Transcription

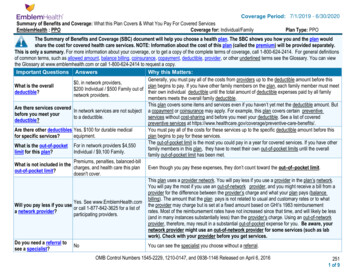

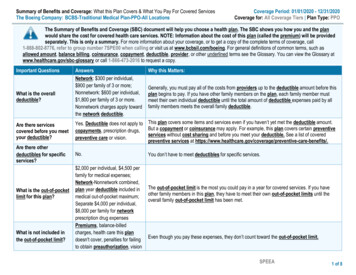

Summary of Benefits and Coverage: What this Plan Covers & What You Pay For Covered ServicesThe Boeing Company: BCBS-Traditional Medical Plan-PPO-All LocationsCoverage Period: 01/01/2020 - 12/31/2020Coverage for: All Coverage Tiers Plan Type: PPOThe Summary of Benefits and Coverage (SBC) document will help you choose a health plan. The SBC shows you how you and the planwould share the cost for covered health care services. NOTE: Information about the cost of this plan (called the premium) will be providedseparately. This is only a summary. For more information about your coverage, or to get a copy of the complete terms of coverage, call1-888-802-8776, refer to group number 7SPE00 when calling or visit us at www.bcbsil.com/boeing. For general definitions of common terms, such asallowed amount, balance billing, coinsurance, copayment, deductible, provider, or other underlined terms see the Glossary. You can view the Glossary atwww.healthcare.gov/sbc-glossary or call 1-866-473-2016 to request a copy.Important QuestionsWhat is the overalldeductible?Are there servicescovered before you meetyour deductible?Are there otherdeductibles for specificservices?What is the out-of-pocketlimit for this plan?What is not included inthe out-of-pocket limit?AnswersNetwork: 300 per individual, 900 per family of 3 or more;Nonnetwork: 600 per individual, 1,800 per family of 3 or more.Nonnetwork charges apply towardthe network deductible.Why this Matters:Generally, you must pay all of the costs from providers up to the deductible amount before thisplan begins to pay. If you have other family members on the plan, each family member mustmeet their own individual deductible until the total amount of deductible expenses paid by allfamily members meets the overall family deductible.Yes. Deductible does not apply to This plan covers some items and services even if you haven’t yet met the deductible amount.But a copayment or coinsurance may apply. For example, this plan covers certain preventivecopayments, prescription drugs,services without cost sharing and before you meet your deductible. See a list of coveredpreventive care or vision.preventive services at e-benefits/.No. 2,000 per individual, 4,500 perfamily for medical expenses;Network-Nonnetwork combined,plan year deductible included inmedical out-of-pocket maximum;Separate 4,000 per individual, 8,000 per family for networkprescription drug expensesPremiums, balance-billedcharges, health care this plandoesn't cover, penalties for failingto obtain preauthorization, visionYou don’t have to meet deductibles for specific services.The out-of-pocket limit is the most you could pay in a year for covered services. If you haveother family members in this plan, they have to meet their own out-of-pocket limits until theoverall family out-of-pocket limit has been met.Even though you pay these expenses, they don’t count toward the out-of-pocket limit.SPEEA1 of 8

Important QuestionsAnswersWhy this Matters:Will you pay less if youuse a network provider?Yes. Seewww.bcbsil.com/boeing or call1-888-802-8776 for a list ofnetwork providersDo you need a referral tosee a specialist?This plan uses a provider network. You will pay less if you use a provider in the plan’snetwork. You will pay the most if you use a nonnetwork provider, and you might receive a billfrom a provider for the difference between the provider’s charge and what your plan pays(balance billing). Be aware, your network provider might use a nonnetwork provider for someservices (such as lab work). Check with your provider before you get services.No.You can see the specialist you choose without a referral.All copayment and coinsurance costs shown in this chart are after your deductible has been met, if a deductible applies.CommonMedical EventIf you visit a healthcare provider’s officeor clinicIf you have a testServices You May NeedWhat You Will PayNetwork(You will pay the least)Nonnetwork(You will pay the most)Limitations, Exceptions, & OtherImportant InformationPrimary care visit to treat aninjury or illnessSpecialist visit10% after deductible40% after ––––––––––10% after deductible40% after deductiblePreventivecare/screening/immunizationNo charge, deductible doesnot applyNot –––––––––According to prescribed guidelines. Youmay have to pay for services that aren'tpreventive. Ask your provider if theservices needed are preventive. Thencheck what your plan will pay for.Diagnostic test (x-ray, bloodwork)Imaging (CT/PET scans, MRIs)10% after deductible40% after ––––––––––10% after deductible40% after ––––––––––2 of 8

