Transcription

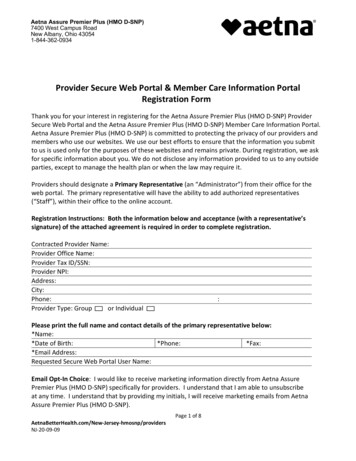

A Guide to the European VAT Directives 2021Why this book?Published annually, this two-volume set provides a comprehensive overview of the key elements of theEuropean Union’s VAT Directives. Written with ease of use in mind, it covers topics ranging from sources ofEU tax law and the effectiveness of EU (indirect tax) law to methods of interpretation, taxable persons andtaxable transactions. It serves as an invaluable textbook and reference tool for both advanced tax law orcommunity law students and tax professionals.Volume 1: Introduction to European VATThis volume offers a systematic survey of the implications of the EU legal principles on indirect tax matters andof the EU VAT rules in force, and a discussion of the case law of the Court of Justice of the European Unionin indirect tax matters, especially in VAT. It is divided into two parts: (i) General subjects; and (ii) EuropeanVAT.Part I deals with six subjects: sources of EU tax law; legal principles; legal acts; judicial remedies andjudicial protection; effectiveness of EU (indirect tax) law; and methods of interpretation. In Part II, after ageneral introduction on VAT as fiscal phenomenon, the European VAT is discussed as provided for in theVAT Directive (i.e. Directive 2006/112/EC replacing the First and Sixth VAT Directives) and ImplementingRegulation (EU) No. 282/2011 (recast) as amended. VAT issues are illustrated by excerpts of decisions of theCourt of Justice of the European Union.Volume 2: Integrated Texts of the VAT Directives (including the Implementing Regulations) and of the formerSixth VAT DirectiveThis volume contains: an integrated text of the VAT Directive (Council Directive 2006/112/EC on the commonsystem of VAT, as amended) including the implementing Regulation as amended and references to theguidelines of the VAT Committee; the integrated texts of the refund VAT Directives 2008/9/EC (as amended,including a Commission Implementing Regulation) and the Thirteenth (Refund) Directive (86/560/EEC);the three Directives granting exemption on importation: Directive 2006/79/EC, Directive 2007/74/EC andDirective 2009/132/EC; and an integrated text of the Sixth VAT Directive as applicable until 1 January 2007.Title:Author(s):Date of publication:ISBN:A Guide to the European VAT Directives 2021Ben Terra, Julie KajusApril 2021978-90-8722-680-0 (print/online vol. 1),978-90-8722-681-7 (print/online vol. 2),978-90-8722-682-4 (ePub vols. 1 & 2),978-90-8722-683-1 (PDF vols. 1 & 2)Type of publication:BookNumber of pages:Vol. 1 1,746, Vol. 2 764Terms:Shipping fees apply. Shipping information is available on our websitePrice (print/online):EUR 435 / USD 520 (VAT excl.)Price (eBook: ePub or PDF): EUR 300 / USD 360 (VAT excl.)Price (subscription):EUR 300 / USD 360 (VAT excl.)Order informationTo order the book, please visit www.ibfd.org/IBFD-Products/shop. You can purchase a copy of thebook by means of your credit card, or on the basis of an invoice. Our books encompass a widevariety of topics, and are available in one or more of the following formats: IBFD Print books IBFD eBooks – downloadable on a variety of electronic devices IBFD Online books – accessible online through the IBFD Tax Research PlatformIBFD, Your Portal to Cross-Border Tax Expertise

A Guide to the EuropeanVAT DirectivesVolume 1Introduction to European VAT2021Ben Terra – Julie Kajus

Published by IBFDISBN 978-90-8722-680-0 (print)ISBN 978-90-8722-682-4 (eBook, ePub); 978-90-8722-683-1 (eBook, PDF)ISSN 2589-9244 (print); 2590-1052 (electronic)NUR 826 Julie Kajus 2021Disclaimer of liabilityThis publication is sold with the understanding that the authors, publisher and anyother person involved in the preparation of this work are not responsible for theresults of any actions taken on the basis of information in this work, nor for anyerrors or omissions contained therein.This publication is protected by international copyright law. All rights reserved. Nopart of this publication may be reproduced, stored in a retrieval system, ortransmitted in any form or by any means, electronic, mechanical, photocopying,recording or otherwise, without the prior permission of the authors.

