Transcription

Your Coverage AdvisorCoverage for Punitive DamagesBy Andrew P. Moses – amoses@brouse.comWhether liability insurance policies provide coverage for punitivedamages depends not only on the language of the policies, butalso on public policy considerations as expressed in both statestatutes and case law handed down by state courts.The starting point for every coverage analysis is the languageof the insurance policy. With respect to coverage for punitivedamages, it may also be the end point. Some insurance policiescontain explicit exclusions for punitive or exemplary damages.Other insurance policies contain definitions of “Loss”* Andrew Moses acknowledges, gratefully, Gabrielle T. Kelly and Amanda M. Lefflerfor their contributions to this article.(Continued on page 2)Vol. IV, Spring 2015IN THIS ISSUECoverage for PunitiveDamages . . . . . . . . . . . . . . . . . . page 1Insurance Coverage Basicsfor Contractors. . . . . . . . . . . . page 1Decision Points . . . . . . . . . . . page 8Attorney Profile:Caroline L. Marks . . . . . . . . page 11Attorney Highlights. . . . . .page 12Insurance Coverage Basics for ContractorsBy James T. Dixon – jdixon@brouse.comConstruction contracts inevitably contain detailed insuranceprovisions intended to allocate risk and provide for coverage.Contractors must have a basic understanding of insuranceterminology and insurance coverage principles when presentedwith contracts for execution, or when preparing their owncontracts for their subcontractors and suppliers. All too often,insurance misunderstandings results in trouble down the road.What Types of Insurance Should Be Purchased?Contractors generally obtain commercial general liability(“CGL”) insurance, along with commercial auto and workers’(Continued on page 6)Your Coverage Advisor 1

Coverage for Punitive Damages (Continued from page 1)or “Ultimate Net Loss” thatexplicitly carve out punitive orexemplary damages. Courtswill give effect to such explicitpolicy language.Many policies, however,are silent when it comesto punitive damages, neitherexplicitly providing coveragefor them, nor explicitlyexcluding them. Insurers whohave issued such policies maynonetheless take the positionthat such damages are notcovered on the groundsthat coverage would violatepublic policy.Under Ohio law and under thelaw of many states, the natureof the punitive damagesdetermines whether insurancefor such damages violatespublic policy, and courts havenot articulated a clear rule oflaw that would apply in everycase. Generally, where punitivedamages are awarded againsta party to punish that party forits own malicious or egregiousconduct, that party will notbe able to obtain insurancecoverage for such punitivedamages. In other situations,however, such as when anemployer is vicariously liablefor punitive damages, or whenthe damages are awardedpursuant to a statute thatdoes not require proof ofmalice, courts have refused topreclude coverage on publicpolicy grounds.2 Your Coverage AdvisorTypically, one looks to thelaw of the state where theunderlying claim is broughtto determine the nature ofthe punitive damages. Forexample, in New Jersey, anaward of punitive damageis governed by statute,specifically the PunitiveDamages Act, N.J.S.A. 2A:15-5.9 through 5.17. NewJersey law requires that inorder for punitive damages tobe awarded, the plaintiff mustprove by clear and convincingevidence that:the harm suffered was theresult of defendant’s acts oromissions, and such acts oromissions were actuated byactual malice or accompaniedby a wanton and willfuldisregard of persons whomay foreseeably be harmedby those acts or omissions.This burden of proof may notbe satisfied by proof of anydegree of negligence includinggross negligence.N.J.S.A. 2A:15-5.12.A different state’s law mayapply to the question whethercoverage for the punitivedamages violates public policy.The law that applies to thiscoverage question may bethe law of the state of whichthe policyholder is a citizen,the state where the insurancecontracts were negotiated anddelivered, or another state thathas a significant interest in thecoverage question. Becauseinsurance coverage law variesdramatically from state tostate, counsel for policyholdersand insurers alike should fullyanalyze the choice-of-lawissue before reaching anyconclusion on the substantivecoverage question.The law of differentjurisdictions as to theinsurability of punitivedamages varies and, evenwithin some states, theinsurability of punitivedamages can vary dependingon the type of insurance atissue and the elements ofthe punitive damages claim.In Ohio, for example, bothstatutory and common lawgovern the insurability ofpunitive damages. The Ohiolegislature has enacted R.C.3937.182, which providesas follows:(B) No policy of automobileor motor vehicle insurancethat is covered by sections3937.01 to 3937.17 of theRevised Code, including,but not limited to, theuninsured motorist coverage,underinsured motoristcoverage, or both uninsuredand underinsured motoristcoverages included in sucha policy as authorized bysection 3937.18 of the RevisedCode, and that is issued by aninsurance company licensedto do business in this state,and no other policy of casualtyor liability insurance that is