CommonMedical EventServices You May NeedGeneric drugsIf you need drugs totreat your illness orconditionMore information aboutprescription drugcoverage is available atwww.expressscripts.com/boeing.Preferred brand drugsNon-preferred brand drugsSpecialty drugsWhat You Will PayNetwork(You will pay the least)Retail: 10%, deductibledoes not apply, memberpays minimum 5, maximum 25 per prescriptionMail Order: 10 copaymentper prescription, deductibledoes not applyRetail: 20%, deductibledoes not apply, memberpays minimum 15maximum 75 perprescriptionMail Order: 40 copaymentper prescription, deductibledoes not applyRetail: 30%, deductibledoes not apply, memberspays minimum 30 (nomaximum)Mail Order: 70 copaymentper prescription, deductibledoes not applySpecialty drug programsapply for certain high costitemsNonnetwork(You will pay the most)Limitations, Exceptions, & OtherImportant InformationRetail: 10%, deductibledoes not apply, memberpays minimum 5, maximum 25 per prescriptionMail Order: Not coveredRetail: 34 day supplyMail Order: 90 day supplyRetail: 20%, deductibledoes not apply, memberpays minimum 15maximum 75 perprescriptionMail Order: Not coveredRetail: 34 day supply, Member Pay theDifference rule applies if generic availableMail Order: 90 day supply, Member Paythe Difference rule applies if genericavailableRetail: 30%, deductibledoes not apply, memberspays minimum 30 (nomaximum)Mail Order: Not coveredRetail: 34 day supply, Member Pay theDifference rule applies if generic availableMail Order: 90 day supply, Member Paythe Difference rule applies if genericavailableSpecialty drug programsapply for certain high costitemsPreauthorization may apply or you mayneed to obtain specialty drugs from apharmacy designated by the servicerepresentative, failure to follow planprocedures may result in non-payment bythe plan3 of 8

CommonMedical EventIf you have outpatientsurgeryIf you need immediatemedical attentionIf you have a hospitalstayIf you need mentalhealth, behavioralhealth, or substanceabuse servicesServices You May NeedFacility fee (e.g., ambulatorysurgery center)Physician/surgeon feesWhat You Will PayNetwork(You will pay the least)Nonnetwork(You will pay the most)Limitations, Exceptions, & OtherImportant Information10% after deductible40% after ––––––––––10% after deductible40% after ––––––––––Emergency room care10% after ––––––––––Emergency medicaltransportation10% after deductible, nonemergent care 40% afterdeductible10% after deductible10% after ––––––––––Urgent care10% after deductible40% after ––––––––––Facility fee (e.g., hospital room) 10% after deductible40% after deductiblePhysician/surgeon fee10% after deductible40% after deductibleOutpatient services10% after deductible40% after deductibleInpatient services10% after deductible40% after deductiblePreadmission review or preapprovalrequired or penalty is 50% of first 2,000of eligible –––––––––Failure to obtain preapproval for certainintensive level outpatient services mayresult in non-payment by the planPreadmission review or preapprovalrequired or penalty is 50% of first 2,000of eligible charges4 of 8

CommonMedical EventIf you are pregnantServices You May NeedWhat You Will PayNetwork(You will pay the least)Nonnetwork(You will pay the most)Office visits10% after deductible40% after deductibleChildbirth/delivery professionalservices10% after deductible40% after deductibleChildbirth/delivery facilityservices10% after deductible40% after deductibleLimitations, Exceptions, & OtherImportant InformationCost sharing does not apply forpreventive services, maternity care mayinclude tests and services describedelsewhere in the SBC (i.e. ultrasound),depending on the type of services, acopayment, coinsurance, or deductiblemay apply.Cost sharing does not apply forpreventive services, maternity care mayinclude tests and services describedelsewhere in the SBC (i.e. ultrasound),depending on the type of services, acopayment, coinsurance, or deductiblemay apply.Cost sharing does not apply forpreventive services, maternity care mayinclude tests and services describedelsewhere in the SBC (i.e. ultrasound),depending on the type of services, acopayment, coinsurance, or deductiblemay apply.5 of 8

