Transcription

U p DAT ESPRING/SUMMER 2018-ISSUE NO. 87PRESIDENT'S MESSAGEAs we continue through a very busy andproductive 2018, I want to share some of theCalifornia Board of Accountancy's (CBA)accomplishments as we pursue diligently ourmission to protect consumers.One particular area of focus this yearhas been our heavy investment with theLegislature and governor's administrationto support proposed legislation that wouldbenefitconsumers. As discussed in priorMichael M. Savoy, CPA, PresidentUPDATE issues, CBA has spent the pastseveral years developing its mobility program, which allows qualifiedout-of-state licensees to practice public accountancy in Californiawithout providing notice or paying a fee. The current program wasscheduled to end on Jan. 1, 2019.Following the adoption of our report in December 2017, California'sMobility Program for Accountancy - Implementation, Enforcement andits Consumer Benefits (available on CBA's website at www.cba.ca.gov),CBA vigorously supported the approval of Senate Bill 795 (Galgiani)that would make this program permanent. I am pleased to share thatthe Legislature approved this bill without a single "no" vote, and inSeptember 2018, Governor Brown signed it into law.We are grateful to the governor and Legislature for their considerationand are appreciative that the public will continue to benefit from thevaluable consumer protections in this program and maintain easyaccess to a larger pool of certified public accountants (CPAs) from otherparts of the country who will continue to be authorized to practicepublic accountancy in California. In addition, we were pleased to workwith professional accounting organizations, including the CaliforniaSociety of CPAs, on this effort.CONTINUED ON PAGE 2IN THIS ISSUEPRESIDENT'S MESSAGECBA MEMBERS, COMMITTEE CHAIRS, AND STAFF2MESSAGE FROM THE EXECUTIVE OFFICER3MOVING? DON'T FORGET A CBA CHANGE-OF-ADDRESS FORM3NEW CBA MEMBERS APPOINTED4THANK YOU TO PEER REVIEW SURVEY PARTICIPANTS4CANNABIS INDUSTRY INFORMATION AVAIIABLE ON (BA'S WEBSITE 5FOLLOW CBA SOCIAL MEDIA ACCOUNTS FOR CONVENIENT UPDATES 5THE CBA WANTS TO HEAR FROM YOU5UNDER THE DOME6YOUR FEES AT WORK7FUTURE MEETINGS7ENFORCEMENT PROCESS8ENFORCEMENT ACTIONS10POLICY OF NONDISCRIMINATION ON THE BASISOF DISABILITY AND EQUAL EMPLOYMENT OPPORTUNITY37ADDRESS CHANGE FORM38CBA DIRECTORY39LIST OF CONTRIBUTORSBACK

CALIFORNIABOARD OFACCOUNTANCYNewsletterPRESIDENT'S MESSAGE CONTINUED FROM PAGE 1Now that this program is permanent, CBA willcontinue its work through the CBA's MobilityStakeholder Group to monitor the enforcement practicesof the various states and U.S. territories to ensure thatCalifornia's consumers are protected.Another large CBA priority this year has been theimplementation of a system that allows licensees to paytheir renewal fees with a credit card on CBA's website.We expect this service will be available by the end of2018.When we near the launch, complete details about howto use this new service will be shared through UPDATEand other means.Michael M. Savoy, CPAPresidentCBA MEMBERSMichael M. Savoy, CPA, PresidentGeorge Famalett, CPA, Vice-PresidentMark J. Silverman, Esq., Secretary/TreasurerAlicia BerhowJose A. Campos, CPANancy J. Corrigan, CPAKarriann Farrell Hinds, Esq.Mary M. Geong, CPADan Jacobson, Esq.Xochitl A. LeonLuz Molina LopezCarola A. Nicholson, CPASunny Youngsun Park, Esq.Deidre RobinsonKatrina L. Salazar, CPACOMMITTEE CHAIRSJoseph Rosenbaum, CPAEnforcement Advisory CommitteeJeffrey De Lyser, CPAPeer Review Oversight CommitteeDavid Evans, CPAQualifications CommitteeCBA STAFFPatti Bowers, Executive OfficerDeanne Pearce, Assistant Executive OfficerDominic Franzella, Enforcement ChiefGina Sanchez, Licensing ChiefAaron Bone, UPDATE Managing EditorTerri Dobson, UPDATE Production2