covered by sections 3937.01to 3937.17 of the RevisedCode and that is so issued,shall provide coverage forjudgments or claims againstan insured for punitive orexemplary damages.Ohio Rev. Code § 3937.182(B).Ohio case law also prohibitscoverage for punitivedamages awarded wherethe insured’s actions weremalicious. Wedge Prods.,Inc. v. Hartford EquitySales Co., 31 Ohio St.3d65, 67 (1987); see alsoNeal-Pettit v. Lahman,125 Ohio St.3d 327, 331(2010) (“It is true that publicpolicy prevents insurancecontracts from insuringagainst claims for punitivedamages based upon aninsured’s malicious conduct.”).Because the purpose ofpunitive damages is “topunish an offender for thewanton, reckless, malicious oroppressive character of the actcommitted and to deter othersfrom committing similar acts,”there is a public policy interestagainst allowing offenders totransfer responsibility to itsinsurance company. Caseyv. Calhoun, 40 Ohio App.3d83, 84 (8th Dist. 1987); seealso Ruffin v. Sawchyn,75 Ohio App. 3d 511, 518(8th Dist. 1991)(settlementthat purported to satisfypunitive damages award withpayments from codefendant’sinsurer was void.); Stephensv. Grange Mut. Ins. Co., 2ndDist. No. 2011 CA 102, 2012Ohio-4980, 28 (“Punitivedamages are not insurable,and the use of insuranceproceeds to satisfy an awardof punitive damages is againstpublic policy.”); WorldHarvest Church v. GrangeMut. Ins. Co., 10th Dist. No.13AP-290, 2013-Ohio-5707.The question is less settledin other jurisdictions. Forexample, in New Jersey, somecourts have held that punitivedamage awards intended topunish the insured for theinsured’s malicious acts arenot insurable. In Johnson& Johnson v. Aetna Cas.& Sur. Co., 285 N.J. Super.575, 585, 667 A.2d 1087(N.J. App. 1995), the courtstated that “New Jersey sideswith those jurisdictions whichproscribe coverage for punitivedamage liability because sucha result offends public policyand frustrates the purposes ofpunitive damage awards. Id.,583, citing Variety Farms,Inc. v. New Jersey Mfrs.Ins. Co., 172 N.J. Super.10, 13, 410 A.2d 696 (App.Div. 1980); Leimgruber v.Claridge Assocs., 73 N.J.450, 454, 375 A.2d 652(1977). There, however, alsois some authority in NewJersey that punitive damages(Continued on page 4)Your Coverage Advisor 3

