Transcription

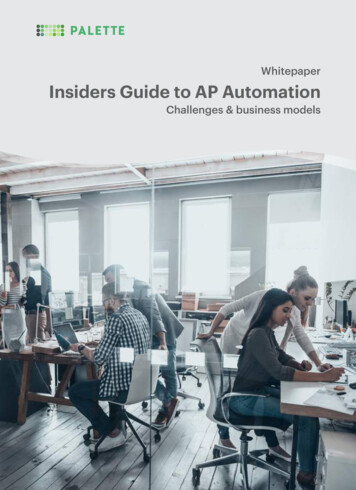

WhitepaperInsiders Guide to AP AutomationChallenges & business models

WhitepaperInsiders Guide to AP AutomationRPAAccording to Gartner, extrawork caused by human error infinance departments could bereduced by up to 30% annuallyby deploying robotic processautomation (RPA)And yet, states the 2019 report, “fewer thanone-third of finance departments that havedeployed RPA have utilized the technology forfinancial reporting, leaving major efficiencygains on the table.”Despite a plethora of accounts payable (AP)automation tools, email and paper stilldominate the North American market, with80% to 90% of invoices received via one ofthose two mediums.Manual processes account for75% of data capture, with legacyOCR technology—with limitedfunctionality and integrationcapabilities—used to capturethe bulk of the remaining 25%.palettesoftware.comThe impact of manualprocesses on financedepartmentsFragmented finance systems, deeplyentrenched, error-prone manual processes,and high employee turnover results inincreasing the cost, complexity, and auditconcerns for already overwhelmed APdepartments.Streamlined finance departments, efficient andreliable automated processes, and motivatedemployees focused on high-value work is thesolution.The challenge, however, is exacerbated byglobalization. That requires the normalizationof core business operations across borders,while remaining flexible enough to meet localrequirements.Any new business solutions must includecurrency, language, and tax regulationtranslation engines facilitating seamlesspurchase and payment operations as well asdata set normalization.These complexities—and others—can beaddressed by applying RPA to financialprocesses. Then why aren’t companies rushingto implement AP automation?2

WhitepaperInsiders Guide to AP Automation3. The ROI isn’t big enough: With a varietyof business models to navigate and ROIchallenging to ascertain, manybusinesses would instead maintain thestatus quo than venture into the“unknown.”Let’s explore each of these in turn.Obstacle #1: “We aren’t ready”Organizational ObstaclesMired in complex, manual processes—vetting suppliers, receiving emailedinvoices, distributing them to approvers orbuyers, resolving issues with accountcodes, and handling a multitude of otherrelated tasks—optimizing the AP processcan be a challenge.While manual processes require a massiveeffort— and often result in lost invoices,slow process times, increased accrualefforts, and frustrated auditors—employeesdevelop a level of comfort throughfamiliarity.Working to the adage, “if it ain’t broke, don’tfix it,” managers themselves tend tobecome complacent, dismissing theopportunities automation brings.When questioned, finance executives oftencite one of three reasons as obstacles toimplementing AP automation:1. We aren’t ready: With many organizationsuncertain as to what their actualprocesses are, the thought ofstandardizing those processes beforeimplementing automation appears amassive mountain to climb.2. We have specialized knowledge:Reluctant to minimize the aspect ofhuman judgment from the AP process,many companies believe theiroperations are too complicated forsoftware to handle.palettesoftware.comMany organizations believe that—withoutstandardized processes—deployingautomation increases the risk of financialmisstatements or missed reportingdeadlines. But, in retrospect, is that reallythe case? Challenges related to scalingmanual processes in an increasinglyintegrated world economy snowball overtime, creating the very scenario thatfinance executives fear.The real question is: “Do I need tostandardize my processes beforeautomating?”Challenges related to scalingmanual processes in anincreasingly integrated worldeconomy snowball over time,creating the very scenario thatfinance executives fear.While it’s true that standardizing andsimplifying processes can help prevent theautomation of needless inefficiencies orcomplexities, so can choosing the right APautomation business model for yourcompany.With a vast variety of vendors offering APautomation tools, platforms, and services,navigating your options and makinginformed decisions can both standardizeand automate your processes.3