CommonMedical EventIf you need helprecovering or haveother special healthneedsIf your child needsdental or eye careServices You May NeedWhat You Will PayNetwork(You will pay the least)Nonnetwork(You will pay the most)Limitations, Exceptions, & OtherImportant Information120 visits limited per year, preadmissionreview or preapproval required or penaltyis 50% of first 2,000 of eligible charges,visit limit does not apply to mental healthand substance use disordersLimited to 3 months, may be extended ifapproved by plan, visit limit does notapply to mental health and substance usedisordersHabilitative services not meeting medicalnecessity/policy are excluded under theplanPreadmission review or preapprovalrequired or penalty is 50% of first 2,000of eligible chargesHome health care10% after deductible40% after deductibleRehabilitation services10% after deductible40% after deductibleHabilitation services10% after deductible40% after deductibleSkilled nursing care10% after deductible40% after deductibleDurable medical equipment10% after deductible40% after ––––––––––Subject to 6 month review, preadmissionreview or preapproval required or penaltyis 50% of first 2,000 of eligible chargesHospice services10% after deductible40% after deductibleChildren’s eye examCoverage offered throughseparate vision benefitCoverage offered throughseparate vision benefitChildren’s glassesCoverage offered throughseparate vision benefitCoverage offered throughseparate vision benefitChildren’s dental check-upCoverage offered throughseparate dental benefitCoverage offered throughseparate dental benefitNot covered under the medical plan,coverage offered through separate visionbenefitNot covered under the medical plan,coverage offered through separate visionbenefitNot covered under the medical plan,coverage offered through separate dentalbenefit6 of 8

Excluded Services & Other Covered Services:Services Your Plan Does NOT Cover (This isn’t a complete list. Check your policy or plan document for other excluded services.) Children’s dental check-up Dental care (Adult) Routine eye care (Adult) Children’s eye exam Routine foot care (limited coverage may apply) Children’s glassesInfertility treatment (limited coveragemay apply)Weight loss programsCosmetic surgery (unless reconstructive)Long-term care Private-duty nursing (limited coveragemay apply)Other Covered Services (Limitations may apply to these services. This isn’t a complete list. Please see your plan document.) Acupuncture Chiropractic care Bariatric surgery (limited coverage may apply) Hearing aids Non-emergency care when traveling outside the U.S.;www.bcbsil.com/boeing/resources/international travel.htmlYour Rights to Continue Coverage: There are agencies that can help if you want to continue your coverage after it ends. The contact information for thoseagencies is: 1-866-444-EBSA (3272) or www.dol.gov/ebsa/healthreform. Other coverage options may be available to you too, including buying individual insurancecoverage through the Health Insurance Marketplace. For more information about the Marketplace, visit www.HealthCare.gov or call 1-800-318-2596.Your Grievance and Appeals Rights: There are agencies that can help if you have a complaint against your plan for a denial of a claim. This complaint is called agrievance or appeal. For more information about your rights, look at the explanation of benefits you will receive for that medical claim. Your plan documents alsoprovide complete information to submit a claim, appeal, or a grievance for any reason to your plan. For more information about your rights, this notice, orassistance, contact: 1-888-802-8776. You can also contact the Employee Benefits Security Administration at 1-866-444-EBSA (3272) orwww.dol.gov/ebsa/healthreform.Does this Coverage Provide Minimum Essential Coverage? Yes.If you don’t have Minimum Essential Coverage for a month, you’ll have to make a payment when you file your tax return unless you qualify for an exemption fromthe requirement that you have health coverage for that month.Does this Coverage Meet the Minimum Value Standard? Yes.If your plan doesn’t meet the Minimum Value Standards, you may be eligible for a premium tax credit to help you pay for a plan through the Marketplace.Language Access Services:Spanish (Español): Para obtener asistencia en Español, llame al 1-866-473-2016.Tagalog (Tagalog): Kung kailangan ninyo ang tulong sa Tagalog tumawag sa 1-866-473-2016.Chinese (中文): �1-866-473-2016.Navajo (Dine): Dinek'ehgo shika at'ohwol ninisingo, kwiijigo holne' �––––––––––To see examples of how this plan might cover costs for a sample medical situation, see the next –––––––7 of 8

About these Coverage Examples:This is not a cost estimator. Treatments shown are just examples of how this plan might cover medical care. Your actual costs will bedifferent depending on the actual care you receive, the prices your providers charge, and many other factors. Focus on the cost sharingamounts (deductibles, copayments and coinsurance) and excluded services under the plan. Use this information to compare the portionof costs you might pay under different health plans. Please note these coverage examples are based on self-only coverage.Peg is Having a BabyManaging Joe’s type 2 Diabetes(9 months of network pre-natal careand a hospital delivery) The plan’s overall deductible Specialist coinsurance Hospital (facility) coinsurance Other coinsurance 30010%10%10%This EXAMPLE event includes services like:Specialist office visits (prenatal care)Childbirth/Delivery Professional ServicesChildbirth/Delivery Facility ServicesDiagnostic tests (ultrasounds and blood work)Specialist visit (anesthesia)Total Example CostIn this example, Peg would pay:Cost SharingDeductiblesCopaymentsCoinsuranceWhat isn’t coveredLimits or exclusionsThe total Peg would pay isMia’s Simple Fracture(a year of routine network care of awell-controlled condition) 12,800 300 0 1,200 60 1,560 The plan’s overall deductible Specialist coinsurance Hospital (facility) coinsurance Other coinsurance(network emergency room visit andfollow up care) 30010%10%10%This EXAMPLE event includes services like:Primary care physician office visits (including diseaseeducation)Diagnostic tests (blood work)Prescription drugsDurable medical equipment (glucose meter)Total Example CostIn this example, Joe would pay:Cost SharingDeductiblesCopaymentsCoinsuranceWhat isn’t coveredLimits or exclusionsThe total Joe would pay is 7,400 300 0 1,000 60 1,360 The plan’s overall deductible Specialist coinsurance Hospital (facility) coinsurance Other coinsurance 30010%10%10%This EXAMPLE event includes services like:Emergency room care (including medicalsupplies)Diagnostic test (x-ray)Durable medical equipment (crutches)Rehabilitation services (physical therapy)Total Example CostIn this example, Mia would pay:Cost SharingDeductiblesCopaymentsCoinsuranceWhat isn’t coveredLimits or exclusionsThe total Mia would pay is 1,900 300 0 200 0 500The plan would be responsible for the other costs of these EXAMPLE covered services.8 of 8