Coverage for Punitive Damages (Continued from page 3)may, in some situations, beinsurable. Chubb Custom Ins.Co. v. Prudential Ins. Co. ofAmerica, 195 N.J. 231 (N.J.2008).“Many othercourts in otherjurisdictions havefound that publicpolicy allowspunitive damagesto be covered byinsurance in certainsettings. Commonly,where an employeris vicariously liablefor the acts of a nonmanagement levelemployee, courtshave permitted theemployer’s liabilityfor punitive damagesto be covered byinsurance.”4 Your Coverage AdvisorIn other states, the courtshave held that it does notviolate public policy to insurepunitive damage awards. Forexample, Georgia courts haverepeatedly held that it doesnot violate public policy toinsure punitive damages. See,e.g., Greenwood Cemetery,Inc. v. Travelers Indem.Co., 238 Ga. 313 (1976);Lunceford v. PeachtreeCas. Ins. Co., 230 Ga.App. 4(1997).Even those states that havefound it against public policyto insure punitive damagesawarded against an insureddirectly, to punish theinsured for its own wrongfulconduct, may not find thatall punitive damage awardsare uninsurable. This is thecase in Ohio where, despitethe language of Ohio Rev.Code 3937.182(B), severalcourts have held that punitivedamages are insurable whenthere is no finding of maliceor ill will. These courts lookbeyond the breakdownof damages to the reasonpunitive damages wereimposed to determine theirinsurability. In cases wherepunitive damages wereimposed by statute and thepolicyholder did not commitmalice or ill will, an Ohiocourt will allow insurancecoverage. For example, inThe Corinthian v. HartfordFire Ins. Co., 143 OhioApp.3d 392 (8th Dist.2001), the Eighth DistrictCourt of Appeals analyzedthe insurability of punitivedamages in a personal injuryand wrongful death suitarising from a violation ofa patient’s statutory rights.The court contrasted thecase with Casey v. Calhoun,supra, and held that althoughOhio public policy precludescoverage when an individualseeks to insure “against hisown intentional or maliciousacts,” indemnification ispermitted when there is astatute at issue and no actualmalice. Id.Additionally, in Foster v.D.B.S. Collection Agency,Case No. 01-CV-514, 2008WL 755082 (S.D. Ohio Mar.20, 2008), the SouthernDistrict of Ohio consideredwhether punitive damagesstemming from the insured’sdebt collection actions werecovered. In that case, thepolicyholder was a debtcollection agency that wassued for its methods ofcollecting debts. The plaintiffalleged fraud, violation of theOhio Consumer Sales PracticesAct, and other related claims.Relying on The Corinthian,the court held that “Ohio lawdoes not prohibit insurance

coverage of punitive damagesin all cases,” particularly thosepursuant to a statute andwithout any finding of malice.Foster, at *9. Furthermore,the court noted that the policylanguage at issue in the casewas more persuasive thanin The Corinthian, becausethe insured’s policy explicitlyincluded coverage for punitivedamages. Id. Thus, policiesconstrued under Ohio law mayprovide coverage for punitivedamages, particularly whenthe policies expressly providesuch coverage and punitivedamages are assessed againstthe policyholder without afinding of malice or ill will.Many other courts in otherjurisdictions have found thatpublic policy allows punitivedamages to be coveredby insurance in certainsettings. Commonly, wherean employer is vicariouslyliable for the acts of a nonmanagement level employee,courts have permittedthe employer’s liability forpunitive damages to becovered by insurance. Forexample, in Celotex Corp. v.AIU Ins. Co., 152 B.R. 652(Bankr.M.D.Fla.1993), thecourt found that “insurancecoverage will not be availablefor punitive damagesrelated to asbestos-relatedproperty damage wherethose punitive damages areimposed upon Debtor forwrongs committed directly byDebtor. However, coverageis available where punitivedamages are incurred byDebtor based upon Debtor’svicarious liability providedthe relevant insurance policyaffords coverage for punitivedamages.” Applying Floridaand Ohio law, the courtreasoned that in those states:[P]ublic policy bars coveragefor punitive damages wherethose damages were imposeddue to wrongdoing committedby the insured. U.S. Fire Ins.Co. v. Beltmann N. Am. Co.,695 F. Supp. 941 (N.D. Ill.1988), rev’d on other grounds,883 F.2d 564 (7th Cir. 1989);Beaver v. Country Mut. Ins.Co., 95 Ill. App. 3d 1122, 420N.E.2d 1058, 51 Ill. Dec. 500(Ill. App. Ct. 1981); Casey v.Calhoun, 40 Ohio App. 3d83, 531 N.E.2d 1348 (OhioCt. App. 1987); State FarmMut. Ins. Co. v. Blevins, 49Ohio St. 3d 165, 551 N.E.2d955 (Ohio 1990). Both states,however, create a vicariousliability exception. U.S. FireIns. Co., 695 F. Supp. at 949;Beaver, 420 N.E.2d at 1061;Blevins, 551 N.E.2d at 958.Other states also recognizesuch an exception. See,e.g., First Nat’l Bank of St.Mary’s v. Fidelity & DepositCo., 283 Md. 228, 389 A.2d359 (Md.1978); ContinentalIns. Co. v. Hancock, 507S.W.2d 146 (Ky.1973). Therationale in such decisions isthat the public policy does notprohibit insurance coveragefor punitive damage awardsagainst parties who did notengage in the reprehensibleconduct because the purposeof punitive damages -deterrence and punishmentof the wrongdoer -- wouldnot be thwarted in suchsituations. That was the pointin Chubb Custom Ins. Co.v. Prudential Ins. Co. ofAmerica, 195 N.J. 231, 245,fn.3 (2008), in which thecourt observed that statutoryand case law in New Jerseyprovided some authoritythat where an insurancepolicy provides coverage forpunitive damages, and wherethe punitive damages awarddoes not fulfill the purpose ofpunishing the wrongdoer, itwould not violate the publicpolicy of New Jersey to allowcoverage for the punitivedamages.Punitive damage awards areoften calculated by triplingthe amount of compensatorydamages and are a significantrisk in many types of litigation.The evaluation of whetherinsurance will extend to suchdamages requires a carefulexamination of the policylanguage, a thorough choiceof-law analysis, and an upto-the-minute evaluationof the law of the applicablejurisdiction. Don’t just takeyour insurer’s word for it. nYour Coverage Advisor 5

