Transcription

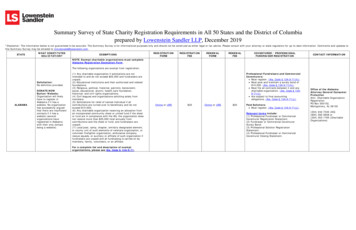

Summary Survey of State Charity Registration Requirements in All 50 States and the District of Columbiaprepared by Lowenstein Sandler LLP, December 2019*Disclaimer: The information below is not guaranteed to be accurate. The Summary Survey is for informational purposes only and should not be construed as either legal or tax advice. Please consult with your attorney or state regulators for up-to-date information. Comments and updates tothis Summary Survey may be emailed to mmcdonald@lowenstein.com.STATEWHAT REGISTRATIONFEERENEWALFORMRENEWALFEECOVENTURER / PROFESSIONALFUNDRAISER REGISTRATIONCONTACT INFORMATIONNOTE: Exempt charitable organizations must completeAlabama Registration Exemption Form.The following organizations are exempt from registration:Solicitation:No definition provided.ALABAMADONATE NOWButton/Website:Organization will likelyhave to register inAlabama if it has awebsite. No organizationhas successfully arguedthat there are insufficientcontacts if it has awebsite (severalorganizations haveregistered in Alabamawith their only contactbeing a website).(1) Any charitable organization if solicitations are notintended to and do not exceed 25,000 and fundraisers areunpaid;(2) Educational institutions and their authorized and relatedfoundations;(3) Religious, political, fraternal, patriotic, benevolent,social, educational, alumni, health care foundation,historical, and civil rights organizations;(4) Civil leagues and organizations soliciting solely frommembers;(5) Solicitations for relief of named individual if allcontributions are turned over to beneficiary and do notexceed 10,000;(6) Any charitable organization receiving an allocation froman incorporated community chest or united fund if the chestor fund are in compliance with the AG, the organization doesnot receive more than 25,000 total annually fromcontributions and the chest or fund, and fundraisers areunpaid;(7) Local post, camp, chapter, similarly designated element,or county unit of such elements of veterans organization, orvolunteer firefighter organization, ambulance company,rescue squads, or auxiliary or affiliate of such organization iffundraisers are unpaid and all fundraising is carried on bymembers, family, volunteers, or an affiliate.For a complete list and description of exemptorganizations, please see Ala. Code § 13A-9-71.Professional Fundraisers and CommercialCoventurers: Must register. (Ala. Code § 13A-9-71(h)). Must post and maintain a surety bond of 10,000. (Ala. Code § 13A-9-71(h)). Must file all contracts between it and anycharitable organization. (Ala. Code § 13A9-71(i)). Are subject to final accountingobligations. (Ala. Code § 13A-9-71(j)).Online or URS 25Online or URS 25Paid Solicitors: Must register. (Ala. Code § 13A-9-71(j)).Relevant forms include:(1) Professional Fundraiser or CommercialCoventurer Registration Statement;(2) Fundraiser or Commercial CoventurerSurety Bond;(3) Professional Solicitor RegistrationStatement;(4) Professional Fundraiser or CommercialCoventurer Closing Statement.Office of the AlabamaAttorney General ConsumerProtectionAttn: Charitable OrganizationRegistrationPO Box 300152,Montgomery, AL 36130(334) 242-7335 (AG)(800) 392-5658 or(334) 353-1765 (CharitableOrganizations)