PrefaceIt has been said that VAT “arouses as much interest as a new execution techniquedoes to somebody waiting in death row”. On the other hand, it has been suggestedthat VAT may be thought of as the Mata Hari of the tax world, “many are tempted,many succumb, some tremble at the brink, while others leave only to return,eventually, the attraction appears irresistible”. Between the ends of this spectrumVAT is a day-to-day reality within the European Union.As of 1 July 2013, 28 Member States (from 31 January 2020, 27 Member States)levy VAT based upon a “uniform basis of assessment”. In these Member States thenational VAT laws are based on EU legislation, predominantly Directive2006/112/EC on the common system of value added tax, the recast of the First andSixth VAT Directives, as amended.A directive is binding upon each Member State to which it is addressed as to theresult to be achieved, but allows the national authorities to choose the form andmethods of reaching such end. As a result of this freedom of choice national VATlaws are not identical. However, in the final analysis EU legislation is decisive;individual taxpayers can derive rights from it.In 1990, we wrote A Guide to the European VAT Directives, a two-volumecommentary on the European VAT directives. In 1992 these bound volumes werereplaced by a loose-leaf version, eventually of six binders of several thousands ofpages. In 2004 the loose-leaf version was replaced by an even more extendeddigital version (updated regularly).The digital version of the “European VAT Directives”, part of the IBFD digital TaxResearch Platform, is accompanied by two bound volumes (replaced yearly):Volume 1: Introduction to European VAT; andVolume 2: Integrated text of Council Directive 2006/112/EC on the common systemof VAT (“the VAT Directive”) as amended including implementing Regulation (EU)No. 282/2011, as amended; Integrated text of the refund VAT Directive 2008/9/EC,as amended (including a Commission implementing Regulation); the Thirteenth(refund) Directive (86/560/EEC); the three Directives granting exemption onimportation: Directive 2006/79/EC on the exemption from taxes of imports of smallconsignments of goods of a non-commercial character, Directive 2007/74/EC onthe exemption from VAT and excise duty of goods imported by persons travellingfrom third countries and Directive 2009/132/EC regarding exemption from VAT onthe final importation of certain goods; and the Integrated text of the Sixth VATDirective as applicable until 1 January 2007.Volume 1 “Introduction to European VAT” is meant to serve as a textbook foradvanced students of tax law and/or EU law and as a reference book for (indirect)tax law or EU law practitioners. It offers a systematic survey of the implications ofv

Prefacethe legal principles on indirect tax matters and VAT rules of the European Union inforce and a discussion of the case law of the Court of Justice of the European Unionin indirect tax matters, particularly in VAT.Volume 1 is divided into two parts:I)II)General subjects;European VAT.Part I “General subjects” deals with six subjects:1)2)3)4)5)6)Sources of EU tax law;Legal principles;Legal Acts;Judicial remedies;Effectiveness of EU (indirect tax) law; andMethods of interpretation.In Part II, after a general introduction on VAT as fiscal phenomenon, the EuropeanVAT is discussed as provided for in the Sixth VAT Directive as replaced by CouncilDirective 2006/112/EC on the common system of VAT (the Recast VAT Directive,referred to as “the VAT Directive”). VAT issues are illustrated by excerpts ofdecisions of the Court of Justice.In the interest of brevity, we have at various places omitted citations, references tothe European Court Reports and footnotes from quoted materials withoutspecifically mentioning the omission.We have included the changes by the VAT package and updated all chapters andreferences with the changes by the Lisbon Treaty.For an (unofficial) integrated text of Directive 2006/112/EC on the common systemof VAT and the Directives amending it, including Regulation (EU) No. 282/2011, therecast implementing Regulation, as amended, we refer to Volume 2. Early July2012, the Commission made available a list, which is regularly updated, ofguidelines agreed by the VAT Committee. In footnotes the guidelines arementioned relating to the provision in question. We have added to Volume 2 an(unofficial) integrated text of the Sixth VAT Directive as applicable until 1 January2007.Although more than 800 cases are covered in this book, the choice to omit others isentirely ours. We welcome comments from readers.Ben Terra/Julie Kajus – Hoorn/Hornbæk, 30 June 2019/1 January 2021vi

