Transcription

Cohort Default Rates &Default PreventionLisa DowneyMohave Community CollegeMay 202220th Anniversary Joint Conference – Spring 2020

Agenda Understanding the CDR Rewards and Sanctions Challenges, Adjustments, & Appeals Default Management Plans Resources Mohave Community College Actions Mohave Community College (MCC) Prevails! Questions?

Definitions & AbbreviationsTermDefinitionDefaultMissed scheduled payments for 270 days (Direct and FFEL programs)CDRCohort Default RateFiscal YearOctober 1 – September 30Cohort DefaultPeriodThree year time period during which a borrower’s default affects the institution’s cohort default rateCohort Fiscal YearThe fiscal year for when the rate is calculatedNumeratorNumber of borrowers in the denominator who defaultedDenominatorNumber of borrowers who entered repayment in the cohort fiscal yearLRDRLoan Record Detail Report, extract type received in eCDR packageLRDR Import ToolSpreadsheet formatted to facilitate easy import of LRDR fileeCDRRefers to the electronic transmission of the CDR to schools, transmission starts the clock for thechallenge, adjustment, and appeal process

Cohort Default RatePercentage of borrowers who enterrepayment during a specific fiscal year anddefault on certain federal loans, or meetsother specified conditions, during aspecified monitoring period.Schools with 29 or fewer borrowers the CDRis an “average rate” based on borrowersentering repayment over a 3 year period.https://ifap.ed.gov/dm/cdrguidemaster20t Anniversary Joint Conference – Spring 2020

Types of LoansIncluded in CDRNot Included in CDR FFEL Subsidized Loans* FFEL Unsubsidized Loans* Federal Direct Subsidized Loans* Federal Direct Unsubsidized*Loans Federal PLUS Loans Federal Graduate PLUS Loans Federal Direct Graduate PLUSLoans Federal Insured Student Loans(FISLs) Federal Perkins Loans*may be referred to as Stafford or Ford loans

CohortDefaultPeriod

Cohort Fiscal YearTimeframe for borrowers to enter repayment.10/1/169/30/17FY 2017

Cohort Default Monitoring Period10/1/169/30/19FY 2017

3 Year Cohort Default Rate REWARDS3 most recent CDRsare less than 15%Most recent CDR isless than 5% 1 disbursement for single termloans No 30 day delay for first-timefirst-year undergraduateborrowers For a study abroad program,may make 1 disbursement for afull loan period For a study abroad program, no30 day delay for first-time firstyear undergraduate borrowers

3 Year Cohort Default Rate REWARDSRewards take effect as soon as the school isnotified of the official CDR.Loss of rewards take effect 30 days after the official CDR isreceived.

3 Year Cohort Default Rate SANCTIONS3 most recent CDRsare 30% or greaterCurrent CDR is 40%or more Loss of eligibilityfor Direct Loan &Pell Grant Loss of eligibilityfor Direct Loan

3 Year Cohort Default Rate SANCTIONSSanctions begin 30 days after the school receives notice of loss ofeligibility.Loss of eligibility affects the remainder of the fiscal year in which theschool was notified of the sanction. It remains in effect for anadditional two fiscal years.A successful adjustment appeal will end the sanction early.20th Anniversary Joint Conference – Spring 2020

MCC Almost Loses Title IV Eligibility FY 2009, 2010 and 2011 draft rates were over 30% MCC was close to losing Title IV funding At the time on average, 65% of MCC students utilized Title IV aid Current Title IV aid usage is around 40% Losing Title IV funding would have been detrimental to the college

Challenges, Adjustments, & AppealsChallengesAdjustmentsAppeals(Draft Rate)(Official Rate)(Official Rate) Incorrect Data Challenge(IDC) Participation Rate IndexChallenge (PRI) Uncorrected DataAdjustment (UDA) New Data Adjustment(NDA) Loan Servicing Appeal(LS) Erroneous Data Appeal(ER) EconomicallyDisadvantaged Appeal(EDA) Participation Rate IndexAppeal (PRI)

ChallengesType of ChallengeDefinitionWhen FiledWhy FiledIncorrect DataChallenge (IDC)Data exists to show that borrowerswere reported incorrectlyDuring theDraft PeriodCorrection of data will impact the official rate Borrower did not enter repayment duringcohort year Borrower did not default during themonitoring period Other borrowers entered repaymentduring the cohort period