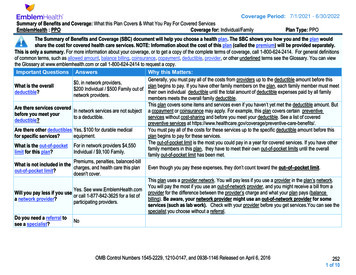

Insurance Coverage Basics for Contractors (Continued from page 1)compensation insurance.Design professionals typicallyalso obtain errors andomissions (“E&O”) liabilityinsurance. These policiesprovide protection, includingboth defense and indemnity,from liability in the event ofan accident or “occurrence”which results in propertydamage or injury. Owners ofthe property being developedshould have first-partyproperty insurance, whichprotects the owner in theevent of loss or damage tothe owner’s property. Fora specific development orbuilding project, an ownermay elect to purchase, orrequire the contractor topurchase, a Builder’s Riskpolicy. For large projects, amore comprehensive OwnerControlled Insurance Program(“OCIP”) or a ContractorControlled InsuranceProgram (“CCIP”), whichprovides insurance for allproject participants, may beappropriate. Such insuranceprograms are sometimesreferred to as “wraps.”What are Policy Limits?The limit of a policy is theamount it will pay in theevent of a loss. Limits areusually expressed as being for“each occurrence” and/or inthe aggregate for the termof the policy. Sometimes anaggregate limit is providedfor a particular constructionproject. A policyholder can6 Your Coverage Advisorobtain additional limits ofinsurance by purchasingumbrella insurance whichmay provide broader coverageas well. Limits can also beextended higher with excessinsurance.The limits of the policy aretypically set forth on thedeclarations page of thepolicy. Construction contractsgenerally will specify thelimits, or the amount ofcoverage, the parties arerequired to maintain.What is the DifferenceBetween Claims-Made and“Occurrence” Policies?A “claims-made” policygenerally will provide coveragefor claims first asserted againstthe insured and reported tothe insurance company duringthe period of the policy. An“occurrence” policy generallywill provide coverage if theinjury or property damagetakes place during the periodof the policy, regardless ofwhen the claim is made. Bothtypes of policies are available,and contractors should be verycareful not to inadvertentlycreate gaps in coverage whenswitching from one kind toanother.What Should I Do If I HaveA Claim?Insurance policies alwaysinclude provisions obligatingyou to provide prompt noticeto the insurance company,and to cooperate with theinsurance company’s handlingof the matter. You shouldnotify your insurer as soonas possible after you becomeaware of a problem that maybe covered by the insurance.If you are sued, you shouldsend the suit papers to yourinsurer immediately andrequest that your insurerdefend and indemnify you. Itis a good idea to also includeyour insurance broker or agenton these communications. Inmany instances, your brokeror agent may provide yourinsurer notice on your behalf.What Does Defend andIndemnify Mean?Even groundless lawsuits canbe expensive to defend. Ifyour insurance policy providesthat your insurer is obligatedto defend you, that usuallymeans retaining and payingan attorney to represent you,and paying other costs andexpenses incurred for thedefense. In the unfortunateevent you are found liable, oryou and your insurer decide tosettle, your insurer indemnifiesyou by paying the amount ofthe settlement or judgement,up to the limits.What Should I Expect AfterI Notify My Insurer Of AClaim?Once you submit a claim,your insurer should either (1)unconditionally acknowledgeits insurance obligations, (2)acknowledge its defense