UPDATE SPRING/SUMMER 2018MESSAGE FROM THE EXECUTIVE OFFICEROn behalf of CBA, I would liketo express my appreciation tothose who took our recent surveyabout the UPDATE newsletter.At its July 2018 meeting, CBAapproved moving to primarilyelectronic-based distribution ofUPDATE, beginning in 2020.Over the coming months, CBAPatti Bowers, Executive Officerwill communicate importantinformation about this transitionthrough future UPDATE issues on its website and byother means. This change will save valuable resourcesand speed up production of future UPDATE issues.Those who prefer to receive a paper copy will continueto have that option. Stay tuned for more informationon this important development.Speaking of the future, CBA is invested in helpingprepare the next generation of CPAs. Last year,we held our first-ever meeting on the campusof a California university. That event was a bigsuccess and we are looking to hold another CBAmeeting on a college campus before the end of 2019.Doing so helps us build relationships with faculty,administrators, and aspiring CPAs. As plans beginto take shape, we will share them in future issues ofUPDATE.As always, we encourage you to fill out ourstakeholder survey whenever you interact with CBA.We use that valued feedback to identify areas ofneeded improvement and recognize our staff whoprovide excellent customer service. You may find thelink to the survey on CBA's website(www.cba.ca.gov) or visit www.surveymonkey.com/r/H3XH8SV.Patti BowersExecutive OfficerMOVING? DON'T FORGET A CBA CHANGE-OF-ADDRESS FORMCBA uses your address of record to contact you with important documentation related to license renewal,law changes, and other matters. To ensure that you continue to receive written communication from CBA,whenever your address of record on file with CBA changes, you are required to provide your new address ofrecord to CBA within 30 days of that change. Although the U.S. Postal Service is the primary method usedby CBA to communicate with applicants and licensees, we request that you provide an email address as well.For your convenience, CBA has provided an address change form in the back of this publication and madeit available online. To access it, visit www.cba.ca.gov and click the "Licensees" link. Then, under "CA CPALicensees Forms," select ''Address Change."3

CALIFORNIABOARD OFACCOUNTANCYNewsletterNEW CBA MEMBERS APPOINTEDCBA is pleased to welcome two new members appointed by Governor Edmund G. Brown Jr. in August 2018:Nancy J. Corrig an, CPAMs. Corrigan recentlytransitioned fromSingerLewak LLP where shewas a partner and co-ownersince 2015. She was a partnerand co-owner at Jeffery,Corrigan & Shaw LLP from1985 to 2015, a manager atApodaca, Finocchiaro &Company from 1978 to 1985, and a staff accountant atSwenson & Clark from 1977 to 1978.Ms. Corrigan is a member of California Society ofCertified Public Accountants, American Institute ofCertified Public Accountants, and previously served onCBA's Enforcement Advisory Committee, Peer ReviewOversight Committee, and Qualifications Committee.She is also a member of the California State PolytechnicUniversity's Accounting Department AdvisoryCouncil and Advisory to the Audit Committee of TeenChallenge of Southern California.Ms. Corrigan earned a Bachelor of Science degree fromCalifornia State Polytechnic University in Pomona.Her term end date is Nov. 26, 2021.Mary M. Geong, CPAMs. Geong has beenprincipal owner at MaryGeong, CPA since 2013 andfinancial advisor at HD VestFinancial Services since 1999.She held several positionsat the Franchise Tax