Transcription

CONFERENCE AT A GLANCE“A great enrichment experience with excellent quality of speakers and various financial crimetopics covered, complemented by a great networking opportunity to meet experts from variousindustries.” KAMAL SOOD, BANK OF AMERICA, SENIOR AUDITOR II, VICE PRESIDENT

ABOUT THE CONFERENCEACFCS 2015 CONFERENCE - FINANCIAL CRIME WITHOUT BOUNDARIESThe only event to span the full spectrum of financial crime, the ACFCS Financial Crime Conferenceequips public and private sector professionals with critical skills and insights to confront proliferatingthreats and to be ready for expanding regulatory expectations.The Conference is uniquely focused on guiding attendees to leverage tools and share best practicesacross disciplines, including AML, fraud, corruption, tax evasion, cybersecurity and others. Leadingexperts will provide practical knowledge on how to improve results in financial crime detection andprevention, in a hands-on format that allows the audience to guide the discussion.WHAT’S NEW THIS YEAR - More opportunities to CONNECT, COLLABORATE AND CONVERGE withprofessionals in roundtable sessions, tackle real-world challenges in collaborative problem-solvingworkshops, and interact with experts through extended Q&A during panels. The program hones in oncross-cutting issues that impact all financial crime professionals, encouraging attendees and presentersto share tips and spread best practices across departments, industries and the public and private sectors.FINANCIALCRIMECONFERENCE.COMCONNECT, COLLABORATE, CONVERGE.

NEW CONFERENCE LAYOUTINTERACTIVE PANELS, WORKSHOPS & ROUNDTABLES NETWORKINGPANELS: Leading experts will provide practical knowledge on how to improve results in compliance,investigations and more, in a hands-on format that encourages the audience to ask questions andengage in the discussion.WORKSHOPS: The ACFCS 2015 Conference is all about equipping attendees with actionable toolsand knowledge. That’s why this year’s conference will offer problem-solving workshops – a chance tobring your most vexing real-world questions related to compliance, investigation or other financial crimechallenges directly to a panel of experts.In dialogue with audience members, experts and moderators will help attendees work through theirproblem, and offer solutions they can apply directly to their jobs. Questions can be submitted in advanceor during an open Q&A session.ROUNDTABLE SESSIONS: The ACFCS community encompasses compliance officers, regulators, lawenforcement, auditors, lawyers and a diverse range of other professionals. Roundtable sessions willbring them all together to tackle some of the most pressing issues and emerging risks in the financialcrime field.Led by subject matter experts, attendees will share their thoughts and insights, connect with their peers,and come away with useful tips on how to respond to new financial crime threats.NETWORKING: The ACFCS 2015 Conference gives attendees opportunities to network throughoutthe entire conference. Attendees CONNECT, COLLABORATE AND CONVERGE with hundredsof professionals spanning the full financial crime spectrum with exclusive networking events,comprehensive roundtable sessions and workshops.FINANCIALCRIMECONFERENCE.COMCONNECT, COLLABORATE, CONVERGE.

SPEAKERS & MODERATORSLEADING EXPERTS FROM ACROSS THE FINANCIAL CRIME SPECTRUMAt the ACFCS 2015 Financial Crime Conference, leading experts gather to give attendees knowledge,guidance and best practices on trending subjects in financial crime.KEYNOTE SPEAKERCYRUS R. VANCE, JR.District Attorney of New York CountyNationally recognized leader in enforcement against 21st century financialcrimes, including cyber threats, identity fraud and terrorist financing.Read Full Bio at FinancialCrimeConference.comKEN BARDENDANIEL P. BOYLANGARRY CLEMENTSenior AnticorruptionAdvisorUSAIDSenior Vice President& Audit DirectorBank of AmericaPresident & CEOClement Advisory GroupJOSEPH DEMARCOSONIA DESAIKELVIN DICKENSONPartnerDeVore & DeMarco LLPSenior VP BSA/OFACDirector of OperationsBank of the West –BNP Paribas GroupVice President ofCompliance , COLLABORATE, CONVERGE.

COURT E. GOLUMBICJ.R. HELMIGRON P. KINGManaging DirectorGoldman SachsFounderLeveraged OutcomesChief Anti-moneyLaundering OfficerScotiabank Group ofCompaniesBARRY KOCHJOHN LASHALLEN G. LOVEChief ComplianceOfficerWestern UnionManagerBDO ConsultingExecutive VP and BSAOfficer/Deputy GlobalAML OfficerTD BankPAUL PELLETIERTROY PUGHANDERS RODENBERGMemberMintz, Levin, Cohn,Ferris, Glovsky andPopeoRed Cell LeaderIBMDirector of SalesBureau van DijkHILLARY ROSENBERGLATONIA TINKERJEFFREY SKLARCounselLewis Baach KaufmannMiddlemissFounder & PresidentBayshore GroupManaging DirectorSHC ConsultingSANDRA STIBBARDSJOHN F. WALSHBRUCE ZAGARISOwner & PresidentCamelot InvestigationsPresidentSightSpan Inc.PartnerBerliner, Corcoran andRoweMore speakers are to be announced.FINANCIALCRIMECONFERENCE.COMCONNECT, COLLABORATE, CONVERGE.