WhitepaperInsiders Guide to AP AutomationA) In-house vs. OffshoreB) Build vs. Buy vs. HybridMany financial institutions offer a businessprocess outsourcing (BPO) service to theirclients, usually comprising a simple “liftand shift” of AP processes to an offshoreservices company.Both models have pros and cons. Buildingyour own solution may give you preciselywhat you needed at the time of design, butis it scalable and flexible enough to meetyour future requirements?This transition takes the manual effort—and associated headcount—off yourhands. Unfortunately, however,outsourcing scanning and data capturedoesn’t necessarily eliminate the errorcount and often you can only count on60-70% of your invoice volume to be errorfree.Most businesses find building their own APautomation solutions too risky in terms oftime, effort, and investment.These outsourced services oftenintroduce additional challenges such ascommunicating across time zones orovercoming a lack of understanding ofyour unique business accountingprocesses.While choosing to outsource is often acultural decision, the alternate option is toautomate your AP processes whilekeeping them in-house. Hereprocurement, implementation, anddeployment decisions need to be made.AP automation solution modelscan be divided into 4 categories: Business Process Outsourcing Build Your Own Toolkit Platform Hybrid Saaspalettesoftware.comA different “build” option is to go with avendor offering a flexible toolkit platformcustomized for your business. While thismodel may give you what you want—and isquicker than building it yourself—theproject-based approach still means monthsof development before you’ll begin to seeresults.Keep in mind the “build” option canobscure deeply entrenched bad practicesthat will under the radar – and this wouldinclude the opportunity for fraud. As well,there is the danger of recreating the wheelfor functions that someone else hasformulated an elegant solution for already.The alternative is to buy a commercial offthe-shelf (COTS) system that can be quicklyimplemented, including prepackagedinvoicing models.Be aware, however, that possible solutions—for both enterprise and SMB segments—often enforce standardized processes,requiring your employees to adopt—andadapt to—inflexible built-in workflows.If you’re an SMB with relatively “loose” APprocesses, this may be a great option. Forenterprises with complex establishedworkflows a COTS solution may beprohibitive in terms of flexibility.4

WhitepaperInsiders Guide to AP AutomationAnother Option?C) Hybrid SaaS AP AutomationThe third alternative is a secure, hybridSaaS solution –– like Palette — offering youthe best of both worlds with speed andflexibility.Software-as-a-Service (SaaS) AP platformsreduce—or eliminate—manual handling,improve accuracy, and enhancecommunications between systems withintelligent automation.Hybrid AP automation solutions provideimmediate access to most of the requiredfunctionality, while providing a platformeasily tailored to meet the unique needs ofyour organization.Support for remote workers, increasedflexibility and scalability, optimizedefficiencies, and reduced cost-per-invoicemakes SaaS an attractive proposition forcompanies of all sizes.Remember however that SaaS vendors offera range of usage, volume, and paymentbased subscriptions. Make sure youunderstand the pricing implications for yourbusiness before committing.More importantly, choose avendor who’s in a position tocommit to a meaningfulpartnership for the long term.Large vendors with thousandsof customers may not providethe support you need.Choose a vendor with a customerbase matching your organizationand a reputation for listening to itscustomers.Palette Software is a market-leading vendor of financial process automation for domesticand global corporations, including AP Automation and Purchase to Pay Automation.palettesoftware.com5