The Boeing CompanyGrievance Procedure under Section 1557 of the Affordable Care ActIt is the policy of The Boeing Company (“Boeing”), as the sponsor of the Boeing health care plans(“Plans”), not to discriminate on the basis of race, color, national origin, sex, age or disability in itsadministration of the Plans. Boeing has adopted an internal grievance procedure providing for promptand equitable resolution of complaints alleging any action prohibited by Section 1557 of the AffordableCare Act (42 U.S.C. § 18116) and its implementing regulations at 45 C.F.R. pt. 92, issued by the U.S.Department of Health and Human Services. Section 1557 prohibits discrimination on the basis of race,color, national origin, sex, age or disability in certain health programs and activities. Section 1557 andits implementing regulations may be examined by contacting Benefits Compliance and Governance,The Boeing Company, 100 N. Riverside, MC 5002-8421, Chicago, IL 60606-1596, telephone 1-312544-2297.The Director – Corporate Investigations, Ethics and Business Conduct, The Boeing Company, 6300James S. McDonnell Blvd, Mail Code 100-1495, Berkley, MO 63134, telephone 888-970-7171, hasbeen designated as the Section 1557 Coordinator to coordinate the efforts of Boeing and the Plans toensure compliance with Section 1557 by investigating any complaints that the Plans have failed tocomply with Section 1557. Any person who believes an eligible employee or eligible dependent underthe Plans has been subjected to discrimination on the basis of race, color, national origin, sex, age ordisability by the Plans may file a grievance under this procedure. It is against the law for Boeing or thePlans to retaliate against anyone who opposes discrimination, files a grievance, or participates in theinvestigation of a grievance.Procedure: Grievances must be submitted to the office of the Director – Corporate Investigations, Ethicsand Business Conduct, The Boeing Company, 6300 James S. McDonnell Blvd, Mail Code100-1495, Berkley, MO 63134, telephone 888-970-7171 within sixty (60) days of the date theperson filing the grievance becomes aware of the alleged discriminatory action. A complaint must be in writing, containing the name and address of the person filing it. Uponcontacting the Director – Corporate Investigations, Ethics and Business Conduct, a ComplaintIntake Form will be provided for the convenience of the person filing the grievance. Thecomplaint must state the problem or action alleged to be discriminatory and the remedy orrelief sought. The Section 1557 Coordinator (or her/his designee) shall conduct an investigation of thecomplaint. This investigation will be thorough, affording all interested persons an opportunityto submit evidence relevant to the complaint. The Section 1557 Coordinator will maintain thefiles and records of Boeing relating to such grievances. To the extent possible, and inaccordance with applicable law, the Section 1557 Coordinator will take appropriate steps topreserve the confidentiality of files and records relating to grievances and will share them onlywith those who have a need to know.

The Section 1557 Coordinator will issue a written decision on the grievance, based on apreponderance of the evidence, generally within thirty (30) days after its filing (unless theSection 1557 Coordinator informs the complainant of a reasonable extension), including anotice to the complainant of their right to pursue further administrative or legal remedies. The person filing the grievance may appeal the decision of the Section 1557 Coordinator bywriting to the Vice-President – Ethics and Business Conduct (“VP, EBC”), The BoeingCompany, 100 N. Riverside MC 5003-5459, Chicago, IL

SPEEA 1 of 8 Summary of Benefits and Coverage: What this Plan Covers & What You Pay For Covered Services Coverage Period: 01/01/2020 - 12/31/2020 The Boeing Company: BCBS-Traditional Medical Plan-PPO-All Locations Coverage for: All Coverage Tiers Plan Type: PPO The Summary of Benefits and Coverage (SBC) docu