Transcription

FINALGROUP - IVPAPER - 16ADVANCEDFINANCIALACCOUNTING& REPORTINGThe Institute of Cost and Works Accountants of India12, SUDDER STREET, KOLKATA - 700 016

First Edition : January 2008Revised Edition : March 2009Second Revised Edition : June 2010Published by:Directorate of StudiesThe Institute of Cost and Works Accountants of India12, SUDDER STREET, KOLKATA - 700 016Printed at :India Limited,50/2, TTC MIDC Industrial Area, Mahape, Navi Mumbai - 400 710, IndiaCopyright of these Study Notes is reserved by the Institute of Cost and Works Accountantsof India and prior permission from the Institute is necessary for reproduction of the wholeor any part thereof.

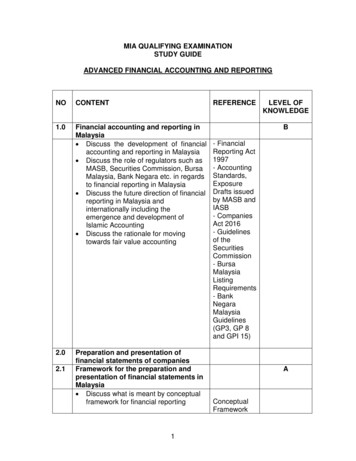

CONTENTSPage No.Study Note - 1Introduction to IAS, USGAAP, Indian Accounting Standard .1.1Framework of Accounting .1.1.1 Introduction .1.1.2 Meaning of Accounting .1.1.3 Objectives and Functions of Accounting .1.1.4 Fundamental Accounting Assumptions .1.1.5 Limitations of Accounting .1.1.6 Financial Statements .1.1.7 Qualitative Characteristics of Financial Statements .1.2Accounting Standards - Applicability, Interpretation, Scope and Compliance .1.31.41.51.6122233445US GAAPS .1.3.1 Established Accounting Principles in the US .1.3.2 Other Accounting Literature .1.3.3 AICPA .1.3.4 FASB .1.3.5 Components of US GAAP.International Accounting Standards .1.4.1 Introduction .1.4.2 Extract of the International Accounting Standards .7101011111111131313International Financial Reporting Standards .A Comparison IGAAP - US GAAP - IFRS .2939Study Note - 2Preparation of Company Accounts under Various Circumstances .492.1Merger and Acquisitions .502.1.1 Introduction .502.1.2 What is Merger? .502.1.3 Varieties of Mergers .512.1.4 Acquisitions.512.1.5 Types of Acquisitions .522.1.6 Distinction Between Mergers and Acquisitions .52Accounting for Mergers and Acquisitions.542.2.1 Methods of Accounting .55Pooling of Interest Method .55Purchase Method.562.2.2 How to Value an Acquisition .602.2

Page No.2.32.2.3 Sources of Gains from Acquisitions .602.2.4 Valuation Procedures .61External Reconstruction.62Illustrations.IComputation and Discharge of Purchase Consideration .IIBasics of Amalgamation and Absorption .IIIPurchasing Company holding shares in Selling Company .IVSelling Company holding shares in Purchasing Company .VCross Holding .666673118142146VIVIIVIIIIXXXIXIIXIIIChain Holding .Internal Reconstruction .Reverse Merger .External Reconstruction .Surrender of Shares .Demerger .Sales of Division .Impact of Reconstruction over Wealth of Investor and Company .155158171176179182205208XIVBuy back of Shares .211XVConversion .217Study Note - 3Group Financial Statements .2253.1Holding Company.2263.2Methods of Combination .2263.3Accounting Treatment .2273.4Preparation of Group Cash Flow Statement .2993.5Statement of Cash Flows .3003.6Illustrations on Cash Flow Statement.304Study Note - 4Segmental Reporting .3594.1Introduction.3604.2Need for Segmental Reporting .3604.3Arguments against Segmental Reporting .3614.4International Scenario .362