Table of ContentsPrefacevTable of ContentsList of AbbreviationsviixxvPart I General Subjects1Chapter 131.11.21.31.41.51.61.71.81.9IntroductionPrimary lawThe Lisbon Treaty1.3.1Institutional frameworkInternational agreementsInternational customary lawGeneral principlesIndirect taxation and primary EU law; the acquisSecondary lawFundamental freedomsChapter 22.12.22.32.42.5Legal PrinciplesIntroductionFundamental legal principles2.2.1The principles of conferral, subsidiarity and ofproportionality2.2.2The principle of sincere cooperation2.2.3The principle of non-discrimination on grounds ofnationalityFundamental rights2.3.1Charter of Fundamental Rights of the European UnionGeneral principles2.4.1The principles of equivalence and effectiveness2.4.2Abuse of law2.4.3The principle of prohibition of abuse of law in VATFiscal neutralityChapter 33.1Sources of EU Tax LawLegal 555860818989vii

Table of Contents3.23.33.43.53.63.7Regulations3.2.1Customs Regulations3.2.2VAT implementing Regulation3.2.3Administrative cooperation Regulation3.2.4Statistics RegulationsDirectivesDecisions3.4.1Own resources DecisionObligation to motivate legal actsRecommendations and opinionsExplanatory notesChapter 44.14.24.34.44.5viiiJudicial Remedies and Judicial ProtectionIntroduction4.1.1The EFTA CourtDirect appealsViolation of EU law by a Member State4.3.1Infringement proceedings against a Member State4.3.1.1 No infringement procedures have been initiated4.3.1.2 Discontinuation of an infringement procedure4.3.1.3 The principle of reciprocity4.3.1.4 Political motives4.3.1.5 Enforcement of an infringement procedure by anindividual4.3.1.6 The principle of sincere cooperation4.3.1.7 Breach of EU law by the highest court of a Member State4.3.2Non-compliance with judgments4.3.2.1 Penalty payments4.3.3Infringement proceedings between Member StatesDirect access by individuals4.4.1Review of the legality of acts4.4.2Failure to act4.4.3Compensation for damages4.4.4Disputes between the European Union and its servantsPreliminary questions4.5.1Court or tribunal against whose decisions there is ajudicial remedy4.5.2Court or tribunal against whose decisions there is nojudicial remedy4.5.3Rephrasing questions4.5.4Relevance of 129130131131

Table of 2Chapter 55.15.25.35.45.55.65.75.86.26.3Effectiveness of EU (Indirect Tax) LawIntroductionDirect effect of directivesReverse direct effectHorizontal effectReconciliatory interpretation5.5.1The supremacy of Union law and VATNational time limitsLiability for damagesObstacles put forward against liability for damages5.8.1Limitation of the temporal effect of judgments5.8.2Respect for res judicata5.8.2.1 The ECtHR as guardian of the case law of the Court ofJustice5.8.3Unjust enrichment5.8.3.1 Passing on taxes5.8.4Interest on sums collected in breach of EU lawChapter 66.1Changing the subject matter of the question by the partiesApplication of EU law not referred toThe requirement of national courts to raise of their ownmotion an issue concerning the breach of provisions ofEU lawFailure to ask a preliminary questionExclusion of all State liabilityApplication for a revision of a judgment of the Court ofJustice by an individualQualifications for the court of referenceHypothetical questionsMethods of InterpretationIntroduction6.1.1What is evident?Acte éclairéActe clair6.3.1Equally obvious to the courts of the other Member States6.3.2Twenty-four authentic languages6.3.3EU terminology6.3.4Contextual interpretation method6.3.4.1 Consistent 3224226232235237ix

