Transcription

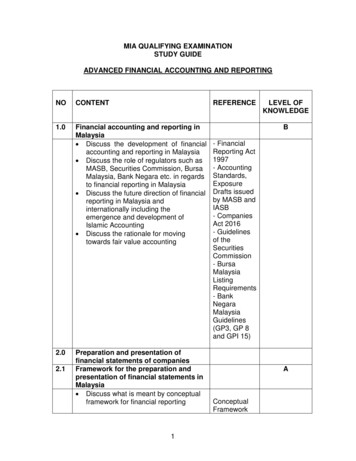

MIA QUALIFYING EXAMINATIONSTUDY GUIDEADVANCED FINANCIAL ACCOUNTING AND REPORTINGNOCONTENT1.0Financial accounting and reporting inMalaysia Discuss the development of financialaccounting and reporting in Malaysia Discuss the role of regulators such asMASB, Securities Commission, BursaMalaysia, Bank Negara etc. in regardsto financial reporting in Malaysia Discuss the future direction of financialreporting in Malaysia andinternationally including theemergence and development ofIslamic Accounting Discuss the rationale for movingtowards fair value accounting2.02.1REFERENCEPreparation and presentation offinancial statements of companiesFramework for the preparation andpresentation of financial statements inMalaysia Discuss what is meant by conceptualframework for financial reporting1LEVEL OFKNOWLEDGEB- FinancialReporting Act1997- AccountingStandards,ExposureDrafts issuedby MASB andIASB- CompaniesAct 2016- Guidelinesof theSecuritiesCommission- BursaMalaysiaListingRequirements- BankNegaraMalaysiaGuidelines(GP3, GP 8and GPI 15)AConceptualFramework

2.2Describe the objectives of financialstatements and the qualitativecharacteristics of financial informationIdentify the users of financialstatements and their informationneeds to make economic decisionsDiscuss the criteria for the recognitionof the elements of financial statementsExplain the different measurementbases of the elements of financialstatementsDiscuss the importance of fair valueaccounting in the present environmentof financial accounting and reporting inMalaysiaDiscuss the measurement of incomeand capital maintenance underhistorical cost accounting andalternative approachesDiscuss the importance of recognising,measuring and reporting transactionsand events in accordance to thesubstance and not just the legal formPreparation and presentation offinancial statements for publiccompanies Prepare the financial statements inaccordance with Financial ReportingStandards and Malaysian CompaniesAct 1965o Statement of Financial Positiono Statement of Comprehensiveincomeo Statement of Changes in Equityo Statement of Cash Flowo Notes to the financialstatements including thedisclosure on accountingpolicies adopted by companieso Disclosure of operating results,assets and liabilities ofdiscontinued operationso Computation of basic earningsper share and diluted earningsper share2for thePreparationandPresentationof FinancialStatements- AccountingStandards,ExposureDrafts issuedby MASB andIASBAMFRS 101,MFRS 107, &MFRS 134

3.03.1Prepare interim financial report andexplain the requirements of MFRS 134o Explain the content of interimfinancial statementso Explain the presentation of interimfinancial statementso Explain the recognition andmeasurement of items in interimfinancial statementso Explain the accounting treatment ifthere is a change in accountingpolicyApplication of financial reportingstandards on the preparation offinancial statementsAccounting for assets Property, plant and equipmento Discuss the recognition criteriaof property, plant andequipmento Determine the initialmeasurement of property, plantand equipmento Explain the accountingtreatment of subsequentexpenditureo Explain the subsequentmeasurement of property, plantand equipment Cost model Revaluation model Explain the accountingtreatment whenrevaluation model isadopted by company Explain the treatment ofrevaluation surplus /deficit on the initialrevaluation andsubsequent revaluation Explain the treatment ofrevaluation surplus whenthe property, plant and3AMFRS 116MFRS 141