IN THE HEART OF NEW YORKSAVE WITH SPECIAL CONFERENCE ROOM RATE, LIMITED AVAILABILITYLocated in the heart of New York City in Midtown Manhattan, the stylish New York Hilton Midtown hotel iswithin walking distance from New York’s premier attractions such as Times Square, Radio City Music Hall,Fifth Avenue shopping, the Broadway Theatre District, Central Park, The Museum of Modern Art (MOMA)and many more iconic New York landmarks.Select from a variety of modern, spacious guest rooms featuring on-demand entertainment and highspeed internet access. Upgrade to a suite and enjoy access to the Executive Lounge for complimentarybreakfast and afternoon hors d’oeuvres. The special roomrate is 299 ( 267 Govt.) a night, expires April19, 2015.Visit financialcrimeconference.com to learn more and book your room today.SPONSORSHIP & EXHIBITIONMARKET YOUR ORGANIZATION TO THE FINANCIAL CRIME COMMUNITYThe ACFCS Conference gives technology and professional service providers unique access to hundredsof qualified private and public sector professionals from diverse financial crime fields. Providers to theglobal financial crime market also get other benefits before, during and after the conference. Reserveyour space and start receiving these invaluable branding, marketing and sales benefits.Visit financialcrimeconference.com to learn more about sponsorship opportunities.FINANCIALCRIMECONFERENCE.COMCONNECT, COLLABORATE, CONVERGE.

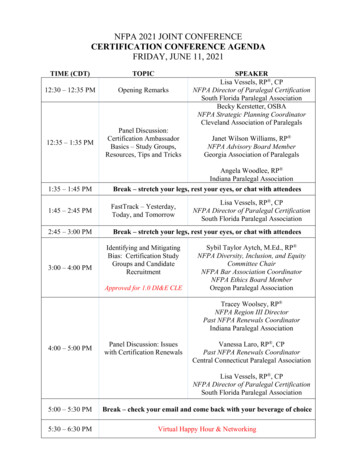

CONFERENCE PROGRAMFULL SCHEDULE WITH PANELS, CONCURRENT SESSIONS AND BREAKSThe ACFCS Conference gives technology and professional service providers unique access to hundredsof qualified private and public sector professionals from diverse financial crime fields. Providers to theglobal financial crime market also get other benefits before, during and after the conference.SUNDAY, APRIL 19TIMESESSIONS8:00 AM - 4:30 PM10:00 AM - 12:00 PMRegistrationCFCS Certification Exam Preparation Seminar Part 112:00 PM - 1:00 PMLunch1:00 PM - 2:30 PMCFCS Certification Exam Preparation Seminar Part 22:30 PM - 3:00 PMBreak3:00 PM - 4:30 PMCFCS Certification Exam Preparation Seminar Part 34:45 PM - 6:15 PMNetworking Cocktail ReceptionMONDAY, APRIL 20TIMESESSIONS7:30 AM - 5:45 PMRegistration7:30 AM - 8:30 AMNetworking Breakfast8:30 AM - 8:45 AMOpening Remarks8:45 AM - 9:45 AMGeneral Session 1: Breached! – The explosive rise of data breaches and cyber financial crime,and the keys to an effective response9:45 AM - 10:15 AMKeynote Address by Cyrus Vance10:15 AM - 11:15 AMConcurrent Sessions "How To" Session: How to commit synthetic ID fraud (and how to prevent it) Roundtable Sessions:-- Roundtable Session 1: Emerging money laundering channels and techniques-- Roundtable Session 2: Combating Human Trafficking-- Roundtable Session 3: Detecting and preventing elder financial abuse-- Roundtable Session 4: Doing more with less – converging existing resources to deal withnew financial crime risks and regulatory expectations11:15 AM - 11:45 AMNetworking Break11:45 AM - 12:45 PMGeneral Session 2: Navigating the new reality of customer due diligence – How to preparefor FinCEN’s beneficial owner rules, new tax reporting systems, and other sweeping KYCchallenges12:45 PM - 1:45 PMLunchFINANCIALCRIMECONFERENCE.COMCONNECT, COLLABORATE, CONVERGE.