Boardfrom 1994 to 2013, includingtax auditor, audit supervisor,and program specialist.Ms. Geong was manager of administration at WorldSavings and Loan from 1989 to 1994 and managerof accounting at the Federal Reserve Bank in SanFrancisco from 1984 to 1989. Ms. Geong is presidentof the Oakland Rotary Endowment and a member ofthe California Society of CPAs Statewide Committeeof Taxation and Personal Financial Planning, PiedmontAsian American Club, East Bay Association of EnrolledAgents, Asian Real Estate Association of the EastBay, Ascend Pan-Asian Leaders, Northern CaliforniaChapter and Tax Aid.Ms. Geong earned a Master of Business Administrationdegree in management and a Master of Science degreein taxation from Golden Gate University.Her term end date is Nov. 26, 2021.THANK YOU TO PEER REVIEW SURVEY PARTICIPANTSThank you to all who participated in CBA's recent Peer Review Survey. This information was tremendouslyvaluable as CBA prepares a report due later in 2018 to the Legislature on its Peer Review Program. Thesurvey helped CBA understand how firms benefitted from peer review, the difficulties experienced, and whatcorrective actions firms took. The survey results will help state leaders understand how peer review helpssupport CBA's consumer protection mission and increases an accounting firm's compliance with professionalstandards.4

UPDATE SPRING/SUMMER 2018FOLLOW CBA SOCIAL MEDIAACCOUNTS FOR CONVENIENTUPDATESIf you use Facebook, Twitter, or Linkedin to keepup with up your relatives, friends, and colleagues,consider following the CBA's social media accountsto get important updates on changes in CBA lawsor processes. Since social media is a very rapidcommunication platform, you could be among the firstto learn about important changes.Also, CBA responds to questions and commentsreceived through social media, so it is a convenientway to get quick answers and guidance.To find CBA on Facebookand Linkedin, search for"California Board ofAccountancy." CBA's Twitteraccount is @CBANews.CANNABIS INDUSTRY INFORMATION AVAILABLE ON CBA'S WEBSITESince California legalized the recreational use ofcannabis in 2016, CBA has been contacted by licenseesseeking a position statement that discusses the renderingof professional accounting services to businesses in thecannabis industry. CBA does not issue such statements,which are effectively legal opinions. In this state, theCalifornia attorney general is the only official authorizedto issue legal opinions on behalf of a state agency.Presently, CBA has no position on this issue. Licenseesmay wish to consider consulting with their legalcounsel to assess the risk factors and make their owndetermination whether to engage in services for clientsin the cannabis industry.CBA has developed a webpage to share cannabis-relatedinformation developed by various state and federalagencies. To view the webpage, visit www.cba.ca.govand select the "Licensees" link, then select "CannabisIndustry Information."CBA WANTS TO HEAR FROM YOUCBA wants to hear from consumers, applicants,licensees, and other stakeholders regarding how itcan improve the services provided. CBA uses theStakeholder Satisfaction Survey as an important toolto receive feedback and allow stakeholders to expresstheir thoughts on their interactions with CBA staff.CBA management reviews the comments receivedand uses them to help shape its priorities anddetermine training needs for staff.Please take a moment to tell CBA about the serviceyou received, or any other topic you wish to commenton related to CBA. All responses can be anonymous.To access the survey, visit www.cba.ca.gov andunder "Quick Hits," select the "CBA StakeholderFeedback " link.