oooo equipment are disposedofAccount for depreciation Calculate depreciationon assets purchased orself-constructed usingdifferent methods Calculate depreciationon assets subsequent tothe incurrence ofsubsequent expendituresthat are capitalised Calculate depreciationon assets subsequent torevaluationExplain the disclosurerequirements of MFRS 116 onproperty, plant and equipmentExplain the effects of‘amendments on MFRS 141’ onPPE (Agriculture: BearerPlants) (amendments to MFRS116 and MFRS 141)Explain effects of Clarification ofAcceptable Methods ofDepreciation and Amortisation(amendments to MFRS 116 andMFRS 138)Borrowing costso Define borrowing costso Discuss the examples ofborrowing costs according toMFRS 123o Define qualifying asseto Discuss the treatment forborrowing costso Discuss the arguments for andagainst capitalising borrowingcostso Explain the rules relating tocommencement, suspensionand cessation of capitalisationof borrowing costs on qualifyingasset4MFRS 123

o Explain the disclosurerequirements of MFRS 123 onthe treatment of borrowingcostsImpairment of assetso Define impairmentso Explain the underlying principlein testing and measuringimpairment losso Discuss the indications that anasset may be impairedo Apply the appropriateaccounting treatment on anindividual asset that is impaired– including the determination ofthe recoverable amount Explain the value in useand the asset’s fair valueless costs to sello Apply the appropriateaccounting treatment on cashgenerating unit that is impaired– recoverable amount Apply the procedures tobe followed whenallocating impairmentloss between the assetsin the cash-generatingunito Explain the measurement ofcorporate assets that areimpairedo Explain and calculate reversalof an impairment loss for anindividual asseto Explain and calculate reversalof an impairment loss for acash-generating unito Explain the disclosurerequirements of MFRS 136pertaining the impairment ofassetsAccounting for investment propertyo Define investment property5MFRS 136

o Explain the recognition criteriaand initial measurement ofinvestment propertyo Discuss the subsequentmeasurement of investmentproperty Fair value model Cost modelo Discuss the measurement ofinvestment property when thereare transfers Transfer from investmentproperty to owneroccupied property Transfer from investmentproperty to inventories Transfer from owneroccupied property toinvestment property Transfer from inventoriesto investment property Transfer from property inthe course ofconstruction ofdevelopment (MFRS116) to investmentpropertyo Transfer a property to or frominvestment property when thereis evidence of change of useo Explain the disclosurerequirements of MFRS 140 oninvestment property Accounting for government grantsand disclosure of governmentassistanceo Define government grantso Explain the recognition criteriaof government grantso Discuss the possibletreatments/ approaches ofaccounting of governmentgrants Capital approach Income approach6MFRS 140MFRS 120

o Discuss the presentation ofgrants related to assets in thefinancial statements Treat as deferred income Deducting the grant fromthe asset’s carryingamounto Explain the accountingtreatments of governmentsgrants that are revoked orbecomes repayableo Define government assistanceo Explain the disclosurerequirements of MFRS 120 ongovernment grants andgovernment assistance Non-current assets held for saleand presentation of discontinuedMFRS 5operationso Explain non-current asset heldfor sale and disposal groupo Explain the recognition criteriafor non-current asset ordisposal groupo Explain and apply theappropriate measurementrequirements of non-currentasset or disposal groupclassified as held for sale At time of classificationas held for sale After classification asheld for sale Impairment Explain the recognition ofimpairment losses andreversals of impairmentlosses when themeasurement of noncurrent asset or disposalgroup classified as heldfor sale take place Assets carried at fairvalue prior to initialclassification7

Subsequent increases infair valueo Discuss the cessation of theclassification of non-currentasset or disposal group held forsale Explain themeasurement of the noncurrent asset or disposalgroup that are no longerclassified as held for saleo Explain the disclosurerequirements of MFRS 5 Accounting for assets acquiredthrough leaseso Discuss the substance overform principle in relation toleaseso Distinguish between a financelease and an operating leaseo Explain the accountingtreatment of a finance lease inthe books of the lessor and thelesseeo Explain the accountingtreatment of an operating leasein the books of the lessor andthe lesseeo Explain the methods ofallocating finance charges Actuarial method Sum-of-digits methodo Explain the accountingtreatment in the books of amanufacturer of property, plantand equipment who is also alessor or dealero Discuss the rationale of a saleand leaseback transactiono Explain the accountingtreatment of a sale andleaseback transaction in thebooks of lessor and lessee8MFRS 117