Table of Contents6.3.56.3.66.3.7The teleological interpretation methodThe state of evolution of EU lawHistorical interpretation methodPart II VATChapter 77.17.27.37.47.5x238240241245Introduction to VAT as Fiscal PhenomenonGeneral7.1.1Legal character7.1.2Tax on consumptionGeneral indirect tax on consumption7.2.1General ernal neutrality7.3.1.1 Legal neutrality7.3.1.2 Competition neutrality7.3.1.3 Economic neutrality7.3.2External neutralitySystems of levying turnover taxes7.4.1Single-stage levies7.4.1.1 Manufacturer’s tax7.4.1.2 Wholesale tax7.4.1.3 Retail sales tax7.4.2Multiple-stage levies7.4.2.1 Cumulative cascade systems7.4.2.2 Non-cumulative systems7.4.2.3 Synopsis7.4.3Examples7.4.3.1 Single-stage (cumulative) taxes7.4.3.2 Multiple stage leviesSystems of levying a VAT7.5.1Extent of vertical coverage7.5.2Treatment of capital equipment7.5.2.1 Consumption type7.5.2.2 Income type7.5.2.3 Product type7.5.3Methods of calculation7.5.3.1 The direct subtraction and the addition methods7.5.3.2 The tax credit 74275275276

Table of Contents7.67.5.3.3 Example of the tax credit method7.5.4SummaryThe VAT as fiscal phenomenon7.6.1Advantages7.6.1.1 Fiscal advantages7.6.1.2 Psychological advantages7.6.1.3 Economic advantages7.6.2Disadvantages7.6.2.1 Is VAT a regressive tax?7.6.3Some idiosyncrasies of VAT7.6.3.1 Scope of the VAT7.6.3.2 VAT is not a cost price factor7.6.3.3 The recouping effect7.6.3.4 Exemptions7.6.3.5 Exemption at the retail level7.6.3.6 Consequences of the deduction mechanismChapter 88.18.28.38.48.5Introduction8.1.1Dates of introduction and expiry datesThe Recast: the VAT Directive8.2.1Amendments to the VAT DirectiveSubject matterScope8.4.1Illegal transactions8.4.1.1 Carousel fraud/denial of transactions8.4.1.2 Knowledge test8.4.2Transactions without consideration8.4.3Payments without transactions8.4.4Transactions for consideration8.4.4.1 From a direct to an indirect link8.4.5Legal relationship8.4.6Acting as such8.4.7Tax amnestyTerritorial scope8.5.1Extra-territorial activitiesChapter 99.1Subject Matter and ScopeTaxable PersonsIntroduction9.1.1Any person in any place9.1.2Whatever the purpose or 60361365366369369369372xi

Table of Contents9.29.39.49.59.6Economic activities9.2.1.Exploitation of tangible or intangible property9.2.2Occasional activitiesPreparatory actsActing independently9.4.1VAT grouping9.4.1.1 The territorial scope of VAT groupingPublic bodies9.5.1Activities engaged in as public authorities9.5.2Assimilation to activities engaged in as public authorities9.5.3Road tolls9.5.4Parking charges9.5.5Granting of licences for third generation mobiletelecommunications systems“Special” taxable persons9.6.1Societas Europaea9.6.2EEIG9.6.3General legal aspects of the Societas Europaea9.6.4Indirect tax aspects of the Societas Europaea9.6.5Societas Cooperativa Europaea9.6.6The certified taxable 5447449451455455Chapter 10 Taxable 482xiiIntroductionSupplies of goods10.2.1Member States must treat as supplies of goods10.2.1.1 Tangible property10.2.1.2 Transfers by order made in the name of a public authority10.2.1.3 Hire/purchase and finance lease10.2.1.4 Commission10.2.1.5 Private use10.2.1.6 Transfers to another Member State10.2.1.7 Call-off stock10.2.1.8 Definitions of and facilitating, through the use of anelectronic interface, supplies to non-taxable persons;distance sales10.2.2Member States may treat as supplies of goods10.2.2.1 Certain interests in immovable property and rights in rem10.2.2.2 Supplies under a contract to make up work10.2.2.3 Works of construction484486486487489