CALIFORNIABOARD OFACCOUNTANCYNewsletterUNDER THE DOMEThe California Legislature adjourned for the year onAug. 31, 2018. Throughout 2018, CBA was very activein the legislative process. Here are a few bills CBA hastaken positions on that may be of interest to licenseesand other stakeholders.Assembly Bill 2138 (Chiu/Low)CBA's Position: Oppose, Unless AmendedSummary: This bill significantly limits a licensingboard's authority to consider an individual's historyof unprofessional conduct and criminal activity whenevaluating an application for licensure. Except forcertain serious felonies or financial crimes, the billprohibits a licensing board from considering crimescommitted by an applicant more than seven yearsprior to the date of application.Governor Brown sign,ed this bill into law.Senate Bill 795 (Galgiani)CBA's Position: SupportSummary: This bill makespermanent CBA's mobilityprogram, which allows qualifiedout-of-state licensees to practicepublic accountancy in Californiawithout providing notice orpaying a fee. The programwas previously scheduledto end Jan. 1, 2019.6CBA's report on the program, California's MobilityProgram for Accountancy - Implementation, Enforcementand Its Consumer Benefits, is available atwww.cba.ca.gov.Governor Brown sign,ed this bill into law.Senate Bill 1492 (Senate Business, Professions andEconomic Development Committee)CBA Position: SupportSummary: This bill includes three changes to theBusiness and Professions Code relevant to CBA. Thefirst two proposals include amendments to the law thatremove or replace outdated language.The third proposal adds Business and Professions Codesection 5100.1, stating that in certain causes fordiscipline against a licensee, CBA shall rely uponthe findings or events as stated in a certified ortrue and correct disciplinaty action of anotheragency.Governor Brown signed this bill into law.For a complete list of all legislationCBA took action on during the2017-18 legislative session, go towww.cba.ca.gov, then under the"Quick Hits" section, click"Laws and Rules," then select"Pending Legislation."

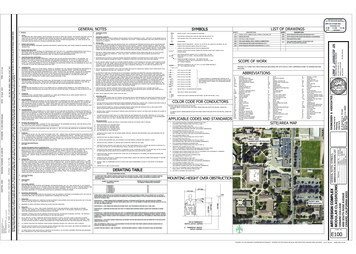

UPDATE SPRING/SUMMER 2018YOUR FEES AT WORKEvery year, CBA is appropriated a maximum amount of funding to carry out its mission of consumer protection.These amounts are based on the prior year's budget and are then adjusted to account for any program changes andadministrative adjustments approved or ordered by the Department of Finance. CBA's total budget for fiscal year2017-18 was 14,089,000.CBA allocates its budget to various organizational units to best attain its consumer protection goals while alsostriving to provide the best customer service to its stakeholders. The chart below depicts all of the organizationalunits comprising CBA and their associated funding levels for 2017-18.FY 2017/18 AllocationsTotal Budget: 14,089,000Renewal 1,474,028 - 10.5%LicensingAdministration 655,124 - 4.6%Administration 3,013,568 - 21.4%Board 184,000 - 1.3%Initial Licensing 1,474,028 - 10.5%Executive 491,343 - 3.5%,,,Exam 818,905 - 5.8% ------Enforcement 5,978,004 - 42.4%FUTURE MEETINGSNov. 15-16, 2018CBA and Committee MeetingsDouble Tree by Hilton Hotel San Diego Downtown1646 Front St.San Diego, CA 92101(619) 239-6800Dec. 6, 2018Enforcement Advisory CommitteeMarriott Fullerton2701 NutwoodAve.Fullerton, CA 92831(714) 738-7800Dec. 7, 2018Peer Review Oversight CommitteeCalifornia Board ofAccountancy2450 Venture Oaks Way, Suite 300Sacramento, CA 95833(916) 263-3680Jan. 17-18, 2019CBA and Committee MeetingsCalifornia Board ofAccountancy2450 Venture Oaks Way,Suite 300Sacramento, CA 95833(916) 263-3680CBA and committee meetings are open tothe public. Consumers, licensees, and allinterested persons are encouraged to attend.As meeting locations are determined, theywill be posted on the CBA website atwww.cba.ca.gov under "Quick Hits,"using the "CBA and Committee Meetings"link. Meeting locations are also available bycalling the CBA office at (916) 263-3680.Public notices and agendas are posted to thewebsite at least 10 days prior to meetings.All CBA meetings are webcast live andarchived at www.cba.ca.gov.7

