Transcription

The right coverage makes all the differenceThis information is a solicitation for insurance.ILMSDG21

How Does Medicare Work?There are four parts to Medicare, each providing different types of health careservices. Medicare Supplement Insurance is often added on top of Parts A, B,and D to form more complete medical coverage.PARTHospital InsurancePARTMedicareAdvantage PlansAHelps pay for inpatient hospitalcare, skilled nursing facility care,home health care and hospicecare. While most Americans areenrolled automatically in Medicare Part A, itmay not cover all of your health care costs.Parts B, C and D are voluntary programs thatprovide additional coverage.COffers medical coverage through a networkof providers, such as an HMO or PPO,that is an alternative to Original Medicare(Parts A & B). These plans may or may notcover prescription drugs.Medical InsurancePARTBHelps pay for covereddoctor’s services and manyother medical servicesand supplies. If you don’tenroll in Part B when you are first eligiblefor Medicare, you may have to pay apenalty later.PrescriptionDrug CoveragePARTDHelps pay for covered prescriptionmedications. As with Part B, if you do notenroll when first eligible, you may have topay a penalty later.Medicare Supplement InsuranceOptional coverage helps to pay for expenses beyond what is covered by Medicare. There areseveral Medicare Supplement insurance plans, each with different benefits and premiums, soyou can choose the plan that works best for your specific needs. Medicare Supplement insuranceplans are identified by the separate letters A through N. The basic benefits of each plan areexactly alike for all insurance companies.If you are already a member of a Medicare Advantage plan, you cannot purchase a MedicareSupplement Insurance plan.Learn more about your Medicare Supplement Insurance optionsat www.getblueil.com/medsupp