If the sale and leasebackfalls under operatinglease If the sale and leasebackfalls under finance leaseo Explain the disclosurerequirements of MFRS 117 onleases in the books of lessorand lessee for both financelease and operating leaseLeases (effective for annual periodbeginning or after 1 January 2019)o Explain the scope andrecognition exemptionso Explain and apply therequirements in ‘identifying alease’ and ‘separatingcomponents of a contract’o Apply MFRS 16 requirements inrespect of ‘accounting bylessees’o Apply MFRS 16 requirements inrespect of ‘accounting bylessors’o Explain and apply thetreatments for sale andleaseback transactionso Explain the disclosurerequirements of MFRS 16Accounting for intangible assetso Define intangible assetso Discuss the recognition criteria,initial and subsequentmeasurement of intangibleassetso Explain the accountingtreatment of research anddevelopment costso Explain the accountingtreatment of development coststhat are impairedo Explain the disclosurerequirements of MFRS 138 onintangible assets9MFRS 16MFRS 138

o Explain effects of Clarification ofAcceptable Methods ofDepreciation and Amortisation(amendments to MFRS 116 andMFRS 138)3.2Accounting for inventories Explain the measurement ofinventories in accordance with MFRS102o Explain how the cost ofinventories is arrived at Cost of purchase Cost of conversion Other costs Cost formulas used toassign the cost ofinventories Costs not includedo Explain how net realisablevalue is determinedo Explain how the writing down ofinventories to the net realisablevalue is made Explain the circumstances underwhich the cost of inventories isrecognised as expenses Explain the measurement rule of rawmaterials at the balance sheet date Explain the disclosure requirements ofMFRS 102 on inventories3.3Accounting for financial instrumentsMFRS 7, Disclosure and presentationo Define financial assets, financial MFRS 132,liability and equity instrumento Discuss the classification offinancial instruments intofinancial assets, financialliability and equity instrumento Measurement of compoundfinancial instruments andsubsequent accountingtreatment10MFRS 102

o Explain the accountingtreatment of treasury shareswhen they are purchased, sold,issued or cancelledo Discuss the accountingtreatment of interest, dividends,losses and gains relating tofinancial instrumentso Discuss the circumstancesunder which offsetting offinancial asset and a financialliability is allowedo Explain the disclosurerequirements of MFRS 132 onfinancial instruments Recognition and measuremento Explain derivativeso Explain the different categoriesof financial instrumentso Explain the recognition offinancial asset and financialliability Trade date method Settlement date methodo Explain the initial measurementof financial asset and financialliabilityo Explain the accountingtreatment of transaction costso Explain the subsequentmeasurement of financial assetand financial liabilityo Explain the accountingtreatment of financialinstruments that are reclassifiedo Explain the accountingtreatment of change in fairvalue of financial instrumentso Discuss the evidence thatfinancial asset or group offinancial asset is impairedo Explain the accountingtreatment of impairment offinancial assets under variousclassifications11MFRS 139

o Discuss the derecognition of afinancial asset and a financialliabilityMFRS 9 Financial InstrumentsMFRS 9 Explain and apply the requirements asper MFRS 9o Explain the initial measurementof financial instrumentso Account for the subsequentmeasurement of financialassets Debt instruments –business model test andcash flow characteristicstest Fair value option Equity instruments Other comprehensiveincome optiono Account for subsequentmeasurement of financialliabilities Fair value option Trade date method Settlement date methodo Apply and account forderecognition of financial assetso Apply and account forderecognition of financialliabilitieso Apply and account forderivatives and embeddedderivativeso Perform reclassification inaccordance with MFRS 9o Apply hedge accounting Fair value hedge Cash flow hedge Hedge of a netinvestment in a foreignoperationo Apply and account forimpairment as per MFRS 912