obligation, but reserve itsright to disclaim coveragefor reasons that it shouldexplain in writing in whatis called a “reservation ofrights” letter, or (3) decline toprovide coverage, again forreasons that it should explainin writing. Unless there hasbeen a denial, your insurershould then appoint a lawyerto defend the contractor andpay that attorney’s bills. Insome instances, the reasons ina reservation of rightsletter may mean that you canand should hire your ownattorney and submit his or herbills to the insurance companyfor payment.The insurance companymay hire its own attorney toanalyze any coverage issues.The insurance company mayalso decide to intervene inthe lawsuit in order to havethe court decide any disputeover coverage. Or, you or theinsurance company may filea separate lawsuit for thesame purpose.Should I Respond to aReservation of Rights?Always carefully review andrespond, in writing, to areservation of rights letter.Where the amount at stakeis significant, consult with anindependent attorney who isexperienced with insurancecoverage disputes from yourperspective. nYour Coverage Advisor 7

DecisionPointsBy Sallie Conley Luxslux@brouse.comLegal decisions interpreting laws, statutes, and insurance policies provideguidance on the meaning of various provisions in insurance policies and whetheror not a particular happening may or may not be covered. A few recent legaldecision points of note follow:The Rest of the Story:The most recent issue of“Your Coverage Advisor”included an article aboutthe “Impact of ‘PresumptiveIntent’ on Coverage.”Subsequently, on March 14,2015, the Ohio SupremeCourt issued a decision inHoyle v. The CincinnatiIns. Co., 2015-Ohio-843reversing prevailing OhioCourt of Appeals law thatan employer’s “presumptiveintent” intentional torts werecovered under the employer’sinsurance policy.8 Your Coverage AdvisorTHE FACTS:Hoyle was injured in theworkplace when he fell froma “ladderjack” scaffold,landing on a concrete floor.Although the ladders weretypically secured in place bya bolt, Hoyle claimed that hissupervisor “kept the bolts in[an] office and told employeesthey did not need thembecause they take too muchtime to use.”Under RC 2745, an employeemay recover for an employerintentional tort injury eitherthrough direct evidence (theemployer’s deliberate intentto injure or belief that injuryis substantially certain tooccur), RC 2745(A) and (B), orthrough proof that establishesa statutorily created rebuttablepresumption of intent toinjure where the employerdeliberately removes anequipment safety device. RC2745(C). Hoyle had asserteda “presumptive intent” claimunder RC 2745(C).THE POLICY:Cincinnati issued a CGL policyto the employer that included,for an additional premium,