CALIFORNIABOARD OFACCOUNTANCYNewsletterENFORCEMENT PROCESSWhen CBA receives a complaint, an investigation isconducted. Information regarding a complaint generallyis gathered by enforcement staff, which could includea licensee's appearance before the CBA EnforcementAdvisory Committee.STANDARD TE RMS OF PROBATIONFollowing this investigation, a recommendation ismade to either (1) close the case with no violation of theAccountancy Act or CBA Regulations; (2) require thelicensee to take prescribed continuing education;(3) issue a citation and fine; or (4) refer the case to theAttorney General's Office for review and possiblepreparation of an accusation against the licensee ora statement of issues relating to the applicant. Obey all federal, California, other state, and locallaws, including those rules relating to the practice ofpublic accountancy in California.If charges are filed against a licensee, a hearing maybe held before an independent administrative law judgewho submits a proposed decision to be considered byCBA, or the matter may be settled. CBA may eitheraccept the proposed decision or decide the matter itsel Please note that CBA actions reported here may notbe final. After the effective date of CBA's decision, thelicensee may obtain judicial review of its decision. Onoccasion, a court will order a stay of CBA's decisionor return the decision to CBA for reconsideration.Copies of the accusations, decisions, and settlementsregarding any of these disciplinary and/orenforcement actions are available on the CBA website,www.cba.ca.gov, or by sending a written request to:California Board of AccountancyAttention: Disciplinary/Enforcement Actions2450 Venture Oaks Way, Suite 300Sacramento, CA 95833Please state the licensee's name and license number,and allow 10 days for each request.CBA may revoke, suspend, or impose probation on alicense for violation of applicable statutes or regulations.In addition to any case-specific terms of probation, thestandard probationary terms include: Submit, within 10 days of completion of the quarter,written reports to CBA on a form obtained fromCBA. The respondent shall submit, under penaltyof perjury, such other written reports, declarations,and verification of actions as are required. Thesedeclarations shall contain statements relativeto respondent's compliance with all the termsand conditions of probation. Respondent shallimmediately execute all release of information formsas may be required by CBA or its representatives. During the period of probation, appear in personat interviews or meetings as directed by CBA or itsdesignated representative, provided such notificationis accomplished in a timely manner. Comply with the terms and conditions of theprobation imposed by CBA, and cooperate fullywith representatives of CBA in its monitoring andinvestigation of the respondent's compliance withprobation terms and conditions. Be subject to and permit a "practice investigation" ofthe respondent's professional practice. Such "practiceinvestigation" shall be conducted by representativesof CBA, provided notification of such review isaccomplished in a timely manner. Comply with all final orders resulting from citationsissued by CBA. In the event respondent should leave California to resideor practice outside this state, respondent must notifyCONTINUED ON PAGE 98