1:45 PM - 2:45 PMConcurrent Sessions Session 1: The hunt for beneficial owners – How to pierce corporate structures, peel backlayers, and uncover the true owners behind legal entities Session 2: The death of tax and secrecy havens? FATCA, GATCA and what comes next forglobal financial transparency2:45 PM - 3:15 PMNetworking Break3:15 PM - 4:15 PMConcurrent Sessions Session 3: Man vs. machine - balancing the data-driven approach to compliance and investigations with the human touch Session 4: Oh, what a tangled web of sanctions – effective compliance in an era of complexity and high-stakes enforcement4:15 PM - 4:45 PMNetworking Break4:45 PM - 5:45 PMGeneral Session 3: Unlocking ‘open source intelligence’ – Harnessing online tools to excel ininvestigations, due diligence and more6:00 PM - 7:30 PMNetworking Cocktail ReceptionTUESDAY, APRIL 21TIMESESSIONS8:00 AM - 4:15 PMRegistration8:00 AM - 9:00 AMMembers and Chapters Only VIP Mimosa Breakfast8:00 AM - 9:00 AMNetworking Breakfast9:00 AM - 10:00 AMGeneral Session 4: Terrorist financing’s shifting terrain – How to recognize and counteremerging threats in your customer base, business lines and supply chain10:00 AM - 10:30 AMNetworking Break10:30 AM - 11:30 AMConcurrent Workshops: Workshop Session 1: Financial crime compliance programs Workshop Session 2: Investigative tools and techniques Workshop Session 3: The financial crime landscape for money services businesses Workshop Session 4: The financial crime landscape for the securities industry11:30 AM - 12:30 PMGeneral Session 5: Building (and borrowing) an effective anti-corruption program – LeveragingAML and anti-fraud tools to combat bribery and mitigate corruption risks12:30 PM - 1:30 PMLunch1:30 PM - 2:30 PMGeneral Session 6: Trade-based money laundering unleashed – Confronting the rise offinancial crime risks in global trade2:30 PM - 3:00 PMNetworking Break3:00 PM - 4:00 PMGeneral Session 7: Countering illicit finance in the year 2020 – Unpacking the challenges andpressures that will reshape AML and anti-fraud compliance over the next five years4:00 PM - 4:15 PMEnding RemarksFINANCIALCRIMECONFERENCE.COMCONNECT, COLLABORATE, CONVERGE.

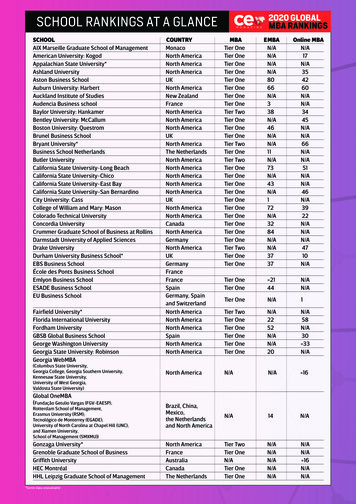

PRE-CONFERENCE CFCS PREPTRAIN FOR THE CFCS EXAM WITH THE EXPERTS WHO HELPED CREATE ITThe Pre-Conference CFCS Live Exam Preparation Seminar is the ultimate tool to learn the crucialknowledge needed for being effective as a financial crime specialist. Once completed, you will be betterprepared to sit for the Certified Financial Crime Specialist (CFCS) exam. The Pre-Conference CFCS LivePrep Seminar will take place April 19.EIGHT REGISTRATION RATESFOR THE FIRST YEAR EVER, ACFCS NOW OFFERS EIGHT SPECIAL RATESACFCS now offers eight special conference rates, including CFCS-certified, event alumni, chaptermember, student and more. See the pricing chart below, group rates available for groups of 3 . Contactus today to learn more.REGISTRATION TYPEREGULAR RATESNon Member 1,495Member 1,295Government 895Student 695BARBRI Student 495CFCS-Certified 1,195Alumni (Previous Attendee) 1,295Chapter Member 1,245Pre-Conference CFCS Seminar 495CONTACT USPHONE: 305-854-2345EMAIL: CUSTOMERSERVICE@ACFCS.ORGWEB: FINANCIALCRIMECONFERENCE.COMFAX: 786-316-0006FINANCIALCRIMECONFERENCE.COMCONNECT, COLLABORATE, CONVERGE.

prepared to sit for the Certified Financial Crime Specialist (CFCS) exam. The Pre-Conference CFCS Live Prep Seminar will take place April 19. EIGHT REGISTRATION RATES FOR THE FIRST YEAR EVER, ACFCS NOW OFFERS EIGHT SPECIAL RATES ACFCS now offers eight special conference rates, including CFCS-certified, event alumni, chapter member, student and more. See the pricing chart