Page No.4.5The Indian Scenario.3704.5.1 Definitions .3704.5.2 Disclosure Requirements .3734.5.3 Accounting and Auditing Issues .3734.6Segmental Reporting Problems & Difficulties .3754.7Specific Issues Relating to Management Accountants .3774.8Segmental Disclosure – A Practical Example .3814.9Illustrations on Segmental Reporting .385Study Note - 5Development in External Reporting .3895.1Indian Accounting Standards .3905.1.1 Companies (Accounting Standards) Rules, 2006.3905.1.2 Applicability of Accounting Standard to Non-corporate Entities .3925.2Accounting Standards .3955.3Financial Reporting across the world .4735.4Post Balance Sheet Events .4775.5External Reporting under Capital Market Regulations .4795.6Value Added Statement .4945.7Economic Value Added Statement .5075.8Human Resource Accounting.5125.9Environmental Accounting .5125.10Guidance Notes on Accounting for Tax Matters .5165.11Guidance Notes on Derivatives.5335.12Guidance Notes for Special Businesses / Reports .556Study Note - 6Government Accounting in India .5716.16.26.36.4Government Accounting in India .General Principles of Government Accounting .Methods of Government Accounting .Comparison with Commercial Accounting.5725725735736.5Comptroller and Auditor General of India .5746.6Audit of Government Companies (Commercial Audit) .5746.7Audit Board Setup in Commercial Audit .574

Page No.Section - 11 Comptroller and Auditor General to Prepare and Submit Accounts to thePresident, Governors of State and Administrators of Union Territories havingLegislative Assemblies.5766.8Public Accounts Committee.5766.9Role of Public Accounts Committee .5816.10Committee on Public Undertakings .5826.11Specimen Report .583

STUDY NOTE - 1Introduction toIAS, USGAAP,IndianAccountingStandardThis Study Note includes: Framework of Accounting Indian Accounting Standard US GAAP International Accounting Standards International Financial Reporting Standards Comparative Analysis of the Indian AccountingStandard, IFRS and USGAAP

Framework of Accounting1.1Framework of Accounting1.1.1 IntroductionMost of the world’s work is done through organizations - g roups of people who work together toaccomplish one or more objectives. In doing its work, an organization uses resources - l abor, materials,various services, buildings, and equipment. These resources need to be financed, or paid for. To workeffectively, the people in an organization need information about the amounts of these resources, themean of financing them and the results achieved through using them. Parties outside the organizationneed similar information to make judgments about the organization. Accounting is a system that providessuch information.Organizations can be classified broadly as either for-profit or nonprofit. As these names suggest, adominant purpose of organizations in the former category is to earn a profit, whereas organizations inthe latter category have other objectives, such as governing, providing social services, and providingeducation. Accounting is basically similar in both types of organizations.1.1.2 Meaning of AccountingThe Committee on Terminology set up by the American Institute of Certified Public Accountantsformulated the following definition of accounting in 1961:“Accounting is the art of recording, classifying, and summarizing in a significant manner and in terms ofmoney, transactions and events which are, in part at least, of a financial character, and interpreting theresult thereof.As per this definition, accounting is simply an art of record keeping. The process of accounting startsby first identifying the events and transactions which are of financial character and then be recordedin the books of account. This recording is done in Journal or subsidiary books, also known as primarybooks. Every good record keeping system includes suitable classification of transactions and events aswell as their summarization for ready reference. After the transaction and events are recorded, they aretransferred to secondary books. i.e. Ledger. In ledger transactions and events are classified in terms ofincome, expense, assets and liabilities according to their characteristics and summarized in profit & lossaccount and balance sheet. Essentially the transactions and events are to be measured in terms of money.Measurement in terms of money means measuring at the ruling currency of a country, for example, rupeein India, dollar in the U.S.A. and like. The transactions and events must have at least in par, financialcharacteristics. The inauguration of a new branch of a bank is an event without having financial character,while the business disposed of by the branch is an event having financial character. Accounting alsointerprets the recorded, classified and summarized transactions and events.1.1.3 Objectives and Functions of AccountingThe main objectives are Systematic recording of transactions, Ascertainment of results of recordedtransactions and the financial position of the business, providing information to the users for rationaldecision-making and to know the solvency position. The functions of accounting are Measurement,Forecasting, Decision-making, Comparison & Evaluation, Control, Government Regulation and Taxation.2