UPDATE SPRING/SUMMER 2018ENFORCEMENT PROCESS CONTINUED FROM PAGE 8CBA in writing of the dates of departure and return.Periods of non-California residency or practice outsidethe state shall not apply to reduction of the probationaryperiod, or of any suspension. No obligation imposedherein, including requirements to file written reports,reimburse CBA costs, or make restitution to consumers,shall be suspended or otherwise affected by such periodsof out-of-state residency or practice, except at the writtendirection of CBA. If respondent violates probation in any respect, CBA,after giving respondent notice and an opportunityto be heard, may revoke probation and carry out thedisciplinary and/or enforcement order that was stayed.If an accusation or a petition to revoke probation isfiled against respondent during probation, CBA shallhave continuing jurisdiction until the matter is final,and the period of probation shall be extended untilthe matter is final. Upon successful completion of probation, respondent'slicense will be fully restored.E NFORCE ME NTDE FINITIONSAccusationA formal document that charges violation(s) of theCalifornia Accountancy Act and/or CBA Regulations bya licensee. The charges in the accusation are allegations.Allegations are not a final determination of wrongdoingand are subject to adjudication and final review by CBApursuant to the Administrative Procedure Act.Cost RecoveryThe licensee is ordered to pay CBA certain costs ofinvestigation and prosecution including, but not limitedto, attorney's fees.Default DecisionThe licensee failed to file a Notice of Defense orhas otherwise failed to request a hearing, object,or otherwise contest the accusation. CBA takesaction without a hearing based on the accusation anddocumentary evidence on file.Effective DateThe date the disciplinary decision becomes operative.ProbationThe licensee may continue to engage in activities forwhich licensure is required, under specific terms andconditions.ReinstatementA revoked license that is restored, not sooner thanone year from the date of revocation, to a clear orinactive status after petition to and approval by CBA.Reinstatement may include probation and/or termsand conditions.RevocationThe individual, partnership, or corporation no longer islicensed as a result of a disciplinary action.StayedThe action does not immediately take place and may nottake place if the licensee complies with other conditions(such as a probation term).StipulationThe matter is negotiated and settled without goingto hearing.SurrenderedThe licensee has surrendered the license. The individual,partnership, or corporation no longer is licensed. CBA,however, may impose discipline against a surrenderedlicense in certain circumstances. Surrender also mayrequire certain conditions be met should the formerlicensee ever choose to reapply for licensure.SuspensionThe licensee is prohibited for a specific period oftime from engaging in activities for which licensureis required.9

CALIFORNIABOARD OFACCOUNTANCYNewsletterENFORCEMENT ACTIONSC PA R EVO CAT I O N S T H R O U G H S E PT. 4, 2 0 1 8AY LWA R D, W I L L I A M K E V I NC h e rr y Va l l ey, C a l i f.(CPA 4 7 0 2 5 )DISCIPLINARY ACTIONS/LICENSE RESTRICTIONS:Revocation of C PA l icense, via defa u l t decisio n .Effective J u n e 2 5 , 2018CAUSES FOR DISCIPLINE:Accusation No. AC-201 8-63 conta i n s the fol l ow i n ga l l egations: (1) u n p rofess i o n a l con d u ct-co nviction o fsu bsta ntia l l y related cri me; ( 2 ) u n p rofess i o n a l co n d u ct fiscal d is ho n esty; a n d (3) u n p rofess i o n a l co n d u ct em bezzlement/m i s a p p ropriation of funds.M r. Aylwa rd is s u bject to d i sci p l i na ry action i n that o n o ra bout D e c . 1 9, 2017, h e w a s convicted o n h i s g u i lty plea o fv i o l a t i n g Pen a l C o d e sections 504/51 4 (em bezz lem ent o fp u b l i c funds), a fe l ony, a n d Penal C o d e section 424(a) (1)(m isappropriation of p u b l ic funds), a fe lo ny.M r. Aylwa rd is s u bject to d i sci p l i na ry action in that heengaged in fiscal d i s h o n esty by d ive rt i n g a n d co n cea l i n gp u b l i c f un d s .FOR VIOLATIONS OF:B u s i n ess a n d Professions Code, Divis i o n 3, C h a pter 1 ,§ 510 0(a), (i), a n d (k).CASTRO, CA R LOS A .B u rb a n k, C a l i f.