Transcription

8SYLLABUS-2016INTERMEDIATE : PAPER -COSTACCOUNTINGSTUDY NOTESThe Institute of Cost Accountants of IndiaCMA Bhawan, 12, Sudder Street, Kolkata - 700 016INTERMEDIATE

First Edition : July 20161st Revision: October 2017Revised Edition: January 2018Published by :Directorate of StudiesThe Institute of Cost Accountants of India (ICAI)CMA Bhawan, 12, Sudder Street, Kolkata - 700 016Printed at :Jayant Printery LLP352/54, Girgaum Road,Murlidhar Temple Compound,Mumbai - 400 002.Copyright of these Study Notes is reserved by the Institute of CostAccountants of India and prior permission from the Institute is necessaryfor reproduction of the whole or any part thereof.

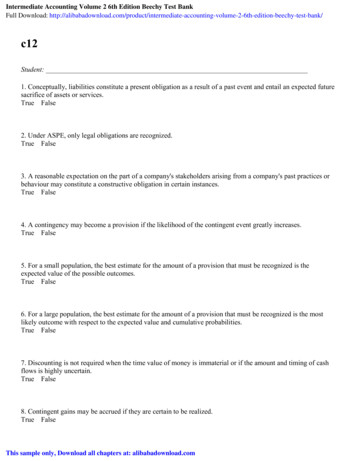

PAPER 8: COST ACCOUNTINGSyllabus - 2016Syllabus Structure:The syllabus comprises the following topics and study weightage:Introduction to Cost AccountingACost Ascertainment - Elements of CostCost Accounting Standards40%Cost Book KeepingBMethods of Costing30%CCost Accounting Techniques30%C30%A40%B30%ASSESSMENT STRATEGYThere will be written examination paper of three hoursOBJECTIVESTo provide an in depth study of the Cost Accounting Principles and Techniques for identification, analysis and classification ofcost components to facilitate managerial decision making.Learning aimsThe syllabus aims to test the student’s ability to: U nderstand and explain the conceptual framework of Cost Accounting E xplain the basic concepts and processes in determination of cost of products and services U nderstand the Cost Accounting Standards (CAS) A pply marginal costing in decision making A pply the concept of Standard Costing for variance analysisSkill set requiredLevel B: Requiring the skill levels of knowledge, comprehension, application and analysis.COST ACCOUNTING – INTRODUCTION TO COST ACCOUNTING [40 MARKS]1.2. INTRODUCTION TO COST ACCOUNTING:(a)Definition, Scope, objectives and significance of cost accounting, its relationship with financialaccounting and management accounting(b)Cost Objects, Cost centers and Cost Units(c)Elements of cost(d)Classification of costsCOST ASCERTAINMENT - ELEMENTS OF COST:(a)Material Costs:(i)Procurement of Materials,(ii)Inventory Management and Control,(iii)Inventory Accounting & Valuation(iv)Physical Verification, treatment of losses(v)Scrap, spoilage, defectives and wastage.

(b)3.Employee Costs:(i)Time keeping, Time booking and payroll,(ii)Labour Turnover, Overtime and idle time(iii)Principles and methods of remuneration and incentive schemes(iv)Employee cost reporting and measurement of efficiency.(c)Direct Expenses(d)Overheads:(i)Collection, classification and apportionment and allocation of overheads(ii)Absorption and treatment of over or under absorption of overheads(iii)Reporting of overhead costsCOST ACCOUNTING STANDARDS (Basic Understanding only)(CAS 1 to CAS 24)4.5.6.COST BOOK KEEPING:(a)Cost Accounting Records, Ledgers and Cost Statements(b)Items excluded from cost and normal and abnormal items/cost(c)Integral accounts(d)Reconciliation of cost accounting records with financial accounts(e)Infrastructure, Educational, Healthcare and Port servicesMETHODS OF COSTING:(a)Job Costing(b)Batch Costing(c)Contract Costing(d)Process Costing – Normal and abnormal losses, equivalent production, Joint and By Products.(e)Operating Costing or Service Costing – Transport, Hotel and HospitalCOST ACCOUNTING TECHNIQUES: (Basic Understanding only)(A)(B)Marginal Costing(i)Meaning of Marginal Cost and Marginal Costing(ii)Absorption Costing vs. Marginal Costing(iii)Break-even analysis(iv)Margin of safety(v)Application of Marginal Costing for decision making (simple problems only)Standard Costing & Variance Analysis(i)Concept of standard cost and standard costing(ii)Advantages and limitations(iii)Computation of variances relating to material and labour costs only(C) Budget and Budgetary Control (simple problems only)(i)Concepts, Types of Budgets(ii)Budgetary Control Vs Standard Costing(iii)Advantages and limitations(iv)Preparation of Budgets (simple problems only)