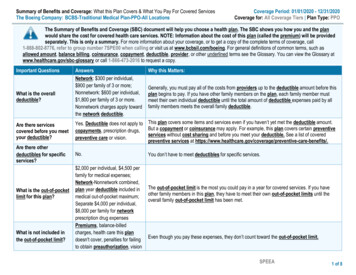

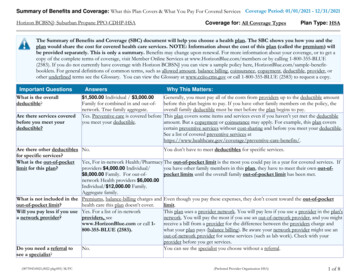

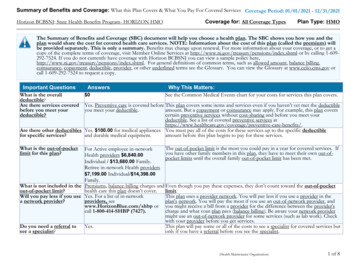

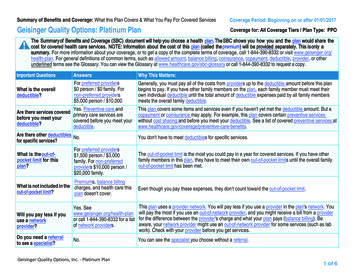

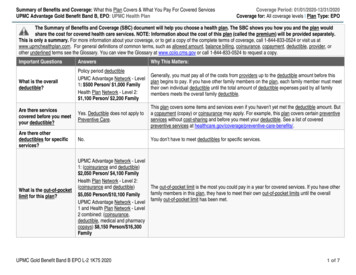

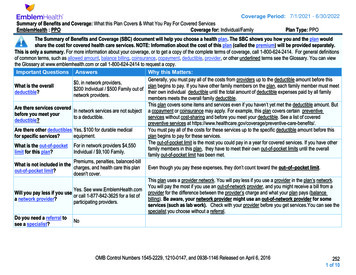

What Are My Plan Options and Coverage?Medicare Supplement Insurance Plans offered by Blue Cross and Blue Shield of Illinois are outlined in thetable below. Each plan offers a different set of benefits.Plans F and High Deductible F are also available but only if you were eligible for Medicare beforeJanuary 1, 2020.BasicComprehensiveBenefitPlan OptionOptionPlan APlan GInnovativePlan OptionsPlan G PlusBudget-Conscious Plan OptionsHighHighDeductible Deductible Plan K 7 Plan L 7 Plan NPlan G Plus 6Plan G 6ReducedPremiumMedicareSelect OptionAvailable 1,2(eligibility basedon ZIP code)Basic Benefits100% /50%100% /75%Skilled NursingCoinsurance50%75%Part ADeductible50%75% 6,220 3,110Part B Excess 3ForeignTravelEmergencyCare 4Annual Out-ofPocket Limit 5SilverSneakers 24/7 NurselineDental Benefits 9HearingBenefits 9Vision Benefits 9copayapplies 8

What Does a Medicare Supplement Insurance Plan Cover?Medicare Supplement Insurance Plans cover the costs that Original Medicare does not on deductibles,coinsurance and copayments. With your Medicare Supplement Insurance Plan, you can choose anydoctor or specialist who accepts Medicare. At the time of your doctor’s visit, there is no cost upfront.Just show your ID and your claim will be sent to Medicare and then sent electronically to us.Innovative Plan Options include coverage of dental benefits of cleanings, exams and X-ray, hearingbenefits of 0 annual exam with hearing aid discounts, free SilverSneakers Fitness Program and accessto 24/7 Nurseline. Medicare Supplement Insurance Plans do not cover prescription drugs, but they canbe paired with a prescription drug plan.DeductiblesCoinsuranceThe amount you must payfor health care beforeOriginal Medicare begins to pay.An amount you may be required to pay as your shareof the cost for services after you pay any deductibles.Coinsurance is usually a percentage (for example, 20%).CopaymentsAn amount you may be required to pay as your share of the cost for a medical service or supply,like a doctor’s visit, hospital or outpatient visit. A copayment is usually a set amount, rather thana percentage. Network restrictions apply. Only certain hospitals are network providers under this policy. Check with your physician todetermine if he or she has admitting privileges at the network hospital. If he or she does not, you may be required topay for all expenses.2 You must live within 30 miles of a participating Medicare Select hospital to be eligible.3 Not to exceed any charge limitation established by the Medicare program or state law.4 Plans cover medically necessary emergency care services needed immediately because of an injury or illness of suddenand unexpected onset, beginning during the first 60 days of each trip outside the USA. There is a deductible of 250and a lifetime maximum benefit of 50,000.5 The out-of-pocket annual limit may increase each year for inflation (2021 limits shown).6 High deductible plans pay the same benefits as Plans F and G after one has paid a calendar-year 2,370 deductible.Benefits from High Deductible Plans F and G will not begin until out-of-pocket expenses are 2,370. Out-of-pocketexpenses for this deductible are expenses that would ordinarily be paid by the policy. This includes the Medicaredeductibles for Part A and Part B, but does not include the separate foreign travel emergency deductible.7 Plans K and L provide for different cost-sharing for items and services than the other plans we offer. Once you reach theannual limit, the plan pays 100% of the Medicare copayments, coinsurance and deductibles for the rest of the calendaryear. The out-of-pocket annual limit does NOT include charges from your provider that exceed Medicare approvedamounts, called “excess charges.” You will be responsible for paying excess charges.8 Plan N requires a copayment of up to 20 for office visits and a copayment of up to 50 for ER.9 For a detailed explanation of dental, hearing and vision benefits for Plan G Plus options, refer to the Outline ofCoverage.10 Source: Continuous Tracking Program 2019; SPH Analytics, BCBSIL1