STATEWHAT REGISTRATIONFEERENEWALFORMRENEWALFEENOTE: Exempt charitable organizations can completea Notice of Exemption.The following organizations are exempt from registration:ALASKASolicitation:A direct or indirectwritten or oral request.(Alaska Stat.§ 45.68.900(5)).DONATE NOWButton/Website:Charleston Principlesappear to apply.ARIZONASolicitation:A request of any kind fora contribution or arequest for the purchaseof goods, tickets, orservices for charitablepurposes. (Arizona Rev.Stat. § 44-6551).DONATE NOWButton/Website:N/A.(1) Any charitable organization that does not intend to oractually receive contributions (excluding government grants)in excess of 5,000 or from more than 10 persons duringfiscal year, if all of its functions (including solicitation) areperformed by persons not being paid and officers ormembers of the organization are not paid and do nototherwise receive assets or income of the organization;(2) Churches or religious organizations exempt from filing afederal annual information return underI.R.C. § 6033(a)(3)(A);(3) Candidates for national, state, or local office or politicalparties, committees, or groups required to file certainfinancial information with Alaska or the Federal ElectionsCommission;(4) Persons or municipalities who have a permit underAlaska Stat. § 05.15.100.State Form or Online 40State Form orOnline 40COVENTURER / PROFESSIONALFUNDRAISER REGISTRATIONPaid Solicitors: Must register and pay a 200 registrationfee. (Alaska Stat. § 45.68.010.b). Must post and maintain a surety bond of 10,000. (Alaska Stat. § 45.68.010.c). Must file all contracts between it and anycharitable organization. (Alaska Stat.§§ 45.68.010.c, 020, 055). Must provide a copy of all scripts used forfundraising in Alaska. (Alaska Stat.§§ 45.68.010.c, 020, 055). Must submit financial reports onsolicitation campaigns. (Alaska Stat.§§ 45.68.010.c, 020, 055).Relevant forms include:(1) Paid Solicitor Annual Registration Form;(2) Paid Solicitor Surety Bond;(3) Paid Solicitor Solicitation CampaignFinancial Report.For a complete list and description of exemptorganizations, please see Alaska Stat. § 45.68.120.Only charitable organizations that solicit funds in the nameof American veterans are required to register.For a complete list and description of exemptorganizations, please see Ariz. Rev. Stat. § 133722(A).State FormNoneN/AN/AN/ACONTACT INFORMATIONState of AlaskaDepartment of LawAttorney General's Office1031 W. 4th Ave.,Suite 200,Anchorage, AK 99501-1994(907) 269-5200 or(888) 576-2529LawCharities@alaska.govSecretary of StateAttn: Veterans Charities Dept.400 W. Congress,Ste. 141,Tucson, AZ 85701(602) 542-6187 or(800) 458-5842

STATEWHAT REGISTRATIONFEERENEWALFORMRENEWALFEENOTE: Exempt charitable organizations must completeArkansas Exempt Organization Form EX-01.ARKANSASSolicitation:A direct or indirectwritten or oral requestfor a contribution on theplea or representationthat the contribution willbe used for a charitablepurpose. (Ark. Code § 428-401(13)).DONATE NOWButton/Website:Charleston Principlesappear to apply.For a complete list and description of exemptorganizations, please see Ark. Code § 4-28-404.CONTACT INFORMATIONPaid Solicitors: Must register. (Ark. Code § 4-28-407(a)). Must file all contracts between it and anycharitable organization. (Ark. Code §§ 428-407(b), (h)). Must file annual financial reports. (Ark.Code §§ 4-28-407(b), (h)).The following organizations are exempt from registration:(1) Organizations that do not intend to or actually receivecontributions in excess of 25,000 in calendar year if allfunctions (including fundraising) are carried on by personsunpaid for their services and no part of assets or incomeinures to benefit of or is paid to any officer or member;(2) Religious organizations if exempt from federal taxationand no part of income inures to direct benefit of anyindividual;(3) Educational institutions (i.e., any parent-teacherassociation or educational institution, the curricula of whichin whole or in part are registered or approved by any stateor the United States either directly or by acceptance ofaccreditation by an accrediting body);(4) Political candidates and organizations required to fileinformation with Federal Election Commission or stateelection commission or its equivalent agency;(5) Governmental organizations (i.e., any departmentbranch or other instrumentality of the federal, state, or localgovernments);(6) Nonprofit hospitals (i.e., any nonprofit hospital licensedby Arkansas or in any other state);(7) Persons who solicit solely for the benefit of the abovelisted organizations.COVENTURER / PROFESSIONALFUNDRAISER REGISTRATIONState FormNoneState FormNoneProfessional Telemarketers Employed byPaid Solicitors: Any person employed or retained by aPaid Solicitor to solicit charitablecontributions in Arkansas must register.(Ark. Code § 4-28-411).Fund-Raising Counsel: Must register. (Ark. Code § 4-28-406).Commercial Coventurers: Must file a written agreement between itand the charitable organization beforeconducting a charitable sales promotionon the charity’s behalf. (Ark. Code § 428-408).For each of the above categories, relevantdocuments outlined in the Instructions mustbe submitted to charities@sos.arkansas.gov.Arkansas Secretary of State,Business and CommercialServicesATTN: Charities Registration1401 W. Capitol Ave.,Suite 250,Little Rock, AR 72201(501) 683-0094charities@sos.arkansas.gov