ContentsCOST ACCOUNTINGStudy Note 1 : Introduction to Cost Accounting1.1Definition, Scope, Objectives and Significance of Cost Accounting11.2Cost Object, Cost Centers and Cost Unit – Elements of Cost71.3Classification of Cost13Study Note 2 : Cost Ascertainment - Elements of Cost2.1Material Cost (CAS-6)232.2Employee Costs (CAS-7)712.3Direct Expenses (CAS-10)1162.4Overheads (CAS-3)121Study Note 3 : Cost Accounting Standards3.1Preface to Cost Accounting Standards (CASs)1713.2Objective and Functions of Cost Accounting Standards Board1723.3CAS 1-24 as issued by The Institute of Cost Accountants of India174Study Note 4 : Cost Book Keeping4.1Cost Accounting Records, Ledgers and Cost Statements1854.2Items excluded from Cost and Normal and Abnormal Items/Cost2004.3Integral Accounts2014.4Reconciliation of Cost Accounting Records with Financial Accounts2114.5Infrastructure, Educational, Healthcare and Port Services224Study Note 5 : Methods of Costing5.1Job Costing2335.2Batch Costing2455.3Contract Costing2495.4Process Costing – Joint & By-Products2645.5Operating Costing or Service Costing – Transport, Hotel and Hospital296Study Note 6 : Cost Accounting Techniques6.1Marginal Costing3076.2Standard Costing & Variance Analysis3416.3Budget and Budgetary Control366

Cost Accounting

Study Note - 1INTRODUCTION TO COST ACCOUNTINGThis Study Note includes1.1Definition, Scope, objectives and significance of Cost Accounting, its Relationship withFinancial Accounting and Management Accounting1.2Cost Objects, Cost Centres and Cost Units – Elements of Cost1.3Classification of Costs1.1 DEFINITION, SCOPE, OBJECTIVES AND SIGNIFICANCE OF COST ACCOUNTING, ITS RELATIONSHIPWITH FINANCIAL ACCOUNTING AND MANAGEMENT ACCOUNTINGWay back to 15th Century, no accounting system was there and it was the barter system prevailed.It was in the last years of 15th century Luca Pacioli, an Italian found out the double entry system ofaccounting in the year 1494. Later it was developed in England and all over the world upto 20thCentury. During these 400 years, the purpose of Cost Accounting needs are served as a small branchof Financial Accounting except a few like Royal wallpaper manufactory in France (17th Century), andsome iron masters & potters (18th century).The period 1880 AD- 1925 AD saw the development of complex product designs and the emergenceof multi activity diversified corporations like Du Pont, General Motors etc. It was during this period thatscientific management was developed which led the accountants to convert physical standards intoCost Standards, the latter being used for variance analysis and control.During the World War I and II the social importance of Cost Accounting grew with the growth of eachcountry’s defence expenditure. In the absence of competitive markets for most of the material requiredfor war, the governments in several countries placed cost-plus contracts under which the price to bepaid was cost of production plus an agreed rate of profit. The reliance on cost estimation by parties todefence contracts continued after World War II.In addition to the above, the following factors have made accountants to find new techniques toserve the industry :(i) Limitations placed on financial accounting(ii) Improved cost consciousness(iii) Rapid industrial development after industrial revolution and world wars(iv) Growing competition among the manufacturers(v) To control galloping price rise, the cost of computing the precise cost of product / service(vi) To control cost several legislations passed throughout the world and India too such as EssentialCommodities Act, Industrial Development and Regulation Act.etcDue to the above factors, the Cost Accounting has emerged as a speacialised discipline from theinitial years of 20th century i.e after World War I and II.In India, prior to independence, there were a few Cost Accountants, and they were qualified mainlyfrom I.C.M.A. (now CIMA) London. During the Second World War, the need for developing theprofession in the country was felt, and the leadership of forming an Indian Institute was taken by someCOST ACCOUNTING1