InstitutionalCDRCalculationsby CDR ments/201906/CDRGudeAppendixA.pdf

Incorrect Data ChallengeTypes of Incorrect Data1. Default date or status is incorrect and borrower should not beincluded in the numerator2. Borrower did not enter repayment in the cohort fiscal year andshould not be included in the numerator or the denominator3. Borrower is incorrectly excluded from the cohort and should beadded to the denominator

Incorrect Data ChallengeDocumentation of Incorrect Data Documentation to show correct last date of attendance or less thanhalf time status Documentation to show that a loan was fully refunded and canceledwithin 120 days of disbursement Documentation of borrower’s death

Default Management PlansVoluntary Promote repayment Reduce risk of defaultInvoluntary Required if CDR is greater than30% Must be revised if over 30% for asecond year Must be submitted to FSAEvery school should have a Default Management Plan!

Nevada Association ofFinancial Aid AdministratorsDefault Management PlansEstablish DefaultPrevention Team Senior Officials Financial Aid Student Affairs Academics EnrollmentManagement Admissions StudentRepresentativeAnalyze Risk Understandwho defaults Understandwhy borrowersdefault Determine atriskpopulationsEstablishMeasurable Steps Timeline Specific actionsto improveloanrepayment Informed byanalysis of whoand why Addresses atriskpopulationsCreate DefaultPrevention Plan Written plan Has buy-inacrossinstitution Wholeinstitutionplays a role20th Anniversary Joint Conference – Spring 2020Send Plan to FSA Must bereviewed bySchoolParticipationTeam May be askedto revise

MCC Actions FA staff tirelessly went thru every loan disbursed and challenged all that mayhave been incorrect Discovered enrollment reporting errors Discovered loan servicing errors Was able to bring the 3rd year draft rate over 30% down to 28.6%, saving Title IV fundingfor MCC Since then, the CDR has gradually decreased with growing efforts 30-day delay for first time borrowers Financial awareness counseling (Now, annual borrower acknowledgment) required Hired a default management person to contact borrowers to avoid default Phone USPS mailings Emails

Partnered with Solutions at ECMC Not a debt collector Third party non-profit organization to helpborrowers avoid default In grace outreach Inbound/outbound calls Online chat Provide one-on-one counseling Debt summary letters Printable learning resources Preparing for college workbooks for firsttime college students (2021) Financial literacy platform, free toeveryone ECMCLearning.org/Mohave Learning modules Budgeting tools Tailored to user

(2021) Financial Aid Student Support Coordinator position created to: Create a robust financial literacy program Main focus, lowering CDR CDR goal of 5% or less In person Entrance/Exit counseling Financial literacy Zoom sessions In person student loan counseling Boomer’s Buggy Outreach to borrowers In grace outreach Inbound/outbound calls USPS mailings Emails Tube mailers Post cards Sense with Cents scholarship created (2022) Based on modules completed successfully in ECMC Learning platform Intended to encourage students to participate in financial literacy

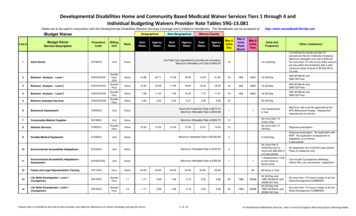

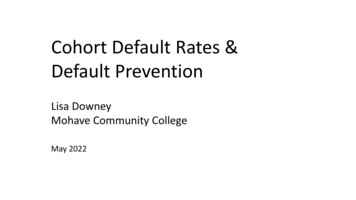

MCC Historical Cohort Default Rates40.0%35.0%30.0%It Draft2013Official201420152016

ResourcesFSA’s Default Management Pagehttps://ifap.ed.gov/dmCohort Default Rate Guidehttps://ifap.ed.gov/dm/cdrguidemasterFSA Handbook Vol 2, Chpt ts/2020-01/1920FSAHbkVol2Ch4.pdfFSATC slides, 2019, Session tmlNSLDS Reference es/nslds-reference-materialseCDR Appeals CDR User tml

ContactLisa DowneyFinancial Aid ManagerMohave Community College928-692-3088ldowney@Mohave.eduHeather PatenaudeDirector of Financial AidMohave Community College928-757-0857hpatenaude@Mohave.edu

QUESTIONS?20th Anniversary Joint Conference – Spring 2020

LRDR Loan Record Detail Report, extract type received in eCDR package LRDR Import Tool Spreadsheet formatted to facilitate easy import of LRDR file eCDR Refers to the electronic transmission of the CDR to schools, transmission starts the clock for the challenge, adjustment, and appeal process