STATECALIFORNIAWHAT CONSTITUTESSOLICITATION?Solicitation:Any request, plea,entreaty, demand, orinvitation, or attemptthereof, to give moneyor property for charitablepurposes. (Cal. Businessand Professional Code§ 17510.2; Cal. Gov.Code § 12581.2).DONATE NOWButton/Website:Charleston Principlesappear to EWALFORMRENEWALFEEState FormThe following organizations are exempt from registration:(1) Government entities (including their agencies orgovernmental subdivisions);(2) Religious organizations;(3) Cemetery corporations;(4) Hospitals;(5) Licensed health care service plans;(6) Political committees;(7) Educational institutions.For a complete list and description of exemptorganizations, please see Cal. Gov. Code § 12583.State Form 25State AnnualFinancialSolicitationReport (CT 694)*Note:Organizationmust file only ifcollects morethan 50% ofannual incomeand more than 1 million inCalifornia duringthe previouscalendar year.Sliding Scale: 0- 300COVENTURER / PROFESSIONALFUNDRAISER REGISTRATIONCommercial Fundraisers and FundraisingCounsel: Must register and provide 10 workingdays' notice to the AG beforecommencement of solicitation. (Cal. Gov.Code §§ 12599.3, 12599(h)). Must post and maintain a surety bond of 25,000 or a cash deposit with eachapplication for registration or renewal.(Cal. Gov. Code § 12599.5). Must make all contracts between it andany charitable organization available forinspection to the AG upon demand. (Cal.Gov. Code §§ 12599, 12599.1, 12599.7). Must make certain specific records (e.g.,solicitation campaign records and eventrecords) available for inspection to the AGupon demand. (Cal. Gov. Code §§ 12599,12599.1, 12599.7). Are subject to accounting and annualfinancial reporting obligations. (Cal. Gov.Code § 12599).Commercial Coventurers: Must register unless it has a writtencontract with the charitable organization,transfers all funds, assets or propertyreceived within 90 days afterrepresentation, and provides a writtenaccounting to the organization. (Cal. Gov.Code § 12599.2).Relevant forms include:CT-1CF, CT-2CF, CT-3CF, CT-5CF, CT-6CF,CT-10CF, CT-11CF.CONTACT INFORMATIONRegistry of Charitable TrustP.O. Box 903447,Sacramento, CA 94203-4470(916) 210-6400 or (916) 2107613