(C PA 9 0 7 1 4)DISCIPLINARY ACTIONS/LICENSE RESTRICTIONS:Revocation of C PA l icense, via defa u l t decisio n .Effective J u ly 5 , 2018CAUSES FOR DISCIPLINE:Accusation No. AC-201 8-32 conta i n s the fo l l owinga l l egations: (1) practicing w ith ou t a perm it; (2) d is h o n esty;(3) w il lfully violat i n g the Accou nta n cy Act; (4) know i n gprepa rati on , p u b l ication, o r dissemi nation of fa lse,fra u d u lent, o r materi a l l y m i s l ead i n g fi n a n c i a l documents;(5) obta i n i n g m on ey by fra u d u lent means o r fa lsep retenses; (6) i m p roperly using C PA designation; and (7)a dve rtis i n g/soliciting i n a false, m islea d i n g m a n n e r.M r. Castro is s u bject to d isci p l i na ry action i n that heengaged i n the p ractice of accou nta n cy without a va l i dpermit.M r. Castro is s u bject to d isci p l i na ry action i n that heco m m itted acts of d is h o n esty when h e o bta ined a feefrom a client after prepa r in g a n d fi l i n g a c l i e nt 's tax returnsw h i l e h is l icense was d e l i n q uent a n d d i d not have otherautho rity to do so, a n d advertised a n d solicited busi ness tope rfo rm a cco u n t i n g services u s i n g the CPA designatio n .M r. Castro is s u bject t o d isci p l i na ry action i n that h ew i l lf u l l y violated a su bdivision o f t h e Accou nta n cy Act a sdescribed here i n .M r. Castro is s u bject t o d isci p l i na ry action i n t h a t h eknowi n g l y p repa red, p u b l ished, o r d isse m i nated fa lse,fra u d u lent, o r materi a l l y m i s l ead i n g fi n a n c i a l state m ents,repo rts, o r i nfo rmation when h e i m p roperly used theCPA designation i n advertis i n g a n d soliciting b u s i n ess tope rfo rm a cco u n t i n g services.M r. Castro is s u bject to d isci p l i na ry action i n that heobta i n ed m on ey o r oth er va l u a b l e consideration byfra u d u lent means o r fa lse p retenses when h e o bta i ned afee from a client after prepa r in g a n d fi l i n g a c l i e nt 's taxreturns w h i l e his l icense was d e l i n q uent and did not haveoth e r autho rity to do so, a n d advertised a n d solicitedbusi ness to pe rfo rm a cco u n t i n g services u s i n g the CPAdesignati o n .CONTINUED O N PAGE 1 1IO

UPDATE SPRING/SUMMER 2018C PA REVOCATIONS THROUGH SEPT. 4, 2 0 1 8M r. Castro is s u bject t o d isci p l i na ry action i n t h a t hei m p roperly a n d u n lawfu l l y d e s i g n ated h i mself as a certifiedp u b l i c a ccou nta nt and used the a b b reviation "C PA" w h e nh i s l i cense w a s i n "de l i n q u e n t " status.M r. Castro is s u bject to d isci p l i na ry action i n that hea dve rtised a n d s o l i cited busi ness i n a fa lse, fra u d u l ent, andm is l ea d i n g m a n n e r as described a bove.FOR VIOLATIONS OF:B u s i n ess a n d Professions Code, Division 3, C h a pter 1 ,§§ 5050, 5055, 5 1 0 0 (c), (g), (j), a n d (k). C a l ifo r n i a Code ofReg u lations, Title 1 6 , Division 1, § 63.C H E N , TO N I TO N GH a c i e n d a H e i g h t s , C a l i f.