Advanced Financial Accounting & ReportingAccounting conceptsAccounting concepts define the assumptions on the basis of which financial statements of a businessentity are prepared. Certain concepts are perceived, assumed and accepted in accounting to providea unifying structure and internal logic to accounting process. The word concept means idea or notion,which has universal application. Financial transactions are interpreted in the light of the concepts, whichgovern accounting methods. Concepts are those basic assumptions and conditions, which form the basisupon which the accountancy has been laid. Unlike physical science, accounting concepts are only resultof broad consensus. These accounting concepts lay the foundation on the basis of which the accountingprinciples are formulated.Accounting principles“Accounting principles are a body of doctrines commonly associated with the theory and procedures ofaccounting serving as an explanation of current practices and as a guide for selection of conventions orprocedures where alternatives exists.”Accounting principles must satisfy the following conditions:1.They should be based on real assumptions;2.They must be simple, understandable and explanatory;3.They must be followed consistently;4.They should be able to reflect future predictions;5.They should be informational for the users.Accounting conventionsAccounting conventions emerge of accounting practices, commonly known as accounting, principles,adopted by various organizations above a period of time. These conventions are derived by usage andpractice. The accountancy bodies of the world may change any of the convention to improve the qualityof accounting information. Accounting conventions need not have universal application.1.1.4 Fundamental Accounting AssumptionsThe Financial Statements are prepared with the following three Fundamental Accounting Assumptions.Unless otherwise specified the readers of the Financial Statements assume that the Financial Statementsare prepared in line with these assumptions. They are Going Concern, Consistency & Accrual. AccountingStandard 1 describes them as followsGoing Concern: The enterprise is normally viewed as a going concern, that is, as continuing in operationfor the foreseeable future. It is assumed that the enterprise has neither the intention nor the necessity ofliquidation or of curtailing materially the scale of the operations.Consistency It is assumed that accounting policies are consistent from one period to another.Accrual Revenues and costs are accrued, that is, recognised as they are earned or incurred (and not asmoney is received or paid) and recorded in the financial statements of the periods to which they relate.(The considerations affecting the process of matching costs with revenues under the accrual assumptionare not dealt with in this Statement.)3

Framework of Accounting1.1.5 Limitations of AccountingThe Financials Statements are prepared on the basis of the above-mentioned assumptions, conventionsand the Accounting Principles which the accountant chooses to adopt. These bring in lot of subjectivityto the Financial Statements and hence these basis assumptions conventions and principles become thelimitation of accounting.The Financial Statements as the name states, accounts only for the items that can be measured by Money.There are lots of items that money cannot measure but still are the most valuable assets for the enterprise,like Human Resources, which the Financial Statements does not depict.The language of accounting has certain practical limitations and, therefore, the financial statements shouldbe interpreted carefully keeping in mind all various factors influencing the true picture.1.1.6 Financial StatementsFinancial statements form part of the process of financial reporting. A complete set of financial statementsnormally includes a balance sheet, a statement of profit and loss (also known as ‘income statement’), acash flow statement and those notes and other statements and explanatory material that are an integralpart of the financial statements. They may also include supplementary schedules and information basedon or derived from, and expected to be read with, such statements. Such schedules and supplementaryinformation may deal, for example, with financial information about business and geographical segments,and disclosures about the effects of changing prices. Financial statements do not, however, include suchitems as reports by directors, statements by the chairman, discussion and analysis by management andsimilar items that may be included in a financial or annual report.Users and Their Information NeedsThe users of financial statements include present and potential investors, employees, lenders,suppliers and other trade creditors, customers, governments and their agencies and the public. Theyuse financial statements in order to satisfy some of their information needs. These needs include thefollowing:(a)Investors. The providers of risk capital are concerned with the risk inherent in, and return provided by,their investments. They need information to help them determine whether they should buy, hold orsell. They are also interested in information which enables them to assess the ability of the enterpriseto pay dividends.(b)Employees. Employees and their representative groups are interested in information about the stabilityand profitability of their employers. They are also interested in information which enables themto assess the ability of the enterprise to provide remuneration, retirement benefits and employmentopportunities.(c)Lenders. Lenders are interested in information which enables them to determine whether their loans,and the interest attaching to them, will be paid when due.(d) Suppliers and other trade creditors. Suppliers and other creditors are interested in information whichenables them to determine whether amounts owing to them will be paid when due. Trade creditorsare likely to be interested in an enterprise over a shorter period than lenders unless they are dependentupon the continuance of the enterprise as a major customer.4

