Transcription

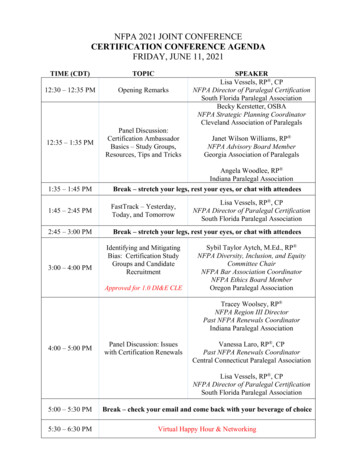

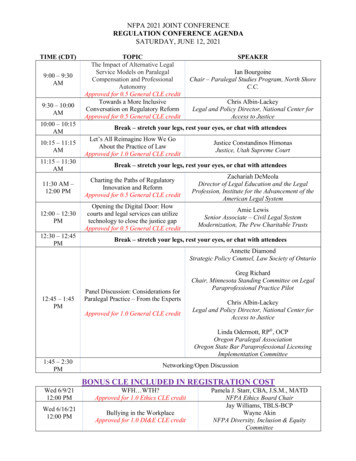

Niagara UniversityAnnual Logistics Conference&University of MassachusettsFOMGT 341How Leaders are LeveragingSupply Chain ExpertiseJack Ampuja

Supply Chain OptimizersFocused on helping clients reduce supplychain costs through:z Packaging Optimizationz Network Optimizationz Transportation Optimizationz International Optimization

Supply Chain Managementz It is all about virtual integrationz Support comes from computer links tocustomers and suppliersz External integration is not possible untilinternal integration has been completedz Focus must be on mutual benefit or theprocess will not flourishz Measurable results must be achieved

Supply Chain Goalsz Need to balance level of customizationand complexityz Too many companies have a “one size fitsall approach”- need distinct supply chain by channelz Differentiate between ‘logical’ and‘physical’ supply chains- services, pricing, products can be unique

Supply Chain Challengesz Increasing transportation expense- equipment availability may be as bigz Safety is #1 concern in food supply- can add 1% - 3% to costsz Unreliable inventory management- gold standard: fast food friesz Least cost country sourcing

Service Provider Dilemmasz For logistics companies significant growthleads to increased over-management, lessadaptability to market changez Users want low price without commitmentz Differentiation between service providersis shrinking– Integrated logistics is the goal– Impossible to be all things to all clients– Transportation & warehousing still 80%

Lack of Integrationz US business culture does not encouragepartnering between operations and S&M- often are adversaries- too many sales people are stillcompensated on volume not profitz CPG manufacturer supplying Costco waspleased with 7% annual sales increase- cost to serve Costco increased 6%/yr

Supplier Relationshipsz Generally not as sophisticated or as welldeveloped as customer relationships- but SRM has much greater value thanCRM which has very spotty resultsz SRM is in top five supply chain initiatives- 60% of companies want to improveconnection, coordination, measurement ofsuppliers

Supplier Managementz Top 20% have lowered transactionprocessing cost with suppliers by 20% - event monitoring technology doubles ortriples chance of achieving 40% performance improvementsz Phone, fax, email still most popular meansof exchanging information but internet isnow preferred by all segments

Supplier Management Cont.z Top performers attempt to measure entirerelationship- domestic threshold is to monitor 6 ormore events- international segment needs 10 or moremeasurements for clarityz The best get extreme improvement in leadtime reduction and increased perfect order

Relationship Paradoxz Businesses want to link with suppliers tocut costsz Getting closer to suppliers is in itself risky- it is impossible to partner with supplierswithout sharing information but the moresuppliers know, the more leverage theygain in the relationship

Wal*MartData Synchronization [Midyear ‘04]z Now linked to 547 manufacturersz Top 100 80% participationz Companies supplying 200 items 27%z Companies supplying 1 or 2 items 3%

2004 Food Service Elitez Attributes raising winners are- innovation- solutions- added value servicesz Surveyed 470 food service operators andmanufacturersz McDonalds [27%], Wendys [20%], Subway,Darden, Outback are leaders in operatorcategory

2004 Food Service EliteInnovation begins with creativepractical insights, with research thatexplores current and potential patrondesires and behaviors and translates theminto new actionable programs. This maycover not only unique menu offerings andservices but also merchandising materialsand programs to drive patron excitementand loyalty.