Ohio form EmployersLiability Insurance (“ELI”).The Ohio ELI form coveredemployee workplace injuries“caused by an ‘intentionalact’ to which this insuranceapplies.” “Intentional” wasdefined as “an act which issubstantially certain to cause‘bodily injury.’” The OhioELI form explicitly excludedfrom coverage “liabilityfor acts committed . withthe deliberate intent toinjure.” Thus, the Ohio Formpurported to provide coveragefor “substantial certainty,” or“presumptive intent” claims,but not direct intent claims.others concurring only in thejudgment and syllabus. TwoJustices dissented: “Can thiscourt truly countenance aninsurance company’s assertionthat it should be permittedto collect a premium for anevent that is never going tohappen?” Hoyle at 44. Thedissenting opinion found itsignificant that the Ohio ELIform at issue did not limitthe definition of intent tomean deliberate intent, thusobserving that an employercould be found liable for anintentional tort under RC2745, and still be covered bythe language of the policy.THE RESULT:THE “PRACTICAL EFFECT”:Notwithstanding thedistinction between intentionalacts and intentional injury inthe Ohio ELI form, the OhioSupreme Court found no suchdistinction in the language ofthe statute. Thus, regardlessof whether a claim is broughtunder RC 2745(C) instead ofRC 2745(A) or (B), “intent toinjure” is an essential elementof the claim. Accordingly,“[a]n insurance provision thatexcludes coverage for actscommitted with the deliberateintent to injure an employeeprecludes coverage for [all]employer intentional torts,which require a findingthat the employer intendedto injure the employee.”Id., syllabus.A majority of the Justices (thetwo concurring and the twodissenters) agreed that “asa result of this decision,‘[t]here is now nothing lessthan deliberate intent[.]’”Id. at 41. The practical effectof Hoyle is that while injuredemployees have a very difficultburden of proof, if they meetthat burden, their employerswill have not have thecoverage they thoughtthey purchased.Only three Justices joinedin the opinion, with twoWho is a “ResidentRelative”?The adult son (Robert) of theinsureds (Jean and James)was involved in a car accidentthat resulted in a death. Hesought additional coveragein a subsequent wrongfuldeath suit under his parents’umbrella policy, claimingto be a “resident relative.”Robert lived in Ohio in ahouse he co-owned withJean. Jean also owned a homein Florida, where she livedpermanently. James lived parttime in Florida, and part-timein Ohio. James consideredFlorida his residence andhome (he voted there, hadhis social security depositedin his bank accounts there,had a Florida driver’s license,did not pay Ohio taxes, wascareful to comply with Ohiolaw limiting time in Ohioto avoid a presumptive taxdomicile, etc.), but he spentsignificant time, approximately2 weeks per month, in Ohio,running his business. Whenin Ohio, he lived at Robertand Jean’s house, for whichJames paid the insurance andutilities. James also used thatOhio address for one of hisbusinesses. a person’s domicileis “where he has histrue, fixed, permanenthome and principalestablishment, and towhich, whenever heis absent, he has theintention of returning.”Cincinnati issued an umbrellapolicy, naming Jean andJames as the “insureds,”and the Ohio house as their(Continued on page 10)Your Coverage Advisor 9

Decision Points (Continued from page 9)address. The policy extendedcoverage to the insureds, andto “resident relatives” for an“occurrence” involving a carowned by the resident relative.A “resident relative” includeda person “that is a resident of‘your’ household and whoselegal residence of domicile isthe same as [the insured’s].”Coverage for Robert’s accidentboiled down to whetherJames was domiciled in Ohioor Florida, which under Ohiolaw is a very fact-intensiveinquiry. Ultimately findingthat James was domiciled inFlorida, which meant Robert’saccident was not covered, theOhio Supreme Court explainedthat a person’s domicile is“where he has his true, fixed,permanent home and principalestablishment, and to which,whenever he is absent, he hasthe intention of returning.”A person’s intent is essential,as a person can reside in oneplace, but be domiciled inanother. The Court furthercautioned that the motivebehind the intent to establisha domicile is immaterial. Schillv. Cincinnati, Ins. Co., 2014Ohio-4527Are Bicyclists Pedestrians?Ohio courts have reacheddifferent results. The Courtof Appeals for the FifthDistrict, which includes muchof central Ohio, recentlysaid “No.” Dye v. Grose,2015-Ohio-1001 (March 12,10 Your Coverage Advisor2015). Dye was injured ina collision with a car whileriding his bicycle. Nationwideissued an auto policy to Dyethat extended coverage “formedically necessary services,regardless of who was at fault,for treatment of accidentalinjury suffered by insureds,‘as pedestrians if hit by anymotor vehicle.’” Althoughthe term “pedestrian” wasnot defined in the policy,the court observed thatthat did not mean thatthe policy was ambiguous,which would have mandatedconstruction in favor of theinsured (Westfield Ins.Co. v. Hunter, 2011-Ohio1818). The court concludedthat a bicyclist was not apedestrian for purposes ofcoverage under the policy.In reaching its decision,the court recognized, butattempted to distinguish,Schroeder v. Auto Owner’sIns., Co., 2004-Ohio-5667, adecision from the Sixth DistrictCourt of Appeals whichincludes Toledo and muchof northwestern Ohio. Thatcourt reached the oppositeconclusion, determining theterm “pedestrian” to beambiguous and to includea bicyclist. The dissentingJudge in Dye agreed withSchroeder, observing thatusing the definition advancedby Nationwide could result inthe conclusion that “a personstruck while traveling in awheelchair” would not becovered. Or “a person pushinga baby in a stroller would becovered if struck by a car whilethe baby would not.”The inconsistent decisionsby these two Courts ofAppeals could mean thatthe Ohio Supreme Courtwill agree to considerthis issue. n