Why Choose Blue Cross and Blue Shield of Illinois?Blue Cross and Blue Shield of Illinois is a name you can trust, and has been serving the people ofIllinois for more than 80 years. Our Medicare Supplement insurance plans offer in-depth coverage tohelp protect your health while also offering our high-level customer service and additional benefits.Here Are 10 Great Reasons to Choose Blue Cross and Blue Shieldof Illinois (BCBSIL):1. A choice of 10 BCBSIL MedicareSupplement insurance plans to helpyou cover Medicare gaps.2. Virtually hassle-free claims processing.3. A name recognized by doctors andspecialists everywhere.4. Reliable coverage from a respectedindustry leader.5. Helpful individual service from MedicareSupplement insurance agents.6. 100 percent of our subscribers say theyare satisfied.107. Medicare Select is a money-savingoption for members who live within30 miles of a contracting hospital.It has all the same benefits as a standardoption, but it costs less as long as amember uses Medicare Select hospitalsfor non-emergency admissions.8. Over 80 years of experience, know-how,and service to Illinois residents.9. Medicare Supplement also has ValueAdded Benefits that include an annualhearing exam, hearing aid discounts, andaccess to the 24/7 Nurseline.10. Easy, online application is available.Household DiscountYou may be eligible for a household discount if at least two members reside in thesame household and are enrolled in Blue Cross and Blue Shield of Illinois MedicareSupplement Insurance Plans effective on or after May 1, 2019.The best time to buy a Medicare Supplement insurance policy is around the time you turn 65. You have guaranteedacceptance on the first day of the month in which you turn 65 and are enrolled in Medicare Part B. If you are underage 65, have Medicare Part A and are enrolled in Medicare Part B, your acceptance is guaranteed within six months ofyour Part B effective date or another qualifying event. In any scenario, you must have Medicare Part B to be eligible fora Medicare Supplement insurance policy.

Make the Right Choice for Your Peace of Mind.CallToll Free: 1-877-566-1277 TTY 7118:00 a.m. – 8:00 p.m., local time, Monday through Friday.Webwww.getblueil.com/medsuppSeminars: An Insurance Sales PresentationFind a free seminar near you: www.bcbsil.com/medicare/seminarsBlue Cross , Blue Shield and the Cross and Shield Symbols are registered service marks of the Blue Cross andBlue Shield Association, an association of independent Blue Cross and Blue Shield Plans.SilverSneakers is a wellness program owned and operated by Tivity Health, Inc., an independent company.Tivity Health and SilverSneakers are registered trademarks or trademarks of Tivity Health, Inc., and/or its subsidiariesand/or affiliates in the USA and/or other countries.Not connected with or endorsed by the U.S. Government or Federal Medicare Program.Medicare Supplement Insurance Plan Notice:Medicare Supplement insurance plans are offered by Blue Cross and Blue Shield of Illinois, a Division of Health CareService Corporation, a Mutual Legal Reserve Company, an Independent Licensee of the Blue Cross and Blue ShieldAssociation.32101.0121

2021Retirement BenefitsSSA.gov

What's insideSocial Security and your retirement plan1Your retirement benefits1Family benefits6What you need to know when you’reeligible for retirement benefits9A word about Medicare14When should I apply for Medicare?14Contacting Social Security17

Social Security and your retirement planSocial Security is part of the retirement plan of almostevery American worker. It’s important to know how thesystem works and how much you’ll receive from SocialSecurity when you retire. This booklet explains: How you qualify for Social Security benefits.How your earnings and age can affect your benefits.What you should consider in deciding when to retire.Why you shouldn’t rely only on Social Security for allyour retirement income.This basic information on Social Security retirementbenefits isn’t intended to answer all questions. For specificinformation about your situation, talk with a Social Securityrepresentative. Please visit us online at www.ssa.gov, orcall our toll-free number.Your retirement benefitsHow do you qualify for retirement benefits?When you work and pay Social Security taxes, you earn“credits” toward Social Security benefits. The number ofcredits you need to get retirement benefits depends onwhen you were born. If you were born in 1929 or later,you need 40 credits (10 years of work).If you stop working before you have enough credits toqualify for benefits, the credits will remain on your SocialSecurity record. If you return to work later, you can addmore credits to qualify. We can’t pay any retirementbenefits until you have the required number of credits.1