WhitepaperInsiders Guide to AP AutomationPalette Automated PO MatchingRoadblock #2: We havespecialized knowledgeYes, you have specialized knowledge aboutyour business. How you do things may varyfrom one department to another, but thebasic process is the same.One thing you don’t have is the ability tomanually scan thousands of invoices withhundreds of line items and get it right everytime.That’s where AP automation vendors likePalette can help. Designed and built by APprofessionals for AP departments, Palettespeaks the language. We understandpurchasing and AP processes,incorporating best practices into a flexible,SaaS model.Automated 2 & 3 Way PO MatchingAn example of this is Palette’s automated,three- and four-way PO matching, andworkflow management. Using ourintelligent capture and OCR solutions, wecapture electronic invoices with 100%accuracy, and paper or image data withover 95% accuracy. Once the information isin our system, automated purchase ordermatching takes over, reducing the approvalcycle by up to three times.palettesoftware.comPalette’s intuitive UI allows you to watch theprocess as purchase orders with hundredsof line items are matched within minutes ofreceipt, meaning a huge savings in terms ofefficiency, time, and money.Intuitive Color CodingAs the platform matches invoices, purchaseorders, goods receipts and contract data,lines on the screen turn green indicating amatch with line-level color coding speedingup error identification and remediation.Highlighted exceptions are automaticallysent to the relevant approver—based onworkflow rules—for validation and one-clickapproval.Once an invoice is matched and approvedthe automated process sends thoseinvoices to the ERP for downstreamprocesses—such as vouchering and agingbefore payment—to take over.This hands-off approach to accountspayable processing increases dataaccuracy and shortens payment cycles,increasing vendor satisfaction and openingthe door to more significant discounts.6

WhitepaperInsiders Guide to AP AutomationObstacle #3: The ROI isn’t bigenoughAutomation isn’t just about speed, andmeasuring ROI isn’t just about licensing anddeployment costs for the AP department.ErrorsYou can’t measure the impact of accuracybut errors cost money, a savingscomponent that is often overlooked. Just afew invoices where the decimal is enteredin the wrong place by AP can cause asignificant financial impact.Maverick SpendingInadequate oversight of indirect spending isoften due to decentralization and a lack ofprotocols, rules, and standards to managetransactions. Automated purchase to payhelps ensure the effective management ofindirect spend.Poor visibility is the primary reason forinefficiency concerning indirect spend.Increased transparency enables thepurchasing department to pursue andengage with suppliers involved in indirectprocurement, consolidating vendoragreements, ensuring on-time payments,and opening the way for negotiatingimproved volume discounts. The result issignificant cost savings benefitting yourentire organization.The Bottom LineWhen done properly—andwith the right softwarepartner—deploying anautomated AP solution canbenefit everyone within yourorganization. Reducedmanual intervention,streamlined processes, andon-time payments translateto increased employee andvendor satisfaction.If you haven’t yet decided onthe way forward, exploreyour options, choose apartner and solution modelthat matches your business,and takes steps to deploywithout delay. The sooneryou begin, the sooner you—and your entire organization—will reap the benefits.Deploying a streamlined purchase to payprocess also eliminates endless holdingpatterns, with POs waiting for approval frommultiple individuals spread across theorganization, reducing average approvaltimes from days or weeks to minutes. It alsoprovides CFOs with the insight they needinto both budgets and indirect spending.palettesoftware.com7

A Track Record of SuccessPalette Software is a market-leadingvendor of financial processautomation for domestic andglobal corporations, includingAP Automation and Purchase to PayAutomation.3,500 Customers Worldwide250,000 UsersPalette solutions automate theconnecting and matching of purchaseorders, invoices and contracts, onpremise or in the cloud.Customers experience significant andmeasurable cost savings, productivitygains and operational excellence. Palettesolutions are GDPR compliant andoptimize financial management for morethan 4,000 customers in 50 countries.96% Customer Satisfaction RatingSchedule an Appointmentto increase the productivityin your organizationSchedule an Appointmentpalettesoftware.com

Insiders Guide to AP Automation 5 The third alternative is a secure, hybrid SaaS solution -- like Palette — offering you the best of both worlds with speed and flexibility. Hybrid AP automation solutions provide immediate access to most of the required functionality, while providing a platform easily tailored to meet the unique needs of