Introduction to Cost Accountingmembers of Defence Services employed at Kolkata. However, with the enactment of the Cost andWorks Accountants of India Act, 1959, the Institute of Cost and Works Accountants of India (Now calledas The Institute of Cost Accountants of India) was established at Kolkata. The profession assumed furtherimportance in 1968 when the Government of India introduced Cost Audit under section 233(B) of theCompanies Act, 1956. At present it is under Section 148 of the Companies Act, 2013.Many times we use Cost Accounting, Costing and Cost Accountancy interchangeably. But there aredifferences among these terms. As a professional, though we use interchangeably we must know themeaning of each term precisely.Cost Accounting : Cost Accounting may be defined as “Accounting for costs classification and analysisof expenditure as will enable the total cost of any particular unit of production to be ascertainedwith reasonable degree of accuracy and at the same time to disclose exactly how such total cost isconstituted”. Thus Cost Accounting is classifying, recording an appropriate allocation of expenditurefor the determination of the costs of products or services, and for the presentation of suitably arrangeddata for the purpose of control and guidance of management.Cost Accounting can be explained as follows :Cost Accounting is the process of accounting for cost which begins with recording of income andexpenditure and ends with the preparation of statistical data.It is the formal mechanism by means of which cost of products or services are ascertained andcontrolled.Cost Accounting provides analysis and classification of expenditure as will enable the total cost of anyparticular unit of product / service to be ascertained with reasonable degree of accuracy and at thesame time to disclose exactly how such total cost is constituted. For example it is not sufficient to knowthat the cost of one pen is 25/- but the management is also interested to know the cost of materialused, the amount of labour and other expenses incurred so as to control and reduce its cost.It establishes budgets and standard costs and actual cost of operations, processes, departments orproducts and the analysis of variances, profitability and social use of funds.Thus Cost Accounting is a quantitative method that collects, classifies, summarises and interpretsinformation for product costing, operation planning and control and decision making.Costing : Costing is defined as the technique and process of ascertaining costs.The technique in costing consists of the body of principles and rules for ascertaining the costs ofproducts and services. The technique is dynamic and changes with the change of time. The processof costing is the day to day routine of ascertaining costs. It is popularly known as an arithmetic process.For example If the cost of producing a product say 200/-, then we have to refer material, labour andexpenses accounting and arrive the above cost as follows:Material 100Labour 40Expenses 60Total 200Finding out the breakup of the total cost from the recorded data is a daily process. That is why itis called arithmetic process/daily routine. In this process we are classifying the recorded costs andsummarizing at each element and total is called technique.Cost Accountancy: Cost Accountancy is defined as ‘the application of Costing and Cost Accountingprinciples, methods and techniques to the science, art and practice of cost control and the ascertainmentof profitability’. It includes the presentation of information derived there from for the purposes of managerialdecision making. Thus, Cost Accountancy is the science, art and practice of a Cost Accountant.2COST ACCOUNTING

(a) It is a science because it is a systematic body of knowledge having certain principles which a costaccountant should possess for proper discharge of his responsibilities.(b) It is an art as it requires the ability and skill with which a Cost Accountant is able to apply theprinciples of Cost Accountancy to various managerial problems.(c) Practice includes the continuous efforts of a Cost Accountant in the field of Cost Accountancy.Such efforts of a Cost Accountant also include the presentation of information for the purpose ofmanagerial decision making and keeping statistical records.Objectives of Cost AccountingThe following are the main objectives of Cost Accounting :(a) To ascertain the Costs under different situations using different techniques and systems of costing(b) To determine the selling prices under different circumstances(c) To determine and control efficiency by setting standards for Materials, Labour and Overheads(d) To determine the value of closing inventory for preparing financial statements of the concern(e) To provide a basis for operating policies which may be determination of Cost Volume relationship,whether to close or operate at a loss, whether to manufacture or buy from market, whetherto continue the existing method of production or to replace it by a more improved method ofproduction.etcScope of Cost AccountancyThe scope of Cost Accountancy is very wide and includes the following:(a) Cost Ascertainment: The main objective of Cost Accounting is to find out the Cost of product /services rendered with reasonable degree of accuracy.(b) Cost Accounting: It is the process of Accounting for Cost which begins with recording of expenditureand ends with preparation of statistical data.(c) Cost Control: It is the process of regulating the action so as to keep the element of cost within theset parameters.(d) Cost Reports: This is the ultimate function of Cost Accounting. These reports are primarily preparedfor use by the management at different levels. Cost reports helps in planning and control,performance appraisal and managerial decision making.(e) Cost Audit: Cost Audit is t

COST ACCOUNTING – INTRODUCTION TO COST ACCOUNTING [40 MARKS] 1. INTRODUCTION TO COST ACCOUNTING: (a) Definition, Scope, objectives and significance of cost accounting, its relationship with financial accounting and management accounting (b) Cost Objects, Cost centers and Cost Units (c) Elements of cost (d) Classification of costs 2. COST ASCERTAINMENT - ELEMENTS