How much will your retirement benefit be?We base your benefit payment on how much you earnedduring your working career. Higher lifetime earnings resultin higher benefits. If there were some years you didn’twork or had low earnings, your benefit amount may belower than if you had worked steadily.The age at which you decide to retire also affects yourbenefit. If you retire at age 62, the earliest possible SocialSecurity retirement age, your benefit will be lower than ifyou wait. The “Early retirement” section explains this inmore detail.Get personalized retirement benefit estimatesAs you make plans for your retirement, you may ask,“How much will I get from Social Security?” If you havea personal my Social Security account, you can get anestimate of your personal retirement benefits and seethe effects of different retirement age scenarios. If youdon’t have a my Social Security account, create one atwww.ssa.gov/myaccount or you can use our onlineRetirement Estimator at www.ssa.gov/estimator.You can create a personal my Social Security account ifyou have a Social Security number, a valid U.S. mailingaddress, and an email address. You’ll need to providesome personal information to confirm your identity. You’llbe asked to choose a username and password, and thenyou’ll be asked for your email address. You’ll also needto select how you would like to receive an activationcode — to a text-enabled cell phone, to the email addressyou registered, or mailed to the physical address youprovided — that you will need to enter to finish creatingyour account. Each time you sign in with your usernameand password, we’ll send a one-time security code to yourcell phone or to your email address. The security code2

is part of our enhanced security feature to protect yourpersonal information. Keep in mind that your cell phoneprovider's text message and data rates may apply.Full retirement ageIf you were born in 1954 or earlier, you’re already eligiblefor your full Social Security benefit. The full retirementage is 66 if you were born from 1943 to 1954. The fullretirement age increases gradually if you were born from1955 to 1960 until it reaches 67. For anyone born 1960 orlater, full retirement benefits are payable at age 67. Thefollowing chart lists the full retirement age by year of birth.Age to receive full Social Security benefitsYear of birthFull retirement age1943-195466195566 and 2 months195666 and 4 months195766 and 6 months195866 and 8 months195966 and 10 months1960 and later67NOTE: People born on January 1 of any year, refer to theprevious year.Early retirementYou can get Social Security retirement benefits as earlyas age 62. However, we’ll reduce your benefit if you retirebefore your full retirement age. For example, if you turnage 62 in 2021, your benefit would be about 29.2 percentlower than it would be at your full retirement age of 66and 10 months.3

Some people will stop working before age 62. But if theydo, the years with no earnings will probably mean a lowerSocial Security benefit when they retire.Sometimes health problems force people to retireearly. If you can’t work because of health problems,consider applying for Social Security disabilitybenefits. The disability benefit amount is the same asa full, unreduced retirement benefit. If you’re gettingSocial Security disability benefits when you reach fullretirement age, we convert those benefits to retirementbenefits. For more information, read Disability Benefits(Publication No. 05-10029).Delayed retirementYou can choose to keep working beyond your fullretirement age. If you do, you can increase your futureSocial Security benefits in two ways.Each extra year you work adds another year of earningsto your Social Security record. Higher lifetime earningscan mean higher benefits when you retire.Also, your benefit will increase a certain percentagefrom the time you reach full retirement age, until youstart receiving benefits, or until you reach age 70. Thepercentage varies depending on your year of birth. Forexample, if you were born in 1943 or later, we’ll add8 percent to your benefit for each full year you delayreceiving Social Security benefits beyond your fullretirement age.NOTE: You should sign up for Medicare threemonths before your 65th birthday, even if you haven’tstarted receiving retirement benefits yet. In somecircumstances, medical insurance costs more if youdelay applying for it. You can find more information in the“A word about Medicare” section.4

