policies will be sold to individuals mainly through worksite marketing efforts via an agencydistribution system to employees at the workplace, members of affinity associations and 1099contractors. This product will also be available for conversions from a group product.VIII.UnderwritingEmployees or members and any eligible dependents will be underwritten on a class basis with riskclasses determined by industry, existence or absence of a pre-existing condition exclusion, and pastcompany experience.IX.Premium Cells and Issue Age RangePremium rates vary by issue age, family coverage tier and risk classification.X.Area FactorsPremiums do not vary by geographic area.XI.Distribution of Business and Average Annual PremiumThe following distribution of policies was assumed by age and family 40–4922%50–5920%60–646%65 2%2

Distribution of Business by Family StatusEmployee Employee 1-Parent 2-ParentTotalOnly SpouseFamilyFamily58%17%11%14%100%The average first-year annual premium per certificate is 850.XII.Premium ModalizationThe following premium modalization factors will be applied in billing calculations. Billable premiums willbe rounded to the nearest cent following application of the modalization factor.Annual modeSemiannual modeQuarterly modeMonthly mode1.0000.5000.2500.083XIII.ReservesReserves will be calculated to meet the minimum reserve requirements in your state.XIV.Trend AssumptionsNo claim trend was included.XV.Anticipated Loss RatiosThe anticipated lifetime loss ratio for this policy form is 50.6%.XVI.Contingency and Risk MarginsA 5% contingency margin for adverse deviation was included in the claims costs.XVII. Proposed Effective DateThe proposed rates are effective upon approval.3

XVIII. Actuarial CertificationI hereby certify that to the best of my knowledge and judgment, the following are true with respect tothis filing:(1)The assumptions represent my best judgment as to the expected value for each assumption andare consistent with the issuer’s business plan at the time of filing;(2)The anticipated lifetime loss ratio meets or exceeds the appropriate regulatory minimum value;(3)The filing was prepared based on the current standards of practice as promulgated by theActuarial Standards Board, including the Standard on data quality;(4)The filing is in compliance with applicable laws and regulations in the State;(5)The rates are reasonable in relationship to the benefits.March 4, 2013DateGray Townsend, FSA, MAAAActuary4

District of Columbia Department of Insurance,Securities and Banking810 First Street, NEWashington, DC 20002RE:TRANSAMERICA LIFE INSURANCE COMPANYNAIC: 468-86231 FEIN: 39-0989781New Individual Health Rate FilingCPIHI4DC, et al. – Individual Hospital Indemnity Insurance PolicyTransmitted via SERFF is the rate filing (separate from the form filing submitted same date under AEGG-128946041)for your review and approval. This is a new rate filing for new forms and are not intended to replace any formspreviously approved by the Department. This filing does not contain any unusual or potentially controversial itemsthat vary from normal company or industry standards.Rates and an Actuarial Memorandum are attached for your review under the Rate/Rule Schedule tab. We have animplementation date requested for April 22, 2013.The rest of this letter explains the forms for which the rates apply.Form CPIHI4DC is an Individual Hospital Indemnity Insurance Policy intended to provide a daily hospital indemnitybenefit not to exceed the maximum benefit or maximum number of days outlined in the Schedule of Benefits. Thispolicy is guaranteed renewable to age 75 subject to our right to change the premiums for all insureds under policyform, following approval of such rate increase as required by the laws of your state.Although this is an individual policy that will be available to any resident of your state, we will be offering this form in aWorksite Marketing solicitation to the individual employees and/or members of employers, associations or unions, aspermitted under the laws of your state. At the time we contact an employer, association or union regarding the offer ofthis policy to their employees or members, we will put together a predetermined package of the policy plus riderbenefits. This predetermined package will then be offered to the individual employees or members in a WorksiteMarketing solicitation. For the most part, premiums will be paid through payroll deduction.The following Optional Riders will be available for issue with the policy. The policy benefits and/or optional riderbenefits will be offered to individuals in a preset package as indicated in the previous paragraph. All of these benefitsare indemnity benefits, subject to per day limitations. They may also be subject to other maximum limitations, suchas calendar year and lifetime maximums, as noted in the policy schedule of benefits.CRAMB400 – Ambulance Indemnity Benefit Rider – provides a daily benefit for ambulance transportation to a hospitalor emergency center.CRCI0400 – Critical Illness Indemnity Benefit Rider – provides a lump sum benefit for the specified critical illnesses.CRERS400 – Emergency Room Sickness Indemnity Benefit Rider – provides a daily benefit for emergency roomtreatment for a sickness.CRHA0400 – Hospital Confinement Indemnity Benefit Rider – provides an additional daily benefit when confined in ahospital, not to exceed the number of days or confinements shown in the Schedule of Benefits.*CRDA0400 – Inpatient Drug and Alcohol Addiction Indemnity Benefit Rider. This rider is considered part of the basepolicy, not optional in the District of Columbia. It pays a benefit for each day of confinement in a treatment facility fordrug or alcohol addiction.

*CRMN0400 – Inpatient Mental and Nervous Disorder Indemnity Benefit Rider. This rider is considered part of thebase policy, not optional in the District of Columbia. It pays a benefit for each day of confinement in a facility for thetreatment of mental or nervous disorders.CRIPM400 – Inpatient Miscellaneous Indemnity Benefit Rider – pays a benefit for each day of confinement in ahospital.CRISRG00 – Inpatient Surgical Indemnity Benefit Rider – pays a daily benefit for inpatient surgery.CRCICU00 – Intensive Care Indemnity Benefit Rider – pays a benefit for each day of confinement in an intensive careunit.CRACIN00 – Off-The-Job Accidental Injury Indemnity Benefit Rider – provides a daily benefit for each day oftreatment for an off-the-job accidental injury.CRASD400 – Outpatient Advanced Studies Diagnostic Test Indemnity Benefit Rider – pays a benefit for each day thediagnostic advanced studies listed in the rider are performed a

New Individual TransChoice Hospital Select Act Mem - long version - FAQ 7 changes - DC.pdf, SERFF Tracking #: AEGG-128946040 State Tracking #: Company Tracking #: CPIHI4DC RATE State: District of Columbia Filing Company: Transamerica Life Insurance Company TOI/Sub-TOI: H14I Individual Health - Hospital Indemnity/H14I.000 Health - Hospital Indemnity