Table of Contents10.310.410.510.610.2.2.4 Internal supplies10.2.2.5 Transfer of a going concern/the “no-supply rule”Intra-Community transactions10.3.1Goods excluded from intra-Community acquisitions10.3.2Exceptions: Intra-Community transactions not subjectto VAT10.3.3Second-hand goods10.3.4Intra-Community supply of services10.3.5New means of transport10.3.6Intra-Community acquisitions of goodsSupplies of services10.4.1Qualification as services10.4.1.1 Composite supplies10.4.2Private use10.4.3Private use and allocation of assets10.4.4Business purpose test10.4.5Undisclosed agent10.4.5.1 Undisclosed agent and electronic services10.4.6Transfer of a going concern/the “no supply rule”of 9514518520523532537547551553554556557Chapter 11 Place of Taxable 3IntroductionSupply of goods11.2.1Supply of goods without transport11.2.2Supply of goods with transport11.2.2.1 Sales by connected contract11.2.2.2 Distance sales11.2.2.3 Installation and assembly11.2.2.4 Chain transactions and the proof of transport11.2.2.5 Importation by a non-taxable legal person followed bya transfer11.2.3Supply of goods on board ships, aircraft or trains11.2.4Supply of goods through distribution systemsThe place of intra-Community n measures for triangulation11.3.2.1 Case law on intra-Community triangulation573574576579582585588xiii

Table of Contents11.411.5Supply of services11.4.1Particular provisions11.4.1.1 Services supplied by an intermediary to non-taxablepersons11.4.1.2 Supply of services connected with immovable property11.4.1.3 Supply of transport11.4.1.4 Supply of cultural, artistic, sporting, scientific, educational,entertainment and similar services and/or services relatedto the admission, ancillary transport activities andvaluations of and work on movable property11.4.1.5 Supply of restaurant and catering services11.4.1.6 Hiring of means of transport11.4.1.7 Supply of restaurant services on board ships, aircraftand trains11.4.1.8 Supply of TBE services to non-taxable persons11.4.1.9 Supply of services to non-taxable persons outside theCommunity11.4.2Main rule for supplies to taxable persons11.4.3The concept of an establishment11.4.3.1 Case law of the Court of Justice on the subject ofestablishments11.4.4Dual capacity11.4.5Main rule for supplies to non-taxable persons11.4.6Use and enjoyment overrideImportation of 670671674Chapter 12 Chargeable Event and Chargeability of lies of goods and services12.2.1The main rule12.2.2Supplies which give rise to successive statements ofaccount or payments12.2.3Payments on account12.2.4Chargeability on a later date than that of the chargeableevent12.2.5Facilitating the supply pursuant to Article 14a12.2.6Intra-Community supplies of goodsIntra-Community acquisitionsImportation686689699701701703703

Table of ContentsChapter 13 Taxable pplies of goods or services13.2.1Barter transactions13.2.2Promotion schemes13.2.2.1 The voucher Directive13.2.3Subsidies13.2.3.1 State aid13.2.3.2 Third party payment13.2.4Service charges13.2.5Credit cards13.2.5.1 Factoring13.2.6Gaming machines and bingo13.2.7Binding in honour only13.2.8Investment gold13.2.9Subjective or objective valuation of supplies13.2.9.1 Open market value13.2.10 Disbursements13.2.11 Full cost of self-supplied services13.2.11.1 Internal supplies13.2.12 Advance payment in the event of cancellation and tie-incontracts13.2.13 VAT in- or exclusive13.2.14 Second-hand goods13.2.15 Rounding of VAT amounts13.2.16 Crowdfunding13.2.17 VAT implications of transfer pricing13.2.18 VAT treatment of sharing economyIntra-Community acquisitionsImportation of goodsMiscellaneous provisions13.5.1Cancellation, refusal or total or partial non-payment13.5.2Exchange rates13.5.3Returnable packing r 14 Rate differentiationsApplication, structure and level of ratesZero ratesxv