Deciding when to retireChoosing when to start receiving retirement benefits isan important and personal decision. No matter the ageyou retire, contact Social Security in advance to learnyour choices and make the best decision. Sometimes,your choice of the month to begin receiving benefits couldmean higher benefit payments for you and your family.Social Security replaces a percentage of a worker’spre-retirement income based on their lifetime earnings.The amount of your average wages that Social Securityretirement benefits replaces varies depending on yourearnings and when you choose to start benefits. If youstart benefits at age 67, this percentage ranges fromas much as 75 percent for very low earners, to about40 percent for medium earners, and about 27 percentfor high earners. If you start benefits earlier than age67, these percentages would be lower, and after age67 they’d be higher. Most financial advisers say you willneed about 70 percent of pre-retirement income to livecomfortably in retirement, including your Social Securitybenefits, investments, and other personal savings.For more information on other factors to consider asyou think about when to start receiving Social Securityretirement benefits, read Your Retirement Checklist(Publication No. 05-10377).Apply for benefits about four months before you want yourbenefits to start. If you’re not ready to begin receivingretirement benefits, but are thinking about doing so soon,visit our website at www.ssa.gov/benefits/retirementto learn more.Retirement benefits for widows and widowersWidows and widowers can begin getting Social Securitybenefits at age 60, or at age 50, if disabled. Widows andwidowers can take reduced benefits on one record, andthen switch to full benefits on another record later. For5

example, a woman can take a reduced widow’s benefit at60 or 62, and switch to her own full retirement benefit atfull retirement age. Please contact Social Security to talkabout your choices because the rules may be different foryour specific situation.Advance DesignationAdvance Designation is part of the StrengtheningProtections for Social Security Beneficiaries Act of 2018,which was signed into law on April 13, 2018.Advance Designation allows capable adult andemancipated minor applicants and beneficiaries ofSocial Security, Supplemental Security Income (SSI),and Special Veterans Benefits to choose one ormore individuals who could potentially serve as theirrepresentative payee in the future, if the need arises.By selecting a representative payee in advance, you’llhave peace of mind knowing that someone you trust maybe appointed to manage your benefits if needed.You can submit an Advance Designation request whenfiling a claim for benefits online using your personalmy Social Security account, by telephone, or in-person.Family benefitsBenefits for family membersIf you’re getting Social Security retirement benefits,some members of your family may also be eligible forbenefits, including: Spouses age 62 or older. Spouses younger than 62, if they are taking care of achild entitled on your record who is younger than age16 or disabled.6

Former spouses, if they are age 62 or older(see our section “Benefits for a divorced spouse” formore information). Children up to age 18, or up to 19 if full-time studentsand have not graduated from high school. Disabled children, even if they are age 18 or older, ifthey were disabled before age 22.If you become the parent of a child (including an adoptedchild) after you begin getting benefits, let us knowabout the child. Then we’ll decide if the child is eligiblefor benefits.Spouse’s benefitsSpouses who never worked or have low earnings can getup to half of a retired worker’s full benefit. If you’re eligiblefor both your own retirement benefits and spouse’sbenefits, we always pay your own benefits first. If yourbenefits as a spouse are higher than your own retirementbenefit, you’ll get a combination of benefits equaling thehigher spouse’s benefit.For example, Mary Ann qualifies for a retirement benefitof 1,250 and a spouse’s benefit of 1,400. At her fullretirement age, she will get her own 1,250 retirementbenefit. We also will add 150 from her spouse’s benefit,for a total of 1,400. If she takes her retirement benefitbefore her full retirement age, we’ll reduce both amounts.If you were born before January 2, 1954, are at leastfull retirement age and qualify for your own retirementbenefits and also spouse’s (or divorced spouse’s)benefits, you can choose to restrict your application, applyfor one of the benefits, and delay applying for the otheruntil a later date.If you were born on or after January 2, 1954, andqualify for both retirement and spouse’s (or divorcedspouse’s) benefits, you must apply for both benefits. This7