STATEWHAT REGISTRATIONFEERENEWALFORMRENEWALFEECOVENTURER / PROFESSIONALFUNDRAISER REGISTRATIONCONTACT INFORMATIONSolicitation:Direct or indirect requestfor anything of value(e.g., money, credit,property, financialassistance) on the pleaor representation thatsuch contribution will beused for a charitablepurpose or will benefit acharitable organization.(Colo. Rev. Stat. § 6-16103(10)).COLORADODONATE NOWButton/Website:Organizations domiciled(i.e., principal place ofbusiness) in Coloradoand using internet toconduct charitablesolicitations in Coloradomust register unlessexempt under Colo. Rev.Stat. § 6-16-104(6). (8CCR 1505-9 Rule 10.2).Organizations domiciledoutside of Colorado mustregister (unless exemptunder Colo. Rev. Stat.§ 6-16-104(6)) if: (1) itsnon-internet activitiesare sufficient to requireregistration in Colorado;or(2) it solicitscontributions through aninteractive website (orinvites offlinecontributions orestablishes contacts topromote websites) andeither targets personsphysically located inColorado for solicitationor receives contributionsfrom Colorado on arepeated and ongoingbasis or a substantialbasis through itswebsite. (8 CCR 1505-9Rule 10.3).The following organizations are exempt from registration:(1) Certain churches exempt from filing a federal annualinformation return;(2) Political parties, candidates for federal or state office,and political action committees required to file financialinformation with federal or state election commissions;(3) Veterans' service organizations;(4) Organizations (sponsors) that do not intend to and donot actually receive gross revenue (excluding governmentgrants and contributions from other 501(c)(3) organizations)in excess of 25,000 during a year or do not receivecontributions from more than 10 persons during a yearunless organization has contracted with a paid solicitor tosolicit within Colorado;(5) Persons exclusively making appeals for funds on behalfof a specific individual named in the solicitation if allproceeds of the solicitation are given to or expended fordirect benefit of such specified individual.For a complete list and description of exemptorganizations, please see Colo. Rev. Stat. § 6-16104(6).Online 10Online 10Professional Fundraising Consultants andPaid Solicitors: Must register. (Colo. Rev. Stat. §§ 6-16104.3, 104.6). Must provide all contracts between it andany charitable organization to the stateupon request. (Colo. Rev. Stat. §§ 6-16104.3, 104.6). Must file annual financial reports. (Colo.Rev. Stat. §§ 6-16-104.3, 104.6).Commercial Coventurers: Not required to s/FAQ/registration.html).All filings (including registration and renewal)are online. Professional FundraisingConsultants and Paid Solicitors need to createan account before beginning the registrationprocess.Colorado Department ofState1700 Broadway,Suite 200,Denver, CO 80290(303) 894-2200, option 2charitable@sos.state.co.us

STATECONNECTICUTWHAT CONSTITUTESSOLICITATION?Solicitation:Any request directly orindirectly for anything ofvalue (e.g., money,credit, property, financialassistance) on the pleaor representation thatsuch thing is to be usedfor a charitable purposeor benefit a charitableorganization(membership feesexcluded). (Conn. Gen.Stat. §§ 21a-190a(3),(5)).DONATE NOWButton/Website:Charleston Principlesappear to EWALFORMRENEWALFEEPaid Solicitors: Must register. (Conn. Gen. Stat. § 21a190f(b)). Must post and maintain a surety bond of 20,000. (Conn. Gen. Stat. § 21a190f(b)). Must jointly file together with thecharitable organization a notice of intentto solicit before each separate fundraising campaign. (Conn. Gen. Stat.§ 21a-190f(c)). Must file a financial report at theconclusion of each campaign. (Conn. Gen.Stat. § 21a-190f(j)). Are subject to annual financial reportingobligations. (Conn. Gen. Stat. § 21a190f(j)).NOTE: Exempt organizations must submit anExemption Form (Online application is also available).The following organizations are exempt from registration:(1) Religious corporations, institutions, or societies;(2) Parent-teacher associations or educational institutions ifthe curricula is at least partially registered or approved bythe US or any state directly or by acceptance ofaccreditation by an accrediting body;(3) Licensed nonprofit hospitals;(4) Governmental units or instrumentalities of the US or anystate;(5) Any person who solicits solely for the benefit of theabove listed ((1)-(4)) organizations;(6) Organizations normally receiving less than 50,000 incontributions annually provided it does not compensate anyperson primarily to conduct solicitations.For a complete list and description of exemptorganizations, please see Conn. Gen. Stat. § 21a190d.COVENTURER / PROFESSIONALFUNDRAISER REGISTRATIONState Form or Online 50State Form orOnline 50Fund-Raising Counsels: Not required to register unless it hascustody or control of contributions; if so,must file a surety bond of 20,000.(Conn. Gen. Stat. § 21a-190e(b)). Must file all contracts between it and anycharitable organization. (Conn. Gen. Stat.§ 21a-190e(a)).Commercial Coventurers: Not required to register. (Conn. Gen.Stat. § 21a-190g(a)). Must file all contracts between it and anycharitable organization. (Conn. Gen. Stat.§ 21a-190g(a)). Are subject to final accountingobligations. (Conn. Gen. Stat. § 21a190g(a)).Relevant forms include:(1) Paid Solicitor Registration Statement;(2) Bond Form for Paid Solicitor;(3) Solicitation Notice;(4) Fundraising Counsel RegistrationStatement;(5) Bond Form for Counsel.CONTACT INFORMATIONDepartment of ConsumerProtection UnitPublic Charities450 Columbus Blvd.,Ste. 801,Hartford, CT 06103860-713-6170dcp.publiccharities@ct.gov