Attorney Profile:Caroline L. MarksCaroline L. Marks - a graduate of the University ofVirginia and Case Western Reserve University Schoolof Law - joined Brouse McDowell in 2006, after havingclerked for both the Ohio Supreme Court and the OhioNinth District Court of Appeals. As a member of theInsurance Recovery and Litigation Practice Groups,Caroline devotes her practice to representing clients incomplex insurance recovery litigation involving a widerange of coverage issues and in appellate proceedings.Caroline is certified as a Specialist in Insurance CoverageLaw by the Ohio State Bar Association and was appointedto the Insurance Coverage Law Specialty Board. Shehas been recognized as either a Rising Star or an OhioSuper Lawyer every year since 2012, through a peer- andachievement-based review. In addition, Caroline regularlyauthors insurance-related articles for various publicationsand is an active member in the Cleveland legalcommunity, participating in the Cleveland MetropolitanBar Association’s Insurance Coverage Law Section and theJudge John M. Manos Inn of Court.When Caroline is not advocating on behalf of her clients,she enjoys playing racquet sports and captains a USTAteam for the Cleveland Racquet Club. She also enjoyshiking with Harry, her Golden Retriever, and spendingtime with her family in Chautauqua, NY. nYour Coverage Advisor 11

Attorney HighlightsOffice LocationsAkron388 South Main StreetSuite 500Akron, OH 44311-4407Phone: 330.535.5711Cleveland600 Superior Avenue EastKeven Drummond Eiber was one of the luncheon speakers at the AmericanBar Association 2015 Insurance Coverage Law Seminar in Tucson, Arizona,speaking on issues relating to litigating coverage questions in federal courts.Paul A. Rose also was a speaker on issues related to forum selection. Caroline L.Marks attended the three-day seminar, as well.Paul A. Rose addressed the Ohio Chapter of the Society of CorporateSecretaries & Governance Professionals in March, 2015, addressing litigationplanning and privilege issues.James T. Dixon has stepped up as one of Brouse McDowell’s two “Partnersin Justice,” along with David Sporar. Jim and David serve as the firm’sambassadors to the Legal Aid Society of Cleveland.Lorain County5321 Meadow Lane CourtAndrew P. Moses, a member of the Regional Leadership Council for the AmericanLung Association, helped create the Cleveland Asthma Games. In its second year,the Asthma Games is a free event which provides pulmonary function testingfor children, consultation with pulmonologist and nurses, education for parentsabout asthma and lung health, and provides a play day of various sports and funactivities with former Ohio State and NFL football players. The Games take placeon June 6, 2015 at Cleveland Central Catholic High School.Suite 7Lucas M. Blower welcomed their new baby girl, Lucy Marie, on February 20, 2015.Suite 1600Cleveland, OH 44114-2604Phone: 216.830.6830Sheffield Village, OH 44035-0601Phone: 440.934.8080Insurance RecoveryAttorneysLucas M. BlowerNicholas P. CapotostoChristopher J. CarneyElizabeth E. CollinsAlexandra V. DattiloClair E. DickinsonKeven Drummond EiberMatthew K. GrashoffKerri L. KellerLucy Marie Blower,born on February 20, 2015.Keven Drummond Eiber (L) andCaroline L. Marks (R) at the ABA 2015Insurance Coverage Law Seminar in Tucson.Amanda M. LefflerSallie Conley LuxCaroline L. MarksMeagan L. MooreAndrew P. MosesCharles D. PricePaul A. Rose12 Your Coverage AdvisorSave the date!Insurance Coverage ConferenceOctober 1, 2015 1:30 P.M. to 5:30 P.M.Location:Embassy Suites Independence5800 Rockside Woods Blvd.Independence, OH 44131

Whether liability insurance policies provide coverage for punitive . and no other policy of casualty or liability insurance that is Coverage for Punitive Damages (Continued from page 1) . Peachtree Cas. Ins. Co., 230 Ga.App. 4 (1997). Even those states that have