Explain the presentation anddisclosure requirements of MFRS 9 onfinancial instruments3.4Accounting for employee benefits Discuss the different categories ofemployee benefitso Short-term employee benefitso Post-employment benefits Defined contribution plan Explain the accountingtreatment of definedcontribution plan Defined benefit plan Explain and apply theappropriate accountingtreatment of definedcontribution plan, includingrequirements formeasurement and pastservice costs Unit credit method Account for actuarial gainsand losseso Other long-term employeebenefitso Termination benefits Explain the disclosure requirements ofMFRS 119 and MFRS 126 onaccounting for retirement benefitsMFRS 119A3.5Accounting for income taxes Explain what is meant by tax base,deferred tax, taxable and deductibletemporary differences Discuss the full provision method indetermining the deferred tax Account for deferred taxo Calculate the taxable temporarydifference and deductibletemporary differenceo Deferred tax liability and deferredtax asset Explain the measurement of deferredtaxo Change in tax rateMFRS 112A13

o Items relate to equityo Business combinationExplain the presentation anddisclosure requirements of MFRS 112on accounting for income taxes3.6Provisions, Contingent Liabilities andContingent Assets Define provision, liability, contingentliability and contingent asset Explain the recognition of provisionthat gives rise to liability Explain the measurement of provisionrecognisedo Best estimateo Assess risks and uncertaintieso Present value of the obligationo Future events Explain the recognition of contingentliability and contingent asset Explain the disclosure requirements ofMFRS 137 on provision, contingentliability and contingent assetMFRS 137A3.7Operating Segments Define operating segments Discuss the factors to be considered inidentifying operating segments Explain the tests used in determiningwhether an operating segment can bea reportable segment Prepare a segment report inaccordance with MFRS 8 Explain the disclosure requirements ofMFRS 8Revenue recognition Revenueo Explain the criteria or conditions ofrevenue recognition under thefollowing: Sale of goods Rendering of services Interest royalties and dividendsMFRS 8A3.814AMFRS 118

o Explain the timing of revenuerecognition under variousexamples or situations given in theAppendix of MFRS 118o Explain the disclosurerequirements of MFRS 118 onrevenue Accounting for constructioncontractso Define fixed cost contract and costplus contracto Explain the circumstances where acontract should be combined orsegregatedo Determine the contract costs andrevenueo Explain the recognition of contractrevenue and expenses Discuss the relationshipbetween the outcome of theconstruction contracts and therecognition of revenue andexpenses Explain when the outcome ofthe contract can be estimatedreliably or not under the fixedcost contract and cost pluscontract Explain the various methods ofdetermining the stage ofcompletiono Present the information regardingconstruction contracts in theincome statement and balancesheet Accounting for propertydevelopment activitieso Explain property developmento Explain the accounting treatment ofland held for property development Undeveloped land Land under developmento Determine the propertydevelopment costs and revenueMFRS 111FRS 20115

o Explain the recognition of propertydevelopment revenue andexpenses Discuss the relationshipbetween the outcome of theproperty development and therecognition of revenue andexpenses Explain the various methods ofdetermining the stage ofcompletiono Explain the accounting treatment ofunsold completed developmentunitso Present the information regardingproperty development activities inthe income statement and balancesheeto Explain the disclosurerequirements of FRS 201 onproperty development activitiesMFRS 15 Revenue from Contract withCustomerso Explain the key definitions underMFRS 15o Discuss and apply the five stepmodel framework Identify the contract with thecustomer Identify the performanceobligations in the contract Determine the transaction price Allocate the transaction price tothe performance obligations inthe contracts Recognize revenue when (oras) the entity satisfies aperformance obligationo Explain and apply the accountingrequirements in respect of contractcostso Review the implementationguidance in relation to MFRS 1516