is called “deemed filing.” If you file for one benefit, you are“deemed” to file for the other one, too, even if you don’tbecome eligible for it until later.If you’re receiving a pension based on work for whichyou didn’t pay Social Security taxes, we may reduceyour spouse’s benefit. More information see the section“Pensions from work not covered by Social Security”.If spouses get Social Security retirement benefits beforethey reach full retirement age, we reduce the benefit.The amount we reduce the benefit depends on when theperson reaches full retirement age.For example, if full retirement age is 67, a spouse can get32.5 percent of the worker’s unreduced benefit at age 62.The benefit increases the longer you wait to receivebenefits, up to the maximum of 50 percent at fullretirement age.Your spouse can get full benefits, regardless of age, iftaking care of a child entitled on your record. The childmust be under age 16, or disabled, if they becamedisabled before age 22.NOTE: Your current spouse can’t get spouse’s benefitsuntil you file for retirement benefits.Children’s benefitsYour dependent child may get benefits on your earningsrecord when you start your Social Security retirementbenefits. Your child may get up to half of your full benefit.To get benefits, your child must be unmarried and one ofthe following: Younger than age 18. 18-19 years old and a full-time student(no higher than grade 12). 18 or older and disabled before age 22.8

Under certain circumstances, we can also pay benefits toa stepchild, grandchild, step-grandchild, or adopted child.NOTE: Disabled children whose parents have limitedincome or resources may be eligible for SSI benefits.For more information, visit our website or call ourtoll-free number.Maximum family benefitsIf you have children eligible for Social Security, each willget up to half of your full benefit. But there’s a limit to howmuch money we can pay to you and your family. Thislimit varies between 150 and 180 percent of your ownbenefit payment. If the total benefits due to your spouseand children are more than this limit, we’ll reduce theirbenefits. Your benefit won’t be affected.Benefits for a divorced spouseYour divorced spouse can get benefits on your SocialSecurity record if the marriage lasted at least 10 years.Your divorced spouse must be 62 or older and unmarried.The benefits they get don’t affect the amount you or yourcurrent spouse can get.Also, your former spouse can get benefits even if youhaven’t started to receive retirement benefits. You bothmust be at least 62 and divorced at least two years.What you need to know when you’re eligiblefor retirement benefitsHow do you sign up for Social Security?You can apply for retirement benefits online atwww.ssa.gov, or call our toll-free number. Or you canmake an appointment with a local Social Security office toapply in person.9

Depending on your circumstances, you’ll need some orall the documents listed below. Don’t delay in applying forbenefits if you don’t have all the information. If you don’thave a document you need, we can help you get it.Information and documents you’ll need, include: Your Social Security number. Your birth certificate. Your W-2 forms or self-employment tax returnfor last year. Your military discharge papers if you hadmilitary service. Your spouse’s birth certificate and Social Securitynumber if they’re applying for benefits. Your children’s birth certificates and Social Securitynumbers, if you’re applying for children’s benefits. Proof of U.S. citizenship or lawful alien status if you (ora spouse or child applying for benefits) were not bornin the United States. The name of your financial institution, the routingnumber, and your account number for direct deposit.If you don’t have an account at a financial institution,or prefer getting your benefits on a prepaid debitcard, you can get a Direct Express card. For moreinformation, visit www.GoDirect.org.You must submit original documents or copies certified bythe issuing office. We must see the original document(s)or copies certified by the agency that issued them.We cannot accept expired, notarized, or photocopieddocuments. You can mail or bring them to Social Security.We’ll make photocopies and return your documents.10

Right to appealIf you disagree with a decision made on your claim,you can appeal it. You can handle your own appealwith free help from Social Security, or you can chooseto have a representative help you. We can give youinformation about organizations that can help you find arepresentative. For more information about the appealsprocess and selecting a representative, read YourRight to Question the Decision Made on Your Claim(Publication No. 05-10058).If you work and get benefits at the same timeYou can continue to work and still get retirement benefits.Your earnings in (or after) the month you reach yourfull retirement age won’t reduce your Social Securitybenefits. We’ll reduce your benefits, however, if yourearnings exceed certain limits for the months beforeyou reach full retirement age. (See the chart in the“Full retirement age” section).Here is how it works:If you’re younger than full retirement age, we’ll deduct 1in benefits for each 2 you earn above the annual limit.In the year you reach your full retirement age, we’ll reduceyour benefits 1 for every 3 you earn over an annuallimit. This reduction continues until the month you reachfull retirement age. Once you reach full retirement age,you can keep working, and we won’t reduce your SocialSecurity benefit no matter how much you earn.If, during the year, your earnings are higher or lower thanyou estimated, let us know as soon as possible, so wecan adjust your benefits.11