STATEWHAT REGISTRATIONFEERENEWALFORMRENEWALFEECOVENTURER / PROFESSIONALFUNDRAISER REGISTRATIONCONTACT INFORMATIONRegistration online,in-person, via mail,or URSDCSolicitation:Any direct or indirectrequest for contributionon the plea orrepresentation that suchcontribution will or maybe used for a charitablepurpose, including butnot limited to any oral orwritten request andmaking announcementto the press, over theradio, by telephone, orother means. (D.C. Code§ 44-1701(3)).DONATE NOWButton/Website:Organization with donatenow button does notneed to register in DC ifnot doing business inDC.DELAWARESolicitation:Any oral or writtenrequest, directly orindirectly, for anything ofvalue on the plea orrepresentation that suchthing or any portionthereof, will be used fora charitable/fraternalpurpose or the benefit ofa charitable/fraternalorganization.(6 Del. C. § 2593).DONATE NOWButton/Website:No registrationrequirement.The following organizations are exempt from registration:(1) Church, religious corporation, corporation orunincorporated association under supervision and control ofchurch or religious corporation if granted exemption fromtaxation under I.R.C. § 501;(2) Persons soliciting solely for American National RedCross;(3) Persons soliciting exclusively among membership ofsoliciting agency;(4) Persons soliciting for educational purposes.For a complete list and description of exemptorganizations, please see D.C. Code § 44-1703.N/AMost organizationsmust registeraccording to thefollowing:(1) File corporateregistration with theCorporations Division(requires a corporateagent);(2) Apply for BasicBusiness License(BBL) and providedocuments requiredby BBL (includingClean Hands SelfCertification,notarized CertifiedResolution and IRSdetermination letterto Department ofConsumer andRegulatory Affairs);(3) Register with theOffice of Tax andRevenue and applyfor exemption afterregistration has beenprocessed.N/A 80 (corporateregistration) 412.50 (basicbusiness license) 70 (taxexemption)OnlineRenewal 412.50Professional Fundraisers and Solicitors: Must register. (D.C. Code § 44-1703). Must provide all contracts between it andany charitable blesolicitation-license). Must file reports as to contributionssecured. (D.C. Code §§ 44-1705, 1706). Must obtain, and exhibit upon soliciting, asolicitor information card. (D.C. Code§§ 44-1705, 1706).Corporations Division(202) 442-4432Office of Tax and Revenue(202) 727-4829Department of Consumerand Regulatory Affairs 11004th Street, SW, WashingtonD.C. 20024(202) 442-4400dcra@dc.govN/AN/AN/AProfessional Solicitors: Not required to register. (6 Del C.§ 2594). Must have a written contract with thecharitable/fraternal organization. (6 DelC. § 2594). Must maintain fiscal records for at least 3years from the termination of thecontract. (6 Del C. § 2594).Commercial Coventurers and Others: Not required to register.N/A

STATEFLORIDAWHAT CONSTITUTESSOLICITATION?Solicitation:Any direct or indirect

NOTE: Exempt charitable organizations must complete Alabama Registration Exemption Form. The following organizations are exempt from registration: (1) Any charitable organization if solicitations are not intended