o Explain the presentation anddisclosure requirements in thefinancial statements of MFRS 153.9Accounting for share-based payment Explain the different types of sharebased payments Equity-settled Cash-settled Choice of equity-settled or cashsettled Share-based payments to third parties Share-based payments to employees Apply and account for ‘share-basedpayments’ in accordance with MFRS 2– recognition and measurement;accounting for modifications Explain the disclosure requirements ofMFRS 2 on share-based paymentsMFRS 23.10 Accounting policies, changes inaccounting estimates and errors Define accounting policies, changes inaccounting estimates and errors Explain the accounting treatment of achange in accounting policy, change inaccounting estimate and errors Explain the disclosure requirements ofMFRS 108 when a company changesits accounting policies, changes itsaccounting estimates and errorsMFRS 1083.11 Events after the reporting period Define events after the reportingperiod Discuss the accounting treatment ofevents after the reporting periodo Adjusting events after the reportingperiodo Non-adjusting events afterreporting periodo Dividends and going concernstatusMFRS 11017

Explain the disclosure requirements ofMFRS 110 on events after thereporting period3.12 Fair Value measurement Explain the key definitions in MFRS 13 Explain and apply the fair valuehierarchy – level 1, 2 and 3 inputs Apply the measurement and valuationtechniques as per MFRS 13 Explain the disclosure requirements ofMFRS 13I4.04.14.2Consolidated financial statementsBusiness Combinations – Basicintroduction Describe the concept of a group andthe objective and usefulness ofconsolidated financial statements Define a subsidiary Describe the circumstances when aparent is exempted from preparingconsolidated financial statements Describe the circumstances andreasoning for subsidiaries to beexcluded from consolidated financialstatements Prepare a consolidated statement offinancial position and statement ofcomprehensive income for a groupdealing with pre and post acquisitionprofits, non-controlling interests andgoodwill arising on consolidationBusiness Combinations – Intra-grouptransactions and balances, incomefrom subsidiaries, bonus sharesissued by subsidiaries and fair valueadjustments Explain what is meant by intra-grouptransactions and balances and whythey should be eliminated onconsolidation Account for the intra-grouptransactions and balances in the18MFRS 13AMFRS 3MFRS 10,MFRS 127A

4.34.44.54.6preparation of consolidated statementof financial positionAccount for bonus shares issued bysubsidiaryAccount for income/dividendsreceived/paid from/by subsidiaryPrepare consolidated financialstatements dealing with fair valueadjustmentsConsolidated statement ofcomprehensive income Account for intra-group dividends Account for the preference sharesdividends in subsidiary Account for the intra-grouptransactions Account for acquisition of subsidiariesduring the yearBusiness Combinations – associatesand joint ventures Define associates and joint ventures Accounting for associates using equitymethod Accounting for joint ventures using theequity methodBusiness Combinations – increases inshare holding Account for the increase in shareholdingo Increase in controlling interesto Gradual acquisition resulting incontrolo Deemed purchase Prepare consolidated financialstatements when there are increasesin share holdingBusiness Combinations – decrease inshare holding Account for all and partial disposal ofshares in subsidiary19AMFRS 3AMFRS 128;MFRS 11AMFRS 3AMFRS 3

Calculate and account for the gain orloss on disposal of interest insubsidiary (all and partial)Explain and account for deemeddisposal of shares in subsidiary4.7Business Combinations – foreignoperations Explain functional and presentationcurrency Translating financial statements fromlocal/foreign currency to functionalcurrency Translating financial statements fromfunctional currency to presentationcurrency Translating the goodwill onconsolidation as an asset of thesubsidiary4.8Business Combinations – statement ofcash flow Prepare a group statement of cash flowincluding acquisition or disposal ofsubsidiary or associate during the yearA4.9Business Combinations – complexgroup structures Explain the different types of groupstructureo Group with fellow subsidiarieso Vertical groupo Mixed group Prepare consolidated financialstatements for a complex groupstructureA20MFRS 121A

financial statements o Explain the presentation of interim financial statements o Explain the recognition and measurement of items in interim financial statements o Explain the accounting treatment if there is a change in accounting policy 3.0 Application of financial reporting standards on t