Table of Contents14.4Temporary and special provisions14.4.1The Proposal as regards rates of VATChapter 15 xemptions without the right to deduction90615.2.1Exemptions for certain activities in the public interest90815.2.1.1 Postal services90815.2.1.2 Hospital and medical care91215.2.1.3 Medical care91915.2.1.4 Human organs, blood and milk92715.2.1.5 Dental technicians92815.2.1.6 Cost sharing exemption of independent groups of persons 93015.2.1.7 Welfare and social security work94015.2.1.8 Protection of children94815.2.1.9 Education94815.2.1.10 Private tuition95215.2.1.11 Supplies of staff by religious or philosophical institutions 95415.2.1.12 Trade unions95415.2.1.13 Sport or physical education95515.2.1.14 Cultural services96015.2.1.15 Fund-raising96315.2.1.16 Transport services for sick or injured persons96315.2.1.17 Public radio and television96315.2.1.18 Limitations with regard to the exemptions964Exemptions for other activities97115.3.1Insurance and reinsurance transactions97215.3.2Financial transactions98515.3.2.1 Granting of credit98915.3.2.2 Credit guarantees99515.3.2.3 Transactions concerning negotiable instruments, butexcluding debt collection99615.3.2.4 Transactions concerning currency100515.3.2.5 Transactions in shares100715.3.2.6 Management of special investment funds101915.3.3Postage stamps103215.3.4Betting, lotteries103315.3.5Immovable property103915.3.6Goods used wholly for an exempt activity104015.3.7Facilitating distance sales by non-established persons1042

Table of Contents15.415.515.615.715.815.915.10Exemptions relating to intra-Community transactions15.4.1Case law regarding exempt intra-Communitytransactions15.4.2The amendment of Article 138(1); new substantiveconditions15.4.3Case law on intra-Community chain transactions15.4.4Amendments regarding the proof of transportExemptions on importation15.5.1Small consignments and a special import schemeExemptions on exportationExemptions related to international transportExemptions relating to certain transactions treated as exportsExemptions for the supply of services by intermediariesExemptions for transactions relating to international trade15.10.1 Customs warehouses, warehouses other than customswarehouses and similar arrangements15.10.2 Transactions exempted with a view to 111111111119Chapter 16 Immovable slative history of the supply of buildings andbuilding land16.1.2Definition of immovable propertyHanding-over of a work of constructionLetting and leasing16.3.1Case law on exempt letting and leasing16.3.1.1 Lease below a minimum required amount16.3.1.2 Lease of garages to residents16.3.1.3 Surrender of a lease to the landlord16.3.1.4 Assignment of a lease to a third party16.3.1.5 Inducement payments to future tenants16.3.1.6 “Normal rent” between associated parties16.3.1.7 Letting of tents, caravans and mobile homes16.3.1.8 Letting of short-term accommodation16.3.1.9 Exemption of letting by way of exception16.3.1.10 Damages for incorrect exemption of leasing16.3.1.11 Usufructuary rights treated as a lease16.3.1.12 Leasing of prefabricated houses16.3.1.13 Installation of vending machines16.3.1.14 Leasing of part of a farm16.3.1.15 Letting of water-based mooring 113611361137113711391141114211441144xvii

Table of Contents17.7The maze of VAT on shares and dividends17.7.1Acquisition and the sale of securities and placements insecurities (EDM)17.7.2Issuing shares in connection with an IPO (Kretztechnik)17.7.3General costs and direct link (Investrand)17.7.4No attribution to downstream activities/the pre-pro rata(Securenta, Związek Gmin Zagłębia Miedziowego)17.7.5Pure holding company re-invoicing subsidiairies(Portugal Telecom)17.7.6Costs incurred on sale of shares/link with totality ofbusiness activities (SKF)17.7.7Expenditure connected with capital transactions byholding company (Larentia)17.7.8Holding company supplying services to its subsidiariesfree of charge (MVM)17.7.9The letting of a building by a holding company to itssubsidiary constitutes involvement in the managementof that subsidiary (Marle Participations)17.7.10 The right to deduct input VAT by a holding companyrelating to consultancy services even if ultimately theplanned economic activity was not carried out (Ryanair,Sonaecom)17.7.11 The law as it standsChapter 18 Obligations of Taxable Persons and Certain ligation to pay18.2.1Persons liable for payment of VAT to the tax authorities18.2.1.1 Reverse charge mechanism18.2.1.2 Cross-border transactions18.2.1.3 Entering VAT on an invoice18.2.1.4 Fiscal representation18.2.1.5 Joint and several liability18.2.1.6 Optional reverse payment18.2.1.7 Split payment model18.2.1.8 The generalized reverse charge mechanism18.2.2Payment arrangementsIdentificationInvoicing18.4.1Concept of 4481449145014581459