Advanced Financial Accounting & Reporting(e)Customers. Customers have an interest in information about the continuance of an enterprise, especiallywhen they have a long-term involvement with, or are dependent on, the enterprise.(f)Governments and their agencies. Governments and their agencies are interested in the allocation of resourcesand, therefore, the activities of enterprises. They also require information in order to regulate theactivities of enterprises and determine taxation policies, and to serve as the basis for determinationof national income and similar statistics.(g)Public. Enterprises affect members of the public in a variety of ways. For example, enterprises maymake a substantial contribution to the local economy in many ways including the number of peoplethey employ and their patronage of local suppliers. Financial statements may assist the public byproviding information about the trends and recent developments in the prosperity of the enterpriseand the range of its activities.The Objective of Financial StatementsThe objective of financial statements is to provide information about the financial position, performanceand cash flows of an enterprise that is useful to a wide range of users in making economic decisions.Financial statements prepared for this purpose meet the common needs of most users. However, financialstatements do not provide all the information that users may need to make economic decisions since(a) they largely portray the financial effects of past events, and(b) do not necessarily provide non-financial information.1.1.7 Qualitative Characteristics of Financial StatementsQualitative characteristics are the attributes that make the information provided in financial statementsuseful to users. The qualitative characteristics are Understandability Relevance Reliability Comparability. Faithful Representation Substance Over Form Neutrality Prudence CompletenessAmong these characteristics most important are Prudence and Substance over form.PrudenceThe preparers of financial statements have to contend with the uncertainties that inevitably surround manyevents and circumstances, such as the collectability of receivables, the probable useful life of plant andmachinery, and the warranty claims that may occur. Such uncertainties are recognised by the disclosure5

Framework of Accountingof their nature and extent and by the exercise of prudence in the preparation of the financial statements.Prudence is the inclusion of a degree of caution in the exercise of the judgements needed in making theestimates required under conditions of uncertainty, such that assets or income are not overstated and liabilitiesor expenses are not understated. However, the exercise of prudence does not allow, for example, the creationof hidden reserves or excessive provisions, the deliberate understatement of assets or income, or thedeliberate overstatement of liabilities or expenses, because the financial statements would then not beneutral and, therefore, not have the quality of reliability.Substance Over FormIf information is to represent faithfully the transactions and other events that it purports to represent,it is necessary that they are accounted for and presented in accordance with their substance andeconomic reality and not merely their legal form. The substance of transactions or other events is notalways consistent with that which is apparent from their legal or contrived form. For example, whererights and beneficial interest in an immovable property are transferred but the documentation andlegal formalities are pending, the recording of acquisition/disposal (by the transferee and transferorrespectively) would in substance represent the transaction entered into.Accounting StandardsAccounting standards codify acceptable accounting practices. They are the primary source of theGenerally Accepted Accounting Principles (GAAP) and, therefore, they are at the top in the hierarchyof GAAP. Other sources of GAAP are technical pronouncements issued by various professionalbodies, regulating the accounting and auditing profession, that stipulate accounting principles andmethods.Accounting standards are issued by institutions that are authorized to set accounting standards. Thestandard-setting body that issues accounting standards is constituted by representatives from variousstake holders such as the accounting profession, the industry and regulators. The process of formulatingstandards is a long ‘due-diligence’ process. The process is somewhat akin to a ‘political process’ becausethe objective is to establish accounting standards.(a) that are practical in the sense that those can be implemented with reasonable costs and efforts; and(b) that are acceptable to all stake holders.Most countries have their own accounting standard setting bodies. In USA Statements of FinancialAccounting Standards (SFAS) are issued by the Financial Accounting Standards Board (FASB). InIndia accounting standards are issued by the Institute of Chartered Accountants of India (ICAI). Withglobalization of capital markets, a trend towards convergence of accounting practices in differentterritories emerged in 1970s. The International Account Standards Committee (IASC) was formed in 1973to formulate International Accounting Standards (IAS). In 2001 IASC was restructured and now it is knownas International Accounting Standards Board (IASB). Accounting standards issued by IASB are calledInternational Financial Reporting Standards (IFRS). Each territory (a country or a group of countries likeEuropean Union) has initiated actions to harmonise its accounting practices with accounting principlesand methods stipulated in IAS / IFRS. Many countries use IAS / IFRS without modification.Details of Indian Accounting Standards, US GAAP and IFRS are discussed in the ensuing Sections.6

Advanced Financial Accounting & Reportingl.2Accounting Standar

1.1.6 Financial Statements Financial statements form part of the process of fi nancial reporting. A complete set of fi nancial statements normally includes a balance sheet, a statement