(CPA 7 3 6 6 3 )DISCIPLINARY ACTIONS/LICENSE RESTRICTIONS:Revocati on of C PA l icense, via defa u l t d e c i s i o n .Effective Sept. 4, 201 8CAUSE FOR DISCIPLINE:Accusation No. AC-201 8-1 7 conta i n s the fo l l owi n ga l l egations: ( 1 ) co nvi ction o f a su bsta ntially related cri me;(2) d i s ho n esty and fra u d ; (3) fiscal d is h o nesty o r b reachof fi d u c i a ry respo n s i b i l ity; (4) e m bezz l e m ent, th eft, o rm is a p p ropriations o f f u n d s ; ( 5 ) i m position o f d i sci p l i n e bythe U n ited States Secu rities a n d Exc h a n g e Com m ission(SEC); (6) d isci p l i n a ry action by a ny a g e ncy of the federalgove r n m ent; (7) suspension of r i g h t to p ractice beforegove r n m e n t a l body o r a g e n cy; and (8) fa i l u re to reportevents.M s . Chen is s u bject to d isci p l i na ry action i n thats h e d is h o n estly and fra u d u l ently m is a p p ro p riateda p p roxi m ately 372,585 from victi m i nvesto rs.Ms. Chen is s u bject to d isci p l i na ry action i n that sheknowi n g l y co m m itted fiscal d is h o nesty o r breached h e rfi d u c i a ry respo n s i b i l ity b y m isa p p ro p r i a t i n g a p p roxi m ately 372,585 from vict i m i nvestors.Ms. Chen is s u bject to d isci p l i na ry action i n that sheknowi n g l y e m bezzled and m is a p p ropriated a p p roxi mately 372,585 from vict i m i nvestors.Ms. Chen is s u bject to d isci p l i na ry action i n that s h e wasd isci p l i ned by t h e S EC on J u ly 8, 201 6 , i n the p roceed i n gtitled I n the M atter o f To n i To ng C h e n , C PA. Ad m i n i strativeProceed i n g F i l e N o . 3-1 7329.Ms. Chen is s u bject to d isci p l i na ry action i n that s h e wasd isci p l i ned by t h e S EC, a n a g e ncy esta b l ished by thefederal gove r n m ent.M s . Chen i s s u bject to d i sci p l i na ry action i n that h e r rightto p ractice before a g ove r n m e n t body o r a g e ncy wassuspended o r revo ked .M s . C h e n is s u bject t o d isci p l i n a ry action i n that s h e fa iledto report i n writing to CBA with i n 30 days of her g u i lty pleaa n d the cancellation, revocation, or suspension of the rightto practice as a certified public accou ntant before the S E C .FOR VIOLATIONS OF:B u s i n ess a n d Professions Code, Division 1, Cha pter 1 ,§ 141; D i v i s i o n 1 . 5, Cha pter 3 § 490; Division 3, Cha pter 1 ,§§ 5063(a)(l ) a n d (a) (3), 5 1 0 0 (a), (c), (h), ( i ), ( k) a n d ( I ).C a l ifo r n i a Code of Reg u lations, Title 1 6, D i v i s i o n 1 , § 99.Ms. Chen i s s u bject to d isci p l i na ry action i n that s h ew a s convicted of a c r i m e su bsta ntia l l y related t o theq u a l ificatio n , functions, a n d duties of a certified p u b l i ca ccou ntant. S pecifical ly, M s . C h e n w a s convi cted o f o n ec o u n t o f w i re fra u d .CONTINUED ON PAGE 12II

CALIFORNIABOARD OFACCOUNTANCYNewsletterC PA REVOCATIONS THROUGH SEPT. 4, 2 0 1 8HART, T H O MASP a s a d e n a , C a l i f.(C PA 5 6 0 5 2 )DISCIPLINARY ACTIONS/LICENSE RESTRICTIONS:Revocation of C PA l i cense, via defa u l t decision.Effective April 30, 201 8CAUSE FOR DISCIPLINE:The fo l l ow i ng g ro u n d s fo r d isci p l i ne a re a l leged in thePetition to Revoke Probation.PROBATION VIOLATION:(1) fa i l u re to s u b m i t written repo rts; (2) fa i l u re to co m p l eteethics conti n u i ng e d u cation (C E); (3) fa i l u re to co m p l etereg u l atory review cou rse; (4) fa i l u re to co m p l ete a n dp rovide p r o p e r docum entation of C E cou rses; a n d (5)fa i l u re to co m p l y with probation by fa i l i ng to s u b m itq u a rterly re ports.LEVI N E, PAU LWood l a n d H i l l s , C a l i f.(CPA 1 5 9 8 6)DISCIPLINARY ACTIONS/LICENSE RESTRICTIONS:Revocation of C PA l i cense, via sti p u lated settlement.Effective J u n e 25, 2018CAUSES FOR DISCIPLINE:Accusation No. AC-201 7-27 conta i n s the fo l lowi n ga l l egations: (1) w i l l f u l v i o l a t i o n of Accou nta ncy A c t a n dCBA reg u lations; ( 2 ) d ish o n esty, fra u d ; (3) know in gprepa ration, p

s of that change. Although the U.S. Postal Service is the primary method used by CBA to communicate with applicants and licensees, we request that you provide an email address as well. For your convenience, CBA has provided an address change form in the back of this publication and made it available online. To access it, visit . www.cba.ca.gov