Table of Contents18.518.618.718.818.918.4.2Member State where the rules are applicable18.4.2.1 The invoicing rules of a single Member State18.4.3Issue of invoices18.4.4Simplified invoices18.4.5Time when an invoice must be issued18.4.6Summary invoices18.4.7Self-billing18.4.8Outsourcing to third parties outside the European Union18.4.9Invoice details18.4.10 Content of a full VAT invoice18.4.11 Content of a simplified VAT invoice18.4.12 Paper invoices and electronic invoices18.4.13 Storage of invoicesAccounting18.5.1Facilitating, through the use of an electronic interface,supplies to a non-taxable person18.5.2Keeping a register18.5.3Payment service providers from 1 January 2024Returns18.6.1Standard VAT returnRecapitulative statementsMiscellaneous provisions18.8.1Other obligations to prevent evasionObligations in respect of certain importations and 1512Chapter 19 Special nSmall and medium-sized enterprises19.2.1Small and medium-sized enterprises from1 January 2025FarmersTravel agents19.4.1Transactions of travel agents19.4.2Treated as a single service19.4.3The margin19.4.4Outside the European Union, deductions andderogationsSecond-hand goods, works of art, collectors’ items and antiques19.5.1Margin scheme152415251532153315391542155015521559xxi

Table of Contents19.619.7Investment gold19.6.1General provisions regarding investment gold andexemption from VAT19.6.2Taxation option for investment gold19.6.3Transactions on a regulated gold bullion market19.6.4Special rights and obligations for traders in investmentgoldNon-established taxable persons supplying telecom, broadcastingor electronic services to non-taxable persons19.7.1Non-Union scheme19.7.2Union scheme19.7.3The special import scheme19.7.3.1 Special arrangements for declaration and payment ofimport VAT and exchange ter 20 ogations applying until the adoption of definitive arrangements20.2.1Derogations for States which were members of theCommunity on 1 January 197820.2.2Derogations for specific States which acceded after1 January 197820.2.3Derogations applicable to all Member StatesDerogations subject to authorization20.3.1Special measures applied at 1.1.197720.3.2Special measures to simplify or prevent evasion oravoidance20.3.3Agreements with third countries or international bodies20.3.4Rationalisation Directive20.3.5The quick reaction and the optional reverse chargemechanism20.3.5.1 The Directive regarding the period of application of theoptional reverse charge hapter 21 1.321.421.5xxiiIntroductionImplementing measures21.2.1The implementing RegulationVAT Committee and proposed Comitology CommitteeConversion ratesTaxes not to be characterized as turnover taxes

Table of ContentsChapter 22 Final 22.3IntroductionTransitional arrangements and transitional measures22.2.1The Green Paper22.2.2Action plan for a definitive VAT system22.2.3Follow-up to the action plan for a definitive VAT system22.2.4Action plan for fair and simple taxationTransposition and entry into forceTable of Cases1669Index1695xxiii

A Guide to the EuropeanVAT DirectivesVolume 2Integrated Text ofthe VAT Directives2021Ben Terra – Julie Kajus

Published by IBFDISBN 978-90-8722-681-7 (print)ISBN 978-90-8722-682-4 (eBook, ePub); 978-90-8722-683-1 (eBook, PDF)ISSN 2589-9244 (print); 2950-1052 (electronic)NUR 826 Julie Kajus 2021Disclaimer of liabilityThis publication is sold with the understanding that the authors, publisher and anyother person involved in the preparation of this work are not responsible for theresults of any actions taken on the basis of information in this work, nor for anyerrors or omissions contained therein.This publication is

In 1990, we wrote A Guide to the European VAT Directives, a two-volume commentary on the European VAT directives. In 1992 these bound volumes were replaced by a loose-leaf version, eventually of six binders of several thousands of pages. In 2004 the loose-leaf version was replaced by an even more extended digital version (updated regularly).