2004 Food Service EliteSolutions are the results of innovativeresearch and insights. They go beyondthe basic tactics to benefit both operatorand manufacturer businesses. Today,solutions may drive improvements toboth the back of the house as well asthe front. Manufacturers can help withsupply chain and equipment/mealpreparation in addition to productpresentation and day-part management

2004 Food Service EliteAdded Value Services go beyond thebasics of product training andspecifications. Operators want to knowhow to use the product more efficientlyand effectively. They are looking fortechnical, culinary and product expertisefrom the manufacturers.

Top ManufacturersTysonCoca ColaGeneral MillsPepsi ColaKraftSara LeeKelloggFrito LayRich ProductsSchwans27%17%15%12%11%11%10%10%9%9% 3.3 0.5 0.4 2.7 0.9 2.2 0.7 1.9-0.8 1.6-Technomic Inc

Elite Manufacturer Elementsz Clearest company strategyz Best combination of growth and profitabilityz Best products or brand namesz Best business partnersz Best sales force or broker teams

Elite Elements Cont .z Most innovative marketingz Leading information providersz Category management leadersz Best supply chain managementz Best new products

Customer ServiceOrder delivery commitment achievementz Median: 81%z Best in class: 96%- Performance Management Groupreported in Supply Chain ManagementReview May ’04

Leaders Approach to Riskz Risk taking ultimately delivers shareholdervalue no substantial growth without it- but risk must be accepted and managedz Leaders are leaders because they lead- take on risk and move ahead- less able firms miss chances as they aremore risk averse or indecisive- recognize opportunity and act

Strategic Outsourcingz Toshiba had no easy way to get brokenlaptops returned for servicez Now laptop customers drop off units forrepair at UPS storez UPS moves all units to central repairfacility operated by UPSz Repaired units are returned to customervia UPS delivery

Another Examplez Kellogg’s operated food manufacturingplant with only 40% utilization- cost & volume circumstances negatedefforts to add more productsz Outsourced entire operation high coststo Total Logistics Control which purchasedplant, equipment, people, businessz TLC added volume from other companies

Grocery Salesz Costcoz Wal*Martz Walgreensz CVSz Targetz K Mart61%44%38%31%18%14% .2003 Results

Share Forecast 2007z Traditional Groceryz Supercenterz Dollar Storez Drug2004 200756% - 48%11% - 17%1.5% - 3.0%4.4% - 5.2%- All traditional food & food/drug formatsare declining. Sav-a-lot is fastest growingretail food chain behind Wal*Mart.

Wal*Martz Supercenter food sales in 1st quarter ’04:- up 24%- same store sales “almost double digit”z Food sales are now 82B- can be up to 162B by ’07 35% ofUS marketz Aggressive expansion for supercenters- converting traditional stores

Private Labelz 22% of supermarket sales in Europez 42% share in UK, 21% in USz Wegmans 11.5% of items, 25% of z Tops 7% of items, 16% of z Overall growth is much faster than nationalbrands and provide retailers higher profitz Quality equal to or better than nationalbrands at all leading chains

Private Labelz Store brands grew 2.3% in 03 ( 1B)- national brands grew 1.4%z Store brands now make up:- 21% of all units- 16% of (account for 43B in total)z Aldi is primarily private label- Publix and Loblaws have outstandingquality and wide array of products

Food Service BarcodingGoal for case barcodes is 96%Actual year ‘04

RFIDz First barcode 1974 on Wrigley’s Juicy Fruitz RFID tags will be in short supply for nextsix monthsz Target is 5 cents per unit now at 25 z Excellent potential for warehouses onrandom storage and inventory accuracyz Can also track temperature and dating

Impact of Complexityz Chrysler’s Dodge Ram offers 1.2 millionvehicle combinationsz Competing Toyota Tundra offers 22,000z Ram sales decreasing, Tundra increasingz Between line efficiency and fewervariations Toyota’s manufacturing laborcost is 80% lower than Chrysler’s

Lessons From Leadersz Better internal integration- more people on the same page- understand corporate strategyz Strong continuous improvement mentality- open to consider change & new conceptsz Recognize opportunity and move quicklyz Many strengths & no major weaknesses

Supply Chain Optimizers Focused on helping clients reduce supply chain costs through: zPackaging Optimization zNetwork Optimization zTransportation Optimization zInternational Optimization. Supply Chain Management zIt is all about virtual integration zSupport comes from computer links to