A special monthly ruleA special rule applies to your earnings for one year,usually your first year receiving retirement benefits. Underthis rule, you can get a full Social Security payment forany month you earn under a certain limit, regardless ofyour yearly earnings.If you want more information on how earnings affect yourretirement benefit, read How Work Affects Your Benefits(Publication No. 05-10069). This pamphlet has a list of thecurrent annual and monthly earnings limits.Your benefits may be taxableAbout 40 percent of people who get Social Security haveto pay income taxes on their benefits. For example: If you file a federal tax return as an “individual,”and your combined income is between 25,000and 34,000, you may have to pay taxes on up to50 percent of your Social Security benefits. If yourcombined income is more than 34,000, up to 85percent of your Social Security benefits is subject toincome tax. If you file a joint return, you may have to pay taxeson 50 percent of your benefits if you and yourspouse have a combined income between 32,000and 44,000. If your combined income is more than 44,000, up to 85 percent of your Social Securitybenefits is subject to income tax. If you’re married and file a separate return, you’llprobably pay taxes on your benefits.At the end of each year, we’ll mail you a Social SecurityBenefit Statement (Form SSA-1099) showing the amountof benefits you received. Use this statement when youcomplete your federal income tax return to find out if youmust pay taxes on your benefits.12

Although you’re not required to have Social Securitywithhold federal taxes, you may find it easier than payingquarterly estimated tax payments.For more information, read Tax Guide for Seniors (IRSPublication No. 554) and Social Security and EquivalentRailroad Retirement Benefits (IRS Publication No. 915) atwww.irs.gov/publications, or call the Internal RevenueService’s toll-free telephone number, 1-800-829-3676.NOTE: On the 1040 tax return, your “combined income”is the sum of your adjusted gross income plus nontaxableinterest plus half of your Social Security benefits.Pensions from work not covered bySocial SecurityIf you get a pension from work for which you paid SocialSecurity taxes, that pension won’t affect your SocialSecurity benefits. However, if you get a retirement ordisability pension from work not covered by SocialSecurity — for example, the federal civil service,some state or local government employment, or workin a foreign country — we may reduce your SocialSecurity benefit.Government workers who are eligible for Social Securitybenefits on the earnings record of a spouse, can readGovernment Pension Offset (Publication No. 05-10007)for more information. People who worked in anothercountry, or government workers who are also eligiblefor their own Social Security benefits, can read WindfallElimination Provision (Publication No. 05-10045).Leaving the United StatesIf you’re a U.S. citizen, you can travel to, or live in, mostforeign countries without affecting your Social Securitybenefits. There are, however, a few countries where wecan’t send Social Security payments. These countries13

are Azerbaijan, Belarus, Cuba, Kazakhstan, Kyrgyzstan,Moldova, North Korea, Tajikistan, Turkmenistan, andUzbekistan. We can make exceptions, however, forcertain eligible beneficiaries in countries other than Cubaand North Korea. For more information about theseexceptions, contact your local Social Security office.If you work outside the United States, different rules applyin deciding if you can get benefits.For more information, read Your Payments While You AreOutside The United States (Publication No. 05-10137).A word about MedicareMedicare is a health insurance plan for people whoare age 65 or older. However, you can get Medicare atany age if: You’ve been entitled to Social Security disabilitybenefits for 24 months. You have End-Stage Renal Disease (permanentkidney failure requiring dialysis or a kidney transplant),or amyotrophic lateral sclerosis (Lou Gehrig’s disease).When should I apply for Medicare?If you’re not already getting benefits, you should contactSocial Security abou

hearing exam, hearing aid discounts, and access to the 24/7 Nurseline. 10. Easy, online application is available. The best time to buy a Medicare Supplement insurance policy is around the time you turn 65. You have guaranteed acceptance on the first day of the month in which you turn 65 and are enrolled in Medicare Part B. If you are under